Winners Summary

Best broker for order execution - Fidelity

| Company |

Overall |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

Fidelity Fidelity

|

|

$0.00 |

$0.00 |

$0.65 |

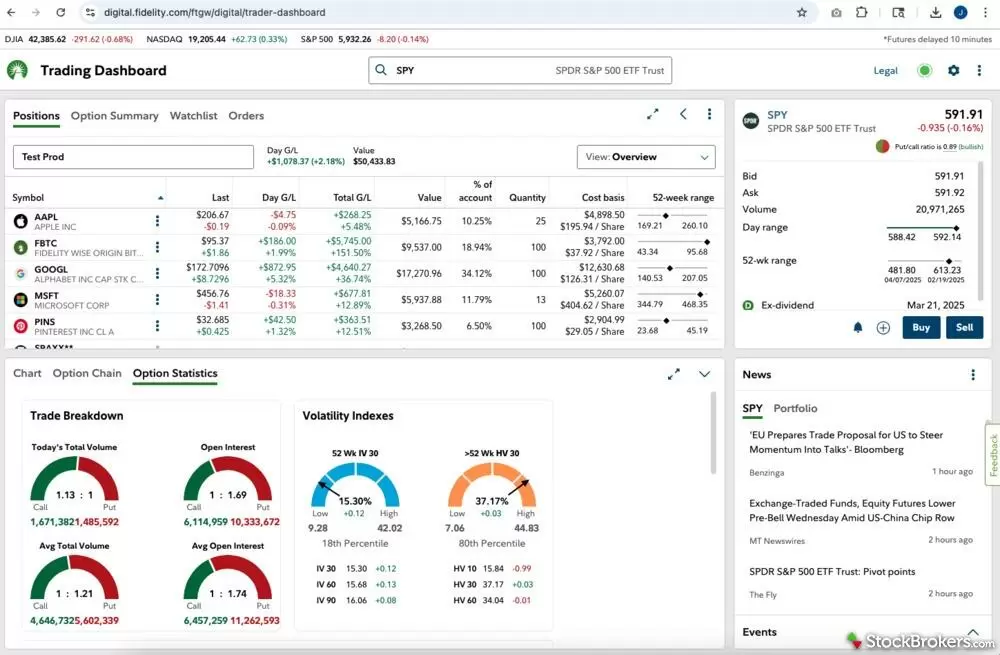

Fidelity’s order execution quality is one of the best in the industry, driven by a clear commitment to price improvement over profit. Unlike most brokers offering commission-free trades, Fidelity does not accept payment for order flow (PFOF). This decision means that Fidelity isn’t paid by market makers to route your trades, allowing it to prioritize getting you the best price possible. In my experience, this focus on order quality ensures that trades are executed at optimal prices, often resulting in better price improvement, which can add up significantly over time.

Price improvements: Beyond avoiding PFOF, Fidelity’s sophisticated technology actively seeks price improvements on each trade. This means that, instead of routing orders to the highest bidder, Fidelity’s system looks for opportunities to secure you a price better than the one you entered. This feature can be particularly valuable for active traders or those investing in larger volumes, where even slight improvements in price can yield noticeable savings. Fidelity’s commitment to this technology has led to its ranking as a top broker for order execution, especially among firms that prioritize client value.

Transparency: Another compelling feature is Fidelity’s transparency around its execution quality. Fidelity regularly reports on the price improvement it achieves for clients, showcasing its above-average results and instilling confidence in the trade quality clients can expect. As someone who values both transparency and performance in my trades, I find this openness refreshing and trust-building. Fidelity’s focus on execution quality, free from PFOF incentives, makes it a smart choice for investors who prioritize fair and favorable trade pricing.

Learn more about its other features and fees by visiting my complete review of Fidelity.

Best order execution for professionals - Interactive Brokers

| Company |

Overall |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

Interactive Brokers Interactive Brokers

|

|

$0.00 |

$0.00 |

$0.65 info |

Interactive Brokers (IBKR) is a top choice for professional traders due to an account type specially developed for the task of optimal order execution. The commission-based account type, IBKR Pro, does not accept payment for order flow (PFOF), ensuring that trades are executed at the best available prices without compromise. For institutional traders and high-frequency investors, IBKR’s focus on transparent routing and execution quality across U.S. and international markets provides a level of precision essential for competitive trading strategies. By avoiding PFOF, IBKR prioritizes client trade quality over internal profit, making it a trusted platform for those who depend on optimized order placement.

SMART routing: A key advantage of IBKR’s execution quality is its advanced SMART routing system, which is designed to seek the best possible price across multiple exchanges. I’ve found IBKR’s SMART routing to be highly effective in managing order complexity, as it considers both speed and price improvements by sending orders to venues that offer the greatest advantage in real-time. This feature is especially beneficial for options traders and those working with larger volumes, where split-second decisions can have a significant impact on profitability. IBKR’s routing technology is a standout for professionals needing a brokerage that enhances, rather than hinders, precise trade execution.

Order types: IBKR also excels by offering extensive customization for order types and routing options, giving traders a high level of control over their strategies. The platform supports over 100 order types, including limit, stop, trailing, and complex order setups, allowing professionals to tailor executions to specific goals. With a global reach and access to more than 150 markets, IBKR empowers traders to implement and refine intricate strategies across multiple asset classes. For professionals looking to maximize execution quality without the constraints of PFOF, Interactive Brokers is unmatched in the industry.

Check out my full review of Interactive Brokers for more information about its account types and available platforms.

FAQs

What is PFOF?

One lesser-known way brokers make money is through referring your orders to market centers that pay them a referral fee, called payment for order flow (PFOF).

PFOF comes out of the tiny profits trading venues make between the bids and the offers for stocks. It might be as low as a few pennies per trade, but that can add up quickly to millions of dollars a year for brokers routing thousands of trades a day. PFOF is a hot topic because, in theory at least, brokers should be trying to execute your orders at the best prices they can get you instead of routing them to the market center that might pay the most.

To get a better grip on PFOF, let’s look at how a stock trade works. When you push the “submit order” button to trade, your order won’t go directly to an exchange. Instead, your broker electronically directs it to one of a variety of different market centers (which might include market makers, exchanges, alternate trading systems, electronic communication networks, or possibly even the broker itself). Then the order is filled, usually in a fraction of a second.

What is order execution quality?

Order execution quality is how much you pay or receive on a trade compared to the nationally published quote on a security, called the National Best Bid and Offer (NBBO). If you buy a stock less than the current offer, you are getting a high quality fill, and the more you save, the higher quality it is. The same relationship holds for selling stock. If you receive more per share than the published bid price, you are getting a high quality fill.

What is price improvement?

Price improvement means that your buy or sell order was filled at a price better than the National Best Bid and Offer (NBBO), which is the highest bid and the lowest offer for a stock at any moment. For a detailed, streaming real-time view of what the current bid and ask is for any stock, traders use Level 2 quotes.

What is SEC Rule 606 reporting?

Rule 606 reports show where brokers are routing their trades and how much payment from order flow they receive from market centers. The SEC requires each broker to file a Rule 606 report quarterly.

The two most important categories of information are, first, a table showing which market centers received orders and their respective share; and second, the payment for order flow (PFOF) the broker receives, on average, from each market center.

Unfortunately, Rule 606 reporting isn’t standardized well. There’s no universal measure that can be pulled and used to conduct an apples-to-apples comparison between PFOF brokers.

Why does PFOF matter?

Brokers, by regulation, have to execute your market orders at the best published price, officially known as the National Best Bid and Offer (NBBO), but there are often better prices available than the published price. By better, we’re talking pennies per share.

But why are there hidden prices? The reason is that huge traders, like mutual funds and pension plans, don’t like to give away their intentions. If word got out that a large mutual fund planned to buy a huge block of a company’s stock, other investors would pile in, driving the stock price up. And that would hurt the fund’s performance.

When brokers are able to get better prices than the NBBO, they report that as “price improvement.” Brokers advertise price improvement as one of the services they offer, but the amount of price improvement they get could be influenced by how aggressively the broker prioritizes PFOF over most price improvement.

Do all brokers use PFOF?

Not all brokers use PFOF, and the amount of payment per share varies across brokers. Fidelity is one broker that doesn’t accept PFOF, and it has repeatedly won a spot in our top picks for order execution. On the other side of the spectrum, Robinhood was being paid as high as 71 cents per market order of 100 shares, according to its Q4 2023 Rule 606 report.

Does order size impact order execution?

It’s not yet clear how much order size impacts execution. According to a Nasdaq blog post, exchanges don’t differentiate between round and odd lots, but algorithmic and routing traders do tend to emphasize round lots for stocks under $500 per share. We think choosing and holding the right stocks for the right length of time will have a far bigger impact on your success than concerning yourself about only buying in round lots.

Which broker has the best order execution?

For everyday investors, Fidelity offers the best order execution quality. For professional traders, Interactive Brokers, under the IBKR Pro commissions plan, offers the best order execution quality.

Which broker has the fastest order execution time?

In our testing, tastytrade’s downloadable platform stood out as lightning-fast. We think speed played a part in every decision tastytrade made while developing its platform. But we can’t say for certain which broker has the fastest execution, because internet connectivity plays a very large role.

Can brokers trade against their customers?

Some brokers might claim they don’t accept PFOF, but they trade against you instead. Operating a market maker and using an algorithm to pick and choose which customer orders you want to bet against certainly sounds like a losing proposition for the customer. However, as long as the broker meets the Best Execution standards, it's perfectly legal, and it's not technically PFOF. In our view, this sure sounds like profiting from order flow.

How the industry interprets the definition of PFOF is subject to much debate. For example, with options trading, if you think about "payment" more broadly as "profiting," then all brokers accept PFOF for options. More specifically, if the online broker receives rebates from the exchanges they route their customer options traders to (which they all do), then they are profiting from their customer order flow. So, isn't that PFOF? Our take is that yes, it is, but technically speaking, it's debatable.

What about equities, you may ask. Well, that's a bit more complicated. Some online brokers own and operate an Alternative Trading System (ATS). These firms technically do not accept PFOF; however, the ATS of each firm is a separate legal entity and is undoubtedly not operated as a nonprofit. So, are they generating revenue from their order flow? How does the overall order quality compare to other brokers who do not operate an ATS? In most cases, we believe these ATSes benefit customers, but we don't know with certainty.

Similarly, some online brokerages own and operate a market maker. In their disclosures, they acknowledge that they can internalize orders, meaning trade against their own customer orders. As a result, they keep any profit or loss realized from the trade. That also sounds like a losing proposition for the customer. However, as long as the broker meets the Best Execution standards, it's perfectly legal, and it's not technically PFOF. In our view, this sure sounds like profiting from order flow.

How do I get the best order execution?

A variety of factors come into play with your broker’s ability to provide quality order execution. If you’re trading large amounts of shares frequently, best execution is critical. Interactive Brokers’ sophisticated order routing algorithms make the broker a favorite for professionals. If you’re trading a few hundred shares a few times a year, you don’t need a library of algorithms to get satisfactory execution.

Here’s a list of factors in your control that directly impact execution quality:

- The stock that's being traded. Companies in the S&P 500, for example, all boast extremely large market caps (they’re worth billions) and high average daily volumes of millions of shares per day. This means there is a lot of liquidity (buyers and sellers), which translates into consistently tight spreads (the difference in price between the bid and the ask). On the flip side, a micro-cap stock (or a penny stock traded on a non-major market, e.g. OTCBB) that trades only 10,000 shares per day, on average, has little liquidity. As a result, spreads are often very wide, which means you are less likely to obtain a quality fill on your order.

- Time of day. The first 15 minutes of each trading day are statistically the most volatile, meaning stocks fluctuate the most during these times. More specifically, bid / ask spreads are wider, on average. Similarly, pre- and post-market hours have much wider spreads, including far less liquidity, as compared to regular market hours.

- Order type. The most commonly used order type is a market order, which basically says, “buy or sell these shares immediately at whatever the best current market price is.” Limit orders, the second most commonly used order type, on the other hand, say, “buy or sell these shares only at the price I set, or better.” As one can imagine, limit orders may sometimes take longer to fill (if they fill at all), but, compared to a market order, have a better chance of being filled at a better price.

- Order size. According to the Wall Street Journal, "nearly half of all trades in the U.S. stock market are in odd-lot sizes—in which fewer than 100 shares change hands." However, regulation does not currently cover these odd lot orders. Trading using round lots instead of an odd lot may result in a cleaner fill from your online broker.

StockBrokers.com Review Methodology

Why you should trust us

Sam Levine, CFA, CMT, formerly a lead writer for StockBrokers.com, has over 30 years of investing experience and actively trades stocks, ETFs, options, futures, and options on futures. He's held roles as a portfolio manager, financial consultant, investment strategist and journalist. He holds the Chartered Financial Analyst (CFA) and the Chartered Market Technician (CMT) designations and served on the board of directors of the CMT Association.

Blain Reinkensmeyer, co-founder of StockBrokers.com, has been investing and trading for over 25 years. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. Today, Blain is widely respected as a leading expert on finance and investing, specifically the U.S. online brokerage industry. Blain has been quoted in The New York Times, The Wall Street Journal, Forbes, and Fast Company, among others. Blain created the original scoring rubrics for StockBrokers.com and oversees all testing and rating methodologies.

How we tested

- We used our own brokerage accounts for testing.

- We collected thousands of data points for each broker.

- We tested each online broker's website, desktop platforms, and mobile app, where applicable.

- We maintained strict editorial independence; brokers cannot pay for inclusion or a higher rating.

Our research team meticulously collected data on every feature of importance to a wide range of customer profiles, including beginners, casual investors, passive investors, and active traders. We carefully track variables like margin rates, trading costs, fees, and platform features and use them to help rate brokers across a range of categories measuring ease of use, range of investments, research, education, and more.

At StockBrokers.com, our reviewers use a variety of computing devices to evaluate platforms and tools. Our reviews and data collection were conducted using the following devices: iPhone SE running iOS 17.5.1, MacBook Pro M1 with 8 GB RAM running the current MacOS, and a Dell Vostro 5402 laptop i5 with 8 GB RAM running Windows 11 Pro.

Each broker was evaluated and scored on over 200 different variables across seven key categories: Range of Investments, Platforms & Tools, Research, Mobile Trading, Education, Ease of Use, and Overall. Learn more about how we test.