Why you can trust us

Why you can trust us

Led by Jessica Inskip, Director of Investor Research, the StockBrokers.com research team collects thousands of data points across hundreds of variables. We evaluate features important to every kind of investor, including beginners, casual investors, passive investors, and active traders. We carefully track data on margin rates, trading costs, and fees to rate stock brokers across our proprietary testing categories.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on StockBrokers.com. Learn more about how we test.

Canadian self-directed investors have never had more, and frankly better, options when it comes to online brokerages. In just the past year, we’ve seen two more brokers (Questrade and Qtrade) scrap commissions on stock and ETF trades, and multiple brokers, specifically Questrade and TD Direct Investing, rolling out fractional shares. There’s also been a push from several brokers towards more valuable tools.

But with the landscape changing so quickly, choosing the right platform can seem overwhelming. That’s why I’ve updated our list of the best Canadian brokerages. I’ve been reviewing online trading platforms for almost eight years, and over the past few months, I’ve gone hands-on with each of the brokers in this guide. I’ve opened accounts, placed trades, tested mobile apps, engaged with customer support, and compared fees and features to help you find the platform that fits your investing style.

To highlight the best trading platforms in Canada, I evaluated each Canadian broker across pricing, usability, tools, market access, and account features. Based on this hands-on testing, here are the platforms that deliver the strongest overall experience for beginner and active investors.

Winners Summary

1. Questrade - The best overall trading platform in Canada

| Company |

Overall |

Minimum Deposit |

Stock/ETF Trade Fee |

Questrade Questrade

|

|

$0 |

$0.00 |

Questrade is Canada’s largest independent online brokerage, with over $50 billion in assets under administration. Over the years, it’s been a popular choice for ETF investors for offering free ETF purchases. However, in early 2025, it removed all trading fees on stocks and ETFs, joining other low-cost platforms such as Wealthsimple and National Bank Direct Brokerage. But Questrade is more well-rounded than both of those brokerages, and is our current pick for Canada’s best overall trading platform.

Trading platform and pricing: In addition to low fees, it also doesn’t charge account maintenance or inactivity fees, Questrade provides quick and easy account opening, for most account types, and has multiple trading platforms that cater to different types of investors. Its standard web trading platform (and mobile companion app) are intuitive and easy to use, and includes third-party trading tools such as TipRanks SmartScore, Seeking Alpha’s Bulls Say, Bears Say. With fractional shares available for U.S. stocks and ETFs, it packs enough features to satisfy most investors, including new traders.

Colin's take:

"With its recent move to commission-free trades, Questrade has staked its claim as the best-value brokerage in Canada. It combines low fees with robust trading platforms that can appeal to traders of all experience levels. I’m hopeful it will soon make fractional shares available for Canadian stocks and ETFs."

Colin Graves

Active and global traders will appreciate Questrade’s advanced trading platforms, Questrade Edge and Questrade Global. Edge is available as a downloadable desktop app, web, or mobile app, and while it’s free to use, you’ll need to pony up $11.95/month for a Questrade Plus subscription to unlock all of its features.

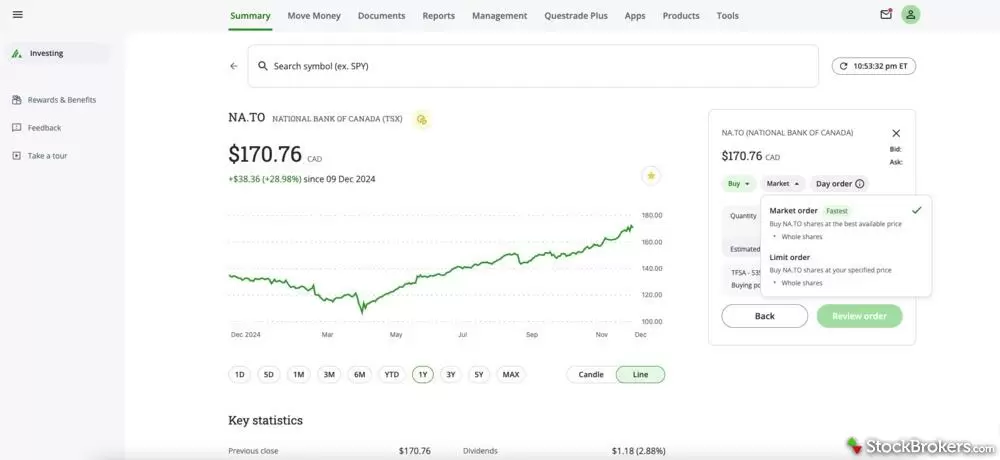

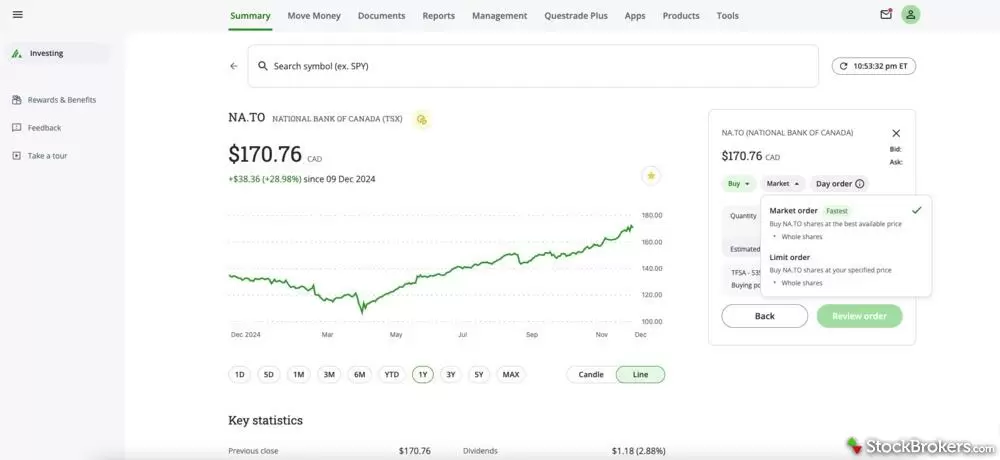

As you can see from this Buy Order screenshot, Questrade’s trading platform is clean and modern, with the stock lookup feature prominently displayed at the top of the screen. You can access various reports and create watchlists. Unfortunately, its standard trading platform doesn’t allow you to set custom alerts, and it only supports two order types.

It’s hard to complain about such a well-rounded platform, but like any brokerage, Questrade isn’t perfect. Its standard trading platform is not best-in-class. That title belongs to TD WebBroker. It only provides two order types (market and limit), doesn’t allow you to set custom alerts (you need to pay for Questrade Plus for that), and charting and research tools are limited. Also, fractional shares are only currently available for U.S. equities. That said, Questrade’s shortcomings are minor, and not likely to dissuade the average trader.

2. TD Direct Investing - Best trading and research tools

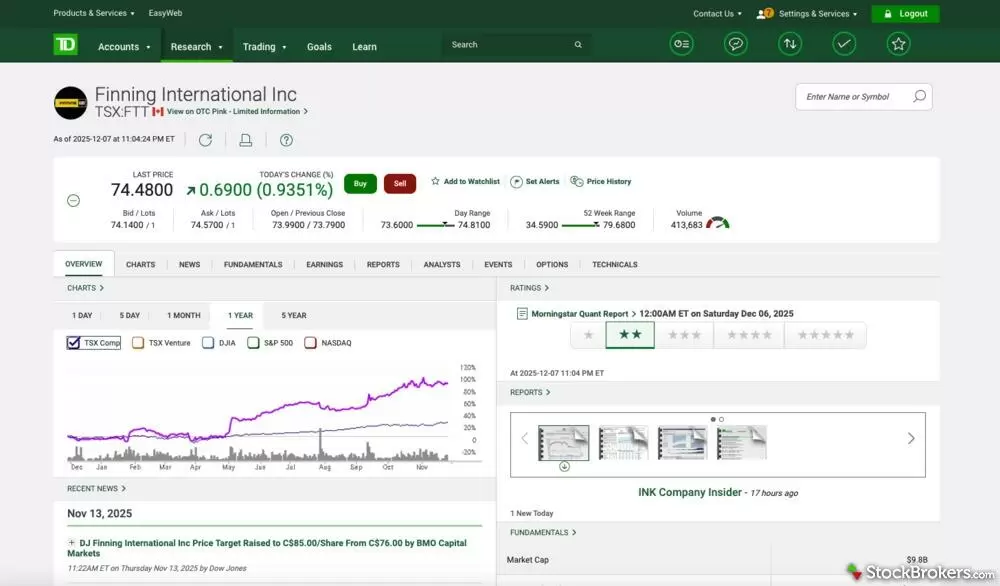

If Questrade is the reliable, great-value Toyota of online brokers, then TD Direct Investing (TD DI) is closer to a Lexus. That is, it delivers a premium trading experience for investors at varying levels. Its standard trading platform, WebBroker, offers a wide range of investments and is packed with trading and research tools most brokers only offer on their advanced platforms, if at all. For example, you can execute up to six order types, create custom alerts, view and save a multitude of chart types, add dozens of indicators, and access in-depth technical analysis.

Trading platform: Unlike some brokerages, TD DI continually invests in its platform. It recently introduced fractional share trading, and it helps investors stay informed by publishing regular webinars in its education centre.

Pricing: Unfortunately, the premium experience also comes at a premium price, and TD is one of the most expensive brokerages in the industry. Its trading fees are as high as $9.99 on stocks, ETFs, and options, and it charges account maintenance fees for most registered accounts, although the fees are waivable.

TD Direct Investing also offers a separate trading platform, called TD Easy Trade, designed for beginner investors. The mobile-only platform supports four account types (Cash, TFSA, RRSP, FHSA), offers 50 free stock trades per year, and unlimited TD ETF trades. However, third-party ETFs are not available via Easy Trade.

Overall, TD Direct Investing is an excellent choice if you are a buy-and-hold investor with a large enough portfolio to avoid paying the account maintenance fees, or an active trader who is willing to pay a premium for top-notch trading tools and research capability. Budget-conscious investors will be better off with a commission-free platfom such as Questrade or Qtrade.

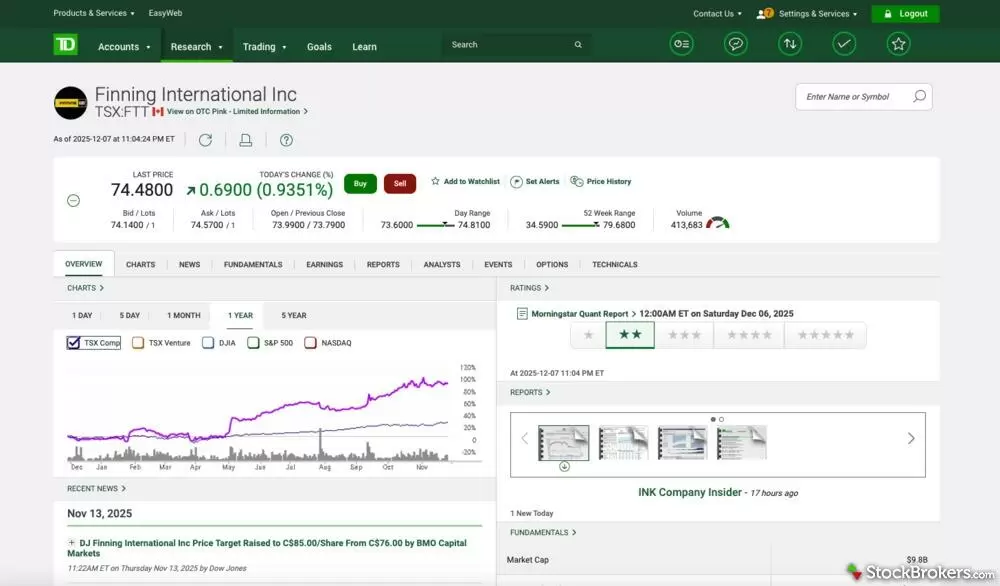

TD Direct Investing provides investors with extensive stock research data, including advanced charting, detailed company fundamentals, market news, analyst ratings, technical analysis, and more.

3. QTrade - Best for long-term investors

Qtrade is a owned by Aviso, a Canadian wealth and investment services provider. It partners with credit unions across Canada to provide their clients with a self-directed investing option, but anyone can open an account.

Trading platform: Qtrade is my top recommendation for Canadian investors focused on long-term wealth building due to its comprehensive portfolio management tools. This includes its Portfolio Creator, which shows you how to use ETFs to optimize your portfolio’s risk exposure, and Simulator tools, which allow you to compare simulated portfolios to your actual portfolio. Qtrade also puts a large number of investment and retirement planning calculators at your disposal.

Long-term investors will also appreciate the in-depth analysis from Morningstar and FactSet, which provide valuable insights into the performance of individual stocks and funds over time. And while separate from its self-directed platform, Qtrade has its own robo-advisor portfolios, called Guided Portfolios, for those who prefer an automated investment solution.

Pricing: But while Qtrade can appeal to long-term investors, it’s become an excellent choice for fee-conscious traders, after it removed trading fees for stocks, ETFs, and options in late 2025. It still charges a quarterly administration fee for U.S.-registered accounts ($15 per quarter, per account), but it’s now one of the lowest-cost brokerages in Canada.

Beyond fees, Qtrade delivers smooth account opening (mine was opened within minutes), and an excellent mobile trading app that offers more order types and better charting than Questrade’s standard platform. I don’t recommend Qtrade for active traders, as it does not have a dedicated active trading platform, nor does it support forex, CFD, crypto, or futures trading, or fractional shares.

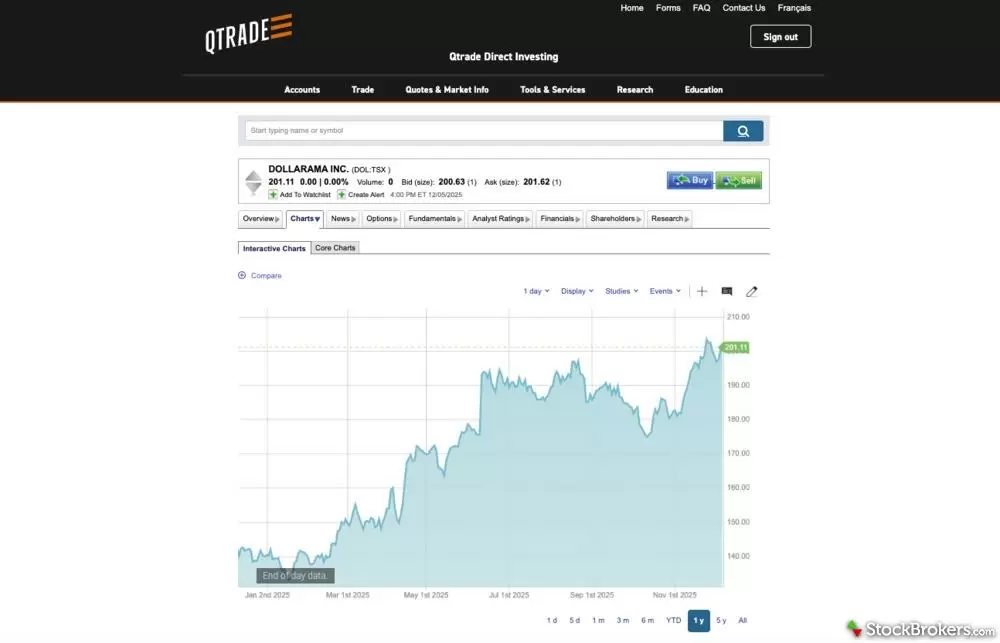

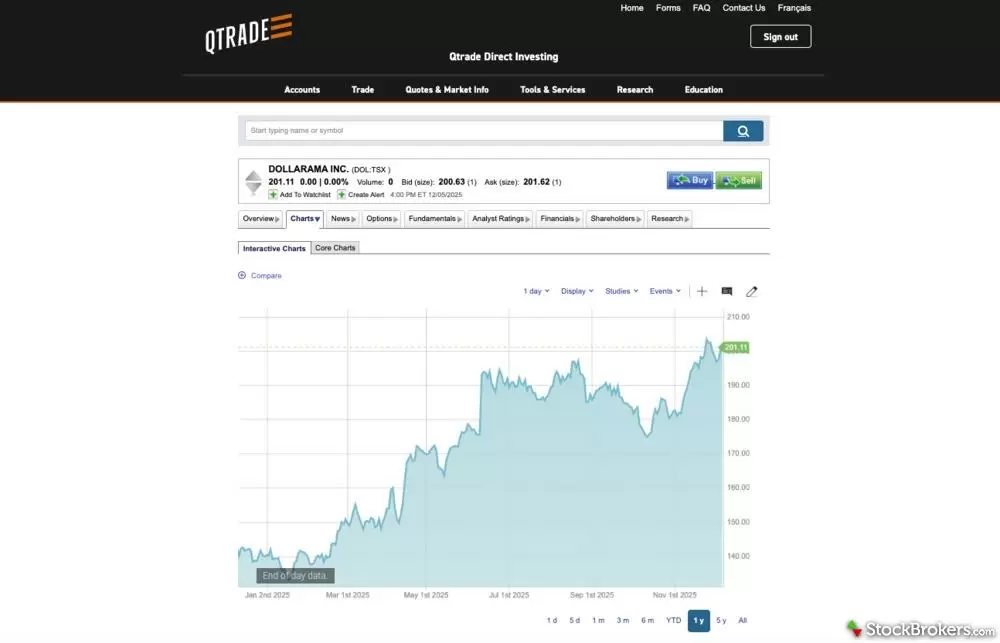

Qtrade’s desktop trading platform isn’t as visually appealing as its mobile app, but it places a lot of information at your fingertips, including advanced charting capabilities. You can view interactive and core charts and compare a stock’s performance with various indices.

4. Interactive Brokers - Best for professionals and active traders

Interactive Brokers (IBKR) is a global investment brokerage and dealer that’s been in business for almost 50 years. It’s a top choice for professional and active traders, who benefit from its unparalleled access to global markets, including forex markets. Investors can access over 100 global markets, and you can fund and trade your account in dozens of currencies.

Trading platform: IBKR is a U.S.-based brokerage, open to Canadian investors, and offers a unified trading platform (there isn’t a dedicated Canadian platform). While it doesn’t offer zero-commission stock and ETF trades in Canada, its fees are much lower than the big bank brokers. For example, you can trade Canadian-denominated stocks and ETFs for $0.008 per share (min. $1.00 per order) and $0.006 per share for USD-denominated (min. $0.80 per order).

Account offerings: IBKR's primary drawback is the limited account types available in Canada. It only offers Cash, Trust, RRSP/SRSP, TFSA, and FHSA accounts. You can’t open locked-in plans, RESPs, RRIFS, or RDSPs, and there are some limitations on inbound and outbound transfers of registered accounts between IBKR and other financial institutions.

Finally, it’s trading platforms (there are eight different ones), while robust, are rather complex and not suitable for beginners. For example, the Order Ticket screen in the Client Portal web platform lists over 10 different investment options across the top of the screen, which could overwhelm new investors. But for professionals and frequent traders, IBKR stands out for its access to global exchanges and advanced features that few other brokers in Canada can match.

5. Wealthsimple - Best for beginners

| Company |

Overall |

Minimum Deposit |

Stock/ETF Trade Fee |

Wealthsimple Wealthsimple

|

|

$0 |

$0.00 |

Wealthsimple is perhaps best known for being Canada’s largest robo-advisor, but it also offers a self-directed trading platform geared to beginner investors, particularly Millennials and Gen Z. It offers no-fee trades on thousands of Canadian and U.S. stocks and ETFs, as well as crypto trading, though you have to open a separate crypto account.

One of the things that impressed me most about Wealthsimple was how capable its AI chatbot is. I found myself having to use it outside of business hours when live support wasn’t available, and it was able to answer some pretty detailed questions for me. It’s a great tool for beginner investors who are likely to have a lot of questions when starting out.

Wealthsimple is my top pick for new investors, and I love the no-fee trades, but its platform has some major drawbacks, including a limited investment offering (no mutual funds, bonds, GICs, forex, etc.), no advanced trading platform, limited trading and research tools, and an annoying $10 monthly fee to keep a U.S.-denominated account.

6. CIBC Investor's Edge - Transparent fees

| Company |

Overall |

Minimum Deposit |

Stock/ETF Trade Fee |

CIBC Investor’s Edge CIBC Investor’s Edge

|

|

$0 |

$6.95 |

CIBC Investor’s Edge is one of five big bank brokers in Canada. While it charges higher fees than brokers like Questrade, Qtrade, and Wealthsimple, its fees are lower, and I would argue, more transparent, than the other big bank brokers.

For example, its standard stock and ETF trading fee is $6.95 per trade, but it drops to $4.95 for active traders, and is waived for young investors (25 and under with a CIBC chequing account with CIBC Smart Set). Student investors over 25 can qualify for reduced fees of $5.95 per trade, and both groups can see their account fees waived.

As with the other big bank brokerages, Investor’s Edge offers a wide range of accounts and investment types. Its trading platform is solid, but not as powerful as others, including TD Direct Investing.

Compare the best stock brokers in Canada

Commission structures vary widely across brokers. Larger and frequent investors should check the detailed pricing of any broker under consideration.

| Canadian Online Broker |

Best For |

Commission |

Overall Rating |

| Questrade |

Overall best trading platform |

$0 |

5 Stars |

| TD Direct Investing |

Best trading and research tools |

$9.99 |

4.5 Stars |

| Qtrade Direct Investing |

Best for long-term investors |

$8.75 |

4.5 Stars |

| Interactive Brokers |

Best for professionals and active traders |

$0.01 per share |

4.5 Stars |

| Wealthsimple |

Best for beginners |

$0 |

4 Stars |

| CIBC Investor's Edge |

Transparent fees |

$6.95 |

4.5 Stars |

FAQs

What is the best trading platform for beginners in Canada?

While there are a few contenders, Wealthsimple gets our nod as the best trading platform for beginners. In addition to a seamless account-opening process, its web and mobile trading platforms are intuitive and easy to use, and you can access thousands of stocks and ETFs commission-free. Not only that, but it offers responsive live chat support and one of the best AI chatbots I’ve reviewed.

What is the best stock trading app in Canada?

Questrade is our pick for the best overall stock trading platform in Canada. It solidified its position in early 2025 by removing fees on stock and ETF trades, but it also doesn’t charge any account or inactivity fees. It supports almost every account type imaginable, offers dedicated trading platforms for active and global traders, and its mobile trading apps are solid. Annoying drawbacks include the inability to set custom alerts without upgrading to Questrade Plus and the lack of fractional shares for Canadian stocks and ETFs.

How are stock brokerages in Canada regulated?

Online brokerages in Canada must be licensed as securities brokers with the Canadian Investment Regulatory Organization, or CIRO. CIRO is a self-regulatory organization responsible for overseeing investment dealers, mutual fund dealers, and trading activity on Canadian exchanges and marketplaces. In addition to setting and enforcing rules for Canadian investment firms and their representatives, its compliance teams ensure compliance with conduct and trading rules, and enforcement teams investigate possible rule breaches. It also enlists surveillance teams that monitor equity markets to maintain market integrity.

Are discount brokerages like Questrade and Wealthsimple safe?

Questrade vs Wealthsimple, which is better?

Between Questrade and Wealthsimple, Questrade is the better option for most investors due to its broader investment options and advanced trading tools. While Wealthsimple offers simplicity, Questrade provides more features that appeal to a wider range of investors, including those who trade U.S. and Canadian stocks, options, and ETFs. Questrade also has superior research tools and customizable platforms, making it ideal for both beginners and active traders who need more control over their trades. Wealthsimple is a good choice for beginners who prioritize ease of use, but Questrade's overall flexibility and $0 trade commissions structure make it the stronger option for most investors.

balance Compare: Questrade vs Wealthsimple

Questrade and Wealthsimple are two of the most popular Canadian brokers. Dive into my in-depth, head-to-head comparison of Questrade vs Wealthsimple to see how these two brokers stack up.

Which brokerage has the best execution in Canada?

Interactive Brokers offers the best execution quality in Canada, especially for active traders who care about price improvement. It's smart order routing scans multiple Canadian exchanges and dark pools to find the best available price, reducing slippage and improving trade outcomes. Unlike most Canadian brokers that route orders to a single venue, IBKR actively seeks out liquidity to fill orders more efficiently.

IBKR is transparent about its order execution and uses smart order routing across multiple venues to seek price improvements, making it my preferred choice for getting better fills when trading on a Canadian exchange. It’s one of the few brokers in Canada that actually reports execution quality and price improvement statistics. For traders placing larger or more frequent orders, those small savings can make a meaningful difference over time.

Which types of accounts do online brokerages offer in Canada?

Canadian investors can choose among a variety of brokerage account types. In addition to standard brokerage accounts, investors meeting the appropriate criteria may open more advanced or specialty account types. Note that some brokers might only offer some of these account options.

- Cash and Margin accounts

- Tax Free Savings Accounts (TFSAs)

- Registered Retirement Savings Plans (RRSPs)

- Spousal RRSPs

- Registered Retirement Income Plans (RRIFs)

- Locked-in Retirement Accounts (LIRAs)

- Life Income Funds (LIFs)

- Registered Education Savings Plans (RESPs)

- First Home Savings Accounts (FHSAs)

- Registered Disability Savings Plans (RDSPs)

- Non-personal accounts (Corporation, Trust, Non-Profit, etc.)

Which Canadian brokerage has the lowest fees?

The list of Canadian brokerages offering no-fee trades is growing, with Questrade and Qtrade\ being the latest brokers to introduce commission-free trades for stocks and ETFs. They join Wealthsimple, Desjardins (Disnat), and National Bank Direct Brokerage in offering free trading. Wealthsimple and Questrade also waive account maintenance and inactivity fees, making them the low-cost leaders among Canadian brokerages (Qtrade charges a quarterly fee for U.S. dollar-registered accounts).

What is the best Canadian broker for both US and Canadian stocks?

Most Canadian brokerages allow you to trade both U.S. and Canadian stocks, but Questrade, TD Direct Investing, and Interactive Brokers (IBKR) stand out because all three platforms support fractional share trading of U.S. stocks. You can also hold Canadian and U.S. cash separately on these platforms, making it easier to manage currency exchange. All three brokers offer robust trading and research tools, with TD Direct Investing as arguably the best.

Can you buy US stocks in your TFSA?

Yes, you can buy U.S. stocks in your Tax-Free Savings Account, provided the exchange the stock is listed on is supported by your brokerage. Most brokers support the major U.S. exchanges. There are, however, a couple of things you should keep in mind. First, you will have to convert your Canadian currency into U.S. dollars to buy a U.S.-listed stock. This will require you to pay currency conversion fees. Thankfully, several brokerages, including TD Direct Investing and Questrade, allow you to hold funds in a U.S. account, making currency conversions easier to manage. Something else to consider is that you may be subject to a 15% withholding tax on dividends that you earn on your U.S. stocks.

StockBrokers.com Review Methodology

Why you should trust us

Colin Graves, a contributing writer for StockBrokers.com, has over seven years of experience covering investments and Canadian brokerage platforms. Before becoming a full-time writer, Colin spent over two decades in the banking industry, including 15 years as a people manager with a Top 10 North American financial institution. He has completed both the Canadian Securities (CSC) and the Professional Financial Planning (PFPC) courses and has appeared in leading Canadian personal finance publications such as MoneySense, Money.ca, MapleMoney, and The College Investor.

Blain Reinkensmeyer, co-founder of StockBrokers.com, has been investing and trading for over 25 years. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. Today, Blain is widely respected as a leading expert on finance and investing, specifically the U.S. online brokerage industry. Blain has been quoted in The New York Times, The Wall Street Journal, Forbes, and Fast Company, among others. Blain created the original scoring rubrics for StockBrokers.com and oversees all testing and rating methodologies.

How we tested

- We used our own brokerage accounts for testing.

- We collected hundreds of data points across the brokers we review.

- We tested each online broker's website, desktop platforms, and mobile app, where applicable.

- We maintained strict editorial independence; brokers cannot pay for inclusion or a higher rating.

Our research team meticulously collected data on every feature of importance to a wide range of customer profiles, including beginners, casual investors, passive investors, and active traders. We carefully track variables like margin rates, trading costs, fees, and platform features and use them to help rate brokers across a range of categories measuring ease of use, range of investments, education, and more.

At StockBrokers.com, our reviewers use a variety of computing devices to evaluate platforms and tools. Our reviews and data collection were conducted using the following devices: iPhone SE running iOS 17.5.1, MacBook Pro M1 with 8 GB RAM running the current MacOS, and a Dell Vostro 5402 laptop i5 with 8 GB RAM running Windows 11 Pro.

Each broker was evaluated and scored on over 60 different variables across six key categories for Canadian investors: Range of Investments, Platforms & Tools, Mobile Trading, Education, Ease of Use, and Overall. Learn more about how we test.

Explore further guidance on trading in Canada, here and on our sister site, ForexBrokers.com.

Questrade

Questrade

TD Direct Investing

TD Direct Investing

Qtrade Direct Investing

Qtrade Direct Investing

Interactive Brokers

Interactive Brokers

Wealthsimple

Wealthsimple

CIBC Investor’s Edge

CIBC Investor’s Edge