Annual Review Historical Rankings

Since 2011, the research team at StockBrokers.com has been thoroughly researching and assessing U.S. online brokers and their offerings. The data points assessed continually increase and the broker roster changes. New awards recipients, new best in class winners, and new star ratings are assessed to the firms included.

You can read more about How We Test for these reviews.

2026 Overall Rankings

In the 2026 Annual Awards, we reviewed 14 U.S. online brokerage firms across more than 300 variables spanning six core categories: Range of Investments, Advanced Trading, Research, Mobile Trading Apps, Education, and Ease of Use.

2025 Overall Rankings

The 2025 Annual Awards assessed 16 online brokers on more than 200 variables across 7 categories. See full results here.

2024 Overall Rankings

The 2024 Annual Awards assessed 17 online brokers on more than 200 variables across 7 categories. See full results here.

2023 Overall Rankings

The 2023 Annual Review assessed 17 online brokers on 196 variables across 8 categories. See full results here.

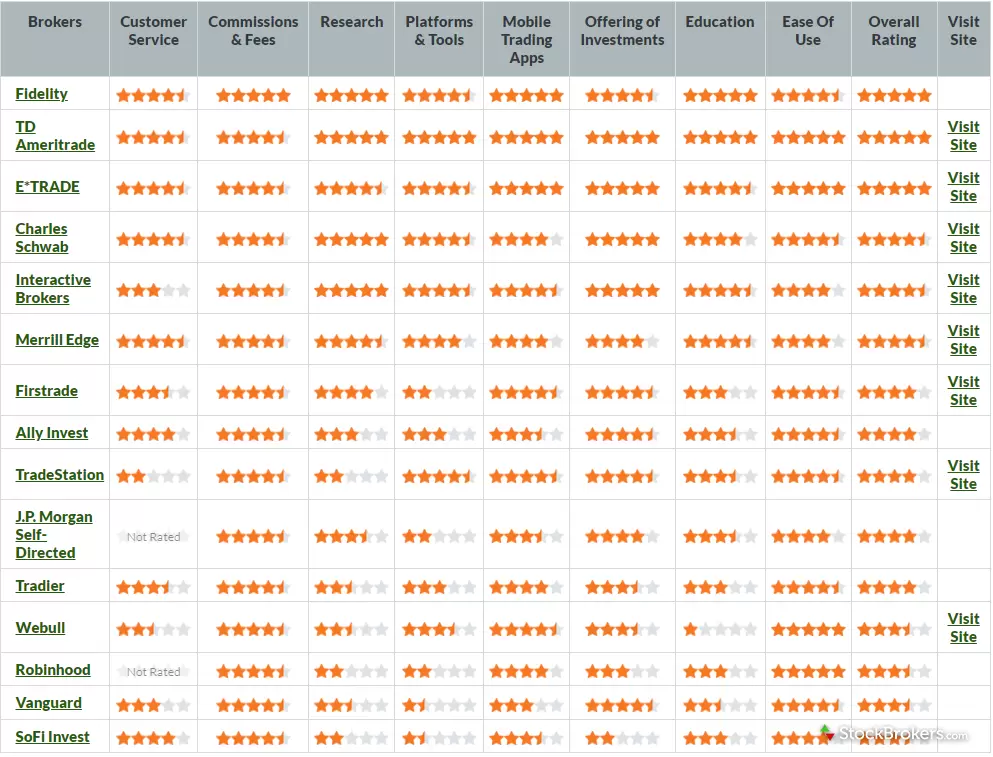

2022 Overall Rankings

The 2022 Annual Review assessed 15 online brokers on 205 variables across 9 categories.

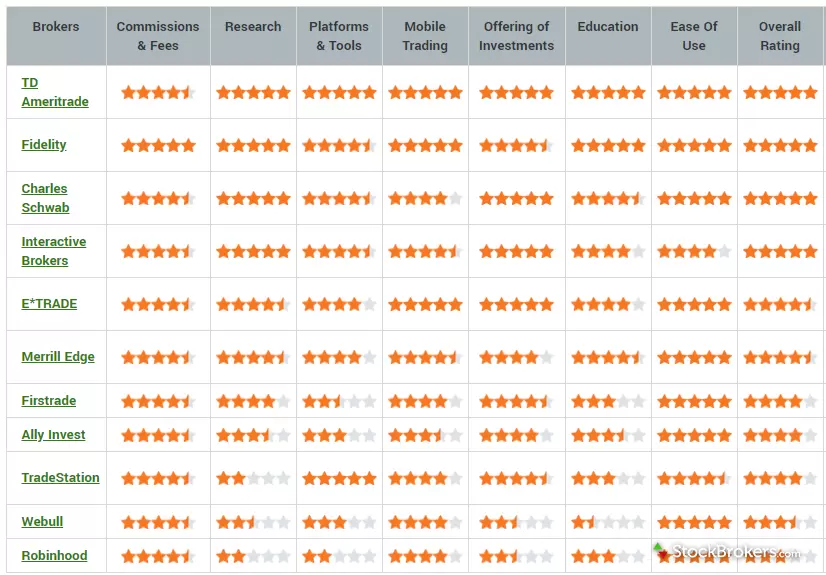

2021 Overall Rankings

The 2021 Annual Review assessed 11 online brokers on 256 variables across 7 categories. Note: Due to the pandemic and extensive market volatility, Customer Service was not scored as a main category.

2020 Overall Rankings

The 2020 Annual Review assessed 15 online brokers on 236 variables across 8 categories.

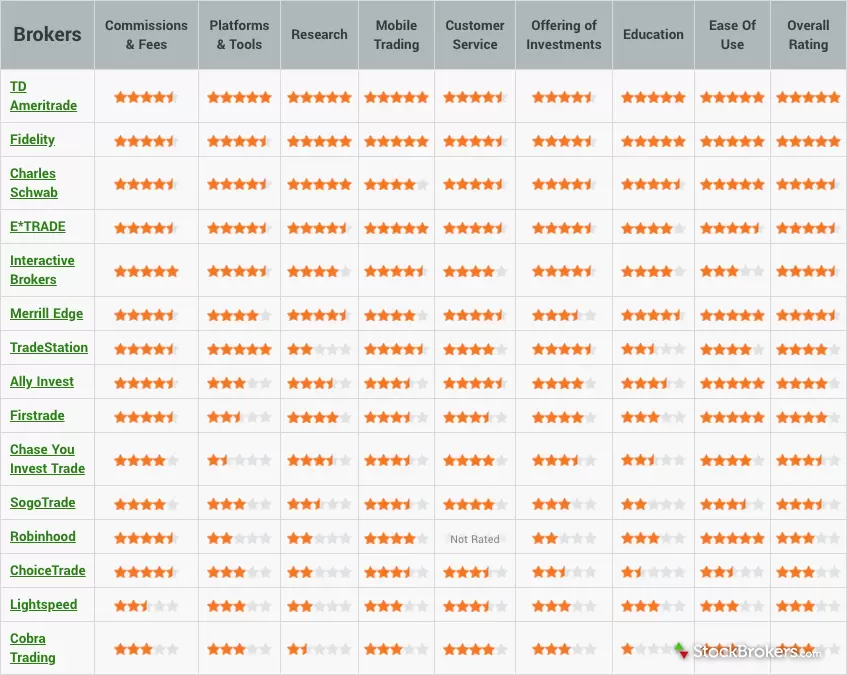

2019 Overall Rankings

The 2019 Annual Review assessed 16 online brokers on 284 variables across 9 categories.

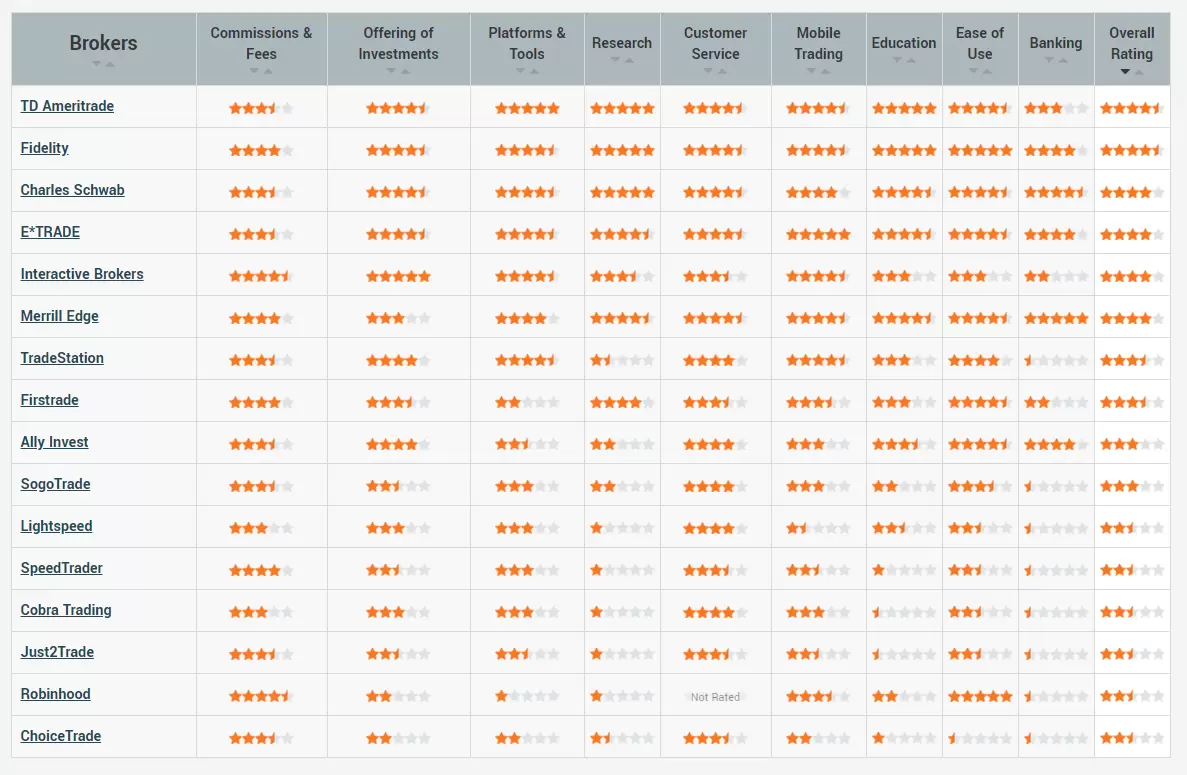

2018 Overall Rankings

The 2018 Annual Review assessed 13 online brokers on 292 variables across 10 categories.

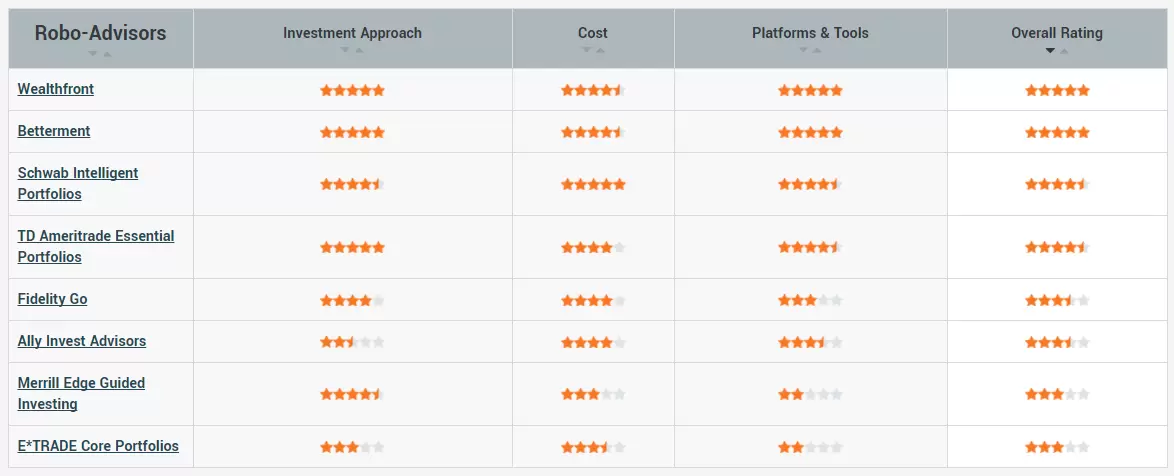

2018 Robo Rankings

The 2018 Annual Robo Review assessed 8 robo-advisors on 22 variables across 3 categories.

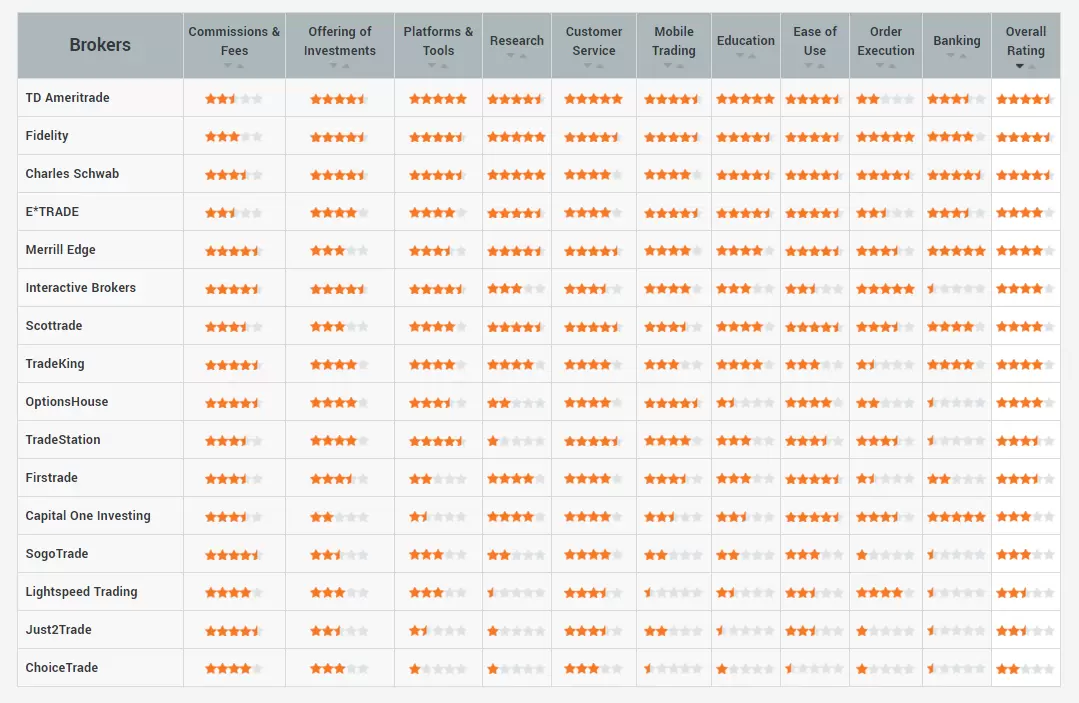

2017 Overall Rankings

The 2017 Annual Review assessed 16 online brokers on 308 variables across 10 categories.

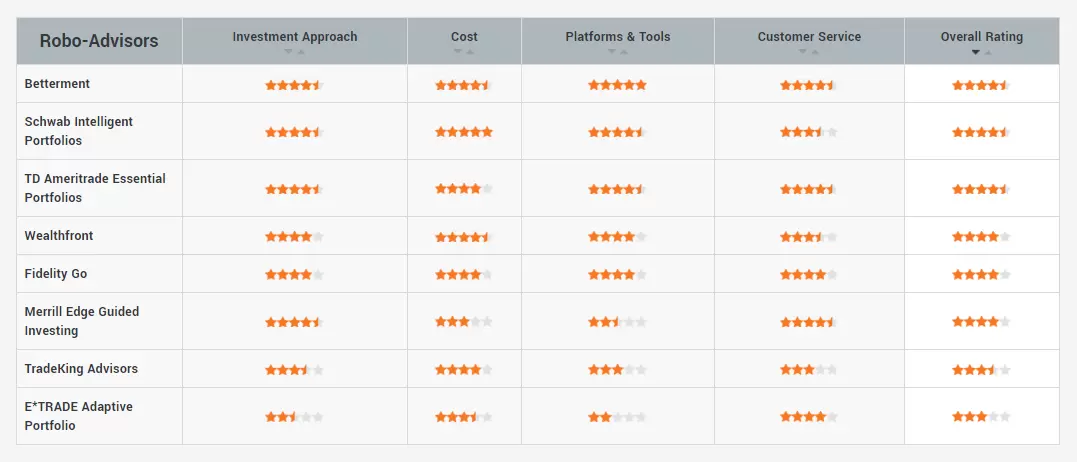

2017 Robo Rankings

The 2017 Annual Robo Review assessed 8 robo-advisors across 4 categories.

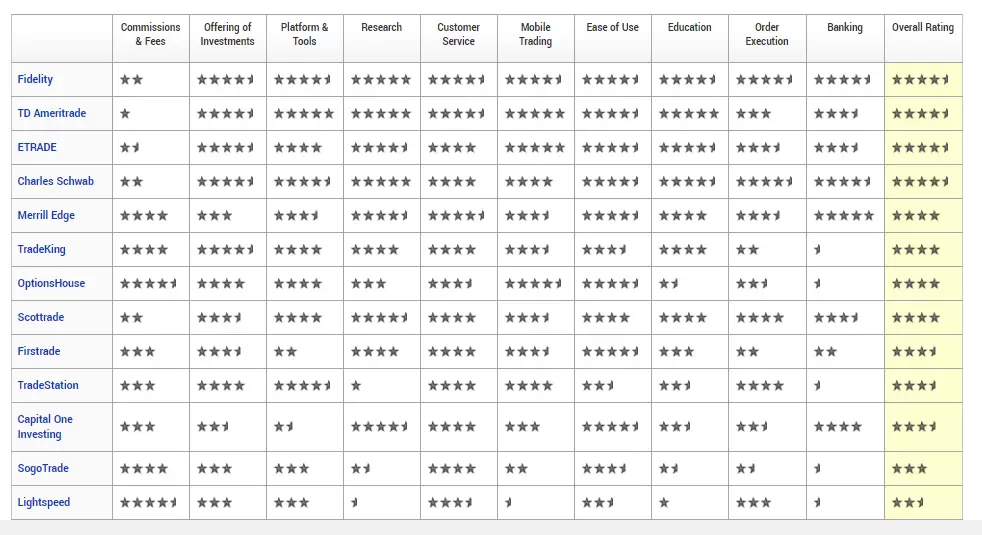

2016 Overall Rankings

The 2016 Annual Review assessed 13 online brokers on 295 variables across 10 categories.

2015 Overall Rankings

The 2015 Annual Review which assessed 15 online brokers on 272 variables across 9 categories.

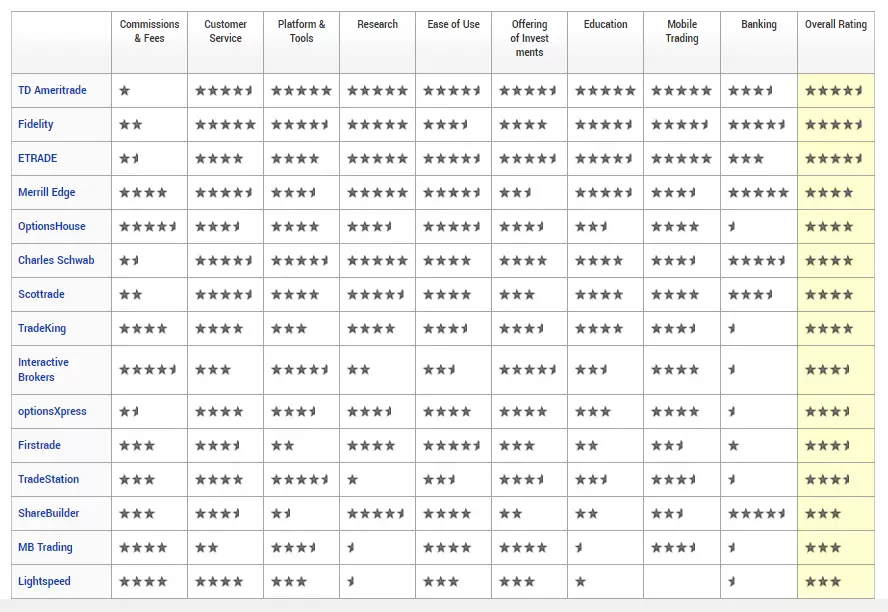

2014 Overall Rankings

The 2014 Annual Review which assessed 17 online brokers on 266 variables across 8 categories.

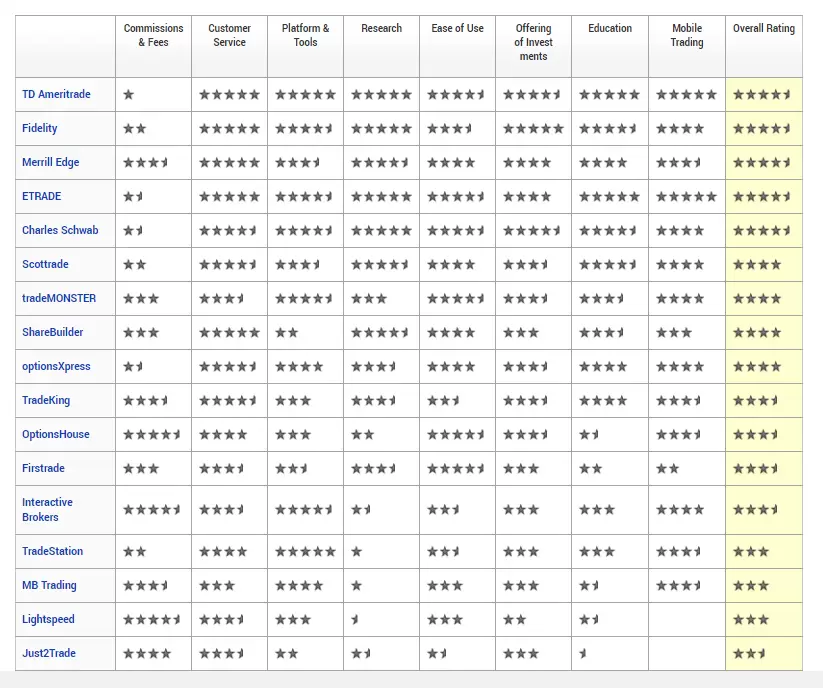

2013 Overall Rankings

The 2013 Annual Review assessed 17 online brokers on 283 variables across 8 categories.

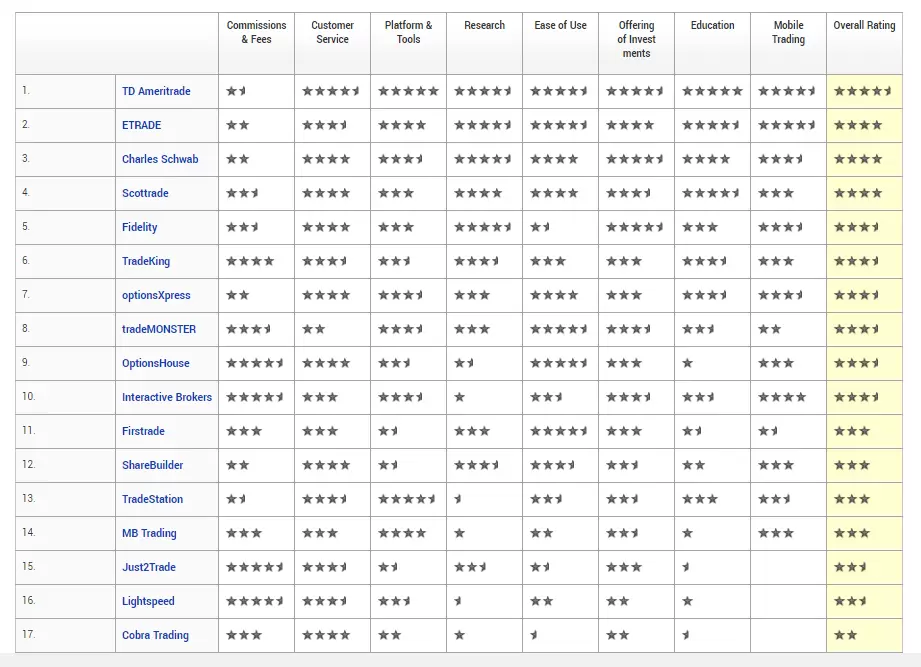

2012 Overall Rankings

The 2012 Annual Review which assessed 24 online brokers across 8 categories.

2011 Overall Rankings

The 2011 Annual Review assessed 23 brokers on 7 categories.

2011 Forex Rankings

See our latest forex broker rankings and reviews at our sister site, ForexBrokers.com.