Winners Summary

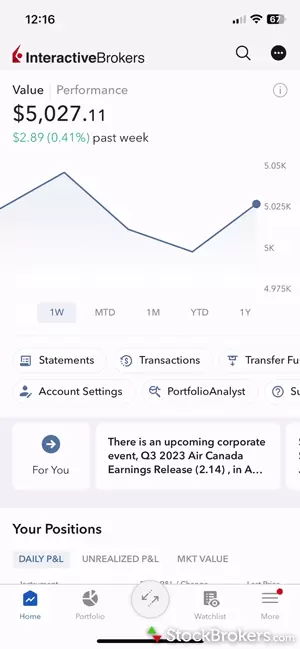

Best for professionals - Interactive Brokers

| Company |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

Offers

|

Visit Site |

Interactive Brokers Interactive Brokers

|

$0.00 |

$0.00 |

$0.65 |

New clients, special margin rates. |

Visit Site

|

If you trade large positions, many different instruments, and demand cutting edge tools, Interactive Brokers’ Trader Workstation is really your best choice. Though IBKR is also one of the lowest-cost brokers I tested when all costs are considered, I also found it to be one of the most restrictive about which products I was allowed to trade, and Trader Workstation is one of the most complex platforms to navigate.

IBKR Trader Workstation (TWS) gallery

IBKR mobile app gallery

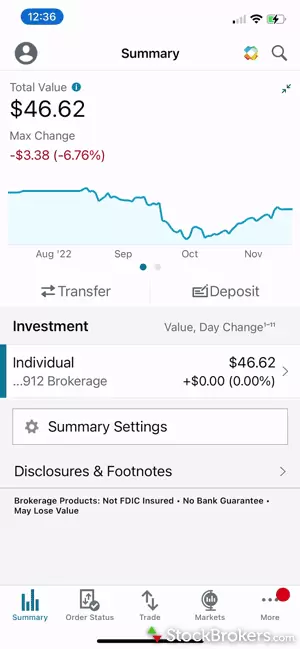

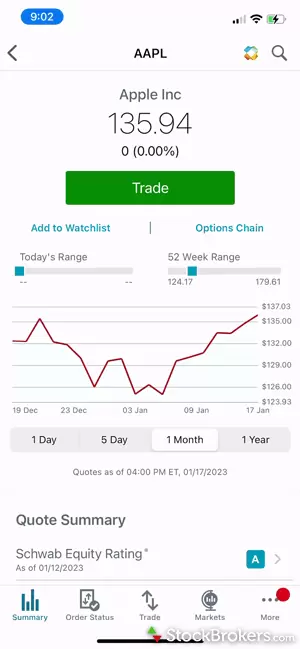

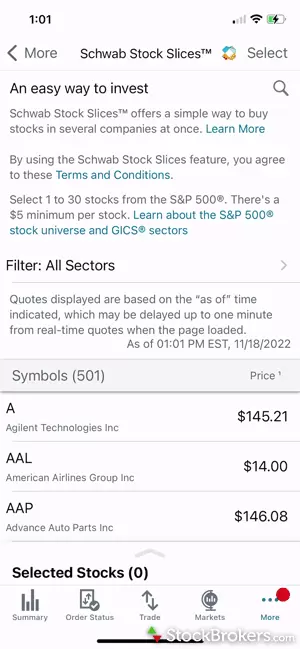

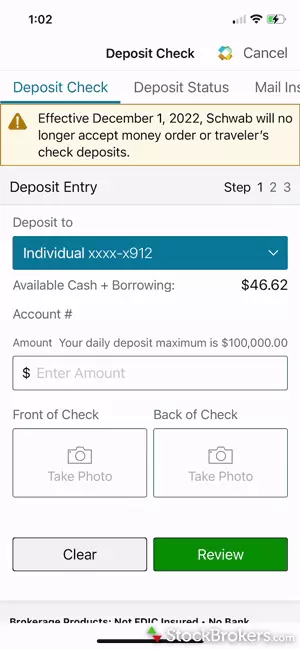

Best desktop stock trading platform - Charles Schwab

Schwab, which bought TD Ameritrade in 2020, is now the home of the outstanding thinkorswim platform suite— and that's a big plus for traders. The mobile and desktop platforms are powerful, and intermediate traders will find the learning curve manageable. Beginners will appreciate online trading coaches and the mountains of videos, webinars and articles.

Charles Schwab desktop and web gallery

Charles Schwab mobile app gallery

Best options trading platform - tastytrade

| Company |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

Offers

|

Visit Site |

tastytrade tastytrade

|

$0.00 |

$0.00 |

$0.50 info |

Open and fund & earn up to $4,000* |

Visit Site

|

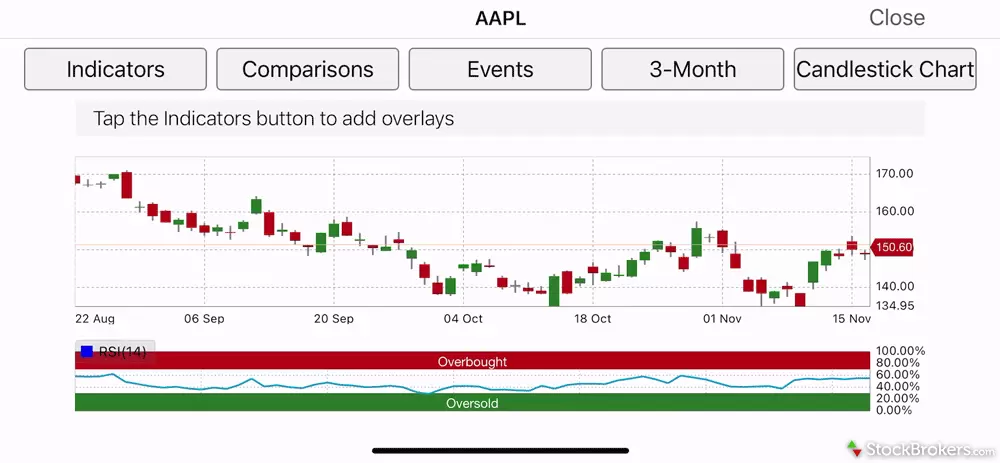

Tastytrade (formerly known as tastyworks) might be the best broker you haven’t heard of. It’s my primary broker for futures and futures options trading because I like the desktop platform’s layout, and its options pricing is attractive. In fact, tastytrade is StockBrokers.com’s favorite for trading options. There’s powerful charting, crisp graphics, vibrant live and recorded commentary and positively savory tools and pricing for options trading. Some traders might long for more stock research and fundamental data, but they’ll have one of the most responsive platforms in the business.

Tastytrade desktop gallery

Tastytrade mobile app gallery

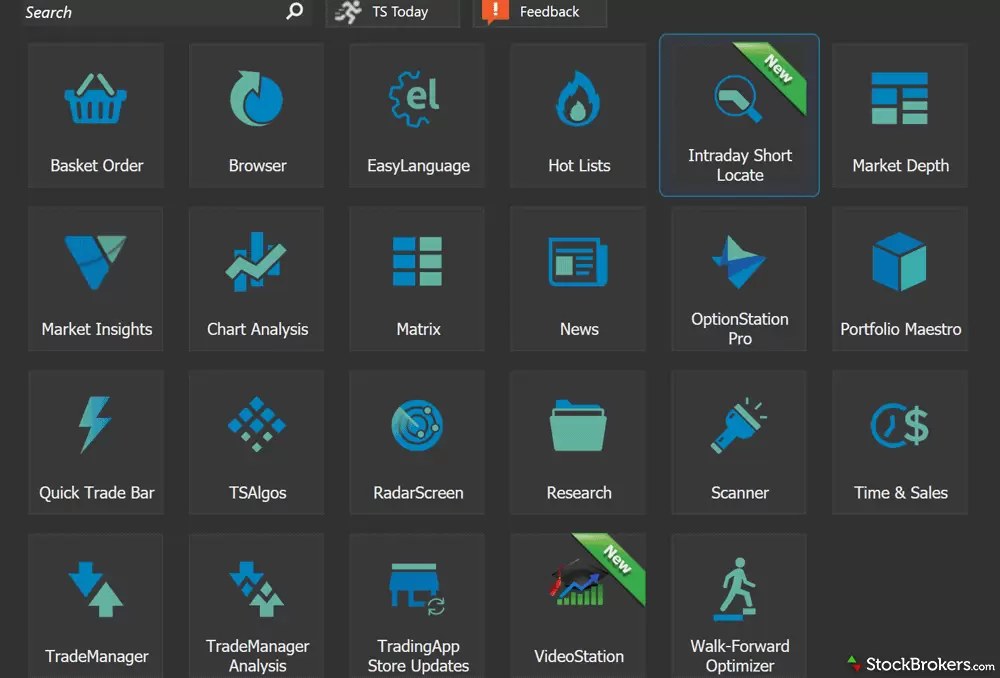

Best for automated trading - TradeStation

| Company |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

Offers

|

Visit Site |

TradeStation TradeStation

|

$0.00 |

$0.00 |

$0.60 |

Trade Stocks, Options, & Futures. |

Visit Site

|

TradeStation is a pioneer in desktop trading platforms. I used it 20 years ago when I was learning how to analyze charts, and I was in love with how the platform analyzed charts and placed trades automatically. The current iteration of TradeStation is still a top choice for automated trading and backtesting. Its proprietary programming language, EasyLanguage, is thoroughly documented and well-supported by a passionate user base.

TradeStation gallery

TradeStation mobile app gallery

Day trading platforms comparison

Popular day trading platform tools include ladder trading, Level 2 quotes, trading hotkeys, direct market routing, stock alerts, streaming time and sales, customizable watch lists, and backtesting, among many others.

It’s important to have the right tools, but the overall “feel” of a broker’s platform is just as critical. Day traders live and die according to their workflows. We spent hours on platforms creating custom watchlists, marking up charts, and executing trades. Some platforms were a joy to use while others felt like a chore.

Here's a trading platform comparison table of common tools and features. For a full comparison of 150+ features, use our comparison tool.

|

Feature |

Interactive Brokers Interactive Brokers

|

Charles Schwab Charles Schwab

|

tastytrade tastytrade

|

TradeStation TradeStation

|

Fidelity Fidelity

|

|

Streaming Time & Sales

info

|

Yes

|

Yes

|

No

|

Yes

|

Yes

|

|

Streaming TV

info

|

Yes

|

Yes

|

Yes

|

No

|

Yes

|

|

Direct Market Routing - Stocks

info

|

Yes

|

Yes

|

No

|

Yes

|

Yes

|

|

Ladder Trading

info

|

Yes

|

Yes

|

Yes

|

Yes

|

No

|

|

Trade Hot Keys

info

|

Yes

|

Yes

|

No

|

Yes

|

Yes

|

|

Level 2 Quotes - Stocks

info

|

Yes

|

Yes

|

No

|

Yes

|

Yes

|

|

Trade Ideas - Backtesting

info

|

Yes

|

Yes

|

No

|

Yes

|

Yes

|

|

Trade Ideas - Backtesting Adv

info

|

Yes

|

Yes

|

No

|

Yes

|

No

|

|

Short Locator

info

|

Yes

|

Yes

|

Yes

|

Yes

|

Yes

|

|

Order Liquidity Rebates

info

|

Yes

|

No

|

No

|

Yes

|

No

|

|

Visit Site

|

Visit Site

|

|

Visit Site

|

Visit Site

|

Visit Site

|

And here's a trading platform comparison table of common fees. To compare all brokerage fees, use our comparison tool.

|

Feature |

Interactive Brokers Interactive Brokers

|

Charles Schwab Charles Schwab

|

tastytrade tastytrade

|

TradeStation TradeStation

|

Fidelity Fidelity

|

|

Minimum Deposit

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

|

Stock Trades

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

|

ETF Trade Fee

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

|

Mutual Fund Trade Fee

|

$14.95

|

Varies

|

N/A

info |

$14.95

|

$49.95

|

|

Options (Base Fee)

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

|

Options (Per Contract)

|

$0.65

|

$0.65

|

$0.50

info |

$0.60

|

$0.65

|

|

Futures (Per Contract)

|

$0.85

|

$2.25

|

$1.25

|

$1.50

|

(Not offered)

|

|

Broker Assisted Trade Fee

|

$30

|

$25

|

$0

|

$25

|

$32.95

|

|

Visit Site

|

Visit Site

|

|

Visit Site

|

Visit Site

|

Visit Site

|

FAQs

What is day trading?

Day trading is a strategy in which a trader opens and closes trading positions within a single trading day. The goal is to end each trading session with a net profit after costs. Day traders primarily trade during the opening 60 minutes (9:30-10:30 a.m. Eastern) and closing 30 minutes (3:30-4 p.m. Eastern) of each market session, which is when price volatility is highest.

How do I start day trading?

- Knowledge is as important as capital. Start reading. Watch the financial news and read investment books.

- Practice day trading using virtual money, also known as paper trading.

- Use our broker comparison tool to find the best broker for you.

- Open a margin account with the selected broker.

- You must deposit and maintain at least $25,000 in equity to avoid “pattern day trader” restrictions.

- Look for stocks that you think have favorable upside to downside risk ratios.

- Trade. Consider only putting a maximum of 5% of your capital in one stock.

- Keep a trading journal.

- Exit trades when they fail to perform as expected or when they hit their target prices.

- It’s unrealistic to expect all of your trades will be profitable. Focus instead on improving your win-loss ratio.

What is a pattern day trader?

Once you engage in four day trades within five business days, you will be labeled a “pattern day trader.” The broker may also classify you as a pattern day trader if it has good reason to believe you will frequently day trade. Pattern day traders must maintain $25,000 in equity to day trade. If they do not maintain that level of equity, their accounts will be restricted from exiting positions intraday. Pattern day traders may also be permitted a higher degree of leverage than other margin investors.

What is margin?

Margin is a form of leverage. Margin accounts let traders use their portfolios as collateral for loans, which they can use to buy more investments. Buying on margin increases both potential upside and downside and the client will be charged interest on the money borrowed. Here’s a hypothetical example of how margin works:

- Jesse has $100,000 of Nvidia stock in his account. If that stock goes up by 15% after a year, his account will be worth $115,000.

- Instead, Jesse borrows $50,000 at a 7% annual interest rate from his broker to buy more Nvidia stock. He will have $150,000 in NVDA, but his equity will stay the same at $100,000 ($150,000 in stock minus the $50,000 loan).

- If NVDA stock goes up by 15% over that year, his account will be worth $119,000 ($172,500 minus the $50,000 loan and $3,500 interest).

- If the stock goes down by 15% after a year, his account will be worth $74,000 ($127,500 minus the $50,000 loan and $3,500 interest).

There are regulations and broker policies related to the use of margin. Before borrowing, clients should make sure they understand the rules thoroughly.

Can you day trade on multiple platforms?

Yes. It’s common for day traders to have multiple brokerage accounts and use several trading platforms simultaneously. A trader might prefer the chart analysis tools of one broker but prefer to trade options at another. It’s also a good idea to have a backup account open and at the ready in case a preferred broker suffers a data glitch or crash.

What are the risks of day trading?

Because day trading involves actively buying and selling stocks throughout the day using margin (borrowed capital), it is inherently risky. Like poker, losing streaks can lead traders to take undisciplined risks, magnifying losses. Some day trading software — for example, a trading journal — can help identify your strengths and weaknesses, provided you’re diligent in entering your trades. For more on that strategy, see the guide to best trading journals on our sister site, investor.com.

Is day trading still profitable?

Yes, day trading is still profitable, but the real question should be “for whom?” Generally speaking, day trading should only be done by highly disciplined, knowledgeable, experienced, and well capitalized investors, and to get that experience, novices have to make their rookie mistakes and find a personal trading style. There is, however, one clear group of winners, and that’s brokerage firms. Brokers love active traders because they pay more fees and rack up margin interest and payments for order flow.

Is day trading illegal?

In the U.S., day trading is legal. To day trade, once you’re classified as a "pattern day trader," you must have at least a $25,000 minimum account equity to day trade. On the positive side, you gain access to 4:1 intraday margin and 2:1 margin overnight.

Is day trading worth it?

In today's market, hedge funds running sophisticated algorithms make it very difficult to day trade profitably. Most day traders are also severely undercapitalized and get suckered into paying for expensive chat room memberships, educational courses, and newsletter subscriptions on social media. Here's a breakdown of what our founder, Blain Reinkensmeyer, learned from day trading.

query_stats Trading vs. investing

While these terms are often used interchangeably, there are some important differences to know that can help you clarify your overall investment goals. See the article Trading vs. Investing: What You Should Know on our sister site, investor.com.

What is the fastest trading platform?

The fastest trading platform will be found among TradeStation, tastytrade, Charles Schwab's thinkorswim, Interactive Brokers' Trader Workstation (TWS), and Webull because they are desktop-based. With a desktop trading platform, the base code runs locally on your computer, maximizing speed. That said, web-based trading platforms built with modern code can match desktop platforms in overall speed. Software aside, like esports, the most common bottleneck for any trading platform is the internet connection.

Our Research

Why you should trust us

Sam Levine, CFA, CMT, the lead writer for StockBrokers.com, has over 30 years of investing experience and actively trades stocks, ETFs, options, futures, and options on futures. He's held roles as a portfolio manager, financial consultant, investment strategist and journalist. He holds the Chartered Financial Analyst (CFA) and the Chartered Market Technician (CMT) designations and served on the board of directors of the CMT Association.

Blain Reinkensmeyer, head of research at StockBrokers.com, has been investing and trading for over 25 years. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. Blain created the original scoring rubric for StockBrokers.com and oversees all testing and rating methodologies.

For this guide:

- Whenever possible, we used our own brokerage accounts for testing. For several brokers, we used a test account that was provided to us.

- We collected more than three thousand data points (196 per broker).

- We tested each online broker's website, browser-based trading platform (where applicable), downloadable desktop trading platform (where applicable), and of course, the mobile app (or apps in the case of several brokers).

How we tested

Our research team rigorously tested the most important features sought by day traders, such as trading costs — including order execution quality — and factors such as ladder trading, stock alerts, streaming time and sales and customizable watch lists, among others. In total, we evaluate more than 200 variables for each broker. All research, writing and data collection at StockBrokers.com is done by humans, for humans. Read our generative AI policy here.

Our testing used a combination of quantitative data points, tool comparisons and opinion scoring. Our opinion scores were derived from actually using the platforms for trading and monitoring markets.

StockBrokers.com uses a variety of computing devices to evaluate trading platforms. Our reviews were conducted using the following devices: iPhone 12 Pro, iPhone 15 Pro Max, MacBook Pro M1 with 8 GB RAM running the current MacOS, and a Dell Vostro 5402 laptop i5 with 8 GB RAM running Windows 11 Pro. In testing platforms and apps, our reviewers place actual trades for a variety of instruments.

As part of our data check process, we sent a data profile link to each broker summarizing the data we had on file and the data they provided us last year, with a field for entering any data that had since changed. For the brokers that filled out these profiles, we audited the information for any discrepancies between our data and the broker’s data to ensure accuracy.

As part of our review process, all brokers had the opportunity to provide updates and key milestones in a live meeting that took place in the fall. Meetings with broker teams also took place throughout the year as new products rolled out. Insights gathered from these calls helped steer our testing efforts to ensure every feature and tool was assessed.

Trading platforms tested

We tested 17 online trading platforms for this guide: