Why you can trust us

Why you can trust us

Led by Jessica Inskip, Director of Investor Research, the StockBrokers.com research team collects thousands of data points across hundreds of variables. We evaluate features important to every kind of investor, including beginners, casual investors, passive investors, and active traders. We carefully track data on margin rates, trading costs, and fees to rate stock brokers across our proprietary testing categories.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on StockBrokers.com. Learn more about how we test.

The modern brokerage landscape is often dominated by talk of high-speed execution and complex algorithmic tools, yet for most investors, the true measure of a firm’s value is felt most acutely when something goes wrong. Whether it is a technical glitch during a volatile market session or a complex question about an inherited IRA, the quality of customer service remains the bedrock of a reliable trading experience.

In an era where many fintech startups have retreated behind automated chatbots and endless FAQ loops, a select group of established brokers has doubled down on human connection. Choosing a partner that prioritizes responsive, knowledgeable support can be the difference between a minor hiccup and a significant financial headache. We believe that professional-grade service should not be a luxury reserved only for the ultra-wealthy.

To help you find the best brokers for customer service in 2026, StockBrokers.com partnered with Confero to conduct 132 phone tests across the U.S., measuring wait times and service quality. We evaluated brokers based on responsiveness, professionalism, and knowledgeability to ensure you get the support you need.

This guide highlights the top five brokers for customer service — Charles Schwab, Fidelity, Ally Invest, J.P. Morgan Self-Directed Investing, and tastytrade. Each broker earned its spot by consistently demonstrating quick response times and well-trained representatives who delivered clear, actionable information.

Top 5 Winners for Customer Service

1. Charles Schwab - Best broker for customer service

| Company |

Overall |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

Charles Schwab Charles Schwab

|

|

$0.00 |

$0.00 |

$0.65 |

Charles Schwab has reclaimed the top spot for customer service in 2026, setting the industry benchmark for both speed and substance. In our rigorous testing, Schwab delivered an exceptional performance, boasting an average connection time of just under 47 seconds. This efficiency, combined with a Net Promoter Score (NPS) of 9.4 out of 10, highlights a support infrastructure that is not just accessible but genuinely effective at resolving client needs on the first contact.

Professionalism and expertise: The quality of Schwab’s representatives stood out as a defining feature of our evaluation. Unlike competitors that often rely on tiered support systems where entry-level agents strictly follow scripts, Schwab’s team demonstrated a remarkable depth of knowledge. Whether the call was about the nuances of a Roth IRA conversion or technical specifications within the thinkorswim platform, the representatives provided clear, accurate answers without needing to transfer the caller. This versatility ensures that both passive investors and active traders receive support tailored to their sophistication level.

phone_callbackSample phone call:

Chase used my name throughout the call. He was friendly and respectable. He made an attempt to build rapport about my current status, and he said it was free to open an account, trades are free, and they offer 24/7 licensed stockbroker assistance. ... Chase invited me to call back at any time, provided his email, and encouraged me to provide my email and phone number so he could follow up with me. I felt Chase did a great job.

The branch advantage: While its digital support is top-tier, Schwab’s physical footprint remains a massive competitive advantage. With over 400 branches nationwide, it offers a level of traditional care that digital-only rivals cannot match. This hybrid model, combining 24/7 phone access with the ability to sit down face-to-face with a specialist, makes Schwab the ideal partner for investors who value having a safety net for significant financial life events.

- Average Connection Time: Under a minute

- Average Net Promoter Score: 9.4 / 10

- Average Professionalism Score: 9.1 / 10

- Overall Score: 9.28 / 10

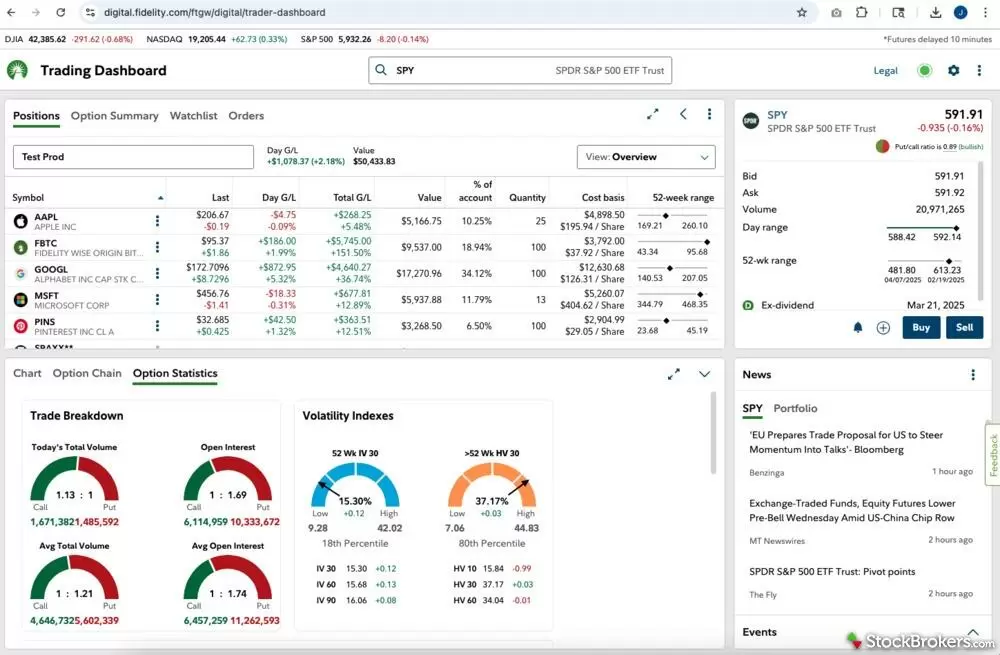

2. Fidelity - Best for 24/7 reliability

| Company |

Overall |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

Fidelity Fidelity

|

|

$0.00 |

$0.00 |

$0.65 |

In our testing, Fidelity clocked an industry-leading average connection time of just under 35 seconds. For investors who demand immediate attention and have zero tolerance for hold music, Fidelity delivers a frictionless experience that, in terms of responsiveness, is the most efficient in the business.

Speed meets substance: The "always-on" nature of Fidelity’s service is its strongest asset. During our evaluation, we tested their customer service lines at various off-peak hours, including late nights and weekends. Unlike competitors that often route after-hours calls to generalist answering services, Fidelity consistently connected me with capable representatives who could access account details and resolve complex issues on the spot. This 24/7 reliability provides a critical safety net for traders who manage their portfolios outside of standard market hours.

phone_callbackSample phone call:

This was an outstanding call experience. The associate answered my call after 2 seconds with a warm greeting that included the company name and her own. ... She asked if I had additional questions and said that she hoped I would consider opening an account. She then closed the call with pleasant parting remarks and invited me to call back if I had additional questions. She had excellent phone presence. She was knowledgeable and provided thorough answers.

Educational coaching: What truly distinguishes Fidelity from a standard call center is the proactive, educational approach of its agents. During our calls, representatives didn’t just answer the immediate question; they often pivoted to a coaching role. When one caller inquired about finding potential investments, the agent guided the caller to the specific screener tools on the website, explaining how to filter by sector or rating score. This approach empowers clients to use the platform's robust research tools independently, turning a transactional support call into a learning opportunity.

- Average Connection Time: Under a minute

- Average Net Promoter Score: 9.2 / 10

- Average Professionalism Score: 8.9 / 10

- Overall Score: 9.08 / 10

3. Ally Invest - Fast, friendly, and always available

| Company |

Overall |

Minimum Deposit |

Stock Trading |

Options (Per Contract) |

Ally Invest Ally Invest

|

|

$0.00 |

Yes |

$0.50 |

Ally Invest secures the third spot in our 2026 rankings, impressing our testing team with a service model that effectively bridges the gap between digital convenience and human support. With an average connection time of roughly one minute and 45 seconds, Ally demonstrated that a digital-first firm can still provide timely, personal assistance. Our testers consistently noted the "warm introductions" and professional tone of the representatives, who often made the interactions feel more like a conversation than a transaction.

Integrated banking experience: A key takeaway from our evaluation was the seamless nature of Ally's ecosystem. One representative explicitly confirmed that the mobile app for trading is the exact same one used for banking, reinforcing the "one-stop-shop" appeal for clients who want to view their entire financial life in a single login. This integration simplifies the user experience, allowing for a level of fluidity between cash management and investing that standalone brokerages struggle to match.

phone_callbackSample phone call:

The employee answered the call with a professional greeting and introduced himself just three seconds after the automated system transferred me. … When I asked if after-hours trading was offered and what order types I can use for after-hours trading, he indicated that it is pre- and post- by one hour and uses limit orders. … He wished me a great day and closed the call.

Accountability and accuracy: During our calls, the support team prioritized accuracy over speed. When we asked niche questions, such as specific limits on watchlists, the representatives didn't guess; they paused to "look it up" and provided verified answers. One tester noted that the agent explicitly checked if the website data synced with the mobile app before confirming. This willingness to verify details rather than recite a script built a strong sense of trust with our team.

- Average Connection Time: 1.8 minutes

- Average Net Promoter Score: 8.3 / 10

- Average Professionalism Score: 8.3 / 10

- Overall Score: 8.43 / 10

4. JP Morgan Self-Directed Investing - Best for in-branch access

J.P. Morgan Self-Directed Investing leverages the massive scale of Chase Bank to offer a unique hybrid experience. For investors who prioritize face-to-face interaction, the ability to walk into one of thousands of local Chase branches for support is a game-changer that digital-only firms cannot match. This makes it an ideal choice for existing Chase clients who want to consolidate their banking and investing under one roof with a unified service team.

In our phone testing, J.P. Morgan delivered the fastest raw connection speeds of any broker in the group, with representatives answering in an average of just 29 seconds. While the service is incredibly responsive, our testers noted that the depth of specialized trading knowledge trailed the top-tier firms. It is a reliable, efficient service model built for convenience and banking integration rather than complex strategy coaching.

phone_callbackSample phone call:

Walter answered my call, greeted me by introducing himself, and asked for my name. … He said that since I was a JP Morgan credit card holder, I could log in to my account and set up a self-directed account online. Walter asked me if I had any additional questions and ended the call warmly, telling me to have a great rest of the week. Walter said that if I had further questions, I could call back and someone would be happy to answer my questions. Walter was professional and friendly.

- Average Connection Time: Under a minute

- Average Net Promoter Score: 7.7 / 10

- Average Professionalism Score: 8.3 / 10

- Overall Score: 7.89 / 10

5. tastytrade - Best for active trader support

| Company |

Overall |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

tastytrade tastytrade

|

|

$0.00 |

$0.00 |

$0.50 info |

tastytrade rounds out our top five with a service model built specifically for the high-velocity world of active trading. Earning its reputation as a platform "by traders, for traders," the support team operates less like a traditional help desk and more like a trade desk. In our testing, connection times were impressively fast, averaging just 35 seconds which is a critical feature when you are managing complex options positions in a moving market.

The customer service experience here is distinctively technical. The representatives are industry veterans who speak the language of Greeks and rolling strategies fluently, allowing advanced traders to bypass the usual introductory scripts. While it may not offer the broad financial planning guidance of a full-service brokerage, for those focused on derivatives and speed, tastytrade’s specialized support is a potent asset.

phone_callbackSample phone call:

The rep answered in an upbeat manner, stating the company name and his own, and asked how he could help. When I asked what tastytrade was best known for, he cited the industry's best commission and fee structure and top-tier customer service. He noted a key benefit is that they are among the few offering free broker-assisted trades. He explained that if I were traveling, I could simply call to place orders for free, which is a feature that attracts many clients.

- Average Connection Time: Under a minute

- Average Net Promoter Score: 7.8 / 10

- Average Professionalism Score: 7.4 / 10

- Overall Score: 7.82 / 10

Comparison of the best stock brokers for customer service

Compare the top brokers at a glance with this table highlighting their overall ratings, minimum deposit requirements, and options contract pricing. This quick reference will help you pinpoint the broker that aligns with your trading preferences and budget.

Our testing

Why you should trust us

Jessica Inskip is Director of Investor Research at StockBrokers.com, bringing 15 years of experience in brokerage and trading strategy. A former FINRA-licensed rep, she held Series 7, 63, 66, and 4 licenses. Jessica focuses on investor education and brokerage industry research, appears regularly on CNBC, Bloomberg, The Schwab Network, Fox Business, and Yahoo! Finance, and hosts the Market MakeHer podcast.

Blain Reinkensmeyer, co-founder of StockBrokers.com, has been investing and trading for over 25 years. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. Today, Blain is widely respected as a leading expert on finance and investing, specifically the U.S. online brokerage industry. Blain has been quoted in The New York Times, The Wall Street Journal, Forbes, and Fast Company, among others. Blain created the original scoring rubrics for StockBrokers.com and oversees all testing and rating methodologies.

How we tested

- We used our own brokerage accounts for testing.

- We collected thousands of data points across the brokers we review.

- We tested each online broker's website, desktop platforms, and mobile app, where applicable.

- We maintained strict editorial independence; brokers cannot pay for inclusion or a higher rating.

Our research team meticulously collected data on every feature of importance to a wide range of customer profiles, including beginners, casual investors, passive investors, and active traders. We carefully track variables like margin rates, trading costs, fees, and platform features and use them to help rate brokers across a range of categories measuring ease of use, range of investments, research, education, and more.

At StockBrokers.com, our reviewers use a variety of computing devices to evaluate platforms and tools. Our reviews and data collection were conducted using the following devices: iPhone SE running iOS 17.5.1, MacBook Pro M1 with 8 GB RAM running the current MacOS, and a Dell Vostro 5402 laptop i5 with 8 GB RAM running Windows 11 Pro.

Each broker was evaluated and scored on over 200 different variables across seven key categories: Range of Investments, Platforms & Tools, Research, Mobile Trading, Education, Ease of Use, and Overall. Learn more about how we test.

Trading platforms tested

We tested 14 online trading platforms for this guide:

Charles Schwab

Charles Schwab

Fidelity

Fidelity

Ally Invest

Ally Invest

J.P. Morgan Self-Directed Investing

J.P. Morgan Self-Directed Investing

tastytrade

tastytrade