TraderSync is a trading journal platform built for serious traders who want to track their trades, uncover patterns, and improve performance over time. In this TraderSync review, I’ll walk through how it works, what it costs, and whether it’s worth the investment.

A trading journal tracks your trading history plus any additional notes to find patterns, mistakes, and ideas for the future. While that’s a simple concept in theory, modern trading journal tools like TraderSync offer far more capabilities. This advanced platform automatically records your trades and provides in-depth reports and insights, including analysis powered by AI. TraderSync isn’t cheap, but it could be well worth it if you’re an active trader looking to level up.

TraderSync pros and cons

thumb_up_off_alt Pros

- Well-designed and easy to use

- Creates ongoing insights based on historical trading data

- Offers a live chat with human support during the day

- Demo trial doesn’t require a credit card

thumb_down_off_alt Cons

- No free version

- Costly monthly subscription, especially to access AI tools

- No community engagement with other users

Overall summary

|

Feature |

TraderSync TraderSync

|

|

Overall

info

|

|

|

Features

info

|

|

|

Ease of Use

info

|

|

|

Cost

info

|

|

|

Free version

info

|

No

|

|

Monthly Pricing

info

|

$29.95/mo

|

|

Annual Pricing

info

|

$312.60/yr

|

Cost and plans

TraderSync lets you sign up for a free seven-day trial, with all platform capabilities. I appreciated how easy they made it to get started. I only had to provide my name and email, with no credit card. From there, I was able to explore every feature firsthand, including the AI assistant, trade reports, and broker sync tools.

After the trial ends, you’ll need a paid subscription to continue using TraderSync. The plans and costs are:

| Plan |

Monthly Price |

Annual Price |

Key Features |

| Pro |

$29.95 |

$312.60 |

Core trading journal features, manual & broker import, detailed trade reports |

| Premium |

$49.95 |

$521.40 |

Everything in Pro, plus AI assistant, Strategy Checker, sector reports |

| Elite |

$79.95 |

$834.60 |

All Premium features, plus Trading Plan tool, stock market replay, AI insights for 100+ trades |

You save 13% by paying annually. Each plan unlocks additional tools to analyze your trades, including AI-generated insights, strategy checkers, and stock market replay features.

No free version

While TraderSync used to offer a free Basic version, it is no longer available. You’ll need to pay for a subscription at the end of your 7-day trial. I found that a little disappointing as it would have been nice to experiment for longer for free, even with limited capabilities.

Pro version

TraderSync's Pro version gives you access to all of the main features of the trading journal. It allows you to record and organize all your trades based on results, strategies, and mistakes. The Pro version also generates reports that can break down your results based on time, strategies, volume, common mistakes, and other factors.

However, the Pro version requires you to analyze the data independently without access to the AI tools. This tier of the tool could be worthwhile if you feel confident that you can figure out the insights yourself.

Premium version

The Premium version unlocks some interesting capabilities, notably an AI assistant that lets you query your trading data. I found it great for spotting new patterns and habits I didn't notice before, and it is especially effective with a lengthy trading history.

It also includes a Strategy Checker that can hold you accountable over time, telling you whether you followed rules set for yourself over the past month, like not chasing losses. I can see how this would be effective in my own trading, similar to how I’m more likely to stick to a New Year’s Resolution when it's written right in front of me.

Elite version

TraderSync's Elite version provides even more analysis. Once you record at least 100 trades, it automatically starts generating AI insights about your history. Elite also gives you access to the Trading Plan tool. I liked how this tool visually showed my performance versus how my portfolio would have performed had I followed the optimal strategies identified by the platform. Serious traders looking for every edge would find this worthwhile.

Features

TraderSync is a trading journal at its core, but it delivers far more than simply a convenient place to list your notes. TraderSync offers various research capabilities that can help you identify ways to improve your strategies, based on your trading history.

In exchange, TraderSync is one of the more expensive trading journals, especially if you want all the advanced capabilities. However, if you’re willing to pay up, the provided features could help take your portfolio to the next level.

Trading journal

You can connect the TraderSync trading journal to over 900 brokers. Doing so will upload all your past trading data, and future trades will automatically be recorded. TraderSync lets you track stocks, options, forex, futures, and crypto.

There is an option to upload trades manually, but I found this feature to be slow and time-consuming. Realistically the trading journal is best used by syncing automatically with your broker.

The trading journal tool is sleekly designed and well-organized. The color code helped me recognize days that were major winners and losers, so I could pinpoint the ones to dive into deeper.

The dashboard organizes all the trades along with my performance data in one place neatly. In each trade, I could record what strategy and setup I was following and if I believed I made any mistakes, such as FOMO or failing to cut losses. That setup made it easy to stay organized and track patterns, even with hundreds of trades to sort through.

You can also create a written journal, listing information about each trade. I get the sense that this feature was likely more heavily utilized in the past, but now you get many more insights from TraderSync's various automated tools so you don’t have to take all these notes yourself. However, if you like doing things the old-fashioned way, you can easily do so.

Data reports

TraderSync automatically organizes your portfolio across several reports. You can generate reports based on time, sector, trading volume, and entry price, among other factors. You get more reports for higher-tier subscriptions. For example, sector reports are not available with the lowest-cost Pro subscription but are available for Premium and Elite.

I appreciated the insights and charts from these reports. For example, when I organized my data report by hour, I was surprised to see how much better I performed in the morning versus the afternoon. I was frequently getting crushed right before markets closed, revealing that I should probably wrap up my trading session earlier in the day. Finding a hidden bias or problem like that can certainly make TraderSync worth the subscription.

AI assistant

TradeSync has built-in AI capabilities to analyze your records. The AI assistant lets you ask questions, pulling insights from your trading history. For example, you could ask what setup or strategies generated the best performance over your past 50 trades, or your return at a specific time each trading day. I thought this was a valuable addition, especially as generative AI becomes more common in our lives.

The Premium account automatically generates ongoing AI insights for your reports. You don’t have to ask. That’s a great feature, but it’s a shame they lock it up behind the most expensive plan.

Trading plan

TraderSync also allows you to design a "Trading Plan" that is set to your own rules and criteria, enabling you to see how often you followed them when making trades. This tool was a little tricky to figure out, but I can see how it could help you identify patterns in your behavior and ways to improve for the future. By committing to this tool, you will be able to fine-tune your strategies based on past results and patterns.

Stock market replay

If you have an Elite subscription, you can access a stock market replay tool, similar to what you’d get by backtesting with charting software. This tool lets you slowly replay what happened with past trades so you can see whether you’d do anything differently. It also lets you experiment with different strategies over past situations to see if you would have performed better.

It’s a nice add-on if you’re already planning on using the Elite package, but you could get similar capabilities at a much lower cost with a charting tool like TradingView.

Ease of use

I found TraderSync very easy to set up and use for the most part. As a brand-new user, I appreciated that I didn’t have to put down my credit card for a 7-day trial. I also liked that TraderSync provided demo portfolio data for the trading journal and tools. This allows you to immediately start experimenting with its various functions without linking a broker or importing a full history of trades, which a beginner may not possess yet.

While uploading my portfolio for this review, I was impressed by how clearly TraderSync guided the process. It provided clear, tailored instructions for both Robinhood and Vanguard, where I hold accounts. It even warned me in advance about problems they were currently having with Robinhood so that I could get around them.

TraderSync provided several well-organized YouTube videos and articles that quickly taught me how to use the platform. For more help, there was a live chat tool with human support during the working day. I felt like if I needed guidance, it was there for me.

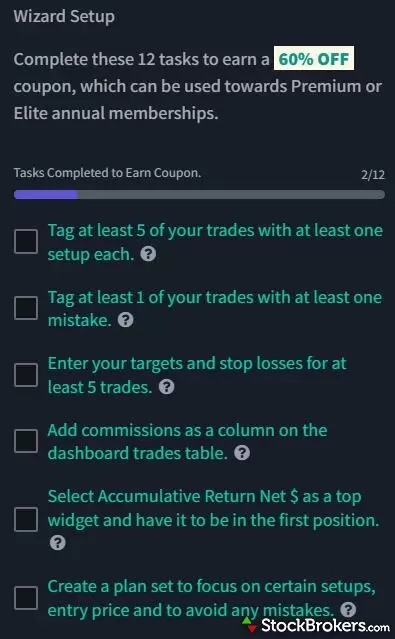

Finally, TraderSync includes a checklist of tasks for new users to complete as they explore the platform. I found it to be a helpful, low-pressure way to get familiar with the tools and features — it felt like a fun onboarding game for traders.

Final thoughts

Is TraderSync worth it?

TraderSync goes above and beyond the typical trading journal. The platform is well-designed, provides quality data and AI insights, and offers ongoing hands-on customer support. If you want more than a place to list your trades and thoughts, you will get far more information from TraderSync.

Overall, while TraderSync is a little costly by trading journal standards, I feel that it would definitely pay off if it could generate just a few insights for you to improve as an investor.

A steep cost

The drawback of TraderSync is that all of this comes at a cost. There’s no free version beyond the 7-day trial. The lowest cost version costs $30 a month, $312 a year, while full capabilities will cost you nearly a grand annually.

Alternatives to TraderSync

If you want only basic trading journal support and insights, Edgewonk is a more affordable alternative. It’s much more low-frills in design and capabilities, but only costs $169 annually. Tradervue is another alternative. Starting at $30 per month, it’s not cheap either, but it provides a similar high-quality analysis to TraderSync. It could also be worth testing to see which you click with best. For a comprehensive look at the top choices, read our guide to the best stock trading journals.

StockBrokers.com Review Methodology

Why you should trust us

David Rodeck, a contributing writer for StockBrokers.com, has over a decade of writing experience specializing in investing, trading, and retirement planning. Before becoming a full-time writer, David was a financial advisor and passed the Series 6 and CFP exams. He has written for AARP, Kiplinger Magazine, Forbes Advisor, and Investopedia.

Blain Reinkensmeyer, co-founder of StockBrokers.com, has been investing and trading for over 25 years. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. Today, Blain is widely respected as a leading expert on finance and investing, specifically the U.S. online brokerage industry. Blain has been quoted in The New York Times, The Wall Street Journal, Forbes, and Fast Company, among others. Blain created the original scoring rubrics for StockBrokers.com and oversees all testing and rating methodologies.

How we tested

- We used paid trading tool accounts for testing.

- We collected dozens of data points across the tools we review.

- We tested each tool’s website, desktop platforms, and mobile app, where applicable.

- We maintained strict editorial independence; trading tools cannot pay for a higher rating.

Our researchers thoroughly test a wide range of popular trading tools' features, such as trading journals and screeners, charting providers, and educational resources. We also evaluate the overall design of each tool’s mobile experience and look for a fluid user experience moving between mobile and desktop tools.

At StockBrokers.com, our reviewers use a variety of devices to evaluate trading tools. Our reviews and data collection are conducted using the following devices: iPhone SE running iOS 17.5.1, MacBook Pro M1 with 8 GB RAM running the current MacOS, and a Dell Vostro 5402 laptop i5 with 8 GB RAM running Windows 11 Pro.

Each trading tool was evaluated and scored across three key categories: Ease of Use, Features, and Cost. Learn more about how we test.

Trading tools tested in 2026

We tested 9 trading tools and service providers for stock traders in 2026:

TraderSync

TraderSync