Firstrade Review

Firstrade pairs the fee structure of a deep-discount broker with much of the capability of a full-service brokerage. The platform distinguishes itself with aggressive $0 options contract fees, a rare pricing model that directly improves profit margins for active traders. Beyond these low costs, the broker relies on infrastructure designed to support a comprehensive catalog of investment products.

Firstrade offers a depth of account types, including Trusts and business IRAs, and international access that many fintech competitors simply cannot match. It lacks the curatorial hand-holding of a premium advisory firm, but for the self-reliant investor focused on efficiency and cost, Firstrade is a formidable offering.

-

Minimum Deposit:

$0.00 -

Stock Trades:

$0.00 -

Options (Per Contract):

$0.00

| Range of Investments | |

| Mobile Trading Apps | |

| Advanced Trading | |

| Research | |

| Education | |

| Ease of Use | |

| Customer Service |

Check out StockBrokers.com's picks for the best stock brokers in 2026.

| 2026 | #9 |

| 2025 | #7 |

| 2024 | #6 |

| 2023 | #7 |

| 2022 | #7 |

| 2021 | #7 |

| 2020 | #9 |

| 2019 | #8 |

| 2018 | #9 |

| 2017 | #11 |

| 2016 | #9 |

| 2015 | #11 |

| 2014 | #12 |

| 2013 | #11 |

| 2012 | #16 |

| 2011 | #10 |

Led by Jessica Inskip, Director of Investor Research, the StockBrokers.com research team collects thousands of data points across hundreds of variables. We evaluate features important to every kind of investor, including beginners, casual investors, passive investors, and active traders. We carefully track data on margin rates, trading costs, and fees to rate stock brokers across our proprietary testing categories.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on StockBrokers.com. Learn more about how we test.

Table of Contents

Pros & cons

Pros

- $0 options contract fees significantly reduce costs for active traders.

- Offers Trusts, Business IRAs, and custodial accounts rarely found at discount brokers.

- Options-focused mobile app offers a streamlined, visual experience for complex strategies.

- International capabilities cater to investors from over 20 global regions.

Here are my top takeaways for Firstrade in 2026:

- Value for options traders: Firstrade's zero commission model extends to options contract fees with no exercise or assignment costs, offering unbeatable value for active traders. Combined with a top-tier mobile experience that makes building multi-leg strategies seamless, it rivals execution platforms that charge premium prices.

- Institutional depth in a discount wrapper: While it lacks crypto and futures, Firstrade secures a top spot for its wide account infrastructure. It supports complex needs like Trusts, LLCs, and business IRAs, and supports investors from over 20 global regions.

- A sanctuary for the self-reliant: Firstrade avoids both gamification and hand-holding, focusing instead on powerful tools for the pure stock and options trader. Innovation is present with the AI-powered FirstradeGPT, though education remains lopsided, offering deep resources for options but thinner content for other asset classes.

Range of investments

While Firstrade presents itself as a streamlined discount platform, its infrastructure rivals firms ten times its size, particularly when you factor in account types and global accessibility. It is best-in-class for Range of Investments in 2026, not because it offers every asset class on earth, but because it supports nearly every way an investor might want to hold them.

Account types: It is rare to find a smaller brokerage that seamlessly supports business-friendly structures like Trust, LLC, SEP, and SIMPLE IRAs alongside the standard individual and joint accounts. I was particularly impressed by the inclusion of Coverdell ESAs and custodial accounts. These are essential tools for building generational wealth that modern fintech competitors frequently neglect. Furthermore, Firstrade opens its doors to residents of over 20 international regions, from Austria to Taiwan, making it a strong bridge for global investors seeking access to U.S. markets.

Viewing positions: Once the account is open, the management experience is data-rich. I found the positions page to be far more than a simple ledger. It is a customizable workspace in its own right. I was able to tailor my view with over 42 specific data fields, pulling in everything from fundamental metrics to complex options details. Managing the account’s capabilities is equally frictionless. The service center allowed me to apply for margin or options privileges digitally, avoiding the archaic "print, sign, and scan" workflow that plagues many legacy brokers.

Available assets: The limitation here is the scope of assets, not the quality of infrastructure. You will not find futures, forex, or crypto trading, and there are no advisor-led portfolios to manage your money for you. This is a sanctuary for the strictly self-directed stock, ETF, and options trader. However, with the ability to trade fractional shares and access a comprehensive library of mutual funds, Firstrade provides a professional-grade foundation for building a serious portfolio.

| Feature |

Firstrade Firstrade

|

|---|---|

| Stock Trading | Yes |

| Account Feature - Margin Trading | Yes |

| Fractional Shares (Stocks) | Yes |

| OTC Stocks | Yes |

| Options Trading | Yes |

| Complex Options Max Legs | 4 |

| Fixed Income (Treasurys) | Yes |

| Futures Trading | No |

| Forex Trading | No |

| Crypto Trading | No |

| Crypto Trading - Total Coins | 0 |

| Traditional IRAs | Yes |

| Roth IRAs | Yes |

| Advisor Services | No |

Firstrade fees

In an industry where "zero commission" often comes with asterisks, Firstrade offers one of the cleanest and most aggressive pricing structures I have encountered. While most competitors have settled on $0 for stock trades but retained a fee for options, Firstrade eliminates the per-contract cost entirely. For a day trader dealing in options extensively, it can be a significant improvement to the bottom line.

Equity and options trading: The headline here is simple: $0. Firstrade charges $0.00 for stock and ETF trades, which is the industry standard. However, they break away from the pack with $0.00 per contract on options trades as well. Considering the industry average hovers around $0.65 per contract, the savings compound quickly for multi-leg strategists. I was also pleased to see that Firstrade charges $0.00 for options exercise and assignment. This is often a hidden fee that can annoyingly chip away at profits at other firms.

Penny stocks: Penny stock traders are frequently penalized elsewhere, but Firstrade extends its $0 commission model to OTC stocks as well. However, if you need help placing a trade, broker-assisted trades cost $19.95, one of the few significant administrative fees on the platform.

Margin rates: The trade-off for these low commissions appears in the lending rates. I found the margin rates to be on the higher side, starting at 12.75% for balances under $25,000 and scaling down slightly to 12.00% for balances up to $99,999. If you are a trader who utilizes significant leverage, the interest costs could outweigh the commission savings.

Fixed income pricing: Bond pricing at Firstrade requires a shift in mindset. Unlike brokers that act as agents and charge a transparent commission, Firstrade acts as a principal. This means they sell bonds from their own inventory, and their fee is baked into the price. This is a practice known as pricing on a "net yield" basis. While you won't see a transaction fee on your confirmation, you are still paying a markup. If you are actively trading fixed income, you must pay close attention to the yield to ensure you are getting a competitive price.

Banking and transfers: Incidental fees are standard. There are no annual fees for IRAs and no fee to liquidate and close an account, but if you decide to leave with your positions intact, a full outgoing account transfer (ACAT) will cost $75.00.

| Feature |

Firstrade Firstrade

|

|---|---|

| Minimum Deposit | $0.00 |

| Stock Trades | $0.00 |

| Penny Stock Fees (OTC) | $0.00 |

| Options (Per Contract) | $0.00 |

| Options Exercise Fee | $0.00 |

| Options Assignment Fee | $0.00 |

| Futures (Per Contract) | (Not offered) |

| Mutual Fund Trade Fee | $0 |

| Broker Assisted Trade Fee | $19.95 |

Mobile trading apps

Firstrade’s mobile app functions as a streamlined tool for the tactical trader. It is sleek, modern, and decidedly "mobile-first," prioritizing speed and order entry over the dense, clutter-heavy menus found in legacy broker apps. While it lacks the deep fundamental research capabilities of the web platform counterpart, it serves as an efficient terminal for managing active options strategies.

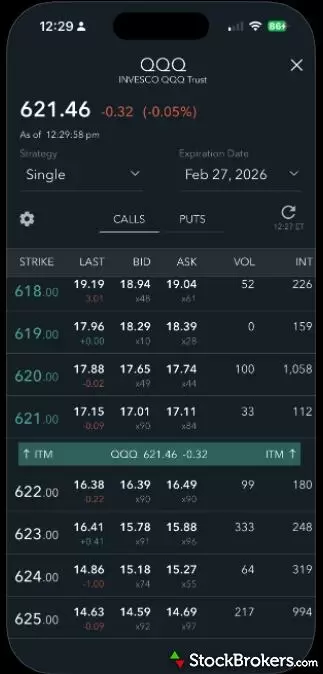

The options experience: The options interface is where this app truly separates itself from the discount broker pack. It is clear that experienced traders had a hand in designing the workflow. When I built multi-leg trades, I appreciated the visual clarity. Legs I was buying turned green, while those I was selling turned red, allowing me to audit the strategy instantly. The sticky header that keeps the underlying stock price visible while you navigate the chain is a small but critical detail that prevents constant scrolling. With streaming real-time quotes and a customizable chain that displays the Greeks, it is an excellent environment for managing complex positions on the go.

Firstrade’s mobile app features one of the most impressive options chains available, shown here with NVDA contracts. You can easily scroll through strike prices while viewing key data like the Greeks, making it incredibly user-friendly for active options traders. Built with direct input from real traders, the app even includes a full order flow experience that goes beyond what’s pictured here.

Charting and technical analysis: Charting on a mobile device is often a battle against screen real estate, but Firstrade manages it well. The app offers a library of 81 technical studies, though I found manually plotting indicators to be slightly cumbersome on a smaller screen.

Jessica's take

"The real highlight for me was the Analysis tab. This feature aggregates technical events to provide a short, medium, and long-term outlook. I found the directional bias indicators to be a fantastic shortcut for spotting trends without a full chart markup."

Jessica Inskip

Director of Investor Research

Data and research gaps: If you are looking to research the "why" behind a market move, the app struggles. While the Markets tab offers a sentiment-based Market Buzz and other technical insights, it lacks the broader economic context found on the website. I missed having access to an economic or earnings calendar. Additionally, deep-dive data for ETFs, such as portfolio composition, is notably absent. There is also no integrated educational content, meaning beginners will need to look elsewhere to learn the ropes. This is a platform designed for traders who already know what they want to buy and simply need a powerful tool to execute the trade.

| Feature |

Firstrade Firstrade

|

|---|---|

| iPhone App | Yes |

| Android App | Yes |

| Apple Watch App | No |

| Stock Alerts | Yes |

| Charting - After-Hours | No |

| Charting - Technical Studies | 81 |

| Charting - Study Customizations | Yes |

| Watchlist (Streaming) | Yes |

| Mobile Watchlists - Create & Manage | Yes |

| Mobile Watchlists - Column Customization | Yes |

Research

Firstrade’s research experience is a pleasant surprise. It is richer and more integrated than its discount branding suggests. It offers a solid balance of fundamental depth and technical insight, though it occasionally forces you to dig for the broader macroeconomic picture.

Funds and fundamentals: The standout feature is the depth of data available for ETFs and mutual funds. I found the quote pages to be exceptionally comprehensive, mirroring the institutional-grade experience of Morningstar. Beyond the standard expense ratios and performance charts, I could visualize portfolio exposure by sector and region, and even drill down into fixed income metrics like effective duration and credit quality. The inclusion of ESG metrics and “product involvement” data (e.g., carbon footprint) is a modern touch that aligns well with socially responsible investing.

For individual stocks, the integration with Morningstar excels again. I was delighted to find Forward P/E ratios easily accessible. It is a metric I often have to hunt for elsewhere. The "Fair Value" visualization provides a quick, color-coded sanity check on whether a stock is over- or undervalued, backed by analyst commentary that adds necessary context to the raw numbers.

Options and technicals: For options traders, the research toolkit is expansive. The integration of OptionsPlay is a significant value-add, offering strategy-based screeners that go beyond simple chains. Whether looking for covered calls or credit spreads, I found tools to not just generate ideas but also to validate them with risk/reward scenarios. On the technical side, Trading Central powers the "Technical Insight" widgets, which automatically identify chart patterns and offer directional biases. While the web-based options chain is functional but basic (requiring a toggle to see Greeks), it gets the job done.

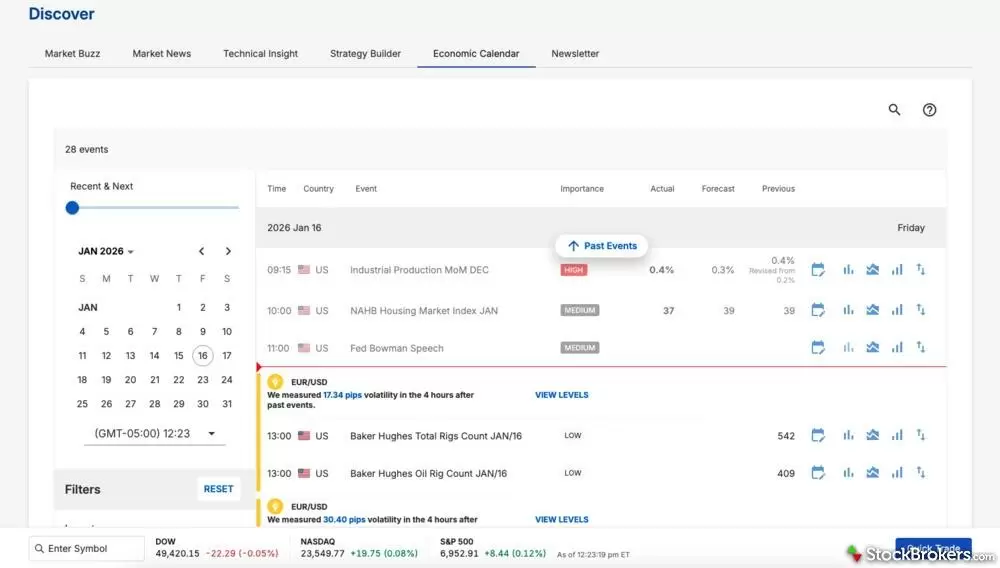

Macro and market context: Where the platform stumbles slightly is in connecting the dots. While there is a dedicated Markets page with a sentiment-based "Market Buzz" tool and a heat map, I found the macroeconomic commentary to be somewhat siloed. The economic calendar is powerful, allowing you to analyze price reactions to past events, but it is heavily skewed toward currency impacts rather than broader market indices like the S&P 500. I missed having a centralized earnings calendar and deeper insights into commodities and credit markets, which are essential for a truly holistic view of the investment landscape.

Firstrade’s economic calendar goes beyond listing events, it adds valuable analysis by showing how past releases have impacted market movements, particularly in currencies. It’s a detailed, data-driven tool that helps investors understand not just what’s happening, but why it matters. A great resource for those who want to connect economic trends with price action.

| Feature |

Firstrade Firstrade

|

|---|---|

| Research - Stocks | Yes |

| Stock Research - ESG | Yes |

| Stock Research - PDF Reports | 1 |

| Screener - Stocks | Yes |

| Research - ETFs | Yes |

| Screener - ETFs | Yes |

| Research - Mutual Funds | Yes |

| Screener - Mutual Funds | Yes |

| Research - Pink Sheets / OTCBB | Yes |

| Research - Fixed Income | Yes |

Education

Firstrade’s educational offering tells a clear story: this is a platform built for the aspiring options trader. While many discount brokers offer a broad but shallow pool of articles, Firstrade has chosen to specialize, delivering an impressive depth of content for derivatives while keeping the articles for other asset classes surprisingly lean.

The options specialist: If you are here to learn options, you are in the right place. The platform leans heavily on content from the Options Industry Council and tools from OptionsPlay that create an in-depth learning environment. I found the strategy guides to be particularly strong, featuring clear profit-and-loss (P/L) visuals that help visualize risk versus reward, a critical concept for beginners. The material covers everything from sentiment analysis to the effects of volatility and time decay. While the breakdown of "The Greeks" is somewhat high-level in the text articles, the integrated webinars and videos from OptionsPlay fill in the gaps with actionable, advanced insights.

Stocks and calculators: Outside of options, the highlights are specific rather than systemic. The article "What is a Stock?" is arguably one of the best primers I have read. It moves beyond dictionary definitions to explain supply, demand, and market mechanics in a way that actually respects the reader's intelligence.

The drop-off: The experience falters when you step away from equities and options. The education for mutual funds, ETFs, and fixed income is sparse, often reduced to dense, high-level overviews that lack the engagement found elsewhere. I also noted a complete absence of broader macroeconomic education. If you are looking for courses on how the Federal Reserve impacts your portfolio or how to navigate a business cycle, you will not find them here. Furthermore, there is no progress tracking or paper trading capability, meaning you cannot test your new knowledge without risking real capital.

Firstrade’s ETF Guide is a polished, beginner-friendly resource that walks investors through the essentials of exchange-traded funds. With well-produced videos and clear explanations, including the history of ETFs as an innovation born from mutual funds.

| Feature |

Firstrade Firstrade

|

|---|---|

| Education (Stocks) | Yes |

| Education (ETFs) | No |

| Education (Options) | Yes |

| Education (Mutual Funds) | No |

| Education (Fixed Income) | No |

| Education (Retirement) | Yes |

| Videos | Yes |

| Webinars | Yes |

| Progress Tracking | No |

| Interactive Learning - Quizzes | No |

Customer service

To score Customer Service, StockBrokers.com partners with customer experience research firm Confero to conduct phone tests from locations throughout the United States. For this year's testing, 132 customer service tests were conducted over six weeks, with wait times logged for each call.

Customer service representatives were asked for assistance or details for prospective customers in several areas of broker services, including account opening, trading tools, apps, crypto offerings, active trading, and more. Here are the results for Firstrade.

- Average Connection Time: Under a minute

- Average Net Promoter Score: 7.2 / 10

- Average Professionalism Score: 7.3 / 10

- Overall Score: 7.65 / 10

- Ranking: 7th of 11

IRA review

Firstrade offers a retirement experience that prioritizes function over form. If you already know your retirement roadmap and simply need a cost-effective vehicle to get there, Firstrade is a compelling choice. It lacks the complete tutorials and rich educational courses of full-service brokers, but it makes up for it with a comprehensive selection of account types and an absence of maintenance fees.

Account options and fees: While many discount brokers limit their retirement menu to standard Traditional and Roth IRAs, Firstrade goes deeper. I was pleased to see support for business-centric accounts like SEP and SIMPLE IRAs, which are often omitted by new competitors. For those looking to manage generational wealth, the inclusion of Coverdell ESAs and custodial accounts is a significant plus.

The strongest selling point, however, is the lack of fees that are common at other brokers. There are $0 annual fees, $0 setup fees, and $0 maintenance fees. Perhaps most surprisingly, there is a $0 IRA termination fee. Most brokers charge upwards of $50 to close a retirement account, so seeing this fee eliminated entirely is a refreshing change that gives investors freedom of movement without penalty (although transferring positions via ACAT still incurs a $75 fee).

Tools and resources: You won't find a dedicated Retirement Planning Center with flashy graphs and progress trackers here. Instead, Firstrade tucks its most useful resources inside its Tax Resource Center. I found a suite of calculators there designed in a helpful "Q&A" format. It answers questions like "Should I convert to a Roth IRA?" or "Are my current savings sufficient?" rather than just asking for raw inputs.

The trade-off is education. I found no dedicated coursework or deep-dive articles on retirement strategies. If you need to learn the nuances of a backdoor Roth conversion or RMD strategies, you will likely need to consult external resources. Firstrade provides the machinery to build your retirement, but you are expected to be the architect.

Final thoughts

Firstrade avoids attempting to be a holistic wealth management firm or chasing gamified crypto trends, operating instead as an efficient conduit for stock and options traders. Its elimination of per-contract options fees is a genuine bottom-line booster, while its mobile app prioritizes workflow over flash. Notably, it supports accounts for residents in over 20 regions, serving an international community often ignored by U.S.-centric firms.

This focus comes with trade-offs: the absence of futures, forex, and advisor-assisted portfolios means it cannot serve as a "one-stop shop." It is a platform for the self-reliant. For experienced traders looking to strip away fees and execute strategies with precision, Firstrade skips white-glove service to offer the active trader pure efficiency at a discount.

Firstrade's Star Ratings

| Feature |

Firstrade Firstrade

|

|---|---|

| Overall |

|

| Range of Investments |

|

| Mobile Trading Apps |

|

| Advanced Trading |

|

| Research |

|

| Customer Service |

|

| Education |

|

| Ease of Use |

|

StockBrokers.com Review Methodology

Why you should trust us

Jessica Inskip is Director of Investor Research at StockBrokers.com, bringing 15 years of experience in brokerage and trading strategy. A former FINRA-licensed rep, she held Series 7, 63, 66, and 4 licenses. Jessica focuses on investor education and brokerage industry research, appears regularly on CNBC, Bloomberg, The Schwab Network, Fox Business, and Yahoo! Finance, and hosts the Market MakeHer podcast.

Blain Reinkensmeyer, co-founder of StockBrokers.com, has been investing and trading for over 25 years. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. Today, Blain is widely respected as a leading expert on finance and investing, specifically the U.S. online brokerage industry. Blain has been quoted in The New York Times, The Wall Street Journal, Forbes, and Fast Company, among others. Blain created the original scoring rubrics for StockBrokers.com and oversees all testing and rating methodologies.

How we tested

- We used our own brokerage accounts for testing.

- We collected thousands of data points across the brokers we review.

- We tested each online broker's website, desktop platforms, and mobile app, where applicable.

- We maintained strict editorial independence; brokers cannot pay for inclusion or a higher rating.

Our research team meticulously collected data on every feature of importance to a wide range of customer profiles, including beginners, casual investors, passive investors, and active traders. We carefully track variables like margin rates, trading costs, fees, and platform features and use them to help rate brokers across a range of categories measuring ease of use, range of investments, research, education, and more.

At StockBrokers.com, our reviewers use a variety of computing devices to evaluate platforms and tools. Our reviews and data collection were conducted using the following devices: iPhone SE running iOS 17.5.1, MacBook Pro M1 with 8 GB RAM running the current MacOS, and a Dell Vostro 5402 laptop i5 with 8 GB RAM running Windows 11 Pro.

Each broker was evaluated and scored on over 200 different variables across seven key categories: Range of Investments, Platforms & Tools, Research, Mobile Trading, Education, Ease of Use, and Overall. Learn more about how we test.

Trading platforms tested in 2026

We tested 14 online trading platforms in 2026:

Read next

- Best Futures Trading Platforms for 2026

- Best Stock Brokers for 2026

- Best Day Trading Platforms of 2026 for Beginners and Active Traders

- Best Brokers for Penny Stock Trading of 2026

- Best Stock Trading Platforms for Beginners of 2026

- Best Stock Trading Apps for 2026

- Best Paper Trading Apps & Platforms for 2026

- Best Options Trading Platforms for 2026

More Guides

Popular Stock Broker Reviews

About Firstrade

Founded in 1985, Flushing, New York-based Firstrade began as a deep-discount online broker offering $0 stock, ETF, mutual fund, and options trades and is now growing into a competitive full-service brokerage. Firstrade is continuing to innovate by embracing AI tools and rolling out powerful research suites like its economic calendar.