Merrill Edge Review

Merrill Edge and its corporate parent, Bank of America, make a strong case to be your cradle-to-grave financial services partner. Other than Red Bull-fueled day trading, this broker does almost everything well and some tools are game changers.

-

Minimum Deposit:

$0.00 -

Stock Trades:

$0.00 -

Options (Per Contract):

$0.65

Pros

- Portfolio Story, Dynamic Insights, and the Stock and Fund Stories are the best features for everyday investors since $0 commission stock trades.

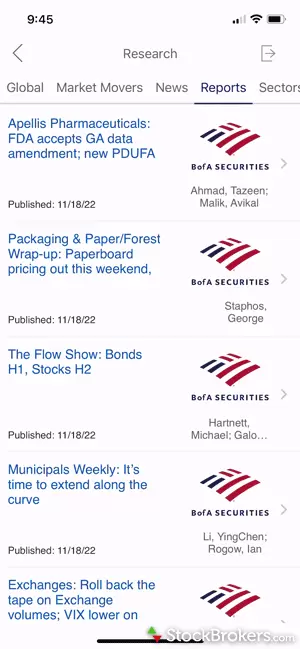

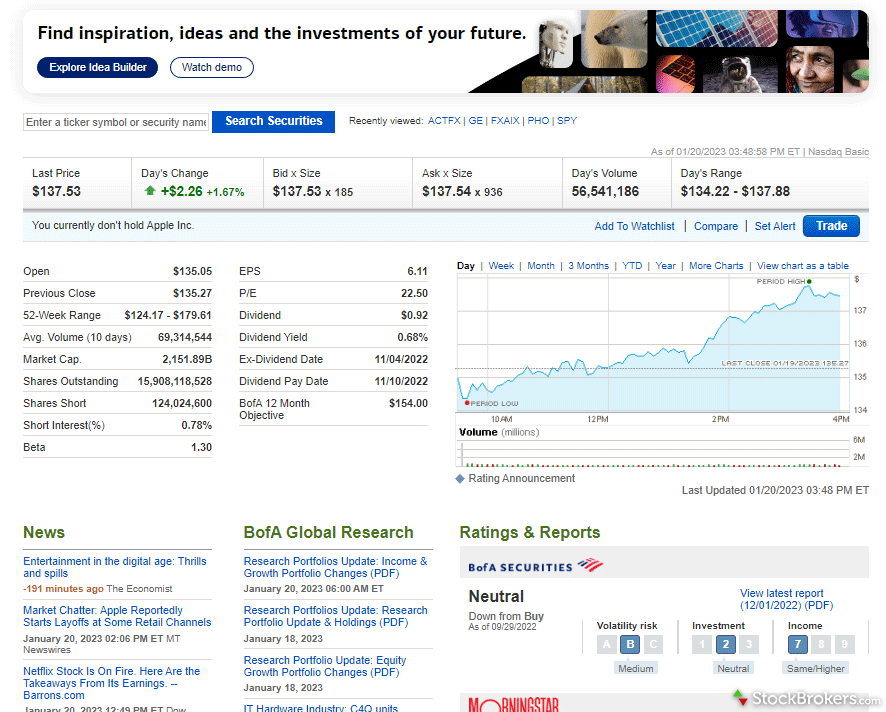

- Merrill Edge gives access to high-quality Bank of America Securities proprietary research.

- Clients can view their Merrill Edge account via the Bank of America app, making Bank of America and Merrill Edge a very convenient combination.

- Bank of America’s Preferred Rewards program, which contributed to Merrill Edge’s Best In Class rating for high net worth investors, counts Merrill Edge assets alongside banking assets for reward tiers.

- Merrill has the best user experience for everyday investors out of all the brokers I tested. It has one of the best stock trading apps; both the app and Merrill's browser platform are attractive, informative, and easy to navigate.

Cons

- This is my second year testing Merrill and I still haven’t been able to get a direct answer what their margin rates are. Reps say the rates are based on the overall relationship. I prefer straightforward pricing.

- Merrill, like Fidelity, isn’t super geared toward active traders. Its desktop app, MarketPro, seems better suited for fundamental research than trading, or at least that’s how I prefer using it.

- Edge doesn’t offer cryptocurrencies, futures, foreign exchange, fractional shares, or paper trading.

- The cost of Merrill’s beautiful design is occasionally long page load times, especially when skimming through Stories.

- Calling Merrill’s customer service about anything other than a routine issue can become an exercise in futility.

Overall summary

| Feature |

Merrill Edge Merrill Edge

|

|---|---|

| Overall |

|

| Investment Options |

|

| Commissions & Fees |

|

| Mobile Trading Apps |

|

| Platforms & Tools |

|

| Research |

|

| Customer Service |

|

| Education |

|

| Ease Of Use |

|

Investment options

Merrill Edge provides ample investment choices and the available services of a megabank. On offer are stocks, ETFs, options, mutual funds and bonds. Fractional shares, paper trading, futures, forex, and cryptos are not available.

To get the full capabilities of Merrill Edge, plan on e-signing a few documents and seeing a ton of disclosure boilerplate. Other brokers demand less paperwork to accomplish the same tasks. It’s not overwhelming, but it’s noticeable.

Investment guidance: In addition to do-it-yourself investing, Merrill Edge and its corporate parent, Bank of America, offer a full range of investment guidance solutions.

For those looking for set-and-forget investing, Merrill offers automated (robo) portfolio management with only a $1,000 minimum.

Limited advisory services with an advisor ($20,000 minimum investment) are also available through its Guided Investing program. Guided Investing has what I think is a high annual base fee of 0.85%, but there are introductory offers and discounts based on your Preferred Rewards tier (see below). Guided Investing isn’t intended for clients with advanced planning needs.

High net worth clients of Bank of America and its investing divisions are eligible for curated experiences, lower fees and rates, and, of course, higher priority service. Money doesn’t solve all problems, but the more you have, the less time you’ll spend listening to hold music on your phone.

Cryptocurrency: Merrill Edge does not offer cryptocurrency. You will have to sign up with a crypto exchange to trade popular tokens such as Bitcoin, Ethereum or Dogecoin.

Retirement services: Merrill offers traditional, Roth and rollover IRAs, and placed among the best IRA accounts for 2024.

| Feature |

Merrill Edge Merrill Edge

|

|---|---|

| Stock Trading | Yes |

| Margin Trading | Yes |

| Fractional Shares | No |

| OTC Stocks | Yes |

| Options Trading | Yes |

| Complex Options Max Legs | 4 |

| Bonds (US Treasury) | Yes |

| Futures Trading | No |

| Forex Trading | No |

| Mutual Funds (Total) | 3466 |

| Crypto Trading | No |

| Crypto Trading - Total Coins | 0 |

| Traditional IRAs | Yes |

| Roth IRAs | Yes |

| Advisor Services | Yes |

One of the best for high net worth

We analyzed online brokers' offerings for clients with over $1 million of liquid, investable assets. See our guide to the Best Brokerage Firms for High Net Worth Individuals.

Commissions and fees

Merrill Edge, like other discount brokers, provides customers unlimited free stock trading ($0) and exchange-traded fund (ETF) trading. Options trades cost $0.65 per contract, a common price among top-tier brokers. Broker-assisted trades are a reasonable $19.95.

Margin rates: We ask every broker that we review for their current margin rates. The firm keeps it vague, saying that a client’s margin rate depends on the relationship. I looked on the site. I called in to telephone support. No dice. No one at Merrill would give me specific numbers to share with potential clients.

Penny stocks: Merrill Edge does not typically allow trading of OTC stocks with market caps of $300 million or less and are priced below $5 per share, though I was told there are exceptions. In practice, those restrictions mean that there is essentially no penny stock trading.

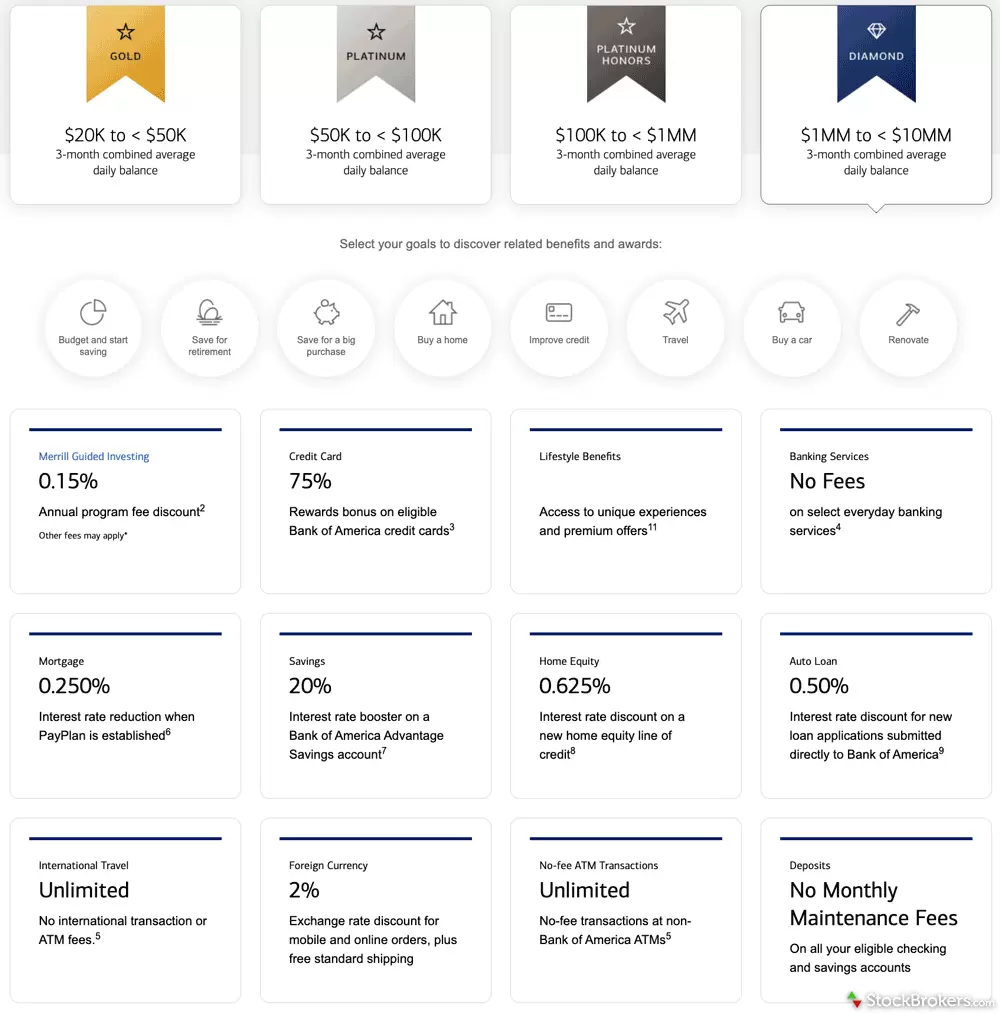

Preferred Rewards: Merrill’s rewards system makes for a top-notch combination of banking and brokerage, and it's a perennial top pick here at StockBrokers.com for best bank brokerages. To qualify for the base tier, Gold, customers must maintain a three-month average combined balance in their bank and brokerage accounts of at least $20,000. Benefits through the Preferred Rewards program include money market savings interest-rate boosts, credit card bonuses, investment discounts and more.

| Feature |

Merrill Edge Merrill Edge

|

|---|---|

| Minimum Deposit | $0.00 |

| Stock Trades | $0.00 |

| Penny Stock Fees (OTC) | N/A |

| ETF Trade Fee | $0.00 |

| Options (Base Fee) | $0.00 |

| Options (Per Contract) | $0.65 |

| Options Exercise Fee | $0.00 |

| Options Assignment Fee | $0.00 |

| Futures (Per Contract) | (Not offered) |

| Mutual Fund Trade Fee | $19.95 |

| Broker Assisted Trade Fee | $29.95 |

Mobile trading apps

Merrill Edge's mobile app is easy to use, great for research and exceeds the industry standard experience. For existing Bank of America customers, the universal account access and functionality make the app an easy winner.

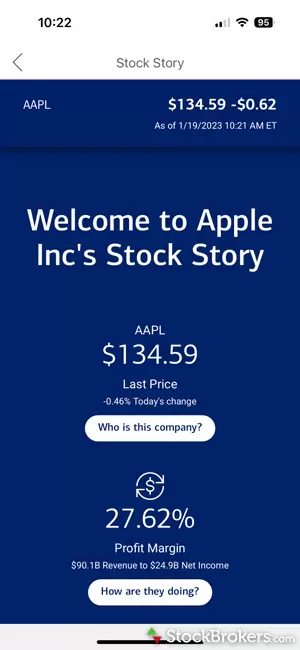

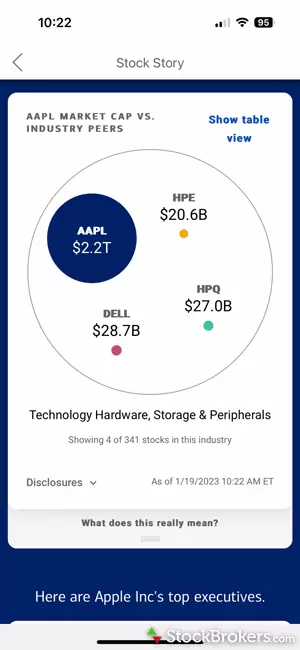

Ease of use: Apple Face ID and fingerprint login, coupled with a cleanly designed dashboard, makes it very easy to jump in and check in on your portfolio. Research is excellent for stocks, ETFs, and mutual funds, thanks to the inclusion of Stock Story and Fund Story, though sometimes pages are slow to load.

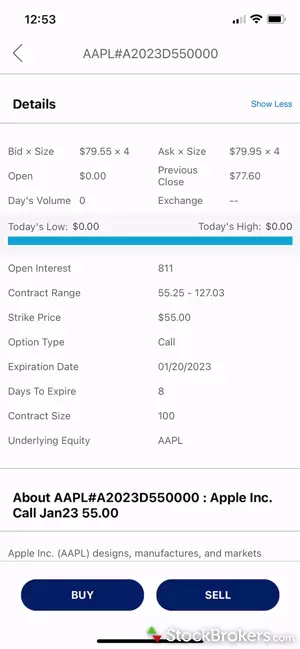

Charting: Charting is comprehensive and includes a variety of customizations. The default view is attractive, but I found navigating and customizing mobile charts to be awkward. Scrolling and zooming in and out was frustrating, because my finger movements never accomplished what I expected. There are 34 optional technical indicators.

Merrill Edge Mobile app gallery

The Stock Story feature on the Merrill Edge mobile app. Press play for a demo.

Charting: Charting is comprehensive and includes a variety of customizations. However, the interface itself is outdated and not HTML 5, making it difficult to read, especially when using any of the 34 optional technical indicators, which are only supported in landscape mode.

| Feature |

Merrill Edge Merrill Edge

|

|---|---|

| iPhone App | Yes |

| Android App | Yes |

| Apple Watch App | Yes |

| Stock Alerts | Yes |

| Charting - After-Hours | No |

| Charting - Technical Studies | 34 |

| Charting - Study Customizations | Yes |

| Watch List (Streaming) | Yes |

| Watch Lists - Create & Manage | Yes |

| Watch Lists - Column Customization | No |

Other trading platforms and tools

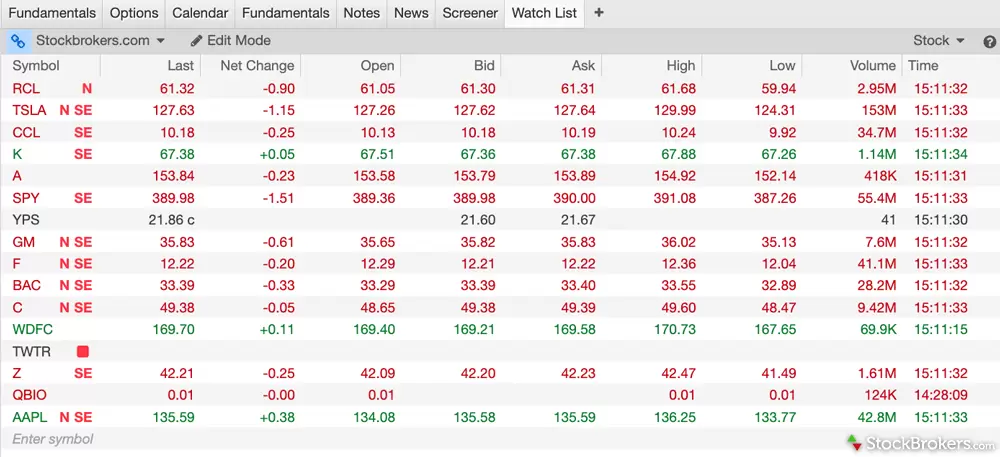

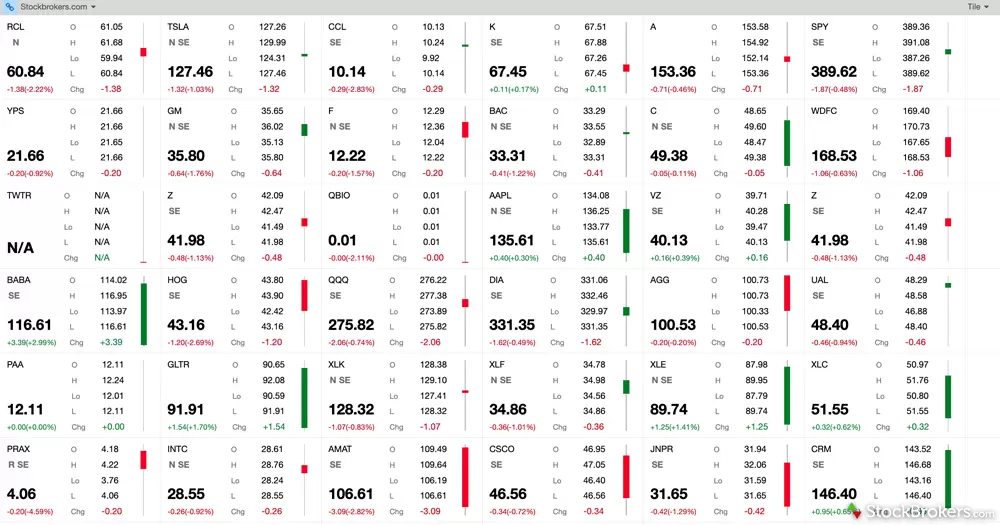

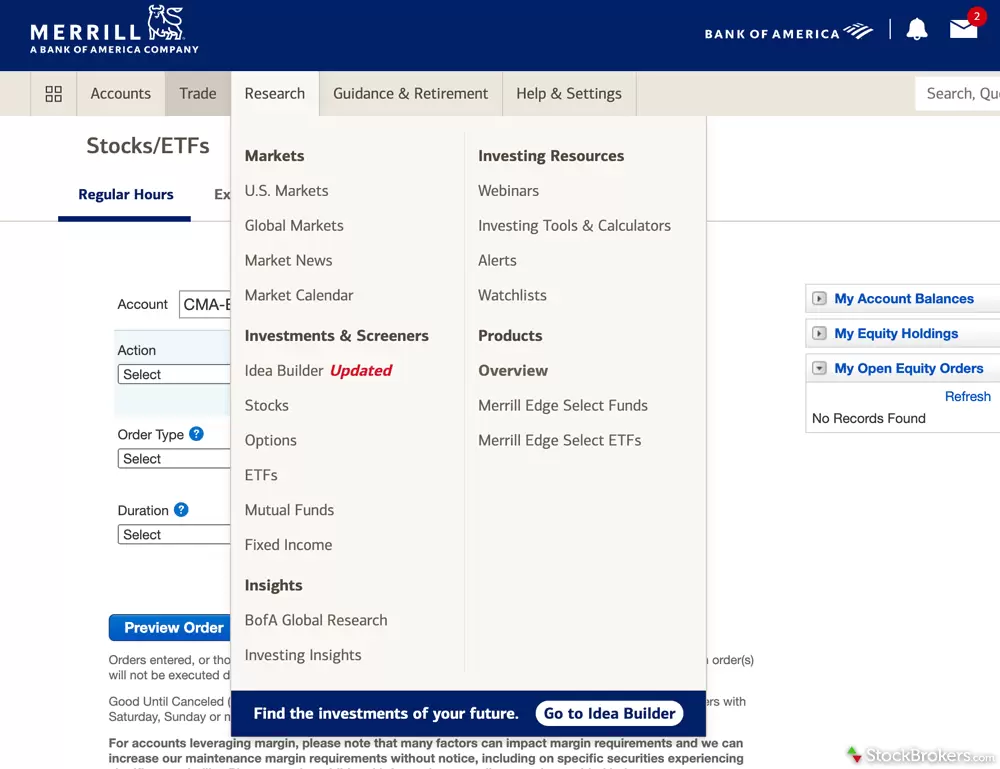

Merrill Edge offers everyday investors access to everything they need (and more) to manage an investment portfolio through the Merrill Edge website. For active traders, Merrill Edge offers its MarketPro desktop trading platform, which is feature-rich but not suitable for day trading.

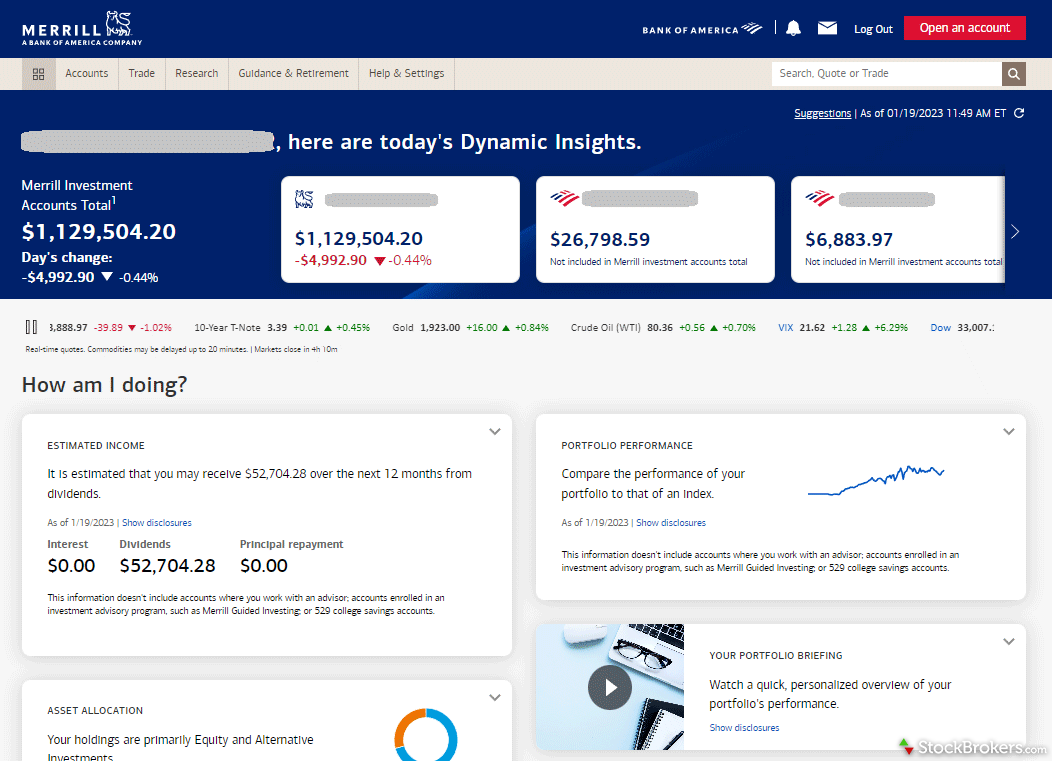

Dynamic Insights: Merrill Edge’s AI powered account dashboard, called Dynamic Insights, again won our industry award for No. 1 Client Dashboard. Dynamic Insights pulls all your data into one spot and uses AI to personalize it, making it the ultimate launching pad for your Merrill Edge account.

After opening Dynamic Insights, you will find a high-level summary of your brokerage and bank accounts. Below that, realized gains and losses, portfolio performance against the market, holdings insights including news events, tax events, movers, and ratings changes, are all included. A high-level market overview for the day is also present.

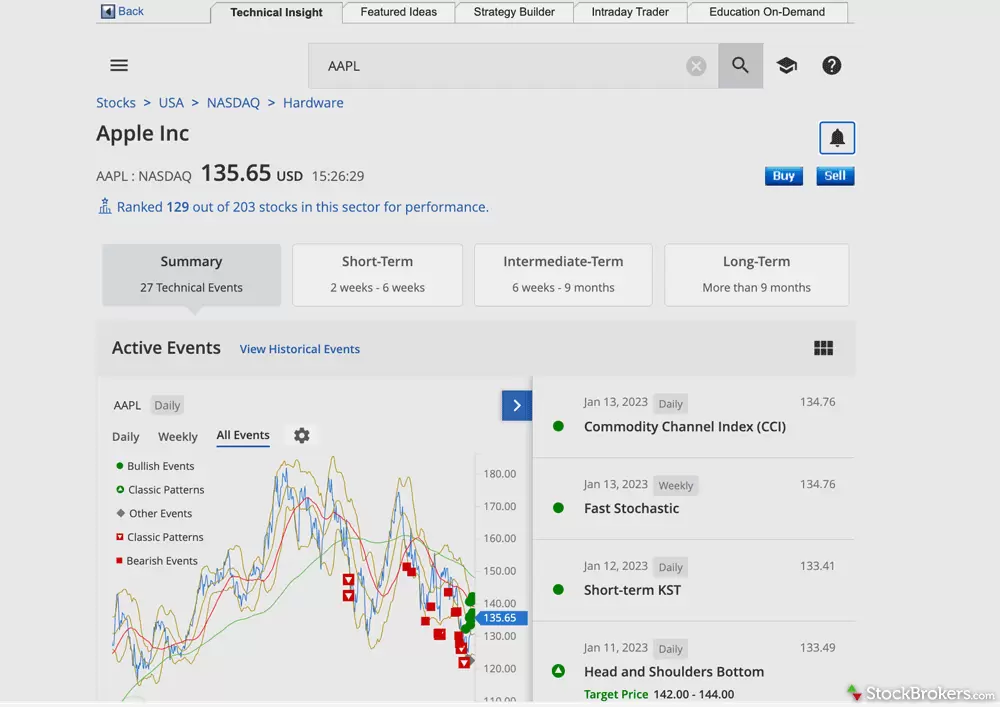

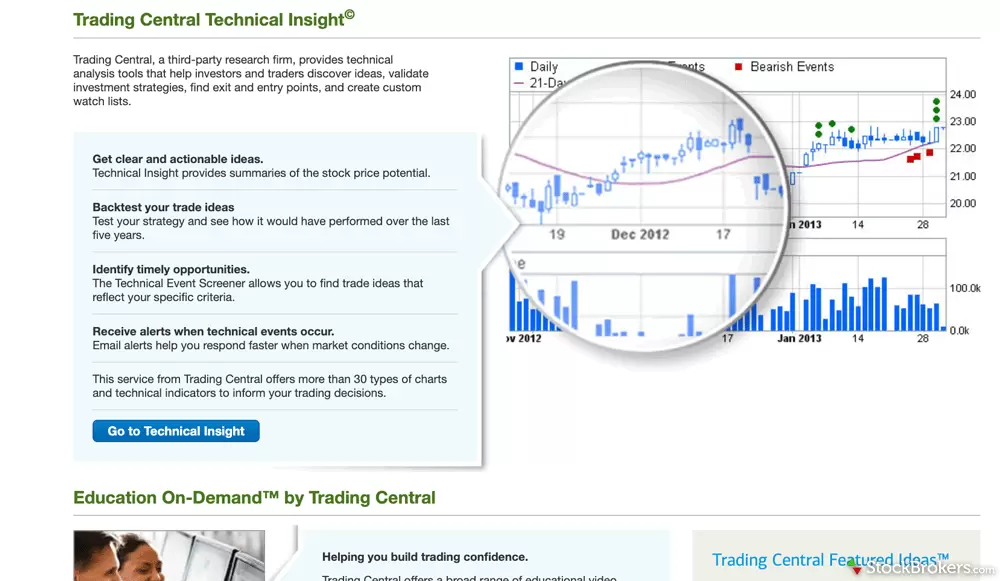

Trading tools: MarketPro is built for active traders and has a variety of bells and whistles. Highlights include close to 300 optional columns for watch lists, easy-to-use charting, automated technical analysis through Trading Central (Recognia), and numerous options tools, including the idea generation tool OptionsPlay.

On the downside, MarketPro has three drawbacks that might deter day traders. First, there are no one-click buy and sell buttons for speedy order entry, nor is there an option to disable the order confirmation window. Second, direct market routing or advanced order types, such as conditional orders, are not supported. And, third, some of the widgets felt as if they were taking forever to load.

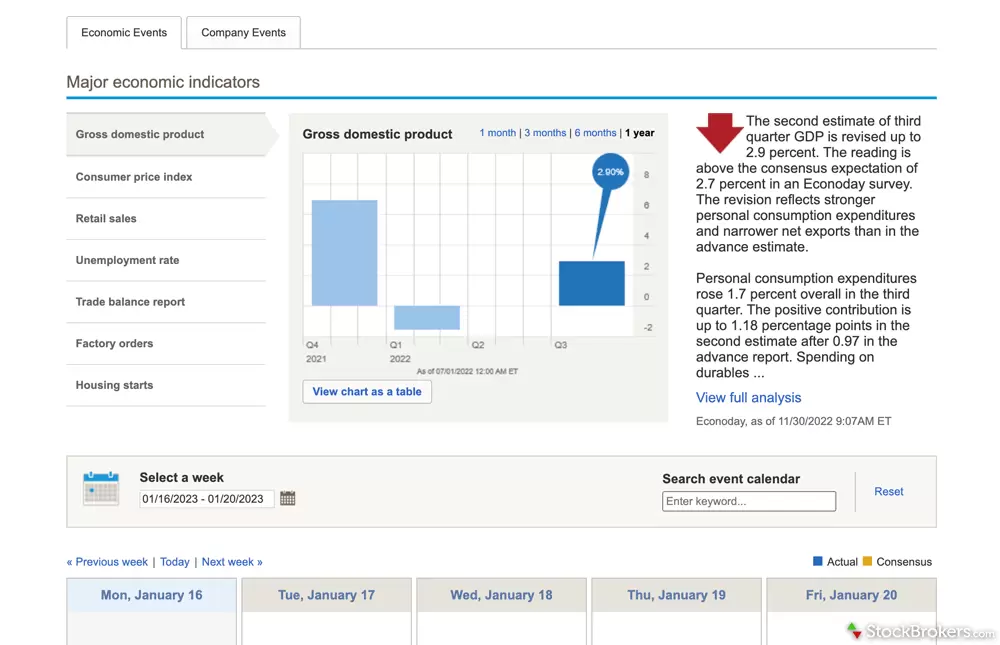

Ironically, for something that’s positioned as a trading platform, I was happiest using MarketPro for fundamentally driven, long-term stock ideas. There’s a phenomenally powerful screener, ample stock data and research, an economic calendar, and good portfolio analysis.

| Feature |

Merrill Edge Merrill Edge

|

|---|---|

| Active Trading Platform | Merrill Edge Market Pro |

| Desktop Trading Platform | No |

| Desktop Platform (Mac) | No |

| Web Trading Platform | Yes |

| Paper Trading | No |

| Trade Journal | No |

| Watch Lists - Total Fields | 285 |

| Charting - Indicators / Studies | 104 |

| Charting - Drawing Tools | 23 |

| Charting - Study Customizations | 8 |

| Charting - Save Profiles | Yes |

| Trade Ideas - Technical Analysis | Yes |

| Streaming Time & Sales | Yes |

| Trade Ideas - Backtesting | Yes |

User experience

Merrill Edge’s design is among the best out of the brokers I review. It’s easy on the eyes and easy to navigate. Users suffering from icon and emoji overload will find a welcome refuge here. Everything is clearly labeled, there’s plenty of space, and the visual elements are appealing but not overdone. The platforms are rich with insights, data and handy explanations. Professional investment advisors would do well to look at Merrill’s Portfolio, Stock and Fund Stories and ask themselves if they do as good a job informing their clients as the job Edge does for its customers.

Merrill presents info in bite-sized chunks that frequently come with explanations and context. The five or 10 minutes it takes to read through a Portfolio Story is time well spent. Mine alerted me to which stocks and sectors are dominating my portfolio, which led me to thinking about how I could diversify further. Too many brokers emphasize short-term thinking through “what’s hot today” lists and charts. Merrill Edge has those lists too, but also encourages you to invest responsibly.

On the downside, I found Merrill Edge’s customer service to be maddening. Though the broker scored well in our third-party customer service testing, in my experience, the reps were ill-equipped to answer moderately complex questions. For example, a question about how to reset MarketPro, Merrill Edge’s browser trading platform, to its “factory default” setting led to extensive hold times, repeat calls, referrals to the wrong people (including to a third-party vendor) and ultimately filing a support ticket. This wasn’t an isolated occurrence. Instead of getting frustrated, I use my calls to Merrill’s support line as opportunities to work on being a kinder, more patient human being.

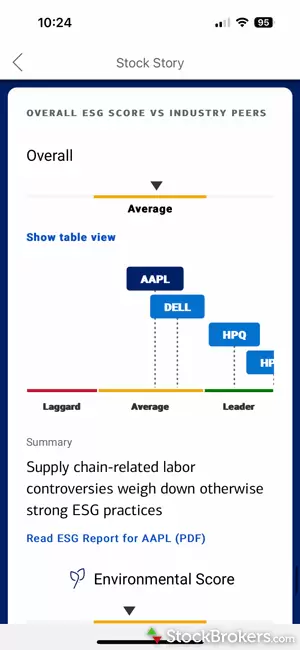

Research

Merrill Edge offers research for stocks, ETFs, and mutual funds that will satisfy the pickiest of investors. Merrill is also quite strong in environmental, social, and governance investing, or ESG.

Stock research: Merrill Edge offers several unique research tools found nowhere else, including Stock Story, Portfolio Story and Idea Builder. Also included are excellent third-party research integrations, including Trefis (company valuations), Trading Central (Recognia) for automated technical analysis, and 43 variables from MSCI ESG ratings, among others.

ETFs and mutual funds research: Merrill Edge is unique in that it uses both Morningstar and Lipper as its primary research providers. Thanks to this dual offering, Merrill Edge's ETF and mutual funds research is extremely thorough. Fund Story presents convenient, bite-sized chunks of relevant mutual fund info.

Bonds research: While the breadth of fixed income research at Merrill Edge isn’t quite as robust as at Fidelity, I found the fixed income reports from B of A Global Research to be high quality with in-depth coverage of news and fundamental analysis of the bond markets.

| Feature |

Merrill Edge Merrill Edge

|

|---|---|

| Research - Stocks | Yes |

| Stock Research - ESG | Yes |

| Stock Research - PDF Reports | 3 |

| Screener - Stocks | Yes |

| Research - ETFs | Yes |

| Screener - ETFs | Yes |

| Research - Mutual Funds | Yes |

| Screener - Mutual Funds | Yes |

| Research - Pink Sheets / OTCBB | Yes |

| Research - Bonds | Yes |

Education

Learning about investing and retirement is a pleasant experience at Merrill Edge, thanks to the excellent organization, high quality, and the breadth of topics covered. If you want to test your knowledge, there are quizzes. Unlike most brokers, Merrill’s education menu is available when you are logged in. Other brokers make education publicly available to get site traffic, which is inconvenient for logged-in clients who must log out to read content when it might matter the most.

Learning center: Resources in Merrill Edge’s Investor Education section feature an assortment of articles and online courses licensed from Morningstar that can be searched according to topic or your level of investing experience. They inform, but they won’t keep you on the edge of your seat, either.

Investing basics: Merrill offers an excellent set of curated webinars on different themes, including ETFs, technical analysis and options trading. The on-demand videos can be searched through topic and/or difficulty level.

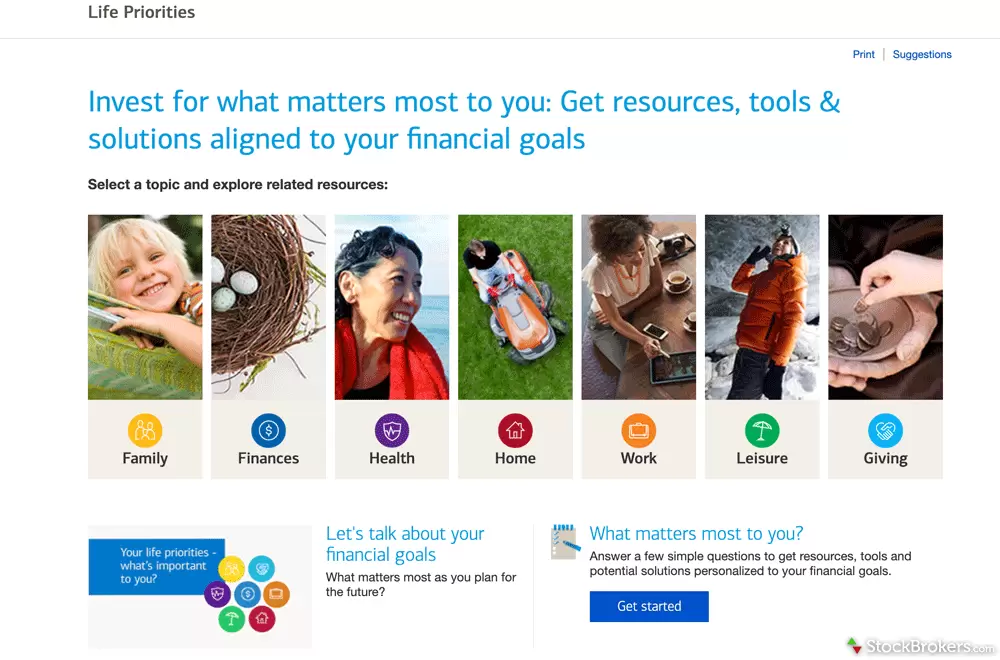

Life events education: Through Merrill Edge's Guidance and Retirement Center, customers can conduct goal planning for life events, use calculators to determine areas for improvement, read educational articles, watch videos, schedule one-on-one appointments, and more.

Podcasts: It’s worth mentioning that Merrill offers audio segments. The Merrill Perspective podcast discusses themes and current news topics. Though it’s driven by current events, it educates at the same time. We like it.

| Feature |

Merrill Edge Merrill Edge

|

|---|---|

| Education (Stocks) | Yes |

| Education (ETFs) | Yes |

| Education (Options) | Yes |

| Education (Mutual Funds) | Yes |

| Education (Bonds) | Yes |

| Education (Retirement) | Yes |

| Paper Trading | No |

| Videos | Yes |

| Webinars | Yes |

| Webinars (Archived) | Yes |

| Progress Tracking | No |

| Interactive Learning - Quizzes | Yes |

Customer service

To score Customer Service, StockBrokers.com partners with customer experience research firm Confero to conduct phone tests from locations throughout the United States. For this year's testing, 135 customer service tests were conducted over six weeks, with wait times logged for each call.

Customer service representatives were asked for assistance or details for prospective customers in several areas of broker services, including account opening, trading tools, apps, rollovers, active trading, and more. Here are the results for Merrill Edge.

- Average Connection Time: <1 minute

- Average Net Promoter Score: 9.1 / 10

- Average Professionalism Score: 9.4 / 10

- Overall Score: 9.3 / 10

- Ranking: 2nd of 13 brokers

Banking services

Merrill Edge is part of Bank of America, which offers a full suite of personal banking products, including savings accounts, checking accounts and credit cards. When it comes to banking and brokerage, Merrill Edge takes the crown thanks to seamless universal account management and its Preferred Rewards program.

Online banking services with Bank of America include $250,000 in FDIC-insured account protection. I’ve found moving back and forth between bank and brokerage accounts to be easy and efficient.

| Feature |

Merrill Edge Merrill Edge

|

|---|---|

| Bank (Member FDIC) | Yes |

| Checking Accounts | Yes |

| Savings Accounts | Yes |

| Credit Cards | Yes |

| Debit Cards | Yes |

| Mortgage Loans | Yes |

Final thoughts

Overall, Merrill Edge offers customers a superb, well-rounded offering. Investors will appreciate Merrill Edge's $0 trades, robust research and reliable customer service. Similarly, Bank of America customers will discover that Merrill Edge is an excellent extension of the Bank of America brand.

Here are our top findings on Merrill Edge for 2024:

- Proprietary tools such as Stock Story and Portfolio Story alongside robust educational resources make Merrill Edge is a standout for research, beginners and goal-focused investors.

- Merrill Edge remains our top pick for investors looking to manage banking and brokerage under one roof.

- While Merrill Edge offers a feature-rich trading platform (MarketPro), it didn't impress us enough to make our top picks lists for day trading. It’s great for fundamental research.

Read next

- Best Paper Trading Platforms of April 2024

- Best Futures Trading Platforms of April 2024

- Best Brokers for Penny Stock Trading of April 2024

- Best Day Trading Platforms of April 2024

- Best Stock Brokers for April 2024

- Best Stock Trading Apps of 2024

- Best Options Trading Platforms & Brokers

- Best Stock Trading Platforms for Beginners of April 2024

More Guides

Popular Stock Broker Reviews

What's the difference between Merrill Lynch and Merrill Edge?

Merrill Lynch is not the same as Merrill Edge, but they do share many resources and both are part of Bank of America. Merrill Lynch is a traditional full-service broker with financial advisors that serve affluent and emerging affluent investors. Merrill Lynch brokers are encouraged to focus on building and retaining relationships with wealthy clients. Merrill Edge is a discount online broker that has no account minimum and $0 commission stock and ETF trades while still providing some access to Merrill Lynch’s research and tools. Both are owned by Bank of America.

Can I trust Merrill Edge?

Yes, you can trust Merrill Edge. The broker is a subsidiary of Bank of America and the assets in your account are insured against insolvency (not market losses) from the Securities Investor Protection Corporation, or SIPC; the FDIC (bank cash deposits only); and Lloyd’s of London.

Is Merrill Edge good for beginners?

Merrill Edge is a top platform for beginner investors. It placed in our top 5 brokers for this category in our 2024 Annual Awards. Its Stock Story, Fund Story, and Portfolio Story features make investing a piece of cake. The downsides are missing out on fractional shares and paper portfolios.

What are the benefits of Merrill Edge?

Merrill Edge shares many features of other popular U.S. brokers, but it’s tops in the class for how it presents its information, thanks to its Stock, Fund, and Portfolio “Story” format. Like most other upper-tier online brokers, Edge offers $0 commission stock and ETF trading, useful analytical tools, and a browser trading platform.

Is there an app for Merrill Edge?

Yes, Merrill Edge has mobile apps for Android and iOS. The apps are generally easy to use and include the Merrill Edge Stock, Fund, and Portfolio Stories, which present highly relevant investing information in an easy-to-digest format.

Is a Merrill Edge account good?

Merrill Edge is a good choice for beginners, those interested in environmental, social and governance (ESG) investing, high net worth investors, and those looking to have their banking and investing experiences under one roof. Merrill Edge’s prices aren’t the lowest, but the prices are justified in the breadth and quality of their services.

How much money do you need to open a Merrill Edge account?

There is no minimum to open a Merrill Edge account. Certain services do require a minimum account balance. The robo-advisor portfolio management requires a $1,000 investment, and fully managed advisory services with an advisor carries a $20,000 minimum.

Does Merrill Edge have hidden fees?

Merrill Edge, like most U.S. online brokers, charges nothing for stock and ETF trades and there are no account fees. There are incidental charges, which can be found on its website. Unfortunately, its margin rates are not published, as they depend on the depth of the customer’s relationship with Bank of America and Merrill.

About Merrill Edge

Launched in 2010 and headquartered in Charlotte, North Carolina, Merrill Edge is the self-directed trading arm of Bank of America. Merrill Edge’s origins go all the way back to discount broker Quick & Reilly. Merrill Edge was originally created by Merrill Lynch, which became a subsidiary of Bank of America in 2008.

Merrill Edge 2024 Results

For the StockBrokers.com 2024 Annual Awards, announced on Jan. 23, 2024, all U.S. equity brokers we reviewed were assessed on over 200 different variables across eight areas: Commissions & Fees, Investment Options, Platforms & Tools, Research, Mobile Trading, Education, Ease of Use, and Overall.

StockBrokers.com also presented “Best in Class” awards to brokers for additional categories Beginners, Options Trading, Futures Trading, Day Trading, IRA Accounts, Investor Community, Penny Stock Trading, Bank Brokerage, High Net Worth Investors, and Customer Service. A “Best in Class” designation means finishing in the top five brokers for that category.

For more information, see how we test.

Category awards

Merrill Edge Merrill Edge

|

Overall | Research | Platforms & Tools | Mobile Trading Apps | Education | Ease of Use | Bank Brokerage | Beginners | Customer Service | IRA Accounts | Options Trading | High Net Worth Investors |

| Rank #1 | ||||||||||||

| Streak #1 | 10 | |||||||||||

| Best in Class | ||||||||||||

| Best in Class Streak | 2 | 11 | 1 | 2 | 10 | 2 | 10 | 4 | 3 | 5 | 2 | 1 |

Industry awards

Merrill Edge Merrill Edge

|

#1 Client Dashboard | #1 Overall Client Experience |

|---|---|---|

| Rank #1 | ||

| Streak | 4 | 7 |

Compare Merrill Edge Competitors

Select one or more of these brokers to compare against Merrill Edge.

Show allStockBrokers.com Review Methodology

Our mission at StockBrokers.com is simple: provide thorough and unbiased reviews of online brokers, based on an extraordinary level of hands-on testing and data collection. Our ratings and awards are based on this data and our in-house experts’ deep authority in the field; brokers cannot pay for preferential treatment. Here’s more about trustworthiness at StockBrokers.com.

Our research team conducts thorough testing on a wide range of features, products, services, and tools for U.S. investors, collecting and validating thousands of data points in the process; this makes StockBrokers.com home to the largest independent database on the web covering the online broker industry. We test all available trading platforms for each broker and evaluate them based on a host of data-driven variables. All research, writing and data collection at StockBrokers.com is done by humans, for humans. Read our generative AI policy here.

As part of our process, all brokers had the annual opportunity to provide updates and key milestones and complete an in-depth data profile, which we hand-checked for accuracy. Brokers also were offered the opportunity to provide executive time for an annual update meeting.

Our rigorous data validation process yields an error rate of less than .001% each year, providing site visitors quality data they can trust. Learn more about how we test.

Merrill Edge fees and features data

The data collection efforts at StockBrokers.com are unmatched in the industry. The following tables show a deeper dive into the offerings available at this broker. You can also compare its offerings side-by-side with those of other brokers using our Comparison Tool.

In addition to meticulous annual data collection by our in-house analyst, every broker that participates in our review is afforded the opportunity to complete an in-depth data profile. We then audit each data point to ensure its accuracy.

Trading fees

| Feature |

Merrill Edge Merrill Edge

|

|---|---|

| Minimum Deposit | $0.00 |

| Stock Trades | $0.00 |

| Mutual Fund Trade Fee | $19.95 |

| Options (Base Fee) | $0.00 |

| Options (Per Contract) | $0.65 |

| Futures (Per Contract) | (Not offered) |

| Broker Assisted Trade Fee | $29.95 |

Account fees

| Feature |

Merrill Edge Merrill Edge

|

|---|---|

| IRA Annual Fee | $0.00 |

| IRA Closure Fee | $49.95 |

| Account Transfer Out (Partial) | $0.00 |

| Account Transfer Out (Full) | $49.95 |

| Options Exercise Fee | $0.00 |

| Options Assignment Fee | $0.00 |

Margin rates

| Feature |

Merrill Edge Merrill Edge

|

|---|---|

| Margin Rate Under $25,000 | Varies |

| Margin Rate $25,000 to $49,999.99 | Varies |

| Margin Rate $50,000 to $99,999.99 | Varies |

| Margin Rate $100,000 to $249,999.99 | Varies |

| Margin Rate $250,000 to $499,999.99 | Varies |

| Margin Rate $500,000 to $999,999.99 | Varies |

| Margin Rate Above $1,000,000 | Varies |

Investment options

| Feature |

Merrill Edge Merrill Edge

|

|---|---|

| Stock Trading | Yes |

| Margin Trading | Yes |

| Fractional Shares | No |

| OTC Stocks | Yes |

| Options Trading | Yes |

| Complex Options Max Legs | 4 |

| Futures Trading | No |

| Forex Trading | No |

| Crypto Trading | No |

| Crypto Trading - Total Coins | 0 |

| Mutual Funds (No Load) | 2952 |

| Mutual Funds (Total) | 3466 |

| Bonds (US Treasury) | Yes |

| Bonds (Corporate) | Yes |

| Bonds (Municipal) | Yes |

| Advisor Services | Yes |

| International Countries (Stocks) | 0 |

Order types

| Feature |

Merrill Edge Merrill Edge

|

|---|---|

| Order Type - Market | Yes |

| Order Type - Limit | Yes |

| Order Type - After Hours | Yes |

| Order Type - Stop | Yes |

| Order Type - Trailing Stop | Yes |

| Order Type - OCO | No |

| Order Type - OTO | No |

| Order Type - Broker Assisted | Yes |

Beginners

| Feature |

Merrill Edge Merrill Edge

|

|---|---|

| Education (Stocks) | Yes |

| Education (ETFs) | Yes |

| Education (Options) | Yes |

| Education (Mutual Funds) | Yes |

| Education (Bonds) | Yes |

| Education (Retirement) | Yes |

| Retirement Calculator | Yes |

| Investor Dictionary | Yes |

| Paper Trading | No |

| Videos | Yes |

| Webinars | Yes |

| Webinars (Archived) | Yes |

| Progress Tracking | No |

| Interactive Learning - Quizzes | Yes |

Stock trading apps

| Feature |

Merrill Edge Merrill Edge

|

|---|---|

| iPhone App | Yes |

| Android App | Yes |

| Apple Watch App | Yes |

| Trading - Stocks | Yes |

| Trading - After-Hours | Yes |

| Trading - Simple Options | Yes |

| Trading - Complex Options | Yes |

| Order Ticket RT Quotes | Yes |

| Order Ticket SRT Quotes | No |

Stock app features

| Feature |

Merrill Edge Merrill Edge

|

|---|---|

| Market Movers (Top Gainers) | Yes |

| Stream Live TV | No |

| Videos on Demand | No |

| Stock Alerts | Yes |

| Option Chains Viewable | Yes |

| Watch List (Real-time) | Yes |

| Watch List (Streaming) | Yes |

| Watch Lists - Create & Manage | Yes |

| Watch Lists - Column Customization | No |

| Watch Lists - Total Fields | 285 |

Stock app charting

| Feature |

Merrill Edge Merrill Edge

|

|---|---|

| Charting - After-Hours | No |

| Charting - Can Turn Horizontally | Yes |

| Charting - Multiple Time Frames | Yes |

| Charting - Technical Studies | 34 |

| Charting - Study Customizations | Yes |

| Charting - Stock Comparisons | Yes |

Trading platforms overview

| Feature |

Merrill Edge Merrill Edge

|

|---|---|

| Active Trading Platform | Merrill Edge Market Pro |

| Desktop Trading Platform | No |

| Desktop Platform (Mac) | No |

| Web Trading Platform | Yes |

| Paper Trading | No |

| Trade Journal | No |

| Watch Lists - Total Fields | 285 |

Trading platform stock chart features

| Feature |

Merrill Edge Merrill Edge

|

|---|---|

| Charting - Adjust Trades on Chart | Yes |

| Charting - Indicators / Studies | 104 |

| Charting - Drawing Tools | 23 |

| Charting - Notes | Yes |

| Charting - Index Overlays | Yes |

| Charting - Historical Trades | Yes |

| Charting - Corporate Events | Yes |

| Charting - Custom Date Range | Yes |

| Charting - Custom Time Bars | Yes |

| Charting - Automated Analysis | Yes |

| Charting - Save Profiles | Yes |

| Trade Ideas - Technical Analysis | Yes |

| Charting - Study Customizations | 8 |

| Charting - Custom Studies | No |

Day trading features

| Feature |

Merrill Edge Merrill Edge

|

|---|---|

| Streaming Time & Sales | Yes |

| Streaming TV | No |

| Direct Market Routing - Stocks | No |

| Ladder Trading | No |

| Trade Hot Keys | No |

| Level 2 Quotes - Stocks | Yes |

| Trade Ideas - Backtesting | Yes |

| Trade Ideas - Backtesting Adv | No |

| Short Locator | No |

| Order Liquidity Rebates | No |

Investment research overview

| Feature |

Merrill Edge Merrill Edge

|

|---|---|

| Research - Stocks | Yes |

| Research - ETFs | Yes |

| Research - Mutual Funds | Yes |

| Research - Pink Sheets / OTCBB | Yes |

| Research - Bonds | Yes |

| Screener - Stocks | Yes |

| Screener - ETFs | Yes |

| Screener - Mutual Funds | Yes |

| Screener - Bonds | Yes |

| Misc - Portfolio Allocation | Yes |

Stock research features

| Feature |

Merrill Edge Merrill Edge

|

|---|---|

| Stock Research - PDF Reports | 3 |

| Stock Research - Earnings | Yes |

| Stock Research - Insiders | Yes |

| Stock Research - Social | No |

| Stock Research - News | Yes |

| Stock Research - ESG | Yes |

| Stock Research - SEC Filings | Yes |

ETF research features

| Feature |

Merrill Edge Merrill Edge

|

|---|---|

| ETFs - Strategy Overview | Yes |

| ETF Fund Facts - Inception Date | Yes |

| ETF Fund Facts - Expense Ratio | Yes |

| ETF Fund Facts - Net Assets | Yes |

| ETF Fund Facts - Total Holdings | Yes |

| ETFs - Top 10 Holdings | Yes |

| ETFs - Sector Exposure | Yes |

| ETFs - Risk Analysis | Yes |

| ETFs - Ratings | Yes |

| ETFs - Morningstar StyleMap | Yes |

| ETFs - PDF Reports | Yes |

Mutual fund research features

| Feature |

Merrill Edge Merrill Edge

|

|---|---|

| Mutual Funds - Strategy Overview | Yes |

| Mutual Funds - Performance Chart | Yes |

| Mutual Funds - Performance Analysis | Yes |

| Mutual Funds - Prospectus | Yes |

| Mutual Funds - 3rd Party Ratings | Yes |

| Mutual Funds - Fees Breakdown | Yes |

| Mutual Funds - Top 10 Holdings | Yes |

| Mutual Funds - Asset Allocation | Yes |

| Mutual Funds - Sector Allocation | Yes |

| Mutual Funds - Country Allocation | Yes |

| Mutual Funds - StyleMap | Yes |

Options trading overview

| Feature |

Merrill Edge Merrill Edge

|

|---|---|

| Option Chains - Basic View | Yes |

| Option Chains - Strategy View | Yes |

| Option Chains - Streaming | Yes |

| Option Chains - Total Columns | 68 |

| Option Chains - Greeks | 5 |

| Option Chains - Quick Analysis | Yes |

| Option Analysis - P&L Charts | Yes |

| Option Probability Analysis | Yes |

| Option Probability Analysis Adv | No |

| Option Positions - Greeks | Yes |

| Option Positions - Greeks Streaming | Yes |

| Option Positions - Adv Analysis | Yes |

| Option Positions - Rolling | Yes |

| Option Positions - Grouping | Yes |

Banking features

| Feature |

Merrill Edge Merrill Edge

|

|---|---|

| Bank (Member FDIC) | Yes |

| Checking Accounts | Yes |

| Savings Accounts | Yes |

| Credit Cards | Yes |

| Debit Cards | Yes |

| Mortgage Loans | Yes |

Customer service options

| Feature |

Merrill Edge Merrill Edge

|

|---|---|

| Phone Support (Prospect Customers) | No |

| Phone Support (Current Customers) | Yes |

| Email Support | No |

| Live Chat (Prospect Customers) | Yes |

| Live Chat (Current Customers) | Yes |

| 24/7 Support | Yes |