Robinhood Review

Robinhood has grown up. Once dismissed by industry purists as a gamified starter kit for novices, the platform has matured into a formidable ecosystem that demands to be taken seriously. With the launch of its sleek desktop workstation, Robinhood Legend, and the addition of futures trading, the broker aims to court a more sophisticated, active trader.

While it still lacks the encyclopedic fundamental research and macro-level data found at true full-service brokerage firms, Robinhood counters with a value proposition that is one of the strongest in the industry.

Between the unbeatable margin rates, the generous IRA match, and a frictionless mobile experience, Robinhood has evolved from a simple on-ramp into a high-performance destination for the modern wealth builder.

-

Minimum Deposit:

$0.00 -

Stock Trades:

$0.00 -

Options (Per Contract):

$0.00

| Range of Investments | |

| Mobile Trading Apps | |

| Advanced Trading | |

| Research | |

| Education | |

| Ease of Use | |

| Customer Service | N/A |

Check out StockBrokers.com's picks for the best stock brokers in 2026.

| #1 Prediction Markets | Winner |

| 2026 | #7 |

| 2025 | #12 |

| 2024 | #10 |

| 2023 | #10 |

| 2022 | #13 |

| 2021 | #11 |

| 2020 | #12 |

| 2019 | #15 |

Led by Jessica Inskip, Director of Investor Research, the StockBrokers.com research team collects thousands of data points across hundreds of variables. We evaluate features important to every kind of investor, including beginners, casual investors, passive investors, and active traders. We carefully track data on margin rates, trading costs, and fees to rate stock brokers across our proprietary testing categories.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on StockBrokers.com. Learn more about how we test.

Table of Contents

Pros & cons

Pros

- Robinhood Legend offers a sleek, widgetized interface and 90+ technical indicators.

- 3% IRA match on contributions, 3% cash back on the Gold card, and margin rates starting at 5.75% (for balances under $25k).

- The Investor's Guild explains complex topics, minus the jargon.

- Futures trading and 24-hour trading cater to active traders.

Cons

- No economic calendars, sector heat maps, or Treasury yield curves.

- You won't find deep fundamental research.

- Legend lacks critical tools like conditional orders (bracket, OCO) and backtesting.

- No mutual funds, individual bonds, custodial or trust accounts.

My top takeaways for Robinhood in 2026:

- Unbeatable value: Robinhood wins on costs that matter to traders: options fees and margin interest. By removing per-contract charges and undercutting the industry’s borrowing rates by half, they’ve built a pricing structure where the savings on leverage alone are impossible to ignore.

- A "Legendary" evolution: The launch of the Robinhood Legend desktop workstation and the addition of futures trading prove that the platform is no longer just a sandbox for beginners; it’s a serious venue for active traders.

- Inspiration over investigation: While the Investor's Guild provides world-class market commentary, the platform still lacks the deep fundamental data and macro-level tools (like economic calendars) needed to fully vet the ideas it inspires.

Range of investments

Robinhood has grown past its reputation as a simple stock-flipping app, expanding its offering to capture a more serious share of the investor's wallet. While it still lacks the depth of a legacy brokerage (you won't find mutual funds or bonds here), the addition of futures and advisory services signals a clear intent to evolve into a financial hub for the modern retail trader.

Rounded offering: The lineup covers the essentials for the active trader: stocks, ETFs, options, and futures. Crypto enthusiasts can trade 22 different coins, and the ubiquity of fractional shares ensures that even high-priced equities are accessible to every account size. I appreciate the platform's handling of IPO access, which democratizes a corner of the market usually reserved for institutional clients. However, the absence of fixed income and mutual funds remains a noticeable gap for passive investors who prefer traditional diversification methods over ETFs.

Prediction markets: Robinhood has also staked a claim in the emerging frontier of event contracts, earning our 2026 Annual Award for #1 Prediction Markets. Prediction markets allow traders to speculate on the outcomes of specific events, from Fed rate cuts to election results, effectively turning public sentiment into a tradeable asset class. It’s a bold expansion that offers a unique way to hedge against headline risk.

Democratizing advice: Robinhood has entered the wealth management space with "Robinhood Strategies," a goal-based investing service that builds diversified portfolios of ETFs and stocks. The pricing structure is aggressive: the standard annual management fee is 0.25%, but for Robinhood Gold members, fees are waived on the first $100,000 of assets. This effectively makes professional guidance free for a vast swath of their user base – a compelling value proposition that undercuts many traditional robo-advisors.

Account types and maintenance: The account infrastructure is a mix of innovation and limitation. On the positive side, the IRA offering is excellent. I found the inclusion of "limited margin" in retirement accounts to be a thoughtful feature; it allows for settlement flexibility without the danger of leverage, which is perfect for active retirement trading. Maintenance is equally streamlined; adding a beneficiary was the easiest process I have encountered in the industry, requiring only an email address rather than the typical scramble for social security numbers.

However, the ceiling for generational wealth planning is low. Robinhood doesn’t support custodial accounts (UTMA/UGMA), trusts, or business accounts. While the platform is fantastic for the accumulation phase of an individual's life, the inability to open accounts for minors or managed estates means successful investors may eventually outgrow the ecosystem.

| Feature |

Robinhood Robinhood

|

|---|---|

| Stock Trading | Yes |

| Account Feature - Margin Trading | Yes |

| Fractional Shares (Stocks) | Yes |

| OTC Stocks | Yes |

| Options Trading | Yes |

| Complex Options Max Legs | 4 |

| Fixed Income (Treasurys) | No |

| Futures Trading | Yes |

| Forex Trading | No |

| Crypto Trading | Yes |

| Crypto Trading - Total Coins | 22 |

| Traditional IRAs | Yes |

| Roth IRAs | Yes |

| Advisor Services | Yes |

Robinhood fees

Robinhood built its reputation on the promise of commission-free trading, and while the rest of the industry has largely caught up in the race to offer $0 stock trades, the platform still finds ways to undercut the competition. The value proposition at Robinhood isn’t just about what you don't pay; it’s about the aggressive pricing on margin and the unique math behind its Gold subscription service.

Trading costs: The headline remains $0 for stock and ETF trades, which is now the industry standard. However, where I find Robinhood truly separates itself is in options trading. While most brokers charge roughly $0.65 per contract, Robinhood charges $0. For active traders running multi-leg strategies like iron condors, the per-contract fees at other firms can silently eat away at profitability; here, that friction is removed. Futures traders also get a break with a competitive $0.75 per contract fee.

PFOF: It’s worth remembering that Robinhood generates significant revenue through payment for order flow (PFOF), which just means that your order execution quality is the trade-off for these zero commissions.

The margin advantage: If you borrow money to trade, Robinhood is arguably the most cost-effective option on the market for the retail investor. I was impressed to see margin rates starting at 5.75% for balances under $25,000. In an environment where many brokers charge double-digit interest rates for the same tier, this is a massive differentiator. For a trader utilizing leverage, the interest rate difference alone can save thousands of dollars annually, far outweighing the cost of any subscription fee.

Robinhood Gold: The "Robinhood Gold" membership ($5 per month or $50 per year) changes the fee structure from a simple list to an equation. Is it worth it? Well, if you utilize the 3% IRA match on contributions or hold significant uninvested cash earning their higher APY, the subscription effectively pays for itself. It’s a pay-to-play model, but for the right user, the math is compelling.

Transfer and account fees: Keep an eye on the exit door; Robinhood charges a $100 ACAT fee if you decide to transfer your full account to another broker. On the positive side, there are no fees for account maintenance or inactivity, keeping the barrier to entry, and existence, extremely low.

Jessica's take

"Between the 3% IRA match, the 3% cash back on the Gold Card, and margin rates that undercut the industry average by half, Robinhood offers a value proposition that is simply impossible to ignore."

| Feature |

Robinhood Robinhood

|

|---|---|

| Minimum Deposit | $0.00 |

| Stock Trades | $0.00 |

| Penny Stock Fees (OTC) | N/A |

| Options (Per Contract) | $0.00 |

| Options Exercise Fee | $0.00 |

| Options Assignment Fee | $0.00 |

| Futures (Per Contract) | $0.75 |

| Mutual Fund Trade Fee | N/A |

| Broker Assisted Trade Fee | N/A |

Mobile trading apps

Robinhood built its reputation on a mobile-first philosophy, and for years, that meant sacrificing depth for simplicity. However, the platform is aggressively shedding that "lite" label. In 2026, I found that Robinhood’s app has matured into a surprisingly capable tool that challenges the notion that serious analysis can’t happen on a small screen.

Charting and analysis: In the past, I viewed Robinhood’s mobile charts as a last resort. That has changed. I was genuinely impressed to find an advanced charting suite featuring over 90 technical studies and the ability to toggle logarithmic scales. I love charts, and having this level of customization linked directly to my "Legend" desktop settings is a game-changer. It feels like the training wheels have finally come off.

Research and AI integration: A feature that stood out during my time with Robinhood’s app was the AI-powered "Digests" available to Gold subscribers. This is exactly how I want to see artificial intelligence applied to self-directed investing: it explains the why. When I pulled up Nvidia (NVDA), I wasn't just given a price; I was given a concise summary linking the move to tariffs and jobs data. Additionally, the inclusion of an earnings Q&A feature (where users can upvote questions for management) adds a layer of productive community engagement that I haven't seen anywhere else.

Mobile options trading: Trading options on the app is a visual treat but a data frustration. The interface excels at hand-holding; the profit and loss charts clearly visualize risk, and the contextual education pop-ups are fantastic for beginners trying to understand index expirations or multi-leg setups. However, the data density is too low for my taste. You’re limited to viewing only two metrics at a time in the options chain. While you can swap these for Greeks (measurements of risk like Delta, or Theta) or Implied Volatility, I found myself constantly toggling settings to get the full picture.

The macro blind spot: Despite the improvements in stock-specific data, the app struggles with the "big picture." I could not find a clear view of GICS sectors, the Treasury yield curve, or an economic calendar. Tapping the search icon gives you a pulse on trending lists, but it lacks the investigative depth needed to understand broader market cycles. It’s a powerful tool for picking stocks, but a weak lens for viewing the economy.

Robinhood’s mobile options chain features a clean, simplified layout, with percent breakeven shown by default for each contract. While this may appeal to short-term traders, it lacks key metrics, like the Greeks or probability of profit, that serious options traders often rely on. It’s a sleek experience, but one that leans more toward speculation than in-depth strategy analysis.

| Feature |

Robinhood Robinhood

|

|---|---|

| iPhone App | Yes |

| Android App | Yes |

| Apple Watch App | Yes |

| Stock Alerts | Yes |

| Charting - After-Hours | Yes |

| Charting - Technical Studies | 90 |

| Charting - Study Customizations | Yes |

| Watchlist (Streaming) | Yes |

| Mobile Watchlists - Create & Manage | Yes |

| Mobile Watchlists - Column Customization | Yes |

Advanced trading platforms

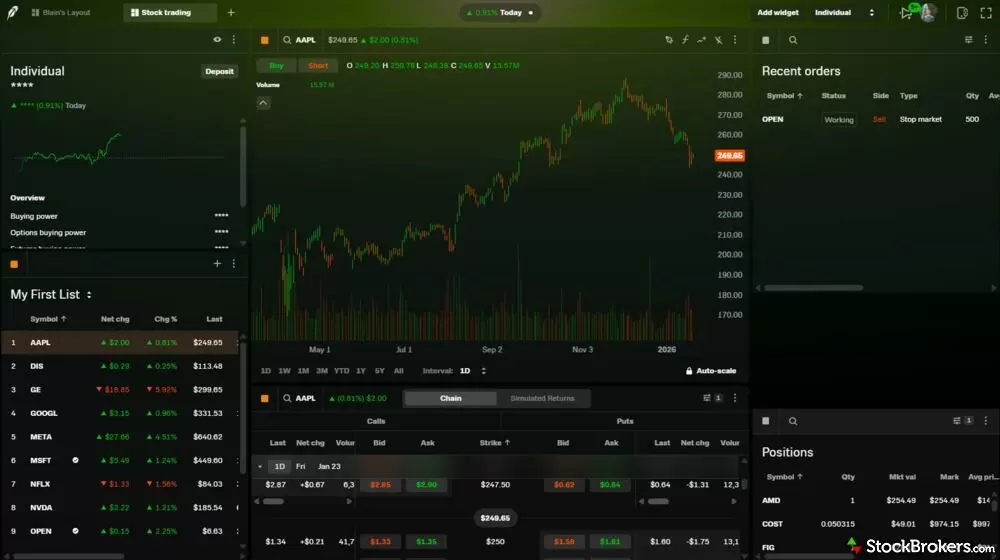

Robinhood has answered the call for a dedicated desktop experience with Robinhood Legend. Though it’s strictly a browser-based platform (not downloadable), it feels remarkably robust. It is sleek, widgetized, and built with a modern aesthetic that makes other legacy platforms look like relics from the Windows 95 era. For the trader graduating from a mobile app to a dual-monitor setup, this is a welcoming, albeit imperfect, new home.

Robinhood Legend is arguably one of the best-looking active trading platforms on the market, with a sleek, modern interface that’s a pleasure to use. However, that clean design comes with trade-offs: some advanced tools and features are missing compared to more robust platforms. It’s a great experience for visual clarity and ease of use, but power traders may find themselves wanting more.

Charting and analysis: I’ll be direct: this is one of the most user-friendly technical analysis platforms on the market. With over 90 technical indicators and 26 drawing tools, it offers enough depth for most retail traders without the intimidation factor. I found the customization intuitive, adjusting moving averages or toggling to a logarithmic scale took seconds – not a trip through three sub-menus. As a chartist, I appreciated the ability to save custom profiles and the "spotlight" templates that help beginners visualize data immediately. That said, the platform does hit a ceiling eventually; there are no backtesting capabilities, no automated pattern recognition, and strangely, no support for relative strength charts (comparing one asset against another).

Trading and execution: The platform excels at simplicity but struggles with complexity. Trading stocks or single-leg options is effortless, aided by a beautiful interface that lets you see Implied Volatility (IV) for each expiration date clearly. However, for complex strategies, the friction increases. When I set up multi-leg options trades, I missed having critical data points like net Greeks or the specific bid/ask for individual legs displayed on the ticket. Furthermore, the absence of conditional orders (like OCO or bracket orders) is a significant omission for active traders who need to automate their risk management.

The data experience: Legend is excellent for focusing on a single asset, but it struggles to show you the entire market. I found the platform lacked the macro-level data – such as Treasury yields, commodities, or sector heat maps – required to get a true pulse of the market. It’s a fantastic environment for analyzing a specific ticker, but if you need to understand the broader economic context, you’ll likely need a second tab open.

| Feature |

Robinhood Robinhood

|

|---|---|

| Active Trading Platform | Robinhood Legend |

| Desktop Trading Platform | No |

| Desktop Platform (Mac) | No |

| Web Trading Platform | Yes |

| Paper Trading | No |

| Trade Journal | No |

| Watchlists - Total Fields | 34 |

| Charting - Indicators / Studies | 90 |

| Charting - Drawing Tools | 26 |

| Charting - Study Customizations | 6 |

| Charting - Save Profiles | Yes |

| Trade Ideas - Technical Analysis | No |

| Streaming Time & Sales | No |

| Trade Ideas - Backtesting | No |

Research

Robinhood’s research experience is a study in contrast: it’s visually engaging and fantastic for discovering what’s trending, but often lacks the depth to tell you why it matters. The platform excels at helping you find a trade idea, but when it comes time for the heavy lifting of due diligence, I found myself reaching for external tools to fill in the gaps.

Editorial and market commentary: Robinhood’s "Investor's Guild" is a gem. Reading these articles felt less like consuming dry financial reports and more like having a conversation with a smart colleague. The content blends statistics, economic data, and prevailing market themes into a narrative that is genuinely a joy to read. For a beginner, or even an intermediate investor, this is a fantastic resource for understanding the markets without getting bogged down in jargon.

Visuals vs. fundamentals: I loved Robinhood’s interactive sector breakdown graphic; it’s animated, clean, and instantly helps you understand a fund’s composition. However, the data for individual stocks hits a wall. While you get the basics (P/E ratios, market cap, and yield) critical details for income investors, such as the dividend ex-date or payout ratio, are missing. If I’m screening for high-yield stocks, for example, I need to see free cash flow to verify the dividend's safety. With Robinhood, that level of fundamental inspection simply isn't possible.

Idea generation and tools: The tools for finding new trades are a mixed bag. The stock screener offers some excellent starting points, such as "Highest Dividend" or "Analyst Picks," but lacks the granular filters needed to weed out value traps. On the other hand, the Options Strategy Builder is fantastic. It guides you through the construction of complex trades (like vertical spreads) with integrated education that explains the strategy's goal and risk profile in plain English. It’s one of the few places where the platform's simplicity enhances the sophistication of the trade.

No macro research: Where the research suite falls short is in providing a pulse of the broader market. I couldn’t find an economic calendar to track Federal Reserve announcements, nor could I see a breakdown of GICS sectors or Treasury yields. Without these inputs, it’s difficult to gauge the broader economic patterns that drive individual stock performance.

Robinhood’s research tools present analyst ratings in a clean, visually appealing format, shown here with the buy, hold, and sell breakdown for Apple. The platform also includes concise “bulls vs. bears” commentary, giving investors a quick snapshot of both sides of the debate. While this type of data is common across brokerages, Robinhood’s design makes it especially easy to digest at a glance.

| Feature |

Robinhood Robinhood

|

|---|---|

| Research - Stocks | Yes |

| Stock Research - ESG | No |

| Stock Research - PDF Reports | 0 |

| Screener - Stocks | Yes |

| Research - ETFs | Yes |

| Screener - ETFs | No |

| Research - Mutual Funds | No |

| Screener - Mutual Funds | No |

| Research - Pink Sheets / OTCBB | Yes |

| Research - Fixed Income | No |

Education

Robinhood’s educational experience begins with a compelling visual of an explorer navigating a vast land, which perfectly sets the tone for what follows: a journey that is inviting, comprehensive, and refreshingly devoid of finance jargon. Robinhood has set the bar for how to speak to the modern self-directed investor, proving that financial literacy doesn’t have to be boring.

Educational content: The written content is excellent, across the board. I was particularly impressed by the Fixed Income section; despite Robinhood’s limited bond trading capabilities, the articles explaining Treasury Bills were readable and informative. Similarly, the ETF section directly addresses the common "fin-fluencer" misconception that ETFs and index funds are synonyms, providing clarity that is often missing on social media. The Retirement content is equally thoughtful, structured chronologically from "Young Adult" to "Nearing Retirement," ensuring the advice meets you exactly where you are in life.

Mastering options: Teaching derivatives to beginners is always tricky, but Robinhood navigates this challenge well. They refer to the four base strategies (long/short calls and puts) as "The Four Horsemen," a touch of flair that makes the concepts stick. I appreciated how they introduced complex risk metrics like the Greeks through practical scenarios ("Best case to nail it" vs. "Watch out for") before diving into the mathematical definitions. It builds a solid foundation without scaring the user away.

The limitations: While the reading material is top-tier, the ecosystem lacks the interactive tools found at full-service rival brokers. There are no calculators to project compound interest or retirement numbers, no webinars to watch live, and no paper trading module to practice strategies risk-free. Robinhood’s Technical Analysis education is the weakest link; it serves as a high-level primer but lacks the depth found in the rest of the library. If you learn by reading, Robinhood is fantastic; if you learn by doing, you may find the toolbox empty.

Robinhood’s education center is one of the most accessible and well-crafted out there, offering clear, engaging content for all levels. This article on understanding ETFs stands out with creative examples, relatable analogies, and a deep dive into how ETFs work.

| Feature |

Robinhood Robinhood

|

|---|---|

| Education (Stocks) | Yes |

| Education (ETFs) | Yes |

| Education (Options) | Yes |

| Education (Mutual Funds) | No |

| Education (Fixed Income) | Yes |

| Education (Retirement) | Yes |

| Videos | Yes |

| Webinars | No |

| Progress Tracking | No |

| Interactive Learning - Quizzes | No |

Banking services

Robinhood is strictly a brokerage firm, not a bank, but it creates a convincing illusion of being both. While you won't find brick-and-mortar branches, mortgages, or certificates of deposit (CDs), the platform has rolled out aggressive spending and cash management tools that allow many users to treat it as their primary financial hub.

Credit and debit: Reserved for Gold subscribers, the Robinhood Gold Card has made waves with its flat 3% cash back on all categories, a rate that challenges premium credit cards with much higher annual fees. For those who prefer spending cash they already have, the Cash Card (a prepaid debit card) integrates investing into daily life. I liked the round-up feature, which rounds your purchases to the nearest dollar and invests the spare change.

Cash management: Robinhood isn’t a bank, and it doesn’t offer traditional checking or savings accounts. Instead, it utilizes a brokerage cash management feature. Uninvested cash can earn a competitive yield (especially for Gold members) via program banks, which also provide FDIC insurance pass-through.

Limitations: The banking experience hits a hard ceiling when your needs expand beyond spending and saving. There are no mortgage loans, auto loans, or CD ladders available. It’s a fantastic ecosystem for the accumulator who wants high yields and cash back, but the absence of traditional banking staples like wire transfers or physical checks means that while Robinhood can replace your wallet, it can’t fully replace a traditional bank for complex financial lives.

| Feature |

Robinhood Robinhood

|

|---|---|

| Bank (Member FDIC) | No |

| Checking Accounts | No |

| Savings Accounts | No |

| Credit Cards | Yes |

| Debit Cards | Yes |

| Mortgage Loans | No |

Crypto review

For many investors, Robinhood is the gateway to trading cryptocurrency, and honestly, it’s one of the smoothest on-ramps in the industry. Unlike brokers that treat cryptocurrency as a speculative outlier to be fenced off, Robinhood integrates it so seamlessly that buying Bitcoin feels as routine as purchasing a share of Tesla.

Crypto offering: Robinhood supports trading in 22 different cryptocurrencies. While this pales in comparison to the hundreds of alt-coins found on dedicated exchanges like Coinbase or Kraken, it covers the coins that most retail investors actually care about (Bitcoin, Ethereum, Dogecoin, Solana). The trades are commission-free, which removes a significant psychological hurdle, though users should always remember that the broker is capturing a spread on the execution.

Functionality and freedom: Where Robinhood separates itself from other fintech brokers is the ability to transfer crypto. Many competitors run walled crypto gardens where you can bet on the price of a coin but never actually hold it. Robinhood allows you to send and receive crypto to and from external wallets. This means you can buy Ethereum at Robinhood and then move it to a cold storage device or use it in the broader DeFi ecosystem.

The safety disclaimer: It’s worth mentioning the legal structure here: your crypto is held by Robinhood Crypto, LLC, a separate legal entity from the stock brokerage. This means your crypto positions are not protected by SIPC insurance. While Robinhood maintains its own crime insurance against theft or cybersecurity breaches, you do not have the same federal safety net for your digital coins that you do for your stocks.

IRA review

Robinhood has effectively disrupted the retirement landscape with its IRA match, offering 1% on contributions for standard accounts and a market-leading 3% for Gold members. For individual savers, this is an immediate, guaranteed return on investment before a single trade is placed. The account is further enhanced by Robinhood’s "Limited Margin," a sophisticated feature that allows for trading on unsettled funds without the risks of borrowing on leverage, making it ideal for active retirement traders.

However, this comes with a five-year vesting period, ensuring you stay committed to the platform to keep the bonus. Additionally, the ecosystem is strictly designed for individuals; business owners looking for SEP IRAs, SIMPLE IRAs, or Solo 401(k)s will find the menu empty and need to look elsewhere.

Final thoughts

I used to view Robinhood as a launchpad for beginners, but with the launch of Robinhood Legend, futures trading, and industry-leading margin rates, it has evolved into a legitimate destination for investors and traders of all experience levels. The platform has successfully layered sophisticated features on top of its signature simplicity, and when combined with the 3% IRA match for Gold members, the value proposition is undeniable for both accumulators and active traders.

The platform excels at teaching complex concepts, like analyzing P/E ratios or economic cycles, yet it often lacks the fundamental data and macro-level research tools needed to apply them. While the educational content is great, the platform forces you to go elsewhere for deep due diligence, creating a gap between what you learn and what you can do.

In 2026, Robinhood has successfully shed its reputation as a starter app, but until it bridges the gap between inspiration and deep analysis, it’s best viewed as a powerful specialized tool rather than a comprehensive financial solution.

Robinhood's Star Ratings

| Feature |

Robinhood Robinhood

|

|---|---|

| Overall |

|

| Range of Investments |

|

| Mobile Trading Apps |

|

| Advanced Trading |

|

| Research |

|

| Customer Service | N/A |

| Education |

|

| Ease of Use |

|

StockBrokers.com Review Methodology

Why you should trust us

Jessica Inskip is Director of Investor Research at StockBrokers.com, bringing 15 years of experience in brokerage and trading strategy. A former FINRA-licensed rep, she held Series 7, 63, 66, and 4 licenses. Jessica focuses on investor education and brokerage industry research, appears regularly on CNBC, Bloomberg, The Schwab Network, Fox Business, and Yahoo! Finance, and hosts the Market MakeHer podcast.

Blain Reinkensmeyer, co-founder of StockBrokers.com, has been investing and trading for over 25 years. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. Today, Blain is widely respected as a leading expert on finance and investing, specifically the U.S. online brokerage industry. Blain has been quoted in The New York Times, The Wall Street Journal, Forbes, and Fast Company, among others. Blain created the original scoring rubrics for StockBrokers.com and oversees all testing and rating methodologies.

How we tested

- We used our own brokerage accounts for testing.

- We collected thousands of data points across the brokers we review.

- We tested each online broker's website, desktop platforms, and mobile app, where applicable.

- We maintained strict editorial independence; brokers cannot pay for inclusion or a higher rating.

Our research team meticulously collected data on every feature of importance to a wide range of customer profiles, including beginners, casual investors, passive investors, and active traders. We carefully track variables like margin rates, trading costs, fees, and platform features and use them to help rate brokers across a range of categories measuring ease of use, range of investments, research, education, and more.

At StockBrokers.com, our reviewers use a variety of computing devices to evaluate platforms and tools. Our reviews and data collection were conducted using the following devices: iPhone SE running iOS 17.5.1, MacBook Pro M1 with 8 GB RAM running the current MacOS, and a Dell Vostro 5402 laptop i5 with 8 GB RAM running Windows 11 Pro.

Each broker was evaluated and scored on over 200 different variables across seven key categories: Range of Investments, Platforms & Tools, Research, Mobile Trading, Education, Ease of Use, and Overall. Learn more about how we test.

Trading platforms tested in 2026

We tested 14 online trading platforms in 2026:

Read next

- Best Stock Trading Platforms for Beginners of 2026

- Best Options Trading Platforms for 2026

- Best Brokers for Penny Stock Trading of 2026

- Best Stock Brokers for 2026

- Best Stock Trading Apps for 2026

- Best Paper Trading Apps & Platforms for 2026

- Best Day Trading Platforms of 2026 for Beginners and Active Traders

- Best Futures Trading Platforms for 2026

More Guides

Popular Stock Broker Reviews

About Robinhood

Founded in 2013 and based in Menlo Park, California, Robinhood is an online broker that has raised $2.2 billion in venture capital funding and has more than 14 million monthly active users. The millennial- and Gen Z-focused broker is best known for offering $0 stock, ETF, options and cryptocurrency trades via an easy-to-use website and mobile trading app.