Trade Ideas Review

Trade Ideas is a software developer and provider of innovative tools for analyzing financial markets. Its web-based platform suite delivers both technical and fundamental analysis, complete with AI-generated trading strategies and trading signals.

With a range of interactive web components and clear visualizations, Trade Ideas helps traders uncover and evaluate potential trading opportunities. Its dedicated backtesting capabilities and premium tools for subscribers, like the first-generation Holly AI and the newer Money Machine, offer depth for serious traders.

From unusual options volume screeners to nearly 50 AI-powered trading strategies and signals, I’ve found Trade Ideas to be a powerful software suite that can complement any active trader’s toolkit. For those seeking to level up with AI trading signals, it’s worth a close look.

-

Free version:

Yes -

Monthly Pricing:

$127/mo -

Annual Pricing:

$1,068/yr

| Ease of Use | |

| Features | |

| Cost |

Pros & Cons

Pros

- Trade Ideas’ AI-powered signals deliver nearly 50 pre-defined strategies for active traders.

- The Stock Race and Market Pulse tools make scanning for opportunities surprisingly visual and engaging.

- Its dedicated channels and Scope 360 dashboard help uncover trading ideas fast.

Cons

- The desktop platform has a steep learning curve and takes time to master.

- Repetitive modules can feel clunky for beginners navigating the web version.

- AI signals are shared across the entire community, so crowded trades can limit potential.

My top takeaways of Trade Ideas in 2026:

- The Trade Ideas platform covers a lot of ground. Holly AI, the original generation of its AI-powered trading assistant, comes with a library of nearly 50 strategies and real-time signals that is a clear advantage for day traders who want AI signals that adapt to the current trading session. I particularly like the Scope 360 dashboard and Market Pulse feature, which offer fresh ways to read market sentiment and spot unusual activity.

- The Stock Race animation and the replay feature add an extra dimension to visual analysis, which is a touch I’ve rarely seen executed well elsewhere. There’s also a social angle here that’s worth noting: Trade Ideas lets traders compete through tournaments like the Pro Masters Challenge, adding a gamified twist to the trading experience. I’ve always found that useful for building discipline under a competitive structure.

- Trade Ideas isn’t without its friction points. The desktop version demands patience and a good grasp of settings if you want to get the most from Holly AI and The Money Machine. And since those AI-generated signals get pushed to the entire community, you’ll need to move quickly to avoid crowded trades that could impact execution. Some modules feel visually repetitive, too, which can be distracting until you know your way around.

- Overall, if you’re looking for a trading tool with unique AI signals, deep backtesting, and community competitions, Trade Ideas is worth considering. Just be prepared to put in the time to learn its full potential.

Overall summary

| Feature |

Trade Ideas Trade Ideas

|

|---|---|

| Overall |

|

| Features |

|

| Ease of Use |

|

| Cost |

|

| Free version | Yes |

| Monthly Pricing | $127/mo |

| Annual Pricing | $1,068/yr |

Cost and plans

Trade Ideas offers multiple subscription plans and add-ons, including monthly options and discounts for annual subscriptions. There’s a free Par Plan and two paid plans: the Birdie Bundle and the Eagle Elite.

The Par Plan is the free option, which provides delayed data but still gives you access to Stock Racing visualizations, PiP Charts, predefined alerts and indicators, and the option to participate in tournaments for a fee (free for paid subscribers).

The TI Basic plan, also known as the Birdie Bundle, has a monthly cost of $127, which drops to $89 with an annual subscription. You get real-time data, 10 charts per screen, customizable layouts, a demo account, and in-app trading.

For full AI-powered signals, the TI Premium plan, also known as the Eagle Elite plan, starts at $254 per month, or $178 when you choose annual pricing. This plan provides access to backtesting, Smart Risk Levels, and the Channel Bar feature.

Additional paid add-ons are also available, ranging from $49 per month for the Alphatrends AVWAP indicator and GoNoGo® Trend charting tool to the Swing Pick add-on for $17, which gives you access to five new trade ideas via email each Sunday as part of Trade Ideas’ ALERT index newsletter.

| Plan | Pricing | Key Features |

| Par Plan (Free) | Free | Delayed market data, Stock Racing visualizations, PiP Charts, predefined alerts and indicators, tournament access for a fee |

| TI Basic (Birdie Bundle) | $127/month or $89/month (annual) | Real-time market data, up to 10 charts per screen, customizable layouts, demo account, in-app trading |

| TI Premium (Eagle Elite) | $254/month or $178/month (annual) | All Basic features plus backtesting, Smart Risk Levels, Channel Bar, Holly AI, The Money Machine, daily AI-optimized strategies |

The three various plans offered by Trade Ideas. A free version, paid basic version, and finally the premium version.

Free version: the Par plan

The free version of Trade Ideas, known as the Par Plan, is a pretty good deal because you still get access to many of the features of the web app, but simply with delayed market data.

If you’re an active trader looking for intraday opportunities, the free version won’t be ideal. However, beginners and traders not yet sure about Trade Ideas can start on this plan and then decide whether upgrading makes sense to access real-time market data and act faster on any opportunities uncovered within the app. Keep in mind that the AI-related tools and signals are only available in the highest tier, the Eagle Elite plan, also known as TI Premium.

Nonetheless, I was pleased to see a freemium version available, which gives you a sneak peek into Trade Ideas’ technology.

The dashboard of Trade Ideas while viewing the free version.

TI Basic: the Birdie Bundle plan

If you decide to upgrade to a paid plan with Trade Ideas, the Birdie Bundle, also known as TI Basic, is the least expensive subscription option, running $127 per month or $89 per month with an annual plan.

The key difference between this plan and the free plan is access to real-time market data. This can be the difference between spotting actionable opportunities versus seeing them in hindsight on the free plan, where data is delayed. However, the full AI-generated trading signals and strategies are only available on the highest plan, so the Birdie Bundle sits squarely between the Par Plan and the TI Premium (Eagle Elite) option.

Trade Idea's main dashboard screen when the Premium plan is enabled.

TI Premium: the Eagle Elite plan

The Eagle Elite plan, also known as TI Premium, is the full package. Here you get not just real-time data, but also the ability to use AI-powered tools, including the first-generation Holly AI and the second-generation Money Machine. This plan provides trading signals from nearly 50 pre-defined strategies, and the use of AI helps optimize these strategies each day based on new market conditions.

These AI-powered modules live in the desktop platform and refresh daily using machine learning and updated backtesting to adapt to changing market trends. This self-optimizing approach is novel for a retail trading product, though results will always vary depending on your strategy, settings, and the stocks you choose to trade.

Even so, just like any signal service, AI tool, or trading strategy, there’s no guarantee of success, and prudent risk management remains key. I appreciate that Trade Ideas gives traders an automated system that adjusts itself daily, but you still need to manage it carefully. There’s no set-it-and-forget-it strategy when it comes to trading with AI.

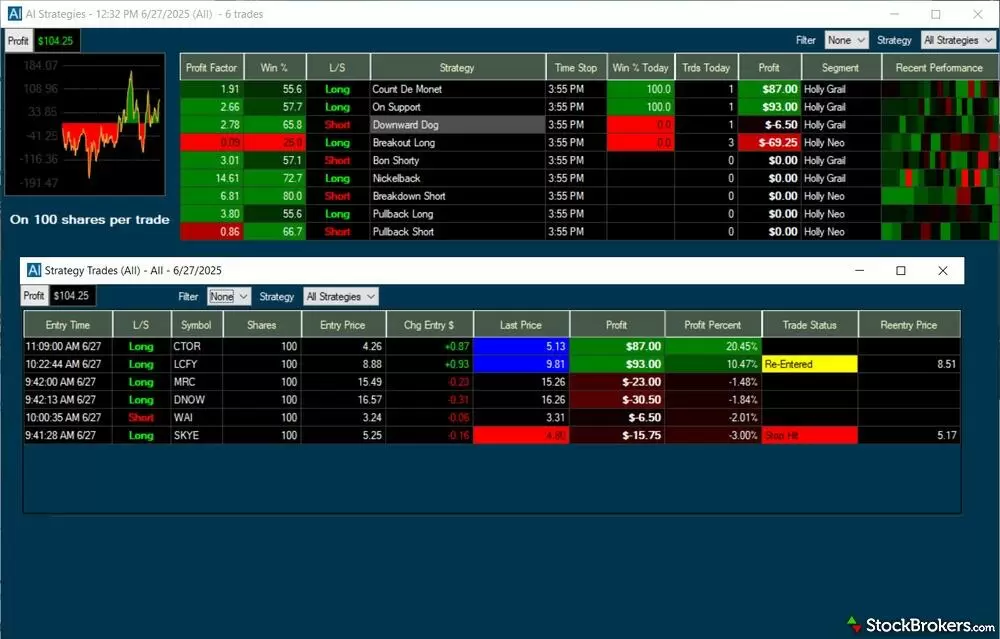

A screenshot of the AI Strategies tool in Trade Ideas. Profit and losses are shown per strategy.

Features

I found Trade Ideas to include many of the core features I expect from an online trading platform, such as pre-defined screeners and watchlists on the web version, plus more advanced charting tools and backtesting features within the desktop software. Trade Ideas does set itself apart with its first- and second-generation AI-powered signals and strategies, along with integration with a growing number of brokers so you can execute trades automatically in a live account.

While the hype around AI products can be overblown, Trade Ideas seems to apply it in a practical way — mainly using machine learning rather than flashy generative AI like its GPT chatbot. That said, a cautious approach is required, as using these tools is no guarantee of success. I noticed that many of the trading results shown for Holly AI appear cherry-picked. I would have liked to see its biggest losing trades too, not just the winners, and an ability to compare the win-to-loss ratio and other key metrics. Overall, though, I’m impressed with the direction Trade Ideas is going and the range of features available across its free and paid plans.

Scope 360 feature

The web version of Trade Ideas provides a list of Channels that work like pre-defined watchlists and heatmaps, along with charting and its flagship Stock Race visualization. I found these useful for spotting market opportunities, especially within the Scope 360 channel. It’s similar to tools you’d typically find within a brokerage trading platform, except for the Stock Race, which is unique.

Four open panels on the web version of Trade Ideas. In the lower left panel, the Stock Race tool is shown.

Desktop version of Trade Ideas

The desktop platform may appear simple on the surface, but under the hood there’s a wide range of settings and parameters you’ll need to tweak to get the most out of your Trade Ideas experience. As a result, I don’t recommend using this unless you subscribe to the Eagle Elite plan and want access to the AI-powered features like Holly AI and The Money Machine.

The desktop version with multiple windows open. You can also choose between various channels.

Holly AI Trading Signals and Strategies

The first- and second-generation trading signals and strategies from Trade Ideas live within its desktop platform, with detailed instructions available in a dedicated user guide. I found the setup process technical but about what you’d expect when configuring an algorithmic trading system — it’s definitely more involved than a simple signals provider.

Trade Ideas provides a full user guide on using their AI trade assistant, Holly.

Thankfully, Trade Ideas offers flexibility: you can either act on the trading signals manually or set up trade automation with a compatible brokerage. While there are countless trading systems and signals on the market, what sets Trade Ideas apart is its use of machine learning to optimize strategies at the end of each trading day. It analyzes new market data, updates its backtesting, and adjusts parameters to adapt to changing conditions.

Keep in mind that past performance doesn’t guarantee future results. Even so, the daily system updates could save countless hours compared to a human tweaking dozens of strategies by hand. That said, I’d still like to see a more detailed performance breakdown that includes weaker strategies, not just the top performers. Results can vary from trader to trader depending on the assets used and other variables, so it’s always best to start small when testing any new strategy, whether automated or manual. I’m curious to see how Trade Ideas continues to evolve Holly AI and The Money Machine in the years ahead.

Ease of use

While the web version of Trade Ideas is straightforward to navigate and fairly easy to use, the desktop version is much more advanced and feels like using a highly complex trading platform.

On that basis, I found the desktop platform does not rank highly for ease of use and comes with a steeper learning curve, especially compared to its web counterpart.

The desktop version of the Trade Ideas platform has a wide range of options. Here you are able to adjust the trade size that the AI makes.

It’s worth noting that the advanced features, including Holly AI, The Money Machine, backtesting capabilities, and both pre-defined and custom strategies, are only available on the desktop version. So if you want to get the most out of Trade Ideas and its AI capabilities, learning the desktop software is essential and requires a commitment of time and focus to understand all the settings and parameters and configure the access to your needs.

The desktop version of Trade Ideas has a wide range of configuration settings. Here you can adjust the alerts it provides per strategy.

Final thoughts

In addition to helping you find trading opportunities through dedicated channels within the web app, what I liked most about Trade Ideas is how it goes further with nearly 50 trading strategies, real-time signals, and the ability to broadcast these ideas to its community of subscribers.

The option to execute trading ideas directly through a compatible brokerage brings Trade Ideas closer to a social-copy trading setup. However, instead of copying other traders, you’re copying AI-generated trading signals produced by Holly AI and the Money Machine. That’s an interesting twist I don’t see offered by many retail trading platforms.

While the performance of signals can look appealing on paper, factors like potential slippage, latency, timing, and other trade-related variables can impact the actual results in your own account. I always recommend a healthy dose of caution when using any trading tool as past performance, whether hypothetical or actual, isn’t guaranteed to match your own results.

Disclaimers aside, Trade Ideas is an innovative developer and provider of advanced trading tools and could be a strong addition to your trading arsenal if you’re an active trader and have the time to set up the software properly. For beginners, the web version is better suited and far easier to learn, while the desktop version caters to intermediate or advanced traders ready to leverage its full AI capabilities.

StockBrokers.com Review Methodology

Why you should trust us

Steven Hatzakis is a well-known finance writer, with 25+ years of experience in the foreign exchange and financial markets. He is the Global Director of Online Broker Research for Reink Media Group, leading research efforts for ForexBrokers.com since 2016. Steven is an expert writer and researcher who has published over 1,000 articles covering the foreign exchange markets and cryptocurrency industries. He has served as a registered commodity futures representative for domestic and internationally-regulated brokerages. Steven holds a Series III license in the US as a Commodity Trading Advisor (CTA).

Blain Reinkensmeyer, co-founder of StockBrokers.com, has been investing and trading for over 25 years. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. Today, Blain is widely respected as a leading expert on finance and investing, specifically the U.S. online brokerage industry. Blain has been quoted in The New York Times, The Wall Street Journal, Forbes, and Fast Company, among others. Blain created the original scoring rubrics for StockBrokers.com and oversees all testing and rating methodologies.

How we tested

- We used paid trading tool accounts for testing.

- We collected dozens of data points across the tools we review.

- We tested each tool’s website, desktop platforms, and mobile app, where applicable.

- We maintained strict editorial independence; trading tools cannot pay for a higher rating.

Our researchers thoroughly test a wide range of popular trading tools' features, such as trading journals and screeners, charting providers, and educational resources. We also evaluate the overall design of each tool’s mobile experience and look for a fluid user experience moving between mobile and desktop tools.

At StockBrokers.com, our reviewers use a variety of devices to evaluate trading tools. Our reviews and data collection are conducted using the following devices: iPhone SE running iOS 17.5.1, MacBook Pro M1 with 8 GB RAM running the current MacOS, and a Dell Vostro 5402 laptop i5 with 8 GB RAM running Windows 11 Pro.

Each trading tool was evaluated and scored across three key categories: Ease of Use, Features, and Cost. Learn more about how we test.

Trading tools tested in 2025

We tested 9 trading tools and service providers for stock traders in 2025:

Read next

- Best Futures Trading Platforms for 2026

- Best Stock Brokers for 2026

- Best Day Trading Platforms of 2026 for Beginners and Active Traders

- Best Stock Trading Apps for 2026

- Best Stock Trading Platforms for Beginners of 2026

- Best Paper Trading Apps & Platforms for 2026

- Best Brokers for Penny Stock Trading of 2026

- Best Options Trading Platforms for 2026