TD Direct Investing Review

TD Direct Investing has been my primary brokerage for more than a decade. I’ve opened and tested brokerage accounts with the top Canadian brokers, and TD Direct still stands out to me as the best full-service option in Canada, largely due to the strength of its WebBroker platform.

That said, it’s also one of the priciest brokerages in Canada. And with rivals like Qtrade and Questrade moving to commission-free trading, TD’s fees are increasingly hard to ignore. In my TD Direct review, I’ll walk through TD Direct Investing’s features, pricing, pros and cons, and let you know who I think will get the most value from its offering.

-

Minimum Deposit:

$0 -

Stock/ETF Trade Fee:

$9.99 -

Mutual Fund Trade Fee:

$0.00

| Fees | |

| Range of Investments | |

| Mobile App | |

| Web Platform | |

| Education | |

| Ease of Use |

Led by Jessica Inskip, Director of Investor Research, the StockBrokers.com research team collects thousands of data points across hundreds of variables. We evaluate features important to every kind of investor, including beginners, casual investors, passive investors, and active traders. We carefully track data on margin rates, trading costs, and fees to rate stock brokers across our proprietary testing categories.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on StockBrokers.com. Learn more about how we test.

Table of Contents

Pros & cons

Pros

- One of the best trading platforms in the industry.

- Wide range of investment and account types.

- Bank and invest from the same mobile app.

- Now offers fractional shares.

Cons

- High trading fees.

- Charges administration fees on registered accounts (waivable).

- Limited charting on TD app.

- Doesn’t offer forex or crypto trading.

My top takeaways for TD Direct Investing in 2026:

- TD Direct Investing is hands-down Canada’s premier trading platform, but at up to $9.99/trade, it’s going to cost you.

- Its primary trading platform, WebBroker, is packed with trading and research tools, including in-depth charting features and a robust stock screener.

- The mobile trading app is the same app TD customers use for their banking, giving you a single view of all of your TD accounts, and making it easy to move money back and forth.

TD Direct Investing fees

Like other big bank brokers, TD Direct Investing is one of the pricier trading platforms in Canada. It charges as much as $9.99 per trade for stocks and ETFs, and a $25 quarterly administration fee on registered accounts, though the cost is waivable. With popular brokerages like Questrade and Qtrade moving away from trading fees in 2025, platforms like TD seem more expensive than ever.

Stocks, ETFs, and options: For Canadian and U.S. stocks, TD charges a flat fee of $9.99 per trade for one full share or more. Options trades are $9.99 + $1.25 per contract. If you place 150 or more trades per quarter (per household), you can qualify for active trader pricing of $7.00, or $7.00 + $1.25 per options contract. TD automatically determines your eligibility for active trader pricing based on your activity from the previous three months.

Mutual funds: TD is an excellent choice for mutual fund investors, as it doesn’t charge commissions on buy or sell transactions and provides access to thousands of funds. Not all brokerages are as mutual-fund friendly. For example, Questrade charges $9.95 per trade, and Wealthsimple doesn’t offer them at all.

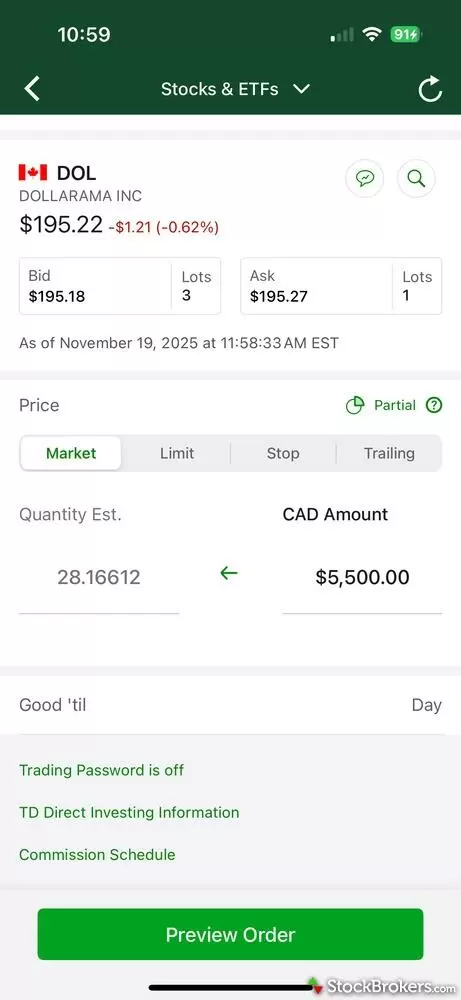

Fractional shares: TD is one of the only brokerages in Canada that supports fractional share trading. This allows you to purchase less than a full share of a stock or ETF, which can be handy for expensive stocks or when you don’t have the exact cash to buy a full share. There is a reduced trading fee of $1.99 when purchasing less than a full share.

Account and inactivity fees: Most of the big bank brokers charge administration fees for registered accounts, and TD Direct Investing is no different. It charges a $25 quarterly maintenance fee on all registered accounts, except for the Registered Disability Savings Account (RDSP). However, the fee is waivable if your household account balance is $15,000 or greater, you set up pre-authorized contributions of $100 or more on at least one household account, you complete three or more commissionable trades among your household accounts over the preceding quarter, or hold an RDSP among your household accounts.

| Feature |

TD Direct Investing TD Direct Investing

|

|---|---|

| Minimum Deposit | $0 |

| Inactivity fees | $0 |

| Stock/ETF Trade Fee | $9.99 |

| Mutual Fund Trade Fee | $0.00 |

| Bond Trade Fee | |

| FX Currency Conversion Fee | |

| Penny Stock Fee (OTC) | |

| Account closure fee | $150 |

Range of investments

TD Direct Investing offers a wide range of investments and account types. You can trade stocks, ETFs, mutual funds, options, bonds, GICs, money market investments, and new issues. You can also buy and sell international stocks on a large number of global exchanges, although trades must be placed through an investment representative over the telephone. TD Direct Investing doesn’t offer forex, CFDs, or crypto (only Crypto ETFs).

TD Direct Investing offers just about every account type imaginable, including Cash and Margin, RRSPs, TFSAs, FHSAs, RESPs, RRIFs, LIRAs, LIFs, and RDSPs. You can also open non-personal accounts for sole proprietorships, corporations, trusts, non-profits, etc.

| Feature |

TD Direct Investing TD Direct Investing

|

|---|---|

| Bond trading | Yes |

| CFD trading | No |

| Crypto trading | No |

| ETF trading | Yes |

| Forex trading | No |

| Fractional Shares (Stocks) | Yes |

| Recurring investments | No |

| Futures trading | No |

| Options trading | Yes |

| Margin trading | Yes |

| Mutual Funds | Yes |

| Penny (OTC) stocks | Yes |

| Stock trading (CA) | Yes |

| Stock trading (U.S.) | Yes |

| Stock trading (Global) | Yes |

Mobile trading app

TD’s standard mobile trading app is simply called the TD App, and it's the same app that TD customers use for their day-to-day banking. It allows you to monitor all of your TD accounts in a single view, and transfer funds to and from your TD Direct Investing accounts with ease. It’s one of the perks of being able to do your banking and investing under the same roof, and something most non-bank brokers can’t offer.

When it comes to trading features, the TD app is one of the best out there. It’s fully integrated with Web Broker, TD Direct Investing’s web trading platform, and includes a customizable home screen, free real-time snap quotes, and access to company profiles, market news, and detailed analyst ratings. It supports no fewer than six order types: Market, Limit, Stop Market, Stop Limit, Trailing Stop Market, and Trailing Stop Limit, and unlike Questrade and Qtrade, you can set custom stock alerts in the app.

The TD app is intuitive and easy to use. It includes features not offered by other brokerage apps, including fractional share trading, six different order types, and the ability to set custom alerts.

Charting features are decent for a mobile app. You can switch between mountain and candlestick charts and change your timeframe views, but it lacks the indicators and compare tools found in Web Broker. It also doesn’t stand up to Qtrade’s mobile charting capabilities, which are phenomenal (see my Qtrade review here).

If you’re an active trader looking to maximize your mobile trading experience, you can download TD Direct Investing’s Advanced Dashboard and Active Trader apps, which integrate with their advanced web trading platforms.

| Feature |

TD Direct Investing TD Direct Investing

|

|---|---|

| iPhone App | Yes |

| Android App | Yes |

Trading platforms

TD Direct Investing has trading platforms for every type of self-directed investor. WebBroker is its main platform, which caters to the largest group of investors. Active traders can opt for TD Advanced Dashboard and/or Active Trader, which are premium, paid platforms. And beginners looking to dip their toes into the trading waters can choose TD Easy Trade, a mobile-only platform that offers 50 free stock trades per year, along with free TD ETFs. Here’s a closer look at each platform.

WebBroker

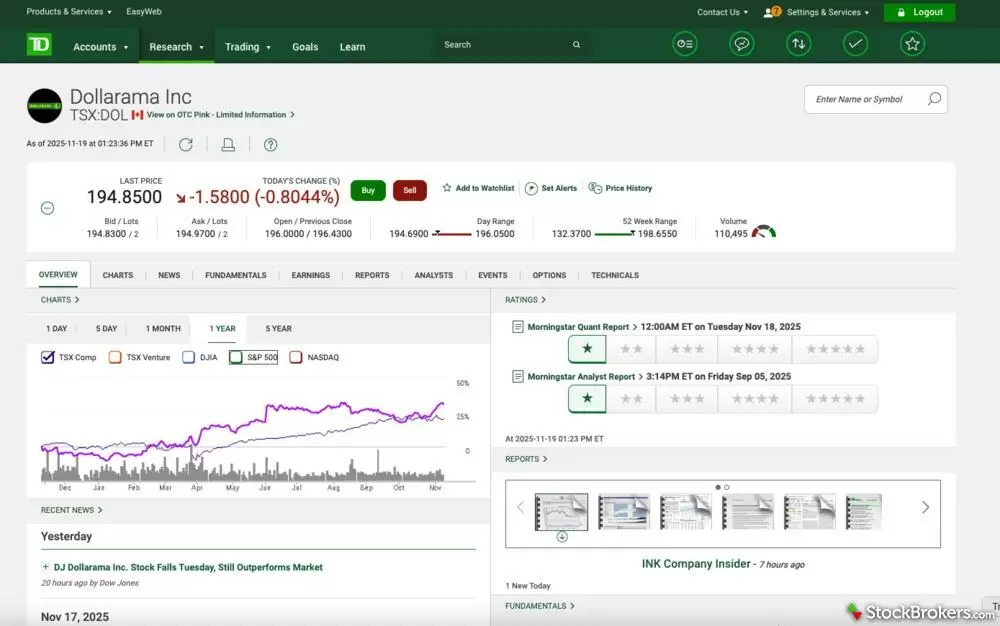

WebBroker, TD's primary trading platform, is incredibly powerful and offers more than enough features to satisfy most investors. You can create watchlists and set custom alerts, and customize your homepage. WebBroker’s stock view screen (see image below) is impressive, putting more information at your fingertips than any other platform I’ve used.

TD Direct Investing’s stock view screen offers a wealth of information. Scroll down, and you’ll see recent market news, a list of key fundamentals, and company information. Click on the horizontal tabs near the top of the screen, and you’ll have access to impressive charting tools, various reports, analyst ratings, and technical research.

With one click, you can access market news, detailed fundamentals, analyst ratings, options details, technical analysis, and advanced charts. You can switch between at least nine different charts, add dozens of indicators, and compare a stock’s performance against other companies and a myriad of indices. You can even add notes to your charts and save them for future use.

Perhaps the best feature WebBroker offers is one of its latest: fractional share trading. It’s one of the only brokerages in Canada that allows you to buy or sell less than one full share of a stock or ETF. The fee for doing so is $1.99.

Each WebBroker account comes with a Canadian and U.S. Dollar component. You can easily transfer cash from your Canadian account into your USD account, where you can purchase and hold U.S.-denominated investments. There is no additional cost for a USD account, but cash transfers are subject to foreign currency exchange.

Advanced Dashboard

If you’re an active trader looking for the most powerful trading tools, you can subscribe to TD Direct Investing’s Advanced Dashboard. This powerful trading platform, which is available for the desktop and mobile app, unlocks streaming Level I and Level II market data, advanced order types, like conditional orders, multi-leg options strategies, more than 100 technical and fundamental indicators, over 50 drawing tools and technical studies, and much more.

Pricing starts at $29/month for Level I real-time streaming, with add-on pricing for additional streaming options. The $29 monthly fee is waived if you hold over $500,000 in assets and/or place 30 or more trades per quarter.

TD Active Trader

TD Active Trader is an advanced trading platform designed for active U.S. options traders. In fact, you can only trade U.S. stocks and options on Active Trader. It offers advanced order types with Advanced Buying Power calculations, contingent orders, multi-leg options strategies (up to four legs), streaming market data, and an extensive list of technical studies and drawings. Like Advanced Dashboard, Active Trader has its own mobile app. Pricing is $32/month, or free if you place more than 30 trades per quarter.

TD Easy Trade

TD Easy Trade is a mobile-only trading platform that’s completely separate from WebBroker. Launched in early 2022, it’s designed for newer investors looking for a simple and affordable way to start trading stocks. The best part about the app is the 50 free stock trades per year, fractional share support, and commission-free TD ETFs. There are also several hours worth of educational videos built into the app.

But TD Easy Trade has shortcomings. While TD has some solid ETFs, I don’t like that you can’t buy popular ETFs from other companies, like Vanguard, iShares, or BMO. It’s also light on market research tools, and only supports four account types: Cash, RRSP, TFSA, and FHSA.

| Feature |

TD Direct Investing TD Direct Investing

|

|---|---|

| Desktop Trading Platform | No |

| Web Trading Platform | Yes |

| Stock Alerts | Yes |

| Charting - Indicators / Studies | 100 |

| Research - Stocks | Yes |

| Research - CFDs | No |

| Research - Mutual Funds | Yes |

| Research - ETFs | Yes |

| Research - Bonds | Yes |

| Trade Journal | |

| Paper Trading | No |

| Screener | Yes |

Research

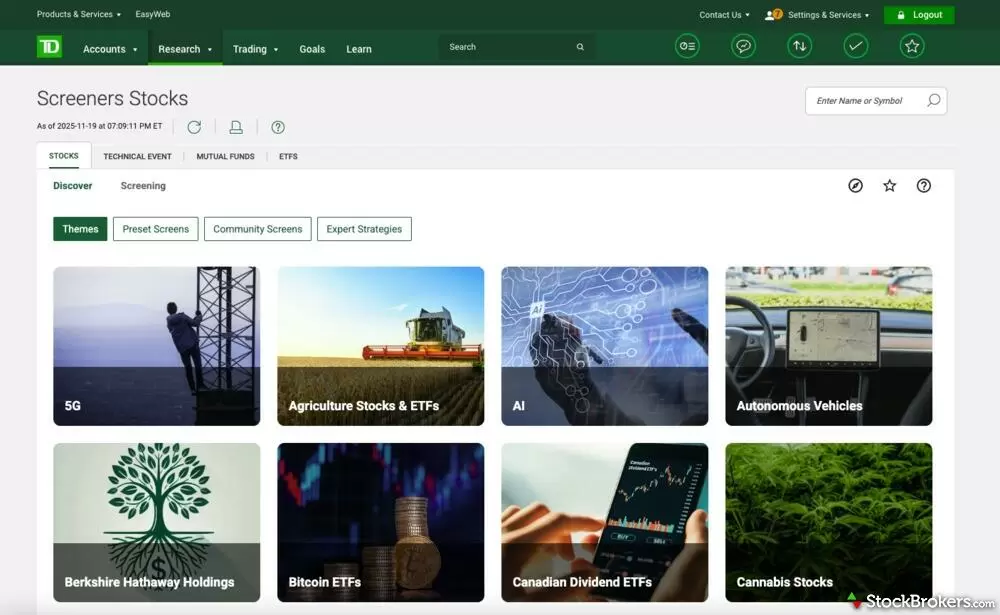

One of TD Direct Investing’s greatest strengths is how much research capability is built into WebBroker, its main trading platform. In addition to detailed market news, powerful charting, fundamentals, and analyst ratings, all investors get free access to a stock screener and dedicated ETF, mutual fund, and technical research tools. And if you need more, the Advanced Dashboard and Active Trader platforms have even more to offer.

TD includes a powerful stock screening tool, which is free for all investors. You can filter new stock ideas by industry, top performers, top dividends, value stocks, upside momentum, and many more. You can also screen stocks based on market cap, stock price, debt-to-equity ratio, dividend yield, EPS, etc.

| Feature |

TD Direct Investing TD Direct Investing

|

|---|---|

| Research - Stocks | Yes |

| Research - Bonds | Yes |

| Research - CFDs | No |

| Research - ETFs | Yes |

| Research - Mutual Funds | Yes |

Education

TD Direct Investing’s educational tools are on par with most other Canadian brokers. They have lots of learning material on stocks, but not as much for ETFs, mutual funds, or retirement planning. I counted fewer than 10 pieces of content for each of those topics. One area where it shines is webinars. As I write this, there are no fewer than five webinars scheduled over the next 30 days, and I counted over 200 archived webinars in the Learning Centre.

| Feature |

TD Direct Investing TD Direct Investing

|

|---|---|

| Education (Stocks) | Yes |

| Education (ETFs) | No |

| Education (Mutual Funds) | No |

| Education (Retirement) | No |

| Webinars | Yes |

| Videos | No |

| Interactive Learning - Quizzes | No |

| Courses | No |

Banking Services

While TD Direct Investing doesn’t offer its own banking products, it’s a division of TD Bank Financial Group, which is Canada’s second-largest financial institution. This means that you can open a wide range of banking products and services through TD, from chequing and savings accounts to credit cards and mortgages, and manage them on the same mobile app you use to do your investing. This also means that you can transfer funds from your bank account to your TD Direct Investing account with a couple of clicks.

Final thoughts

TD Direct Investing offers a premium trading experience, but at a premium price. It’s best suited for buy-and-hold investors with larger portfolios who can avoid account maintenance fees, and for active traders who are willing to pay more for industry-leading trading and research tools.

If you’re a new investor or fee-conscious, you’ll be better served by a commission-free broker such as Questrade or Qtrade. And while TD Easy Trade is an option, many beginners quickly outgrow its limitations. Wealthsimple is also an excellent low-cost alternative, especially for investors who want a simple, user-friendly platform with $0 commissions.

TD Direct Investing Star Ratings

| Feature |

TD Direct Investing TD Direct Investing

|

|---|---|

| Overall |

|

| Fees |

|

| Range of Investments |

|

| Mobile App |

|

| Web Platform |

|

| Education |

|

| Ease of Use |

|

StockBrokers.com Review Methodology

Why you should trust us

Colin Graves, a contributing writer for StockBrokers.com, has over seven years of experience covering investments and Canadian brokerage platforms. Before becoming a full-time writer, Colin spent over two decades in the banking industry, including 15 years as a people manager with a Top 10 North American financial institution. He has completed both the Canadian Securities (CSC) and the Professional Financial Planning (PFPC) courses and has appeared in leading Canadian personal finance publications such as MoneySense, Money.ca, MapleMoney, and The College Investor.

Blain Reinkensmeyer, co-founder of StockBrokers.com, has been investing and trading for over 25 years. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. Today, Blain is widely respected as a leading expert on finance and investing, specifically the U.S. online brokerage industry. Blain has been quoted in The New York Times, The Wall Street Journal, Forbes, and Fast Company, among others. Blain created the original scoring rubrics for StockBrokers.com and oversees all testing and rating methodologies.

How we tested

- We used our own brokerage accounts for testing.

- We collected hundreds of data points across the brokers we review.

- We tested each online broker's website, desktop platforms, and mobile app, where applicable.

- We maintained strict editorial independence; brokers cannot pay for inclusion or a higher rating.

Our research team meticulously collected data on every feature of importance to a wide range of customer profiles, including beginners, casual investors, passive investors, and active traders. We carefully track variables like margin rates, trading costs, fees, and platform features and use them to help rate brokers across a range of categories measuring ease of use, range of investments, education, and more.

At StockBrokers.com, our reviewers use a variety of computing devices to evaluate platforms and tools. Our reviews and data collection were conducted using the following devices: iPhone SE running iOS 17.5.1, MacBook Pro M1 with 8 GB RAM running the current MacOS, and a Dell Vostro 5402 laptop i5 with 8 GB RAM running Windows 11 Pro.

Each broker was evaluated and scored on over 60 different variables across six key categories for Canadian investors: Range of Investments, Platforms & Tools, Mobile Trading, Education, Ease of Use, and Overall. Learn more about how we test.

Read next

Explore further guidance on trading in Canada.

- Best Forex Brokers in Canada for 2026

- Questrade Review

- Best Canadian Brokerage Firms in 2026

- Wealthsimple Review

- Qtrade Review

- Interactive Brokers Review

About TD Direct Investing

Founded in 1984, TD Direct Investing is a leading Canadian online brokerage regulated by IIROC and protected by CIPF. As part of TD Bank Group, it offers millions of investors access to powerful trading platforms, extensive research tools, and a wide range of investment products.