Winners Summary

Best bank brokerage - Merrill Edge (Bank of America)

| Company |

Overall |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

Merrill Edge Merrill Edge

|

|

$0.00 |

$0.00 |

$0.65 |

Merrill Edge, part of Bank of America, provides a comprehensive suite of personal banking products, including savings accounts, checking accounts, and credit cards. Merrill's integrated platform for your banking and brokerage needs offers seamless account management, particularly for customers participating in its Preferred Rewards program. One of my favorite features is the ease with which you can move funds between your bank and brokerage accounts.

Preferred Deposits: For those interested in higher returns on their cash holdings, Merrill Edge Preferred Deposits require a minimum initial deposit of $100,000 and offer variable interest rates, which are typically much higher than what you'd find in standard cash sweep accounts. As of February 4th, 2025, the Preferred Deposit rate was 3.67%, significantly higher than the 0.01% offered for cash sweep accounts with balances under $1 million. However, it's important to note that funds in your Preferred Deposit account must be manually deposited and withdrawn in increments of $1,000, and they won’t be automatically withdrawn to cover trades or margin requirements.

Trading platforms: Merrill also excels as an online brokerage platform, offering no account minimums and $0 commission stock and ETF trades. Trades gain access to Merrill Lynch’s research tools, which are great for beginner investors and those managing a combination of banking and brokerage needs. Merrill Edge’s platform features tools like Stock Story, Fund Story, and Portfolio Story to simplify investing. While Merrill doesn't offer fractional shares or paper trading, it remains one of my top choices for new investors and those looking for a low-cost, well-supported trading environment. Check out my Merrill Edge review to learn more.

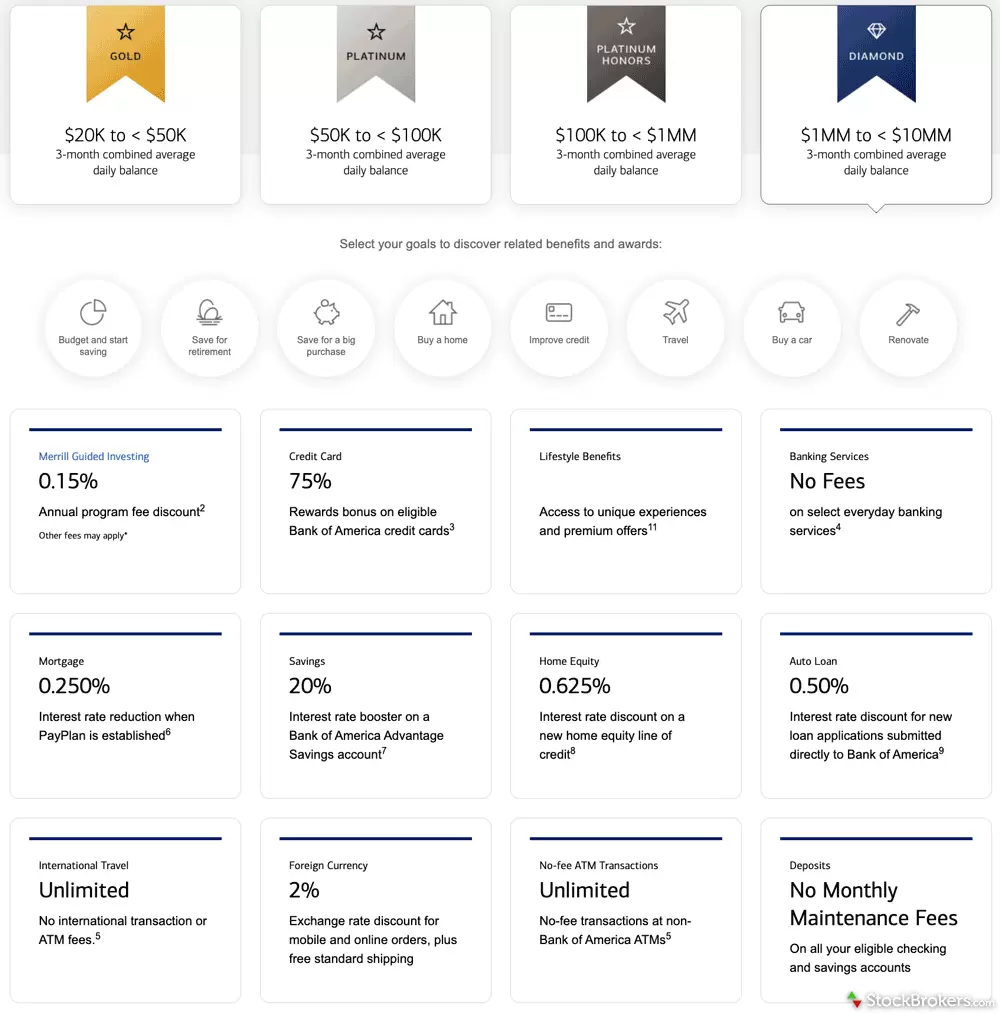

Bank of America Preferred Rewards tiers

Merrill Edge broker research

Best financial planning tool - J.P. Morgan Self-Directed Investing (Chase Bank)

J.P. Morgan Self-Directed Investing provides a comprehensive, user-friendly platform that simplifies money and asset management for Chase Bank customers, the largest bank in the U.S. Customers enjoy benefits like instant transfers, mobile check deposit, universal login, and access to high-quality J.P. Morgan proprietary research. The platform's Wealth Plan feature helps clients prioritize financial goals, create budgets, and design investment strategies. With no minimum deposit and $0 commissions for stock and ETF trades, J.P. Morgan is a convenient choice for casual investors and beginner stock traders.

Robo-advisor services: For traders who prefer a hands-off approach, J.P. Morgan offers Automated Investing, a robo-advisor service that manages money based on individual goals for a low fee. This service requires a $500 minimum deposit (unlike the broker's Self-Directed offering, which has no minimum requirement).

Trading platforms:All that said, the broker's platform is fairly basic and lacks the advanced features favored by active traders and experienced investors. While J.P. Morgan excels at integrating banking and investing with ease, its website and mobile trading app may frustrate those looking for more sophisticated tools or a downloadable trading platform. Serious investors may find more robust offerings at other firms, such as Merrill Edge, which provides additional research tools and more customization for traders.

While convenient for Chase Bank customers, investors who prioritize more advanced features may need to explore competitors like Merrill Edge for a broader range of tools. Read my J.P. Morgan Review to learn more.

J.P. Morgan broker research

Best for beginner investors - Ally Invest (Ally Bank)

| Company |

Overall |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

Ally Invest Ally Invest

|

|

$0.00 |

$0.00 |

$0.50 |

Ally Invest delivers a robust banking and brokerage combination, offering universal account access and the ability to transfer funds instantly between accounts. Investors benefit from $0 commissions on no-load mutual funds and access to a broad range of bonds, backed by detailed muni bond research (though I feel that a bond ladder tool would really enhance the broker's bond trading experience). Ally’s personal wealth management services – available for clients with $100,000 in assets at a 0.85% annual fee – also add significant value.

Trading platforms: That said, Ally’s trading tools don’t quite match the advanced features offered by brokers like Interactive Brokers or tastytrade. The absence of crypto, futures, or forex trading might deter some investors. Despite these limitations, Ally Invest’s platform is highly user-friendly for beginner investors. Learn more by reading my Ally Invest review.

Ally Invest broker research

Bank Broker Pricing and Features Comparison

FAQs

Is a brokerage account the same as a bank account?

No. A brokerage account is used to buy and sell securities (stocks, ETFs, bonds, mutual funds, and other assets) and is SIPC insured, protecting up to $500,000 per customer, of which $250,000 can be cash. Many of the best stock brokers offer “bank-like” services in their brokerage accounts, such as checking, bill pay, and debit cards, but assets in those accounts are not FDIC insured.

Some brokers can automatically roll your cash balances into several banks to provide more FDIC insurance coverage beyond the individual bank limit of $250,000.

StockBrokers.com co-founder Blain Reinkensmeyer breaks down how a bank-brokerage works.

What is a brokerage account at a bank?

A brokerage account at a bank allows you to invest where you take care of traditional banking transactions, like taking out a car loan or paying bills. Financial services holding companies such as J.P. Morgan Chase & Co. and Bank of America can own both FDIC-insured banks and security brokers, which have different rules and different regulators than banks. Bank-owned brokers usually make it very simple to bank and invest at the same firm.

What is a brokerage checking account?

A brokerage checking account typically allows you to write and deposit checks. There are a number of banks with brokerage accounts that provide check writing and/or debit cards. Check to see if there are fees associated with how you intend to use the account.

If you decide to write checks or charge from your brokerage account, be sure to monitor your account balance to maintain a proper cash allocation. Some brokers can link your check writing to borrowing on margin. The good news is that you can access cash very quickly if you need it and, because your investments are collateral for the loan, the interest rates can be much lower than credit cards.

The bad news is that margin is a loan that has to be repaid. Just as it can be easy to max out a credit card, it can also be easy to spend down your investment account. Always monitor your spending.

What are the best banks with brokerage accounts?

My testing and long personal experience puts Merrill Edge, a part of Bank of America, as the best broker/bank combo for clients who have roughly equal banking and brokerage needs. Chase, along with its J.P. Morgan Self-Directed Investing, is another fine choice. Chase has an innovative financial planning tool, Wealth Plan, that earned our Best New Tool award back in 2024. Ally and its broker arm, Ally Invest, offer services and content that will appeal to savers and investors who are just getting started.

What is the difference between a brokerage account and a cash management account?

Think of a cash management account as a brokerage account with a debit card and other bank-like features. The cash management feature enables you to use a debit card to spend any uninvested cash in your brokerage account. Your debit card can be used for everyday purchases such as groceries, dining, entertainment, and leisure. As always, be careful not to spend money you don’t have.

Is a brokerage account safer than a bank account?

Both your brokerage account and your bank account typically carry insurance, the former through the SIPC and the latter through the FDIC. In that sense, both are safe, but FDIC insurance is considered a stronger guarantee than the industry-backed SIPC. Banks do not offer the ability to buy and sell stocks in checking or savings accounts, so, if you want to invest, you’ll have to open a broker account.

Can you buy stocks with a debit card?

No, you cannot use a debit card to buy stocks, at least not directly. Some brokers will allow you to use a debit card to fund your account with cash; then you can buy stock within the account. We don’t recommend choosing a broker based on whether it accepts debit card funds, because brokers accept ACH deposits, which is just as easy, and a few brokers give instant credit once the deposit is entered. Banks do not offer the ability to buy and sell stocks in checking or savings accounts.

StockBrokers.com Review Methodology

Why you should trust us

Sam Levine, CFA, CMT, formerly a lead writer for StockBrokers.com, has over 30 years of investing experience and actively trades stocks, ETFs, options, futures, and options on futures. He's held roles as a portfolio manager, financial consultant, investment strategist and journalist. He holds the Chartered Financial Analyst (CFA) and the Chartered Market Technician (CMT) designations and served on the board of directors of the CMT Association.

Blain Reinkensmeyer, co-founder of StockBrokers.com, has been investing and trading for over 25 years. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. Today, Blain is widely respected as a leading expert on finance and investing, specifically the U.S. online brokerage industry. Blain has been quoted in The New York Times, The Wall Street Journal, Forbes, and Fast Company, among others. Blain created the original scoring rubrics for StockBrokers.com and oversees all testing and rating methodologies.

How we tested

- We used our own brokerage accounts for testing.

- We collected thousands of data points for each broker.

- We tested each online broker's website, desktop platforms, and mobile app, where applicable.

- We maintained strict editorial independence; brokers cannot pay for inclusion or a higher rating.

Our research team meticulously collected data on every feature of importance to a wide range of customer profiles, including beginners, casual investors, passive investors, and active traders. We carefully track variables like margin rates, trading costs, fees, and platform features and use them to help rate brokers across a range of categories measuring ease of use, range of investments, research, education, and more.

At StockBrokers.com, our reviewers use a variety of computing devices to evaluate platforms and tools. Our reviews and data collection were conducted using the following devices: iPhone SE running iOS 17.5.1, MacBook Pro M1 with 8 GB RAM running the current MacOS, and a Dell Vostro 5402 laptop i5 with 8 GB RAM running Windows 11 Pro.

Each broker was evaluated and scored on over 200 different variables across seven key categories: Range of Investments, Platforms & Tools, Research, Mobile Trading, Education, Ease of Use, and Overall. Learn more about how we test.