Qtrade Review

Vancouver-based Qtrade Direct Investing is an online brokerage that also operates a robo-advisor platform, called Qtrade Guided Portfolios. Its roots date back to 2000, when it began as a brokerage platform for credit unions. Since then, it’s grown into a popular Canadian investing platform and is known for continually improving its product and service offerings. Most recently, it removed commission fees on all stocks, ETFs, and mutual fund trades.

I was pleasantly surprised by my experience with Qtrade. Having gone through similar platforms like Wealthsimple and Questrade, I think I was expecting more of the same from a commission-free brokerage: a decent trading experience, but lacking features found in more premium platforms. But what I saw was a feature-rich desktop trading platform packed with free research and portfolio analytics tools. Other brokers may be better suited to brand new investors, and unlike Questrade, Qtrade cannot accommodate forex traders, but it might be the sweet spot for the average investor.

-

Minimum Deposit:

$0 -

Stock/ETF Trade Fee:

$0.00 -

Mutual Fund Trade Fee:

$0.00

| Fees | |

| Range of Investments | |

| Mobile App | |

| Web Platform | |

| Education | |

| Ease of Use |

Led by Jessica Inskip, Director of Investor Research, the StockBrokers.com research team collects thousands of data points across hundreds of variables. We evaluate features important to every kind of investor, including beginners, casual investors, passive investors, and active traders. We carefully track data on margin rates, trading costs, and fees to rate stock brokers across our proprietary testing categories.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on StockBrokers.com. Learn more about how we test.

Table of Contents

Pros & cons

Pros

- Commission-free trading on stocks, ETFs, and mutual funds.

- Quick and easy account opening.

- Visually appealing mobile trading app with advanced charting capability.

- Helpful portfolio analytics tools, like Portfolio Score, Portfolio Simulator, Portfolio Creator, and Goal Planning.

Cons

- Doesn’t support forex, CFD, crypto, or futures trading.

- Doesn’t offer a dedicated platform for advanced traders.

- No support for fractional share trading.

- The stock alerts feature is only available on the web-based platform, not the mobile app.

My top takeaways for Qtrade in 2026:

- Qtrade is Canada’s newest zero-commission brokerage, removing trading fees on stocks, ETFs, and mutual funds in October 2025.

- Qtrade only offers one trading platform, but it's robust, offering up to six order types, custom alerts (web-only), and impressive charting features.

- Investment options are more limited than some top platforms, with no support for forex, CFDs, crypto, futures, or precious metals.

- Qtrade is a self-directed investing platform and doesn’t offer any banking services at this time.

Qtrade fees

In October 2025, Qtrade announced it would introduce zero-commission trading on stocks, ETFs, and mutual funds. Options are also commission-free, although the per-contract fee remains. This move was likely necessary, given that Questrade, a key competitor, made the same move earlier in the year. And Wealthsimple, another popular trading platform, has operated under a no-fee model for several years. Here’s a closer look at how Qtrade’s fees break down:

Stocks, ETFs, and options: As mentioned, Qtrade no longer charges trading fees (a $0.75 per contract fee still applies to options). This move levels the playing field between Qtrade and competitors like Questrade and Wealthsimple. It gives the broker a leg up over higher-priced big bank rivals, such as TD Direct Investing, BMO Investorline, and Scotia iTrade, which charge as much as $9.99 per trade.

Account and inactivity fees: Qtrade doesn’t charge account administration fees for cash trading or Canadian-dollar registered accounts. It does, however, charge an annoying $15 quarterly fee for U.S. dollar-registered accounts, specifically RRSP, RRIF, and TFSA. The fee does not apply to FHSA accounts. While most bank brokerages charge account fees of up to $100 on registered accounts, this puts Qtrade behind Questrade, which doesn’t charge any account fees.

Account closure and transfer-out fees: I think it’s important to note that Qtrade handles account closures a bit differently from most brokers. If you transfer funds from Qtrade to another institution, you’ll have to pay the standard $150 transfer-out charge, which is pretty standard. However, if you close your account within the first year, you’ll be charged an additional $100. It’s something to be mindful of when opening an account.

| Feature |

Qtrade Direct Investing Qtrade Direct Investing

|

|---|---|

| Minimum Deposit | $0 |

| Inactivity fees | $0 |

| Stock/ETF Trade Fee | $0.00 |

| Mutual Fund Trade Fee | $0.00 |

| Bond Trade Fee | $1 |

| FX Currency Conversion Fee | N/A |

| Penny Stock Fee (OTC) | N/A |

| Account closure fee | $150 |

Range of investments

Qtrade’s investment choices will appeal to most investors. You can trade stocks listed on Canadian and U.S. exchanges. This includes over-the-counter (OTC) stocks. It offers thousands of commission-free mutual funds and ETFs, including crypto ETFs, options, bonds, new issues (IPO), and GICs. However, you can’t trade forex, CFDs, cryptocurrencies, precious metals, or futures, so it’s not suitable for dedicated forex, global, or crypto traders.

You can open just about any type of account, including Cash and Margin, and most registered accounts are available, such as RRSPs, Spousal RRSPs, RESPs, TFSAs, FHSAs, RRIFs, LIRAs, and LIFs. RDSPs are not available.

| Feature |

Qtrade Direct Investing Qtrade Direct Investing

|

|---|---|

| Bond trading | Yes |

| CFD trading | No |

| Crypto trading | No |

| ETF trading | Yes |

| Forex trading | No |

| Fractional Shares (Stocks) | No |

| Recurring investments | No |

| Futures trading | No |

| Options trading | Yes |

| Margin trading | Yes |

| Mutual Funds | Yes |

| Penny (OTC) stocks | Yes |

| Stock trading (CA) | Yes |

| Stock trading (U.S.) | Yes |

| Stock trading (Global) | No |

Mobile trading apps

Qtrade offers a single mobile trading platform available on both iOS and Android devices. I found it to be very impressive. In fact, I think it’s better than Questmobile, Questrade’s standard mobile trading platform. It’s more visually appealing and offers more order types (six vs. two). The security details screen provides a wealth of market data, including analyst insights, and offers more advanced charting than Questmobile, with seven chart types and over 20 indicators.

This screenshot displays an advanced chart view for Royal Bank (RY: TO) in a Candlestick+ format, with numerous indicators added, including Weighted Moving Average and Bollinger Bands. Qtrade offers more advanced charting capability in its mobile app than many competitors.

One notable drawback is that you can’t set stock alerts in the mobile app; you can only do so on the web-based platform. That said, Questmobile doesn’t offer that option, either. Additionally, it should be noted that Questrade offers a separate mobile app for advanced traders, Questrade Edge Mobile, which provides more functionality.

| Feature |

Qtrade Direct Investing Qtrade Direct Investing

|

|---|---|

| iPhone App | Yes |

| Android App | Yes |

Trading platforms

Qtrade lags some competitors by only offering a single web-based platform. There is no downloadable desktop version, no advanced trading platform for active traders, and no forex trading platform. But it makes up for it by offering far more features in the platform it does have than you’ll find in competing platforms from Wealthsimple and Questrade’s standard platform.

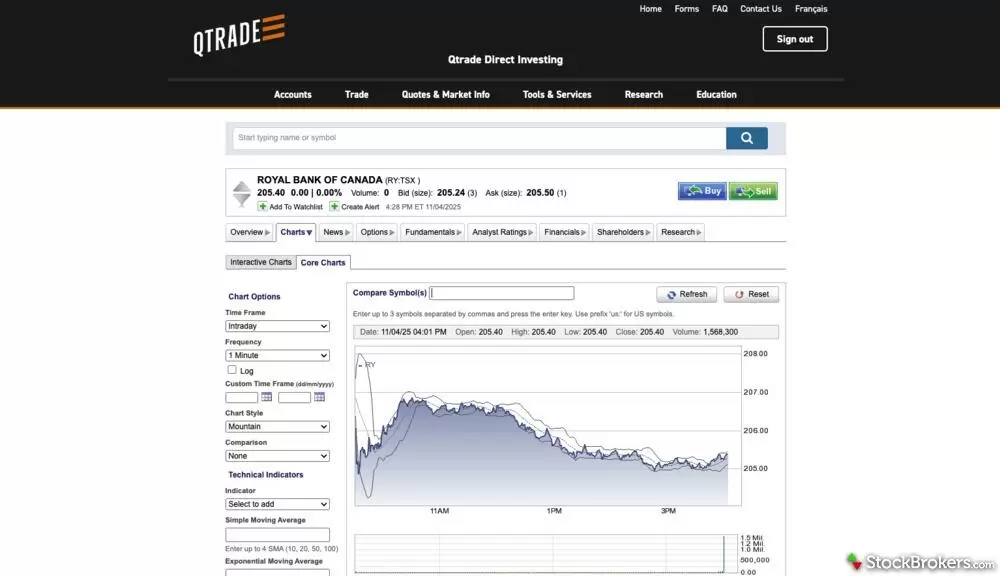

Questrade’s desktop securities view is not as modern-looking as some other platforms. It reminds me a bit of RBC Direct Investing’s user interface, which isn’t my favourite. That said, it’s very robust and gets the job done. You can quickly select various screens using the horizontal tabs above the chart.

Trading Features: Aside from the lack of fractional shares, Qtrade’s platform is well-equipped. Investors can choose from six order types, obtain real-time and Level II quotes, set basic and advanced watchlists, and set custom stock alerts (web platform only). Furthermore, Qtrade offers excellent advanced charting, with seven chart types and over 20 indicators. Its user interface is not quite as clean and modern-looking as some competitors, but I’ve seen worse.

Research: Qtrade offers a range of research tools for investors. In addition to standard information, such as market data and analyst recommendations, you can access dedicated technical, mutual fund, and ETF research tools, a stock screener, a calendar that displays earnings and split dates for companies, and a Morningstar library.

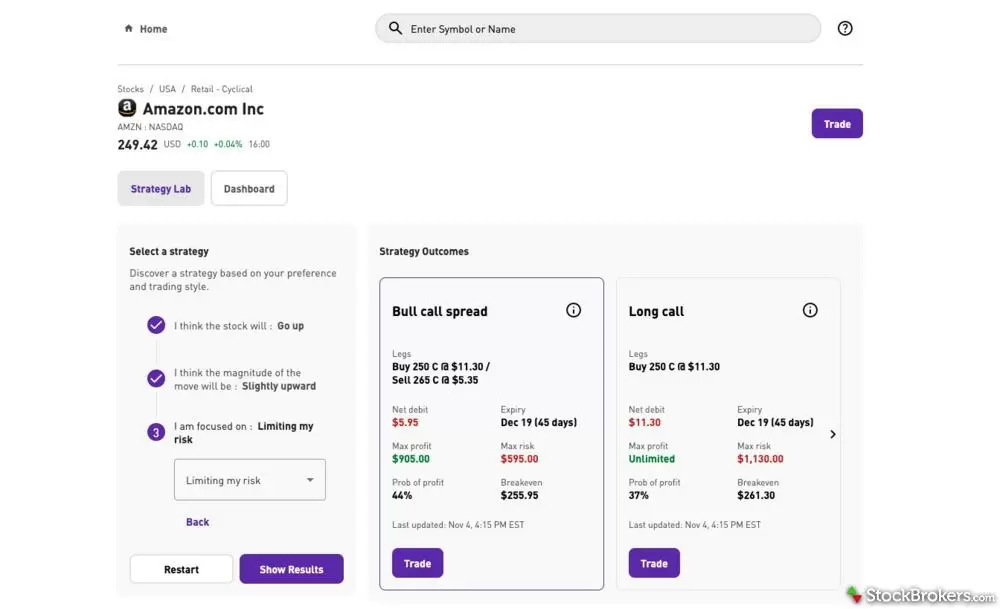

It also offers an Options Lab, which guides investors through various options strategies in a simple, step-by-step manner. The Options Lab is available to all investors, whether or not you trade options. Finally, Qtrade offers several portfolio analytics tools that let you evaluate your portfolio's health, including performance, risk exposure, fees, income level, and even your ESG score.

Qtrade Options Lab is an options research tool that’s available to all users, free of charge, whether or not you trade options in your account. While you can’t see all the functionality in this one screenshot, it asks you a few questions and then guides you through various option strategies, highlighting the potential risks and implications of each.

| Feature |

Qtrade Direct Investing Qtrade Direct Investing

|

|---|---|

| Desktop Trading Platform | No |

| Web Trading Platform | Yes |

| Stock Alerts | Yes |

| Charting - Indicators / Studies | 20 |

| Research - Stocks | Yes |

| Research - CFDs | No |

| Research - Mutual Funds | Yes |

| Research - ETFs | Yes |

| Research - Bonds | Yes |

| Trade Journal | No |

| Paper Trading | No |

| Screener | Yes |

Education

Qtrade’s Education Centre offers articles on a wide range of investment-related topics. I found plenty of articles on stocks and retirement planning, but fewer on ETFs and mutual funds. I like that they split the content for new and experienced investors, making it easier to find relevant articles.

They don’t offer regular webinars or courses. Still, they do have several free downloadable guides that take a deeper dive into topics like stock trading and TFSA investing than a standalone article would. If you’re new to investing, there’s enough there to get a good handle on the basics, but it would be nice if they offered more video content.

| Feature |

Qtrade Direct Investing Qtrade Direct Investing

|

|---|---|

| Education (Stocks) | Yes |

| Education (ETFs) | No |

| Education (Mutual Funds) | No |

| Education (Retirement) | Yes |

| Webinars | No |

| Videos | No |

| Interactive Learning - Quizzes | No |

| Courses | Yes |

Final thoughts

With the move to zero-commission trading, Qtrade has, in many respects, put itself on equal footing with Questrade, depending on the type of investor you are. However, Qtrade isn’t suitable for forex traders, and isn’t the best option if you’re looking for a dedicated advanced trading platform. If that’s what you need, you’ll be better off with Questrade, TD Direct Investing, or Interactive Brokers (IBKR).

But what I love about Qtrade is that its only trading platform is superior to many competitor offerings, including Wealthsimple and Questrade’s standard platform. Its mobile app may not be as intuitive as Wealthsimple’s, but that’s because it has far more features. And its advanced charts and research tools put Questrade to shame. Sure, you can get those features with Questrade’s active trader platform (Edge), but that’s overkill for the average investor.

If you’re an average investor who wants free stock and ETF trading without feeling like you’re giving up features, including robust research, then Qtrade might be the brokerage for you. If they could only add fractional shares, drop the annoying $15 quarterly fee on U.S. registered accounts, and add stock alerts to mobile, it might be close to perfect.

Qtrade Star Ratings

| Feature |

Qtrade Direct Investing Qtrade Direct Investing

|

|---|---|

| Overall |

|

| Fees |

|

| Range of Investments |

|

| Mobile App |

|

| Web Platform |

|

| Education |

|

| Ease of Use |

|

StockBrokers.com Review Methodology

Why you should trust us

Colin Graves, a contributing writer for StockBrokers.com, has over seven years of experience covering investments and Canadian brokerage platforms. Before becoming a full-time writer, Colin spent over two decades in the banking industry, including 15 years as a people manager with a Top 10 North American financial institution. He has completed both the Canadian Securities (CSC) and the Professional Financial Planning (PFPC) courses and has appeared in leading Canadian personal finance publications such as MoneySense, Money.ca, MapleMoney, and The College Investor.

Blain Reinkensmeyer, co-founder of StockBrokers.com, has been investing and trading for over 25 years. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. Today, Blain is widely respected as a leading expert on finance and investing, specifically the U.S. online brokerage industry. Blain has been quoted in The New York Times, The Wall Street Journal, Forbes, and Fast Company, among others. Blain created the original scoring rubrics for StockBrokers.com and oversees all testing and rating methodologies.

How we tested

- We used our own brokerage accounts for testing.

- We collected hundreds of data points across the brokers we review.

- We tested each online broker's website, desktop platforms, and mobile app, where applicable.

- We maintained strict editorial independence; brokers cannot pay for inclusion or a higher rating.

Our research team meticulously collected data on every feature of importance to a wide range of customer profiles, including beginners, casual investors, passive investors, and active traders. We carefully track variables like margin rates, trading costs, fees, and platform features and use them to help rate brokers across a range of categories measuring ease of use, range of investments, education, and more.

At StockBrokers.com, our reviewers use a variety of computing devices to evaluate platforms and tools. Our reviews and data collection were conducted using the following devices: iPhone SE running iOS 17.5.1, MacBook Pro M1 with 8 GB RAM running the current MacOS, and a Dell Vostro 5402 laptop i5 with 8 GB RAM running Windows 11 Pro.

Each broker was evaluated and scored on over 60 different variables across six key categories for Canadian investors: Range of Investments, Platforms & Tools, Mobile Trading, Education, Ease of Use, and Overall. Learn more about how we test.

Read next

- Best Brokers for Penny Stock Trading of 2026

- Best Futures Trading Platforms for 2026

- Best Stock Trading Apps for 2026

- Best Stock Brokers for 2026

- Best Paper Trading Apps & Platforms for 2026

- Best Day Trading Platforms of 2026 for Beginners and Active Traders

- Best Options Trading Platforms for 2026

- Best Stock Trading Platforms for Beginners of 2026

More Guides

Popular Stock Broker Reviews

About Qtrade Direct Investing

Founded in 2000, Qtrade is based in Vancouver and serves investors across Canada. The platform is regulated by the Investment Industry Regulatory Organization of Canada (IIROC) and is a member of the Canadian Investor Protection Fund (CIPF). Qtrade offers commission-free trading on stocks, ETFs, and mutual funds, and also operates a robo-advisor service, Qtrade Guided Portfolios.

Compare Qtrade Direct Investing

See how Qtrade Direct Investing stacks up against other brokers.

Show all