Best Brokers for Range of Investments

Led by Jessica Inskip, Director of Investor Research, the StockBrokers.com research team collects thousands of data points across hundreds of variables. We evaluate features important to every kind of investor, including beginners, casual investors, passive investors, and active traders. We carefully track data on margin rates, trading costs, and fees to rate stock brokers across our proprietary testing categories.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on StockBrokers.com. Learn more about how we test.

Having access to a wide range of investments can make a big difference, especially as your goals and strategies evolve over time. While some brokers focus on the basics, others offer a much deeper lineup that includes multiple asset classes, specialized account types, and access to global markets. The best brokers for range of investments give investors the flexibility to build and adjust their portfolios without needing multiple accounts.

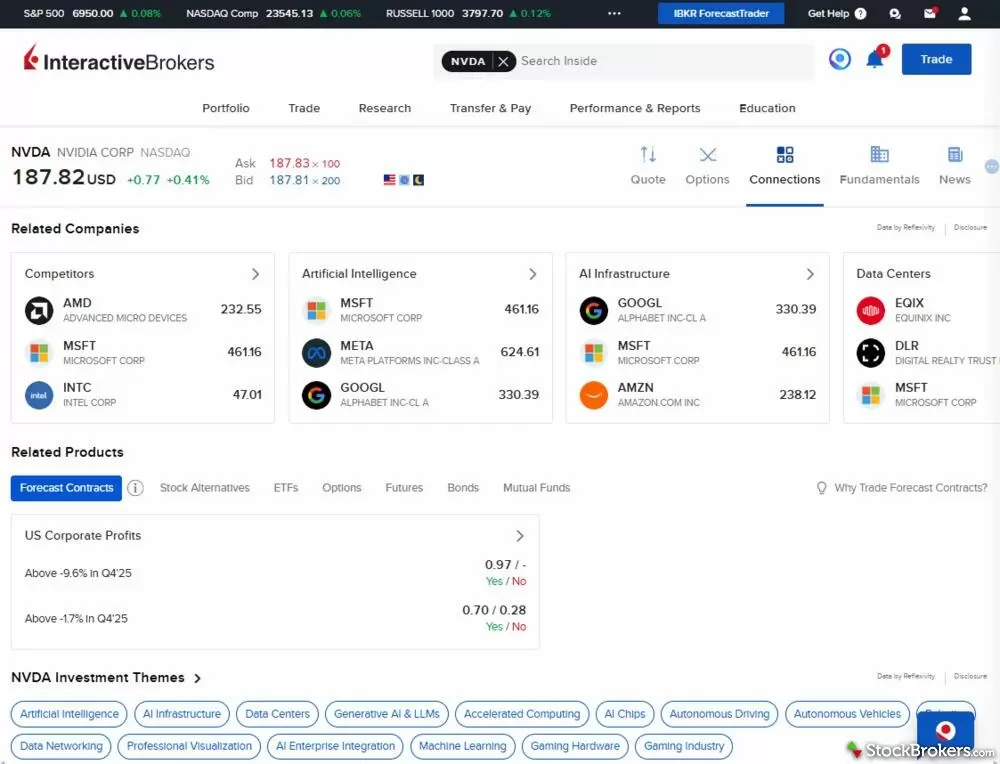

Of course, variety alone isn’t enough. Investment options need to be easy to find, research, and trade across a broker’s platforms. Our analysis looks at both the range of each broker’s offerings and how smoothly those investments are supported across websites, desktop platforms, and mobile apps, helping investors understand which brokers offer the most flexibility and choice.

Best brokers for range of investments

To determine the best brokers for range of investments, we evaluated how broad and flexible each broker’s investment lineup truly is. Our analysis considers the availability of different asset classes, account types, and market access, along with how easily investors can find, research, and trade those investments across the broker’s platforms. Using hands-on testing and detailed data analysis, we aim to highlight brokers that offer not just variety, but practical, well-supported investment choices that can meet the needs of investors at different stages.