TradeStation Review

TradeStation occupies a unique space in the brokerage landscape: it delivers a professional-grade ecosystem made accessible to the retail market. Its powerful new Titan X platform deftly bridges the gap between usability and raw power, offering a streamlined, sophisticated workspace for active traders.

Titan X delivers deep derivatives capabilities, from futures to multi-leg options, wrapped in a design that feels native to the modern era. If you’re looking for a highly customizable environment for serious trading, TradeStation is the right place for you.

However, this accessibility does not imply simplicity. Titan X is a precision instrument for the active trader, not a home for the casual investor seeking fractional shares or curated guidance for beginners.

-

Minimum Deposit:

$0.00 -

Stock Trades:

$0.00 -

Options (Per Contract):

$0.60

| Range of Investments | |

| Mobile Trading Apps | |

| Advanced Trading | |

| Research | |

| Education | |

| Ease of Use | |

| Customer Service |

Check out StockBrokers.com's picks for the best stock brokers in 2026.

| #1 Innovation | Winner |

| 2026 | #8 |

| 2025 | #9 |

| 2024 | #11 |

| 2023 | #13 |

| 2022 | #9 |

| 2021 | #9 |

| 2020 | #7 |

| 2019 | #7 |

| 2018 | #7 |

| 2017 | #10 |

| 2016 | #10 |

| 2015 | #12 |

| 2014 | #14 |

| 2013 | #13 |

| 2012 | #9 |

| 2011 | #14 |

Led by Jessica Inskip, Director of Investor Research, the StockBrokers.com research team collects thousands of data points across hundreds of variables. We evaluate features important to every kind of investor, including beginners, casual investors, passive investors, and active traders. We carefully track data on margin rates, trading costs, and fees to rate stock brokers across our proprietary testing categories.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on StockBrokers.com. Learn more about how we test.

Table of Contents

Pros & cons

Pros

Cons

- Not a good choice for beginners or casual investors.

- Annual IRA maintenance fees and steep option exercise charges feel outdated.

- No spot cryptocurrency trading, fractional shares, or robo-advisory services.

Here are my top takeaways for TradeStation in 2026:

- Titan X has arrived: The broker’s new flagship platform, Titan X, successfully modernizes TradeStation by wrapping its legendary technical power in a sleek, Mac-native interface that excels at charting and options visualization. It effectively eliminates the historical trade-off between depth and usability.

- Derivatives powerhouse: Best in Class for Futures and Advanced Trading in 2026, TradeStation separates itself from the pack with specialized tools like the Matrix price ladder and complex option spread grouping – features that active traders actually rely on for daily execution.

- #1 for Innovation in 2026: TradeStation secured our coveted Annual Award for #1 Innovation for its TradeStation MCP with Claude. This groundbreaking integration allows you to plug your brokerage account directly into Anthropic’s AI, effectively turning Claude into a specialized trading assistant that can fetch quotes, analyze portfolio risk, and preview orders using natural language.

Range of investments

TradeStation has curated its entire experience with a very specific customer in mind: the serious, active trader. If you are looking for a place where you can buy fractional shares of a tech darling, trade spot cryptocurrencies, or dabble in forex, you might want to look elsewhere. Instead, TradeStation doubles down on regulated, exchange-traded markets, offering a robust suite of stocks, ETFs, simple and complex options, and a standout selection of futures and futures options.

Account types: While the asset list is tailored, the range of account types is where TradeStation truly flexes its professional muscle. Beyond the standard individual and joint brokerage accounts, I was impressed to find full support for business entities, including Limited Liability Companies (LLCs), Corporations, Trusts, and General or Limited Partnerships. This is a critical feature for professional traders who treat their operation as a business entity, a nuance often overlooked by retail-first brokers.

Retirement accounts: You’ll find Traditional, Roth, SEP, and SIMPLE IRAs, but the platform draws a hard line at passive investing features. You won’t find 529 plans for education savings or robo- advisors to manage your funds for you.

| Feature |

TradeStation TradeStation

|

|---|---|

| Stock Trading | Yes |

| Account Feature - Margin Trading | Yes |

| Fractional Shares (Stocks) | No |

| OTC Stocks | Yes |

| Options Trading | Yes |

| Complex Options Max Legs | 4 |

| Fixed Income (Treasurys) | No |

| Futures Trading | Yes |

| Forex Trading | No |

| Crypto Trading | No |

| Crypto Trading - Total Coins | 0 |

| Traditional IRAs | Yes |

| Roth IRAs | Yes |

| Advisor Services | No |

TradeStation fees

You’ll find a sharp split within TradeStation’s pricing structure: it’s competitively priced for the aggressive derivatives trader, and surprisingly expensive for the passive investor or retirement saver. While TradeStation aligns with the industry standard of $0 commissions for regular stock and ETF trades, the real story lies in the incidental fees that can quickly chip away at the returns of a smaller account.

Options pricing: For its core client base of futures and options traders, the pricing is straightforward. Options trades are charged at a standard $0.60 per contract, and futures contracts are $1.50 per side. However, unlike most of its modern competitors who have eliminated exercise and assignment fees, TradeStation charges $14.95 to exercise an option and $5.95 for an assignment. Active options traders who frequently hold contracts to expiration must factor this significant drag into their profit and loss calculations.

Other pricing: The fee schedule becomes even less forgiving for retirement accounts and penny stock traders. I was disappointed to see an annual IRA fee of $35 and a closure fee of $50, charges that have largely vanished elsewhere. Penny stock traders also face a stiff $0.01 per share fee. Furthermore, if you decide to move your portfolio to another broker, the full ACAT transfer fee is a steep $125. Even borrowing money is costly; margin rates for balances under $25,000 start at 12.5%, which does little to incentivize holding leveraged positions overnight.

| Feature |

TradeStation TradeStation

|

|---|---|

| Minimum Deposit | $0.00 |

| Stock Trades | $0.00 |

| Penny Stock Fees (OTC) | $0.01 |

| Options (Per Contract) | $0.60 |

| Options Exercise Fee | $14.95 |

| Options Assignment Fee | $5.95 |

| Futures (Per Contract) | $1.50 |

| Mutual Fund Trade Fee | $14.95 |

| Broker Assisted Trade Fee | $25 |

Mobile trading apps

TradeStation’s app serves as a mobile command center for the active trader who needs to execute strategies away from their desk. It’s not designed to replace the analytical depth of the desktop platform, but as a companion for maintaining a pulse on price action and managing positions, it’s remarkably effective.

Mobile features: The app’s standout feature is its ability to instantly contextualize market movement. I absolutely love the "Why is it moving?" tool powered by Benzinga. Instead of forcing me to sift through endless news feeds to understand a sudden spike in volatility, the app provides a concise explanation of the catalyst, whether it’s an earnings beat or a regulatory report. The app’s watchlists are also excellent; they sync seamlessly across devices and offer 11 customizable columns. Active traders will appreciate the inclusion of the Matrix, a mobile price ladder that allows for rapid order entry directly from the quote stream.

Mobile charting: Charting on a mobile device is often a frustrating experience, but TradeStation has solved the "fat finger" problem with intelligent design. I liked the drawing tools, which snap to specific price lines, making it possible to conduct genuine technical analysis on a small screen. You can overlay 45 different technical studies, offering enough depth for a serious intermediate analysis.

Advanced mobile trading: I experienced some friction within the mobile app when constructing complex trades. While the options chain is clean and allows for easy single-leg execution, building a multi-leg strategy requires you to select a custom strategy template first, which feels rigid compared to the fluid drag-and-drop nature of their desktop Titan X platform. I also missed the ability to view "Net Greeks" while building these trades, a critical omission for options traders managing risk. It’s also worth mentioning that TradeStation’s app lacks a holistic macro view; without an economic calendar or Treasury yield data, I found myself switching to other sources to get the full picture of the day's economic landscape.

TradeStation’s mobile app adds real context to market moves with its “Why Is It Moving?” feature, shown here for GOOGL. Instead of just seeing the price, you get quick, relevant insights explaining what's driving the action, whether it’s earnings, analyst calls, or broader news. It’s a powerful way to stay informed without digging through headlines.

| Feature |

TradeStation TradeStation

|

|---|---|

| iPhone App | Yes |

| Android App | Yes |

| Apple Watch App | No |

| Stock Alerts | Yes |

| Charting - After-Hours | Yes |

| Charting - Technical Studies | 45 |

| Charting - Study Customizations | Yes |

| Watchlist (Streaming) | Yes |

| Mobile Watchlists - Create & Manage | Yes |

| Mobile Watchlists - Column Customization | Yes |

Advanced trading platforms

For years, TradeStation set the technical benchmark for advanced traders, but it remained tethered to a dense, Windows-only architecture. With the launch of Titan X, that era is over. Titan X is a sleek, modern, multi-asset platform available natively on both Mac and Windows that bridges the gap between institutional-grade capability and modern usability.

Titan X: The experience begins at the "Launchpad," a thoughtful onboarding screen that offers pre-configured layouts for specific personas, whether you are a day trader, futures specialist, or options strategist. This eliminates the "blank canvas paralysis" often found in professional software. Once inside, the workspace is entirely widget-based. You can drag and drop modules like the Matrix (a lightning-fast price ladder), sophisticated watchlists with over 300 optional data columns, and a reconstructed trade ticket that handles complex order types like OCO (One-Cancels-Other) and OSO (Order-Sends-Order) with ease.

TradeStation Titan X Sector View displays the indices for all 11 GICS sectors in a predefined layout. On the right, the trade ticket shows a quote, applicable buying power, and advanced trade settings for SPY.

Charting: Charting in Titan X is a joy. The interface is crisp, supporting everything from standard candles to Heikin-Ashi and Equivolume. Adding one of the 100+ available indicators is now a simple drag-and-drop action, and I loved the ability to modify parameters on the fly without digging through endless sub-menus.

Options: For options traders, the improvements are profound. The new options chain is visually stunning, offering Net Greeks (Delta, Theta, Gamma) to assess risk instantly and a feature I found critical: Position Spread Grouping. Instead of seeing four disjointed legs of an Iron Condor, the platform groups them into a single, manageable line item.

Other features: While Titan X handles the heavy lifting of execution and technical analysis, some specialized functions still reside in the legacy environment. For instance, I found the Portfolio Maestro, essential for Monte Carlo simulations and beta weighting, to be a separate experience. Similarly, while deep fundamental data is available, accessing it feels like stepping back into the older interface.

Jessica's take

"Titan X is, without exaggeration, the advanced trading platform sophisticated traders have been waiting for. For the active trader focused on price action and speed, Titan X is a triumph."

| Feature |

TradeStation TradeStation

|

|---|---|

| Active Trading Platform | TradeStation 10 |

| Desktop Trading Platform | Yes |

| Desktop Platform (Mac) | Yes |

| Web Trading Platform | Yes |

| Paper Trading | Yes |

| Trade Journal | No |

| Watchlists - Total Fields | 341 |

| Charting - Indicators / Studies | 294 |

| Charting - Drawing Tools | 45 |

| Charting - Study Customizations | 12 |

| Charting - Save Profiles | Yes |

| Trade Ideas - Technical Analysis | Yes |

| Streaming Time & Sales | Yes |

| Trade Ideas - Backtesting | Yes |

Research

If you define research as curling up with a comprehensive PDF report from Morningstar or CFRA, you’ll be disappointed. TradeStation offers zero third-party downloadable reports. However, if you define research as hunting for volatility, identifying price dislocations, and scanning for technical setups, this platform is a goldmine.

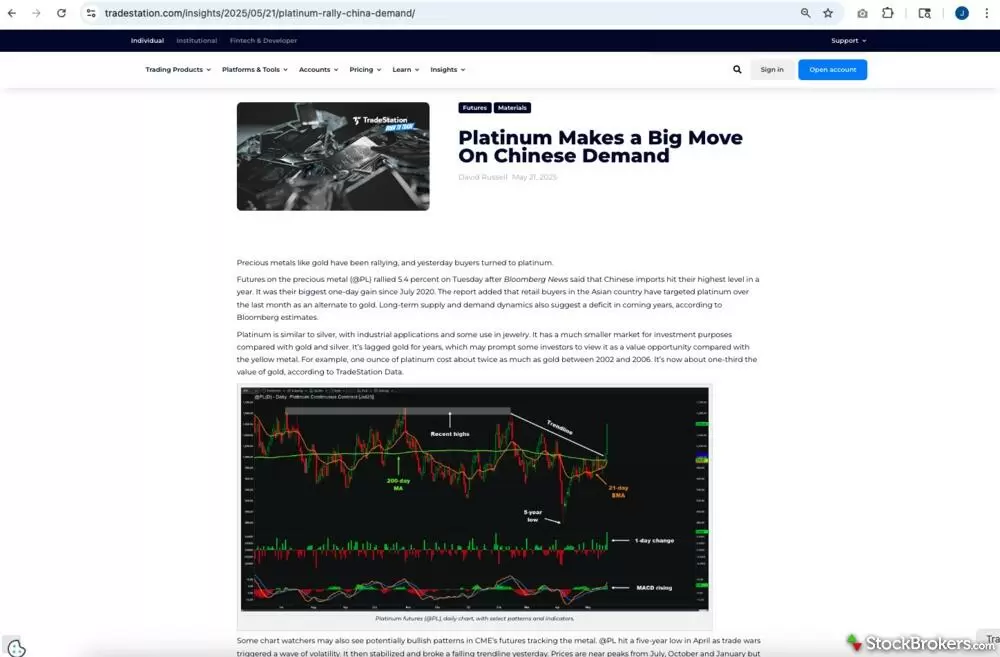

Trade ideas: For the active trader, the "Hot List" widget in the Titan X platform is an invaluable idea generator. Instead of reading about what might happen, I can instantly filter for what is happening, scanning for volume breakouts, gap downs, and unusual options activity across 20 different filters. The more traditional scanning tools in the legacy platform are equally robust, offering over 17 pre-defined scans for chart patterns and technical indicators. I was also pleasantly surprised by the "Insights" page on the website; despite being outside the platform, the daily market commentary provided a surprisingly thorough prep for the week ahead, covering S&P 500 movers and earnings previews with clarity.

TradeStation’s Traders Insight blog delivers actionable market commentary from a trader’s point of view, covering a wide range of asset classes and strategies. This post focuses on commodities and even includes screenshots from the TradeStation platform to help visualize the analysis.

Fundamental analysis: TradeStation’s research fractures when you pivot to fundamental or macro analysis. While I could find deep data, such as valuation ratios, financial strength, and profitability across eight detailed tabs, it felt sequestered in a separate, older research window that didn't match the modern slickness of Titan X. Furthermore, the absence of an economic calendar or easy access to Treasury yield data leaves a blind spot for traders who need to monitor the macro landscape.

| Feature |

TradeStation TradeStation

|

|---|---|

| Research - Stocks | Yes |

| Stock Research - ESG | No |

| Stock Research - PDF Reports | 0 |

| Screener - Stocks | Yes |

| Research - ETFs | Yes |

| Screener - ETFs | Yes |

| Research - Mutual Funds | No |

| Screener - Mutual Funds | No |

| Research - Pink Sheets / OTCBB | Yes |

| Research - Fixed Income | No |

Education

TradeStation’s educational offering is specifically designed for active traders. You won’t find hand-holding introductory content like "What is a Stock?" or "How to Save for Retirement." However, if you are looking for "serious lessons for serious traders" (TradeStation's own tagline), you’ve arrived at one of the most sophisticated learning hubs in the industry.

Master Class series: The crown jewel of TradeStation’s educational experience is its Master Class series. These are not your standard, fluff-filled webinars; they are deep dives into complex topics like cluster analysis, momentum indicators, and coding in EasyLanguage for algorithmic trading. These are paired with a deep schedule of live events, including recurring Monday and Thursday sessions on market trends, which serve as excellent ongoing professional development.

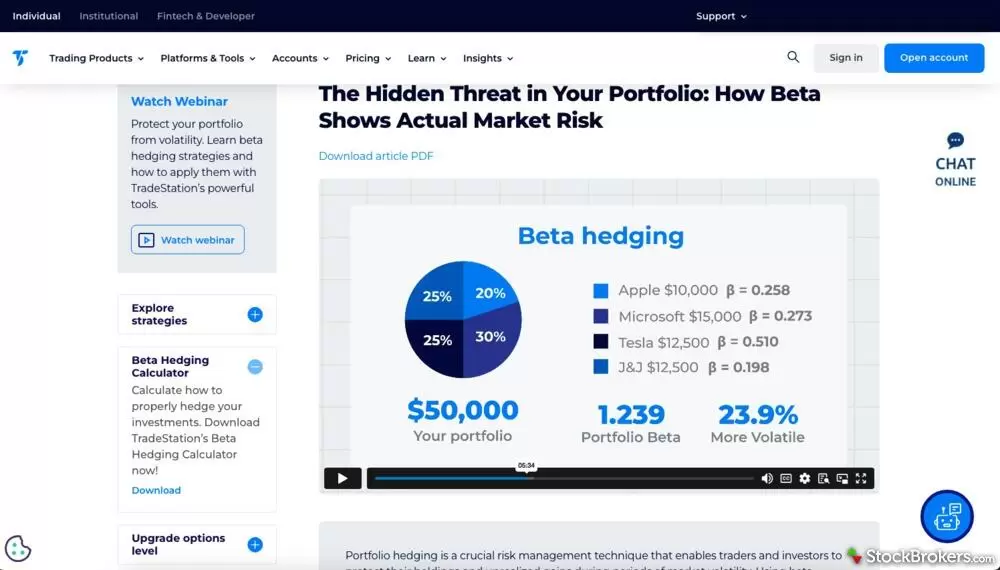

Options education: The options education is equally impressive, though sometimes difficult to find due to a clunky navigational layout. Once located, however, the quality is superb. I found a wealth of resources ranging from strategy implementation to risk management, often accompanied by high-quality downloadable worksheets and PDFs. I appreciated the advanced articles on portfolio management, which skipped generic asset allocation advice in favor of teaching how to calculate weighted beta to properly hedge a portfolio – a skill that true active traders actually need.

TradeStation Education connects concepts directly to platform use, shown here through a beta-weighted hedging walkthrough. The view includes a video, an informational article, in-platform examples, and a downloadable hedging calculator to support practical application.

Foundational education: The flip side of this specialization is the complete lack of foundational content. There is effectively no education on mutual funds, fixed income, or minor investing, and the ETF section is so high-level it offers little practical value. TradeStation assumes you already know the basics before you log in, and frankly, given the complexity of their platform, I think that’s a fair assumption.

| Feature |

TradeStation TradeStation

|

|---|---|

| Education (Stocks) | Yes |

| Education (ETFs) | No |

| Education (Options) | Yes |

| Education (Mutual Funds) | No |

| Education (Fixed Income) | No |

| Education (Retirement) | No |

| Videos | Yes |

| Webinars | Yes |

| Progress Tracking | No |

| Interactive Learning - Quizzes | No |

TradeStation customer service

To score Customer Service, StockBrokers.com partners with customer experience research firm Confero to conduct phone tests from locations throughout the United States. For this year's testing, 132 customer service tests were conducted over six weeks, with wait times logged for each call.

Customer service representatives were asked for assistance or details for prospective customers in several areas of broker services, including account opening, trading tools, apps, crypto offerings, active trading, and more. Here are the results for TradeStation.

- Average Connection Time: 2.6 minutes

- Average Net Promoter Score: 7.9 / 10

- Average Professionalism Score: 7.4 / 10

- Overall Score: 7.66 / 10

- Ranking: 6th of 11

TradeStation IRA review

TradeStation’s approach to retirement accounts is consistent with its broader identity: it’s a high-performance vehicle for execution, not a nurturing environment for a passive account. If you are just looking to park capital in a target-date fund and forget about it, TradeStation actively discourages you from doing so through its fee structure.

IRA fees: In an industry where administrative costs have largely evaporated, I was disappointed to find that TradeStation still charges a $35 annual IRA fee and a $50 termination fee. While these amounts might seem negligible to a trader moving six figures of volume, they are a nuisance for a standard retirement saver. Furthermore, there are no robo-advisory services or human financial planners to help guide your asset allocation – you’re on your own.

SEP and SIMPLE IRAs: TradeStation supports SEP and SIMPLE IRAs in addition to standard Roth and Traditional accounts, allowing sole proprietors to manage their business retirement plans on the same professional-grade platform they use for daily speculation. If your goal is to actively trade futures or complex options strategies within a tax-advantaged wrapper, the annual fee is a small price to pay for the power at your fingertips. For everyone else, there are cheaper, more supportive homes for your retirement savings.

Final thoughts

TradeStation has successfully pulled off one of the most difficult maneuvers in the brokerage industry: it modernized its interface without alienating its core base of professional users. For years, this broker was a platform for power-users, accessible only to those willing to navigate a dense, Windows-based architecture. The Titan X platform is sleek, Mac-native, and surprisingly intuitive, using its "Launchpad" to welcome sophisticated traders rather than intimidate them.

However, this modernization shouldn’t be confused with a pivot toward the mass market. TradeStation remains an unapologetic specialist. It’s a sanctuary for derivatives traders who need a lightning-fast price ladder, complex option spread grouping, and algorithmic capabilities. It’s not a home for the casual buy-and-hold investor. The lack of fundamental education, the absence of mutual fund research, and the presence of outdated administrative fees for retirement accounts send a clear message: this platform is designed for those who treat trading as a business, not a hobby.

If your goal is to actively attack the markets with the best technical tools available, TradeStation is a top-tier contender that has finally matched its backend power with frontend beauty. But if you are looking for a low-cost, set-and-forget home for your retirement savings, you will likely find the experience, and the fees, to be more than you bargained for.

TradeStation Star Ratings

| Feature |

TradeStation TradeStation

|

|---|---|

| Overall |

|

| Range of Investments |

|

| Mobile Trading Apps |

|

| Advanced Trading |

|

| Research |

|

| Customer Service |

|

| Education |

|

| Ease of Use |

|

StockBrokers.com Review Methodology

Why you should trust us

Jessica Inskip is Director of Investor Research at StockBrokers.com, bringing 15 years of experience in brokerage and trading strategy. A former FINRA-licensed rep, she held Series 7, 63, 66, and 4 licenses. Jessica focuses on investor education and brokerage industry research, appears regularly on CNBC, Bloomberg, The Schwab Network, Fox Business, and Yahoo! Finance, and hosts the Market MakeHer podcast.

Blain Reinkensmeyer, co-founder of StockBrokers.com, has been investing and trading for over 25 years. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. Today, Blain is widely respected as a leading expert on finance and investing, specifically the U.S. online brokerage industry. Blain has been quoted in The New York Times, The Wall Street Journal, Forbes, and Fast Company, among others. Blain created the original scoring rubrics for StockBrokers.com and oversees all testing and rating methodologies.

How we tested

- We used our own brokerage accounts for testing.

- We collected thousands of data points across the brokers we review.

- We tested each online broker's website, desktop platforms, and mobile app, where applicable.

- We maintained strict editorial independence; brokers cannot pay for inclusion or a higher rating.

Our research team meticulously collected data on every feature of importance to a wide range of customer profiles, including beginners, casual investors, passive investors, and active traders. We carefully track variables like margin rates, trading costs, fees, and platform features and use them to help rate brokers across a range of categories measuring ease of use, range of investments, research, education, and more.

At StockBrokers.com, our reviewers use a variety of computing devices to evaluate platforms and tools. Our reviews and data collection were conducted using the following devices: iPhone SE running iOS 17.5.1, MacBook Pro M1 with 8 GB RAM running the current MacOS, and a Dell Vostro 5402 laptop i5 with 8 GB RAM running Windows 11 Pro.

Each broker was evaluated and scored on over 200 different variables across seven key categories: Range of Investments, Platforms & Tools, Research, Mobile Trading, Education, Ease of Use, and Overall. Learn more about how we test.

Trading platforms tested in 2026

We tested 14 online trading platforms in 2026:

Read next

- Best Paper Trading Apps & Platforms for 2026

- Best Options Trading Platforms for 2026

- Best Futures Trading Platforms for 2026

- Best Brokers for Penny Stock Trading of 2026

- Best Stock Trading Platforms for Beginners of 2026

- Best Stock Trading Apps for 2026

- Best Day Trading Platforms of 2026 for Beginners and Active Traders

- Best Stock Brokers for 2026

More Guides

Popular Stock Broker Reviews

About TradeStation

Headquartered in Plantation, Florida, TradeStation is a wholly owned subsidiary of Monex Group, Inc. (TOKYO: 8698). TradeStation's roots date back to 1982, when the company was formed under the name Omega Research. The company's flagship TradeStation platform was launched in 1991, and TradeStation Group was a Nasdaq-listed company from 1997 until 2011, at which point it was acquired by Monex Group.