Fidelity Review

Fidelity Investments is a well-rounded powerhouse, offering something for nearly every type of investor. From my experience testing their platform, I’ve found their research tools, customer service, and platform features to be some of the best in the industry.

Fidelity provides incredible depth for intermediate to advanced investors, while still being approachable for those just starting out. Whether you’re a long-term investor looking for market insights or an active trader prioritizing tax efficiency, Fidelity is a strong choice to consider for your portfolio.

-

Minimum Deposit:

$0.00 -

Stock Trades:

$0.00 -

Options (Per Contract):

$0.65

| Range of Investments | |

| Mobile Trading Apps | |

| Platforms & Tools | |

| Research | |

| Education | |

| Ease of Use | |

| Customer Service |

Check out StockBrokers.com's picks for the best stock brokers in 2025.

| #1 Retirement Accounts | Winner |

| #1 Customer Service | Winner |

| #1 High Net Worth Investors | Winner |

| 2025 | #3 |

| 2024 | #1 |

| 2023 | #1 |

| 2022 | #1 |

| 2021 | #2 |

| 2020 | #2 |

| 2019 | #2 |

| 2018 | #1 |

| 2017 | #2 |

| 2016 | #1 |

| 2015 | #2 |

| 2014 | #2 |

| 2013 | #5 |

| 2012 | #7 |

| 2011 | #8 |

Led by Jessica Inskip, Director of Investor Research, the StockBrokers.com research team collects thousands of data points across hundreds of variables. We evaluate features important to every kind of investor, including beginners, casual investors, passive investors, and active traders. We carefully track data on margin rates, trading costs, and fees to rate stock brokers across our proprietary testing categories.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on StockBrokers.com. Learn more about how we test.

Table of Contents

Pros & cons

Pros

- Top-tier research tools, like an economic calendar and thematic stock screening, provide deep insights.

- Fidelity’s widgetized dashboards cater to both beginners and advanced users.

- Fidelity offers managed accounts and hybrid models to meet diverse investment needs.

Cons

- Active Trader Pro feels outdated compared to competitors like Charles Schwab's thinkorswim.

- Lack of a paper trading account limits opportunities for new investors or users of its Youth app.

- Some powerful features, like sector comparisons, are buried and hard to access.

My top takeaways for Fidelity in 2025:

- Comprehensive offerings: From robust research tools and advanced trading platforms to flexible banking services, Fidelity excels in providing a complete ecosystem for managing wealth.

- Leader in education: Fidelity’s live webinars, contextual education, and advanced topic coverage set it apart, though it could benefit from more beginner-friendly foundational content.

- Strong value proposition: With low fees, global ATM reimbursement, and top-notch execution quality, Fidelity is a cost-effective choice for both active traders and long-term investors.

Range of investments

Fidelity offers an impressive array of investment choices, including stocks, options, fixed income, precious metals, and international trading. Its platform supports a wide range of asset classes and account types, making it a versatile choice for building and managing a portfolio. While it doesn’t offer futures or forex, its depth in traditional asset classes and retirement services sets it apart.

Fixed income

Fidelity’s fixed income offerings are among the most robust in the brokerage industry. Investors can access brokerage CDs, corporate bonds, municipal bonds, and U.S. Treasuries. The auto CD laddering tool simplifies portfolio diversification, and Fidelity also enables participation in Treasury auctions and secondary market trading — all online.

Cryptocurrency

Fidelity Crypto allows trading of bitcoin and ethereum in 38 states. While trades are marketed as commission-free, there’s an up to 1% markup or markdown embedded in the execution. Though the crypto offering is limited, Fidelity’s integration and extensive research of digital assets shows its commitment to evolving with investor needs.

Retirement services

Fidelity excels in retirement planning, offering traditional, Roth, SEP, SIMPLE, and rollover IRAs. Additionally, Fidelity offers specialty accounts for charitable giving and minors, as well as tax-advantaged plans for small businesses, ensuring there’s a solution for every stage of the investor journey.

Retirement planning at Fidelity

If retirement planning is top of mind for you, zero in on our comprehensive review of Fidelity’s individual retirement accounts and tools: Fidelity IRA Review.

International trading

Fidelity provides access to 25 global markets and supports 20 currencies, making it a strong choice for investors seeking international exposure. While it doesn’t match the global reach of a competitor like Interactive Brokers, it offers plenty of opportunities to diversify beyond U.S. markets.

| Feature |

Fidelity Fidelity

|

|---|---|

| Stock Trading | Yes |

| Account Feature - Margin Trading | Yes |

| Fractional Shares (Stocks) | Yes |

| OTC Stocks | Yes |

| Options Trading | Yes |

| Complex Options Max Legs | 4 |

| Fixed Income (Treasurys) | Yes |

| Futures Trading | No |

| Forex Trading | Yes |

| Crypto Trading | Yes |

| Crypto Trading - Total Coins | 3 |

| Traditional IRAs | Yes |

| Roth IRAs | Yes |

| Advisor Services | Yes |

One of the best for high net worth

We analyzed online brokers' offerings for clients with over $1 million of liquid, investable assets. See our guide to the Best Brokerage Firms for High Net Worth Individuals.

Fidelity fees

Fidelity sets the bar high when it comes to affordability, offering $0 stock and ETF trades while providing excellent order execution that adds even more value for customers. It avoids many of the nuisance fees other brokers charge, making it one of the best options for cost-conscious investors.

Stocks and options

Fidelity charges $0 for online U.S. stock and ETF trades, with options costing $0.65 per contract. Buy-to-close orders priced $0.65 or less are fee-free, and there are no extra charges for trading penny stocks.

No payment for order flow

Fidelity does not accept payment for order flow (PFOF), prioritizing customer price improvement. It transparently reports the savings passed on to customers, ensuring trust in its order execution.

Bonds and CDs

With $1 commissions on secondary bond trades and no fees for U.S. Treasury auctions or secondary market transactions, Fidelity sets the gold standard for fixed-income investors.

Mutual funds

Fidelity offers zero expense ratio mutual funds like FNILX and FZROX, with no minimum deposits. Transaction-fee funds cost $49.95 to buy but are free to redeem, while no-transaction-fee funds are free if held for at least 60 days.

Added perks

Fidelity’s lack of transfer-out fees and the Fidelity® Cash Management Account, which reimburses ATM fees globally, add even more value, especially for international travelers.

| Feature |

Fidelity Fidelity

|

|---|---|

| Minimum Deposit | $0.00 |

| Stock Trades | $0.00 |

| Penny Stock Fees (OTC) | $0.00 |

| Options (Per Contract) | $0.65 |

| Options Exercise Fee | $0.00 |

| Options Assignment Fee | $0.00 |

| Futures (Per Contract) | (Not offered) |

| Mutual Fund Trade Fee | Varies |

| Broker Assisted Trade Fee | $32.95 |

Mobile trading apps

Fidelity’s mobile solutions offer flexibility, serving both experienced investors and beginners. The Fidelity Investments app serves as the flagship experience, while the Fidelity Youth App provides targeted tools for saving, spending, and financial education.

Fidelity Investments App

Fidelity’s flagship app balances functionality and ease of use, offering tools for investors of all levels. It integrates seamlessly with the desktop experience, bringing key features and simple trading to your fingertips.

Fidelity’s mobile app makes learning on the go super easy with its “On Our Radar” videos which are quick social media style clips that cover everything from market trends to investing basics. They're short, smart, and actually fun to watch, making it simple to stay informed without feeling overwhelmed. It’s a great way to pick up insights in just a few minutes.

App features for navigating the market

- Sector views and yields to understand market movements.

- Unique insights on retail trends through Fidelity’s aggregated customer orders.

- Live Bloomberg TV, which offers real-time news directly within the app.

- Investors can also screen for stocks by sector or explore curated collections for inspiration.

While these features provide solid market insight, the absence of an economic calendar and earnings information is a missed opportunity to elevate the app’s usability.

Learning on the app

Jessica's take:

"Fidelity has taken a major step forward with short-form educational videos, blending financial insights with the familiar feel of social media. These bite-sized lessons are perfect for newer investors in bringing accessible, engaging education. This innovation has the potential to redefine how financial literacy is delivered."

The app also integrates planning tools that go beyond the basics with Credit score tracking, debt analysis, and retirement resources to help users take control of their financial health.

Fidelity Youth App

Fidelity offers the Fidelity Youth App, specifically designed to help beginners and younger investors develop healthy investing habits early on. Created for teens, the app introduces key concepts like saving, spending, and investing, all with parental oversight. For those just starting out, it’s a great way to build a foundation of financial literacy and establish smart money habits early. While it’s an excellent educational tool, its simplicity may not fully engage teens ready to explore more advanced investing strategies.

| Feature |

Fidelity Fidelity

|

|---|---|

| iPhone App | Yes |

| Android App | Yes |

| Apple Watch App | Yes |

| Stock Alerts | Yes |

| Charting - After-Hours | Yes |

| Charting - Technical Studies | 128 |

| Charting - Study Customizations | Yes |

| Watchlist (Streaming) | Yes |

| Mobile Watchlists - Create & Manage | Yes |

| Mobile Watchlists - Column Customization | Yes |

Trading platforms

Fidelity offers a range of trading platforms and tools designed to meet the needs of all types of investors, from beginners to active traders. While its browser-based platform is among the best in the industry, its desktop platform, Active Trader Pro (ATP), provides additional features for those seeking a more hands-on experience.

Active Trader Pro

Fidelity’s Active Trader Pro (ATP) desktop platform offers advanced tools for active investors, supported by live webinars and Fidelity’s Trading Strategy Desk to help users unlock its full potential. Key features include:

- Trade Armor: A unique tool that visualizes bracket orders, combining stop-loss and limit orders to clearly define your exit strategy and manage risk.

- Real-Time Analytics: Stream actionable trade signals and market insights.

- Customizable Layouts: Tailor tools and charts to fit your workflow.

- Advanced Charting: Trade directly from charts with multiple technical indicators and analysis tools.

OptionsPlay integration

Even for those new to options, Fidelity’s OptionsPlay integration offers a simplified yet comprehensive way to evaluate strategies, making the complexities of options trading more accessible. While the tool requires a subscription, its integration and user-friendly design make it a valuable resource for investors exploring options.

The OptionsPlay tool takes ideas and trade management a step further by integrating seamlessly into your portfolio and watchlists to generate ideas and present key data points clearly. It highlights covered call opportunities on stock you own, organizes trade ideas by income or strategy, and flags risks like exercise events and earnings announcements. It also suggests ideas for rolling or closing trades to keep strategies aligned with market changes and your risk tolerance.

Unique tools and innovations

Fidelity’s tools go beyond the basics, offering unique features that set it apart:

- Fixed Income Dashboard: This powerful tool provides institutional-grade analysis for bond investors, including cash flow views, taxable vs. tax-exempt comparisons, and the ability to model hypothetical purchases. It’s a superb tool for fixed-income investors.

- Tax and maintenance resources: Fidelity makes being tax efficient easy, allowing users to update cost basis methods, add beneficiaries, and prepare for tax season with a comprehensive FAQ and intuitive online tools.

- Integrated tools: Features like external account linking and contextual education make portfolio tracking and analysis simple and effective.

- Portfolio and positions monitoring: The platform allows users to customize their positions page to their portfolio type, such as income-focused or trading-oriented views. Investors can easily update DRIP settings and switch to a specialized options pairing view inclusive of margin requirements and wash sale designations.

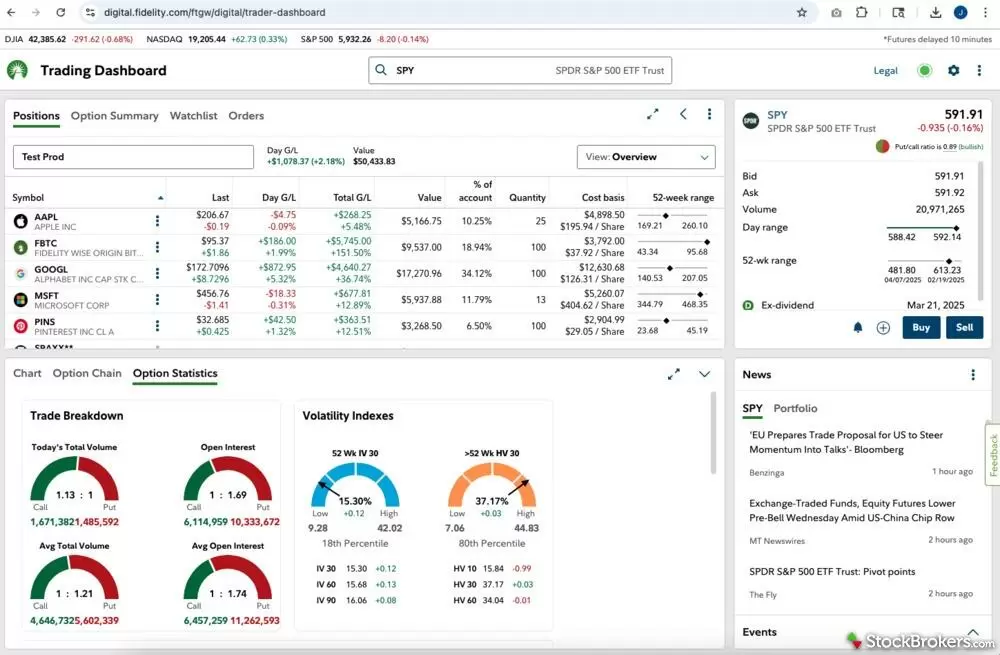

Fidelity’s trading dashboard brings everything together in one place. Here, I’ve linked SPY across all widgets for a seamless view. You can dive into options statistics, volatility indices, and my personal favorite: the trade breakdown activity, which gives great insight into how traders are positioning.

| Feature |

Fidelity Fidelity

|

|---|---|

| Active Trading Platform | Active Trader Pro |

| Desktop Trading Platform | Yes |

| Desktop Platform (Mac) | Yes |

| Web Trading Platform | Yes |

| Paper Trading | No |

| Trade Journal | Yes |

| Watchlists - Total Fields | 92 |

| Charting - Indicators / Studies | 129 |

| Charting - Drawing Tools | 38 |

| Charting - Study Customizations | 5 |

| Charting - Save Profiles | Yes |

| Trade Ideas - Technical Analysis | Yes |

| Streaming Time & Sales | Yes |

| Trade Ideas - Backtesting | Yes |

Research

Whether you’re analyzing individual stocks, screening for ETFs, or diving into macroeconomic trends, Fidelity sets the industry standard for research and its platform provides the depth and clarity needed to make informed decisions.

Stock research

Fidelity’s Equity Summary Score is a superb feature, simplifying complex data by weighting analyst opinions based on accuracy. This makes it easier to understand a stock’s outlook at a glance. Additionally, forward P/E ratios, sector performance comparisons, and estimates are available, though some valuable information — like sector comparisons to the broader market — is buried and could be more accessible.

The platform also offers extensive third-party research reports, with access to sources like Zacks, Morningstar, and FactSet, ensuring that you can choose the analysis that best fits your trading style.

Fund and fixed income research

Fidelity excels in fund and fixed-income research, offering tools that simplify investment decisions. Features like detailed analyst opinions and sub-category filters make it easy to pinpoint suitable mutual funds and ETFs, while highlights such as the yield curve comparison and CD ladder tools optimize fixed-income strategies.

The ability to participate directly in treasury auctions and access an extensive range of fixed-income products adds to its appeal, though the auction schedule could be easier to find. Educational resources further enrich the platform, providing valuable context for informed investing.

Screening and idea generation tools

Fidelity’s screening tools are intuitive and data-driven, making portfolio building seamless. Stock screeners offer thematic filters like AI or clean energy, with Zacks-powered predefined screens and detailed insights for deeper analysis. Fund screeners provide rich data points, including analyst opinions, to refine choices effectively.

For options traders, custom scans and tools like OptionsPlay deliver actionable insights, though some features may require a subscription.

Macro research and economic calendar

Fidelity distinguishes itself with macro research that offers deep insights into sector performance and business cycle positioning. Yet, the true highlight is its economic calendar as it’s simply the most comprehensive I’ve seen and my personal go-to for tracking market events.

Fidelity's economic calendar doesn’t just list dates — it provides meaningful context and analysis, making it an excellent resource for understanding the "why" behind market movements. It includes every significant economic event, trends, and market-moving indicators, along with contextual education that explains why these events matter to investors.

Fidelity’s economic calendar is hands-down one of the best out there. It's clean, easy to navigate, and packed with useful info. It clearly highlights market-moving events for the week, so you know exactly what to watch. Tap on any item to get more context, making it a great tool for staying ahead of and understanding key economic events.

| Feature |

Fidelity Fidelity

|

|---|---|

| Research - Stocks | Yes |

| Stock Research - ESG | Yes |

| Stock Research - PDF Reports | 7 |

| Screener - Stocks | Yes |

| Research - ETFs | Yes |

| Screener - ETFs | Yes |

| Research - Mutual Funds | Yes |

| Screener - Mutual Funds | Yes |

| Research - Pink Sheets / OTCBB | Yes |

| Research - Fixed Income | Yes |

Education

Fidelity’s educational offering provides content tailored to many different experience levels and investment goals. From live coaching to advanced articles on complex topics, Fidelity covers a lot of ground.

Learning Center

The Learning Center organizes Fidelity’s educational content into a centralized hub, offering a variety of formats, including articles, videos, webinars, podcasts, and infographics. Key features include:

- AI-driven recommendations to help users find content aligned with their interests and investment goals.

- A diverse library of archived webinars and beginner classes across topics like crypto, active trading, and retirement planning.

- Specialized content for younger investors via the Fidelity Youth App, with tips, calculators, and educational videos geared toward teens and parents.

Webinars and coaching

Fidelity excels in live education, offering webinars and coaching sessions that cater to virtually every aspect of the investment journey. Topics range from macroeconomic events and budgeting to women-focused investing and active trading strategies. Each webinar includes a live Q&A, providing a direct connection to experienced professionals and coaches. This dynamic format makes learning interactive and accessible for investors seeking guidance in real-time.

Fidelity’s Learning Center is a robust educational hub covering everything from financial essentials and major life events to advanced trading strategies and market insights. It also features specialized content like the “Women Talk Money” series and a calendar of live and on-demand events.

Deep-dive topics

Fidelity provides a wide range of advanced content, offering in-depth guides on fixed-income strategies, detailed coverage of funds concepts like share creation, arbitrage, and futures-based ETNs, and a clear options strategy guide that simplifies complex derivatives. While some foundational options topics are better covered in webinars than the Learning Center, the overall expertise is evident.

Market insights

Fidelity’s timely market commentary provides actionable insights into sector positioning, the business cycle, and macroeconomic events. Whether you want to know why the market sold off or how to position your portfolio, Fidelity’s viewpoints are highly relevant and well-curated. However, more foundational explanations, such as what economic data is and why it matters, would better bridge the gap for newer investors.

| Feature |

Fidelity Fidelity

|

|---|---|

| Education (Stocks) | Yes |

| Education (ETFs) | Yes |

| Education (Options) | Yes |

| Education (Mutual Funds) | Yes |

| Education (Fixed Income) | Yes |

| Education (Retirement) | Yes |

| Paper Trading | No |

| Videos | Yes |

| Webinars | Yes |

| Progress Tracking | Yes |

| Interactive Learning - Quizzes | Yes |

Customer service

To score Customer Service, StockBrokers.com partners with customer experience research firm Confero to conduct phone tests from locations throughout the United States. For this year's testing, 130 customer service tests were conducted over six weeks, with wait times logged for each call.

Customer service representatives were asked for assistance or details in several areas of broker services for prospective customers, including account opening, trading tools, apps, rollovers, active trading, and more. Here are the results for Fidelity.

- Average Connection Time: Under a minute

- Average Net Promoter Score: 9.3 / 10

- Average Professionalism Score: 9.0 / 10

- Overall Score: 9.15 / 10

- Ranking: 1st of 13 brokers

Banking services

Fidelity does not offer traditional bank services but does offer digital “bank-like” alternatives. These services integrate seamlessly with its investment platform, offering flexibility and convenience for managing cash and savings.

- Cash management account: Features include global ATM fee reimbursement, bill pay, mobile check deposit, and a debit card compatible with digital wallets. Automated savings tools make it easy to build financial habits.

- Fidelity Rewards Visa Signature Card: Earn 2% cashback on all purchases when rewards are deposited into a Fidelity account, enhancing savings or investment goals.

While lacking loyalty rewards for multiple products, Fidelity’s no-fee, user-friendly services are a solid choice for managing both cash and investments.

| Feature |

Fidelity Fidelity

|

|---|---|

| Bank (Member FDIC) | No |

| Checking Accounts | No |

| Savings Accounts | No |

| Credit Cards | Yes |

| Debit Cards | Yes |

| Mortgage Loans | Yes |

Final thoughts

Fidelity is a top-tier online brokerage, offering a comprehensive suite of tools, research, and services for investors at every stage of trading experience. While it has a few gaps, such as limited loyalty rewards and some areas of improvement for beginners, its focus on delivering value, innovation, and education makes it a strong contender for most investors.

Overall, Fidelity’s commitment to innovation and customer experience cements its position as a leader in the brokerage industry.

Fidelity Star Ratings

| Feature |

Fidelity Fidelity

|

|---|---|

| Overall |

|

| Range of Investments |

|

| Mobile Trading Apps |

|

| Platforms & Tools |

|

| Research |

|

| Customer Service |

|

| Education |

|

| Ease of Use |

|

StockBrokers.com Review Methodology

Why you should trust us

Jessica Inskip is Director of Investor Research at StockBrokers.com, bringing 15 years of experience in brokerage and trading strategy. A former FINRA-licensed rep, she held Series 7, 63, 66, and 4 licenses. Jessica focuses on investor education and brokerage industry research, appears regularly on CNBC, Bloomberg, The Schwab Network, Fox Business, and Yahoo! Finance, and hosts the Market MakeHer podcast.

Blain Reinkensmeyer, co-founder of StockBrokers.com, has been investing and trading for over 25 years. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. Today, Blain is widely respected as a leading expert on finance and investing, specifically the U.S. online brokerage industry. Blain has been quoted in The New York Times, The Wall Street Journal, Forbes, and Fast Company, among others. Blain created the original scoring rubrics for StockBrokers.com and oversees all testing and rating methodologies.

How we tested

- We used our own brokerage accounts for testing.

- We collected thousands of data points across the brokers we review.

- We tested each online broker's website, desktop platforms, and mobile app, where applicable.

- We maintained strict editorial independence; brokers cannot pay for inclusion or a higher rating.

Our research team meticulously collected data on every feature of importance to a wide range of customer profiles, including beginners, casual investors, passive investors, and active traders. We carefully track variables like margin rates, trading costs, fees, and platform features and use them to help rate brokers across a range of categories measuring ease of use, range of investments, research, education, and more.

At StockBrokers.com, our reviewers use a variety of computing devices to evaluate platforms and tools. Our reviews and data collection were conducted using the following devices: iPhone SE running iOS 17.5.1, MacBook Pro M1 with 8 GB RAM running the current MacOS, and a Dell Vostro 5402 laptop i5 with 8 GB RAM running Windows 11 Pro.

Each broker was evaluated and scored on over 200 different variables across seven key categories: Range of Investments, Platforms & Tools, Research, Mobile Trading, Education, Ease of Use, and Overall. Learn more about how we test.

Trading platforms tested in 2025

We tested 16 online trading platforms in 2025:

- Ally Invest review

- Charles Schwab review

- eToro review

- E*TRADE review

- Fidelity Investments review

- Firstrade review

- Interactive Brokers review

- J.P. Morgan Self-Directed Investing review

- Merrill Edge review

- Public.com review

- Robinhood review

- SoFi Invest® review

- tastytrade review

- TradeStation review

- Tradier

- Webull review

Read next

- Best Stock Trading Platforms for Beginners of 2025

- Best Futures Trading Platforms for 2025: A Beginner-Friendly Guide to an Advanced Market

- Best Stock Trading Apps for 2025

- Best Brokers for Penny Stock Trading of 2025

- Best Options Trading Platforms for 2025

- Best Paper Trading Apps & Platforms for 2025

- Best Day Trading Platforms of 2025 for Beginners and Active Traders

- Best Trading Platforms for 2025

More Guides

Popular Stock Broker Reviews

About Fidelity

Headquartered in Boston, Massachusetts, Fidelity Investments was founded in 1946 and has grown into one of the world's largest asset managers. As of June 2024, Fidelity manages $5.4 trillion in assets under management and oversees $14.1 trillion in assets under administration.