Fidelity vs Merrill Edge Comparison

Comparing brokers side by side is no easy task. We spend hundreds of hours each year testing the platforms, mobile apps, trading tools and general ease of use among online brokerages, as well as comparing commissions and fees, to find the best online broker.

Though many U.S. brokers offer basic trading features, such as an app, charting tools, stock research and educational content, the depth of those features can vary widely. Let's compare Fidelity vs Merrill Edge.

Is Fidelity or Merrill Edge better for beginners?

In stock trading, the more you know, the better you’ll do. Taking advantage of resources like articles, webinars, videos and interactive elements is a great way to shorten the learning curve. In our analysis, we examine the availability of several different types of educational materials.

For 2024, our review finds that Fidelity offers more comprehensive new investor education for beginning investors than Merrill Edge. Both Fidelity and Merrill Edge offer Videos, Education (Stocks), Education (ETFs), Education (Options), Education (Mutual Funds), Education (Bonds) and Education (Retirement). Neither have Paper Trading.

What about Fidelity vs Merrill Edge pricing?

Fidelity and Merrill Edge charge the same amount for regular stock trades, $0.00. Fidelity and Merrill Edge both charge $0.65 per option contract. Fidelity and Merrill Edge both charge (Not offered) per option contract. For a deeper dive, see our best brokers for free stock trading or options trading guides.

Does Fidelity or Merrill Edge offer a wider range of investment options?

Looking at a full range of investment options, including order types and international trading, our research has found that Fidelity offers a more comprehensive offering than Merrill Edge. Fidelity ranks #3 out of 18 brokers for our Investment Options category, while Merrill Edge ranks #7.

Fidelity offers investors access to Stock Trading, Fractional Shares, Options Trading, OTC Stocks, Mutual Funds and Advisor Services, while Merrill Edge offers investors access to Stock Trading, Options Trading, OTC Stocks, Mutual Funds and Advisor Services. Neither have Futures Trading and Forex Trading. Looking at Mutual Funds, Merrill Edge trails Fidelity in its offering of no transaction fee (NTF) mutual funds, with Fidelity offering 3401 and Merrill Edge offering 3095.

Do Fidelity and Merrill Edge offer cryptocurrency?

In our analysis of top U.S. brokerages, we research whether each broker offers the ability to trade cash cryptocurrency, such as bitcoin and ethereum. Though crypto has risen steadily in popularity, availability still varies from broker to broker. Our review finds that Fidelity offers crypto trading, while Merrill Edge does not.

Which trading platform is better: Fidelity or Merrill Edge?

To compare the day trading platforms of Fidelity and Merrill Edge, we focused on trading tools and functionality across both web and desktop-based platforms. Popular day trading platform tools include streaming real-time quotes, stock alerts, trading hotkeys, direct market routing, streaming time and sales, customizable watch lists, backtesting, and fully functional charting packages, among many others. For day trading, Fidelity offers a better experience.

Does Fidelity or Merrill Edge offer a better stock trading app?

After testing 25 features across the stock trading apps of Fidelity and Merrill Edge, we found Fidelity to be better overall. The best stock market apps are easy to use, have excellent design, and deliver a fully featured online trading experience. Fidelity ranks #3 out of 18 brokers, while Merrill Edge ranks #5.

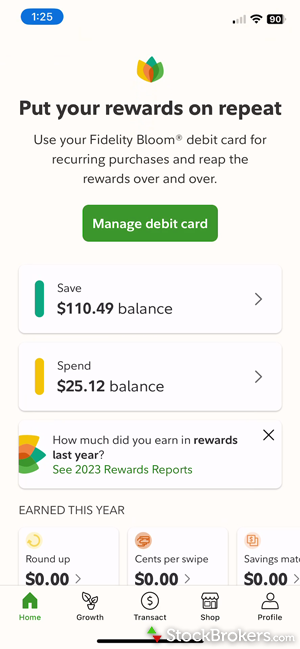

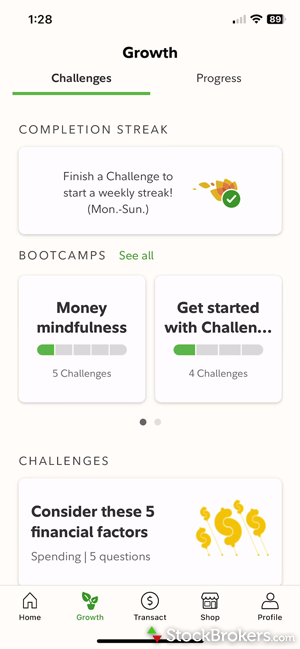

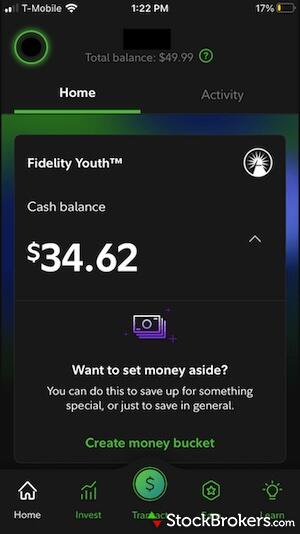

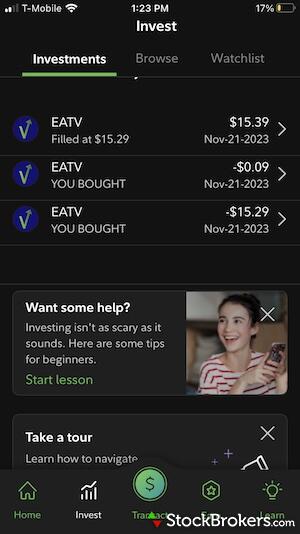

Fidelity Trading App Gallery

Merrill Edge Trading App Gallery

Which broker is better for researching stocks?

For research, Merrill Edge offers superior market research than Fidelity. Fidelity ranks #5 and Merrill Edge ranks #4.

Over the years, we've found that the best brokers provide rich market commentary, a variety of third-party research reports, and thorough quote screens that are not just easy to navigate, but that also include a comprehensive selection of fundamental data. Robust stock, ETFs, and mutual fund screeners are also must-haves for trade idea generation.

How do Fidelity and Merrill Edge compare in terms of minimum deposit required?

Fidelity requires a minimum deposit of $0.00, while Merrill Edge requires a minimum deposit of $0.00. From our testing, we found that SoFi is the only broker that requires a minimum deposit.

Which broker offers better margin rates for accounts under $25,000?

Fidelity charges 13.575% for accounts under $25,000 while Merrill Edge charges a margin rate of Varies. The industry average of the 18 brokers we track is 9%.

Does Fidelity offer fractional shares? Does Merrill Edge?

While Fidelity offers fractional shares, Merrill Edge does not. Our research has found that 46% of brokers offer fractional shares investing. Fractional shares allow traders to buy a part of a whole share of stock. For example, if Amazon is trading at $1,000, you could buy half a share for $500.

Can you trade penny stocks with Fidelity or Merrill Edge?

Both Fidelity and Merrill Edge allow you to trade penny stocks. Fidelity charges $0.00 per trade while Merrill Edge charges N/A. Penny stocks are companies whose shares trade for under $5 and are listed over the counter (OTC). For brokers that do offer penny stock trades, the average commission is $3.

Does either broker offer banking?

Online banking can be a benefit for investors, and some brokerages do provide banking services to customers. Debit Cards and Credit Cards are offered by Fidelity, while Merrill Edge offers Checking Accounts, Savings Accounts, Debit Cards, Credit Cards and Mortgage Loans.

Which broker offers stronger customer service?

StockBrokers.com partners with customer experience research group Confero to conduct phone tests from locations across the United States to thoroughly evaluate the quality and speed of brokerage customer service. (Read more about How We Test.) Here are the results of our current testing.

Fidelity was rated 1st out of 13 brokers, with an overall score of 9.31 out of 10.

Merrill Edge was rated 2nd out of 13 brokers, with an overall score of 9.3 out of 10.

Is Fidelity good?

Fidelity is a value-driven online broker offering $0 trades, industry-leading research, excellent trading tools and an easy-to-use mobile app.

In the 2024 StockBrokers.com Annual Awards, Fidelity was rated No. 1 Broker Overall and No. 1 for Innovation, Phone Support, Beginners, Commissions & Fees, IRA Accounts, Penny Stock Trading, Customer Service, and Education. It also placed among Best in Class for Commissions & Fees, Research, Platforms & Tools, Mobile Trading Apps, Investment Options, Education, Ease of Use, Day Trading, and High Net Worth Investors.

Is Merrill Edge good?

Merrill Edge and its parent, Bank of America, make for a well-rounded offering, with $0 trades, robust research, reliable customer service; and its Stock Stories and Fund Stories are an industry standout. There are some gaps in investment offerings, including crypto and futures.

In the 2024 StockBrokers.com Annual Awards, Merrill Edge was rated No. 1 for Bank Brokerage, Overall Client Experience, and Client Dashboard. It placed among Best in Class for Research, Platforms & Tools, Mobile Trading Apps, Education, Ease of Use, Beginners, Customer Service, IRA Accounts, Options Trading, High Net Worth Investors and Overall.

Fidelity vs Merrill Edge Winner

Overall winner: Fidelity

Popular trading guides

More trading guides

Popular stock broker reviews