Best Trading Platforms for 2026

Choosing the right stock broker is as important as choosing the right investments. With commission-free trading now the industry standard, competition between brokerage firms is no longer about pricing — it’s about tools and features.

Whether you’re a beginner, an active trader looking for institutional-grade tools, or a long-term investor building a retirement portfolio, a great broker can make all the difference. I spent hundreds of hours testing online trading platforms and mobile apps, placing trades, exploring tools, and gathering thousands of data points; here are my picks for the best stock brokers of 2026.

Why you can trust StockBrokers.com

Since 2009, we've helped over 20 million visitors research, compare, and choose an online broker. Our writers have collectively placed thousands of trades over their careers. Here's how we test.

Best Trading Platforms of 2026

Here are the best online stock brokers for 2026, based on over 3,000 data points.

- Minimum Deposit: $0.00

- Stock Trades: $0.00

- Options (Per Contract): $0.65

With the addition of TD Ameritrade's thinkorswim platforms and the enhancement of several features, Schwab is now a vigorous competitor with thought-provoking research and commentary and a client experience to fit any preference. Read full review

- TD Ameritrade’s excellent thinkorswim trading platforms now available

- Trading-friendly app and browser enhancements

- Exceptional high net worth services

- No cryptocurrency trading

- Mutual fund fees are complex

- Minimum Deposit: $0.00

- Stock Trades: $0.00

- Options (Per Contract): $0.65

Interactive Brokers is a go-to choice for professionals because of its institutional-grade desktop trading platform, high-quality trade executions and rock-bottom margin rates. Read full review

- Astounding array of customizable tools

- Allows trading in foreign markets

- Convenient apps for individual investors

- Restrictive trading permissions

- Main platforms might feel cold

- Minimum Deposit: $0.00

- Stock Trades: $0.00

- Options (Per Contract): $0.65

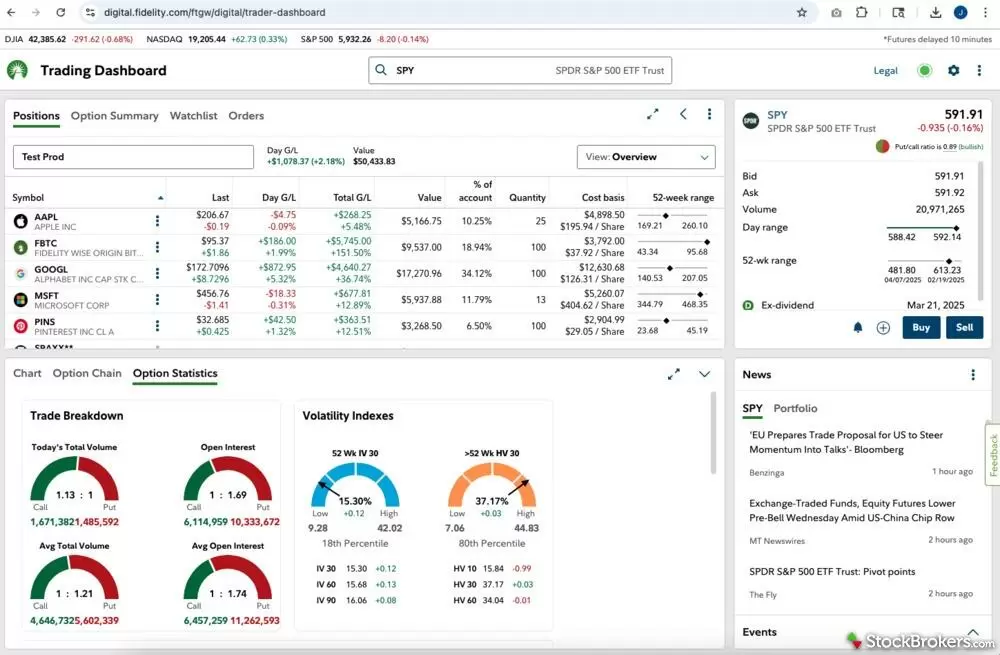

Fidelity is a value-driven online broker offering $0 trades, industry-leading research, excellent trading tools and an easy-to-use mobile app. Read full review

- Excellent research and mobile app

- Top-notch education

- Decades of reliable client service

- No dedicated mobile app for active trading

- Minimum Deposit: $0.00

- Stock Trades: $0.00

- Options (Per Contract): $0.65

E*TRADE is a top-performing broker whose highlights include $0 trades, two excellent mobile apps and the Power E*TRADE platform. Crypto, however, is not available. Read full review

- Watch lists are the best in the business

- Smooth mobile navigation

- High-quality high-net-worth Morgan Stanley proprietary research

- Cryptocurrencies not currently available

- Margin rates are high compared to other brokers

- Minimum Deposit: $0.00

- Stock Trades: $0.00

- Options (Per Contract): $0.65

Merrill Edge and its parent, Bank of America, make for a well-rounded offering, with $0 trades, robust research, reliable customer service; and its Stock Stories and Fund Stories are an industry standout. There are some gaps in investment offerings, including crypto and futures. Read full review

- Portfolio Story, Dynamic Insights, and the Stock and Fund Stories are groundbreaking features

- High-quality proprietary research

- Some site elements slow to load

- No crypto, futures, forex or penny stocks

- Minimum Deposit: $0.00

- Stock Trades: $0.00

- Options (Per Contract): $0.65

J.P. Morgan Self-Directed Investing makes it easy for Chase Bank customers to invest and allows access to J.P. Morgan research. On the downside, the broker features are sparse compared to industry leaders. Read full review

- Among our best brokers for banking services

- Multi-account benefits

- Mobile app provides clean access to investing, education and market news

- Platforms are very basic

- Educational content is hard to browse

- Minimum Deposit: $0.00

- Stock Trades: $0.00

- Options (Per Contract): $0.00

With steady innovation and a growing feature set, Firstrade is quickly climbing the ranks to earn its place among the best online brokers. Firstrade’s $0 contract fee, no exercise/assignment fees, and top-tier options trade ticket make it one of the most cost-effective and well-designed platforms for options trading. Read full review

- Excellent for Chinese-speaking investors

- Has bolstered its options education and trading capabilities

- Easy-to-use mobile app

- Trading platform and tools trail industry leaders

- Investor education is thin

Compare trading platforms head-to-head

Use the broker comparison tool to compare over 150 different account features and fees.

Read next

- Best Futures Trading Platforms for 2026

- Best Stock Trading Apps for 2026

- Best Brokers for Penny Stock Trading of 2026

- Best Day Trading Platforms of 2026 for Beginners and Active Traders

- Best Stock Trading Platforms for Beginners of 2026

- Best Options Trading Platforms for 2026

- Best Paper Trading Apps & Platforms for 2026

Charles Schwab

Charles Schwab

Interactive Brokers

Interactive Brokers

Fidelity

Fidelity