TradeZella has two paid plan subscriptions, Basic and Premium. Both options are available on a monthly or annual basis, with a discount offered for paying upfront.

- Basic: $29 per month, $288 per year

- Premium: $49 per month, $399 per year

Unfortunately, TradeZella doesn’t offer a free plan or any trial period. When I first created my account, I expected to gain at least some access. Instead, they made me jump through a few hoops to submit my info before getting hit with a paywall. That was jarring, especially since the initial questions were getting me excited to dive in.

While most other competitors are willing to offer a refund to unsatisfied customers, TradeZella’s website firmly states that all sales are final. They provide a free Google Sheet template that lets you build your own trade journal, but I would rather check out a competing website that at least offers free basic journaling, like Tradervue.

TradeZella is not the right pick if you’re looking to test-drive a platform. However, subscribers willing to cover the TradeZella cost gain access to a valuable tool.

Basic

With a Basic subscription, you can use most of the TradeZella features and tools, including the trade journal, backtesting, and the mentorship/student program.

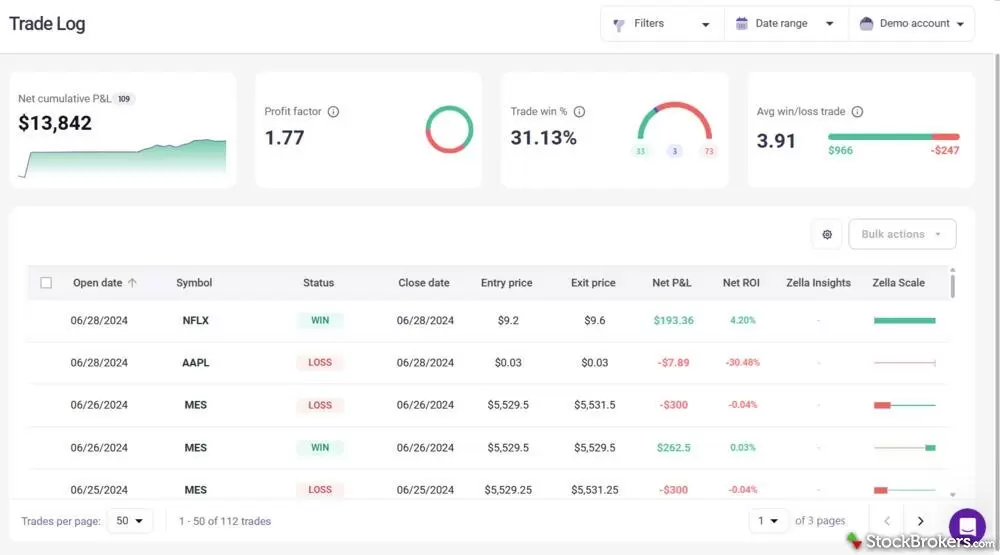

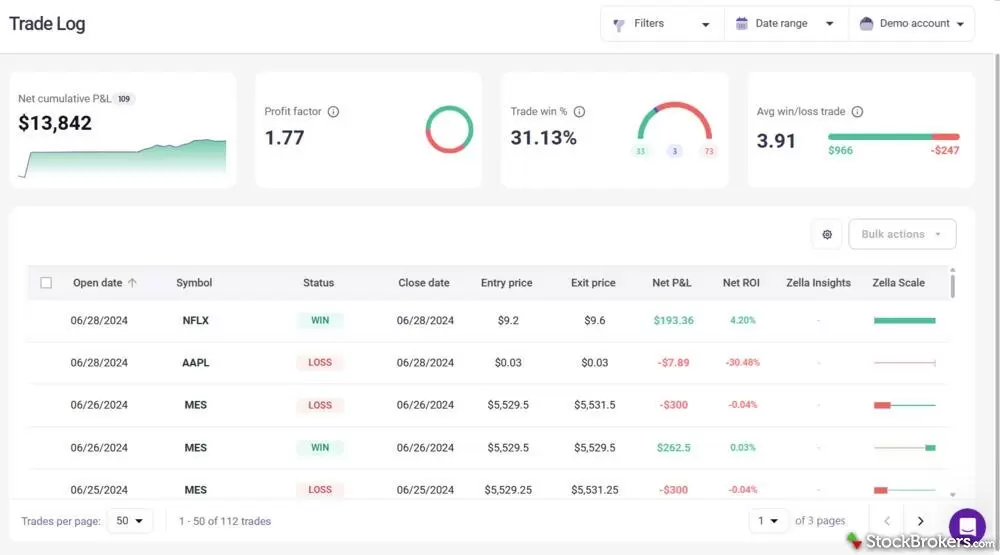

I appreciated how the dashboard provided me with immediate actionable insights into my past trading strategies and results. For example, even though I was profitable over the uploaded stretch, only about 31% of my total trades were profitable. The results suggested that I may want to focus on improving my profit-taking frequency going forward to supplement the less common, large wins.

The biggest downside: trade replay isn’t included. That limits how deep you can go into post-trade analysis on the Basic tier.

TradeZella's trading journal allows you to see your profit factor as well as trade wins and losses.

Premium

Premium opens more capabilities for serious investors paying the higher TradeZella cost. It lets you link unlimited brokerage accounts, and if you trade on multiple platforms, it allows you to track them all simultaneously.

Premium also allows you to set up unlimited mentor connections and playbooks for testing investment strategies, as opposed to the limited amount on Basic.

I found the most notable upgrade for Premium is that it unlocks the trade replay feature. I appreciated being able to review trading sessions and track, by the second, what happened with my entry and exit points to identify mistakes and areas for improvement.

For example, did I get overexcited about momentum and buy too high one day, or was the trade ultimately justified based on the charts? That’s valuable information to go with the overall daily results listed in the trade journal.

As a trade journal, TradeZella gives you a place to actively track your trades, take notes, and find ways to improve. It also provides opportunities to analyze your performance and develop new strategies, with the support of its investor community.

Trade journals and analysis

To get started with TradeZella, you need to upload your past trading history. I found this simple enough. Some brokers, like Robinhood, sync automatically, so Tradezella constantly uploads your sessions in real-time. Others, such as Power E*TRADE, need to be uploaded manually through an Excel spreadsheet.

I tested both approaches. The automatic broker sync was seamless, but it took a few attempts to format my Excel sheet properly, as the system kept rejecting it. However, I eventually figured it out.

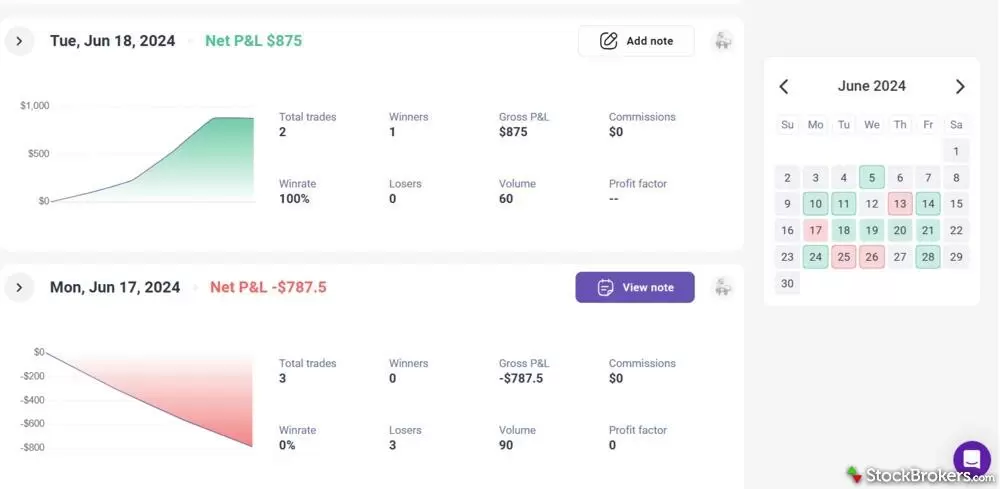

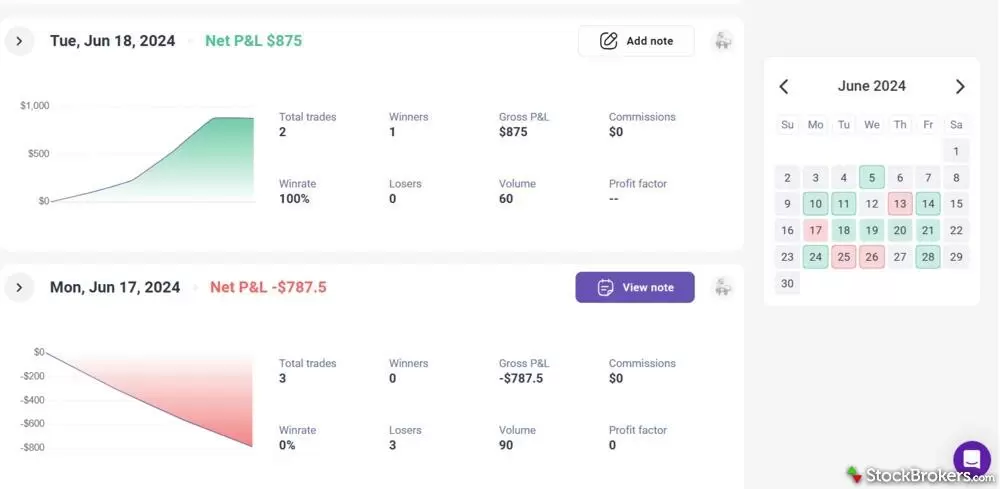

Once everything was loaded correctly, I was impressed by how quickly and effectively TradeZella organized everything. It immediately added all the trades, sorted by date and results, to my calendar. I could track what days went well so I could start looking for patterns and take notes.

What I found unique about this trade journal is that it allows me to set goals, such as the time I want to start trading each day, and whether I hit those goals. It was nice that the platform was proactively pushing me to improve, rather than just creating a database.

Keep in mind that while TradeZella tracks your trades, it doesn’t allow you to enter or exit positions through the platform. You’ll need to use your actual broker to make trades.

TradeZella's daily journal allows you to see the days you trade along with your profits and volume.

Portfolio analysis and reports

Besides simply organizing my trades in the journal, TradeZella gave instant analysis. I liked the inclusion of a “Zella Score,” a 100-point system that rates your performance based on consistency, win/loss ratio, and average trade quality. It’s an easy way to get quick feedback at a glance.

It also generated reports for a deeper dive into my performance, such as whether I did better based on trade size, volume, and risk taken. In this stretch, I was doing better when taking on more volume than in sessions where I was less active, suggesting that I should be more proactive in entering and exiting trades rather than waiting for the perfect opportunity.

Trade replay

Premium subscribers can use TradeZella’s trade replay tool. This tool breaks down past trades tick by tick, allowing you to see exactly what happened. You can set up charts and make notes on the trade replay as well, listing what you think happened and whether there were any mistakes along the way.

For day traders who seek precision, this can be a valuable addition to your general trade journal. If a session got away from you, you can break it down in real-time to figure out where to improve next time. You can also mark the replays with notes and specific mistakes, like “overconfidence” or “carried away by FOMO.”

TradeZella's trade replay tool breaks down past trades tick by tick, allowing you to review your trading patterns.

Backtesting

TradeZella’s backtesting tool lets you experiment with trades and strategies using historical data. I really enjoyed experimenting with this function, as it enables you to place hypothetical buy and sell orders throughout the “trading day,” letting you see how you would have performed.

Even though it was hypothetical, I got caught up in the excitement of trying out new strategies and seeing how they paid off or lost money, as indicated by green and red results at the bottom right of the screen.

The Premium plan offers more precision, allowing you to break down the data by the second, whereas the Basic plan only allows backtesting by longer periods.

Playbooks

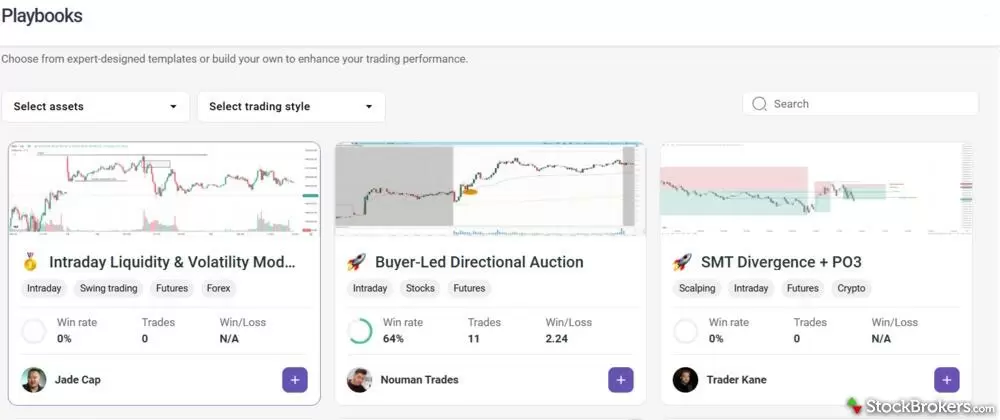

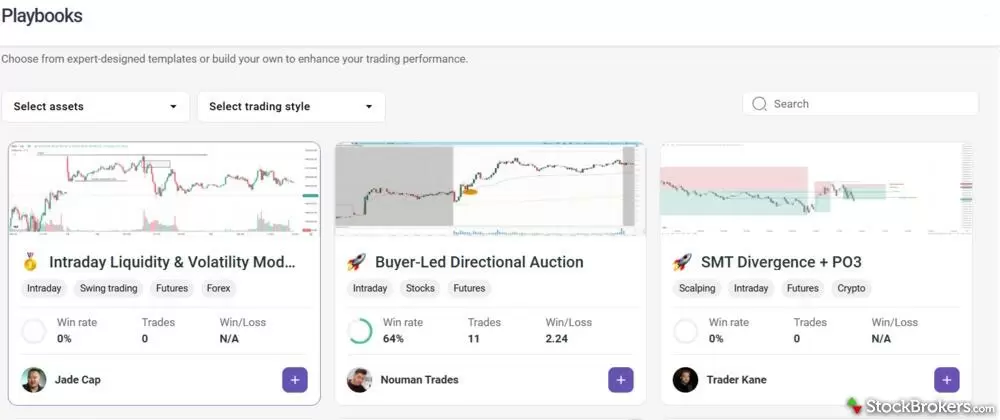

The TradeZella playbooks set rules for your future trading sessions. For example, you can set your entry and exit criteria based on prices, volume, and market ranges.

Once you have a playbook in place, you can check whether your next trading sessions meet these criteria. I can see how this would be valuable, as sometimes I have general rules for what I should be doing, but forget them in the action of trading. Getting scored on whether I followed my personal rules helped to keep me accountable.

If you're looking for strategy recommendations, shared playbooks are available from other users. You can view their success rate and overall strategy before picking the one to guide your own sessions.

TradeZella's playbooks allow you to view other traders' strategies and see their success rates.

Mentorship

TradeZella runs an active community of its users. When you sign up, you gain access to the TradeZella Discord channel to chat with other investors, compare notes, and share strategies.

TradeZella also offers a mentor and student program. If you find someone you want to learn from, you can give them access to your trade journal so they can track and give feedback. Alternatively, you could mentor others who want your advice.

TradeZella’s interface is fun, clean, and easy to navigate. The onboarding process felt welcoming; it even asked me to pick a trader “mode” like Newbie, Ninja Level, or Monk Mode. Small touches like that made the platform more engaging.

I did run into a few minor snags uploading Excel sheets and noticed some lag while using the trade replay feature, but nothing deal-breaking.

If I needed help, TradeZella has an AI-powered chatbot to answer questions and email customer support. You could also ask other users questions on Discord. Overall, I felt like the level of support was appropriate.

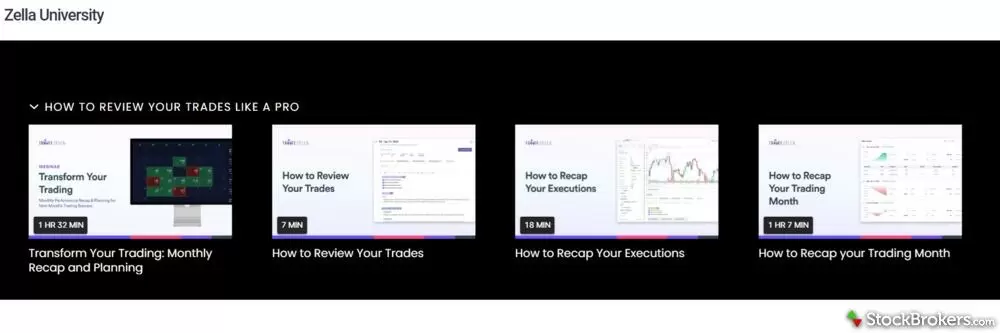

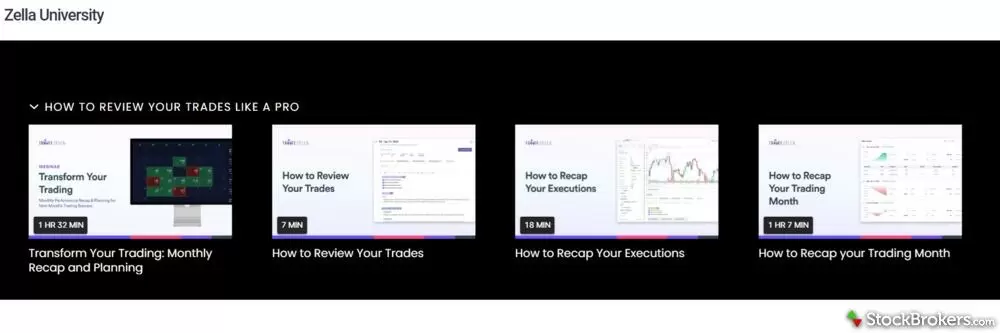

I was impressed by their extensive library of educational courses, known as TradeZella University. It was well-organized and more comprehensive than most competitors, ranging from basic, short how-to-get-started videos to one-hour or longer courses that took deep dives into investment strategies.

TradeZella has a vast library of educational content, known as Zella University, and cover topics like "getting started" to "ICT Models."

Is TradeZella worth it?

As far as trade journals go, TradeZella is a fun and intuitive platform that quickly provides valuable insights for users. Between the community, backtesting, and trade replay, it can also help you understand your results and identify new strategies for the future.

The TradeZella cost is also relatively affordable compared to other, higher-powered trading journals available. Overall, it strikes a good balance between performance and price.

Alternatives to TradeZella

If you are looking for a higher level of analysis, TraderVue is slightly more expensive, but it offers a deeper dive into your trades. And, if you have a large budget, TraderSync can provide AI-generated insights to help you analyze your trading results.

On the other hand, if you’re just looking for somewhere to track trades, Edgewonk is substantially less expensive, while TraderVue has a free version with limits on how many trades you can track per month.

TradeZella

TradeZella