TrendSpider offers investment research and trading tools backed by artificial intelligence. In fact, you can use TrendSpider to create your own customized AI-powered bots that make trades on your behalf.

The TrendSpider platform can be complex to navigate, and it's pricey, especially if you buy the most comprehensive plan. However, it delivers one of the best options for AI trading bots since you can build them without any coding knowledge. Read on through my detailed TrendSpider review to determine whether this platform makes sense for you.

TrendSpider pros and cons

thumb_up_off_alt Pros

- Customizable AI trading bots.

- No programming knowledge required.

- Wide array of research tools.

thumb_down_off_alt Cons

- Pricey services and no free trial.

- Platform can be complicated to understand for inexperienced traders.

- Charts and alert functions are not user-friendly.

- No direct link to brokers for trades.

Overall summary

|

Feature |

TrendSpider TrendSpider

|

|

Overall

info

|

|

|

Features

info

|

|

|

Ease of Use

info

|

|

|

Cost

info

|

|

|

Free version

info

|

No

|

|

Monthly Pricing

info

|

Starts at $82/mo

|

|

Annual Pricing

info

|

Starts at $648/yr

|

Cost and plans

TrendSpider offers three paid plan options, with a substantial discount if you pay annually:

| Plan |

Price (Monthly) |

Price (Yearly) |

| Standard |

$82 |

$648 |

| Premium |

$137 |

$1,092 |

| Enhanced |

$183 |

$1,464 |

New customers receive an additional discount of up to 32% off their first payment, depending on their subscription type and length.

TrendSpider does not offer a free version of its platform. It provides some basic calculators, spreadsheets, and market scanners on its website, but no free trial or access to its actual platform tools.

You could apply for a discounted, 14-day trial instead of paying for a whole month. However, TrendSpider does not reveal the exact price for a paid trial.

All three subscriptions offer access to the same tools, including the AI trading bots. You gain more capabilities for the tools as you go up the TrendSpider cost tiers.

Standard

TrendSpider’s Standard plan gives you access to all its tools, including AI trading bots, market scanners, charting, and alerts.

Your abilities are more limited compared to the higher-tier plans. For example, you can only set up and use five trading bots at a time, versus 50 bots on the most expensive Enhanced plan.

Your ability to analyze past data is also much more limited, as you can only examine up to 2-hour timeframes at the shortest. That might not be an issue for investors with a longer investment focus, but the limits could miss valuable trends and patterns for short-term day trading.

TrendSpider's strategy tester lets you enter in conditions and test your trading strategy before executing it.

Premium

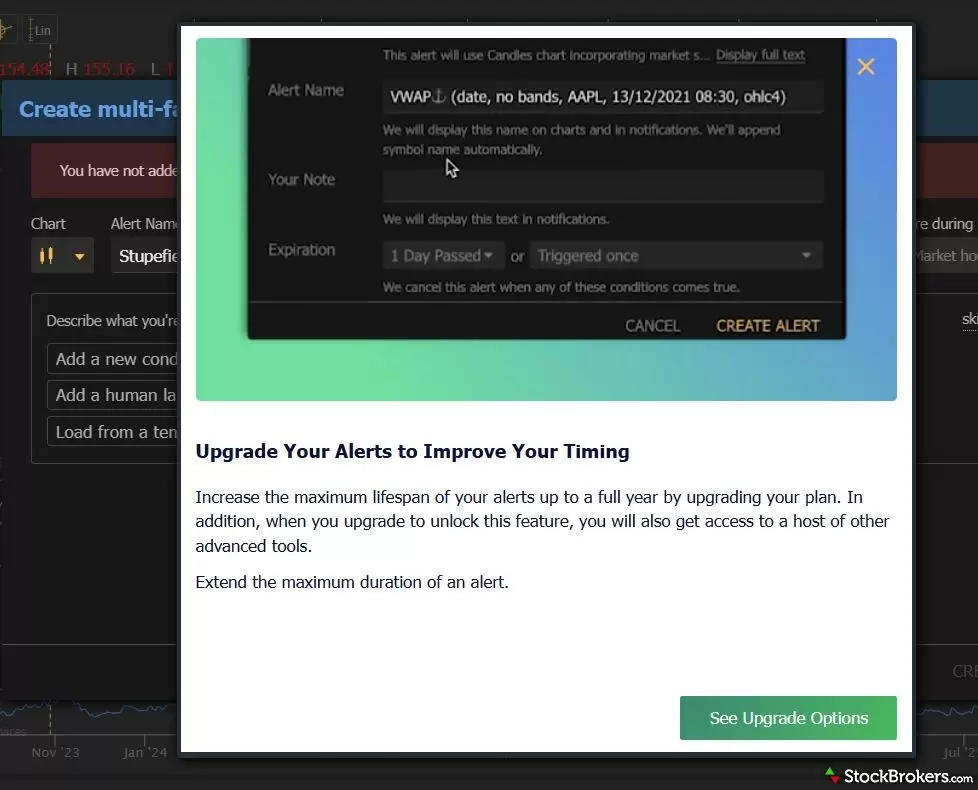

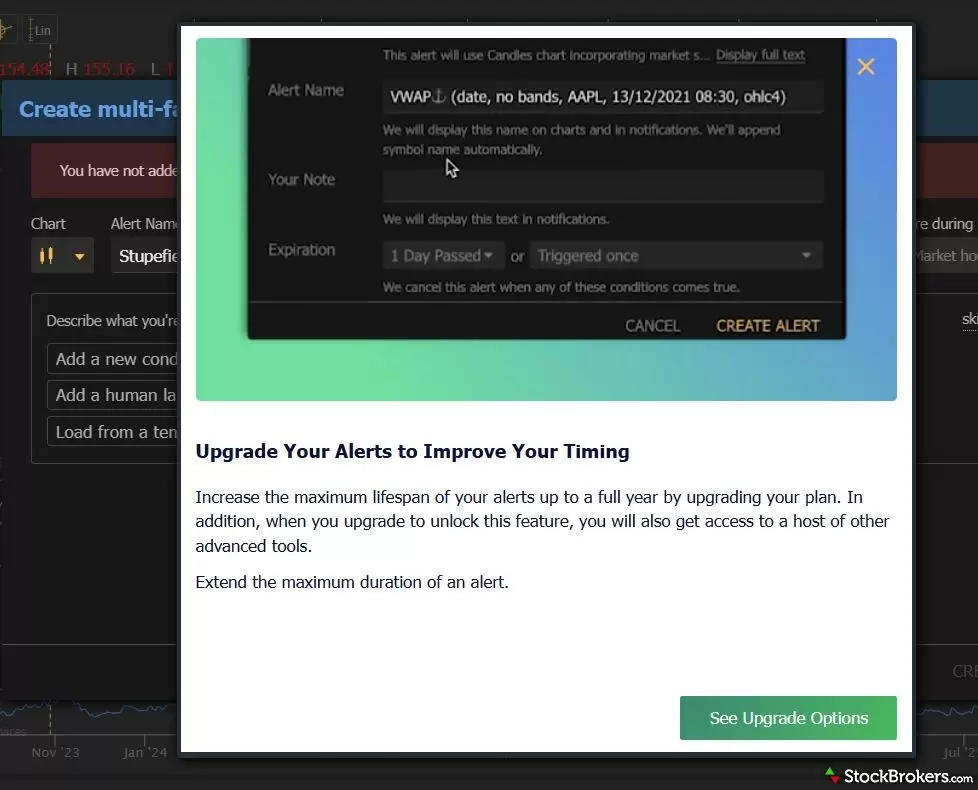

For a small cost increase, the TrendSpider Premium plan significantly expands your capabilities. For example, you can set up 50 trade alerts on your investment strategies that can last up to 90 days each, versus just 10 alerts on the Standard plan, with each alert lasting only 30 days. If you regularly use alerts, the limitations on a Standard plan would get annoying quickly, making this upgrade worthwhile.

You can also analyze data in up to 5-minute increments, helping you get a lot more granular. This subscription seems like the right balance for most serious investors, and TrendSpider notes that it’s powerful enough for 80% of traders.

With TrendSpider's Premium plan you can set up more alerts and avoid getting blocked during your trading.

Enhanced

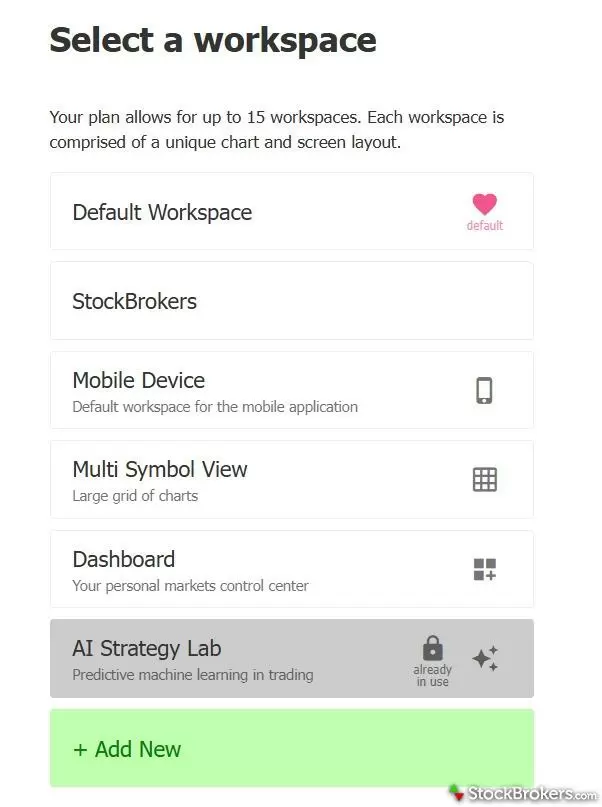

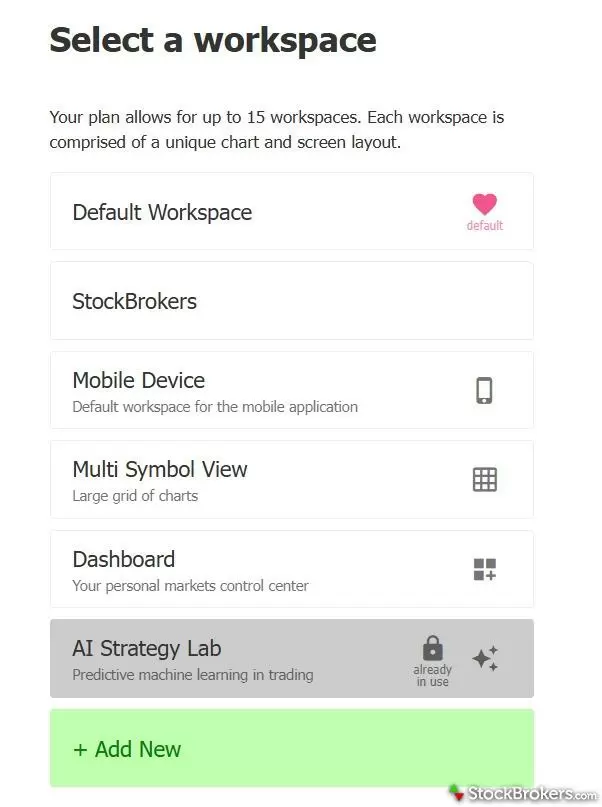

The Enhanced plan provides the highest level of power among the individual plans with up to 50 AI trading bots, 100 alerts with each lasting up to 180 days, and the ability to test data within one-minute increments. You can also create up to 15 Workspaces for different strategies, helping you stay organized, versus 10 on Premium and five on Standard.

If you’re looking for highly precise strategies where even tiny price moments matter, like scalping or professional day trading, the level of precision from Enhanced would come in handy. Not to mention, you could have a small army of trading bots working for you at once.

TrendSpider's Enhanced plan allows you to create multiple workspaces.

Features

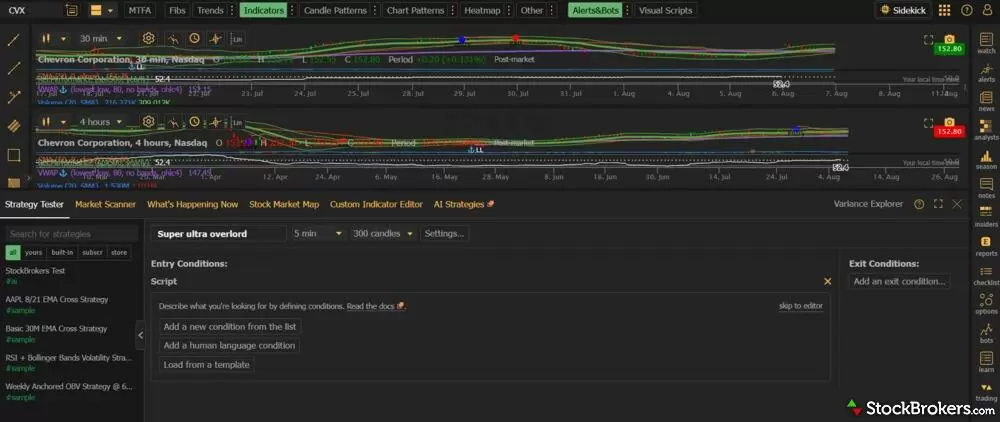

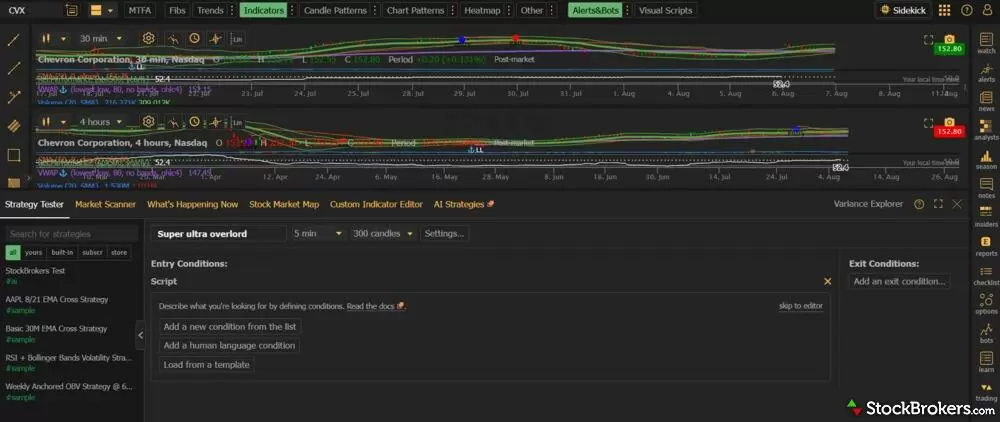

The main TrendSpider platform home screen displays all the tools, widgets, charts, and other information you choose to set up, track, and utilize. As part of my TrendSpider review, I found that the screen got crowded with information quickly, making it a little hard to sort. For example, even laying out two different charts felt like too much.

TrendSpider's main platform screen after setting up charts and tools can get a little crowded.

However, I did like how TrendSpider allows you to organize by creating separate Open Workspaces for different goals, and it was simple to switch back and forth.

While testing out all the features, I appreciated how AI was built in throughout the entire experience, not just for the trading bots themselves. Here are how the main features compare.

AI trading bots

TrendSpider allows you to design customized AI trading bots based on your goals. You pick the market you want the bot to operate on, the timeframe of past data to train on, and the model goals. For instance, if you set your target take profit and stop loss percentages, the model will then check how successful your strategy was versus the benchmark based on the historical training data.

TrendSpider's AI model will help you set up your automations step-by-step with explanations and what to predict.

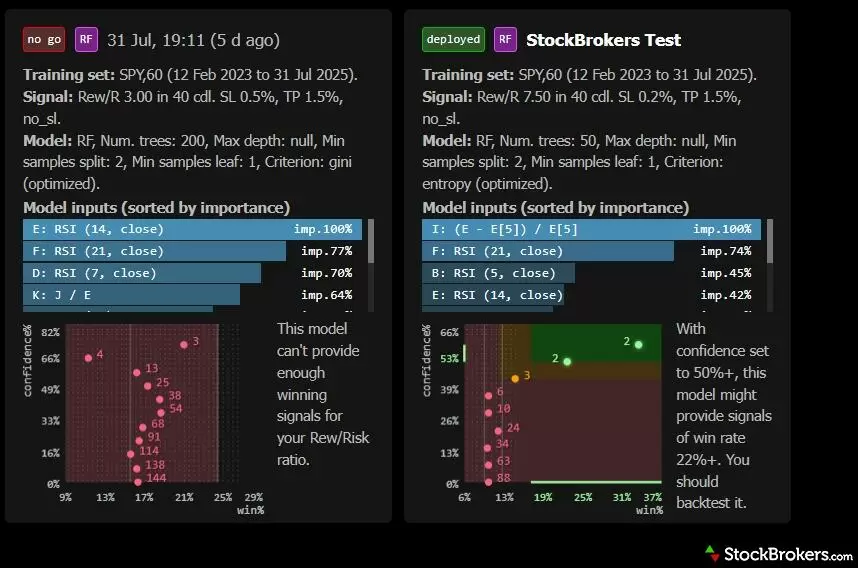

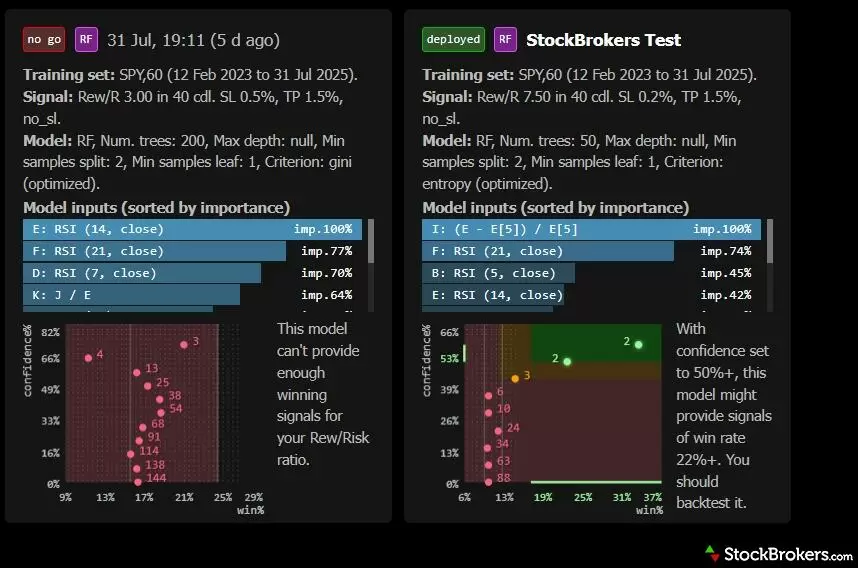

I appreciated how I could ask AI to generate the inputs for creating the strategy. For example, if my goal was to try finding a short-term pricing trend in the data, it picked the factors that made the most sense for my AI model. After initial training, TrendSpider gives feedback as to whether the model might provide useful trading signals or whether it needs to be scrapped and redone.

TrendSpider's AI trading bot will show you what will run successfully and what won't and make suggestions on what to keep or scrap.

From there, you can run backtests to see how successful your model would be at hitting your target returns over a specific timeframe of past market data. I appreciated how, after each backtest, you not only saw the raw performance numbers but could request that the LLM Sidekick give detailed feedback.

TrendSpider's AI trading bot let's you backtest your strategies in real market time to see what works and what doesn't.

I created a couple of strategies I thought looked promising because of how much my backtested return beat the asset benchmark, but the Sidekick flagged some fundamental issues. In one case, the Sidekick warned me that too much of the return came from a few unusual, outsized wins versus consistent results, which made relying on this strategy for future performance unpredictable and risky.

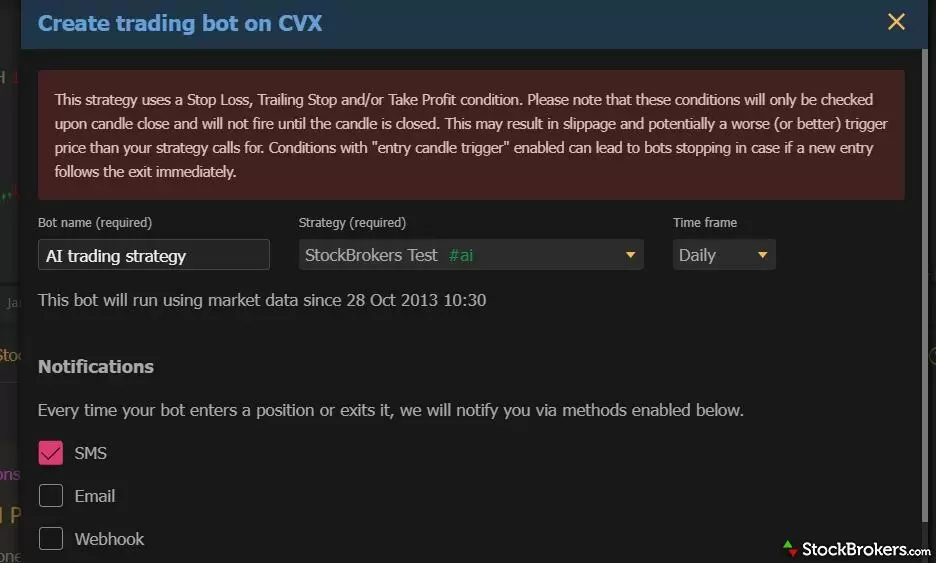

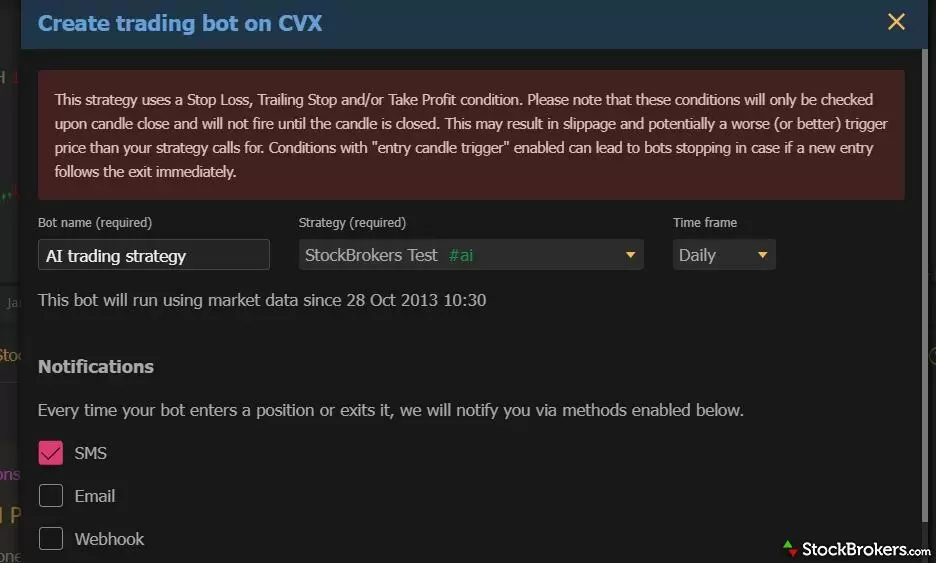

Automated trading

If you feel confident in a bot’s strategy, you can link your brokerage to TrendSpider using SignalStack. You can then give the bot control over your portfolio to execute your strategy.

TrendSpider will notify you by email or text whenever the bot enters or exits positions, or when the model makes changes to itself, like shutting down because it completed the strategy. If you set up alerts, you can have those trades execute automatically when they trigger, too.

You can launch anywhere between five and 50 bots at a time, depending on your subscription. I’m not sure how comfortable I’d be having so many bots working simultaneously without my oversight, but I do like how easy it is to set them up and shut them down, plus TrendSpider gives many updates as to what they’re doing for you, so the trades shouldn’t be a surprise.

You can set up to 50 automated trades with TrendingSpider's automated trading bot.

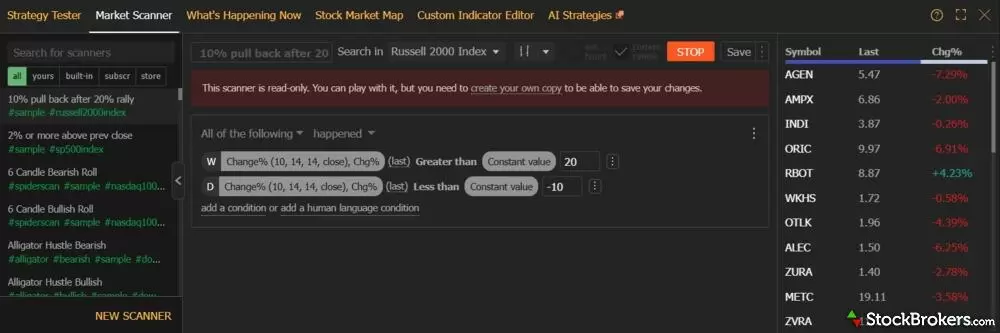

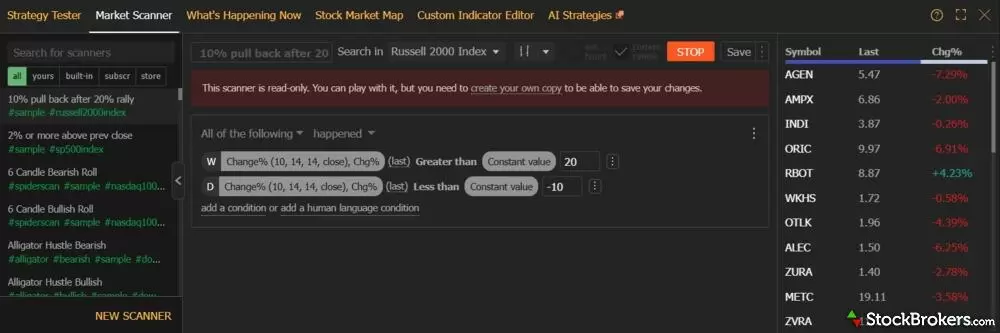

Market data, scanners, and watchlists

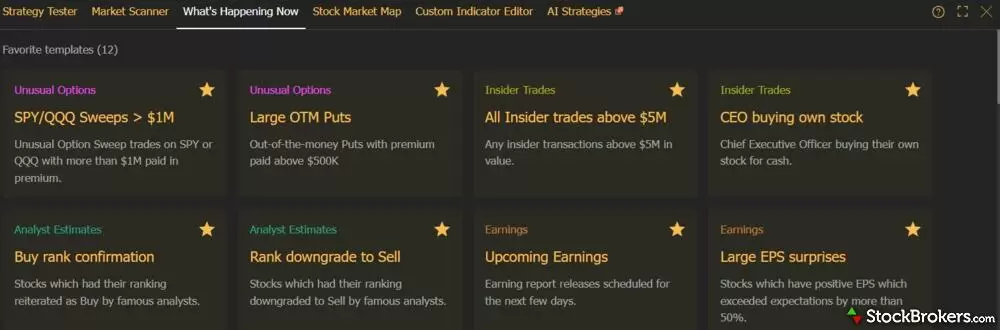

Besides the AI trading bots, the TrendSpider platform offers a wealth of investment news and information. You can track what’s going on through a heatmap or by setting up widgets for your watchlists, market news, and analyst reports.

I like how TrendSpider went beyond the basics. For instance, it has market scanners with tons of pre-built ways to see what’s going on and find specific investment opportunities as simple as finding stocks that are down 10% for the week or showing a bearish volume rush.

With TrendingSpider's market scanner you can find trading opportunities based on current trends.

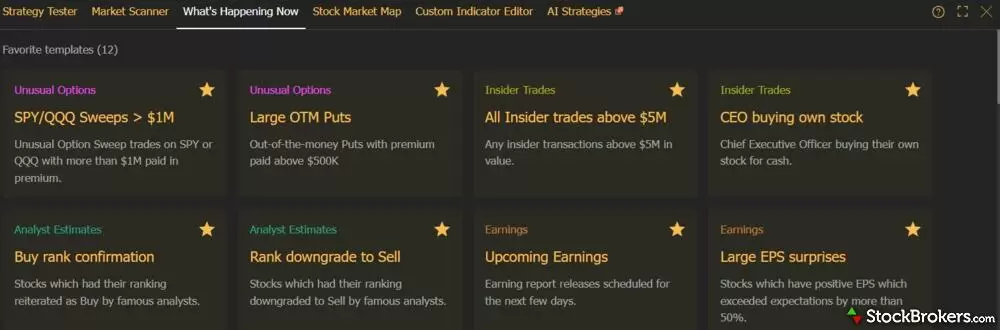

TrendSpider also has some creative tools for flagging market activity worth paying attention to. You can see large buys from company insiders, the opening of unusually large option positions, or even a funny “Pelosi portfolio tracker,” since her portfolio is notoriously famous for being such a strong performer. A recently launched suite of indicators pulling from the Kalshi prediction market adds yet another innovative way to view sentiment data.

TrendingSpider helps you stay in the know with it's "What's Happening Now" feature.

Alerts and charting

TrendSpider includes alerts and charting directly on your platform home screen. I personally did not find these tools as valuable as the others during my TrendSpider review. I found it challenging to design charts with the indicators I wanted or to set up multiple alerts. For instance, adding alerts quickly crowded the screen with data.

TrendingSpider's chart layout can be accessed directly from the home screen.

The functionality is there with TrendSpider. It’s just that I found other platforms do a better job in this area. For example, TradingView allows you to launch up to 1000 alerts, and they are much easier to set up than the maximum 100 with TrendSpider.

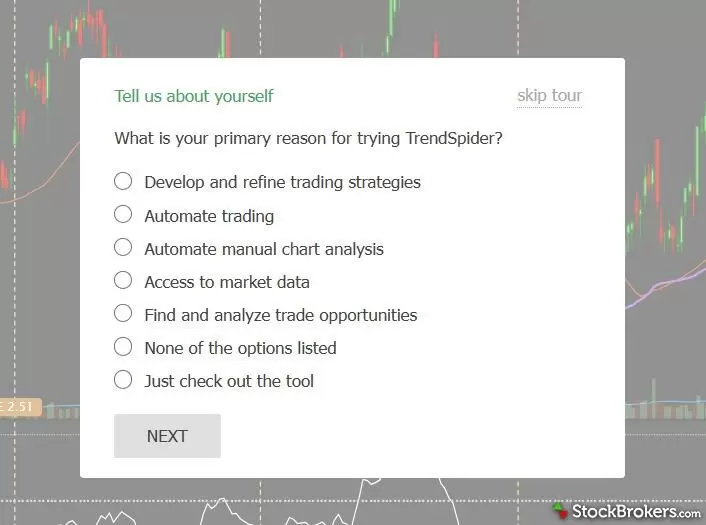

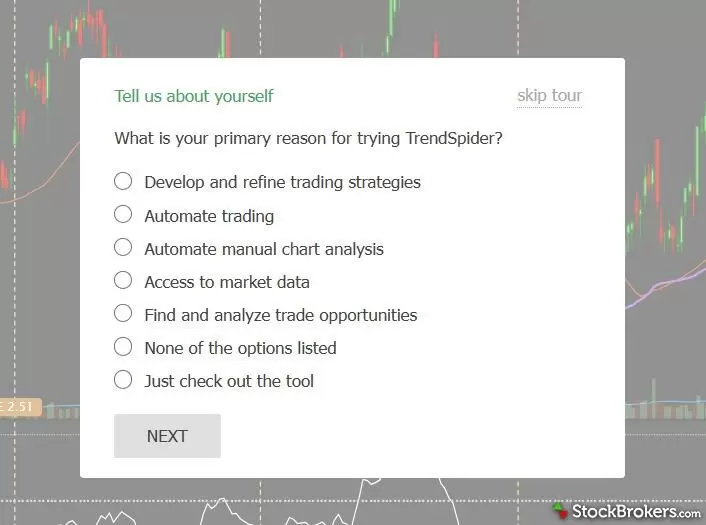

Ease of use

The TrendSpider platform is complex. There’s a lot to figure out, especially when creating your AI trading bots. My first impression upon logging in was “Oh wow, how am I going to sort through all this?” But then TrendSpider does an exceptional job with training and supporting its users.

When I first registered, a customer service rep texted me and asked if I wanted to jump on a call to ask questions, which was a nice welcome. When I first logged in, the platform asked what my priorities were (I chose automated trading), and then it gave a step-by-step tutorial on the features I would most likely use.

TrendingSpider walks you through its platform step by step by asking what you're here for.

There was also plenty of educational material on their website and within the platform itself. For instance, they have a YouTube training video connected directly to the AI trading bot trainer, knowing most people will need help getting started.

TrendSpider offers plenty of human support, too. You can call, email, or text customer service, including through a chatbot. You can also schedule 60-minute formal training sessions. You get between one and three a year for free, depending on your plan. After that, each additional training session costs $49.

It’s a good thing there’s all this handholding because there’s no way I would have been able to decipher everything on my own during the TrendSpider Review. But with its resources, I picked things up quickly, even compared to simpler competitor platforms.

Final thoughts

If you’re an experienced trader looking to build your own AI trading bots, TrendSpider is highly appealing. The process to design, test, and launch your bots is intuitive and a lot of fun. That said, the platform is relatively expensive, and you need to develop your own strategies. You need the market and investment knowledge to come up with useful ideas.

Alternatives to TrendSpider

If you want more help, StockHero offers pre-built AI trading bots, letting you try out and use bots with a proven track record created by others. Trade Ideas uses AI to proactively analyze market trends and come up with trading signals and patterns for users, saving them from having to build everything themselves.

But if you’re looking to design your own customized trading bot with no programming or coding required, TrendSpider is an excellent option and justifies the cost.

StockBrokers.com Review Methodology

Why you should trust us

David Rodeck, a contributing writer for StockBrokers.com, has over a decade of writing experience specializing in investing, trading, and retirement planning. Before becoming a full-time writer, David was a financial advisor and passed the Series 6 and CFP exams. He has written for AARP, Kiplinger Magazine, Forbes Advisor, and Investopedia.

Blain Reinkensmeyer, co-founder of StockBrokers.com, has been investing and trading for over 25 years. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. Today, Blain is widely respected as a leading expert on finance and investing, specifically the U.S. online brokerage industry. Blain has been quoted in The New York Times, The Wall Street Journal, Forbes, and Fast Company, among others. Blain created the original scoring rubrics for StockBrokers.com and oversees all testing and rating methodologies.

How we tested

- We used paid trading tool accounts for testing.

- We collected dozens of data points across the tools we review.

- We tested each tool’s website, desktop platforms, and mobile app, where applicable.

- We maintained strict editorial independence; trading tools cannot pay for a higher rating.

Our researchers thoroughly test a wide range of popular trading tools' features, such as trading journals and screeners, charting providers, and educational resources. We also evaluate the overall design of each tool’s mobile experience and look for a fluid user experience moving between mobile and desktop tools.

At StockBrokers.com, our reviewers use a variety of devices to evaluate trading tools. Our reviews and data collection are conducted using the following devices: iPhone SE running iOS 17.5.1, MacBook Pro M1 with 8 GB RAM running the current MacOS, and a Dell Vostro 5402 laptop i5 with 8 GB RAM running Windows 11 Pro.

Each trading tool was evaluated and scored across three key categories: Ease of Use, Features, and Cost. Learn more about how we test.

Trading tools tested in 2026

We tested 9 trading tools and service providers for stock traders in 2026:

TrendSpider

TrendSpider