TradeStation Review

TradeStation positions itself as the go-to platform for serious traders, especially those with a high net worth and a strong interest in active trading. With a “Born to Trade” philosophy, the firm has sharpened its focus on delivering sophisticated tools that meet the unique needs of experienced, well-capitalized traders.

However, the platform can be challenging for new users, as TradeStation’s complex functionality and segmented design can make navigation frustrating. While it's a powerhouse for those who can fully leverage its capabilities, casual or low-balance investors may find its structure and fees less appealing. Ultimately, TradeStation remains best suited for those who want full control, customization, and high-level support in their trading experience.

-

Minimum Deposit:

$0.00 -

Stock Trades:

$0.00 -

Options (Per Contract):

$0.60

| Range of Investments | |

| Mobile Trading Apps | |

| Platforms & Tools | |

| Research | |

| Education | |

| Ease of Use | |

| Customer Service |

Check out StockBrokers.com's picks for the best stock brokers in 2025.

| 2025 | #9 |

| 2024 | #11 |

| 2023 | #13 |

| 2022 | #9 |

| 2021 | #9 |

| 2020 | #7 |

| 2019 | #7 |

| 2018 | #7 |

| 2017 | #10 |

| 2016 | #10 |

| 2015 | #12 |

| 2014 | #14 |

| 2013 | #13 |

| 2012 | #9 |

| 2011 | #14 |

Table of Contents

Pros & cons

Pros

- Built for options traders.

- Portfolio Maestro offers deep risk and scenario analysis.

- Detailed margin view supports active portfolio monitoring.

Cons

- Complex layout requires time to learn.

- Few stock screeners and no fixed-income research.

- Limited research for long-term or casual investors.

Here are my top takeaways for TradeStation in 2025:

- TradeStation’s desktop platform is a powerhouse for traders who want complete control, but it comes with a steep learning curve.

- TradeStation distinguishes itself with its comprehensive options offering, including top-tier tools, education, and ongoing support, making it a clear choice for single-legged options traders.

- If you’re a long-term investor or rely heavily on research and planning tools, other brokers may fit your needs better.

Range of investments

TradeStation caters to active traders with a variety of asset classes, including stocks, options, futures, futures options, ETFs, and mutual funds. Here’s a quick breakdown:

Stocks & ETFs: TradeStation offers a wide selection of stocks & ETFs with tools geared toward technical analysis, though fundamental insights are limited.

Options: A core focus at TradeStation, options trading is supported with advanced tools, multi-leg trading capabilities, and an Options Resource Center dedicated to strategy and risk management — ideal for active options traders.

Futures and futures options: TradeStation’s futures and futures options feature fast execution, real-time data, and deep market insights, enhancing complex strategies.

| Feature |

TradeStation TradeStation

|

|---|---|

| Stock Trading | Yes |

| Margin Trading | Yes |

| Fractional Shares | No |

| OTC Stocks | Yes |

| Options Trading | Yes |

| Complex Options Max Legs | 4 |

| Bonds (US Treasury) | Yes |

| Futures Trading | Yes |

| Forex Trading | No |

| Mutual Funds (Total) | 4000 |

| Crypto Trading | No |

| Crypto Trading - Total Coins | 0 |

| Traditional IRAs | Yes |

| Roth IRAs | Yes |

| Advisor Services | No |

TradeStation fees

TradeStation offers multiple pricing plans suited for frequent traders, with some unique benefits:

TS Select: TradeStation’s main retail pricing plan, TS Select, includes $0 commissions on stock and ETF trades, options at $0.60 per contract, and futures at $1.50 per contract (per side). All three of TradeStation’s trading platforms are accessible under this plan, though traders may need to pay extra for certain market data subscriptions, depending on their needs.

TradeStation Salutes: Active military, veterans, and first responders can benefit from the TradeStation Salutes program, which waives commissions on stock, ETF, and options trades.

Penny stocks: For penny stocks, the first 10,000 shares trade commission-free, with a charge of $0.005 per share thereafter. Orders directed to specific venues incur an additional $0.005 per share.

Inactivity fees: A $10 monthly inactivity fee applies unless the account has an average balance of $5,000 or has seen 10 trades in the past 90 days.

Other fees: TradeStation’s incidental fees are varied. Notably, the account transfer fee is $125, with an annual IRA fee of $35 and a $50 IRA closure fee — higher than most competitors.

| Feature |

TradeStation TradeStation

|

|---|---|

| Minimum Deposit | $0.00 |

| Stock Trades | $0.00 |

| Penny Stock Fees (OTC) | $0.01 |

| ETF Trade Fee | $0.00 |

| Options (Per Contract) | $0.60 |

| Options Exercise Fee | $14.95 |

| Options Assignment Fee | $5.95 |

| Futures (Per Contract) | $1.50 |

| Mutual Fund Trade Fee | $14.95 |

| Broker Assisted Trade Fee | $25 |

Mobile trading apps

TradeStation’s mobile app provides a streamlined experience for active traders, excelling in real-time data delivery, smooth trade execution, tools for monitoring positions and the market, tracking watch list stocks, and easy access to trading tools.

Monitoring the market

The app provides quick insights into market movers, with major indices, oil, and the VIX displayed at the top using spark charts (the name for the daily performance depicted on a small line chart). Then, you get details on sector performance, top analyst ratings, news, and an earnings calendar. Adding Treasurys and an economic calendar would make tracking markets on the app almost perfect.

Jessica's take

"TradeStation's 'Why is it moving?' tool, powered by Benzinga, offers concise explanations for stock movements, saving users from sifting through news feeds. It's awesome. I'd use the app just for this feature."

Quotes and trading

The trade ticket is user-friendly, even for conditional orders. The options chain is convenient for on-the-go options trading, though it lacks some advanced features. Trade integration is seamless, and the watchlist includes basic data points from the desktop platform, though it would benefit from earnings date visibility.

Charting and analysis

Mobile charting includes four chart types, after-hours visibility, and key indicators. It may not match the desktop platform’s customization but offers enough features for casual and intermediate analysis. Predefined screeners in the “Hot Lists” section help traders quickly scan the market.

TradeStation’s mobile app adds real context to market moves with its “Why Is It Moving?” feature, shown here for GOOGL. Instead of just seeing the price, you get quick, relevant insights explaining what's driving the action, whether it’s earnings, analyst calls, or broader news. It’s a powerful way to stay informed without digging through headlines.

| Feature |

TradeStation TradeStation

|

|---|---|

| iPhone App | Yes |

| Android App | Yes |

| Apple Watch App | No |

| Stock Alerts | Yes |

| Charting - After-Hours | Yes |

| Charting - Technical Studies | 45 |

| Charting - Study Customizations | Yes |

| Watch List (Streaming) | Yes |

| Watch Lists - Create & Manage | Yes |

| Watch Lists - Column Customization | Yes |

Trading platforms

TradeStation’s platforms serve seasoned traders with powerful tools for advanced analysis and customization, though some features are more complex to navigate.

Desktop platform

The desktop platform is TradeStation’s crown jewel, offering advanced tools like:

- Radar Screen: Real-time streaming watchlists.

- Matrix: A ladder trading tool for quick order execution.

- Walk-Forward Optimizer: For testing strategies under various conditions.

- EasyLanguage: Customizable coding for creating and sharing trading tools.

With over 30 years of historical data and nearly 300 customizable indicators, the desktop platform is perfect for backtesting and technical analysis. However, it’s only available on Windows or via emulators like Parallels for Mac.

Options and futures trading

Options traders benefit from OptionStation Pro, offering real-time Greeks, position grouping, and advanced analysis tools. Futures traders enjoy a seamless experience using many of the same tools available for equities, with Futures Plus available for browser and mobile access.

Web platform

The web platform provides a simpler experience for basic trading but lacks the depth and customization of the desktop platform. It’s best for quick trades rather than detailed analysis.

TradeStation’s web platform offers a highly customizable layout, ideal for getting a quick pulse on the markets. In this setup, I’ve displayed an options chain, top news stories, and a watchlist, all in one clean view. While it’s not as robust as the downloadable desktop platform, it works for staying informed.

Portfolio tracking

Portfolio Maestro offers tools like Monte Carlo simulations and correlation analysis, ideal for managing risk and beta weighting. However, it lacks performance comparison features, making it a niche tool for hedging strategies.

Tax and account management

TradeStation simplifies taxes with features like default lot selection and displays of key tax dates. Adding beneficiaries requires a manual form, which feels outdated but is efficiently handled by customer support.

| Feature |

TradeStation TradeStation

|

|---|---|

| Active Trading Platform | TradeStation 10 |

| Desktop Trading Platform | Yes |

| Desktop Platform (Mac) | No |

| Web Trading Platform | Yes |

| Paper Trading | Yes |

| Trade Journal | No |

| Watch Lists - Total Fields | 341 |

| Charting - Indicators / Studies | 294 |

| Charting - Drawing Tools | 23 |

| Charting - Study Customizations | 12 |

| Charting - Save Profiles | Yes |

| Trade Ideas - Technical Analysis | Yes |

| Streaming Time & Sales | Yes |

| Trade Ideas - Backtesting | Yes |

Research

TradeStation will appeal to traders who prefer to generate their own ideas through technical analysis but will fall short for those seeking rigorous fundamental research or external analyst opinions. Active traders with a focus on options and technical signals will find the platform highly valuable, while those seeking a holistic market view may be better served elsewhere.

Stock and fund research

TradeStation offers comprehensive stock screening and equity backtesting tools, with technical analysis driven by price, volume, time, and volatility. However, fundamental data is limited, with details like earnings history and dividends buried in the interface. This makes TradeStation less ideal for those relying on deep, fundamental insights. Research for funds is very minimal.

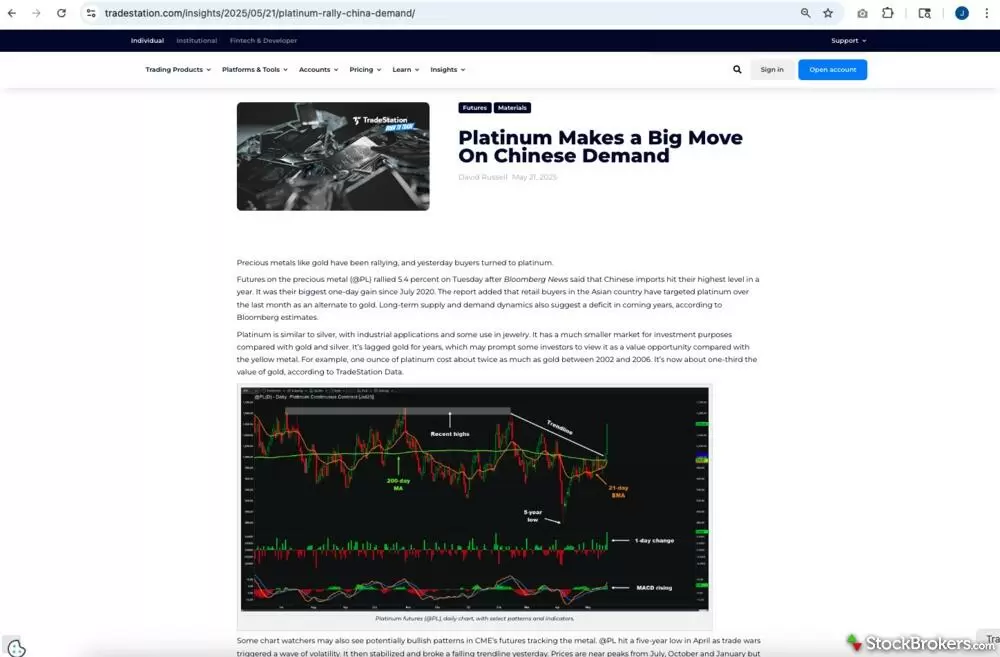

TradeStation’s Traders Insight blog delivers actionable market commentary from a trader’s point of view, covering a wide range of asset classes and strategies. This post focuses on commodities and even includes screenshots from the TradeStation platform to help visualize the analysis.

Options research

Options traders will appreciate TradeStation’s inclusion of delta beta weighting on the options chain, a critical metric for analyzing portfolio risk and aligning strategies with market movements. However, not all the greeks are netted for multi-leg strategies — only delta and theta are available. As an avid options trader myself, I find that this omission significantly limits the platform’s usability for complex multi-leg options strategies, making it fully usable for single-leg trading only.

Macro research

TradeStation offers heatmaps showing sector and industry performance, useful for identifying market leaders. However, it lacks major event tracking, Treasury data, and a cohesive economic calendar, which limits you from having a comprehensive view of the market. But from a technical analysis perspective, you will find everything you need.

Market commentary and opinion research

In-house content under the Learn tab provides news-driven insights, with a blog offering weekly updates and links to attend live webinars.

| Feature |

TradeStation TradeStation

|

|---|---|

| Research - Stocks | Yes |

| Stock Research - ESG | No |

| Stock Research - PDF Reports | 0 |

| Screener - Stocks | Yes |

| Research - ETFs | Yes |

| Screener - ETFs | No |

| Research - Mutual Funds | No |

| Screener - Mutual Funds | No |

| Research - Pink Sheets / OTCBB | Yes |

| Research - Bonds | No |

Education

TradeStation’s education is tailored for already experienced investors, and I have to say, the focus on options trading is impressive. The materials are designed to help you master advanced strategies while navigating the platform with confidence. That said, if you’re just starting out, you might feel a bit lost — the basics are definitely not the priority here.

TradeStation’s education stands out by seamlessly connecting strategy explanation with platform application, like this breakdown of a synthetic position. Complete with visuals from the actual trading interface, it helps traders understand not just the theory, but how to execute the strategy using real tools.

Options education

The Options Resource Center is one of the best I’ve seen. It combines strategy-focused articles, polished videos, and platform tutorials into a cohesive learning experience. I really appreciate how everything — outcomes, risk management, and platform examples — is laid out in a way that makes sense. The biweekly market updates and in-person events available to clients add a real-world touch that’s invaluable.

Stocks and funds

The education here seems designed to fast-track you into becoming a day trader. Education starts with the basics — like explaining what stocks or funds are — then, it jumps straight into margin and day trading concepts. ETFs are grouped in with stocks, so they don’t get a focused overview either. If you’re looking for foundational knowledge before diving into more advanced strategies, you may find this approach a bit overwhelming.

Contextual education

One thing I appreciated was the contextual guidance built into the platform. It’s great to see little descriptions and tooltips as you navigate — it makes using the platform feel a touch more intuitive.

Webinars

Webinars are seamlessly integrated into TradeStation’s educational offerings, with a dedicated space for accessing them. Topics cover technical analysis, market trends, and options-specific strategies.

| Feature |

TradeStation TradeStation

|

|---|---|

| Education (Stocks) | Yes |

| Education (ETFs) | No |

| Education (Options) | Yes |

| Education (Mutual Funds) | No |

| Education (Bonds) | No |

| Education (Retirement) | No |

| Paper Trading | Yes |

| Videos | Yes |

| Webinars | Yes |

| Webinars (Archived) | Yes |

| Progress Tracking | No |

| Interactive Learning - Quizzes | No |

TradeStation customer service

To score Customer Service, StockBrokers.com partners with customer experience research firm Confero to conduct phone tests from locations throughout the United States. For this year's testing, 130 customer service tests were conducted over six weeks, with wait times logged for each call.

Customer service representatives were asked for assistance or details for prospective customers in several areas of broker services, including account opening, trading tools, apps, rollovers, active trading, and more. Here are the results for TradeStation's customer service ranking.

- Average Connection Time: 2-3 minutes

- Average Net Promoter Score: 8.0 / 10

- Average Professionalism Score: 6.4 / 10

- Overall Score: 7.30 / 10

- Ranking: 10th of 13 brokers

Final thoughts

TradeStation is a platform built for serious traders who thrive on customization and advanced tools. The desktop platform is excellent for rules-based and technical trading, offering powerful features like its proprietary EasyLanguage scripting feature that allows traders to develop fully customized, automated trading strategies.

Another great selling point is TradeStation's Private Brokerage service, which offers a concierge-level experience catering to high-net-worth clients with exclusive features, including direct access to a representative and bespoke research resources.

However, TradeStation's platform does require a time investment to fully unlock its potential, making it better suited for experienced traders or those ready to commit to learning. TradeStation’s focus on active trading might also leave long-term investors or beginners wanting more in terms of foundational education and broad market insights.

TradeStation Star Ratings

| Feature |

TradeStation TradeStation

|

|---|---|

| Overall |

|

| Range of Investments |

|

| Mobile Trading Apps |

|

| Platforms & Tools |

|

| Research |

|

| Customer Service |

|

| Education |

|

| Ease of Use |

|

StockBrokers.com Review Methodology

Why you should trust us

Jessica Inskip is Director of Investor Research at StockBrokers.com, bringing 15 years of experience in brokerage and trading strategy. A former FINRA-licensed rep, she held Series 7, 63, 66, and 4 licenses. Jessica focuses on investor education and brokerage industry research, appears regularly on CNBC, Bloomberg, The Schwab Network, Fox Business, and Yahoo! Finance, and hosts the Market MakeHer podcast.

Blain Reinkensmeyer, co-founder of StockBrokers.com, has been investing and trading for over 25 years. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. Today, Blain is widely respected as a leading expert on finance and investing, specifically the U.S. online brokerage industry. Blain has been quoted in The New York Times, The Wall Street Journal, Forbes, and Fast Company, among others. Blain created the original scoring rubrics for StockBrokers.com and oversees all testing and rating methodologies.

How we tested

- We used our own brokerage accounts for testing.

- We collected thousands of data points across the brokers we review.

- We tested each online broker's website, desktop platforms, and mobile app, where applicable.

- We maintained strict editorial independence; brokers cannot pay for inclusion or a higher rating.

Our research team meticulously collected data on every feature of importance to a wide range of customer profiles, including beginners, casual investors, passive investors, and active traders. We carefully track variables like margin rates, trading costs, fees, and platform features and use them to help rate brokers across a range of categories measuring ease of use, range of investments, research, education, and more.

At StockBrokers.com, our reviewers use a variety of computing devices to evaluate platforms and tools. Our reviews and data collection were conducted using the following devices: iPhone SE running iOS 17.5.1, MacBook Pro M1 with 8 GB RAM running the current MacOS, and a Dell Vostro 5402 laptop i5 with 8 GB RAM running Windows 11 Pro.

Each broker was evaluated and scored on over 200 different variables across seven key categories: Range of Investments, Platforms & Tools, Research, Mobile Trading, Education, Ease of Use, and Overall. Learn more about how we test.

Trading platforms tested in 2025

We tested 16 online trading platforms in 2025:

- Ally Invest review

- Charles Schwab review

- eToro review

- E*TRADE review

- Fidelity Investments review

- Firstrade review

- Interactive Brokers review

- J.P. Morgan Self-Directed Investing review

- Merrill Edge review

- Public.com review

- Robinhood review

- SoFi Invest® review

- tastytrade review

- TradeStation review

- Tradier

- Webull review

TradeStation 2025 Results

For the StockBrokers.com 2025 Annual Awards, announced on Jan. 28, 2025, all U.S. equity brokers we reviewed were assessed on over 200 different variables across seven areas: Range of Investments, Platforms & Tools, Research, Mobile Trading, Education, Ease of Use, and Overall.

StockBrokers.com also presented “Best in Class” awards to brokers in the following additional categories: Active Traders, Bank Brokerage, Beginners, Casual Investors, Customer Service, Futures Trading, High Net Worth Investors, Investor Community, Options Trading, Passive Investors, Retirement Accounts. A “Best in Class” designation means finishing in the top five brokers for that category.

For more information, see how we test. New to investing? Check out our beginner's guide on how to invest.

Category awards

| Rank #1 | Streak #1 | Best in Class | Best in Class Streak | |

| Platforms & Tools | 1 | |||

| Range of Investments | 3 | |||

| Futures Trading | 6 |

Read next

- Best Paper Trading Apps & Platforms for 2025

- Best Options Trading Platforms for 2025

- Best Online Brokers & Trading Platforms for 2025

- Best Futures Trading Platforms for 2025: A Beginner-Friendly Guide to an Advanced Market

- Best Day Trading Platforms for 2025

- Best Stock Trading Apps for 2025

- Best Brokers for Penny Stock Trading of 2025

- Best Stock Trading Platforms for Beginners of 2025

More Guides

Popular Stock Broker Reviews

About TradeStation

Headquartered in Plantation, Florida, TradeStation is a wholly owned subsidiary of Monex Group, Inc. (TOKYO: 8698). TradeStation's roots date back to 1982, when the company was formed under the name Omega Research. The company's flagship TradeStation platform was launched in 1991, and TradeStation Group was a Nasdaq-listed company from 1997 until 2011, at which point it was acquired by Monex Group.