Charles Schwab Review

For most investors, the search for a brokerage firm ends at Charles Schwab. It sets the industry standard, offering a financial ecosystem so complete that it renders most competitors niche by comparison. Schwab again secured the #1 Overall ranking in 2026 for scaling its operations without sacrificing sophistication, which is a difficult target for massive institutions. The market typically forces a choice between a simplified mobile experience and a professional-grade trading workstation, but Schwab delivers both.

Following the integration of thinkorswim alongside the flagship mobile app, the broker offers a direct transition from a first fractional share purchase to a futures contract. Whether you manage a multimillion-dollar estate or are opening your first Roth IRA, Schwab provides a platform designed for your specific needs, functioning as the definitive operating system for modern wealth.

-

Minimum Deposit:

$0.00 -

Stock Trades:

$0.00 -

Options (Per Contract):

$0.65

| Range of Investments | |

| Mobile Trading Apps | |

| Advanced Trading | |

| Research | |

| Education | |

| Ease of Use | |

| Customer Service |

Check out StockBrokers.com's picks for the best stock brokers in 2026.

| #1 Overall | Winner |

| #1 Advanced Trading | Winner |

| #1 Mobile Trading Apps | Winner |

| #1 Ease of Use | Winner |

| #1 Customer Service | Winner |

| #1 Active Trading Desktop Platform | Winner |

| #1 High Net Worth Investors | Winner |

| #1 Stock Research | Winner |

| 2026 | #1 |

| 2025 | #1 |

| 2024 | #3 |

| 2023 | #5 |

| 2022 | #4 |

| 2021 | #3 |

| 2020 | #3 |

| 2019 | #3 |

| 2018 | #3 |

| 2017 | #3 |

| 2016 | #4 |

| 2015 | #6 |

| 2014 | #5 |

| 2013 | #3 |

| 2012 | #5 |

| 2011 | #3 |

Led by Jessica Inskip, Director of Investor Research, the StockBrokers.com research team collects thousands of data points across hundreds of variables. We evaluate features important to every kind of investor, including beginners, casual investors, passive investors, and active traders. We carefully track data on margin rates, trading costs, and fees to rate stock brokers across our proprietary testing categories.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on StockBrokers.com. Learn more about how we test.

Table of Contents

Pros & cons

Pros

- thinkorswim remains the industry benchmark for professional-grade trading and charting.

- Research is best-in-class, featuring actionable daily audio updates and deep fundamental data.

- Top-tier education with webinars, videos, and courses.

Cons

- No spot crypto trading; you are limited to ETFs and futures.

- "Stock Slices" (fractional shares) are limited to S&P 500 companies.

- Base margin rates are significantly higher than dedicated low-cost competitors.

My top takeaways for Charles Schwab in 2026:

- Dual-app Dominance: Schwab supports two distinct workflows. The flagship app handles holistic wealth management and fractional shares, while thinkorswim manages professional speculation and charting.

- Institutional Intelligence: The research offering is comprehensive. Daily audio updates bridge macro trends with micro news, and the "BondSource" inventory provides deep data usually reserved for institutional terminals.

- High-Net-Worth Infrastructure: Schwab secures the #1 ranking for High Net Worth Investors in 2026 because it offers tools usually reserved for private banking clients. From "Direct Indexing" for tax-loss harvesting to specialized "Organization Accounts" for managing family trusts or corporate assets, the platform is built to handle complex estates as easily as it handles an IRA.

Range of Investments

If you are looking for an investment platform that can handle every stage of your economic life, Charles Schwab is the destination. It is the definition of a full-service brokerage, offering an ecosystem so vast that most investors will never need to look elsewhere. Whether you are placing your first trade or managing a complex estate, the sheer scope of available assets and account types is impressive.

Full range of assets: From an investment product perspective, the menu is nearly exhaustive. You have access to the standard array of stocks, ETFs, and mutual funds, alongside a massive library of fixed-income products like Treasuries and munis. For the advanced practitioner, Schwab opens the door to futures and forex trading through the powerhouse thinkorswim platform. I particularly appreciate that Schwab now offers 24/5 trading on hundreds of securities, allowing you to react to global news when the domestic markets are sleeping.

Interested in forex trading?

If you intend to trade forex, check out our comprehensive Charles Schwab forex review focusing primarily on this market at our sister site, ForexBrokers.com.

The entry barrier is low, thanks to "Stock Slices," Schwab’s branded take on fractional shares. You can own a piece of the S&P 500 giants for as little as $5. The only noticeable gap in this otherwise armor-clad lineup is direct cryptocurrency trading. While you cannot trade spot Bitcoin or Ethereum here, I believe Schwab’s expansive offering more than compensates for this omission for the vast majority of investors.

Account types: Beyond the assets, the account variety highlights Schwab’s status as a market cornerstone. It supports the entire family lifecycle: 529 plans for education, custodial accounts for minors, and trust accounts for estate planning. Small business owners are equally well-served with SEP IRAs, SIMPLE IRAs, and even Individual 401(k)s.

User experience: Navigating this complexity is surprisingly intuitive. I found the "Positions" page to be one of the most customizable in the industry; being able to toggle a "Reinvest" column to instantly control dividend reinvestment (DRIP) without digging through settings menus is a massive quality-of-life win. Furthermore, administrative tasks that are usually painful, like adding beneficiaries or generating a balance letter for a mortgage application, are centralized and effortless. Schwab also offers limited margin in IRAs, allowing you to trade spreads or with unsettled funds without borrowing against the account.

| Feature |

Charles Schwab Charles Schwab

|

|---|---|

| Stock Trading | Yes |

| Account Feature - Margin Trading | Yes |

| Fractional Shares (Stocks) | Yes |

| OTC Stocks | Yes |

| Options Trading | Yes |

| Complex Options Max Legs | 4 |

| Fixed Income (Treasurys) | Yes |

| Futures Trading | Yes |

| Forex Trading | Yes |

| Crypto Trading | No |

| Crypto Trading - Total Coins | 0 |

| Traditional IRAs | Yes |

| Roth IRAs | Yes |

| Advisor Services | Yes |

One of the best for high net worth

We analyzed online brokers' offerings for clients with over $1 million of liquid, investable assets. See our guide to the Best Brokerage Firms for High Net Worth Individuals.

Charles Schwab fees

As a major financial institution, Schwab aligns its pricing with the industry standard. Schwab doesn't try to undercut the competition with rock-bottom discount pricing; instead, it offers a fair fee structure that justifies its massive ecosystem of tools and research.

Commissions: For the everyday investor, costs are almost non-existent. Standard stock and ETF trades are $0, and options trades are priced at the industry-standard $0.65 per contract. However, if you venture into the weeds of the market, you will encounter friction. Schwab charges $6.95 for trading OTC (penny stocks). While this is lower than some legacy competitors, it is a stark contrast to the fee-free experience at Fidelity.

Options: Where Schwab wins points with me is in its treatment of options mechanics. They do not charge fees for options exercise or assignment, which preserves your capital when strategies play out. I also appreciate the "Options Dime Buyback" program, which allows you to buy back short options positions for free if the price drops to a dime ($0.10) or less. It is a small feature that saves active traders significant commission costs over the long run.

Margin rates: The one area where Schwab feels expensive is leverage. Margin rates, at the date of my testing, started at a hefty 12.58% for balances under $25,000. While this is comparable to other full-service brokers, it is significantly higher than dedicated low-cost brokerages. Finally, if you decide to move your portfolio elsewhere, be aware that Schwab charges a $50 fee for a full account transfer (ACAT), though partial transfers are free.

| Feature |

Charles Schwab Charles Schwab

|

|---|---|

| Minimum Deposit | $0.00 |

| Stock Trades | $0.00 |

| Penny Stock Fees (OTC) | $6.95 |

| Options (Per Contract) | $0.65 |

| Options Exercise Fee | $0.00 |

| Options Assignment Fee | $0.00 |

| Futures (Per Contract) | $2.25 |

| Mutual Fund Trade Fee | Varies |

| Broker Assisted Trade Fee | $25 |

Mobile trading apps

Schwab solves the classic brokerage dilemma, how to serve both the casual saver and the hardcore trader, by refusing to force them into the same room. Instead of a single, cluttered super-app, Schwab offers two distinct, best-in-class experiences: the flagship Schwab Mobile app for everyday investing and thinkorswim for professional-grade speculation. Schwab took the #1 spot for Mobile Trading Apps in our 2026 awards due to the success of this strategy.

Schwab mobile: Everyday investors

The flagship app demonstrates excellent contextual design. It doesn't just show you numbers; it explains them. When I pulled a quote for a leveraged ETF, the app immediately surfaced a warning about the risks of holding such products long-term, which is a crucial piece of education that most brokers bury in fine print. I also loved the integration of the "Schwab Market Update." Being able to listen to a succinct, sub-10-minute podcast covering the day's headlines directly from the markets page makes staying informed incredibly frictionless.

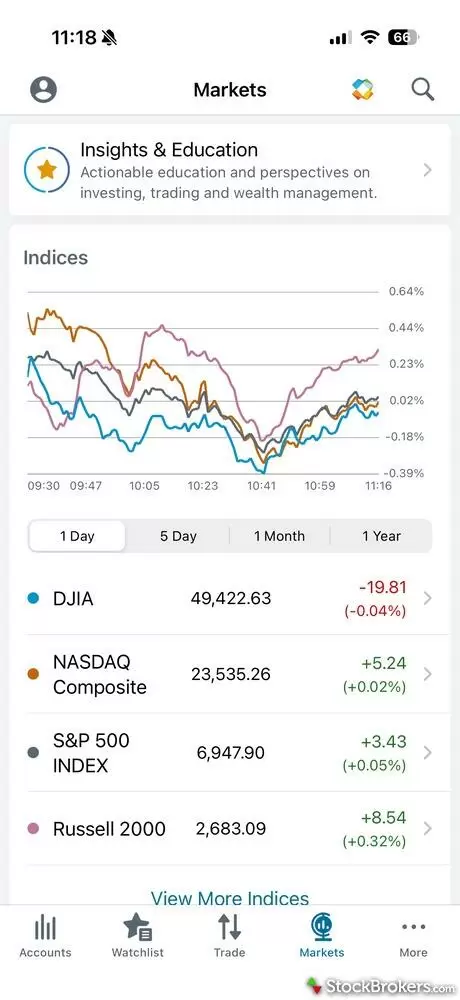

Schwab’s Market Research mobile homepage provides a quick snapshot of daily market performance, with real-time updates on major indices like the S&P 500, Dow, and Nasdaq. Users can also access breaking news headlines, macroeconomic insights, sector performance breakdowns, and even listen to an audio market update—all in one streamlined view.

For managing a portfolio, the experience is seamless. Watchlists are highly flexible, offering a "heatmap" view that instantly visualizes sector performance. Order entry is equally intuitive; I particularly enjoyed the "quantity calculator," which lets you input a dollar amount and automatically calculates the share count. This is perfect for dollar-cost averaging. However, the app hits a wall with complex strategies. While you can trade multi-leg options here, I found the process clunky. Constructing a vertical spread required manually adjusting expirations for each leg, a friction point that active traders will find intolerable.

thinkorswim mobile: Active traders

Enter thinkorswim (TOS). This is where the friction disappears for active traders. If the flagship app is a library, TOS is a trading floor. The mobile version of this legendary platform is fully customizable. You can even rewrite the bottom navigation menu to fit your workflow.

For the technical trader, it is a paradise. You have access to a staggering 373 technical studies, and the charting capabilities rival most desktop platforms. But where TOS truly shines is in options execution. Unlike the manual slog on the flagship app, building spreads here is fluid; you simply tap the bid and ask on the chain to construct complex multi-leg orders instantly. I also appreciate the community aspect; the app hosts active chat rooms like "Swim Lessons" and "Global News," allowing you to talk shop with other traders without leaving your screen. The only trade-off is a lack of broad market context. You won't find the same depth of macro news or sector heatmaps here, but for pure active trading it is unbeaten.

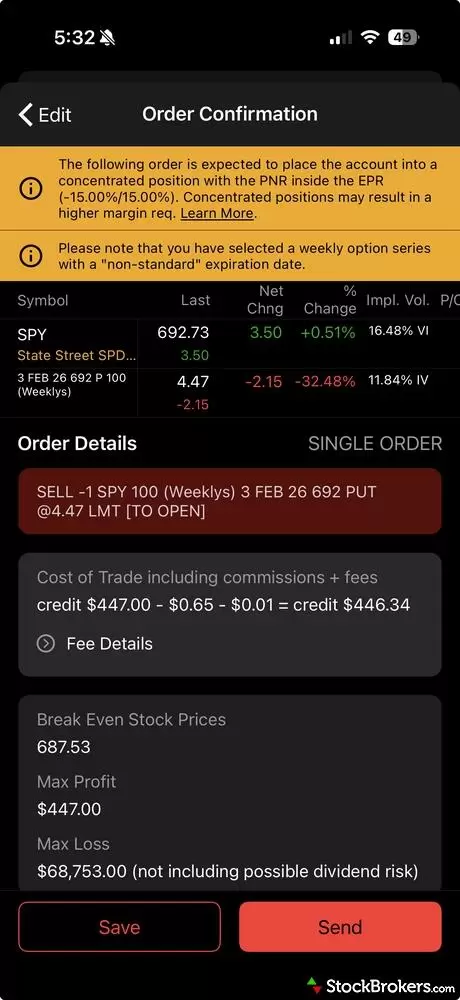

Schwab’s thinkorswim options trade ticket on mobile features a trade calculator view with both a P/L diagram and detailed table analysis. In this example, a 30-day-to-expiration at-the-money (ATM) cash-secured put on AAPL is displayed, clearly showing limited profit potential capped at the premium received—regardless of how high the stock rises. The payoff diagram also illustrates the increasing downside risk, mirroring the risk profile of stock ownership and highlighting the neutral to bullish bias of this strategy.

| Feature |

Charles Schwab Charles Schwab

|

|---|---|

| iPhone App | Yes |

| Android App | Yes |

| Apple Watch App | Yes |

| Stock Alerts | Yes |

| Charting - After-Hours | Yes |

| Charting - Technical Studies | 373 |

| Charting - Study Customizations | Yes |

| Watchlist (Streaming) | Yes |

| Mobile Watchlists - Create & Manage | Yes |

| Mobile Watchlists - Column Customization | Yes |

Advanced trading platforms

For the dedicated trader, Charles Schwab’s thinkorswim (TOS) is a comprehensive workspace. It is the industry benchmark for a reason, offering a depth of analysis and execution power that surpasses most competitors. Whether you are on the desktop downloadable version or the browser-based platform, the interface mimics a professional workstation designed for precise market trading.

Charting: The charting capabilities are, quite simply, hard to top. With 374 technical indicators and 24 drawing tools, the technical analysis suite is exhaustive. But what truly captivates me is the integration of fundamental economic data. You can pull data from the Federal Reserve (FRED), such as interest rates, employment costs, or business surveys, and chart them directly alongside price action. Visualizing the correlation between the 10-year yield and a bank stock’s performance on a single screen provides a macro perspective that pure technical analysis often misses.

This screenshot showcases a desktop chart of U.S. unemployment rates alongside a live news feed and streaming headlines, enabling traders to track macroeconomic trends in real time. Access to this level of economic insight helps investors connect data with market movement.

Options: For options traders, the "Earnings Analysis" tool is a standout feature. It allows you to visualize price action and volatility trends surrounding past earnings reports, overlaying Wall Street consensus against actual EPS.

Jessica's take

"I also frequently use the 'Product Depth' feature, which visualizes options metrics like implied volatility and Greeks, helping to spot anomalies or IV spikes at a glance."

Complexity: However, power comes with a price: complexity. thinkorswim is not intuitive for the uninitiated. The calls to action can be obscure, and navigating the 580 available columns for watch lists can feel overwhelming. I strongly suggest utilizing the "Chart Describer," a hidden gem that explains technical events on your chart in plain English. It is a fantastic way to learn through observation rather than dry theory. Schwab offers excellent educational resources to help you overcome this learning curve, and I advise you to take them seriously. This advanced platform demands the level of trading experience one expects from an advanced trader.

| Feature |

Charles Schwab Charles Schwab

|

|---|---|

| Active Trading Platform | thinkorswim |

| Desktop Trading Platform | Yes |

| Desktop Platform (Mac) | Yes |

| Web Trading Platform | Yes |

| Paper Trading | Yes |

| Trade Journal | Yes |

| Watchlists - Total Fields | 580 |

| Charting - Indicators / Studies | 374 |

| Charting - Drawing Tools | 24 |

| Charting - Study Customizations | 35 |

| Charting - Save Profiles | Yes |

| Trade Ideas - Technical Analysis | Yes |

| Streaming Time & Sales | Yes |

| Trade Ideas - Backtesting | Yes |

Research

Charles Schwab has constructed a research ecosystem that combines high-level macro commentary with granular, micro-level data, creating an experience that is as useful as it is vast.

Daily Market Update: My morning ritual at Schwab begins with the Daily Market Update. Instead of wading through endless headlines, I can listen to a concise, podcast-style briefing directly on the "US Markets" page. It perfectly bridges the gap between broad market moves and individual stock news. For instance, one update explained how a tariff deal triggered a rally in auto stocks like GM. It is the kind of contextual intelligence that sets the tone for a trading day.

Stock research: When drilling down into individual equities, the experience is equally impressive. I tested the platform using IBM on an earnings day and found the "detailed quote" page to be extremely organized. The "Stay Connected" widget kept me informed of the earnings announcement timing and corporate actions without cluttering the screen. However, a key tool is the peer comparison tool. I was able to generate a floating chart comparing IBM’s profit margins against its competitors, and then instantly pivot to compare it against the broader S&P 500. With access to seven different third-party research reports including Morningstar and Argus, plus Schwab’s own proprietary "Equity Ratings," the depth of analysis available is significant.

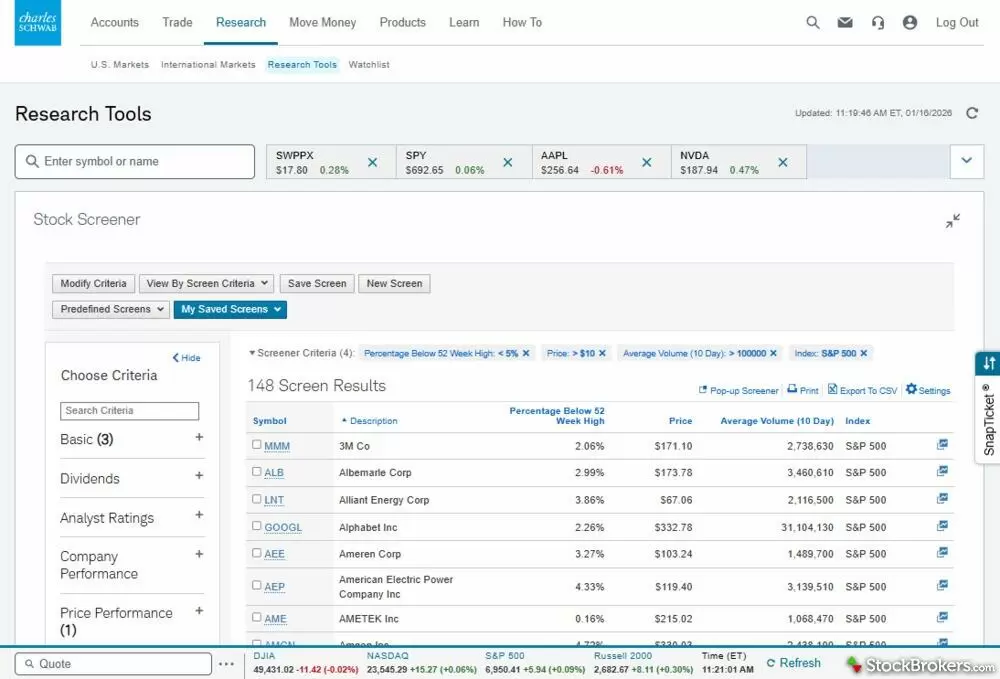

Screeners: For investors hunting for new ideas, Schwab’s screeners are top-tier. I particularly appreciate that the stock screener allows you to filter by forward-looking metrics, such as estimated EPS growth and Forward P/E ratios, rather than just historical data. Markets price the future, not the past, and Schwab understands this. Furthermore, as you build your screen, the platform dynamically explains complex acronyms, integrating education directly into the workflow.

Schwab’s web-based stock screener stands out with advanced filtering tools that include forward-year P/E ratios, projected EPS growth, and revenue estimates—ideal for forward-looking investors. The platform allows users to screen for S&P 500 stocks based on future performance metrics, earnings surprises, and Schwab Analyst Ratings. Unlike many screeners that focus solely on historical data, Schwab helps investors identify high-potential opportunities based on forward projections.

Bond research: Finally, the fixed income research is arguably the best in the business. Through BondSource, you gain access to over 60,000 CUSIPs from 200 dealers. I love the yield curve visualization tool, which overlays the current curve against last year's, allowing you to instantly see shifts in the rate environment. Schwab also smartly suggests bond funds alongside individual bonds. This is a thoughtful touch for investors who might be better served by a diversified fund than a single corporate note.

| Feature |

Charles Schwab Charles Schwab

|

|---|---|

| Research - Stocks | Yes |

| Stock Research - ESG | Yes |

| Stock Research - PDF Reports | 7 |

| Screener - Stocks | Yes |

| Research - ETFs | Yes |

| Screener - ETFs | Yes |

| Research - Mutual Funds | Yes |

| Screener - Mutual Funds | Yes |

| Research - Pink Sheets / OTCBB | Yes |

| Research - Fixed Income | Yes |

Education

If you want to learn to trade, Charles Schwab functions more like an university than a library. With over 200 videos, 850 articles, and a dedicated coaching program, the firm has built an educational ecosystem that rivals paid courses. The depth here is extensive, even if the organization occasionally feels difficult to navigate.

Courses: The centerpiece of this offering is the structured coursework. I immersed myself in the "Stock Investing with Fundamental Analysis" course and found it to be a comprehensive, three-hour deep dive. It didn’t just skim the surface; it walked me through Discounted Cash Flow (DCF) models, intrinsic value calculations, and the Capital Asset Pricing Model (CAPM). Each section ended with a quiz to validate my understanding, and I appreciated the logical progression from theory to application.

Schwab’s value investing course offers a deep dive into the fundamentals of analyzing stocks, making it ideal for long-term, self-directed investors. This introductory screen explores the basics of fundamental analysis—like P/E ratios, earnings reports, and intrinsic value—to help investors identify undervalued opportunities.

Schwab Coaching: For those who prefer a classroom setting, "Schwab Coaching" is a standout. This isn't just a webinar series; it is where traders come to train. I watched a session on advanced charting techniques led by Ben Watson, and I was struck by the quality of instruction. He wasn't just reading slides; he was using the thinkorswim paper trading platform to demonstrate concepts in real-time. This ability to "play along" without risking capital is arguably the most effective way to learn technical analysis.

Videos: The video content itself may also be the most polished in the industry. I watched an explainer on the Federal Reserve that managed to make Quantitative Easing (QE) and FOMC policy not only understandable but engaging, a feat few financial educators achieve. The only resistance I encountered was the way it’s organized. Because the "Learn" center often sorts articles by the most recent, finding the absolute basics like a simple answer to "What is a stock?" can sometimes be more difficult than finding complex market commentary. However, once you find the right path, the quality of the material is undeniable.

| Feature |

Charles Schwab Charles Schwab

|

|---|---|

| Education (Stocks) | Yes |

| Education (ETFs) | Yes |

| Education (Options) | Yes |

| Education (Mutual Funds) | Yes |

| Education (Fixed Income) | Yes |

| Education (Retirement) | Yes |

| Videos | Yes |

| Webinars | Yes |

| Progress Tracking | Yes |

| Interactive Learning - Quizzes | Yes |

Customer service

To score Customer Service, StockBrokers.com partners with customer experience research firm Confero to conduct phone tests from locations throughout the United States. For this year's testing, 132 customer service tests were conducted over six weeks, with wait times logged for each call.

Customer service representatives were asked for assistance or details for prospective customers in several areas of broker services, including account opening, trading tools, apps, crypto offerings, active trading, and more. Here are the results for Charles Schwab.

- Average Connection Time: Under a minute

- Average Net Promoter Score: 9.4 / 10

- Average Professionalism Score: 9.1 / 10

- Overall Score: 9.28 / 10

- Ranking: 1st of 11

Banking services

For many investors, Charles Schwab’s banking suite is the feature that turns a brokerage account into a primary financial home. Unlike competitors that treat banking as an afterthought, Schwab has built a fully integrated experience that rivals traditional brick-and-mortar institutions.

The notable offering is undoubtedly the Schwab Bank Investor Checking™ account. The account offers unlimited ATM fee rebates worldwide and charges no foreign transaction fees. This eliminates the anxiety of hunting for "in-network" machines, a freedom that is hard to give up once you experience it.

Beyond daily spending, the bank serves the broader needs of the high-net-worth investor. Schwab offers mortgages and certificates of deposit (CDs), allowing you to manage both liabilities and safe assets under the same roof. The seamless link between the checking and brokerage accounts also makes cash management effortless; moving money from a stock sale to your debit card is instant, removing the hassle of external transfers. While it may lack the physical branch network of a Chase or Bank of America for cash deposits, the digital-first convenience and travel perks make it a compelling choice for the modern investor.

| Feature |

Charles Schwab Charles Schwab

|

|---|---|

| Bank (Member FDIC) | Yes |

| Checking Accounts | Yes |

| Savings Accounts | Yes |

| Credit Cards | Yes |

| Debit Cards | Yes |

| Mortgage Loans | Yes |

IRA review

Trusting a brokerage with your retirement requires institutional permanence. Charles Schwab took the second-place rank for Retirement Accounts in 2026 because it balances that heavy-duty reliability with tools that remain surprisingly agile. Whether you are structuring a Roth IRA for decades of growth or managing distributions from an inherited account, the infrastructure here feels built to outlast market cycles.

Fees: The cost structure is deliberately transparent. Schwab charges $0 for annual maintenance and, crucially, $0 for account closures. This lack of exit penalties suggests a firm confident that its utility alone is enough to keep you. For investors who prefer to delegate the details, Schwab Intelligent Portfolios offers a sophisticated alternative to manual trading, algorithmically adjusting your asset allocation to keep your risk profile consistent without your constant intervention.

Fixed-income: Furthermore, for those shifting from accumulation to distribution, the platform’s fixed income tools are precise. You can construct bond ladders or scan CD inventories directly in the account, ensuring your capital produces the necessary cash flow exactly when you need it.

Final thoughts

Charles Schwab secures the #1 Overall ranking in our 2026 Annual Awards by offering a complete platform that requires few compromises. The splitting of its apps between casual and active traders prevents feature bloat, allowing novices to use "Stock Slices" in a user-friendly app while professionals can utilize thinkorswim to trade complex assets like futures. While the absence of spot crypto trading is a gap, the combination of deep research, professional-grade charting, and detailed education makes Schwab the definitive full-service brokerage.

Charles Schwab Star Ratings

| Feature |

Charles Schwab Charles Schwab

|

|---|---|

| Overall |

|

| Range of Investments |

|

| Mobile Trading Apps |

|

| Advanced Trading |

|

| Research |

|

| Customer Service |

|

| Education |

|

| Ease of Use |

|

StockBrokers.com Review Methodology

Why you should trust us

Jessica Inskip is Director of Investor Research at StockBrokers.com, bringing 15 years of experience in brokerage and trading strategy. A former FINRA-licensed rep, she held Series 7, 63, 66, and 4 licenses. Jessica focuses on investor education and brokerage industry research, appears regularly on CNBC, Bloomberg, The Schwab Network, Fox Business, and Yahoo! Finance, and hosts the Market MakeHer podcast.

Blain Reinkensmeyer, co-founder of StockBrokers.com, has been investing and trading for over 25 years. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. Today, Blain is widely respected as a leading expert on finance and investing, specifically the U.S. online brokerage industry. Blain has been quoted in The New York Times, The Wall Street Journal, Forbes, and Fast Company, among others. Blain created the original scoring rubrics for StockBrokers.com and oversees all testing and rating methodologies.

How we tested

- We used our own brokerage accounts for testing.

- We collected thousands of data points across the brokers we review.

- We tested each online broker's website, desktop platforms, and mobile app, where applicable.

- We maintained strict editorial independence; brokers cannot pay for inclusion or a higher rating.

Our research team meticulously collected data on every feature of importance to a wide range of customer profiles, including beginners, casual investors, passive investors, and active traders. We carefully track variables like margin rates, trading costs, fees, and platform features and use them to help rate brokers across a range of categories measuring ease of use, range of investments, research, education, and more.

At StockBrokers.com, our reviewers use a variety of computing devices to evaluate platforms and tools. Our reviews and data collection were conducted using the following devices: iPhone SE running iOS 17.5.1, MacBook Pro M1 with 8 GB RAM running the current MacOS, and a Dell Vostro 5402 laptop i5 with 8 GB RAM running Windows 11 Pro.

Each broker was evaluated and scored on over 200 different variables across seven key categories: Range of Investments, Platforms & Tools, Research, Mobile Trading, Education, Ease of Use, and Overall. Learn more about how we test.

Trading platforms tested in 2026

We tested 14 online trading platforms in 2026:

Read next

- Best Brokers for Penny Stock Trading of 2026

- Best Options Trading Platforms for 2026

- Best Stock Trading Platforms for Beginners of 2026

- Best Stock Trading Apps for 2026

- Best Stock Brokers for 2026

- Best Day Trading Platforms of 2026 for Beginners and Active Traders

- Best Paper Trading Apps & Platforms for 2026

- Best Futures Trading Platforms for 2026

More Guides

Popular Stock Broker Reviews

About Charles Schwab

Headquartered in Westlake, Texas, Charles Schwab was founded in 1971 and is one of the largest brokerage firms in the United States with more than 36 million active brokerage accounts, 5.4 million workplace plan participant accounts, 2.0 million banking accounts, and $9.92 trillion in client assets as of October 2024. In October 2020 Schwab acquired fellow online broker TD Ameritrade, now a Schwab subsidiary.