Best Canadian Brokerage Firms in 2026

Led by Jessica Inskip, Director of Investor Research, the StockBrokers.com research team collects thousands of data points across hundreds of variables. We evaluate features important to every kind of investor, including beginners, casual investors, passive investors, and active traders. We carefully track data on margin rates, trading costs, and fees to rate stock brokers across our proprietary testing categories.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on StockBrokers.com. Learn more about how we test.

Canadian self-directed investors have never had more, and frankly better, options when it comes to online brokerages. In just the past year, we’ve seen two more brokers (Questrade and Qtrade) scrap commissions on stock and ETF trades, and multiple brokers, specifically Questrade and TD Direct Investing, rolling out fractional shares. There’s also been a push from several brokers towards more valuable tools.

But with the landscape changing so quickly, choosing the right platform can seem overwhelming. That’s why I’ve updated our list of the best Canadian brokerages. I’ve been reviewing online trading platforms for almost eight years, and over the past few months, I’ve gone hands-on with each of the brokers in this guide. I’ve opened accounts, placed trades, tested mobile apps, engaged with customer support, and compared fees and features to help you find the platform that fits your investing style.

Best Online Trading Platforms in Canada 2026

To highlight the best trading platforms in Canada, I evaluated each Canadian broker across pricing, usability, tools, market access, and account features. Based on this hands-on testing, here are the platforms that deliver the strongest overall experience for beginner and active investors.

- Minimum Deposit: $0

- Stock/ETF Trade Fee: $0.00

- Mutual Fund Trade Fee: $9.95

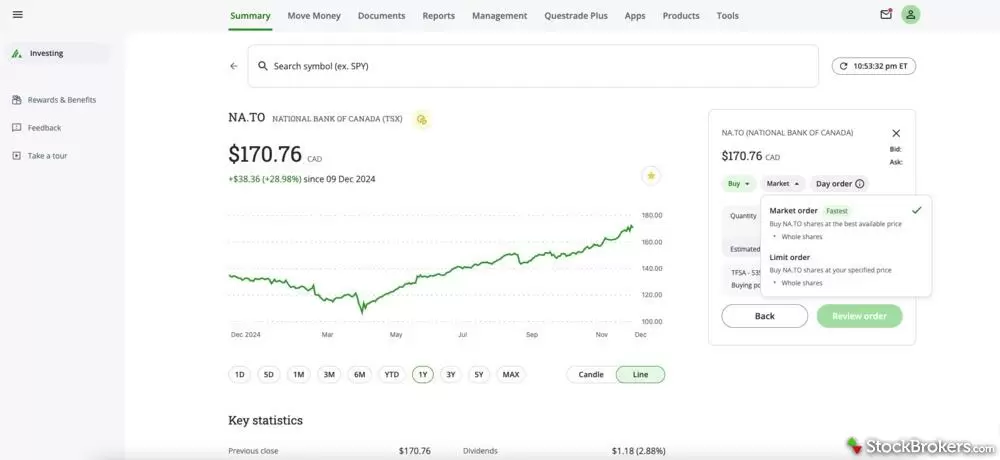

$0 per trade. For residents of Canada, Questrade is the best online broker for trading, not only on the Canadian stock market, but also the U.S. stock market. The client experience is seamless, the tools are numerous, and commissions are competitive. Read full review

- Commission-free trading

- No account or inactivity fees

- Commission-free fractional trading

- Must pay for Questrade Plus to set up custom alerts

- Steep trading fee of $9.95 for mutual funds

- Limited educational content

- Minimum Deposit: $0

- Stock/ETF Trade Fee: $9.99

- Mutual Fund Trade Fee: $0.00

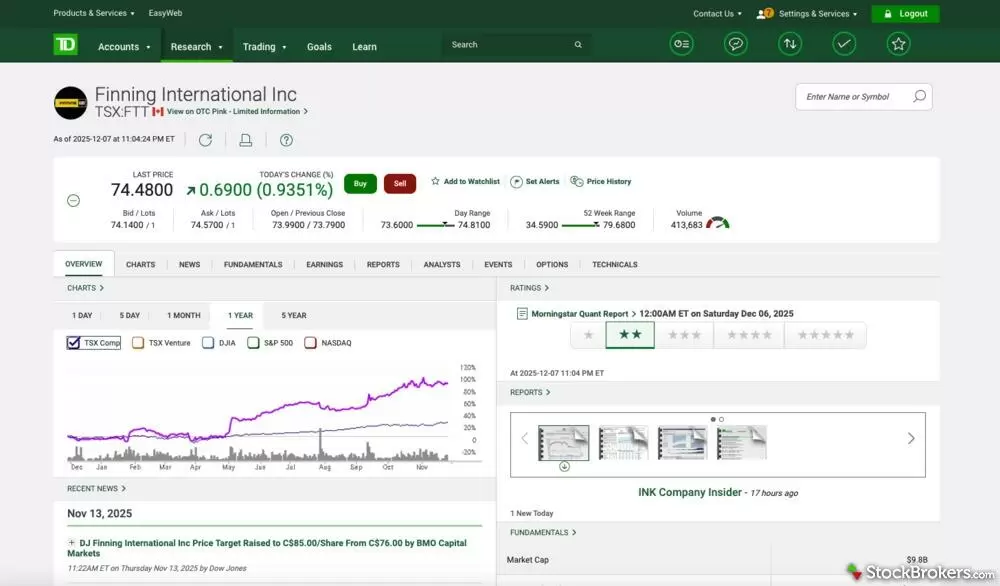

$9.99 per trade. As the most expensive broker in our review, TD Direct Investing offers investors a diverse set of trading tools and research through its WebBroker and Advanced Dashboard platforms. The broker’s mobile app, TD App, provides a similarly clean experience.

- Polished platform with seamless bank investing

- Clear, wide-ranging education (articles, videos)

- Free real-time market data

- Advanced Dashboard lacks depth versus top competitors

- $9.99 stock trades; options $9.99 + $1.25/contract

- $25 quarterly maintenance fee unless waived

- Minimum Deposit: $0

- Stock/ETF Trade Fee: $0.00

- Mutual Fund Trade Fee: $0.00

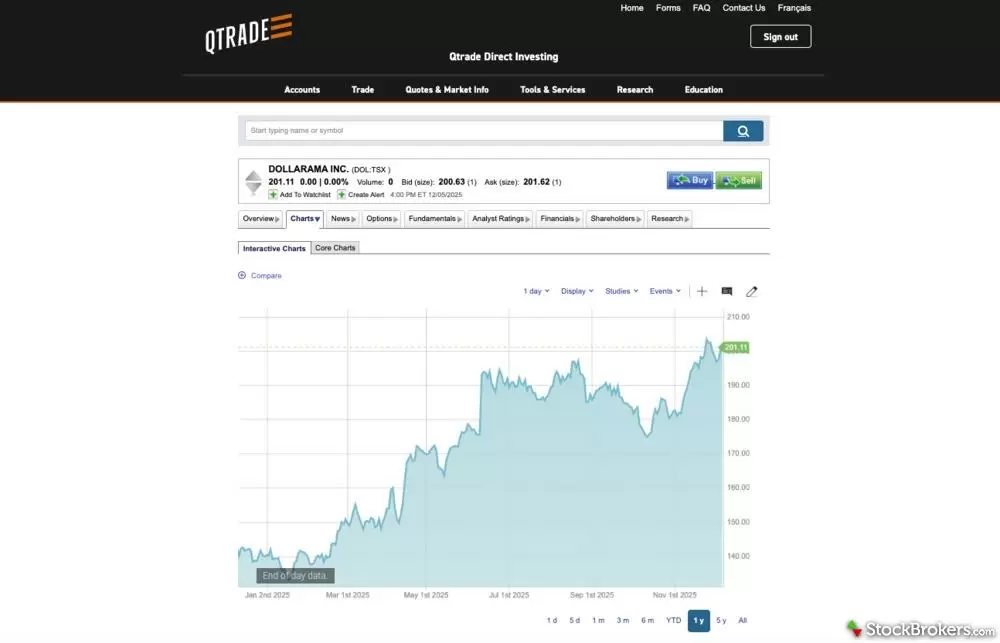

$0 per trade. Qtrade Direct Investing shines for its user-friendly website and all-around client experience. While Questrade has the upper hand with its trading platform, Qtrade provides a more robust stock research center and portfolio analysis tools.

- Commission-free trading

- Quick and easy account opening

- Visually appealing mobile trading app

- No forex, CFD, crypto, or futures trading

- No dedicated platform for advanced traders

- No support for fractional share trading

- Minimum Deposit: $0

- Stock/ETF Trade Fee: $1.00

- Mutual Fund Trade Fee: $8.00

$0.01 per share ($1 min / 0.5% of trade value max). Interactive Brokers is our top pick for professionals because of its institutional-grade desktop trading platform. Professionals aside, Interactive Brokers also appeals to casual investors thanks to its Client Portal web trading platform. Read full review

- 150+ markets to trade.

- IBKR Desktop platform has institutional power and intuitive usability.

- Industry-leading margin rates and competitive interest yields.

- Density of features requires a significant time investment.

- Educational content skips over the basics for true beginners.

- Certain tools lack the curated context needed.

- Minimum Deposit: $0

- Stock/ETF Trade Fee: $0.00

- Mutual Fund Trade Fee: $0.00

$0 per trade. For long-term investors who want to set it and forget it or trade on a more passive basis, Wealthsimple is a great choice. Wealthsimple offers a robo-advisor managed solution as part of its Wealthsimple Invest platform. Read full review

- No fee trading on stocks and ETFs

- Quick and easy account opening process

- Offers a simple trading platform

- No advanced trading platform or research tools

- High $10/monthly fee for a USD account

- Limited investment offering

- Minimum Deposit: $0

- Stock/ETF Trade Fee: $6.95

- Mutual Fund Trade Fee:

$6.95 per online equity trade. For casual investors looking for low-cost trades, who are willing to use a broker without all the bells and whistles, CIBC Investor’s Edge is worth considering. The broker is noteworthy for its transparent account fees and low trading costs across the board.

- No annual account fees for TFSA and RESP.

- Good collection of sentiment indicators.

- Charts are clean.

- No free trading of U.S. shares.

- Can't compete with the advanced platform offerings of top-tier brokers

StockBrokers.com Review Methodology

Why you should trust us

Colin Graves, a contributing writer for StockBrokers.com, has over seven years of experience covering investments and Canadian brokerage platforms. Before becoming a full-time writer, Colin spent over two decades in the banking industry, including 15 years as a people manager with a Top 10 North American financial institution. He has completed both the Canadian Securities (CSC) and the Professional Financial Planning (PFPC) courses and has appeared in leading Canadian personal finance publications such as MoneySense, Money.ca, MapleMoney, and The College Investor.

Blain Reinkensmeyer, co-founder of StockBrokers.com, has been investing and trading for over 25 years. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. Today, Blain is widely respected as a leading expert on finance and investing, specifically the U.S. online brokerage industry. Blain has been quoted in The New York Times, The Wall Street Journal, Forbes, and Fast Company, among others. Blain created the original scoring rubrics for StockBrokers.com and oversees all testing and rating methodologies.

How we tested

- We used our own brokerage accounts for testing.

- We collected hundreds of data points across the brokers we review.

- We tested each online broker's website, desktop platforms, and mobile app, where applicable.

- We maintained strict editorial independence; brokers cannot pay for inclusion or a higher rating.

Our research team meticulously collected data on every feature of importance to a wide range of customer profiles, including beginners, casual investors, passive investors, and active traders. We carefully track variables like margin rates, trading costs, fees, and platform features and use them to help rate brokers across a range of categories measuring ease of use, range of investments, education, and more.

At StockBrokers.com, our reviewers use a variety of computing devices to evaluate platforms and tools. Our reviews and data collection were conducted using the following devices: iPhone SE running iOS 17.5.1, MacBook Pro M1 with 8 GB RAM running the current MacOS, and a Dell Vostro 5402 laptop i5 with 8 GB RAM running Windows 11 Pro.

Each broker was evaluated and scored on over 60 different variables across six key categories for Canadian investors: Range of Investments, Platforms & Tools, Mobile Trading, Education, Ease of Use, and Overall. Learn more about how we test.

Read next

Explore further guidance on trading in Canada, here and on our sister site, ForexBrokers.com.

- Questrade Review

- Wealthsimple Review

- Interactive Brokers Review

- Best Forex Brokers in Canada (ForexBrokers.com)

Questrade

Questrade

TD Direct Investing

TD Direct Investing

Qtrade Direct Investing

Qtrade Direct Investing

Interactive Brokers

Interactive Brokers

Wealthsimple

Wealthsimple

CIBC Investor’s Edge

CIBC Investor’s Edge