Range of investments

Bottom line: Charles Schwab offers a wider range of investments than J.P. Morgan Self-Directed Investing, adding forex and futures that J.P. Morgan doesn’t support. Both skip crypto. For breadth, StockBrokers.com rates Schwab 4.5/5 and ranks it #3 of 14, versus J.P. Morgan Self-Directed Investing at 3.5/5 and #13. That makes Schwab a better fit if you want the most asset types in one place, while J.P. Morgan Self-Directed Investing covers the essentials.

Both brokers let you trade stocks (including fractional shares and OTC stocks), use margin, buy mutual funds, and trade options. They also offer traditional and Roth IRAs plus access to advisor services. Neither offers crypto trading, and each has zero coins available.

The key difference is market access: Schwab supports forex and futures; J.P. Morgan Self-Directed Investing does not. If those markets matter to you now or later, Schwab gives you room to grow. If your plan centers on stocks, funds, and options, J.P. Morgan Self-Directed Investing can meet those needs.

|

Feature |

Charles Schwab Charles Schwab

|

J.P. Morgan Self-Directed Investing J.P. Morgan Self-Directed Investing

|

|

Stock Trading

info

|

Yes

|

Yes

|

|

Account Feature - Margin Trading

info

|

Yes

|

Yes

info |

|

Fractional Shares (Stocks)

info

|

Yes

|

Yes

|

|

OTC Stocks

info

|

Yes

|

Yes

|

|

Mutual Funds

info

|

Yes

|

Yes

|

|

Options Trading

info

|

Yes

|

Yes

|

|

Futures Trading

info

|

Yes

|

No

|

|

Crypto Trading

info

|

No

|

No

|

|

Crypto Trading - Total Coins

info

|

0

|

0

|

|

Range of Investments

|

|

|

Dive deeper: Best Options Trading Platforms for 2026, Best Futures Trading Platforms for 2026

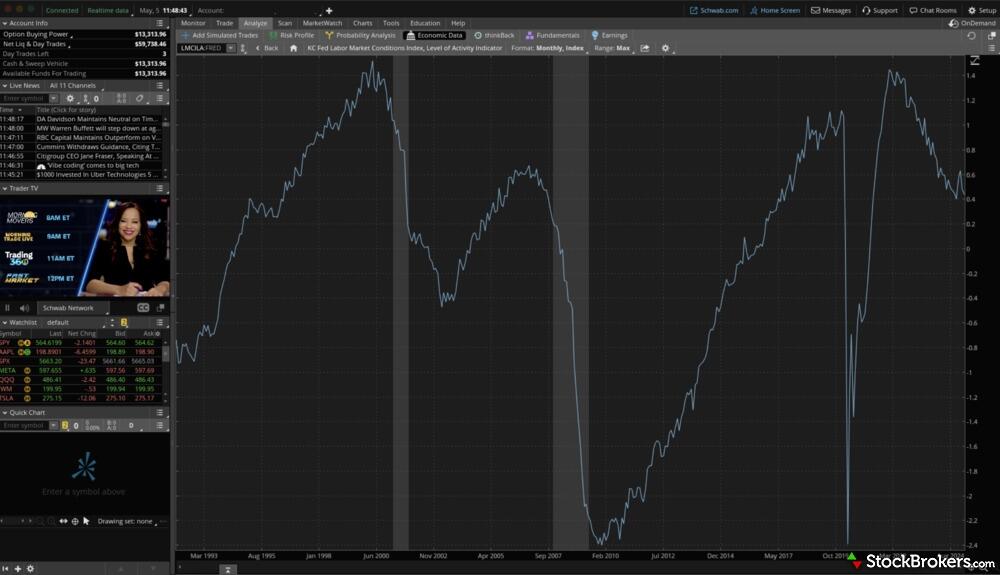

Trading platforms and tools

Bottom line: For trading platforms and tools, Charles Schwab clearly outpaces J.P. Morgan Self-Directed Investing. Schwab earns 4.5/5 stars and ranks #1 of 14 brokers at StockBrokers.com, while J.P. Morgan scores 1/5 stars and ranks #13. If you want fuller platform choice, deeper charting, and practice features, Schwab is the stronger pick; J.P. Morgan suits basic, web-only trading needs.

Platform access and core tools differ sharply. Charles Schwab offers downloadable desktop platforms for both Windows and Mac plus a full browser-based platform; J.P. Morgan provides a browser-based platform only. Schwab includes paper trading and a built-in trading journal; J.P. Morgan offers neither. Watchlists are far more flexible at Schwab (up to 580 columns) versus J.P. Morgan (20 columns). Schwab also lets you adjust open orders directly on a stock chart, which J.P. Morgan does not.

Charting and customization are where Schwab pulls away. Schwab supplies 374 technical indicators and 24 drawing tools, compared with J.P. Morgan’s 36 indicators and 10 drawing tools. Schwab supports notes on charts, historical trade markers, custom date ranges, automated chart pattern detection, and saving multiple chart profiles; J.P. Morgan lacks those, though both brokers can display corporate events like earnings, splits, and dividends. For study controls, Schwab offers 35 fields when editing an SMA (versus 3 at J.P. Morgan) and even lets you create custom studies—something J.P. Morgan does not support.

|

Feature |

Charles Schwab Charles Schwab

|

J.P. Morgan Self-Directed Investing J.P. Morgan Self-Directed Investing

|

|

Web Trading Platform

info

|

Yes

|

Yes

|

|

Desktop Trading Platform

info

|

Yes

|

No

|

|

Desktop Platform (Mac)

info

|

Yes

|

No

|

|

Paper Trading

info

|

Yes

|

No

|

|

Watchlists - Total Fields

info

|

580

|

20

|

|

Charting - Indicators / Studies

info

|

374

|

36

|

|

Charting - Drawing Tools

info

|

24

|

10

|

|

Advanced Trading

|

|

|

Dive deeper: Best Stock Brokers for 2026, Best Paper Trading Apps & Platforms for 2026

A full-featured account for investing

Get up to $1K on new brokerage account*

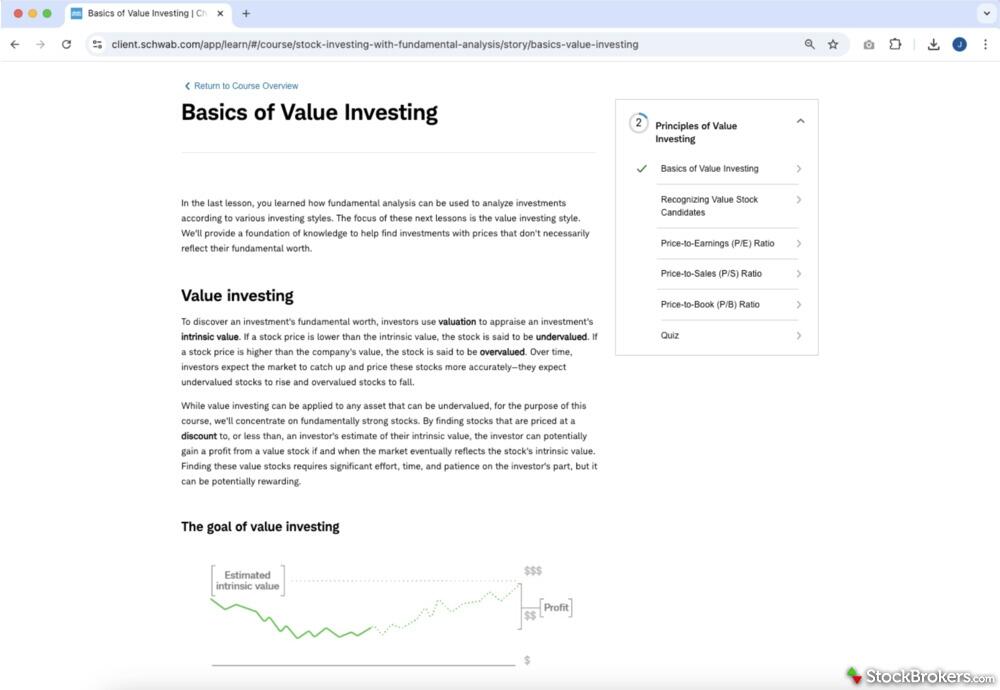

Beginners and education

Both Charles Schwab and J.P. Morgan Self-Directed Investing give beginners and DIY investors broad education across stocks, ETFs, options, mutual funds, and bonds. Each platform includes helpful videos and live webinars to explain core topics and market trends, making it easier to build confidence step by step.

Charles Schwab stands out for hands-on practice and structured learning: it offers paper trading, interactive quizzes, and tools to track your learning progress—advantages J.P. Morgan Self-Directed Investing doesn’t provide. That edge helps explain Schwab’s 5-star education rating and #2 ranking out of 14 brokers by StockBrokers.com, compared with J.P. Morgan Self-Directed Investing’s 4-star rating and #4 ranking.

|

Feature |

Charles Schwab Charles Schwab

|

J.P. Morgan Self-Directed Investing J.P. Morgan Self-Directed Investing

|

|

Education (Stocks)

info

|

Yes

|

Yes

|

|

Education (ETFs)

info

|

Yes

|

Yes

|

|

Education (Options)

info

|

Yes

|

Yes

|

|

Education (Mutual Funds)

info

|

Yes

|

Yes

|

|

Education (Fixed Income)

info

|

Yes

|

Yes

|

|

Videos

info

|

Yes

|

Yes

|

|

Webinars

info

|

Yes

|

Yes

|

|

Education

|

|

|

Dive deeper: Best Stock Trading Platforms for Beginners of 2026

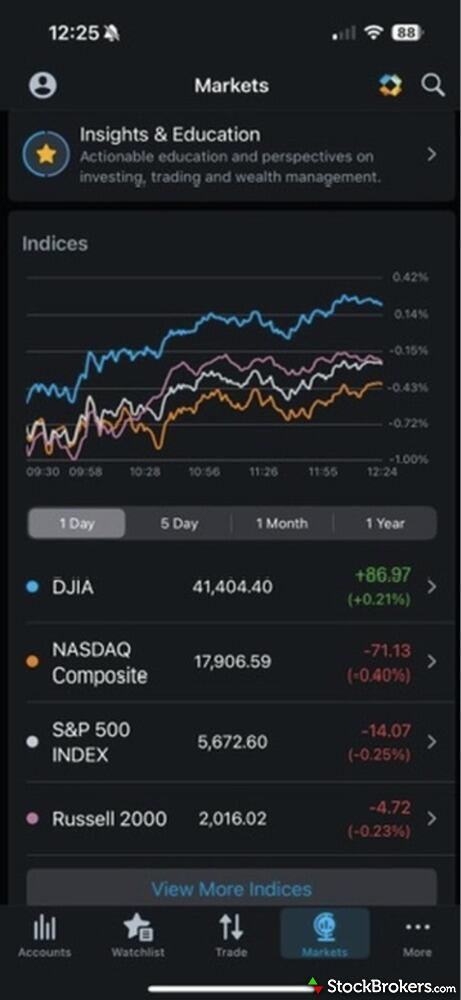

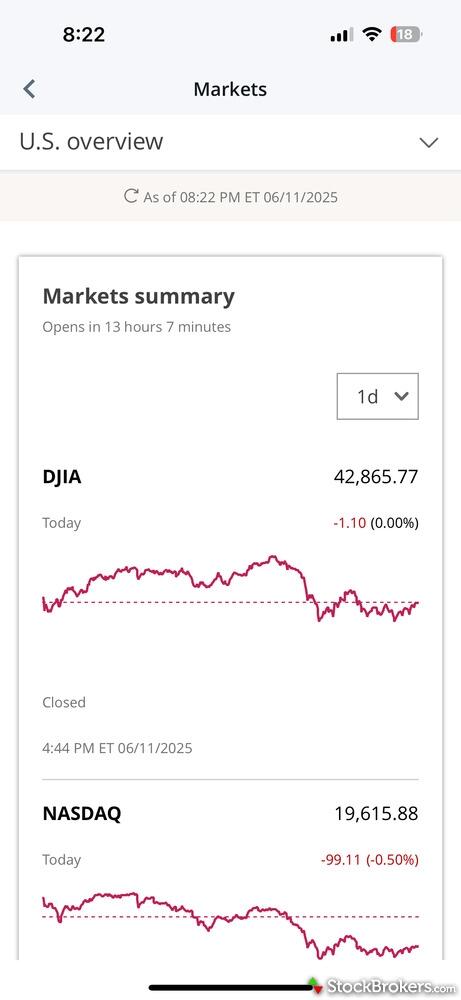

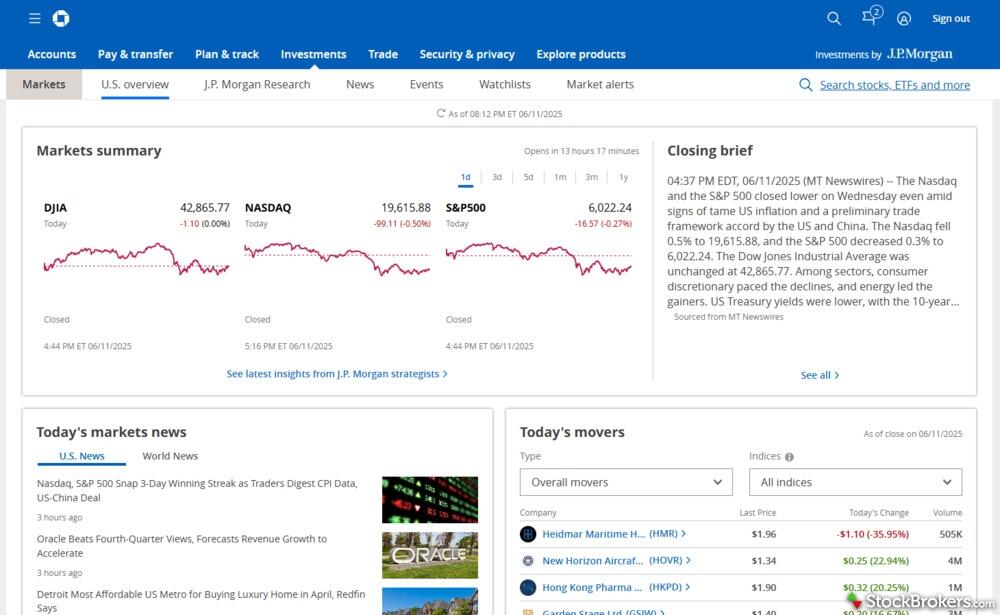

Stock trading apps

Bottom line: For mobile stock trading, Charles Schwab’s app outpaces J.P. Morgan Self-Directed Investing. Both provide iPhone and Android apps and let you trade options on the go, but Schwab adds Apple Watch support, in-app after-hours trading, streaming quotes, live TV, videos on demand, and deeper charting tools. StockBrokers.com rates Schwab 5 stars and #1 out of 14 brokers for stock trading apps, while J.P. Morgan Self-Directed Investing earns 4 stars and ranks #10. J.P. Morgan’s support for mobile after-hours trading isn’t specified.

Platform access and market data: Charles Schwab and J.P. Morgan Self-Directed Investing both offer iPhone and Android apps, stock alerts, custom watch lists, and customizable watch list columns. Schwab also offers an Apple Watch app, while J.P. Morgan does not. Schwab delivers streaming quotes, live TV, and on-demand videos in the app; J.P. Morgan lacks these streaming and video features.

Charts and analysis on mobile: Both apps allow landscape charts and multiple time frames. Schwab supplies after-hours charting and far more technical studies (373 vs 36) plus the ability to compare multiple stocks on a single chart. J.P. Morgan Self-Directed Investing does not offer after-hours charting or stock-to-stock chart comparisons.

|

Feature |

Charles Schwab Charles Schwab

|

J.P. Morgan Self-Directed Investing J.P. Morgan Self-Directed Investing

|

|

iPhone App

info

|

Yes

|

Yes

|

|

Android App

info

|

Yes

|

Yes

|

|

Apple Watch App

info

|

Yes

|

No

|

|

Stock Alerts

info

|

Yes

|

Yes

|

|

Charting - After-Hours

info

|

Yes

|

No

|

|

Charting - Technical Studies

info

|

373

|

36

|

|

Mobile Trading Apps

|

|

|

Dive deeper: Best Stock Trading Apps for 2026

Fees

Here’s the quick take on Charles Schwab vs. J.P. Morgan Self-Directed Investing: both offer $0 account minimums and $0 stock trades, plus the same $0.65 per options contract. For margin, J.P. Morgan is a touch cheaper under $50,000, while Schwab is cheaper from $50,000 to $99,999. Schwab also wins on exit costs with a $0 IRA closure fee and a lower full ACAT transfer fee. If you expect smaller margin balances, J.P. Morgan has a slight edge; if you want lower transfer and closure costs—or plan to carry mid-size margin—Schwab is more favorable.

Core trading costs are nearly identical. Both Charles Schwab and J.P. Morgan Self-Directed Investing have $0 minimum deposits, $0 commissions on regular stock trades, and $0.65 per options contract. Options exercise and assignment fees are $0 at both brokers. IRA annual fees are also $0 on both platforms.

Margin rates vary by balance. For balances under $25,000, Schwab is 12.58% vs. J.P. Morgan at 12.25%. From $25,000 to $49,999, Schwab is 12.08% vs. J.P. Morgan at 12.00%. From $50,000 to $99,999, Schwab is lower at 11.13% vs. J.P. Morgan at 11.50%. On account transfers, both charge $0 for partial ACATs, while full ACATs are $50 at Schwab and $75 at J.P. Morgan. IRA closure is $0 at Schwab and $75 at J.P. Morgan.

|

Feature |

Charles Schwab Charles Schwab

|

J.P. Morgan Self-Directed Investing J.P. Morgan Self-Directed Investing

|

|

Minimum Deposit

info

|

$0.00

|

$0.00

|

|

Stock Trades

info

|

$0.00

|

$0.00

|

|

Options (Per Contract)

info

|

$0.65

|

$0.65

|

|

Options Exercise Fee

info

|

$0.00

|

$0.00

|

|

Options Assignment Fee

info

|

$0.00

|

$0.00

|

|

IRA Annual Fee

info

|

$0.00

|

$0.00

|

|

IRA Closure Fee

info

|

$0.00

|

$75.00

|

Dive deeper: Best Free Trading Platforms for 2026

Day Trading

When it comes to day trading capabilities, Charles Schwab stands out with a range of features that cater to active traders. Schwab offers streaming time and sales for stocks, allowing traders to see detailed trade activity, which is essential for making informed decisions. The platform provides access to streaming live TV, helping traders stay updated with real-time news and market developments. Charles Schwab also offers direct market routing, giving traders more control over how their orders are executed, and supports ladder trading for visualizing order entries effectively. For those who prefer quick actions, trading hotkeys for keyboard trade entry are available, expediting the trading process significantly. Additionally, Schwab provides level 2 quotes that present deeper insights into bid and ask prices beyond the best available offers. Traders can also utilize basic and advanced strategy backtesting tools to refine their trading strategies efficiently.

In contrast, J.P. Morgan Self-Directed Investing lacks several key features sought by day traders. The platform does not offer streaming time and sales, streaming live TV, or direct market routing, which could limit the speed and depth of information needed for high-frequency trading. It also does not support ladder trading or provide trading hotkeys, potentially making swift order execution more cumbersome. Level 2 quotes are unavailable, restricting the depth of market data necessary for spotting trading opportunities. Moreover, J.P. Morgan Self-Directed Investing lacks both basic and advanced strategy backtesting solutions, which could limit the ability of traders to test and optimize their trading strategies. However, neither Charles Schwab nor J.P. Morgan Self-Directed Investing provide order liquidity (maker/taker) rebates, leaving this aspect equal between the two.

|

Feature |

Charles Schwab Charles Schwab

|

J.P. Morgan Self-Directed Investing J.P. Morgan Self-Directed Investing

|

|

Streaming Time & Sales

info

|

Yes

|

No

|

|

Streaming TV

info

|

Yes

|

No

|

|

Direct Market Routing - Equities

info

|

Yes

|

No

|

|

Level 2 Quotes - Stocks

info

|

Yes

|

No

|

|

Trade Ideas - Backtesting

info

|

Yes

|

No

|

|

Trade Ideas - Backtesting Adv

info

|

Yes

|

No

|

|

Short Locator

info

|

Yes

|

No

|

Dive deeper: Best Day Trading Platforms of 2026 for Beginners and Active Traders

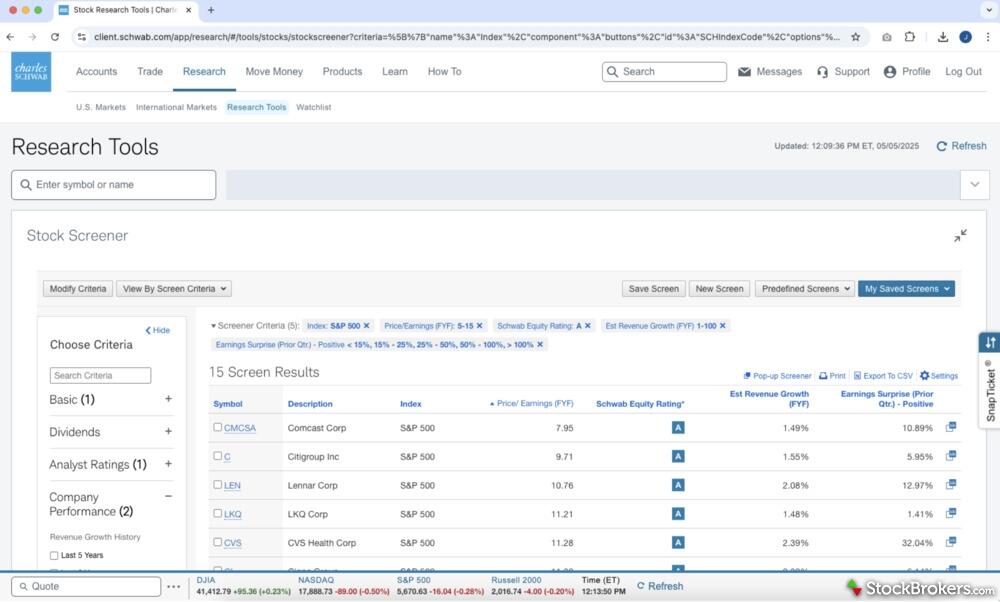

Market Research

For market research, Charles Schwab edges out J.P. Morgan Self-Directed Investing. Schwab earns 4.5/5 stars and ranks #2 of 14 brokers with StockBrokers.com, while J.P. Morgan Self-Directed Investing scores 4/5 stars and ranks #7. Schwab offers more downloadable reports and extra data types, making it the stronger choice for research-driven investors, while J.P. Morgan Self-Directed Investing covers the essentials well.

Both brokers deliver research across key asset types: stocks, ETFs, mutual funds, pink sheets/OTCBB, and bonds. Each platform also lets you see your portfolio allocation by asset class and includes screeners for stocks, ETFs, mutual funds, and bonds to help generate trade ideas.

Where they differ is depth. Charles Schwab adds social media sentiment tools and ESG research, which J.P. Morgan Self-Directed Investing does not provide. Schwab also supplies seven downloadable stock research PDFs versus two at J.P. Morgan Self-Directed Investing, and offers ETF research PDFs while J.P. Morgan Self-Directed Investing does not. Neither broker provides downloadable PDFs for mutual fund research.

|

Feature |

Charles Schwab Charles Schwab

|

J.P. Morgan Self-Directed Investing J.P. Morgan Self-Directed Investing

|

|

Research - Stocks

info

|

Yes

|

Yes

|

|

Screener - Stocks

info

|

Yes

|

Yes

|

|

Research - ETFs

info

|

Yes

|

Yes

|

|

Screener - ETFs

info

|

Yes

|

Yes

|

|

Research - Mutual Funds

info

|

Yes

|

Yes

|

|

Screener - Mutual Funds

info

|

Yes

|

Yes

|

|

Research - Fixed Income

info

|

Yes

|

Yes

|

|

Screener - Fixed Income

info

|

Yes

|

Yes

|

|

Research

|

|

|

Banking

When comparing the banking features of Charles Schwab and J.P. Morgan Self-Directed Investing, both online brokers provide a comprehensive suite of services to meet everyday financial needs. Each offers checking accounts and savings accounts, which are essential for managing funds and earning interest. Both platforms provide debit and credit cards, allowing easy access to money and making purchases convenient. Additionally, they each offer mortgage loans, supporting those looking to finance a new home. For those interested in saving with guaranteed returns, both Charles Schwab and J.P. Morgan Self-Directed Investing offer Certificates of Deposit (CDs). With these similarities in banking capabilities, either broker can cater to a wide range of personal banking needs.

Dive deeper: Best Brokerage Checking Accounts for 2026

Winner

After opening live accounts and testing 14 of the best online brokers, our research and live account testing finds that Charles Schwab is better than J.P. Morgan Self-Directed Investing. Charles Schwab finished with an overall score of 93.3%, while J.P. Morgan Self-Directed Investing finished with a score of 67.5%.

For most investors, the search for a great broker ends with Charles Schwab. Retaining the #1 Overall ranking in 2026, Schwab continues to set the industry standard. The broker uniquely balances scale with sophistication, offering both simplified mobile tools and the professional-grade thinkorswim platform. From buying a first fractional share to managing a multimillion-dollar estate, Schwab provides a platform tailored to every need, serving as the definitive operating system for modern wealth.

FAQs

Can you trade cryptocurrency with Charles Schwab or J.P. Morgan Self-Directed Investing?

Both Charles Schwab and J.P. Morgan Self-Directed Investing do not offer crypto trading, with neither platform providing access to any cryptocurrencies. Investors seeking crypto options may need to look beyond these online brokers.

Dive deeper: Best Online Brokers for Crypto Trading in 2026

Does Charles Schwab or J.P. Morgan Self-Directed Investing offer IRAs?

Both Charles Schwab and J.P. Morgan Self-Directed Investing offer traditional and Roth IRA accounts with no annual fees; however, only Charles Schwab charges no fees for closing IRA accounts, whereas J.P. Morgan imposes a $75 closure fee.

Dive deeper: Best IRA Accounts for 2026

Popular trading guides

More trading guides

Popular broker reviews

navigate_before

navigate_next

|

Broker Screenshots

|

Charles Schwab |

J.P. Morgan Self-Directed Investing |

|

|

Broker Gallery (click to expand) |

|

|

|

|

Trading Fees

|

Charles Schwab |

J.P. Morgan Self-Directed Investing |

|

|

Minimum Deposit info

|

$0.00

|

$0.00

|

|

|

Stock Trades info

|

$0.00

|

$0.00

|

|

|

Penny Stock Fees (OTC) info

|

$6.95

|

$0.00

|

|

|

Mutual Fund Trade Fee info

|

Varies

|

$0

|

|

|

Options (Per Contract) info

|

$0.65

|

$0.65

|

|

|

Futures (Per Contract) info

|

$2.25

|

(Not offered)

|

|

|

Broker Assisted Trade Fee info

|

$25

|

Varies

|

|

|

Margin Rates

|

Charles Schwab |

J.P. Morgan Self-Directed Investing |

|

|

Margin Rate Under $25,000 info

|

12.58%

|

12.25%

|

|

|

Margin Rate $25,000 to $49,999.99 info

|

12.08%

|

12%

|

|

|

Margin Rate $50,000 to $99,999.99 info

|

11.13%

|

11.5%

|

|

|

Margin Rate $100,000 to $249,999.99 info

|

11.08%

|

11.25%

|

|

|

Margin Rate $250,000 to $499,999.99 info

|

10.83%

|

11.25%

|

|

|

Margin Rate $500,000 to $999,999.99 info

|

Varies

info

|

10.5%

|

|

|

Margin Rate Above $1,000,000 info

|

Varies

info

|

10%

info

|

|

|

Account Fees

|

Charles Schwab |

J.P. Morgan Self-Directed Investing |

|

|

IRA Annual Fee info

|

$0.00

|

$0.00

|

|

|

IRA Closure Fee info

|

$0.00

|

$75.00

|

|

|

Account Transfer Out (Partial) info

|

$0.00

|

$0.00

|

|

|

Account Transfer Out (Full) info

|

$50.00

|

$75.00

|

|

|

Options Exercise Fee info

|

$0.00

|

$0.00

|

|

|

Options Assignment Fee info

|

$0.00

|

$0.00

|

|

|

Investment Options

|

Charles Schwab |

J.P. Morgan Self-Directed Investing |

|

|

Stock Trading info

|

Yes

|

Yes

|

|

|

Account Feature - Margin Trading info

|

Yes

|

Yes

info

|

|

|

Fractional Shares (Stocks) info

|

Yes

|

Yes

|

|

|

OTC Stocks info

|

Yes

|

Yes

|

|

|

Options Trading info

|

Yes

|

Yes

|

|

|

Complex Options Max Legs info

|

4

|

1

|

|

|

Futures Trading info

|

Yes

|

No

|

|

|

Forex Trading info

|

Yes

|

No

|

|

|

Crypto Trading info

|

No

|

No

|

|

|

Crypto Trading - Total Coins info

|

0

|

0

|

|

|

Fixed Income (Treasurys) info

|

Yes

|

Yes

|

|

|

Fixed Income (Corporate Bonds) info

|

Yes

|

Yes

|

|

|

Fixed Income (Municipal Bonds) info

|

Yes

|

Yes

|

|

|

Traditional IRAs info

|

Yes

|

Yes

|

|

|

Roth IRAs info

|

Yes

|

Yes

|

|

|

Advisor Services info

|

Yes

|

Yes

|

|

|

International Countries (Stocks) info

|

12

|

0

|

|

|

Order Types

|

Charles Schwab |

J.P. Morgan Self-Directed Investing |

|

|

Order Type - Market info

|

Yes

|

Yes

|

|

|

Order Type - Limit info

|

Yes

|

Yes

|

|

|

Order Type - After Hours info

|

Yes

|

No

|

|

|

Order Type - Stop info

|

Yes

|

Yes

|

|

|

Order Type - Trailing Stop info

|

Yes

|

No

|

|

|

Order Type - OCO info

|

Yes

|

No

|

|

|

Order Type - OTO info

|

Yes

|

No

|

|

|

Order Type - Broker Assisted info

|

Yes

|

Yes

|

|

|

Beginners

|

Charles Schwab |

J.P. Morgan Self-Directed Investing |

|

|

Education (Stocks) info

|

Yes

|

Yes

|

|

|

Education (ETFs) info

|

Yes

|

Yes

|

|

|

Education (Options) info

|

Yes

|

Yes

|

|

|

Education (Mutual Funds) info

|

Yes

|

Yes

|

|

|

Education (Fixed Income) info

|

Yes

|

Yes

|

|

|

Education (Retirement) info

|

Yes

|

Yes

|

|

|

Retirement Calculator info

|

Yes

|

Yes

|

|

|

Investor Dictionary info

|

Yes

|

No

|

|

|

Paper Trading info

|

Yes

|

No

|

|

|

Videos info

|

Yes

|

Yes

|

|

|

Webinars info

|

Yes

|

Yes

|

|

|

Progress Tracking info

|

Yes

|

No

|

|

|

Interactive Learning - Quizzes info

|

Yes

|

No

|

|

|

Stock Trading Apps

|

Charles Schwab |

J.P. Morgan Self-Directed Investing |

|

|

iPhone App info

|

Yes

|

Yes

|

|

|

Android App info

|

Yes

|

Yes

|

|

|

Apple Watch App info

|

Yes

|

No

|

|

|

Trading - Stocks info

|

Yes

|

Yes

|

|

|

Trading - After-Hours info

|

Yes

|

No

|

|

|

Trading - Simple Options info

|

Yes

|

Yes

|

|

|

Trading - Complex Options info

|

Yes

|

No

|

|

|

Order Ticket RT Quotes info

|

Yes

|

Yes

|

|

|

Order Ticket SRT Quotes info

|

Yes

|

No

|

|

|

Stock App Features

|

Charles Schwab |

J.P. Morgan Self-Directed Investing |

|

|

Mobile Research - Market Movers info

|

Yes

|

Yes

|

|

|

Stream Live TV info

|

Yes

|

No

|

|

|

Videos on Demand info

|

Yes

|

No

|

|

|

Stock Alerts info

|

Yes

|

Yes

|

|

|

Option Chains Viewable info

|

Yes

|

Yes

|

|

|

Watchlist (Real-time) info

|

Yes

|

Yes

|

|

|

Watchlist (Streaming) info

|

Yes

|

No

|

|

|

Mobile Watchlists - Create & Manage info

|

Yes

|

Yes

|

|

|

Mobile Watchlists - Column Customization info

|

Yes

|

Yes

|

|

|

Stock App Charting

|

Charles Schwab |

J.P. Morgan Self-Directed Investing |

|

|

Charting - After-Hours info

|

Yes

|

No

|

|

|

Charting - Can Turn Horizontally info

|

Yes

|

Yes

|

|

|

Charting - Multiple Time Frames info

|

Yes

|

Yes

|

|

|

Charting - Technical Studies info

|

373

|

36

|

|

|

Charting - Study Customizations info

|

Yes

|

Yes

|

|

|

Charting - Stock Comparisons info

|

Yes

|

No

|

|

|

Trading Platforms

|

Charles Schwab |

J.P. Morgan Self-Directed Investing |

|

|

Active Trading Platform info

|

thinkorswim

info

|

No

|

|

|

Desktop Trading Platform info

|

Yes

|

No

|

|

|

Desktop Platform (Mac) info

|

Yes

|

No

|

|

|

Web Trading Platform info

|

Yes

|

Yes

|

|

|

Paper Trading info

|

Yes

|

No

|

|

|

Trade Journal info

|

Yes

|

No

|

|

|

Watchlists - Total Fields info

|

580

|

20

|

|

|

Stock Chart Features

|

Charles Schwab |

J.P. Morgan Self-Directed Investing |

|

|

Charting - Adjust Trades on Chart info

|

Yes

|

No

|

|

|

Charting - Indicators / Studies info

|

374

|

36

|

|

|

Charting - Drawing Tools info

|

24

|

10

|

|

|

Charting - Notes info

|

Yes

|

No

|

|

|

Charting - Historical Trades info

|

Yes

|

No

|

|

|

Charting - Corporate Events info

|

Yes

|

Yes

|

|

|

Charting - Custom Date Range info

|

Yes

|

No

|

|

|

Charting - Custom Time Bars info

|

Yes

|

No

|

|

|

Charting - Automated Analysis info

|

Yes

|

No

|

|

|

Charting - Save Profiles info

|

Yes

|

No

|

|

|

Trade Ideas - Technical Analysis info

|

Yes

|

No

|

|

|

Charting - Study Customizations info

|

35

|

3

|

|

|

Charting - Custom Studies info

|

Yes

|

No

|

|

|

Day Trading

|

Charles Schwab |

J.P. Morgan Self-Directed Investing |

|

|

Streaming Time & Sales info

|

Yes

|

No

|

|

|

Streaming TV info

|

Yes

|

No

|

|

|

Direct Market Routing - Equities info

|

Yes

|

No

|

|

|

Ladder Trading info

|

Yes

|

No

|

|

|

Trade Hot Keys info

|

Yes

|

No

|

|

|

Level 2 Quotes - Stocks info

|

Yes

|

No

|

|

|

Trade Ideas - Backtesting info

|

Yes

|

No

|

|

|

Trade Ideas - Backtesting Adv info

|

Yes

|

No

|

|

|

Short Locator info

|

Yes

|

No

|

|

|

Order Liquidity Rebates info

|

No

|

No

|

|

|

Research Overview

|

Charles Schwab |

J.P. Morgan Self-Directed Investing |

|

|

Research - Stocks info

|

Yes

|

Yes

|

|

|

Research - ETFs info

|

Yes

|

Yes

|

|

|

Research - Mutual Funds info

|

Yes

|

Yes

|

|

|

Research - Pink Sheets / OTCBB info

|

Yes

|

Yes

|

|

|

Research - Fixed Income info

|

Yes

|

Yes

|

|

|

Screener - Stocks info

|

Yes

|

Yes

|

|

|

Screener - ETFs info

|

Yes

|

Yes

|

|

|

Screener - Mutual Funds info

|

Yes

|

Yes

|

|

|

Screener - Fixed Income info

|

Yes

|

Yes

|

|

|

Portfolio Asset Allocation info

|

Yes

|

Yes

|

|

|

Stock Research

|

Charles Schwab |

J.P. Morgan Self-Directed Investing |

|

|

Stock Research - PDF Reports info

|

7

|

2

|

|

|

Stock Research - Earnings info

|

Yes

|

Yes

|

|

|

Stock Research - Insiders info

|

Yes

|

No

|

|

|

Stock Research - Social info

|

Yes

|

No

|

|

|

Stock Research - News info

|

Yes

|

Yes

|

|

|

Stock Research - ESG info

|

Yes

|

No

|

|

|

Stock Research - SEC Filings info

|

Yes

|

No

|

|

|

ETF Research

|

Charles Schwab |

J.P. Morgan Self-Directed Investing |

|

|

ETFs - Investment Objective info

|

Yes

|

Yes

|

|

|

ETF Fund Facts - Inception Date info

|

Yes

|

Yes

|

|

|

ETF Fund Facts - Expense Ratio info

|

Yes

|

Yes

|

|

|

ETF Fund Facts - Total Assets info

|

Yes

|

Yes

|

|

|

ETF Fund Facts - Total Holdings info

|

Yes

|

Yes

|

|

|

ETFs - Top 10 Holdings info

|

Yes

|

Yes

|

|

|

ETFs - Sector Exposure info

|

Yes

|

Yes

|

|

|

ETFs - Risk Analysis info

|

Yes

|

No

|

|

|

ETFs - Ratings info

|

Yes

|

Yes

|

|

|

ETFs - Morningstar StyleMap info

|

Yes

|

Yes

|

|

|

ETFs - PDF Reports info

|

Yes

|

No

|

|

|

Mutual Fund Research

|

Charles Schwab |

J.P. Morgan Self-Directed Investing |

|

|

Mutual Funds - Investment Objective info

|

Yes

|

Yes

|

|

|

Mutual Funds - Performance Chart info

|

Yes

|

Yes

|

|

|

Mutual Funds - Performance Analysis info

|

Yes

|

Yes

|

|

|

Mutual Funds - Prospectus info

|

Yes

|

No

|

|

|

Mutual Funds - 3rd Party Ratings info

|

Yes

|

Yes

|

|

|

Mutual Funds - Fees Breakdown info

|

Yes

|

Yes

|

|

|

Mutual Funds - Top 10 Holdings info

|

Yes

|

Yes

|

|

|

Mutual Funds - Asset Allocation info

|

Yes

|

Yes

|

|

|

Mutual Funds - Sector Allocation info

|

Yes

|

Yes

|

|

|

Mutual Funds - Country Allocation info

|

Yes

|

Yes

|

|

|

Mutual Funds - StyleMap info

|

Yes

|

Yes

|

|

|

Options Trading

|

Charles Schwab |

J.P. Morgan Self-Directed Investing |

|

|

Option Chains - Total Greeks info

|

5

|

0

|

|

|

Option Analysis - P&L Charts info

|

Yes

|

No

|

|

|

Banking

|

Charles Schwab |

J.P. Morgan Self-Directed Investing |

|

|

Bank (Member FDIC) info

|

Yes

|

Yes

|

|

|

Checking Accounts info

|

Yes

|

Yes

|

|

|

Savings Accounts info

|

Yes

|

Yes

|

|

|

Credit Cards info

|

Yes

|

Yes

|

|

|

Debit Cards info

|

Yes

|

Yes

|

|

|

Mortgage Loans info

|

Yes

|

Yes

|

|

|

Customer Service

|

Charles Schwab |

J.P. Morgan Self-Directed Investing |

|

|

Phone Support (Prospective Customers) info

|

Yes

|

No

|

|

|

Phone Support (Current Customers) info

|

Yes

|

Yes

|

|

|

Email Support info

|

Yes

|

Yes

|

|

|

Live Chat (Prospective Customers) info

|

No

|

No

|

|

|

Live Chat (Current Customers) info

|

Yes

|

No

|

|

|

24/7 Support info

|

Yes

|

Yes

|

|

arrow_upward