TradeStation Review

TradeStation has a freshly updated mobile app, but the company will probably always be known for its flagship desktop platform. All brokers let you follow your investments, and some provide solid research. TradeStation focuses on finding opportunities. Infrequent and low balance traders should watch out for steep inactivity fees.

-

Minimum Deposit:

$0.00 -

Stock Trades:

$0.00 -

Options (Per Contract):

$0.60

Recent news

January 2024: Crypto ETFs. TradeStation now allows trading of spot bitcoin ETFs in brokerage accounts.

Pros & Cons

Pros

- The web trading platform is well thought-out, especially its wonderfully customizable watch lists.

- If you’re willing to learn the proprietary EasyLanguage, you can code completely automated trading.

Cons

- The user experience can be frustrating.

- Mutual fund orders must be phoned in.

- No third-party fundamental research is available, and everyday investor education is thin.

Overall summary

| Feature |

TradeStation TradeStation

|

|---|---|

| Overall |

|

| Investment Options |

|

| Commissions & Fees |

|

| Mobile Trading Apps |

|

| Platforms & Tools |

|

| Research |

|

| Customer Service |

|

| Education |

|

| Ease Of Use |

|

Investment options

TradeStation gives its customers access to a robust offering of trading products. Clients may trade stocks, ETFs, futures, and options. Features include comprehensive direct-market routing, numerous advanced order types, IPO access, and more.

Dividend reinvestment plans (DRIPs) are not offered at TradeStation and all orders for mutual funds can’t be ordered online. The broker does not offer fractional shares or forex trading, nor is there international trading.

| Feature |

TradeStation TradeStation

|

|---|---|

| Stock Trading | Yes |

| Margin Trading | Yes |

| Fractional Shares | No |

| OTC Stocks | Yes |

| Options Trading | Yes |

| Complex Options Max Legs | 4 |

| Bonds (US Treasury) | Yes |

| Futures Trading | Yes |

| Forex Trading | No |

| Mutual Funds (Total) | 4000 |

| Crypto Trading | No |

| Crypto Trading - Total Coins | 0 |

| Traditional IRAs | Yes |

| Roth IRAs | Yes |

| Advisor Services | No |

Commissions and fees

The retail-oriented TS Select pricing plan offers $0 trades, includes some free market data and has no monthly platform charges. Traders may have to subscribe to data they could get free or less expensively elsewhere, depending on what and how they trade.

TS Select: TradeStation's most commonly used pricing structure includes access to all three of TradeStation’s trading platforms. With TS Select, all stock trades, including ETFs, are $0; options trades run $.60 per contract; and futures are $1.50 per contract (per side).

TradeStation Salutes: TradeStation encourages active military personnel, veterans, and first responders to sign up for the TradeStation Salutes program, which offers free stock, ETF, and options trades. Good on you, TS.

Penny stocks: Under TS Select, penny stock trades are $0 for the first 10,000 shares and $0.005 per share after that (and an extra $0.005 per share if you direct the order to a specific venue).

Inactivity fees: The inactivity fee is a bummer. It’s $10 per month, which is waived if you trade 10 times in the prior 90 days or maintain an average equity balance of $5,000 or more in the prior month.

Other fees: Like all brokers, TradeStation charges incidental fees, and TradeStation’s fee schedule is complicated. We noticed the charge to transfer out, whether it’s some of your positions or all of them, is $125, which is high. There’s an annual IRA fee of $35 and a closure fee of $50. IRA annual fees are unusual.

Paper checks: TradeStation does not mail paper checks. A representative told me via a chat this policy is to prevent the spread of COVID-19. That strikes me as odd. I imagine a broker of TradeStation’s size would use automation to print checks and send them out. Strangely, they do accept paper deposits from retail clients.

| Feature |

TradeStation TradeStation

|

|---|---|

| Minimum Deposit | $0.00 |

| Stock Trades | $0.00 |

| Penny Stock Fees (OTC) | $0.01 |

| ETF Trade Fee | $0.00 |

| Options (Base Fee) | $0.00 |

| Options (Per Contract) | $0.60 |

| Options Exercise Fee | $14.95 |

| Options Assignment Fee | $5.95 |

| Futures (Per Contract) | $1.50 |

| Mutual Fund Trade Fee | $14.95 |

| Broker Assisted Trade Fee | $25 |

Mobile trading apps

TradeStation's new mobile app has a fresh design that feels friendlier than the last version. You can see your account positions on the mobile app, but beyond that, there’s little commonality between the standard-bearing desktop platform and the mobile app.

Thanks to Matrix (ladder) trading and complex options trading support, mobile day traders can zip their money around the markets with ease. The app is smooth and responsive, and bracket orders are supported.

Watch lists and hot lists: While mobile watch lists automatically sync with the Web Trading platform, they do not sync with the TradeStation desktop platform. On the positive side, there are dozens of predefined screeners available in the Hot Lists section to scan the market.

Charting: In my last review, I said TradeStation’s mobile charting was awkward, and I’m happy to say that’s no longer the case. Mobile charting is much improved.

The chart area is clean and includes most features a casual trader would want: four chart types, seven drawing tools, after-hours visibility, active and filled order visibility, and a good roster of indicators, though nowhere near the staggering array of choices on the desktop, which is fine. There isn’t a landscape chart view, but the charts are so crisp that I don’t miss it.

| Feature |

TradeStation TradeStation

|

|---|---|

| iPhone App | Yes |

| Android App | Yes |

| Apple Watch App | No |

| Stock Alerts | Yes |

| Charting - After-Hours | Yes |

| Charting - Technical Studies | 45 |

| Charting - Study Customizations | Yes |

| Watch List (Streaming) | Yes |

| Watch Lists - Create & Manage | Yes |

| Watch Lists - Column Customization | Yes |

Other trading platforms and tools

TradeStation offers three other trading platforms: TradeStation desktop; Web Trading, which is a browser-based platform designed for traders seeking simplicity; and futures options traders should check out Futures Plus, which is available on browser and mobile.

Finicky traders (like me) will gravitate to the desktop platform. Unfortunately for Mac users, it’s only available for Windows. Happily, I had no difficulty running it on my Mac laptop (M1 chip) running Parallels Desktop.

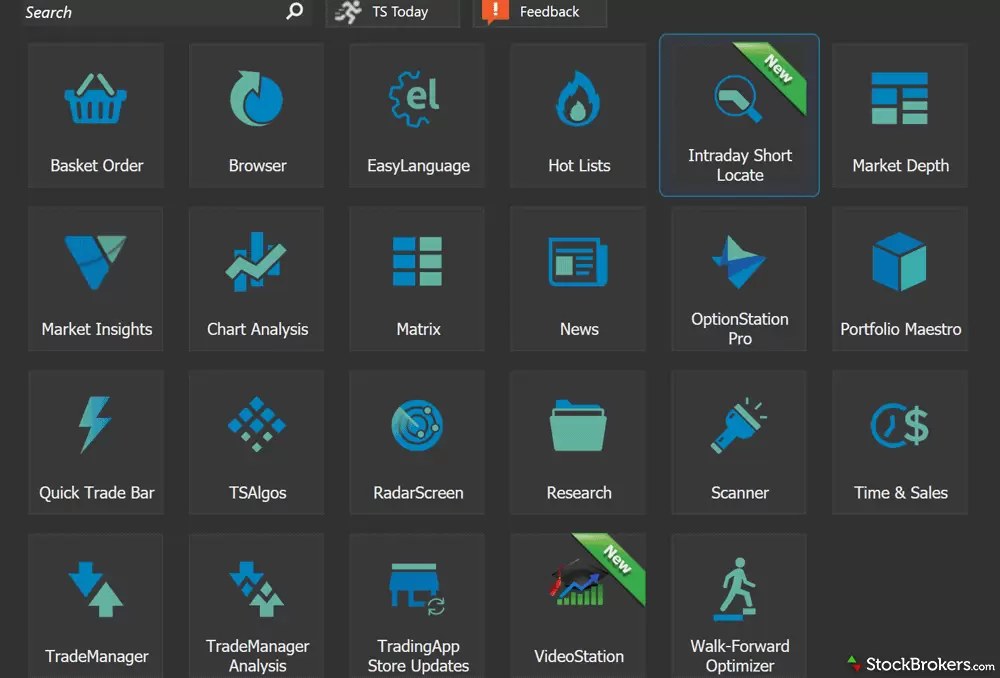

TradeStation desktop tools: The functionality provided in TradeStation’s flagship desktop platform is chock-full of widgets. Tools in the TradeStation arsenal include Radar Screen (real-time streaming watch lists with customizable columns), Scanner (custom screening), Matrix (ladder trading), and Walk-Forward Optimizer (advanced strategy testing), among others. Using TradeStation's proprietary coding language, EasyLanguage, traders can even code apps for the platform and make them available in TradeStation's TradingApp Store.

TradeStation desktop user experience: I have a 55-inch monitor on my desk, and when I’m using TradeStation’s desktop app, I still find myself wishing for more screen space, even if it makes my eyes roll around like a chameleon’s. Other brokers’ desktop apps don’t leave me with that feeling. It’s partly because TradeStation is powerful enough to make me feel as if I could view all the opportunities in the market… If. I. Can. Just. Configure. Everything. Just Right.

That brings me to another point: Don’t expect TradeStation’s default settings to knock your socks off the first time you boot it up. There’s a learning curve and endless tweakability. If you can’t find what you’re looking for among the hundreds of technical studies and indicators, you can code your own solution using their proprietary EasyLanguage, or go even further by coding in entry and exit rules to automatically trade your positions.

The tools are great, but we think its user experience comes across as a bit stale compared to the other top desktop platforms we reviewed. Some of the widgets remind us of Windows 95. Happily, that only applies to the desktop version and not the web platform, the mobile app.

TradeStation desktop charting: More than 30 years of historical data are viewable for stock charts, which is stupendously great for backtesting strategies. Furthermore, close to 300 indicators/studies are available, many of which can be reworked or adjusted to your specifications using EasyLanguage.

Options trading: Options trading is a breeze using OptionStation Pro, a built-in tool within the TradeStation desktop platform designed for streamlined trading and robust analysis. Options tool capabilities include custom grouping for current positions, streaming real-time Greeks, and advanced position analysis.

Futures trading: Futures traders will also find themselves right at home with the TradeStation desktop. Many of the advanced tools used for trading equities apply to futures trading, creating a seamless trading experience.

TradeStation web: The browser version is easy to use and gives traders a way to manage active positions, open orders, set up watch lists, conduct stock chart analysis, and place trades with ease (ladder trading via Matrix included). The chart-trading functionality alone is excellent. As a reminder, watch lists don’t sync with the desktop, which is a bit annoying for traders who use both.

| Feature |

TradeStation TradeStation

|

|---|---|

| Active Trading Platform | TradeStation 10 |

| Desktop Trading Platform | Yes |

| Desktop Platform (Mac) | No |

| Web Trading Platform | Yes |

| Paper Trading | Yes |

| Trade Journal | No |

| Watch Lists - Total Fields | 341 |

| Charting - Indicators / Studies | 294 |

| Charting - Drawing Tools | 23 |

| Charting - Study Customizations | 12 |

| Charting - Save Profiles | Yes |

| Trade Ideas - Technical Analysis | Yes |

| Streaming Time & Sales | Yes |

| Trade Ideas - Backtesting | Yes |

Research

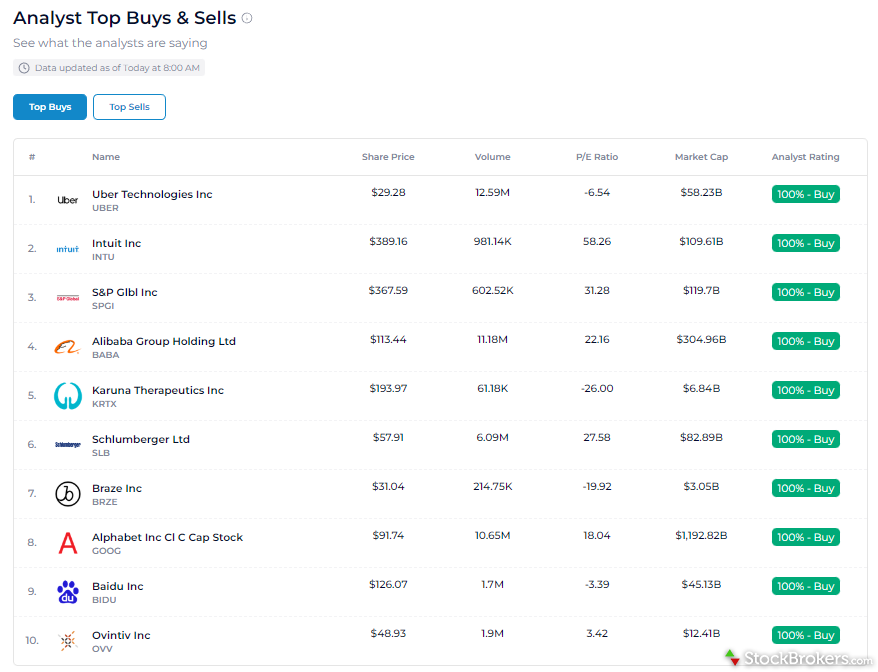

Like its nipping-at-its-heels competitor tastytrade, TradeStation is not built for performing the thoughtful, in-depth company research you’d find in a Wall Street analyst’s stock report. It is, however, excellent at finding trading signals. Do you want to find stocks with a Three Stars in the South candlestick pattern? Sure, no problem.

Stock research: You’ll find full stock and options screening, equity backtesting, and streaming futures and forex data. You can use fundamental data in backtests, custom indicators, and trading rules, but you’ll have to hit the books; the fundamentals aren’t as fully developed as the huge menus of preconfigured studies driven by price, volume, time, and volatility.

You can create indicators and rules that combine both technical and fundamental data. It takes a deep and long dive into the thorough TradeStation documentation to do it, but any reasonably proficient theoretical physicist or software engineer should have no problem whatsoever.

ETFs and mutual funds research: TradeStation does not offer the PDF reports available at many other brokers.

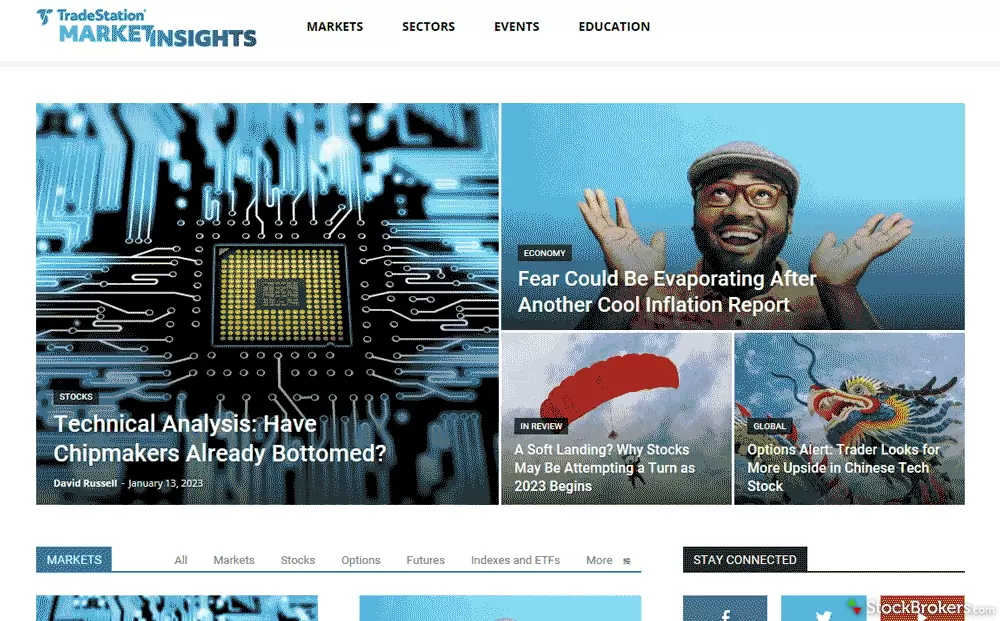

Market commentary: In-house writers provide high-quality, news-driven content on the home page under the Learn tab. I think it deserves to be more prominently featured and separated from the educational content. The news feeds offer excellent filtering options.

To sum up the research capabilities, if you like to find and develop your own trading ideas, TradeStation should be one of the first brokers you consider. If you prefer to rely on others’ opinions on stocks, you’ll most likely be disappointed. You’ll find more analyst write-ups at industry leaders such as Fidelity, Charles Schwab, and E*TRADE.

| Feature |

TradeStation TradeStation

|

|---|---|

| Research - Stocks | Yes |

| Stock Research - ESG | No |

| Stock Research - PDF Reports | 0 |

| Screener - Stocks | Yes |

| Research - ETFs | Yes |

| Screener - ETFs | No |

| Research - Mutual Funds | No |

| Screener - Mutual Funds | No |

| Research - Pink Sheets / OTCBB | Yes |

| Research - Bonds | No |

Education

Learning center: The Learn tab on the TradeStation home links to educational articles that include novice trader topics. There’s a heap of thorough material to help new clients learn how to use the TradeStation desktop platform, which is almost obligatory given its complexity.

| Feature |

TradeStation TradeStation

|

|---|---|

| Education (Stocks) | Yes |

| Education (ETFs) | No |

| Education (Options) | Yes |

| Education (Mutual Funds) | No |

| Education (Bonds) | No |

| Education (Retirement) | No |

| Paper Trading | Yes |

| Videos | Yes |

| Webinars | Yes |

| Webinars (Archived) | Yes |

| Progress Tracking | No |

| Interactive Learning - Quizzes | No |

Customer service

To score Customer Service, StockBrokers.com partners with customer experience research firm Confero to conduct phone tests from locations throughout the United States. For this year's testing, 135 customer service tests were conducted over six weeks, with wait times logged for each call.

Customer service representatives were asked for assistance or details for prospective customers in several areas of broker services, including account opening, trading tools, apps, rollovers, active trading, and more. Here are the results for TradeStation.

- Average Connection Time: <1 minute

- Average Net Promoter Score: 7.8 / 10

- Average Professionalism Score: 7.8 / 10

- Overall Score: 7.98 / 10

- Ranking: 7th of 13 brokers

Final thoughts

Active traders will feel right at home with TradeStation's desktop platform. It ranks among the best for rules-based trading. Casual traders will appreciate the TradeStation web trading platform and the mobile app, thanks to their simplicity and ease of use.

Here are our three top takeaways for TradeStation:

- TradeStation’s unique advantage lies in its desktop’s customizability, but you’ll need to invest time in learning it.

- The mobile and web trading platforms are good starting points for beginning traders if they can avoid paying the inactivity fees.

- Long-term investors hoping for Wall Street analysis and financial planning calculators will be happier at other brokers.

Read next

- Best Futures Trading Platforms of April 2024

- Best Brokers for Penny Stock Trading of April 2024

- Best Stock Trading Platforms for Beginners of April 2024

- Best Stock Brokers for April 2024

- Best Options Trading Platforms & Brokers

- Best Stock Trading Apps of 2024

- Best Day Trading Platforms of April 2024

- Best Paper Trading Platforms of April 2024

More Guides

Popular Stock Broker Reviews

Can TradeStation be trusted?

Yes, TradeStation can be trusted. It’s a well-established broker that traces its roots back to 1982. TradeStation is regulated by the Financial Industry Regulation Authority, or FINRA, in the same manner as other online brokers in the United States.

Is TradeStation good for beginners?

We think there are better trading platforms for beginners for people who are just starting to invest. TradeStation’s target market is active traders, not novices. It doesn’t have nearly the depth of educational content and isn’t as easy to use as our 2024 Best Overall winner, Fidelity. TradeStation also charges inactivity fees if you keep a low account balance and trade infrequently.

Is TradeStation easy to use?

TradeStation’s web trading platform and mobile app are easy enough to use. The desktop application has a learning curve, due to sophisticated tools and a less intuitive user interface. There is, however, a host of tutorials for the desktop app.

Is TradeStation really free?

TS Select, the broker’s most commonly used retail pricing plan, offers $0 stock and ETF trades, up to 10,000 shares, on all platforms. Options and futures contracts do carry fees. Regulatory bodies and exchanges add on small costs, but that’s true for all brokers. Small and infrequent investors should be wary of a steep $10 per month inactivity fee, which is waived under certain conditions.

How much does TradeStation cost per month?

TradeStation recently simplified its commission structure. Retail clients pay $0.00 commissions on ETF and stock trades up to 10,000 shares. The mobile, web and downloadable trading platform are free and there are no minimum deposits. Military personnel and veterans can get a unique pricing plan, TS Salutes.

What is the minimum deposit for TradeStation?

There is no minimum deposit at TradeStation to open an account or use its trading platforms. You will need $2,000 to use a margin account, but that’s a regulatory requirement that applies to all U.S. brokers. Maintaining a trailing 30-day average equity of $5,000 avoids inactivity fees.

Does TradeStation have withdrawal fees?

Outgoing wires are $25 at TradeStation. There is no fee for an ACH withdrawal. Paper checks are not available.

Can I day trade at TradeStation?

TradeStation is an excellent choice for day traders, thanks to its sophisticated downloadable trading platform and day trading margin of 25%.

Can you trade crypto with TradeStation?

While TradeStation discontinued regular crypto trading in 2024 (formerly on its TradeStation Crypto account), the broker still offers crypto futures and ETFs.

About TradeStation

Headquartered in Plantation, Florida, TradeStation is a wholly owned subsidiary of Monex Group, Inc. TradeStation's roots date back to 1982, when the company was formed under the name Omega Research. The company's flagship TradeStation platform was launched in 1991, and TradeStation Group was a NASDAQ listed company from 1997-2011,when it was acquired by Monex Group.

TradeStation 2024 Results

For the StockBrokers.com 2024 Annual Awards, announced on Jan. 23, 2024, all U.S. equity brokers we reviewed were assessed on over 200 different variables across eight areas: Commissions & Fees, Investment Options, Platforms & Tools, Research, Mobile Trading, Education, Ease of Use, and Overall.

StockBrokers.com also presented “Best in Class” awards to brokers for additional categories Beginners, Options Trading, Futures Trading, Active Trading, IRA Accounts, Investor Community, Penny Stock Trading, Banking Services and Customer Service. A “Best in Class” designation means finishing in the top five brokers for that category.

For more information, see how we test. New to investing? Check out the 5 step guide on how to invest on our sister site, investor.com.

Category awards

TradeStation TradeStation

|

Investment Options | Day Trading | Futures Trading | Penny Stock Trading |

| Rank #1 | ||||

| Streak #1 | ||||

| Best in Class | ||||

| Best in Class Streak | 2 | 13 | 5 | 2 |

Compare TradeStation Competitors

Select one or more of these brokers to compare against TradeStation.

Show allStockBrokers.com Review Methodology

Our mission at StockBrokers.com is simple: provide thorough and unbiased reviews of online brokers, based on an extraordinary level of hands-on testing and data collection. Our ratings and awards are based on this data and our in-house experts’ deep authority in the field; brokers cannot pay for preferential treatment. Here’s more about trustworthiness at StockBrokers.com.

Our research team conducts thorough testing on a wide range of features, products, services, and tools for U.S. investors, collecting and validating thousands of data points in the process; this makes StockBrokers.com home to the largest independent database on the web covering the online broker industry. We test all available trading platforms for each broker and evaluate them based on a host of data-driven variables. All research, writing and data collection at StockBrokers.com is done by humans, for humans. Read our generative AI policy here.

As part of our process, all brokers had the annual opportunity to provide updates and key milestones and complete an in-depth data profile, which we hand-checked for accuracy. Brokers also were offered the opportunity to provide executive time for an annual update meeting.

Our rigorous data validation process yields an error rate of less than .001% each year, providing site visitors quality data they can trust. Learn more about how we test.

TradeStation fees and features data

The data collection efforts at StockBrokers.com are unmatched in the industry. The following tables show a deeper dive into the offerings available at this broker. You can also compare its offerings side-by-side with those of other brokers using our Comparison Tool.

In addition to meticulous annual data collection by our in-house analyst, every broker that participates in our review is afforded the opportunity to complete an in-depth data profile. We then audit each data point to ensure its accuracy.

Trading fees

| Feature |

TradeStation TradeStation

|

|---|---|

| Minimum Deposit | $0.00 |

| Stock Trades | $0.00 |

| Mutual Fund Trade Fee | $14.95 |

| Options (Base Fee) | $0.00 |

| Options (Per Contract) | $0.60 |

| Futures (Per Contract) | $1.50 |

| Broker Assisted Trade Fee | $25 |

Account fees

| Feature |

TradeStation TradeStation

|

|---|---|

| IRA Annual Fee | $35.00 |

| IRA Closure Fee | $50.00 |

| Account Transfer Out (Partial) | $125.00 |

| Account Transfer Out (Full) | $125.00 |

| Options Exercise Fee | $14.95 |

| Options Assignment Fee | $5.95 |

Margin rates

| Feature |

TradeStation TradeStation

|

|---|---|

| Margin Rate Under $25,000 | 13.5% |

| Margin Rate $25,000 to $49,999.99 | 13.5% |

| Margin Rate $50,000 to $99,999.99 | 12.5% |

| Margin Rate $100,000 to $249,999.99 | 12.5% |

| Margin Rate $250,000 to $499,999.99 | 12.5% |

| Margin Rate $500,000 to $999,999.99 | 8% |

| Margin Rate Above $1,000,000 | 8% |

Investment options

| Feature |

TradeStation TradeStation

|

|---|---|

| Stock Trading | Yes |

| Margin Trading | Yes |

| Fractional Shares | No |

| OTC Stocks | Yes |

| Options Trading | Yes |

| Complex Options Max Legs | 4 |

| Futures Trading | Yes |

| Forex Trading | No |

| Crypto Trading | No |

| Crypto Trading - Total Coins | 0 |

| Mutual Funds (No Load) | 800 |

| Mutual Funds (Total) | 4000 |

| Bonds (US Treasury) | Yes |

| Bonds (Corporate) | Yes |

| Bonds (Municipal) | Yes |

| Advisor Services | No |

| International Countries (Stocks) | 0 |

Order types

| Feature |

TradeStation TradeStation

|

|---|---|

| Order Type - Market | Yes |

| Order Type - Limit | Yes |

| Order Type - After Hours | Yes |

| Order Type - Stop | Yes |

| Order Type - Trailing Stop | Yes |

| Order Type - OCO | Yes |

| Order Type - OTO | Yes |

| Order Type - Broker Assisted | Yes |

Beginners

| Feature |

TradeStation TradeStation

|

|---|---|

| Education (Stocks) | Yes |

| Education (ETFs) | No |

| Education (Options) | Yes |

| Education (Mutual Funds) | No |

| Education (Bonds) | No |

| Education (Retirement) | No |

| Retirement Calculator | No |

| Investor Dictionary | No |

| Paper Trading | Yes |

| Videos | Yes |

| Webinars | Yes |

| Webinars (Archived) | Yes |

| Progress Tracking | No |

| Interactive Learning - Quizzes | No |

Stock trading apps

| Feature |

TradeStation TradeStation

|

|---|---|

| iPhone App | Yes |

| Android App | Yes |

| Apple Watch App | No |

| Trading - Stocks | Yes |

| Trading - After-Hours | Yes |

| Trading - Simple Options | Yes |

| Trading - Complex Options | Yes |

| Order Ticket RT Quotes | Yes |

| Order Ticket SRT Quotes | Yes |

Stock app features

| Feature |

TradeStation TradeStation

|

|---|---|

| Market Movers (Top Gainers) | Yes |

| Stream Live TV | No |

| Videos on Demand | No |

| Stock Alerts | Yes |

| Option Chains Viewable | Yes |

| Watch List (Real-time) | Yes |

| Watch List (Streaming) | Yes |

| Watch Lists - Create & Manage | Yes |

| Watch Lists - Column Customization | Yes |

| Watch Lists - Total Fields | 341 |

Stock app charting

| Feature |

TradeStation TradeStation

|

|---|---|

| Charting - After-Hours | Yes |

| Charting - Can Turn Horizontally | No |

| Charting - Multiple Time Frames | Yes |

| Charting - Technical Studies | 45 |

| Charting - Study Customizations | Yes |

| Charting - Stock Comparisons | No |

Trading platforms overview

| Feature |

TradeStation TradeStation

|

|---|---|

| Active Trading Platform | TradeStation 10 |

| Desktop Trading Platform | Yes |

| Desktop Platform (Mac) | No |

| Web Trading Platform | Yes |

| Paper Trading | Yes |

| Trade Journal | No |

| Watch Lists - Total Fields | 341 |

Trading platform stock chart features

| Feature |

TradeStation TradeStation

|

|---|---|

| Charting - Adjust Trades on Chart | Yes |

| Charting - Indicators / Studies | 294 |

| Charting - Drawing Tools | 23 |

| Charting - Notes | Yes |

| Charting - Index Overlays | Yes |

| Charting - Historical Trades | Yes |

| Charting - Corporate Events | Yes |

| Charting - Custom Date Range | Yes |

| Charting - Custom Time Bars | Yes |

| Charting - Automated Analysis | Yes |

| Charting - Save Profiles | Yes |

| Trade Ideas - Technical Analysis | Yes |

| Charting - Study Customizations | 12 |

| Charting - Custom Studies | Yes |

Day trading features

| Feature |

TradeStation TradeStation

|

|---|---|

| Streaming Time & Sales | Yes |

| Streaming TV | No |

| Direct Market Routing - Stocks | Yes |

| Ladder Trading | Yes |

| Trade Hot Keys | Yes |

| Level 2 Quotes - Stocks | Yes |

| Trade Ideas - Backtesting | Yes |

| Trade Ideas - Backtesting Adv | Yes |

| Short Locator | Yes |

| Order Liquidity Rebates | Yes |

Investment research overview

| Feature |

TradeStation TradeStation

|

|---|---|

| Research - Stocks | Yes |

| Research - ETFs | Yes |

| Research - Mutual Funds | No |

| Research - Pink Sheets / OTCBB | Yes |

| Research - Bonds | No |

| Screener - Stocks | Yes |

| Screener - ETFs | No |

| Screener - Mutual Funds | No |

| Screener - Bonds | No |

| Misc - Portfolio Allocation | Yes |

Stock research features

| Feature |

TradeStation TradeStation

|

|---|---|

| Stock Research - PDF Reports | 0 |

| Stock Research - Earnings | No |

| Stock Research - Insiders | No |

| Stock Research - Social | No |

| Stock Research - News | Yes |

| Stock Research - ESG | No |

| Stock Research - SEC Filings | No |

ETF research features

| Feature |

TradeStation TradeStation

|

|---|---|

| ETFs - Strategy Overview | No |

| ETF Fund Facts - Inception Date | No |

| ETF Fund Facts - Expense Ratio | No |

| ETF Fund Facts - Net Assets | No |

| ETF Fund Facts - Total Holdings | No |

| ETFs - Top 10 Holdings | No |

| ETFs - Sector Exposure | No |

| ETFs - Risk Analysis | No |

| ETFs - Ratings | No |

| ETFs - Morningstar StyleMap | No |

| ETFs - PDF Reports | No |

Mutual fund research features

| Feature |

TradeStation TradeStation

|

|---|---|

| Mutual Funds - Strategy Overview | No |

| Mutual Funds - Performance Chart | No |

| Mutual Funds - Performance Analysis | No |

| Mutual Funds - Prospectus | No |

| Mutual Funds - 3rd Party Ratings | Yes |

| Mutual Funds - Fees Breakdown | No |

| Mutual Funds - Top 10 Holdings | No |

| Mutual Funds - Asset Allocation | No |

| Mutual Funds - Sector Allocation | No |

| Mutual Funds - Country Allocation | No |

| Mutual Funds - StyleMap | No |

Options trading overview

| Feature |

TradeStation TradeStation

|

|---|---|

| Option Chains - Basic View | Yes |

| Option Chains - Strategy View | Yes |

| Option Chains - Streaming | Yes |

| Option Chains - Total Columns | 29 |

| Option Chains - Greeks | 5 |

| Option Chains - Quick Analysis | Yes |

| Option Analysis - P&L Charts | Yes |

| Option Probability Analysis | Yes |

| Option Probability Analysis Adv | Yes |

| Option Positions - Greeks | Yes |

| Option Positions - Greeks Streaming | Yes |

| Option Positions - Adv Analysis | Yes |

| Option Positions - Rolling | Yes |

| Option Positions - Grouping | Yes |

Banking features

| Feature |

TradeStation TradeStation

|

|---|---|

| Bank (Member FDIC) | No |

| Checking Accounts | No |

| Savings Accounts | No |

| Credit Cards | No |

| Debit Cards | No |

| Mortgage Loans | No |

Customer service options

| Feature |

TradeStation TradeStation

|

|---|---|

| Phone Support (Prospect Customers) | Yes |

| Phone Support (Current Customers) | Yes |

| Email Support | Yes |

| Live Chat (Prospect Customers) | Yes |

| Live Chat (Current Customers) | Yes |

| 24/7 Support | No |