Winners Summary

Best forex broker in Canada – Interactive Brokers

Global powerhouse Interactive Brokers, or IBKR, is a well-capitalized broker regulated in top jurisdictions worldwide, including Canada. Its desktop platform, Trader Workstation, is an industry standout for its vast array of tools and features, but the learning curve is steep, making it best suited to experienced or professional traders. Those newer to forex trading may do better using its web-based Client Portal or the IBKR mobile app. Interactive Brokers offers over a hundred forex pairs for trading as part of a notably large range of tradable products; note, though, that CFDs are not available for Canadian clients. Commissions are competitive.

Read my Interactive Brokers review on our sister site, ForexBrokers.com

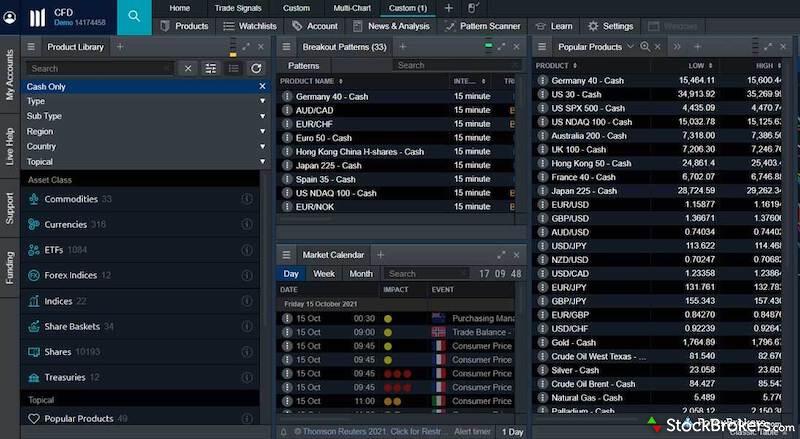

Great broker, low fees for forex trading - CMC Markets

| Company |

Overall |

Minimum Deposit |

CMC Markets CMC Markets

|

|

$0 |

CMC Markets is a great choice for Canadian forex traders in 2025. CMC Markets is a reputable and highly regarded brand that is publicly traded (LON: CMCX). The broker offers over 12,000 CFDs, a large number of forex pairs, and access to international equity markets. CMC Markets also quotes its 158 currency pairs both ways (not just CAD/USD, but also the inverse USD/CAD quote), doubling the number of CMC Markets’ available pairs.

The broker’s Next Generation web trading platform and mobile app are both impressive. The app is a notable industry standout, with intuitive design, great research options and powerful trading tools, including charts and predefined watch lists.

Read my full CMC Markets review on our sister site, ForexBrokers.com

Have a look at CMC Markets's standout mobile app.

Excellent educational resources – FOREX.com

| Company |

Overall |

Minimum Deposit |

FOREX.com FOREX.com

|

|

$100 |

FOREX.com is a trusted forex broker that shines thanks to its extensive product offering and its excellent platform options and trading tools, which will appeal to forex traders of varying experience levels, as will its strong offering of in-house and third-party market research. It offers more than 80 currency pairs via an impressive suite of proprietary platforms, as well as access to MetaTrader 5 and TradingView’s advanced charting features. FOREX.com’s parent company, StoneX, is publicly traded and licensed in Canada and across the globe. Costs, however, are higher than at some competitors.

Read my FOREX.com review on our sister site, ForexBrokers.com

show_chartInterested in stock trading?

See our guide to best online brokers for stock trading in Canada.

FAQs

Is forex trading legal in Canada?

Yes, forex trading is legal in Canada. It’s always recommended to choose a broker that is well-regulated and reputable. Brokers must be licensed as securities brokers with what is now called the Canadian Investment Regulatory Organization, or CIRO, which combined the functions of the Investment Industry Regulatory Organization (IIROC) and Mutual Fund Dealers Association (MFDA). Brokers in Canada must also be registered in the province in which they operate. It’s worth noting that regulators in certain jurisdictions – such as the British Columbia Securities Commission – regulate more strictly than others.

How do I become a forex trader in Canada?

The first step to trading forex is to choose a broker that accepts clients in Canada (see our top recommended brokers above).

- Create a live account: Once you’ve chosen a broker, complete its online account application and read through its terms and conditions, which govern the scope of your relationship.

- Learn the trading software: If you’re new to forex trading, it’s a good idea to try the broker’s demo account, or trading simulator, to get familiar with the platform (for more on simulated trading, see our guide to the best brokers for paper trading).

- Fund with a small amount: To place real trades, you’ll have to fund the account with a deposit method the broker accepts, such as an electronic funds transfer or wire transfer.

- Set trading goals: Consider what your overall goals and what you want to get out of trading in detail. Beyond the general desire to make money, being specific will help you articulate your trading approach better and manage risk.

- Develop a trading plan: Consider the size of the trades you wish to place, relative to your account balance, and the amount of risk/reward you are targeting per trade, and overall on your account. Create rules to follow that will help keep you on track with your goals.

- Identify investment opportunities: Whether by reading headlines, analyzing charts or trading signals, decide how to indentify when to enter the market and planning your exit with a stop-loss (to manage risk) and limit order (to take profit).

- Position sizing: Once you have indentified a trade entry and want to execute your first trade, you will need to select a desired trade size that is appropriate for your risk/reward ratio and expected trade duration (it’s always prudent to know what the value of each pip/point is for a given trade size you are considering, so you can measure the risk/reward potential).

- Execute a live trade: Once you are ready to place a live trade, you can do so for the desired amount by either clicking “Buy” or the “Ask” price to open a long position, or open a short position by clicking “Sell” or the “Bid” price, depending on your market outlook.

- Manage your orders: You will have to get used to monitoring your positions carefully and ensure your stop-loss and limit orders are intact to help manage your risk/reward during the trade duration, or when canceling and replacing orders throughout your trading journey.

Can I trade forex with $100?

Yes, you can get started trading forex with $100; in fact, if you’re a beginner at forex trading, it’s smart to start small, and make sure not to invest more than you can afford to lose. Forex brokers generally offer a range of contract sizes (such as a micro lot), and a $100 investment would allow you to test the waters — and a trading strategy — without outsize risk. Bear in mind that also means the potential payoff will be limited as well. Note also that some forex brokers require a minimum account balance, which may be more than $100.

Do forex traders pay tax in Canada?

Yes, as a forex trader residing in Canada (or Canadian citizen abroad) you’ll be obligated to report your earnings in Canada and pay capital gains taxes on your profits, which must be listed on your tax return. The tax generally applies only to profits of more than $200; gains above that threshold are taxed at 50% of your marginal tax rate. As your specific tax obligation can vary according to other circumstances, it may be smart to consult a tax pro to assist, particularly for more active traders.

Is forex trading regulated in Canada?

Yes, forex trading is heavily regulated in Canada, which is a plus for consumers, as forex trading in some parts of the world is rife with scams. The most important factor when choosing a forex broker in Canada is to verify that it’s properly regulated.

To service Canadian residents, online brokerages must be licensed as securities brokers with the Canadian Investment Regulatory Organization, or CIRO (formerly called the New SRO), which consolidates the functions of the former Investment Industry Regulatory Organization (IIROC) and Mutual Fund Dealers Association (MFDA).

You can search by broker name on this IIROC page to verify it’s properly licensed in Canada. Note that some brokers are regulated under the name of a larger umbrella company; for example, FOREX.com, one of our top picks, is part of the larger StoneX group. Check your broker’s disclosure text to determine its registered name.

Our testing

Why you should trust us

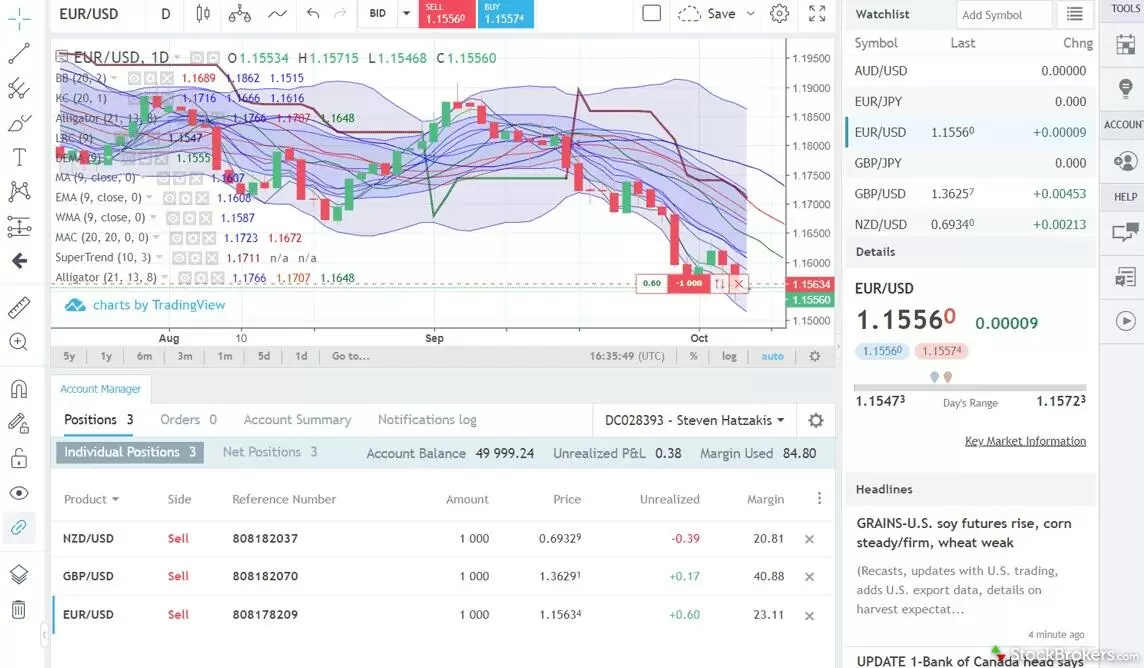

Steven Hatzakis is a well-known finance writer, with 25+ years of experience in the foreign exchange and financial markets. He is the Global Director of Online Broker Research for Reink Media Group, leading research efforts for ForexBrokers.com since 2016. Steven is an expert writer and researcher who has published over 1,000 articles covering the foreign exchange markets and cryptocurrency industries. He has served as a registered commodity futures representative for domestic and internationally-regulated brokerages. Steven holds a Series III license in the US as a Commodity Trading Advisor (CTA).

All content on StockBrokers.com is fact-checked by our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the brokerage industry.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

How we test

At StockBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the best stock brokers.

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running macOS 14.5, and the iPhone XS running iOS 17.6.

- For Android, we use the Samsung Galaxy S9+ and Samsung Galaxy S20 Ultra devices running Android OS 14.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of watch lists, mobile charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms. Learn more about StockBrokers.com.

Explore further guidance on trading in Canada.