Best Bond Trading Platforms for 2026

Led by Jessica Inskip, Director of Investor Research, the StockBrokers.com research team collects thousands of data points across hundreds of variables. We evaluate features important to every kind of investor, including beginners, casual investors, passive investors, and active traders. We carefully track data on margin rates, trading costs, and fees to rate stock brokers across our proprietary testing categories.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on StockBrokers.com. Learn more about how we test.

Finding the best fixed-income trading platform is often a secondary thought for investors focused on equities, but for income-oriented portfolios, the distinction is critical. Unlike stocks, where price discovery is instant, the bond market can be opaque, making the quality of your broker’s inventory and fixed-income analysis tools the primary driver of your success.

Many modern apps completely ignore fixed income, and even some full-service brokers treat it as a legacy feature with clunky interfaces. If you are looking to preserve capital or generate reliable income, you need a broker that provides direct access to competitive pricing on municipal, corporate, and Treasury bonds, rather than just forcing you into ETFs.

I have spent extensive time testing the fixed-income capabilities of major brokerages, specifically looking for those that make building a bond ladder as intuitive as buying a share of stock. The standout winners combine vast inventory with robust tools and educational resources that help you build your fixed-income portfolio.

Whether you are looking to park cash in short-term Treasurys or build a complex portfolio of tax-free municipal bonds, the right tools make all the difference. Here are the top brokers that truly deliver for bond traders in 2026.

How we evaluate the best bond trading platforms

Unlike stock trading, evaluating fixed income requires deep-diving into inventory depth and pricing transparency. Our testing process, led by Jessica Inskip, involves manually searching for specific CUSIPs and comparing secondary market buying power. We prioritize platforms that offer:

- Bond ladder builders: Tools that automate cash flow and interest rate management.

- Transparent pricing: Identifying hidden "markups" or "markdowns" that many brokers obscure.

- Institutional access: Scrutinizing the availability of new-issue Treasurys and CDs.

The brokers selected below represent the gold standard for accessing debt markets efficiently and affordably.

Best bond trading platforms

- Minimum Deposit: $0.00

- Stock Trades: $0.00

- Options (Per Contract): $0.65

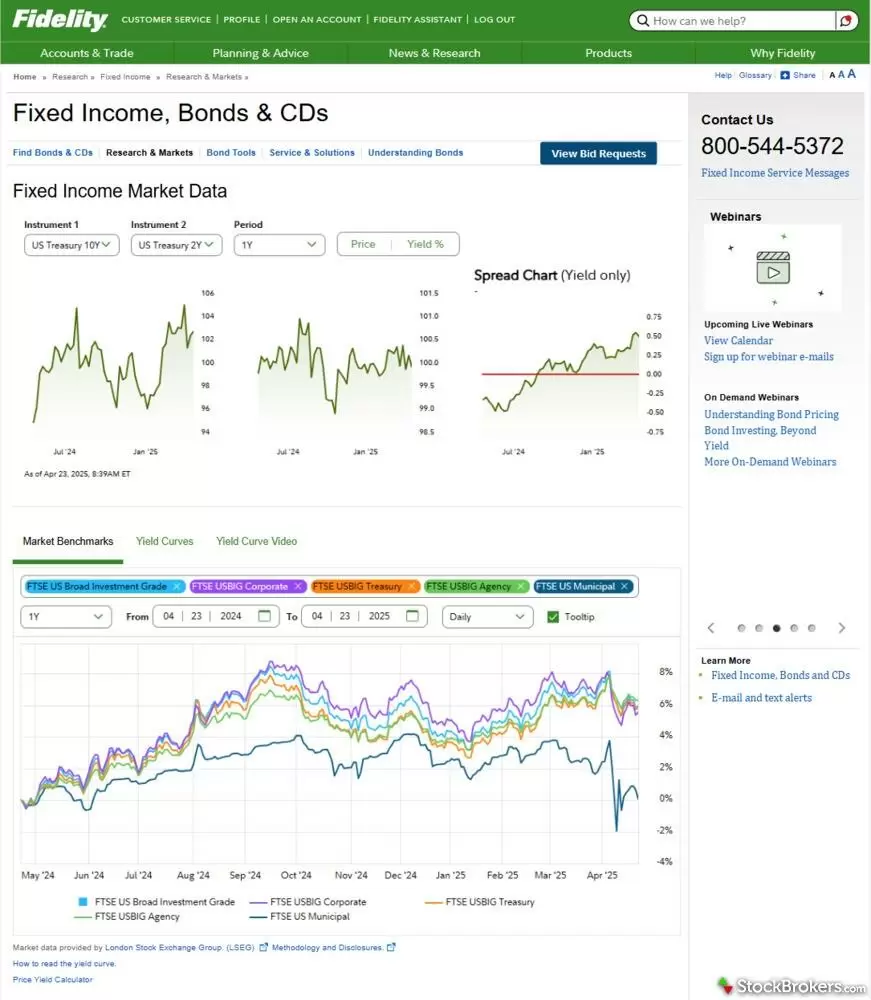

Fidelity is a value-driven online broker offering $0 trades, industry-leading research, excellent trading tools and an easy-to-use mobile app. Read full review

- Excellent research and mobile app

- Top-notch education

- Decades of reliable client service

- No dedicated mobile app for active trading

- Minimum Deposit: $0.00

- Stock Trades: $0.00

- Options (Per Contract): $0.65

For most investors, the search for a great broker ends with Charles Schwab. Retaining the #1 Overall ranking in 2026, Schwab continues to set the industry standard. The broker uniquely balances scale with sophistication, offering both simplified mobile tools and the professional-grade thinkorswim platform. From buying a first fractional share to managing a multimillion-dollar estate, Schwab provides a platform tailored to every need, serving as the definitive operating system for modern wealth. Read full review

- thinkorswim is the industry benchmark for professional-grade trading and charting.

- Best in Class Research features actionable daily updates and deep fundamental data.

- Top-tier education with webinars, videos, and courses.

- No spot crypto trading (limited to ETFs and futures).

- "Stock Slices" (fractional shares) are limited to S&P 500 companies.

- Base margin rates are significantly higher than dedicated low-cost competitors.

- Minimum Deposit: $0.00

- Stock Trades: $0.00

- Options (Per Contract): $0.65

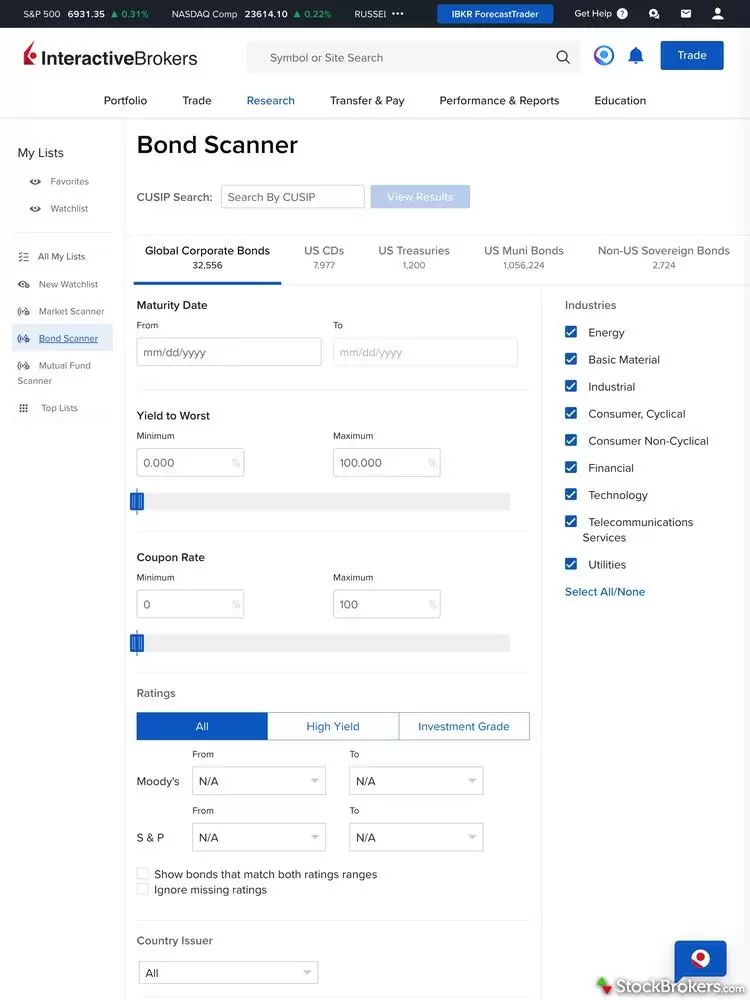

Interactive Brokers is a go-to choice for professionals because of its institutional-grade desktop trading platform, high-quality trade executions and low margin rates. Read full review

- 150+ markets to trade.

- IBKR Desktop platform has institutional power and intuitive usability.

- Industry-leading margin rates and competitive interest yields.

- Density of features requires a significant time investment.

- Educational content skips over the basics for true beginners.

- Certain tools lack the curated context needed.

- Minimum Deposit: $0.00

- Stock Trades: $0.00

- Options (Per Contract): $0.65

With two distinct platforms (E*TRADE Web and Power E*TRADE) the broker effectively serves both the "set-it-and-forget-it" investor and the high-volume derivatives trader. Whether you aim to construct a long-term retirement portfolio or deploy complex options strategies, E*TRADE provides a sophisticated, dependable environment that grows with your ambition. Read full review

- High-quality experience for both passive investors and active traders.

- Access to Morgan Stanley’s deep market analysis and interactive reports.

- Excellent bond resource center and a user-friendly ladder tool.

- Base margin rates, starting at over 12%, are significantly higher than top competitors.

- You can’t buy Bitcoin or Ethereum directly; crypto exposure is limited to ETFs and futures.

- You can’t buy fractional shares of individual stocks.

- Minimum Deposit: $0.00

- Stock Trades: $0.00

- Options (Per Contract): $0.65

J.P. Morgan Self-Directed Investing makes it easy for Chase Bank customers to invest and allows access to J.P. Morgan research. On the downside, the broker features are sparse compared to industry leaders. Read full review

- Instant liquidity transfers between Chase checking and investment accounts.

- Visually stunning and informative bond trading experience

- Zero commissions on penny stocks and secondary U.S. Treasurys.

- No streaming real-time quotes.

- No cryptocurrencies, futures, or forex.

- Poor options change experience.

Read next

- Best Stock Trading Apps for 2026

- Best Stock Brokers for 2026

- Best Paper Trading Apps & Platforms for 2026

- Best Futures Trading Platforms for 2026

- Best Day Trading Platforms of 2026 for Beginners and Active Traders

- Best Stock Trading Platforms for Beginners of 2026

- Best Options Trading Platforms for 2026

- Best Brokers for Penny Stock Trading of 2026

Fidelity

Fidelity

Charles Schwab

Charles Schwab

Interactive Brokers

Interactive Brokers

E*TRADE

E*TRADE

J.P. Morgan Self-Directed Investing

J.P. Morgan Self-Directed Investing