Webull Review

Webull has matured beyond its roots as a low-cost disruptor, establishing itself as a sophisticated environment for the active market participant. The platform excels at translating institutional-grade data, everything from advanced charting to order flow analysis, into a seamless mobile interface.

With the integration of AI-powered summaries to cut through market noise and industry-leading paper trading software for strategy testing, Webull offers a compelling platform for those who desire performance without commission fees. While it may not replace the holistic planning services of a legacy firm, for the self-directed trader who lives in the charts, Webull offers a distinct competitive edge.

-

Minimum Deposit:

$0.00 -

Stock Trades:

$0.00 -

Options (Per Contract):

$0.00

| Range of Investments | |

| Mobile Trading Apps | |

| Advanced Trading | |

| Research | |

| Education | |

| Ease of Use | |

| Customer Service |

Check out StockBrokers.com's picks for the best stock brokers in 2026.

| #1 Paper Trading | Winner |

| 2026 | #6 |

| 2025 | #8 |

| 2024 | #9 |

| 2023 | #8 |

| 2022 | #12 |

| 2021 | #10 |

Led by Jessica Inskip, Director of Investor Research, the StockBrokers.com research team collects thousands of data points across hundreds of variables. We evaluate features important to every kind of investor, including beginners, casual investors, passive investors, and active traders. We carefully track data on margin rates, trading costs, and fees to rate stock brokers across our proprietary testing categories.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on StockBrokers.com. Learn more about how we test.

Table of Contents

Pros & cons

Pros

- Zero commissions for options contracts.

- Crypto trading has been reintegrated into the main app.

- A phenomenal paper trading platform for the perfect sandbox to test strategies without risking capital.

Cons

- A lack of useful account types like Inherited IRAs, Trust accounts, and custodial accounts for minors.

- Constructing multi-leg options strategies can feel cumbersome compared to specialized platforms.

- The educational content is often disorganized and can be confusing for beginners.

My top takeaways for Webull in 2026:

- A mobile workstation, not just an app: Webull’s mobile experience is best-in-class, packing institutional-grade features like 56 technical indicators, a historical "replay mode," and deep order flow analysis into a handheld interface.

- Pricing power for active traders: While zero-commission stock trading is standard, Webull distinguishes itself by extending $0 commissions to equity options contracts. For high-volume active traders, this pricing structure removes the drag of per-contract fees found at most full-service brokerages.

- Data visualization over dense reports: Instead of lengthy PDF reports, Webull excels at visualizing complex market data. From the "Saturn" markets hub that displays yield curves and net inflows to the AI-powered news summaries, the platform is built for traders who want to scan, analyze, and act quickly.

Range of investments

Webull is aggressively shedding its reputation as a niche trading app, steadily expanding its shelf space to court a wider variety of investors. While the menu of tradable assets now rivals some full-service brokers, the infrastructure required to support complex financial lives, specifically diverse account types and mutual funds, has not kept pace.

Beyond standard stocks and ETFs, Webull offers options, futures, and access to 50 cryptocurrencies. I also found the addition of the Webull Smart Advisor to be a welcome pivot toward passive investing. Managed by State Street Global Advisors, this robo-advisor offers goal tracking and personalized portfolios, though the 0.43% annual fee is somewhat steep compared to competitors who offer similar services for free or at a lower cost.

However, Webull remains primarily geared for the individual, taxable trader. If you are looking to manage family wealth or business assets, you will likely hit a wall. I found no option to open Trust accounts, SEP IRAs, or custodial accounts (529s or UTMAs) for minors. Furthermore, while taxable accounts support margin and options, IRAs lack limited margin capabilities and the ability to trade spreads.

The experience of managing these investments also feels utilitarian. The positions page displays total portfolio value and weighting, but frankly, it offers the bare minimum in terms of analysis. Contextual education and research are available, but they feel separate from the flagship platform rather than integrated into the decision-making process.

| Feature |

Webull Webull

|

|---|---|

| Stock Trading | Yes |

| Account Feature - Margin Trading | Yes |

| Fractional Shares (Stocks) | Yes |

| OTC Stocks | Yes |

| Options Trading | Yes |

| Complex Options Max Legs | 4 |

| Fixed Income (Treasurys) | Yes |

| Futures Trading | Yes |

| Forex Trading | Yes |

| Crypto Trading | Yes |

| Crypto Trading - Total Coins | 50 |

| Traditional IRAs | Yes |

| Roth IRAs | Yes |

| Advisor Services | No |

Webull fees

Webull built its reputation on disruption, aggressively cutting costs to attract active traders who are sensitive to the drag of transaction fees. While the industry has largely converged on zero commissions for stock and ETF trades, Webull distinguishes itself by extending that pricing model to options, maintaining a $0.00 per contract fee. For high-volume options traders used to paying the industry standard of $0.65 per contract elsewhere, this represents significant annualized savings.

As the platform expands into new asset classes, the pricing structure remains competitive, though not always free. I found the futures pricing to be reasonable at $1.25 per contract, positioning it well against other discount brokers. If you are venturing into fixed income, Webull charges a markup of 0.10% per bond, which is transparent but worth noting for those building large ladders.

For traders utilizing leverage, the margin rates are competitive, though not the lowest in the industry. Webull charges 8.74% for margin balances under $25,000, with the rate holding steady for balances up to $99,999. It is also important to be aware of the exit costs. Should you decide to move your portfolio to another brokerage, Webull charges a $75 fee for both full and partial ACAT transfers.

| Feature |

Webull Webull

|

|---|---|

| Minimum Deposit | $0.00 |

| Stock Trades | $0.00 |

| Penny Stock Fees (OTC) | N/A |

| Options (Per Contract) | $0.00 |

| Options Exercise Fee | $0.00 |

| Options Assignment Fee | $0.00 |

| Futures (Per Contract) | $1.25 |

| Mutual Fund Trade Fee | N/A |

| Broker Assisted Trade Fee | N/A |

Mobile trading apps

Webull’s mobile app manages to deliver an institutional level of data into a handheld experience without feeling cluttered. For active traders who demand depth, I found this to be one of the most capable apps on the market.

The charting experience is, simply put, outstanding. Webull offers 56 technical indicators and a suite of drawing tools that are surprisingly easy to use on a small screen. I particularly appreciated the "magnifying glass" feature, which pops up when drawing trendlines to ensure your placement is exact, and is a nice detail often overlooked by competitors.

Jessica's take

"Another standout is the 'Replay Mode,' which allows you to watch a time-lapse of a chart's price action. As a lover of technical analysis, I found this feature incredibly cool for reviewing market moves."

Beyond charts, the app is dense with usable data. The "News & Daily" button utilizes AI to provide succinct summaries of what is moving the market and why, filtering out the noise. I also loved the volume analysis on the quote page, which visualizes trading activity at the bid (selling pressure) versus the ask (buying pressure). This level of order flow visibility is rare in a mobile environment.

However, the experience is not without its downsides. While trading stocks and single-leg options is straightforward, I found the multi-leg options interface to be restrictive. Constructing complex spreads felt confined, as I could not easily adjust widths or legs without navigating back and forth. Additionally, while the social "Feeds" tab offers a unique community aspect where you can discuss trades with other users, the sheer volume of notifications and alerts can be overwhelming if you don't take the time to customize your settings.

Webull’s mobile app blends social media with investing, and the “Most Popular” feed is a perfect example. You can quickly see which stocks are being talked about most, along with real comments from individual investors. It’s a unique way to tap into market sentiment and stay connected to what the Webull community is watching.

| Feature |

Webull Webull

|

|---|---|

| iPhone App | Yes |

| Android App | Yes |

| Apple Watch App | Yes |

| Stock Alerts | Yes |

| Charting - After-Hours | Yes |

| Charting - Technical Studies | 56 |

| Charting - Study Customizations | Yes |

| Watchlist (Streaming) | Yes |

| Mobile Watchlists - Create & Manage | Yes |

| Mobile Watchlists - Column Customization | No |

Advanced trading platform

Webull’s desktop experience is clearly designed with the active trader in mind, offering a workspace that feels surprisingly substantial for a discount broker. While it lacks a dedicated mobile app specifically for active traders, the desktop platform, available as both a downloadable application and in the browser, bridges that gap effectively. The layout is widget-based and highly customizable, allowing traders to build a dashboard that suits their specific workflow.

The exemplary feature is undoubtedly the charting. With 52 technical indicators and 19 drawing tools, the platform caters to serious technicians. I particularly enjoyed the "Replay Mode," a feature rarely seen outside of paid software, which allows you to replay historical price action bar-by-bar. This is a fantastic tool for backtesting strategies visually. Customizing charts is also intuitive. I could easily snap drawings to specific prices for precision and adjust settings like logarithmic scaling with a few clicks. However, I did find the inability to set custom time ranges (like a specific 3-year view) to be a minor setback for longer-term analysis.

Webull’s trading platform brings everything together in one clean, customizable view, perfect for making fast, informed decisions. Here, with AAPL selected, you can see a real-time chart, a pre-filled limit order ticket, and a detailed quote panel that includes analyst ratings and sentiment breakdowns.

The platform also excels at keeping traders connected to the broader market. Webull integrates a surprising depth of macro data directly into the workspace, allowing active traders to keep an eye on market conditions without needing to switch context or leave their trading environment.

However, the actual order ticket experience is a mixed bag. Placing stock trades is straightforward, with features like "Turbo Trader" available for speedy trading. But complex options trading felt cumbersome. Constructing multi-leg strategies required me to use a specific "strategy view" rather than building legs organically from the chain, which I found frustrating. Similarly, while the portfolio monitoring tools cover the basics, such as displaying total value and performance against an index, they lack the deeper risk analysis metrics, like beta-weighting, that sophisticated traders often require.

| Feature |

Webull Webull

|

|---|---|

| Active Trading Platform | N/A |

| Desktop Trading Platform | Yes |

| Desktop Platform (Mac) | Yes |

| Web Trading Platform | Yes |

| Paper Trading | Yes |

| Trade Journal | No |

| Watchlists - Total Fields | 35 |

| Charting - Indicators / Studies | 52 |

| Charting - Drawing Tools | 19 |

| Charting - Study Customizations | 2 |

| Charting - Save Profiles | Yes |

| Trade Ideas - Technical Analysis | Yes |

| Streaming Time & Sales | Yes |

| Trade Ideas - Backtesting | No |

Research

Webull takes a distinct approach to research: instead of inundating you with lengthy third-party PDF reports, it visualizes the raw data active traders actually use. If you are looking for a Morningstar analyst's written opinion on a stock's moat, you won't find it here. However, if you want to analyze order flow distribution or visualize financial statements without a spreadsheet, Webull is surprisingly powerful.

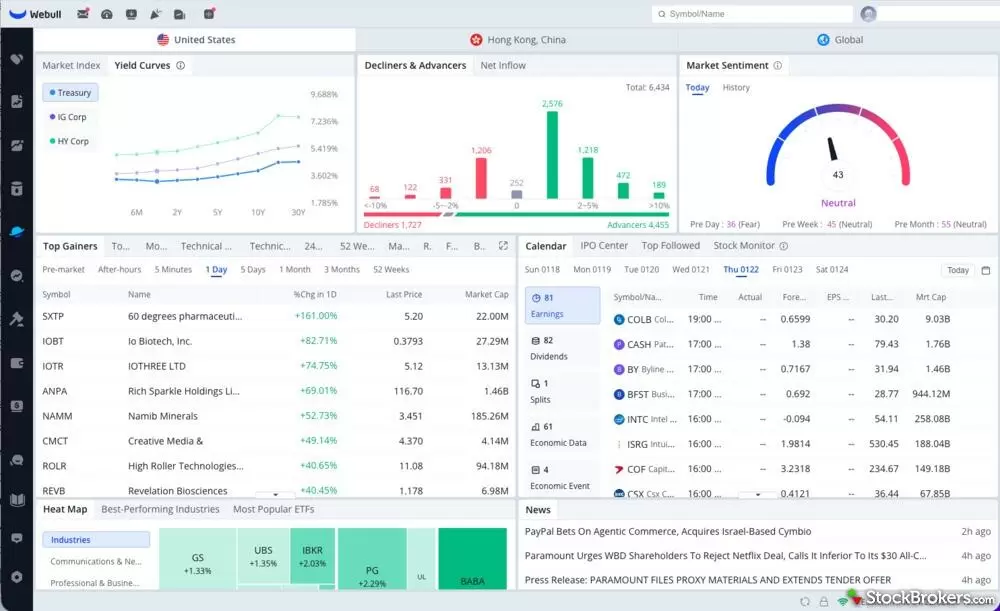

The standout feature of the research experience is the Markets page, accessible via the Saturn icon. I found this section to be fantastic for gathering a quick, visual pulse on the broad market. Rather than just listing indices, Webull uses widget-like cards to display net inflows (NYSE and NASDAQ), sector heatmaps, and advancing/declining ratios. I particularly loved the yield curve visualization, which clearly plots the treasury curve against investment-grade and high-yield bonds. It is a level of macro data visualization rarely seen on discount platforms.

Webull’s Markets overview page is a great way to check in on the market, offering a comprehensive snapshot. It includes tabs for the US as well as international markets. For the US, traders can see major indices prices, yield curves, advance/decline flows, market sentiment, top gainers alongside other most popular lists, market calendars, heatmaps, news, and more.

When drilling down into individual stocks, the experience is dense, offering 12 distinct tabs of data. The "Order Flow" tab is a key differentiator, allowing you to see the distribution of large-scale orders and position cost distribution. These are metrics that are invaluable for understanding short-term sentiment. Even the "Financials" tab is built for visual learners, displaying income statements and balance sheets as year-over-year trend charts rather than static tables.

However, the platform falls short on idea generation for the passive investor. I found the stock screener to be functional but scaled back compared to peers, missing key growth and technical filters I typically look for. The ETF screener is essentially a glorified watchlist, lacking meaningful filtering capabilities. Ultimately, Webull provides excellent tools for analyzing a stock you already know, but it struggles to help you find the next one if you rely on fundamental data.

| Feature |

Webull Webull

|

|---|---|

| Research - Stocks | Yes |

| Stock Research - ESG | No |

| Stock Research - PDF Reports | 0 |

| Screener - Stocks | Yes |

| Research - ETFs | Yes |

| Screener - ETFs | No |

| Research - Mutual Funds | No |

| Screener - Mutual Funds | No |

| Research - Pink Sheets / OTCBB | Yes |

| Research - Fixed Income | No |

Education

Webull’s approach to education can best be described as quantity over quality. While the platform offers an impressive range of content covering stocks, ETFs, options, and even macroeconomics, I found the value to be lacking. The educational experience, housed separately as Webull Learn, feels disconnected from the main platform, and the content itself often struggles with clarity and organization.

For the beginner investor, navigating Webull’s library can be confusing. I found the categorization of topics to be haphazard. For instance, lessons on day trading were listed right next to fundamental concepts like income statements, with no clear learning path to bridge the gap. When I dove into specific articles, the writing quality was inconsistent. The options education, for example, used confusing analogies, like comparing options leverage to a mortgage, that could easily mislead a novice. Similarly, the ETF content felt text-heavy and used odd terminology that didn't align with standard industry definitions.

Webull’s Learning Center, shown here sorted by “Most Popular,” makes it easy to discover what other investors are engaging with most this week. From beginner guides to advanced trading strategies, the platform covers an impressive breadth of material.

That said, there are bright spots. The sheer volume of material means that if you are looking for information on a specific topic, like the yield curve or Fibonacci retracements, you will likely find it. Webull also offers webinars in partnership with third-party experts, though I found these difficult to locate as they weren't centrally housed in the learning hub. Ultimately, I would not direct a true beginner to Webull’s resource center. It is better suited for an intermediate trader who can sift through the noise or someone looking to practice strategies using Webull’s excellent paper trading feature.

| Feature |

Webull Webull

|

|---|---|

| Education (Stocks) | Yes |

| Education (ETFs) | Yes |

| Education (Options) | Yes |

| Education (Mutual Funds) | No |

| Education (Fixed Income) | Yes |

| Education (Retirement) | Yes |

| Videos | Yes |

| Webinars | Yes |

| Progress Tracking | Yes |

| Interactive Learning - Quizzes | Yes |

Customer service

To score Customer Service, StockBrokers.com partners with customer experience research firm Confero to conduct phone tests from locations throughout the United States. For this year's testing, 132 customer service tests were conducted over six weeks, with wait times logged for each call.

Customer service representatives were asked for assistance or details for prospective customers in several areas of broker services, including account opening, trading tools, apps, crypto offerings, active trading, and more. Here are the results for Webull.

- Average Connection Time: Never taken off hold (10+ minutes of waiting)

- Average Net Promoter Score: 1.0 / 10

- Average Professionalism Score: 0.0 / 10

- Overall Score: 0.92 / 10

- Ranking: 11th of 11

IRA review

Webull’s approach to retirement accounts is aggressive, designed entirely for the accumulation phase of an investor's life. If you are looking to build wealth quickly through active trading or take advantage of deposit matches, it is a compelling choice. However, I found that once you move beyond simple growth strategies into complex hedging or estate planning, the platform’s limitations begin to show.

For the cost-conscious saver, the offer is hard to beat. Webull charges $0.00 in annual IRA fees and maintains its signature zero-commission structure on stocks, ETFs, and options within retirement accounts. I also found their recurring promotional "IRA Match" offers, sometimes requiring a lock-up period or a Premium subscription, to be a strong incentive for transferring assets. Furthermore, the Webull Smart Advisor (a robo-advisor) is available within their IRA offerings, allowing for automated, goal-based investing if you prefer a hands-off approach.

The gaps begin to show when you attempt to trade like a professional. While you can trade options in a Webull IRA, the platform restricts you to Level 1 and Level 2 strategies. This means you can write covered calls or buy calls and puts, but you cannot trade spreads. For an active trader, the inability to define risk with vertical spreads in a retirement account is a significant handicap. Additionally, Webull’s account lineup has limitations. While you can open Traditional, Roth, and Rollover IRAs, I found no option for Inherited (Beneficiary) IRAs. If you are managing a passed-down legacy, you will need to look elsewhere.

Crypto review

Webull has corrected course on its digital asset strategy, much to the relief of its user base. In late 2025, the platform reintegrated cryptocurrency trading back into the flagship Webull app, effectively ending the experiment of forcing users to download the separate "Webull Pay" application. Now, you can manage your Bitcoin alongside your Tesla stock in a single, unified interface. It is a move that significantly restores the platform's appeal for the multi-asset trader.

The offering itself is solid for speculative exposure, featuring over 50 cryptocurrencies, including staples like Bitcoin, Ethereum, and Solana, as well as popular altcoins. There is 24/7 trading availability and a low barrier to entry ($1 minimum). The integration allows you to use Webull’s superior charting tools to analyze crypto price action, applying the same technical indicators you would use for equities.

However, crypto purists should temper their expectations. Webull remains siloed for digital assets. While you can buy and sell coins for profit, the ability to transfer crypto into or out of the platform via a personal wallet is restricted. You do not hold the keys; you only hold the price exposure. If your goal is to participate in DeFi or self-custody your assets in cold storage, Webull is not the venue for you. But for the trader looking to capture volatility without the hassle of wallet management, the experience is cleaner than ever.

Final thoughts

Webull has matured into a sophisticated hub for the active trader. The headline feature is the integration of AI-powered tools that summarize news and analyze volume data, proving the platform can compete on tech innovation, not just price. With a best-in-class mobile app, Webull effectively condenses institutional-grade data into a handheld experience, offering a depth of features that rivals desktop platforms.

Despite these advancements, Webull remains a destination for speculative trading rather than holistic wealth management. The disjointed educational resources and lack of deep fundamental research may leave beginners or long-term investors feeling adrift. However, with its industry-leading paper trading and zero-commission structure, Webull is a solid choice for the serious, self-directed trader who prioritizes raw utility over educational guidance.

Webull Star Ratings

| Feature |

Webull Webull

|

|---|---|

| Overall |

|

| Range of Investments |

|

| Mobile Trading Apps |

|

| Advanced Trading |

|

| Research |

|

| Customer Service |

|

| Education |

|

| Ease of Use |

|

StockBrokers.com Review Methodology

Why you should trust us

Jessica Inskip is Director of Investor Research at StockBrokers.com, bringing 15 years of experience in brokerage and trading strategy. A former FINRA-licensed rep, she held Series 7, 63, 66, and 4 licenses. Jessica focuses on investor education and brokerage industry research, appears regularly on CNBC, Bloomberg, The Schwab Network, Fox Business, and Yahoo! Finance, and hosts the Market MakeHer podcast.

Blain Reinkensmeyer, co-founder of StockBrokers.com, has been investing and trading for over 25 years. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. Today, Blain is widely respected as a leading expert on finance and investing, specifically the U.S. online brokerage industry. Blain has been quoted in The New York Times, The Wall Street Journal, Forbes, and Fast Company, among others. Blain created the original scoring rubrics for StockBrokers.com and oversees all testing and rating methodologies.

How we tested

- We used our own brokerage accounts for testing.

- We collected thousands of data points across the brokers we review.

- We tested each online broker's website, desktop platforms, and mobile app, where applicable.

- We maintained strict editorial independence; brokers cannot pay for inclusion or a higher rating.

Our research team meticulously collected data on every feature of importance to a wide range of customer profiles, including beginners, casual investors, passive investors, and active traders. We carefully track variables like margin rates, trading costs, fees, and platform features and use them to help rate brokers across a range of categories measuring ease of use, range of investments, research, education, and more.

At StockBrokers.com, our reviewers use a variety of computing devices to evaluate platforms and tools. Our reviews and data collection were conducted using the following devices: iPhone SE running iOS 17.5.1, MacBook Pro M1 with 8 GB RAM running the current MacOS, and a Dell Vostro 5402 laptop i5 with 8 GB RAM running Windows 11 Pro.

Each broker was evaluated and scored on over 200 different variables across seven key categories: Range of Investments, Platforms & Tools, Research, Mobile Trading, Education, Ease of Use, and Overall. Learn more about how we test.

Trading platforms tested in 2026

We tested 14 online trading platforms in 2026:

Read next

- Best Paper Trading Apps & Platforms for 2026

- Best Stock Trading Platforms for Beginners of 2026

- Best Futures Trading Platforms for 2026

- Best Day Trading Platforms of 2026 for Beginners and Active Traders

- Best Stock Trading Apps for 2026

- Best Brokers for Penny Stock Trading of 2026

- Best Options Trading Platforms for 2026

- Best Stock Brokers for 2026

More Guides

Popular Stock Broker Reviews

About Webull

Webull is part of China-based Fumi Technology, a fintech company that provides real-time market data, analytical tools, and trading technologies. Webull’s technology team is based in Hunan, China, while customer-facing and brokerage operations are located in New York City.