TD Ameritrade Review

Charles Schwab acquired TD Ameritrade in October 2020. All clients of TD Ameritrade, Inc. are now Schwab clients. If you were considering opening an account with TD Ameritrade, head over to our Charles Schwab review to learn more.

*This review reflects our views on TD Ameritrade when it was reviewed as a stand-alone brokerage in 2023.

TD Ameritrade delivered $0 trades, fantastic trading platforms, excellent market research, industry-leading education for beginners and reliable customer service. This outstanding all-around experience made TD Ameritrade one of our top overall brokers in 2023. We've seen many of TD's strongest features find their way over to Schwab.

-

Minimum Deposit:

$0.00 -

Stock Trades:

$0.00 -

Options (Per Contract):

$0.65

| Range of Investments | |

| Mobile Trading Apps | |

| Platforms & Tools | |

| Research | |

| Education | |

| Ease of Use | |

| Customer Service |

Check out StockBrokers.com's picks for the best stock brokers in 2025.

| 2023 | #2 |

| 2022 | #2 |

| 2021 | #1 |

| 2020 | #1 |

| 2019 | #1 |

| 2018 | #2 |

| 2017 | #1 |

| 2016 | #2 |

| 2015 | #1 |

| 2014 | #1 |

| 2013 | #1 |

| 2012 | #1 |

| 2011 | #2 |

Led by Jessica Inskip, Director of Investor Research, the StockBrokers.com research team collects thousands of data points across hundreds of variables. We evaluate features important to every kind of investor, including beginners, casual investors, passive investors, and active traders. We carefully track data on margin rates, trading costs, and fees to rate stock brokers across our proprietary testing categories.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on StockBrokers.com. Learn more about how we test.

Table of Contents

Pros & Cons

Pros

- Excellent platform suite.

- Offered a wealth of third-party research and reliable in-house content.

- Educational content covers all levels and every way people prefer to learn.

Cons

- Though TD Ameritrade provided superior client service, other brokers have friendlier design and writing.

- TDA didn't offer fractional shares or crypto.

Here were our three top takeaways for TD Ameritrade in 2023:

- TD Ameritrade was our best platform for beginners in 2023, thanks to industry-leading education and research, an easy-to-use website and a separate mobile app built specifically for everyday investors.

- Through the top-ranked thinkorswim trading platform, which comes in desktop, browser, and mobile flavors, TD Ameritrade delivered excellence for all active traders, including day traders, options traders, and futures traders. (2024 update: thinkorswim is now available at Charles Schwab.)

TD Ameritrade and Charles Schwab

Schwab bought TD Ameritrade in October 2020 for $26 billion. As of August 2023, Schwab is transferring accounts in batches. For all practical purposes, if you open a TD Ameritrade account, you should expect your assets to port to Schwab. That’s not a bad thing, but it might be more straightforward to simply open your account with Schwab.

Occasionally, there are snafus after brokers acquire competitors. That said, some of us at StockBrokers.com had accounts with OptionsXpress when Schwab bought them in 2011 (we’ve been around for a minute). That experience was painless. We are confident Schwab has thoroughly prepared for the account conversion.

Did Schwab buy TD Ameritrade?

Yes, Schwab entered into an agreement to buy TD Ameritrade in November 2019. The deal closed in October 2020, though the two companies continued to function as separate entities (for the most part) until recently. TD Ameritrade and Schwab clients will see differences in their account features and tools as the TD Ameritrade conversion progresses. Schwab is in the process of moving all TD Ameritrade accounts to Schwab.

Why is TD Ameritrade moving to Schwab?

TD Ameritrade was bought by Schwab in 2020. It’s not unusual for brokerage firms to acquire competitors. The goal for the buyer is to increase revenue without equally increasing costs, once redundant costs are eliminated.

When will my TD Ameritrade account become a Schwab account?

Schwab is moving TD Ameritrade accounts in batches. Current TD Ameritrade clients will receive notice approximately three months in advance of the conversion. You should watch for advance notifications via email or regular mail. If you’re a thinkorswim user, you may be among the last to migrate.

Should I allow my TD Ameritrade account to transfer to Schwab?

TD Ameritrade clients have an important decision to make. Once the merger with Schwab is complete, TD Ameritrade will – for all practical purposes – cease to exist. Some features, such as TD Ameritrade’s excellent thinkorswim platforms, will reappear at Schwab. However, it’s likely that some features will not survive the merger. If another broker will serve your needs better, you should transfer your TD Ameritrade assets to that broker.

What should I do before my TD Ameritrade account transfers to Charles Schwab?

You should receive notice from Schwab that your TD Ameritrade account will be moving approximately three months in advance. First, check out our review of Charles Schwab and decide whether Schwab fits your brokerage needs. If it does, review the Transition Update page on TD Ameritrade’s site for more information on what to expect with the merge. We have accounts that have already moved to Schwab and have experienced no issues. Still, it would be smart to download records of your holdings, account activity, and cost bases before your accounts transfer in case of errors, which we think unlikely. If you’ve decided that Charles Schwab doesn’t suit your needs, you have time to choose a different broker (our brokerage comparison tool can help you there).

How does the merger between Charles Schwab and TD Ameritrade benefit Schwab customers?

Schwab has not itemized all of the changes Schwab customers will see once the acquisition is complete, but it has indicated that it will bring over TD Ameritrade’s excellent thinkorswim trading platforms. There are many other features and content available on TD Ameritrade that we hope will continue at Schwab, but time will tell.

Will Schwab get the thinkorswim trading platform?

TD Ameritrade’s excellent thinkorswim collection of mobile, web, and desktop trading platforms will continue at Charles Schwab. Current thinkorswim users can continue to trade at TD Ameritrade until Schwab notifies them otherwise.

What are the facts and figures for Schwab’s acquisition of TD Ameritrade?

Schwab bought TD Ameritrade for approximately $26 billion of Schwab stock when the deal closed in October 2020. TD Ameritrade stockholders received 1.0837 shares of Schwab for each TD Ameritrade share. Upon closing its acquisition of TD Ameritrade in October 2020, Schwab announced the combined company held $6 trillion in customer assets within 28 million accounts and facilitated an average of five million trades daily.

Investment options

TD Ameritrade provides everything one might expect of a full-service brokerage, from stock trading to retirement guidance. All account types are supported. Also offered are both futures and forex trading (read our TD Ameritrade forex review on our sister site, ForexBrokers.com).

Drawbacks include a lack of fractional shares and international trading; TD Ameritrade customers can only trade U.S. and Canadian-listed securities.

Cryptocurrency: Cryptocurrencies such as Bitcoin, Ethereum, and Dogecoin are not available to trade at TD Ameritrade.

Retirement services: TD Ameritrade offers no-fee traditional, Roth and rollover IRAs, and was among our picks for best IRA providers in 2023.

| Feature |

TD Ameritrade TD Ameritrade

|

|---|---|

| Stock Trading | Yes |

| Account Feature - Margin Trading | Yes |

| Fractional Shares (Stocks) | No |

| OTC Stocks | Yes |

| Options Trading | Yes |

| Complex Options Max Legs | 4 |

| Fixed Income (Treasurys) | Yes |

| Futures Trading | Yes |

| Forex Trading | Yes |

| Crypto Trading | No |

| Crypto Trading - Total Coins | 0 |

| Traditional IRAs | |

| Roth IRAs | |

| Advisor Services | Yes |

TD Ameritrade fees

Thanks to a pricing war in October 2019, TD Ameritrade, like a number of online brokers, slashed its $6.95 stock and ETF trades rate down to $0. Options trades cost just $0.65 per contract.

Penny stocks: Despite $0 stock and ETF trades, there is still a $6.95 flat-rate fee for trading penny stocks.

Mutual funds: Most mutual funds at TD Ameritrade cost $49.95 to buy and $0 to sell; there are some exceptions that cost $74.95 to buy. There is no commission charge for NTF (no transaction fee) funds. Note, however, NTF funds that are held 180 days or less before being sold may be charged a short-term redemption fee of $49.99.

| Feature |

TD Ameritrade TD Ameritrade

|

|---|---|

| Minimum Deposit | $0.00 |

| Stock Trades | $0.00 |

| Penny Stock Fees (OTC) | $6.95 |

| Options (Per Contract) | $0.65 |

| Options Exercise Fee | $0.00 |

| Options Assignment Fee | $0.00 |

| Futures (Per Contract) | $2.25 |

| Mutual Fund Trade Fee | Varies |

| Broker Assisted Trade Fee | $25 |

Mobile trading apps

TD Ameritrade offers two different smartphone apps: TD Ameritrade Mobile, designed for casual investors; and thinkorswim Mobile, for the feature-hungry active trader. Both apps are excellent.

Ease of use: While both apps are feature-rich and great for trading, there is a bit of a learning curve to how much you can do. Being able to customize charts and option chains is great, but makes these apps a little bit more challenging to use. TD Ameritrade Mobile is easier to use than thinkorswim mobile and has more analyst research.

Ask Ted: If you are tired of waiting for live agents or frustrated with useless chatbot answers, TD Ameritrade’s chatbot, Ask Ted, is the best in the business. Ted returns relevant results quickly and he’s… it’s available throughout TDA.

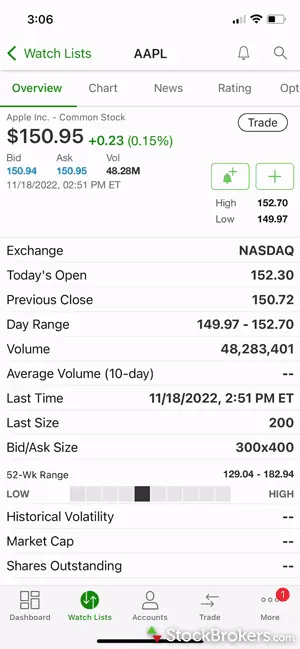

TD Ameritrade Mobile: TD Ameritrade Mobile features a customizable dashboard. Navigating the app is seamless and includes all the features an investor might want. Watch lists sync with your account and are streaming and fully customizable. Meanwhile, stock quotes include price alerts, news, and clean (and fully-featured) charting, and third-party ratings are accompanied by PDF research reports. Placing trades is a breeze.

TD Ameritrade Mobile. Press play for a demo.

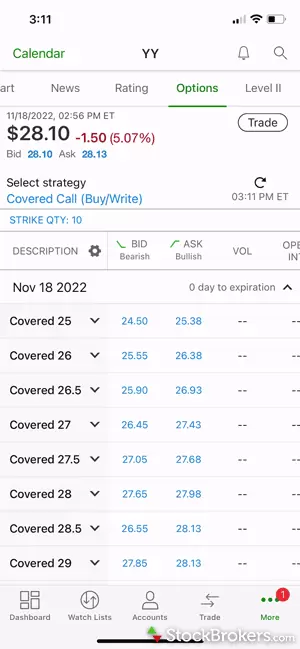

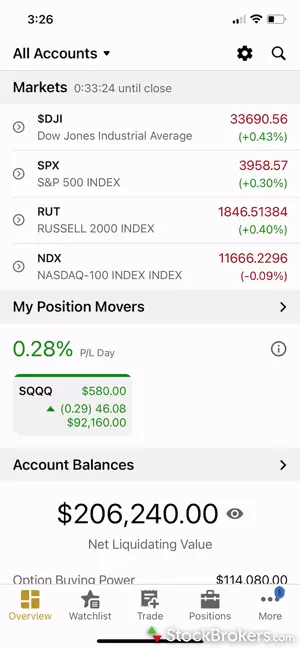

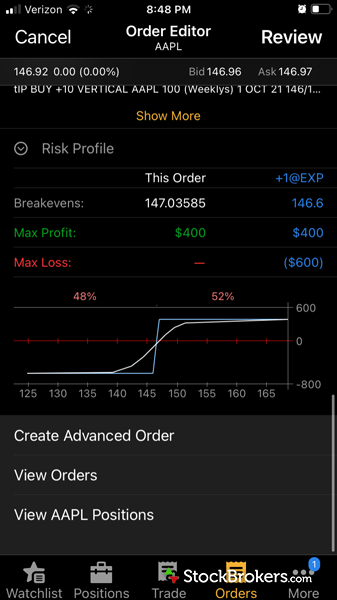

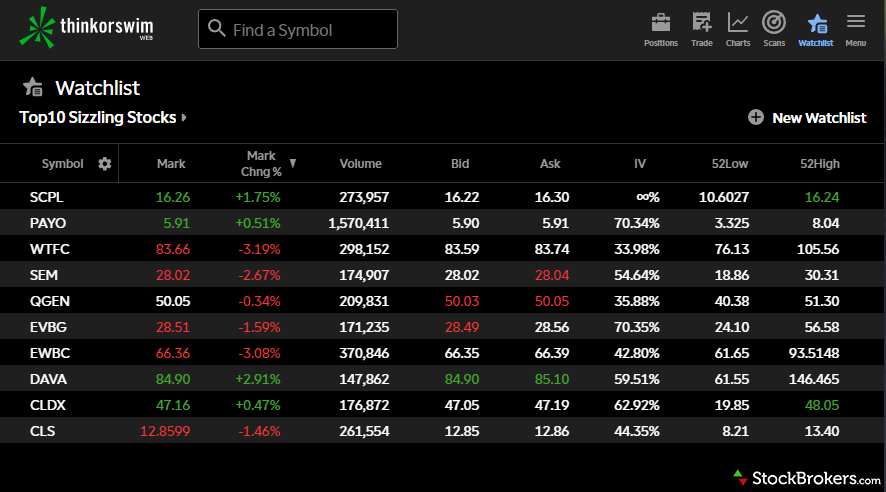

thinkorswim Mobile: thinkorswim Mobile won our Best Trader App in 2023. Upon login, you are taken straight into your watch lists, which sync with the thinkorswim desktop and web version. In fact, the app mirrors the thinkorswim desktop throughout. Charting includes all 400+ indicators from the desktop platform, and chart preferences sync in the cloud. Orders and alerts management is fluid, and there is easy access to Trader TV, which includes the TD Ameritrade Network and CNBC.

TD Ameritrade's feature-rich thinkorswim app.

TD Ameritrade Mobile apps gallery

| Feature |

TD Ameritrade TD Ameritrade

|

|---|---|

| iPhone App | Yes |

| Android App | Yes |

| Apple Watch App | Yes |

| Stock Alerts | Yes |

| Charting - After-Hours | Yes |

| Charting - Technical Studies | 400 |

| Charting - Study Customizations | Yes |

| Watchlist (Streaming) | Yes |

| Mobile Watchlists - Create & Manage | Yes |

| Mobile Watchlists - Column Customization | Yes |

Trading platforms

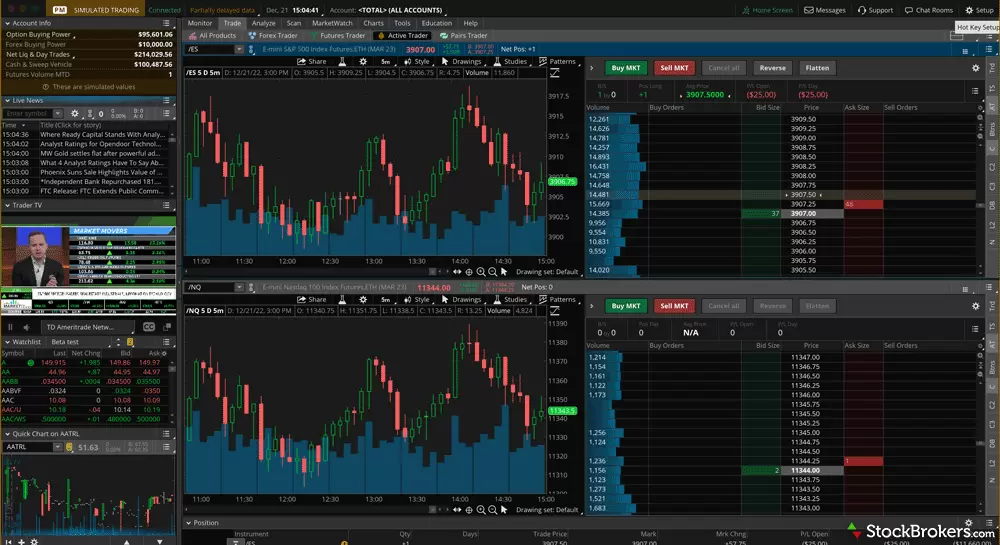

Whether you are day trading, options trading or futures trading, thinkorswim desktop is a winner. For casual investors, TD Ameritrade’s latest platform addition, thinkorswim web, is great.

thinkorswim desktop charting: thinkorswim’s charting capabilities are so advanced they are rivaled only by TradeStation. A few clicks of the mouse will have dozens of charts streaming real-time data. Even the pickiest trader will be satisfied with the 400+ technical studies available, which is the most in the industry.

thinkorswim desktop trading tools: thinkorswim is home to an impressive array of tools. Highlights include paper trading, performing advanced earnings analysis, plotting economic (FRED) data, charting social sentiment, backtesting with thinkOnDemand, and even replaying historical markets tick-by-tick. TD Ameritrade also allows traders to create and conduct real-time stock scans, share charts and workspace layouts, and perform advanced options analysis. The rabbit hole goes as deep as any trader's imagination cares to go. It's a remarkable offering of choices that will set your mind spinning – in a good way.

thinkorswim desktop Earnings Analysis: If you trade on expected earnings, the thinkorswim Earnings Analysis tool is a favorite for planning ahead for earnings releases and assessing each company's results afterward. It plots price action and volatility before and after previous releases, and pulls data from Wall Street analysts and crowd-sourced ratings from Estimize to plot EPS estimate ranges alongside actual results. The whole experience brings clarity with much less noise.

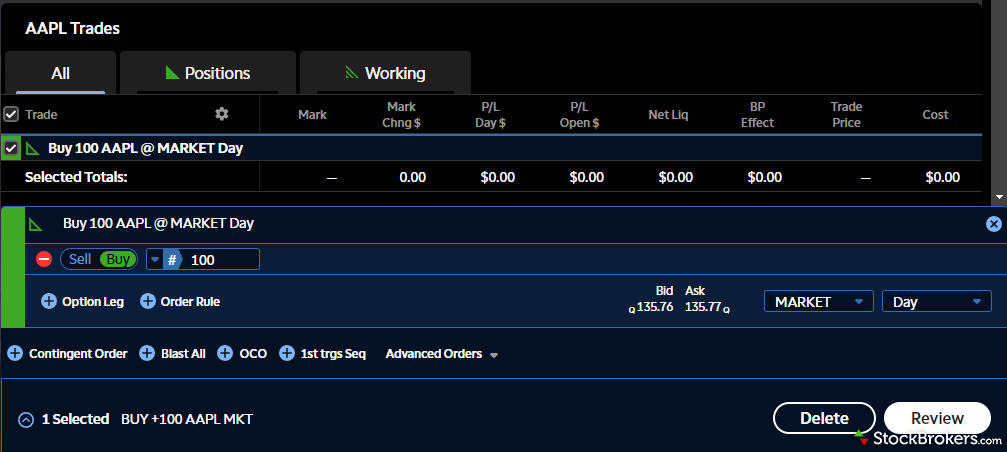

thinkorswim web: Compared to thinkorswim desktop, thinkorswim web gives traders an easy way to quickly manage their account while accessing essential trading features. For example, headlines stream from top-tier providers such as Dow Jones Newswire and charts come with 30 indicators.

thinkorswim web trading tools: While thinkorswim web appears simple on the surface, there are a handful of advanced functions underneath the hood. For example, you can place multi-legged options orders and choose from five default strategies, all from within the same trading window within charts. And when you create an order, it is saved on the same page as the ticker symbol, so if you switch views to another symbol and then come back, the order is still there until you execute or delete it.

TD Ameritrade thinkorswim galleries

| Feature |

TD Ameritrade TD Ameritrade

|

|---|---|

| Active Trading Platform | thinkorswim |

| Desktop Trading Platform | Yes |

| Desktop Platform (Mac) | Yes |

| Web Trading Platform | Yes |

| Paper Trading | Yes |

| Trade Journal | Yes |

| Watchlists - Total Fields | 514 |

| Charting - Indicators / Studies | 429 |

| Charting - Drawing Tools | 24 |

| Charting - Study Customizations | 9 |

| Charting - Save Profiles | Yes |

| Trade Ideas - Technical Analysis | Yes |

| Streaming Time & Sales | Yes |

| Trade Ideas - Backtesting | Yes |

Research

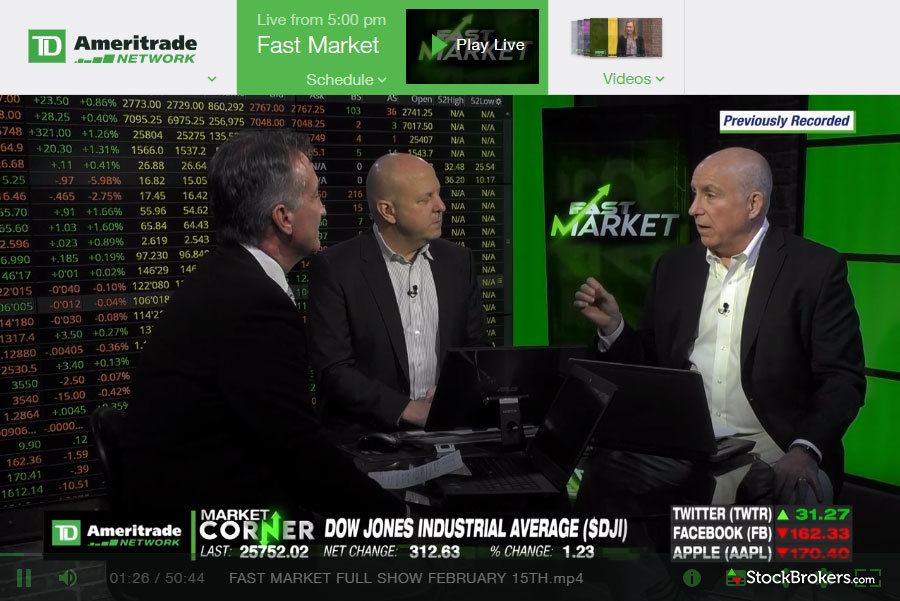

Thanks to the TD Ameritrade Network and a unique lineup of tools, TD Ameritrade offers investors a substantial research offering.

Stock research: TD Ameritrade shines in stock research, offering a wide range of options. ResearchTeam reports consolidate third-party research into a single ranking, stock scanners in thinkorswim can be customized, Market Edge provides insight into technical analysis, and a host of webcasts and research articles add to the robust offering.

TV network and video: The TD Ameritrade Network, TD Ameritrade's live streaming financial network, broadcasts live every day from 8 a.m. to 5 p.m. Eastern and includes an excellent mix of market analysis and trader education. Schwab is the only other online broker to offer live broadcasting during market hours. TD Ameritrade also provides streaming TV from CNBC for the U.S., Europe, and Asia trading sessions.

Market commentary: TD Ameritrade provides written daily market commentary and analysis through the Ticker Tape portal. Content is widespread, covering day-to-day markets as well as general finance, savings, retirement, and trader education. Together with the Ticker Tape, TD Ameritrade publishes thinkMoney, a quarterly print (and digital) magazine, which focuses entirely on education. The bottom line is that for stock and options trading, TD Ameritrade is a standout. For long-term investing and retirement-related content, we prefer Fidelity Viewpoints and Schwab Insights.

Social sentiment: Social sentiment data is available within thinkorswim that tracks the number of times a symbol was mentioned on Twitter and includes rankings. For example, if you pull up a chart of Tesla (TSLA), you can see the social sentiment displayed on the chart, including the percentage of negative, neutral, and positive mentions.

Community features: On thinkorswim, traders can utilize chat rooms, share trade ideas through myTrade and see the trades shared by others from within the Trade Fees section. When we visited a couple of chat rooms, we found them relatively quiet compared to the deluge of investor posts that can be found in the feeds of eToro and Webull.

| Feature |

TD Ameritrade TD Ameritrade

|

|---|---|

| Research - Stocks | Yes |

| Stock Research - ESG | No |

| Stock Research - PDF Reports | 6 |

| Screener - Stocks | Yes |

| Research - ETFs | Yes |

| Screener - ETFs | Yes |

| Research - Mutual Funds | Yes |

| Screener - Mutual Funds | Yes |

| Research - Pink Sheets / OTCBB | Yes |

| Research - Fixed Income | Yes |

Education

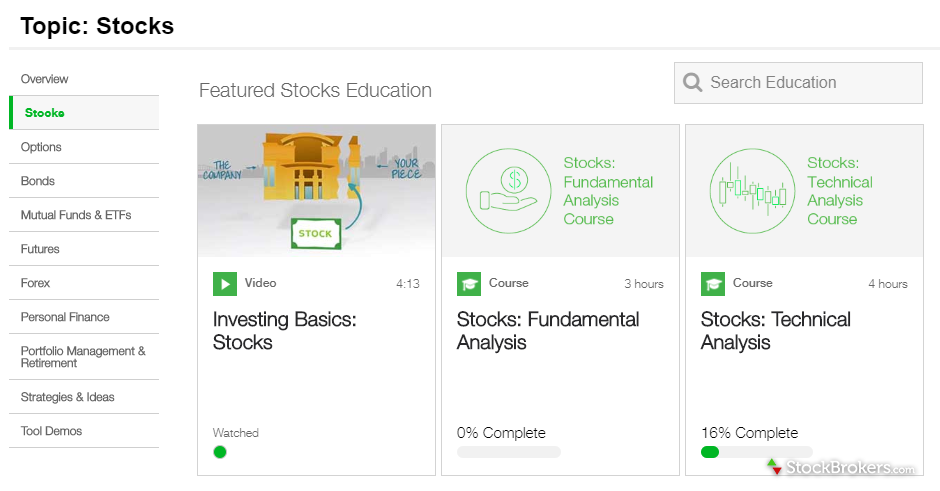

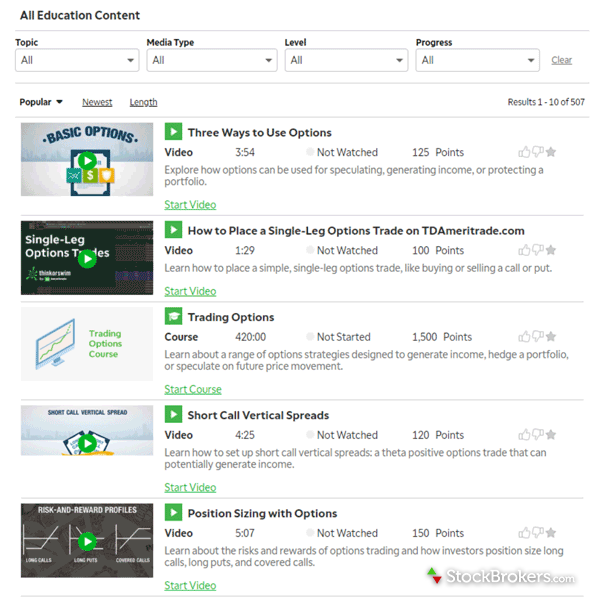

There is no better broker for learning the basics of the stock market than TD Ameritrade. Excellent education makes it an easy winner for beginners.

Learning center: Organized into courses with quizzes, over 200 videos are available, which all include progress tracking. Also provided each month are hundreds of webinars and educational sessions, and education is also broadcast through the TD Ameritrade Network.

TD Ameritrade publishes its own magazine, thinkMoney, and blog on the Ticker Tape. Finally, the thinkorswim Learning Center provides advanced education on all things technical analysis related, including coding custom indicators.

Podcasts and other media: I found the six episodes in the Talking Green podcast to be excellent, with insights into behavioral finance to help you improve your relationship with money. In addition, TD Ameritrade has several YouTube channels, including one dedicated to its Trader Talks series with over 1,000 archived webcasts.

| Feature |

TD Ameritrade TD Ameritrade

|

|---|---|

| Education (Stocks) | Yes |

| Education (ETFs) | Yes |

| Education (Options) | Yes |

| Education (Mutual Funds) | Yes |

| Education (Fixed Income) | Yes |

| Education (Retirement) | Yes |

| Videos | Yes |

| Webinars | Yes |

| Progress Tracking | Yes |

| Interactive Learning - Quizzes | Yes |

Banking services

TD Ameritrade provides essential banking services to customers online and through retail service centers across the United States.

Like its closest competitors, TD Ameritrade offers mobile check deposit, online bill pay, and ATM fee reimbursement. TD Ameritrade also offers cash management accounts with FDIC-insurance protection.

| Feature |

TD Ameritrade TD Ameritrade

|

|---|---|

| Bank (Member FDIC) | No |

| Checking Accounts | Yes |

| Savings Accounts | No |

| Credit Cards | Yes |

| Debit Cards | Yes |

| Mortgage Loans | No |

Final thoughts

With Schwab's acquisition of TD Ameritrade, investors and traders will need to decide whether they're willing to be clients of Charles Schwab. That's not a sacrifice; we rate Charles Schwab very highly and are fans of the powerful thinkorswim trading platforms. If you are okay waiting a bit for thinkorswim, we suggest you open a new account at Schwab instead of TD Ameritrade.

TD Ameritrade's Star Ratings (Historical)

| Feature |

TD Ameritrade TD Ameritrade

|

|---|---|

| Overall |

|

| Range of Investments |

|

| Mobile Trading Apps |

|

| Platforms & Tools |

|

| Research |

|

| Customer Service |

|

| Education |

|

| Ease of Use |

|

StockBrokers.com Review Methodology

Why you should trust us

Sam Levine, CFA, CMT, formerly a lead writer for StockBrokers.com, has over 30 years of investing experience and actively trades stocks, ETFs, options, futures, and options on futures. He's held roles as a portfolio manager, financial consultant, investment strategist and journalist. He holds the Chartered Financial Analyst (CFA) and the Chartered Market Technician (CMT) designations and served on the board of directors of the CMT Association.

Blain Reinkensmeyer, co-founder of StockBrokers.com, has been investing and trading for over 25 years. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. Today, Blain is widely respected as a leading expert on finance and investing, specifically the U.S. online brokerage industry. Blain has been quoted in The New York Times, The Wall Street Journal, Forbes, and Fast Company, among others. Blain created the original scoring rubrics for StockBrokers.com and oversees all testing and rating methodologies.

How we tested

- We used our own brokerage accounts for testing.

- We collected thousands of data points for each broker.

- We tested each online broker's website, desktop platforms, and mobile app, where applicable.

- We maintained strict editorial independence; brokers cannot pay for inclusion or a higher rating.

Our research team meticulously collected data on every feature of importance to a wide range of customer profiles, including beginners, casual investors, passive investors, and active traders. We carefully track variables like margin rates, trading costs, fees, and platform features and use them to help rate brokers across a range of categories measuring ease of use, range of investments, research, education, and more.

At StockBrokers.com, our reviewers use a variety of computing devices to evaluate platforms and tools. Our reviews and data collection were conducted using the following devices: iPhone SE running iOS 17.5.1, MacBook Pro M1 with 8 GB RAM running the current MacOS, and a Dell Vostro 5402 laptop i5 with 8 GB RAM running Windows 11 Pro.

Each broker was evaluated and scored on over 200 different variables across seven key categories: Range of Investments, Platforms & Tools, Research, Mobile Trading, Education, Ease of Use, and Overall. Learn more about how we test.

Read next

Popular Guides

- Best Paper Trading Apps & Platforms for 2026

- Best Day Trading Platforms of 2026 for Beginners and Active Traders

- Best Options Trading Platforms for 2026

- Best Stock Trading Platforms for Beginners of 2026

- Best Trading Platforms for 2026

- Best Brokers for Penny Stock Trading of 2026

- Best Stock Trading Apps for 2026

- Best Futures Trading Platforms for 2026

More Guides

About TD Ameritrade

Headquartered in Omaha, Nebraska, TD Ameritrade was founded in 1975 as one of the first online brokerages in the United States. In 2019, Charles Schwab announced it was acquiring TD Ameritrade in an all-stock transaction valued at approximately $26 billion. At the time of closing in 2020, the combined company housed roughly $6 trillion in assets and 28 million brokerage accounts.