Seeking Alpha offers a free Basic subscription as well as two paid subscriptions, Premium and Pro. The paid plans let you sign up for a one-month trial at a reduced rate, before switching to an annual rate at the following costs:

- Premium = $4.95 for one month, and then $299 per year

- Pro = $99 for one month, and then $2,400 per year

As you progress through the tiers, you gain access to more research and analyst investment recommendations. I found it a little annoying that they don’t have a month-by-month plan. A free trial of the paid plans would have been nice too, but you already get a solid test drive of all the capabilities with the free Basic plan.

Basic plan

You can access the Seeking Alpha screener, market news, and research by visiting its website. You don’t even have to create a free account. I loved how I could dive right in and start testing the stock screener for ideas for my Seeking Alpha review. That said, without an account, you’ll lose all your research and ideas as soon as you leave.

It only took 10 seconds to register for a free Basic plan by providing my email address and a password. Then I was able to save my portfolios to access market news and a wide range of publicly available financial information, such as dividend metrics and trading ranges.

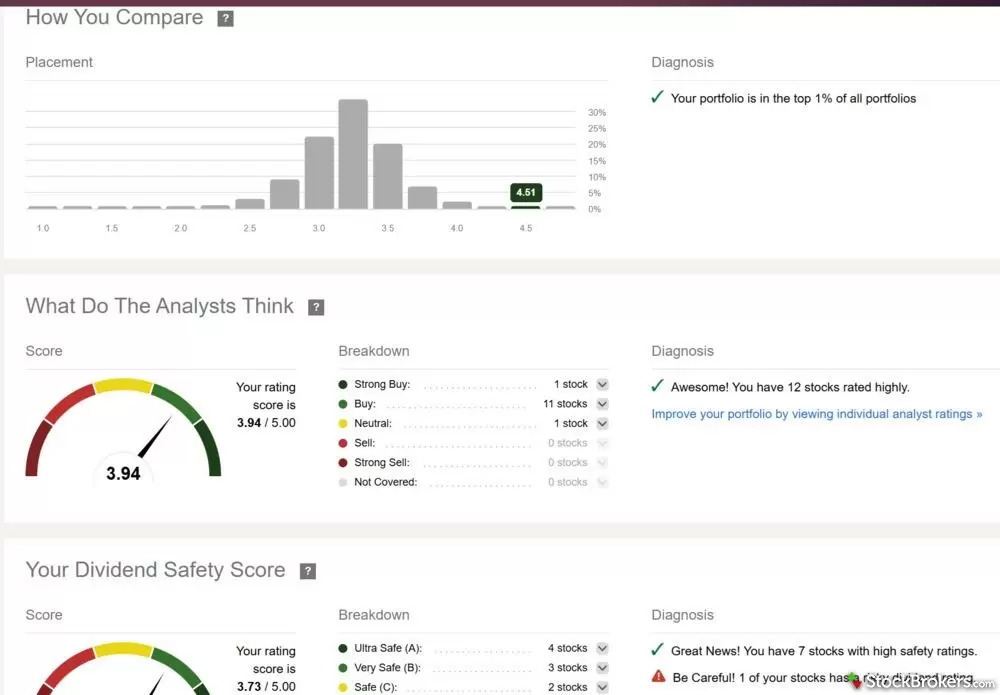

While the Basic plan gave me some basic analysis, it was just enough to whet my appetite. For example, it told me my initial portfolio was in the top 10%, but hid the reasons why. I couldn’t screen based on expert analyst or quant ratings. I also couldn’t read most of the Seeking Alpha articles.

If you’re just looking for a simple place to track your holdings and collect market news, it’s fine, but nothing dramatically different from other free services like Yahoo Finance.

On the free version of Seeking Alpha, you can use the screener’s basic financial filters, but many premium metrics appear locked until you upgrade.

Pro plan

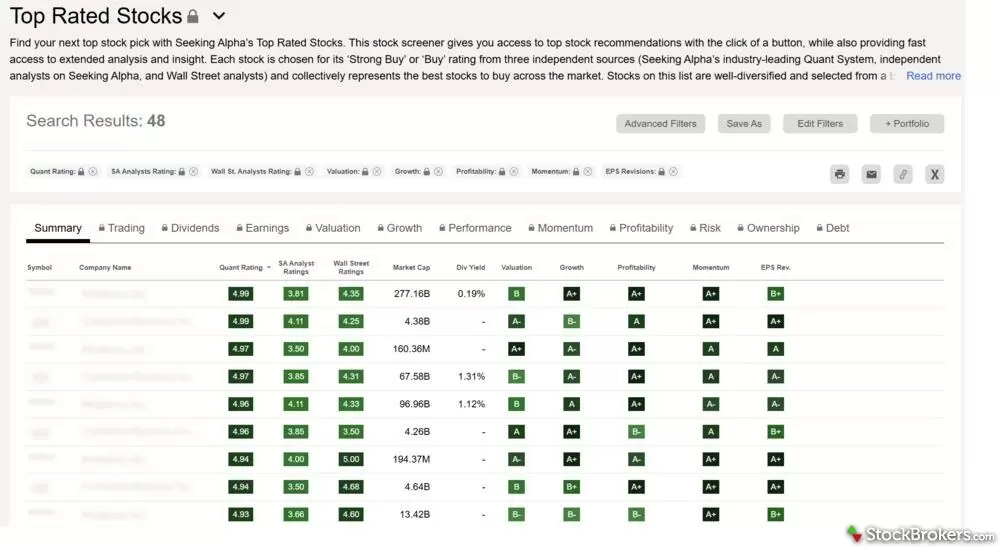

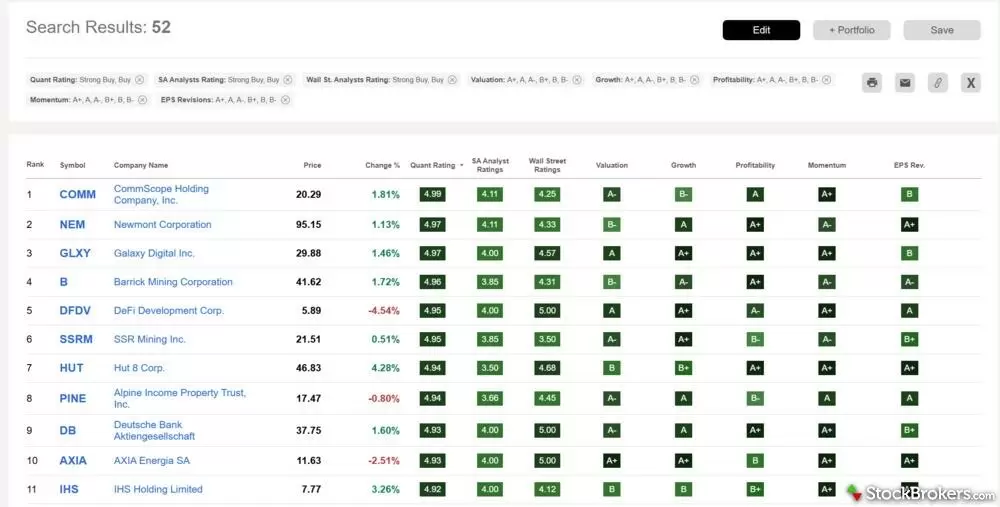

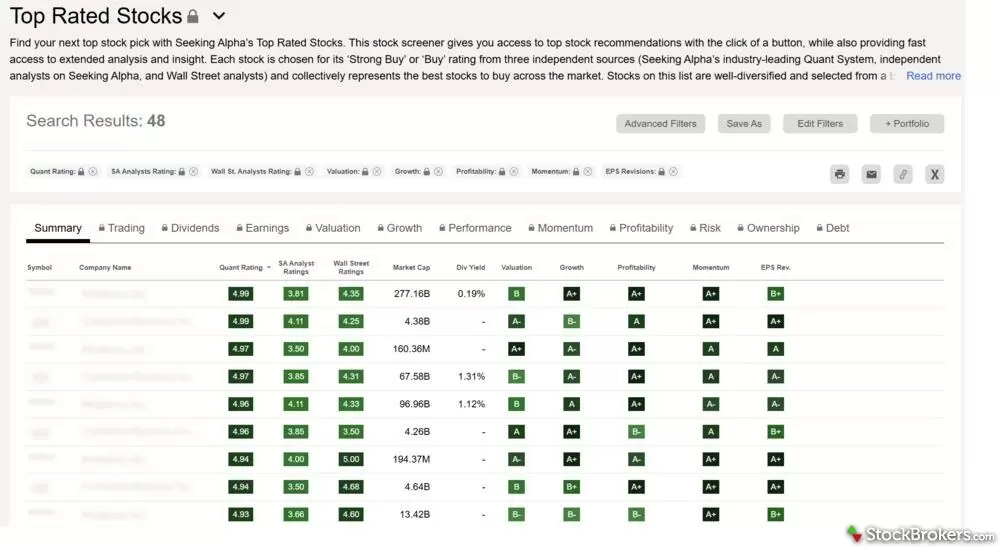

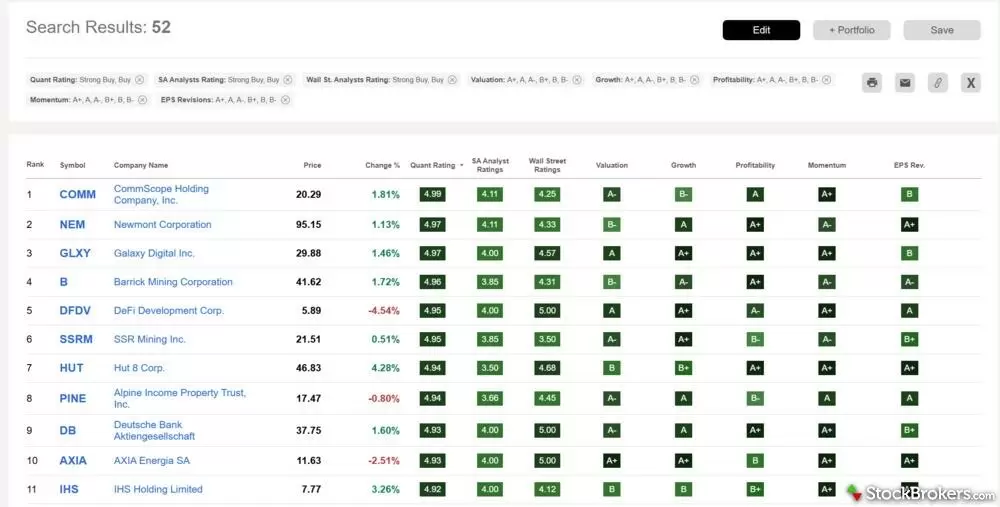

The Pro plan really opens up access to Seeking Alpha's capabilities and research. With this plan, you can sort stocks and ETFs on the screener using ratings from professional analysts and quants.

I’ve used many screeners before, but I was impressed by how quickly this one let me start with pre-built lists of target picks, then refine them using my own metrics. For example, I began with Seeking Alpha’s “Top Picks” based on analyst ratings, but then fine-tuned it to only medium-cap stocks with high dividends. Quickly enough, I had a targeted, specialized portfolio of companies I never would have found on my own.

As a Pro user, you can also read all Seeking Alpha articles and check its Alpha Picks portfolio, designed by its internal experts.

Upgrading to a paid subscription unlocks Seeking Alpha’s full screener, including advanced metrics and premium filters that aren’t available on the free plan.

Premium plan

At $2,400 a year, nearly 10 times the cost of Pro, the Seeking Alpha Premium plan is expensive to say the least. For all that money, you aren’t getting access to new tools or a fundamentally different experience. Instead, you’re shelling out for even rarer research, including ideas and picks from Seeking Alpha’s top 50 analysts that are only released to Premium users.

You can also see Seeking Alpha’s Quant portfolio, which is more finely tuned than the Alpha one, and additional research on stocks in less-traded markets. Without extensive experience trading off Seeking Alpha’s picks, it’s hard for me to say if that steep price is worth it. Obviously, one great idea or two a year could certainly make up the fee and then some.

Seeking Alpha operates as a crowdsourced platform to deliver market news, investment ideas, and portfolio analysis using its internal tools and research from its many users. Here are the top features you get with a Seeking Alpha subscription.

News, market data, and articles

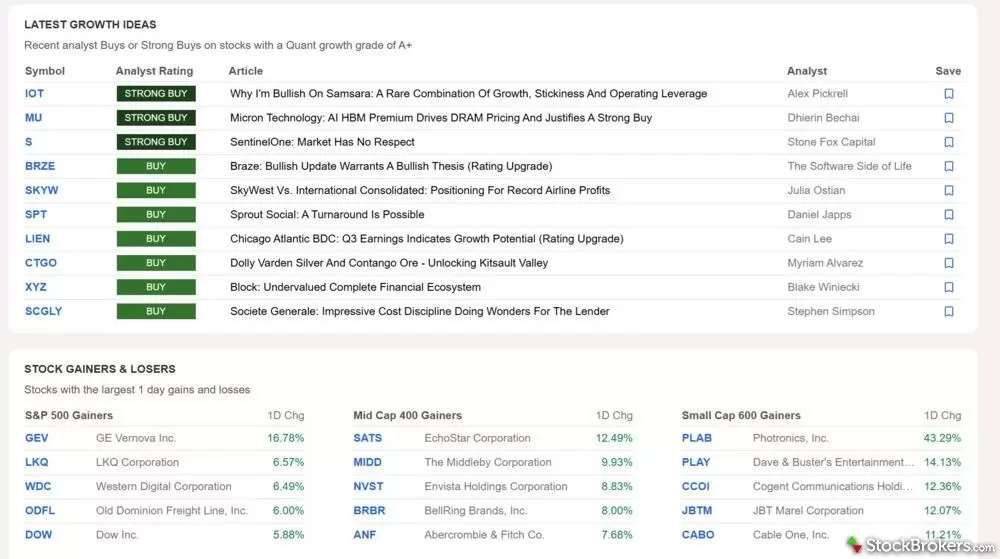

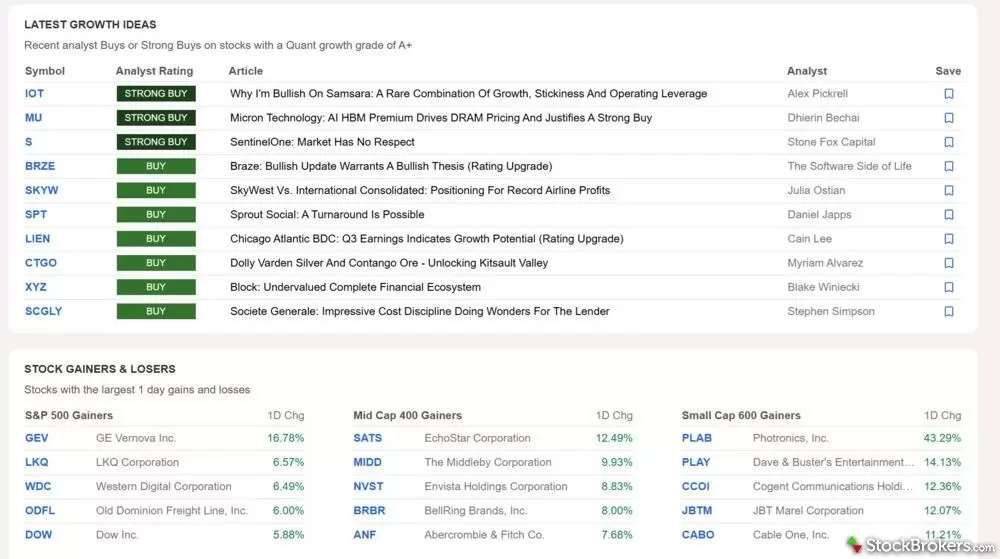

Seeking Alpha provides an ocean of news, market data, trends, charts, and everything else that’s going on in the investment world. The public information is well organized and available to free users. Paid users also have other home page information based on Seeking Alpha data, such as the most compelling analyst ideas and top-rated picks of the day.

The Seeking Alpha homepage surfaces recent growth stock ideas alongside broader market news and analysis.

Paid users gain access to articles on a wide range of subjects, including AI tech, dividend strategies, forex, and undiscovered stocks. Just be warned that Seeking Alpha crowdsources the material, meaning anyone can submit. Articles must qualify through Seeking Alpha’s editorial process, but I imagine there’s a range in quality.

For example, even I, as a totally brand-new user, could submit articles for pay, about $151 each if approved. You’ll get lots of ideas and opinions, but some will be much more qualified than others.

Stock and ETF screeners

Seeking Alpha offers an excellent range of screeners to help you identify your next investment opportunities. You can access it with a free account. As a free user, you can sort using the typical financial information found in most screeners, such as earnings, valuation, and risk metrics.

That said, the most valuable, proprietary information is hidden behind a lock icon, encouraging you to pay. However, you’ll get access to information like quant ratings showing whether professionals agree with a pick, or the dividend grades of stocks produced by Seeking Alpha.

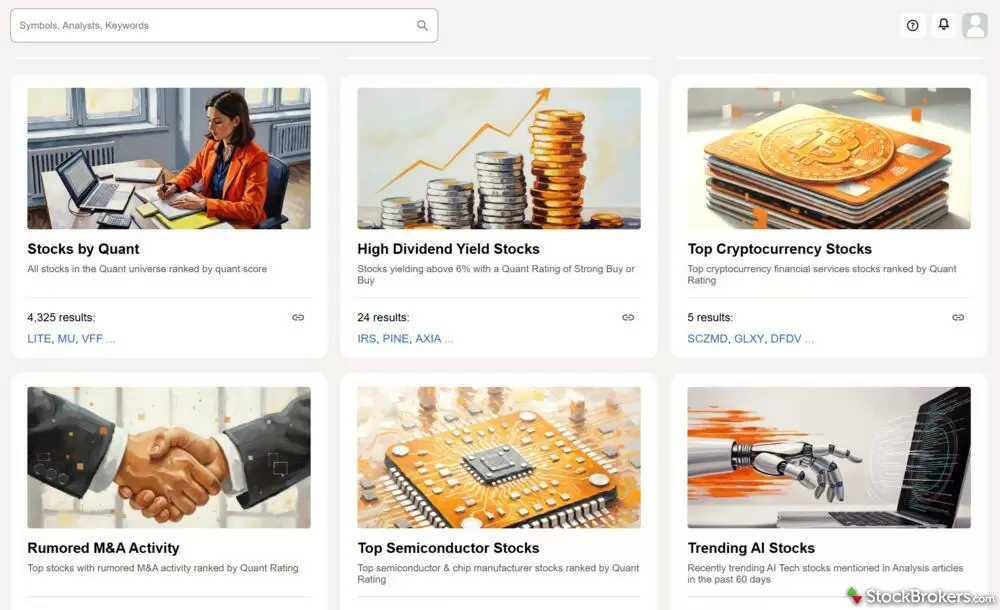

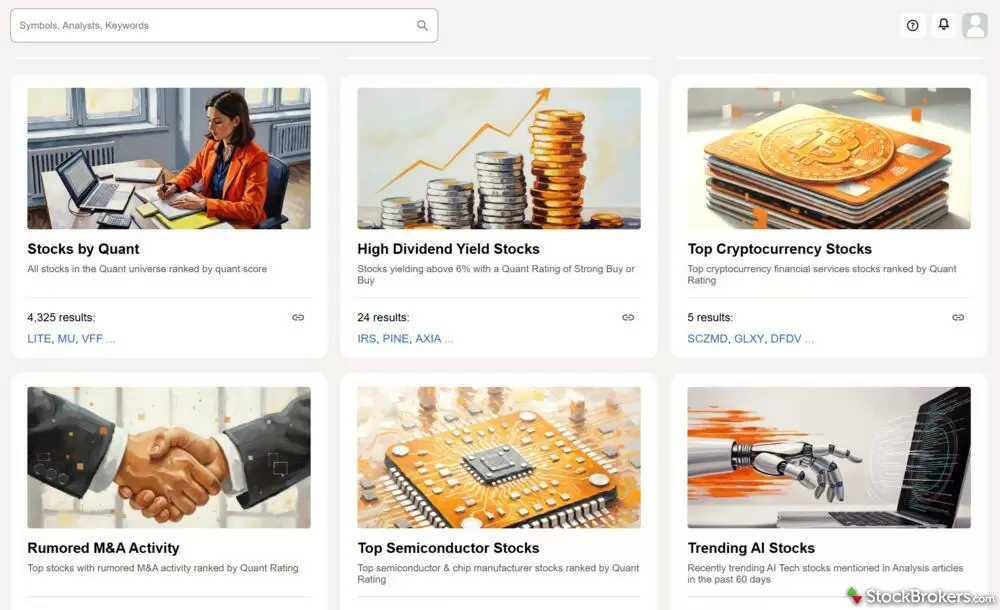

As far as other features go, I liked many of the pre-built lists and screens Seeking Alpha had available, such as top stocks in different sectors (AI, consumer staples, financials, etc.), best dividend stocks, and most shorted stocks.

Instead of building screens from scratch, Seeking Alpha provides curated screener categories such as “Stocks by Quant” and “Trending AI Stocks.”

That gave me a head start on the research, and then from there I could refine even further using the screens. Once I found picks I liked from the screener, it was easy to move them to the Portfolio section.

Portfolio analysis and alerts

Seeking Alpha lets you set up portfolios for tracking and analysis. You can enter stock picks manually, grab them off the screener, upload a CSV file of investments, or sync your broker. I linked my Robinhood account, and it was a breeze.

From there, you’ll automatically get market news, data, and insights about your portfolio. You can also set up alerts by email or phone. But be warned, the alerts add up quickly if you request updates on news and articles. In less than 24 hours, my small test portfolio led to my inbox overflowing, so I had to turn that feature off.

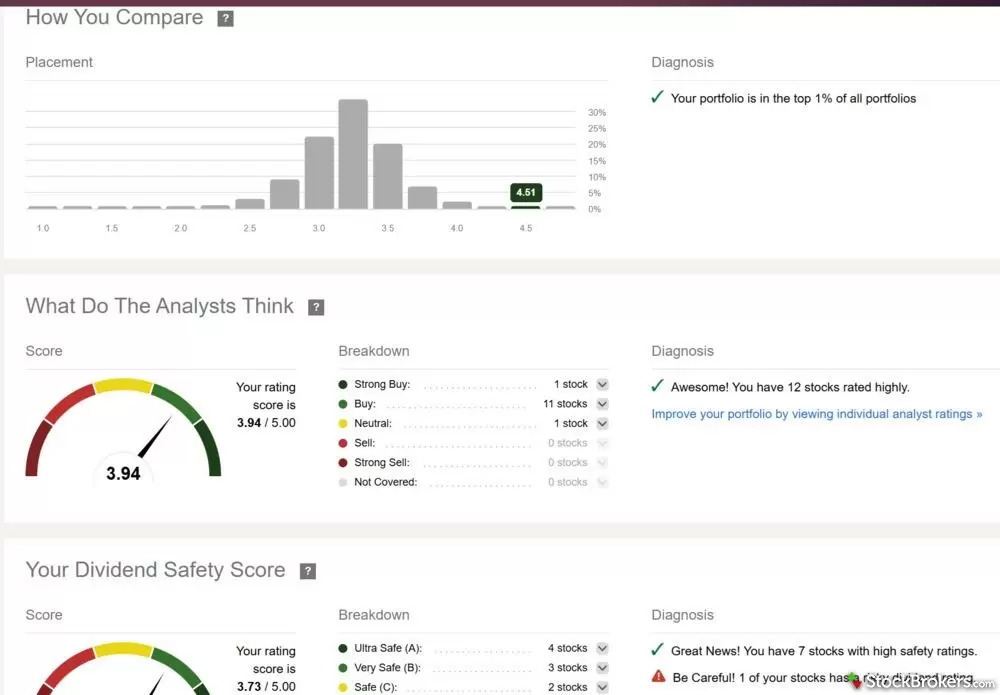

I really appreciated the details and insights from the portfolio analysis. However, I was curious to see that I didn’t get perfect scores across the board. For instance, it only gave me a letter B grade for valuation, and when I dug deeper, I saw that one of my picks was considered grossly overvalued at its current market price, getting a D grade and dragging down my portfolio score. It was a mismatch with the high quality of the other 9. Cutting it from my portfolio improved my rating.

Initially, the platform said my sample portfolio was in the top 1% of all users on the platform (but before you congratulate me, remember that I pulled those picks directly from their best of list).

Seeking Alpha’s Portfolio Check makes it easy to review how analysts view your portfolio and identify potential safety concerns.

Combining the screener with portfolio analysis could help you find some hidden gems like this.

Portfolio recommendations

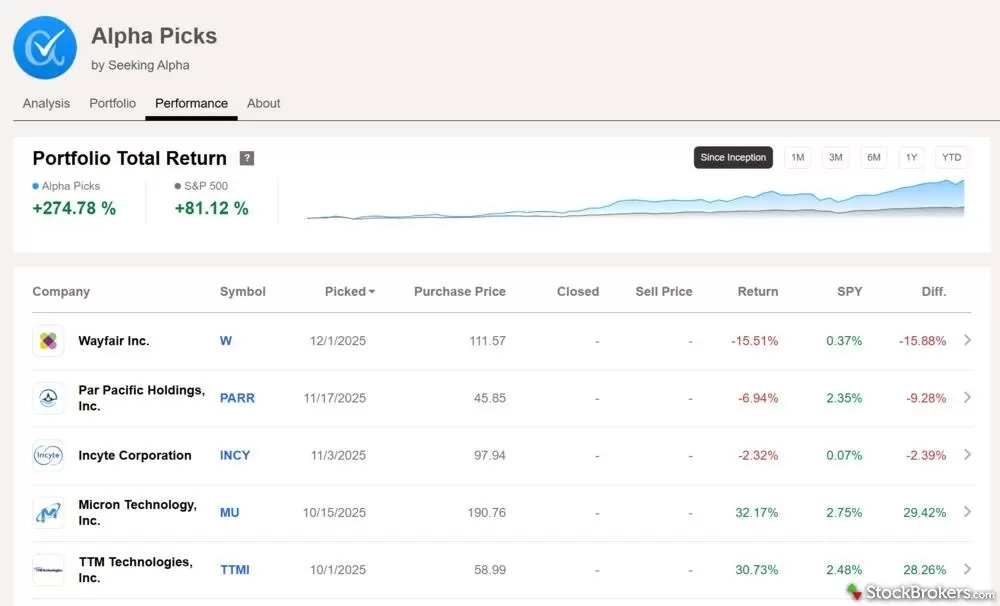

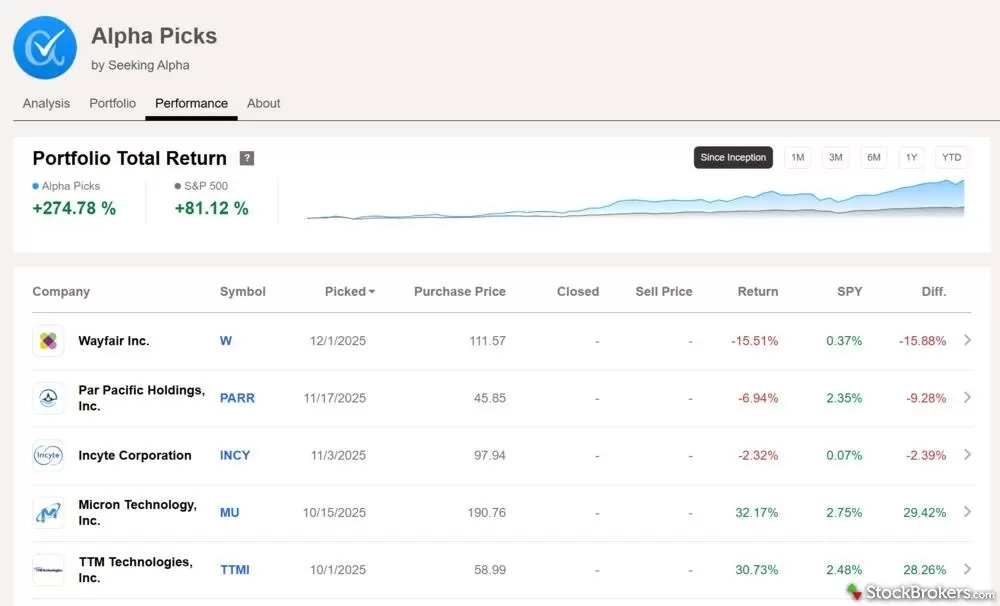

If you want more assistance finding investments, Seeking Alpha has pre-built portfolios. It claims its Alpha Picks portfolio has outperformed the S&P 500 276% vs. 81% since inception in July 2022 (as of December 10, 2025). For Premium users, every pick is listed with detailed information for you to mimic.

Pro users get access to the Quant portfolio, which Seeking Alpha claims is even better. And it provides weekly updates on the specific buy-and-sell trades you need to make to match its performance.

Alpha Picks is Seeking Alpha’s pre-built portfolio, designed to help investors find new stock ideas without building a strategy from scratch.

Investing groups and forums

For more support, you can join a wide range of Investing Groups and forums. You pick one that interests you, like biotech or value investing, and each group is run by an expert. You then get their investment picks, participate in Q&A sessions, and can chat with other investors in the group.

It’s a fun addition, but it isn’t cheap. Each instructor sets their own rate, with some costing about $40 a month and others costing hundreds of dollars. Costs could add up quickly if you join several.

I was disappointed that they didn’t have a free forum. I think they did in the past, but have since decided to limit community access to paid members, perhaps to keep moderation simpler.

Seeking Alpha is incredibly easy to use. It took no time at all to create an account and dive in, and even though there’s a lot of information across the platform, I found it visually pleasing and straightforward to digest. For example, the flow of the homepage made sense, moving from big-picture news to actual stock ideas and picks.

The screener was also fun to click through. I liked how simple it was to automatically find ideas, refine them, and then transfer them to my target portfolio. This was a highlight of my Seeking Alpha review.

That said, Seeking Alpha isn’t built for investors who want the most complex tools and features. It’s mostly articles, insights, and a screener, rather than advanced charting or backtesting. But within that scope, the platform felt very user-friendly.

If you do need help, you can submit a customer service support ticket through the platform. It’s a little barebones since there’s no phone or live chat support, but I don’t see many scenarios where most users would need lots of support to navigate the platform.

Seeking Alpha

Seeking Alpha