Questrade vs Wealthsimple: 2026 Comparison

Led by Jessica Inskip, Director of Investor Research, the StockBrokers.com research team collects thousands of data points across hundreds of variables. We evaluate features important to every kind of investor, including beginners, casual investors, passive investors, and active traders. We carefully track data on margin rates, trading costs, and fees to rate stock brokers across our proprietary testing categories.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on StockBrokers.com. Learn more about how we test.

Questrade and Wealthsimple are two of Canada’s most popular (and talked about) online brokerages. For years, Wealthsimple dominated the low-cost narrative as Canada’s first commission-free trading platform. While known for its free ETF purchases, Questrade catered to more experienced investors. However, all of that changed in early 2025, when Questrade moved to commission-free trading.

As we head into 2026, how do these two brokerages stack up? In this updated comparison, I’ll explain how Wealthsimple and Questrade compare across fees, investment options, trading platforms, mobile apps, and educational tools, to help you decide which brokerage is best for you.

Questrade vs Wealthsimple

- Minimum Deposit: $0

- Stock/ETF Trade Fee: $0.00

- Mutual Fund Trade Fee: $9.95

- Commission-free trading

- No account or inactivity fees

- Commission-free fractional trading

- Must pay for Questrade Plus to set up custom alerts

- Steep trading fee of $9.95 for mutual funds

- Limited educational content

- Minimum Deposit: $0

- Stock/ETF Trade Fee: $0.00

- Mutual Fund Trade Fee: $0.00

Wealthsimple is an excellent broker choice if you are a passive investor in Canada or the U.K. and seeking an innovative robo-advisor solution for automated investing. However, due to limited research and lack of trading tools, it won’t be enough if you want to actively trade. Read full review

- No fee trading on stocks and ETFs

- Quick and easy account opening process

- Offers a simple trading platform

- No advanced trading platform or research tools

- High $10/monthly fee for a USD account

- Limited investment offering

Top takeaways for Questrade in 2026

- Questrade has fully embraced zero-commission trading, eliminating fees on stocks, ETFs, and options, starting in February 2025.

- Opening an account is fast and straightforward, with the entire setup and funding process taking just a few minutes.

- Investors can buy fractional shares of U.S. stocks and ETFs, a rare perk in Canada. Unfortunately, the feature isn’t yet available for Canadian securities.

- Questrade is one of the few Canadian brokerages that offers a dedicated global trading platform for forex and CFD traders.

- Active traders can unlock additional investing tools with Questrade Plus ($11.95/month)

Top takeaways for Wealthsimple in 2026

- Wealthsimple was the first to launch zero-commission investing in Canada, allowing users to invest in stocks, ETFs, and options on major North American markets for free.

- The trading platform is clean and beginner-friendly, but it falls short in advanced charting and in-depth research compared to rivals like Questrade or Qtrade.

- The $10 monthly charge for a USD-denominated account feels expensive and somewhat contradicts Wealthsimple’s otherwise low-cost positioning.

- Wealthsimple supports fractional share trading for both Canadian and U.S. equities.

- Wealthsimple customers can manage all of their Wealthsimple accounts, including stock trading, chequing/savings, automated investing, and crypto, in the same app.

Fees

When Wealthsimple launched its direct investing platform in 2019, it became Canada’s first commission-free online brokerage. Questrade joined Wealthsimple in early 2025 by removing all commissions on stock, ETF, and options trades, though it still charges a $9.95 fee for mutual fund trades. For access to more advanced trading tools (optional), you can sign up for Questrade Plus for $11.95 monthly. Unlike the big bank brokers, neither Wealthsimple nor Questrade charges administration fees on any of their accounts.

| Feature |

Questrade Questrade

|

Wealthsimple Wealthsimple

|

|---|---|---|

| Minimum Deposit | $0 | $0 |

| Inactivity fees | $0 | $0 |

| Stock/ETF Trade Fee | $0.00 | $0.00 |

| Mutual Fund Trade Fee | $9.95 | $0.00 |

| Bond Trade Fee | $0 | |

| FX Currency Conversion Fee | 1.50% | 1.50% |

| Penny Stock Fee (OTC) | $0.000005/share | N/A |

| Account closure fee | $150 | $0 |

Where Questrade stands out

As of February 2025, Questrade removed all commissions on stock, ETF, and options trades. Comparing Wealthsimple vs Questrade, you'll find that Questrade is the cheaper (and more flexible) option if you want to trade U.S.-listed securities, because all registered savings plans allow you to hold Canadian and U.S. cash. While you have to pay a 1.5% fee to convert CAD to USD, you can execute the currency exchange when rates are favourable, not just when you need to place a trade. And when you sell a U.S.-listed stock or ETF, the cash will remain in USD until you decide to place another trade or convert back to Canadian dollars.

This Questrade screenshot highlights their zero-commission self-directed investing platform. It offers $0 commission trading on stocks and ETFs, low-cost options trading, and no hidden fees, positioning Questrade as a powerful, cost-effective choice for DIY investors.

Wealthsimple lets you do the same thing, but they treat their U.S. account as an upgrade and charge a $10 monthly fee. To avoid the fee, you need to hold at least $100,000 with Weathsimple to qualify for a Premium membership.

Where Wealthsimple stands out

Wealthsimple remains one of the lowest-cost online brokerages in Canada. It offers free stock, ETF, and options trades, and doesn’t charge any account administration fees. Another Wealthsimple benefit is that it pays interest of up to 2.25% APY on your uninvested cash, something most brokers, including Questrade, don’t offer.

This screenshot promotes Wealthsimple’s commission-free trading experience, highlighting the ability to buy and sell thousands of stocks, ETFs, and options without trading fees. It emphasizes Wealthsimple’s simple, user-friendly platform.

Verdict

Winner: Questrade

Wealthsimple no longer has a cost advantage over Questrade. Questrade is the cheaper (and more flexible) option, particularly if you want to trade U.S.-listed securities. Wealthsimple lets you do the same thing, but they treat their U.S. account as an upgrade and charge a $10 monthly fee.

| Feature |

Questrade Questrade

|

Wealthsimple Wealthsimple

|

|---|---|---|

| Fees |

|

|

Range of Investments

On its self-directed platform, Wealthsimple’s investment offering is limited to stocks, ETFs, and options listed on the major North American markets. You can’t buy mutual funds, GICs, bonds, forex, etc. Questrade, on the other hand, offers a much broader range of investment choices, including fixed-income products, forex, CFDs, precious metals, and IPOs. It doesn’t offer crypto trading, aside from various crypto ETFs.

Both brokerages offer a wide range of account types, including RRSPs (Individual and Spousal), TFSAs, RRIFs, LIRAs, LIFs, RESPs, and FHSAs. Neither brokerage offers a Registered Disability Savings Account (RDSP).

| Feature |

Questrade Questrade

|

Wealthsimple Wealthsimple

|

|---|---|---|

| Bond trading | Yes | No |

| CFD trading | Yes | No |

| Crypto trading | No | Yes |

| ETF trading | Yes | Yes |

| Forex trading | Yes | No |

| Fractional Shares (Stocks) | Yes | Yes |

| Recurring investments | No | Yes |

| Futures trading | No | No |

| Options trading | Yes | Yes |

| Margin trading | Yes | Yes |

| Mutual Funds | Yes | No |

| Penny (OTC) stocks | Yes | Yes |

| Stock trading (CA) | Yes | Yes |

| Stock trading (U.S.) | Yes | Yes |

| Stock trading (Global) | No | Yes |

Where Questrade stands out

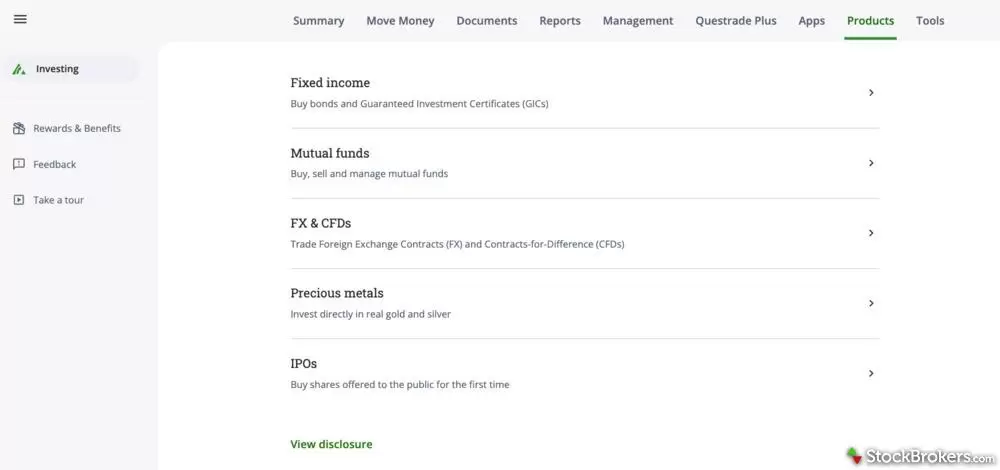

Questrade offers a wide range of investments beyond stocks, ETFs, and options. Fixed-income investors can choose from an extensive selection of bonds, GICs, and money market instruments, and global traders can place forex and CFD trades. In fact, Questrade offers a dedicated global trading platform, Questrade Global, for FX and CFD trading.

This screenshot highlights the wide range of investment products available through Questrade, beyond stocks and ETFs. Investors can also choose from fixed-income products such as bonds and GICs, mutual funds, FX and CFDs, precious metals, and IPO opportunities. It showcases Questrade as a full-service platform for building and diversifying portfolios.

Where Wealthsimple stands out

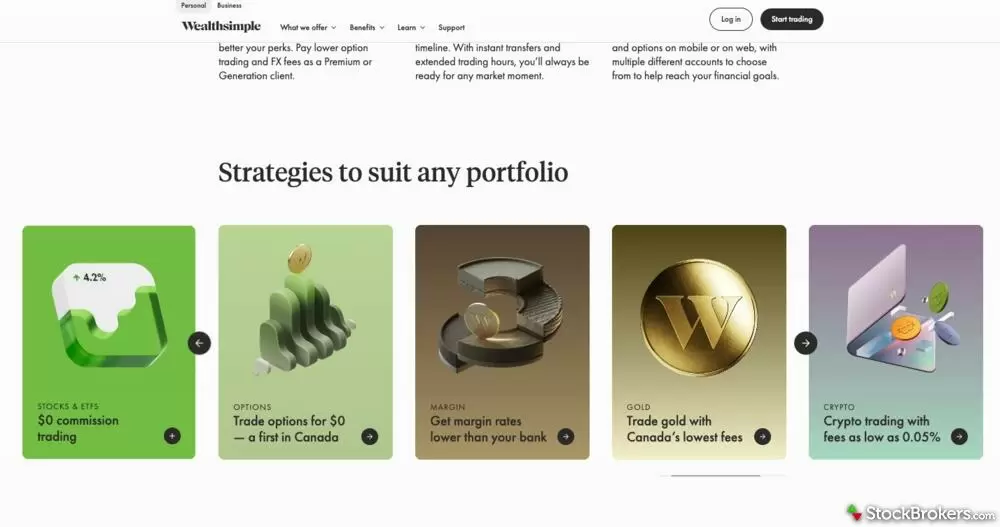

While Wealthsimple has a narrower range of investment options than most brokerages, including Questrade, it does offer crypto trading. You have to open a separate account, called Wealthsimple Crypto, but you can trade over 140 different coins, including Bitcoin, Ethereum, and Solana. You can also save on fees by swapping coins and earn up to 9% per year through staking.

In addition to stocks and ETFs, Wealthsimple offers options trading, margin accounts, gold, and cryptocurrency trading. Overall, Its investment range is narrower than Questrade’s, as it doesn’t provide fixed-income products, mutual funds, or global trading, including FX and CFDs.

Verdict

Winner: Questrade

Questrade offers a broader range of investments than most Canadian brokerages. Wealthsimple has a narrower range of investment options than most brokerages, including Questrade, but it does offer crypto trading.

| Feature |

Questrade Questrade

|

Wealthsimple Wealthsimple

|

|---|---|---|

| Range of Investments |

|

|

Mobile App

Wealthsimple’s mobile app is designed for beginner traders and includes everything you need to place stock and ETF trades on the go. This includes the ability to create watchlists and set basic alerts. Unfortunately, it doesn’t offer advanced charts or any research tools, beyond basic company fundamentals and market news. It does support four order types: Market, limit, stop market, and stop limit.

Questrade offers two mobile trading apps: Questmobile and Edge Mobile, with the latter geared to active traders. Questmobile offers more research tools than the Wealthsimple app, but surprisingly, it has fewer order types and doesn’t offer custom alerts. It’s a solid app, but it lags class-leading mobile apps from brokers like Qtrade and TD Direct Investing. Both the Questmobile and Wealthsimple apps offer limited charting capability.

| Feature |

Questrade Questrade

|

Wealthsimple Wealthsimple

|

|---|---|---|

| iPhone App | Yes | Yes |

| Android App | Yes | Yes |

Where Questrade stands out

Questmobile offers more in-depth research than the Wealthsimple app. This includes third-party tools, such as TipRanks sentiment analysis and Bulls Say, Bears Say Insights from Seeking Alpha. You can build personalized watchlists and sort stocks by category, such as Best Rated, Most Active, Top Gainers, etc. Questrade has recently added overnight trading, so you can place trades after hours.

Questrade's mobile watchlist allows you to create multiple custom watchlists or view stocks by categories, such as Top Gainers, Most Active, Best, Rates, and Most Rated.

Where Wealthsimple stands out

Wealthsimple’s mobile app stands out for its simplicity and ease of use. Surprisingly, it offers more order types than Questrade’s standard app, along with custom alerts, which is a paid feature with Questrade. I also like how you can manage your other Wealthsimple accounts, including chequing or Wealthsimple Invest (robo-advisor), from the same app.

Wealthsimple’s mobile stock view can be switched between light and dark mode, and displays a stock’s historical performance and key fundamentals. You can easily add a stock to your watchlist by tapping on the star icon in the top right corner, or set custom alerts by tapping on the bell icon. Unfortunately, advanced charts are not available on the mobile platform.

Verdict

Winner: Questrade

Questmobile offers more in-depth research than the Wealthsimple app. Wealthsimple’s mobile app stands out for its simplicity and ease of use.

| Feature |

Questrade Questrade

|

Wealthsimple Wealthsimple

|

|---|---|---|

| Mobile App |

|

|

Trading Platforms

When comparing Questrade vs Wealthsimple, I found that their trading platforms don't have a lot in common. Wealthsimple offers a single web-based platform that closely resembles its mobile app; it’s clean and beginner-friendly, with four available order types. You can build watchlists, easily switch between stock and options trading with a single click, and trade fractional shares. There are some advanced charting features on the web platform, but overall, trading tools are limited.

If you include its two mobile apps, Questrade has no fewer than five trading platforms: a standard trading platform for everyday investors; Questrade Edge, which is a dedicated active trader platform; and Questrade Global, a dedicated forex and CFD trading platform. Questrade’s standard trading platform, which is its most popular, is more robust than Wealthsimple’s. That said, it has its shortcomings. For example, it offers only two chart types (line and candle) and only provides fractional shares for U.S. stocks and ETFs.

| Feature |

Questrade Questrade

|

Wealthsimple Wealthsimple

|

|---|---|---|

| Desktop Trading Platform | Yes | No |

| Web Trading Platform | Yes | Yes |

| Stock Alerts | Yes | Yes |

| Charting - Indicators / Studies | 24 | |

| Research - Stocks | Yes | No |

| Research - CFDs | Yes | No |

| Research - Mutual Funds | Yes | No |

| Research - ETFs | Yes | No |

| Research - Bonds | Yes | No |

| Trade Journal | Yes | No |

| Paper Trading | Yes | No |

| Screener | Yes | No |

Where Questrade stands out

With multiple trading platforms, Questrade caters to a much broader range of investors. But one of its main advantages over Wealthsimple is that it doesn’t charge you $10/month for holding a USD-denominated account. This is significant because it affects so many investors who wish to trade U.S.-listed stocks and ETFs.

Where Wealthsimple stands out

Wealthsimple gets the nod over Questrade for ease of use. Its sole trading platform is incredibly intuitive, but that’s partly because it offers limited investment options and trading tools. That said, it has enough features to satisfy its target market of beginner traders. Another Wealthsimple advantage is that it offers fractional share trades on Canadian stocks and ETFs, whereas Questrade only supports fractional shares for U.S. securities, for now.

Wealthsimple offers some advanced charting on its web platform, courtesy of TradingView. Volume, relative strength index, and various moving average indicators are included, and you can also toggle to a candlestick chart view.

Verdict

Winner: Wealthsimple for beginners, Questrade for all investor types.

| Feature |

Questrade Questrade

|

Wealthsimple Wealthsimple

|

|---|---|---|

| Web Platform |

|

|

Education

Questrade offers some articles on the basics of various registered plans, like RRSPs, TFSAs, and FHSAs, but most of its content deals with navigating Questrade’s various trading platforms. Wealthsimple provides a similar number of articles in its Learning Centre. I like that it offers helpful calculators for RRSPs, TFSAs, and retirement planning, but overall, neither brokerage stands out for its learning tools.

| Feature |

Questrade Questrade

|

Wealthsimple Wealthsimple

|

|---|---|---|

| Education (Stocks) | No | No |

| Education (ETFs) | No | No |

| Education (Mutual Funds) | No | No |

| Education (Retirement) | Yes | No |

| Webinars | Yes | No |

| Videos | No | No |

| Interactive Learning - Quizzes | No | No |

| Courses | No | No |

Verdict

Like most Canadian brokerages, Questrade and Wealthsimple’s educational resources are pretty limited.

| Feature |

Questrade Questrade

|

Wealthsimple Wealthsimple

|

|---|---|---|

| Education |

|

|

Final Thoughts

Questrade and Wealthsimple both rank among the best Canadian brokers, but Questrade is the clear winner for 2025. In previous years, Wealthsimple had a clear fee advantage, but now that Questrade has removed trading commissions, it’s the better choice for most investors. If you’re a new investor or have other Wealthsimple accounts and want the ability to buy some Canadian stocks and ETFs, it’s probably easier to open a Wealthsimple trading account and keep everything under the same roof.

However, if you want a platform that can grow with you as you become a more experienced investor, supports a broader range of investments, and provides stronger research tools, Questrade is the better option. It’s also the clear choice for global traders, as Wealthsimple doesn’t offer access to international markets.

Colin's take

"Questrade and Wealthsimple both rank among the best Canadian brokerages, but in a head-to-head comparison, Questrade is the clear winner."

Verdict

Winner: Questrade

| Feature |

Questrade Questrade

|

Wealthsimple Wealthsimple

|

|---|---|---|

| Overall |

|

|

| Fees |

|

|

| Range of Investments |

|

|

| Mobile App |

|

|

| Web Platform |

|

|

| Education |

|

|

| Ease of Use |

|

|

StockBrokers.com Review Methodology

Why you should trust us

Colin Graves, a contributing writer for StockBrokers.com, has over seven years of experience covering investments and Canadian brokerage platforms. Before becoming a full-time writer, Colin spent over two decades in the banking industry, including 15 years as a people manager with a Top 10 North American financial institution. He has completed both the Canadian Securities (CSC) and the Professional Financial Planning (PFPC) courses and has appeared in leading Canadian personal finance publications such as MoneySense, Money.ca, MapleMoney, and The College Investor.

Blain Reinkensmeyer, co-founder of StockBrokers.com, has been investing and trading for over 25 years. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. Today, Blain is widely respected as a leading expert on finance and investing, specifically the U.S. online brokerage industry. Blain has been quoted in The New York Times, The Wall Street Journal, Forbes, and Fast Company, among others. Blain created the original scoring rubrics for StockBrokers.com and oversees all testing and rating methodologies.

How we tested

- We used our own brokerage accounts for testing.

- We collected hundreds of data points across the brokers we review.

- We tested each online broker's website, desktop platforms, and mobile app, where applicable.

- We maintained strict editorial independence; brokers cannot pay for inclusion or a higher rating.

Our research team meticulously collected data on every feature of importance to a wide range of customer profiles, including beginners, casual investors, passive investors, and active traders. We carefully track variables like margin rates, trading costs, fees, and platform features and use them to help rate brokers across a range of categories measuring ease of use, range of investments, education, and more.

At StockBrokers.com, our reviewers use a variety of computing devices to evaluate platforms and tools. Our reviews and data collection were conducted using the following devices: iPhone SE running iOS 17.5.1, MacBook Pro M1 with 8 GB RAM running the current MacOS, and a Dell Vostro 5402 laptop i5 with 8 GB RAM running Windows 11 Pro.

Each broker was evaluated and scored on over 60 different variables across six key categories for Canadian investors: Range of Investments, Platforms & Tools, Mobile Trading, Education, Ease of Use, and Overall. Learn more about how we test.

Read next

Explore further guidance on trading in Canada, here and on our sister site, ForexBrokers.com.

- Questrade Review

- Wealthsimple Review

- Interactive Brokers Review

- Best Forex Brokers in Canada (ForexBrokers.com)