Winners Summary

Best for free stock trading - Interactive Brokers

| Company |

Overall |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

Interactive Brokers Interactive Brokers

|

|

$0.00 |

$0.00 |

$0.65 info |

Interactive Brokers (IBKR) ranks as the best choice for free stock trading, offering a uniquely competitive edge with its IBKR Lite account option. Unlike other brokers that offset zero-commission trades with higher fees elsewhere, IBKR Lite provides zero-commission trades for U.S. stocks and ETFs with no monthly fees or account minimums. This accessible approach allows individual investors to start building their portfolios without upfront costs, making IBKR Lite an appealing choice for budget-conscious traders. And, with IBKR’s wide selection of tradable assets across global markets, investors can diversify their portfolios without worrying about hidden fees that can add up over time.

PFOF: One aspect to consider with Interactive Brokers’ Lite account is its reliance on payment for order flow to support zero-commission trades. While this keeps costs low for investors, it means that IBKR Lite routes orders through partners that pay for the privilege, potentially impacting execution quality by a fraction of a penny per share. For investors who prioritize optimal execution, IBKR Pro offers a solution: a subscription-based account with no PFOF at all. By opting for IBKR Pro, investors ensure their trades are routed for best price execution, free from the compromises often associated with PFOF — a key advantage for those trading with larger volumes or precision-based strategies.

Low fees: In addition to free trades, IBKR delivers significant value through low fees on premium services and investment options. IBKR Lite’s fee-free U.S. trades complement a vast selection of other offerings like low-cost options trading, margin rates, and access to advanced tools at no additional charge. For investors looking to explore other asset classes such as mutual funds, forex, or even cryptocurrencies, Interactive Brokers offers competitively priced, straightforward commissions. With a reputation for keeping fees low across the board and without the common catch-all fees often found at other brokerages, Interactive Brokers is the ideal choice for free stock trading in 2025.

Read my review of Interactive Brokers for a full breakdown of its offering.

Best platforms and tools - Charles Schwab

| Company |

Overall |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

Charles Schwab Charles Schwab

|

|

$0.00 |

$0.00 |

$0.65 |

Charles Schwab provides a well-rounded approach to free stock trading that combines no-cost trades with a powerful set of tools. Schwab offers $0 commissions on listed U.S. stocks and ETFs, keeping it on par with competitors in terms of pricing. However, Schwab goes further by bundling these free trades with access to thinkorswim, one of the industry’s most sophisticated trading platforms. This blend of free trading and high-powered technology allows traders to save on fees without sacrificing the advanced tools that can drive well-informed decisions.

Options: For traders focused on options, Schwab offers competitive pricing at $0.65 per contract, aligning with many other top brokers while also providing one of the richest options trading toolsets on the market. The thinkorswim platform delivers essential options features, from multi-leg trade support to customizable risk management tools that intermediate and advanced options traders find invaluable. I was impressed by how easy it was to execute and monitor complex strategies without added costs — ideal for those who want to practice advanced options trading without the worry of hidden fees cutting into returns.

Pricing: Schwab also shines in its commitment to transparent pricing, which is complemented by strong customer service and educational resources. Unlike some brokers that layer on unexpected fees, Schwab has straightforward pricing for most of its services, including no-fee accounts and low or waived minimums. Additionally, Schwab’s extensive library of educational materials, live coaching, and responsive support means you’re never left wondering about costs or services. This combination of low pricing, accessible support, and powerful tools makes Schwab a top choice for traders who want to keep trading expenses minimal while enjoying a feature-rich platform.

Check out my comprehensive Charles Schwab review to learn more about its entire platform.

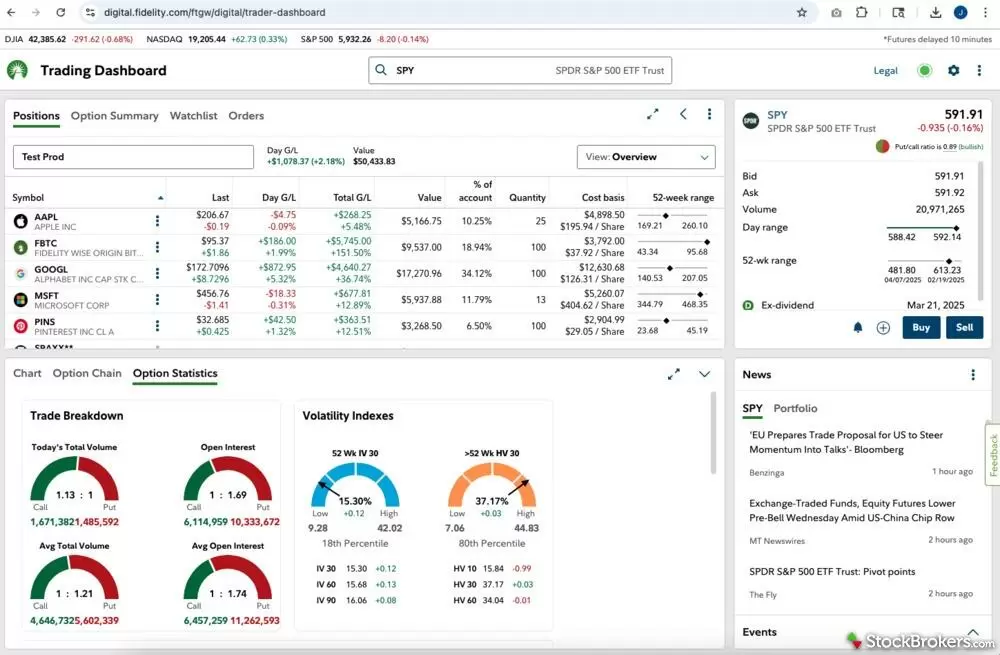

Best for most stock investors - Fidelity

| Company |

Overall |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

Fidelity Fidelity

|

|

$0.00 |

$0.00 |

$0.65 |

Fidelity is the best low-cost choice for most investors, not only because of its zero-commission trades but also because of its truly investor-friendly fee structure. In my experience, Fidelity doesn’t just eliminate trading fees; it removes many hidden costs that can surprise investors elsewhere. For instance, there are no extra fees for trading penny stocks, and Fidelity avoids nuisance charges like account transfer fees that other brokers may tack on. This commitment to minimizing incidental fees makes Fidelity a budget-friendly choice, especially for investors who want clear and predictable pricing without the typical “gotcha” fees.

PFOF: Fidelity’s decision not to accept payment for order flow sets it apart from many other brokers offering free trades. This approach aligns Fidelity with investors’ best interests by focusing on price improvement — meaning clients get the best available prices for their trades. Fidelity’s execution quality frequently ranks among the best in the industry, which directly benefits your bottom line. For cost-conscious investors, knowing Fidelity prioritizes optimal trade execution without sacrificing pricing integrity gives it a strong edge in the market.

Zero-expense funds: Finally, Fidelity offers a range of low-cost investment options beyond free stock trading, including a variety of zero-expense ratio mutual funds. These funds, exclusive to Fidelity, carry no management fees, saving investors on long-term costs and making diversified portfolios more affordable. Fidelity also maintains highly competitive ETF fees and provides fractional share trading, so even higher-priced stocks are accessible to all investors. By combining free stock trades with a spectrum of cost-saving investment options, Fidelity supports both short-term trading and long-term growth without burdening investors with unnecessary fees.

Read my Fidelity review for a deeper dive into all of its features and investment options.

Best user experience - Merrill Edge

| Company |

Overall |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

Merrill Edge Merrill Edge

|

|

$0.00 |

$0.00 |

$0.65 |

Merrill Edge offers one of the best user experiences among stock brokers with free stock trading, combining $0 commission on stocks and ETFs with a clean, easy-to-navigate platform that’s designed with everyday investors in mind. With Merrill Edge, you’ll experience a well-rounded design that balances essential research tools, account management features, and smooth platform navigation, making it easy for beginners and seasoned investors alike to manage their portfolios. The seamless integration with Bank of America also makes transferring funds straightforward, which is a major plus for anyone who already banks with BofA.

Fees: Beyond its fee-free stock and ETF trades, Merrill Edge’s cost structure is both transparent and reasonable, which adds to the trustworthiness and value of the platform. Options trading costs $0.65 per contract, which is competitive with many top brokers, and broker-assisted trades are reasonably priced at $19.95. With Merrill Edge, I never felt like I was hit with unexpected charges or fees, thanks to their straightforward approach to pricing — an advantage for anyone who prioritizes clear, predictable costs as part of their investing experience.

Education: Merrill Edge’s educational tools and research features are another big part of what makes it exceptional for fee-conscious investors. Tools like Stock Story, Fund Story, and the AI-powered Dynamic Insights transform data into actionable insights, making it easy to assess potential trades without needing to pay for premium research. It presents risks and upside in the exact thoughtful way that I, as a former wealth manager, would present them to my clients. For anyone looking for a $0 commission broker that prioritizes a user-friendly, educational experience, Merrill Edge is a superb choice.

Head on over to my review of Merrill Edge to find out more about its pricing and features.

Trading fees comparison

FAQs

What is commission-free trading?

Commission-free trading means the broker does not charge a fee for buying or selling a stock or exchange-traded fund (ETF). Brokers have other ways of making money, though. Most free stockbrokers make money via a practice called payment for order flow, or PFOF, a fee that generates over $1 billion each year in revenue for the industry.

Can you trade stocks for free?

Yes, you can now trade stocks and exchange-traded funds (ETFs) for free with most online brokers. Brokers are competing hard for your investing dollars. A pricing war in 2019 led to full-service brokerages cutting their commissions to $0 to compete with free trading platforms such as Robinhood. Don’t worry about them making money, though: Instead of charging commissions, almost all accept payment for order flow (PFOF), loan money and securities, earn interest on idle cash balances, and charge incidental fees.

How can I trade without fees?

It’s not difficult to trade fee-free. In our analysis, we conducted comprehensive tests on 17 online brokers, all of whom offer “free” stock and ETF trades. By free, they mean that they don’t charge any cost per share to trade. Brokers do pass along some trade fees charged by regulatory bodies and exchanges, but they are almost always minuscule and measured by fractions of a cent per share. Brokers may charge fees for other products and services, such as trading options, mutual funds, robo-advising, or transferring your money in or out. Some brokers also charge for penny stocks.

Are trading platforms free?

Yes, trading platforms with features once only available to investing professionals are now offered to investors for free. Most of the online brokers that cater to individual investors make their trading platforms available for free simply by opening an account. There’s rarely a minimum investment required, which means you can have a zero balance and still use many of the broker’s tools. You may even be able to test-drive the trading platform with paper trading, which allows you to practice trading with pretend money.

What is the best free trading platform?

The best free trading platform in 2025 is Interactive Brokers’ IBKR Lite account option, offering zero-commission trades on U.S. stocks and ETFs without monthly fees or account minimums. What sets IBKR Lite apart is its access to the powerful suite of Interactive Brokers’ trading tools and global assets, making it ideal for those who want professional-grade features without a cost barrier. While IBKR Lite does rely on payment for order flow (PFOF), which can slightly impact execution quality, this is a minor trade-off given the platform’s affordability and versatility. For those prioritizing optimal execution, the subscription-based IBKR Pro offers an alternative with no PFOF, but for free trades with advanced tools, IBKR Lite is unmatched.

What are the best free stock trading apps?

For the best free stock trading apps in 2025, Interactive Brokers, E*TRADE from Morgan Stanley, Fidelity, Charles Schwab, and Merrill Edge each excel in unique ways. Interactive Brokers offers three distinct apps catering to a range of investor needs, from the extensive features in IBKR Mobile to ESG-focused investing with Impact. E*TRADE is a great option for casual traders, thanks to its easy navigation and Power E*TRADE’s advanced tools for chart-driven trades. Fidelity’s app is a favorite among beginners and long-term investors, balancing usability with deep research tools, while Charles Schwab provides the robust thinkorswim app, which is ideal for active traders needing advanced options and charting. Finally, Merrill Edge is fantastic for in-depth research, with features like Stock Story making data easily digestible, particularly for Bank of America customers looking for seamless integration. Each app is free to download and offers commission-free trades, so you can choose one that best suits your trading style and needs.

How do brokers make money on commission-free trades?

For startup brokers such as Robinhood and Webull, payment for order flow (PFOF) is the primary way of making money. With larger full-service brokers such as Fidelity and Schwab, the largest revenue source comes from sweeping the idle cash sitting in customer accounts into subsidiary banks each night. They also loan money to margin investors and charge incidental fees. Brokers also hope to upsell their commission-free stock investors into advisory services or other managed products.

StockBrokers.com Review Methodology

Why you should trust us

Sam Levine, CFA, CMT, formerly a lead writer for StockBrokers.com, has over 30 years of investing experience and actively trades stocks, ETFs, options, futures, and options on futures. He's held roles as a portfolio manager, financial consultant, investment strategist and journalist. He holds the Chartered Financial Analyst (CFA) and the Chartered Market Technician (CMT) designations and served on the board of directors of the CMT Association.

Blain Reinkensmeyer, co-founder of StockBrokers.com, has been investing and trading for over 25 years. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. Today, Blain is widely respected as a leading expert on finance and investing, specifically the U.S. online brokerage industry. Blain has been quoted in The New York Times, The Wall Street Journal, Forbes, and Fast Company, among others. Blain created the original scoring rubrics for StockBrokers.com and oversees all testing and rating methodologies.

How we tested

- We used our own brokerage accounts for testing.

- We collected thousands of data points for each broker.

- We tested each online broker's website, desktop platforms, and mobile app, where applicable.

- We maintained strict editorial independence; brokers cannot pay for inclusion or a higher rating.

Our research team meticulously collected data on every feature of importance to a wide range of customer profiles, including beginners, casual investors, passive investors, and active traders. We carefully track variables like margin rates, trading costs, fees, and platform features and use them to help rate brokers across a range of categories measuring ease of use, range of investments, research, education, and more.

At StockBrokers.com, our reviewers use a variety of computing devices to evaluate platforms and tools. Our reviews and data collection were conducted using the following devices: iPhone SE running iOS 17.5.1, MacBook Pro M1 with 8 GB RAM running the current MacOS, and a Dell Vostro 5402 laptop i5 with 8 GB RAM running Windows 11 Pro.

Each broker was evaluated and scored on over 200 different variables across seven key categories: Range of Investments, Platforms & Tools, Research, Mobile Trading, Education, Ease of Use, and Overall. Learn more about how we test.