Questrade Review

Questrade has been the go-to brokerage for passive index investors in Canada, mainly due to its no-fee exchange-traded fund (ETF) purchases. But it upped the ante in early 2025 by removing all trading fees on stocks and ETFs, and is now a clear leader on pricing. In addition to zero commissions, Questrade doesn’t charge account or inactivity fees.

What isn’t as clear is how Questrade’s trading platforms stack up to premium offerings from competitors like TD Direct Investing and Interactive Brokers (IBKR). Its standard platform has limitations in terms of order types, alerts, and charting capabilities. And its FX & CFD trading platform, Questrade Global, may be too costly for serious forex traders. In this review, we’ll take a look at Questrade’s platforms to find out if its trading experience lives up to its unbeatable pricing.

-

Minimum Deposit:

$0 -

Stock/ETF Trade Fee:

$0.00 -

Mutual Fund Trade Fee:

$9.95

| Fees | |

| Range of Investments | |

| Mobile App | |

| Web Platform | |

| Education | |

| Ease of Use |

Led by Jessica Inskip, Director of Investor Research, the StockBrokers.com research team collects thousands of data points across hundreds of variables. We evaluate features important to every kind of investor, including beginners, casual investors, passive investors, and active traders. We carefully track data on margin rates, trading costs, and fees to rate stock brokers across our proprietary testing categories.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on StockBrokers.com. Learn more about how we test.

Table of Contents

Pros & cons

Pros

- Commission-free trading on stocks, ETFs, and options.

- No account or inactivity fees.

- Commission-free fractional trading on hundreds of U.S. stocks and ETFs, executed in real time.

- Opening an account is fast.

- Questrade Global platform includes a free practice account.

Cons

- You need to pay for Questrade Plus ($11.95/month) to set up custom alerts.

- Steep trading fee of $9.95 for mutual funds.

- Limited educational content in Learning Centre.

- Fractional shares are not yet available for Canadian stocks and ETFs.

My top takeaways for Questrade in 2026:

- Questrade is now a true zero-commission broker, removing all trading fees for stocks, ETFs, and options as of February 2025.

- The account opening process was quick and easy, taking only minutes to open an account and get funded.

- Fractional share trading is available for U.S. stocks and ETFs, a feature not provided by most Canadian brokerages, but access remains limited to U.S. only.

Questrade fees

In February 2025, Questrade announced the removal of commission fees on stock and ETF trades. While Questrade was already known for its no-fee ETF purchases and low account fees, the move firmly cemented the brokerage as a low-fee leader among Canadian platforms. One area where they still lag on pricing is mutual fund trades, which are high at $9.95.

Stocks, ETFs, and options: Questrade offers commission-free stock, ETF, and options trading (there is a per-contract fee of $.99 for options), giving it a distinct pricing advantage over its big bank rivals, which charge as much as $9.99 per trade.

Fractional shares: Questrade is one of the few Canadian brokerages that offer fractional shares. There are no fees; however, trades are limited to select U.S. stocks and ETFs. According to Questrade, Canadian stocks are coming soon, but haven’t yet been added.

Account and inactivity fees: One of the things Canadian investors love about Questrade is that it doesn’t charge administration fees on registered accounts, such as TFSAs, RRSPs, FHSAs, RESPs, and RRIFs. This includes annual account fees, which can be as high as $100 per account at other brokers, like QTrade or Scotia iTrade.

Market data packages: All Questrade accounts include free market data, allowing you to view key price and movement information on your investments. You also have the option to purchase additional market data packages as an add-on. For $9.95 CAD/month, the Real-Time Streaming package offers real-time level 1 data on U.S. options. And for $44.95 USD/month, you can access advanced level 1 and level 2 data for U.S. and Canadian exchanges, including index data.

| Feature |

Questrade Questrade

|

|---|---|

| Minimum Deposit | $0 |

| Inactivity fees | $0 |

| Stock/ETF Trade Fee | $0.00 |

| Mutual Fund Trade Fee | $9.95 |

| Bond Trade Fee | $0 |

| FX Currency Conversion Fee | 1.50% |

| Penny Stock Fee (OTC) | $0.000005/share |

| Account closure fee | $150 |

Range of Investments

Questrade offers a wide enough range of investments and account types to satisfy the vast majority of Canadian DIY investors. Available investments include stocks and ETFs, as well as fixed-income investments, like GICs and bonds.

More sophisticated traders can access options trading, CFDs, foreign exchange, international equities, precious metals, and even IPOs. If you’re interested in trading crypto, you’re out of luck. Questrade does not allow you to buy and sell individual cryptocurrencies, just a selection of crypto ETFs.

Questrade also stands out in terms of account availability. In addition to basic cash (non-registered) accounts, you’ll find a full suite of registered account options including RRSPs, Spousal RRSPs, Locked-In RRSPs, RRIFs, LIRAs, LIFs, and RESPs. The platform also supports informal and formal trusts, as well as non-personal accounts for sole proprietorships, partnerships, and corporations.

| Feature |

Questrade Questrade

|

|---|---|

| Bond trading | Yes |

| CFD trading | Yes |

| Crypto trading | No |

| ETF trading | Yes |

| Forex trading | Yes |

| Fractional Shares (Stocks) | Yes |

| Recurring investments | No |

| Futures trading | No |

| Options trading | Yes |

| Margin trading | Yes |

| Mutual Funds | Yes |

| Penny (OTC) stocks | Yes |

| Stock trading (CA) | Yes |

| Stock trading (U.S.) | Yes |

| Stock trading (Global) | No |

Mobile trading apps

Questrade offers two highly-rated mobile trading apps, both of which are available for iOS and Android devices.

Questmobile

Questrade’s main trading app is designed for the everyday investor and is intuitive and easy to use. It comes with built-in free tools, including TipRanks Sentiment Analysis, and Seeking Alpha “Bulls Say, Bears Say” market insights. You can also create custom watchlists and quickly filter stocks by “Top Gainers”, “Most Active”, “Best Rated”, and more. A recent improvement is the addition of overnight trading. You can now place trades overnight, from 8 PM ET to 2 AM ET.

Questrade's mobile watchlist allows you to create multiple custom watchlists or view stocks by categories, such as Top Gainers, Most Active, Best, Rates, and Most Rated.

One thing I dislike is the lack of a custom alert function to track the various movements of individual stocks. That’s only available for advanced traders on the Edge Mobile app. I use this feature all the time with TD Direct Investing, and not having it in the standard app is a missed opportunity for Questrade.

Edge Mobile

Advanced traders have access to a more robust mobile trading experience with the Questrade Edge Mobile app. You can place advanced order types, including stop and trailing stop orders, option orders, and bracket orders, and access full-screen charting via landscape mode, making it easier to analyze stocks, ETFs, or options. Views are fully customizable, and custom alerts are synced across all of your devices.

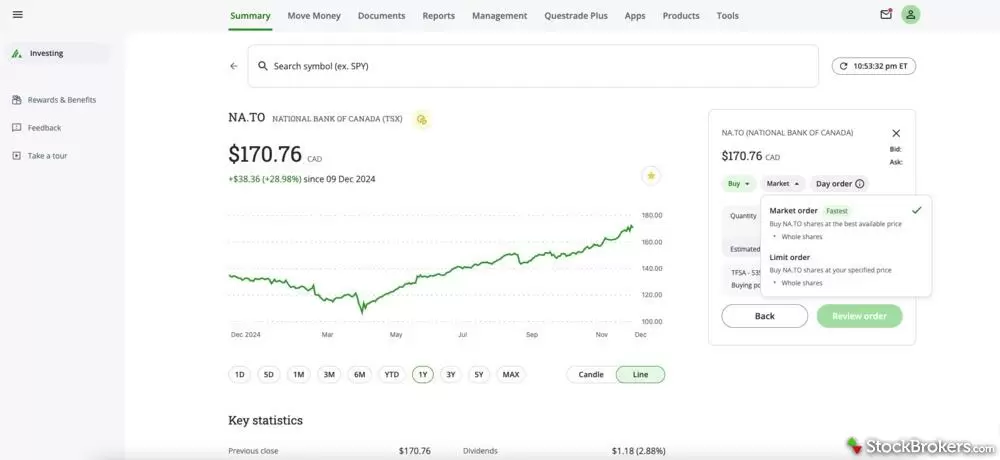

Questrade's mobile stock view screen allows you to view a stock's historical performance along with pricing and fundamentals. Scroll down and you'll see TipRanks Sentimental Analysis, Seeking Alpha Market Insights data (if available), and breaking news.

| Feature |

Questrade Questrade

|

|---|---|

| iPhone App | Yes |

| Android App | Yes |

Trading platforms

Questrade Trading

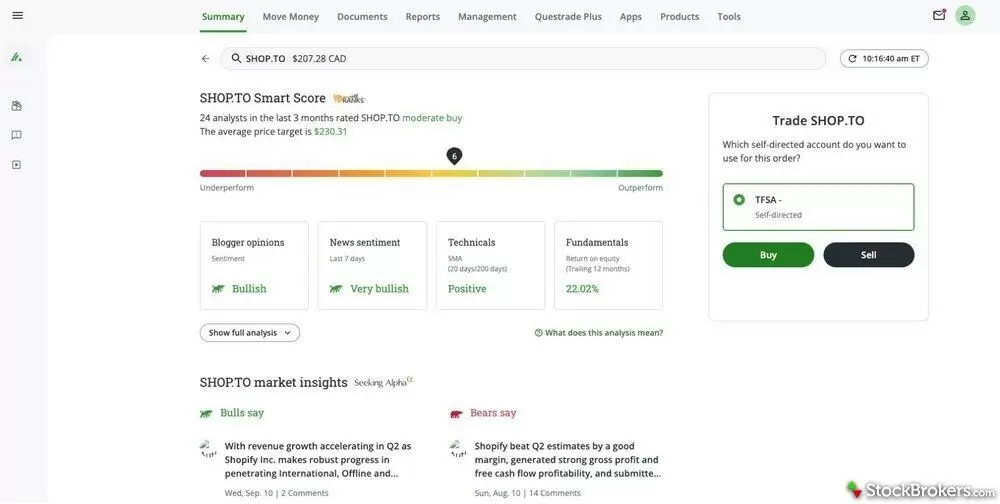

Just like its companion app, Questrade’s standard web trading platform is well laid out and easy to use. The symbol lookup tool is prominently displayed at the top of the page, and you can view a stock’s key statistics without having to click to a separate window or screen. A quick scroll down provides you with a TipRanks Smart Score, Seeking Alpha’s Bulls Say, Bears Say analysis, and the latest market news.

TipRanks' sentimental analysis is provided for individual stocks on web and mobile platforms. This allows you to see how a stock is expected to perform based on a composite of analyst ratings in the last 3 months.

Click on the Move Money tab in the top menu bar, and you’ll see a list of account funding options, along with the estimated time frame, supported currencies, and deposit limits. There are no fees for moving money into your Questrade account, at least not on Questrade’s end.

The recent addition of fractional shares to hundreds of U.S. stocks and ETFs is a big plus, even if Canadian equities are not yet supported.

But while the platform offers enough features to satisfy beginner or novice investors, it has limitations. The investment view is limited to line and candle charting, which is not a big deal, but worth noting. You can only place two order types: market and limit. By comparison, TD Direct Investing supports six different order types on its standard trading platform. Finally, while you’ll receive automated smart alerts for the securities in your portfolio or watchlist, you can’t set up custom alerts to track price movements. In fact, you have to pay for that feature.

As you can see from this Buy Order screenshot, Questrade’s trading platform is clean and modern, with the stock lookup feature prominently displayed at the top of the screen. You can access various reports and create watchlists. Unfortunately, its standard trading platform doesn’t allow you to set custom alerts, and it only supports two order types.

Questrade Edge

Questrade’s advanced trading platform, designed for active traders, is available as a web, desktop, or mobile app. Key features include up to six order types, single and multi-leg options trading, and real-time data from select exchanges, as well as snap quotes. The desktop version unlocks some additional features, including stock screening capability.

Edge is free to use; however, to unlock its full features, you must sign up for Questrade Plus, which costs $11.95/month. Plus features include a P&L calculator, which can help you refine your option strategy, Market View’s heat map, custom alerts, expanded real-time streaming data with more U.S. exchanges and options, advanced charts, and over 50 technical studies.

While I would love to see free custom alerts, Questrade Plus offers good value for the price.

Questrade Global

Questrade’s dedicated FX & CFD trading platform allows you to trade more than 110 currency pairs and CFDs for international stocks, indices, precious metals, energy, and agriculture. It offers its own mobile app for iOS and Android, as well as a free 30-day practice account where you can trade up to $100,000 CAD in virtual cash risk-free.

The app features customizable watchlists and built-in research and analysis from partners, including NewsEdge and AutoChartist.

If you’re an existing Questrade user interested in dipping your toes in global trading, Questrade Global allows you to do this without going to another brokerage. However, other brokerages, particularly Interactive Brokers (IBKR), are a better choice for serious forex traders. For example, while Questrade only allows you to fund your account in Canadian or U.S. dollars, IBKR supports up to 23 base currencies and offers much tighter spreads. Questrade’s 1.5% currency exchange fee makes it even more expensive than IBKR.

| Feature |

Questrade Questrade

|

|---|---|

| Desktop Trading Platform | Yes |

| Web Trading Platform | Yes |

| Stock Alerts | Yes |

| Charting - Indicators / Studies | 24 |

| Research - Stocks | Yes |

| Research - CFDs | Yes |

| Research - Mutual Funds | Yes |

| Research - ETFs | Yes |

| Research - Bonds | Yes |

| Trade Journal | Yes |

| Paper Trading | Yes |

| Screener | Yes |

Education

Questrade’s trading platforms may be beginner-friendly, but that’s not the case when it comes to educational resources. Besides some articles on investment concepts, markets, and goal setting, the content is pretty limited to Questrade basics and platform tutorials. There are webinars available to watch, but they don’t seem to be published regularly (I counted only around 15 in total). It would be nice to see Questrade build an extensive library of video tutorials or mini-courses for new investors.

| Feature |

Questrade Questrade

|

|---|---|

| Education (Stocks) | No |

| Education (ETFs) | No |

| Education (Mutual Funds) | No |

| Education (Retirement) | Yes |

| Webinars | Yes |

| Videos | No |

| Interactive Learning - Quizzes | No |

| Courses | No |

Final thoughts

In my opinion, Questrade is currently the best all-around brokerage in Canada, due to a combination of low fees, diverse trading platform options, solid customer service, and a quick and easy account opening process. It provides a wide range of accounts and investment types, and offers fractional shares on hundreds of U.S. stocks and ETFs. Canadian fractional shares are not yet supported; however, most Canadian brokerages don’t provide any fractional trading.

There are a few shortcomings, and Questrade may not be suitable for everyone. Its educational tools are limited, and while its standard trading platform is capable, it’s not class-leading. It only supports two order types, doesn’t allow you to create custom alerts, and has limited charting and research capability. Questrade Global will enable you to trade forex and CFDs, but it's much more expensive than the class leader, IBKR.

Ultimately, Questrade’s zero-commission stock and ETF trades, along with its no-account-fee policy, more than make up for these drawbacks.

Questrade Star Ratings

| Feature |

Questrade Questrade

|

|---|---|

| Overall |

|

| Fees |

|

| Range of Investments |

|

| Mobile App |

|

| Web Platform |

|

| Education |

|

| Ease of Use |

|

StockBrokers.com Review Methodology

Why you should trust us

Jessica Inskip is Director of Investor Research at StockBrokers.com, bringing 15 years of experience in brokerage and trading strategy. A former FINRA-licensed rep, she held Series 7, 63, 66, and 4 licenses. Jessica focuses on investor education and brokerage industry research, appears regularly on CNBC, Bloomberg, The Schwab Network, Fox Business, and Yahoo! Finance, and hosts the Market MakeHer podcast.

Blain Reinkensmeyer, co-founder of StockBrokers.com, has been investing and trading for over 25 years. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. Today, Blain is widely respected as a leading expert on finance and investing, specifically the U.S. online brokerage industry. Blain has been quoted in The New York Times, The Wall Street Journal, Forbes, and Fast Company, among others. Blain created the original scoring rubrics for StockBrokers.com and oversees all testing and rating methodologies.

How we tested

- We used our own brokerage accounts for testing.

- We collected thousands of data points across the brokers we review.

- We tested each online broker's website, desktop platforms, and mobile app, where applicable.

- We maintained strict editorial independence; brokers cannot pay for inclusion or a higher rating.

Our research team meticulously collected data on every feature of importance to a wide range of customer profiles, including beginners, casual investors, passive investors, and active traders. We carefully track variables like margin rates, trading costs, fees, and platform features and use them to help rate brokers across a range of categories measuring ease of use, range of investments, research, education, and more.

At StockBrokers.com, our reviewers use a variety of computing devices to evaluate platforms and tools. Our reviews and data collection were conducted using the following devices: iPhone SE running iOS 17.5.1, MacBook Pro M1 with 8 GB RAM running the current MacOS, and a Dell Vostro 5402 laptop i5 with 8 GB RAM running Windows 11 Pro.

Each broker was evaluated and scored on over 200 different variables across seven key categories: Range of Investments, Platforms & Tools, Research, Mobile Trading, Education, Ease of Use, and Overall. Learn more about how we test.

Trading platforms tested in 2026

We tested 14 online trading platforms in 2026:

Read next

- Best Brokers for Penny Stock Trading of 2026

- Best Paper Trading Apps & Platforms for 2026

- Best Stock Brokers for 2026

- Best Stock Trading Apps for 2026

- Best Futures Trading Platforms for 2026

- Best Day Trading Platforms of 2026 for Beginners and Active Traders

- Best Stock Trading Platforms for Beginners of 2026

- Best Options Trading Platforms for 2026

More Guides

Popular Stock Broker Reviews

About Questrade

Questrade is a longstanding Canadian brokerage firm. Founded in 1999, Questrade has grown to become Canada’s largest independent brokerage, with over $50 billion in assets under administration. In addition to its self-directed investing platform, Questrade offers automated investing solutions through its Questwealth robo-advisor.