J.P. Morgan Self-Directed Investing Review

J.P. Morgan Self-Directed Investing is the logical choice for the Chase banking client who values convenience over complexity. By embedding a fully-fledged brokerage platform directly into the Chase ecosystem, it turns investing into a seamless extension of your daily finances rather than a standalone chore. Moving cash to buy a stock is as fluid as paying a bill.

However, this integration comes with strict boundaries. The platform lacks streaming real-time quotes, crypto access, and advanced charting necessary for day trading. Rather than trying to be a destination for active traders, J.P. Morgan Self-Directed is a reliable, simplified home for long-term capital.

-

Minimum Deposit:

$0.00 -

Stock Trades:

$0.00 -

Options (Per Contract):

$0.65

| Range of Investments | |

| Mobile Trading Apps | |

| Advanced Trading | |

| Research | |

| Education | |

| Ease of Use | |

| Customer Service |

Check out StockBrokers.com's picks for the best stock brokers in 2026.

| 2026 | #10 |

| 2025 | #6 |

| 2024 | #12 |

| 2023 | #11 |

| 2022 | #10 |

| 2020 | #10 |

Led by Jessica Inskip, Director of Investor Research, the StockBrokers.com research team collects thousands of data points across hundreds of variables. We evaluate features important to every kind of investor, including beginners, casual investors, passive investors, and active traders. We carefully track data on margin rates, trading costs, and fees to rate stock brokers across our proprietary testing categories.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on StockBrokers.com. Learn more about how we test.

Table of Contents

Pros & cons

Pros

- Allows for instant liquidity transfers between Chase checking and investment accounts.

- Authoritative market insights and "Weekly Prospects" directly from J.P. Morgan strategists.

- A visually stunning and informative bond trading experience that simplifies complex yield and maturity data.

- Zero commissions on penny stocks and secondary U.S. Treasurys.

Cons

- Lacks streaming real-time quotes, requiring manual refreshes to see current prices.

- Does not offer trading for cryptocurrencies, futures, or forex.

- The options chain suffers from poor screen real estate usage & separates critical Greeks/IV data from the main research view.

My top takeaways for J.P. Morgan in 2026:

- The Chase Advantage: For existing Chase clients, the ability to view your mortgage, credit cards, and investments in a single dashboard, and move cash between them instantly, creates a level of friction-free liquidity that standalone brokerages simply cannot match.

- Institutional Grade, Consumer Feel: J.P. Morgan leverages its massive institutional brainpower to deliver research that is authoritative yet digestible. The fixed-income quote pages are a visual triumph, making complex bond data easy to read, while the Wealth Plan tool offers sophisticated goal-tracking that feels personal rather than robotic.

- Wealth Building, Not Trading: The platform draws a hard line between investing and trading. While it excels for the "methodical" accumulator buying stocks and ETFs, it is a poor fit for the active speculator. The lack of streaming real-time quotes, the absence of crypto and futures, and a clunky options interface will drive more speculative traders elsewhere.

Range of investments

The platform excels in delivering a methodical and organized view of your holdings. I really loved the positions page. While it lacks customization, the default layout is exceptionally thoughtful. It displays your total account value alongside a clear table of positions, detailing security, price, day's gain and loss, and total gain and loss in both dollar and percentage terms. I found the ability to toggle views by asset class, separating equities from fixed income, particularly useful for keeping a clean mental model of a diversified portfolio. It’s rigid, yes, but it forces a disciplined perspective that benefits long-term holders.

In terms of what you can actually trade, the menu is sufficient for the traditionalist. You have access to stocks, ETFs, mutual funds, and fixed-income products. The inclusion of fractional shares is a welcome feature, allowing investors to put every dollar to work regardless of a share's price tag. However, the guardrails are firm: you will not find futures, forex, or cryptocurrencies here.

Where J.P. Morgan truly separates itself from fintech upstarts is in its account infrastructure. Beyond the standard individual and joint taxable accounts, it supports a number of complex needs including Trust accounts and business investing, which are options often absent in modern apps. Managing these accounts is surprisingly fluid. I appreciated the "Things you can do" dropdown menu, which centralizes administrative tasks like updating beneficiaries or accessing tax documents. It turns potentially tedious paperwork into a few simple clicks, respecting the user's time.

| Feature |

J.P. Morgan Self-Directed Investing J.P. Morgan Self-Directed Investing

|

|---|---|

| Stock Trading | Yes |

| Account Feature - Margin Trading | Yes |

| Fractional Shares (Stocks) | Yes |

| OTC Stocks | Yes |

| Options Trading | Yes |

| Complex Options Max Legs | 1 |

| Fixed Income (Treasurys) | Yes |

| Futures Trading | No |

| Forex Trading | No |

| Crypto Trading | No |

| Crypto Trading - Total Coins | 0 |

| Traditional IRAs | Yes |

| Roth IRAs | Yes |

| Advisor Services | Yes |

One of the best for high net worth

We analyzed online brokers' offerings for clients with over $1 million of liquid, investable assets. See our guide to the Best Brokerage Firms for High Net Worth Individuals.

J.P. Morgan Self-Directed Investing fees

J.P. Morgan Self-Directed Investing adheres to the modern industry standard of $0 commissions for online stock and ETF trades. However, where the broker truly separates itself is in the corners of the market that are often riddled with surcharges at other firms.

For the options trader, the fee structure is the expected $0.65 per contract. But I found the real value lies in penny stocks. While many competitors charge significant commissions for OTC stocks, J.P. Morgan keeps these trades at $0. This is a rare benefit that makes speculative small-cap trading accessible without the friction of per-trade fees eating into your principal. Similarly, conservative investors will appreciate the $0 price tag on secondary U.S. Treasury trades, a critical feature for preserving yield. Corporate and municipal bonds carry a $1 per bond fee with a $10 minimum and a $250 cap.

The costs to watch for are administrative fees or when using leverage. Margin rates start at a lofty 12.25% for balances under $25,000, making this a less attractive venue for borrowing against your portfolio compared to specialized active trading firms. Additionally, leaving the platform has a price tag. You will be charged a $75 fee for full account transfers (ACAT) or IRA closures, so be sure this is the right home for your capital before settling in.

| Feature |

J.P. Morgan Self-Directed Investing J.P. Morgan Self-Directed Investing

|

|---|---|

| Minimum Deposit | $0.00 |

| Stock Trades | $0.00 |

| Penny Stock Fees (OTC) | $0.00 |

| Options (Per Contract) | $0.65 |

| Options Exercise Fee | $0.00 |

| Options Assignment Fee | $0.00 |

| Futures (Per Contract) | (Not offered) |

| Mutual Fund Trade Fee | $0 |

| Broker Assisted Trade Fee | Varies |

Mobile trading apps

For clients of the bank, the J.P. Morgan Self-Directed Investing mobile experience operates as a financial everything app. Housed directly within the Chase app, it allows you to move seamlessly from checking your mortgage balance to buying a stock. It is efficient, centralized, and designed for the investor who views their portfolio of equities as only one part of a larger financial whole.

Watchlists: Navigation is handled through three primary tabs: Overview, Positions, and Watchlists. I found the implementation of the Watchlist tool to be excellent. While the default list view is minimal, toggling to the "Table View" reveals a wealth of data, including P/E ratios, dividend yields, and 52-week ranges. It is rare to see that level of fundamental data density on a mobile screen without it feeling cluttered. Research is equally strong, offering a genuine pulse on the market. You can access J.P. Morgan strategist insights, read analyst ratings, and even view the U.S. Treasury yield curve compared to its standing one month or one year ago. Such visualizations are a sophisticated touch for a generalist app.

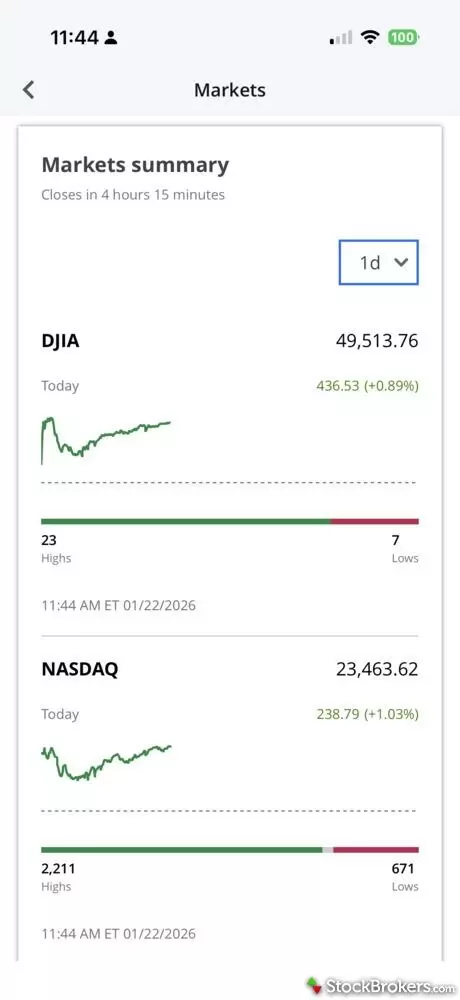

The mobile version of J.P. Morgan's market summary page. You'll get a quick snapshot of market performance – major indices, top movers, and filtered news – all laid out clearly.

Charting: To my surprise, the charting capabilities have also matured significantly. If you expand the daily chart, you unlock a suite of 36 technical studies and drawing tools. I tested this by applying a simple moving average and adjusting it to a 200-period weekly view. The process was fluid and intuitive, a far cry from the bare-bones charts often found in banking apps.

Not for active traders: However, the experience hits a wall the moment you try to trade actively. The app does not offer streaming real-time quotes, meaning you must manually refresh to see the latest price. This would, of course, be a dealbreaker for day traders. Furthermore, while you can trade single-leg options, the options chain suffers from poor use of screen real estate. Each contract takes up so much space that scrolling through strikes becomes a chore. Serious derivatives traders who rely on implied volatility and Greeks will likely find the interface too cumbersome for regular use, but for the long-term investor looking to sell a covered call or acquire shares, it gets the job done.

| Feature |

J.P. Morgan Self-Directed Investing J.P. Morgan Self-Directed Investing

|

|---|---|

| iPhone App | Yes |

| Android App | Yes |

| Apple Watch App | No |

| Stock Alerts | Yes |

| Charting - After-Hours | No |

| Charting - Technical Studies | 36 |

| Charting - Study Customizations | Yes |

| Watchlist (Streaming) | No |

| Mobile Watchlists - Create & Manage | Yes |

| Mobile Watchlists - Column Customization | Yes |

Research

J.P. Morgan feels more like a curated financial library rather than a trading terminal. By leveraging the massive institutional brainpower of J.P. Morgan Global Research, the platform presents market data in a way that is digestible, authoritative, and, quite frankly, beautiful.

Quotes page: I was genuinely struck by the visual quality of the quote pages. The platform employs a consistent design paradigm that I absolutely loved: a "three-bullet-point" overview at the top of every quote. Whether you are viewing a stock or a mutual fund, this serves as a perfect "TL;DR," summarizing the investment objective, next earnings date, or performance versus peers in seconds. The detailed quote pages for mutual funds are equally impressive, featuring interactive NAV charts and portfolio composition breakdowns that are visually compelling without being cluttered.

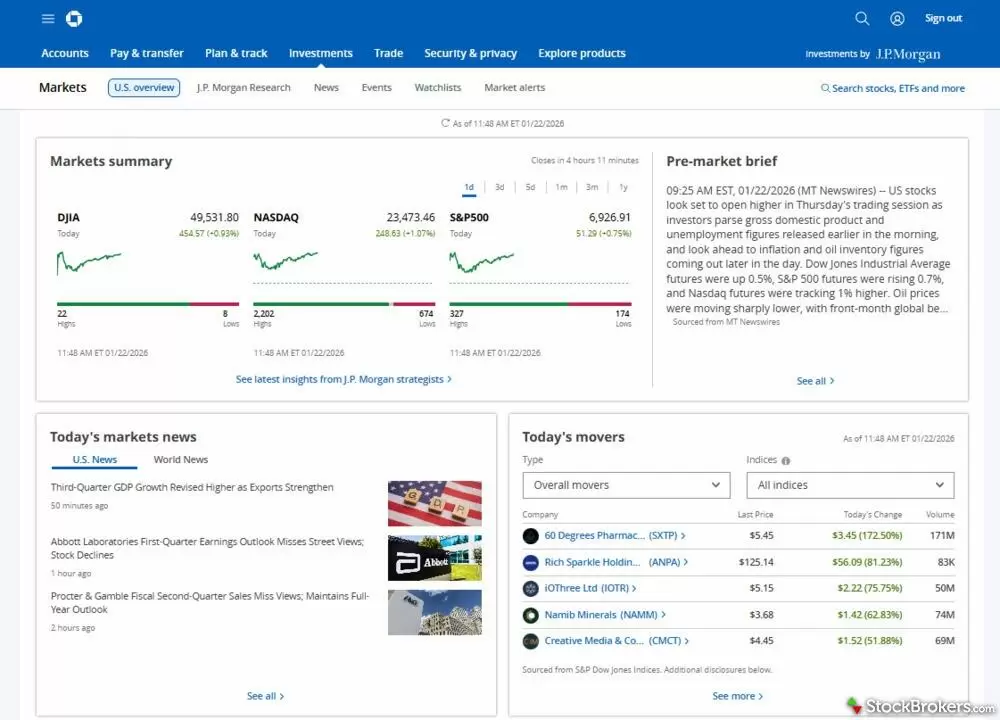

One of J.P. Morgan's standout features is the market research page. It’s among the best I’ve seen for getting an at-a-glance understanding what’s happening in the markets.

Fixed income research: One of my favorite features, however, is the fixed income research. This may be the first time I have ever described a bond quote page as "pretty," but it stopped me in my tracks. It organizes complex details, such as yields, maturity, redemption details, and ratings, into a layout that is not only informative but intuitive. Beneath the aesthetics, the macro tools are powerful. The "Markets Research" page offers a clear view of the U.S. Treasury yield curve (comparing today against last month and last year) and valuable widgets for commodities and global currencies. Reading the "US Weekly Prospects" report felt like getting a direct briefing from a Wall Street strategist.

User experience: However, the user experience has some baffling friction points. For one, the search bar at the top of the page searches the website, not stock symbols. To pull a quote, you often have to navigate through the "Investments" tab or start a trade ticket, which is a tiresome extra step. The research-based options chain is also overly simplistic and lacks key data. I found I had to navigate to the actual trade ticket just to view the Greeks and Implied Volatility I needed to make a decision. Similarly, the events calendar is a torrent of global data that is difficult to filter, leaving me feeling simultaneously overwhelmed by the volume and underwhelmed by the utility.

| Feature |

J.P. Morgan Self-Directed Investing J.P. Morgan Self-Directed Investing

|

|---|---|

| Research - Stocks | Yes |

| Stock Research - ESG | No |

| Stock Research - PDF Reports | 2 |

| Screener - Stocks | Yes |

| Research - ETFs | Yes |

| Screener - ETFs | Yes |

| Research - Mutual Funds | Yes |

| Screener - Mutual Funds | Yes |

| Research - Pink Sheets / OTCBB | Yes |

| Research - Fixed Income | Yes |

Education

J.P. Morgan Self-Directed Investing is best-in-class for Education, but it does so in a way that feels distinctly old-school. It does not rely on gamified quizzes or progress tracking. Instead, it relies on high-quality, authoritative writing that treats the investor like an intelligent adult. The primary downside lies in the challenge of actually finding the resources you need.

The library, housed under "The Know," contains some of the most lucid financial writing I have encountered. I found the explanations for complex topics to be refreshingly accessible. For instance, one article described an ETF like a taco: "one shell, many ingredients." It was a charming, memorable analogy that immediately demystified the product. Similarly, the mutual fund education excels at translation. I loved the "fee jargon" table that took terms like "front-end load" and translated them into plain English ("a sales fee you pay when you buy").

Jessica's take

"The fixed-income education is impressive, using real-world examples, such as the bond market's reaction to tariff announcements, to explain yield curves and economic sensitivity."

J.P. Morgan Self-Directed Investing offers a huge library of educational content, covering everything from stocks and funds to fixed income and macroeconomic trends.

However, navigating this library feels like a scavenger hunt. There are no structured courses or learning paths, meaning you must rely on a search bar that can be overwhelming. Searching for "stocks" yielded over 1,000 results with no clear starting point. You have to know what you are looking for to find the most relevant articles.

Where the platform bridges the gap between education and action is in the Wealth Plan tool. This planning engine is excellent for retirement goals, allowing you to input variables like social security and spending habits. I was particularly impressed by the cost-of-retirement comparison, which shows how your budget stretches (or shrinks) depending on the city you plan to retire in. It is a practical, high-value tool that anchors the educational experience.

While the fundamentals are strong, there remain areas for improvement. I could not find meaningful education on technical analysis, and the options education is sparse, lacking the visual diagrams necessary to explain complex strategies like covered calls.If you are seeking to learn about more advanced topics, like a structured course that teaches you how to trade options, you will need to look elsewhere.

| Feature |

J.P. Morgan Self-Directed Investing J.P. Morgan Self-Directed Investing

|

|---|---|

| Education (Stocks) | Yes |

| Education (ETFs) | Yes |

| Education (Options) | Yes |

| Education (Mutual Funds) | Yes |

| Education (Fixed Income) | Yes |

| Education (Retirement) | Yes |

| Videos | Yes |

| Webinars | Yes |

| Progress Tracking | No |

| Interactive Learning - Quizzes | No |

Customer service

To score Customer Service, StockBrokers.com partners with customer experience research firm Confero to conduct phone tests from locations throughout the United States. For this year's testing, 132 customer service tests were conducted over six weeks, with wait times logged for each call.

Customer service representatives were asked for assistance or details for prospective customers in several areas of broker services, including account opening, trading tools, apps, crypto offerings, active trading, and more. Here are the results for J.P. Morgan.

- Average Connection Time: Under a minute

- Average Net Promoter Score: 7.7 / 10

- Average Professionalism Score: 8.3 / 10

- Overall Score: 7.89 / 10

- Ranking: 4th of 11

Banking services

J.P. Morgan Self-Directed Investing earned a second-place rank for our Bank for Investing award in 2026 by transforming the brokerage account from a standalone destination into a seamless extension of the Chase ecosystem. If you are one of the millions of people who already carry a Chase Sapphire card or pay a Chase mortgage, opening an investment account here feels like you are simply unlocking new features on an app you already know well.

Real-time transfers: The primary benefit is liquidity. It is essentially instantaneous to move funds between a Chase checking account and a self-directed trading account. There is no three-day ACH waiting period, allowing investors to immediately allocate cash when an opportunity arises. This tight integration creates a centralized cash management system that is hard to replicate. A single login combines stock positions alongside credit card balances, savings, mortgages, and CD ladders within one unified dashboard.

Banking products: The range of services is exhaustive. Beyond standard checking and savings, you have direct access to certificates of deposit (CDs), debit cards, and lending products. For the holistic investor, seeing your liabilities (mortgages, credit card debt) side-by-side with your assets (stocks, ETFs) enforces a sober, net-worth-focused perspective that pure-play trading apps usually lack. It is banking-first, yes, but for many, that is exactly the point.

| Feature |

J.P. Morgan Self-Directed Investing J.P. Morgan Self-Directed Investing

|

|---|---|

| Bank (Member FDIC) | Yes |

| Checking Accounts | Yes |

| Savings Accounts | Yes |

| Credit Cards | Yes |

| Debit Cards | Yes |

| Mortgage Loans | Yes |

IRA review

For the Chase banking client, opening an IRA allows you to position your retirement funds directly alongside your daily spending money, creating a unified view of your net worth. The most convenient feature is how it is funded. Contributing to your IRA takes seconds, moving cash from your checking account instantly without the possible multi-day lag found at standalone brokerages.

While the account is self-directed, you are not entirely on your own. The Wealth Plan tool acts as a sophisticated companion, allowing you to input granular details like your target retirement city to adjust purchasing power. I was particularly impressed that the tool automatically calculated and "invested" my theoretical Social Security excess, a nuance that many planning calculators miss entirely.

J.P. Morgan's Wealth Plan tool helps with goal-setting and financial planning. I was able to set my goals and priorities while factoring in my income, monthly spending, and even Social Security.

However, this is a strictly manual experience. If you are looking for automated tax-loss harvesting or a "set it and forget it" robo-advisor, you will need to look elsewhere. But for the hands-on investor building a long-term portfolio of ETFs or mutual funds, the combination of institutional-grade research and banking integration makes this a sturdy home for your future capital.

Final thoughts

J.P. Morgan eschews the gamified noise of modern trading apps in favor of a polished, professional environment. Its true power lies in its seamless integration with Chase, allowing millions of banking clients to treat their investments as a natural extension of their daily financial lives. I found the platform refreshingly methodical, offering excellent research tools, particularly for fixed income, that cater to the serious wealth builder rather than the speculator.

However, this refinement comes with limitations for the active trader. The absence of streaming real-time quotes and a clunky options interface create significant friction for anyone looking to trade for income. Yet, for the long-term investor who values convenience and the backing of a large financial bank, J.P Morgan is a sophisticated and reliable choice.

J.P. Morgan Self-Directed Investing Star Ratings

| Feature |

J.P. Morgan Self-Directed Investing J.P. Morgan Self-Directed Investing

|

|---|---|

| Overall |

|

| Range of Investments |

|

| Mobile Trading Apps |

|

| Advanced Trading |

|

| Research |

|

| Customer Service |

|

| Education |

|

| Ease of Use |

|

StockBrokers.com Review Methodology

Why you should trust us

Jessica Inskip is Director of Investor Research at StockBrokers.com, bringing 15 years of experience in brokerage and trading strategy. A former FINRA-licensed rep, she held Series 7, 63, 66, and 4 licenses. Jessica focuses on investor education and brokerage industry research, appears regularly on CNBC, Bloomberg, The Schwab Network, Fox Business, and Yahoo! Finance, and hosts the Market MakeHer podcast.

Blain Reinkensmeyer, co-founder of StockBrokers.com, has been investing and trading for over 25 years. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. Today, Blain is widely respected as a leading expert on finance and investing, specifically the U.S. online brokerage industry. Blain has been quoted in The New York Times, The Wall Street Journal, Forbes, and Fast Company, among others. Blain created the original scoring rubrics for StockBrokers.com and oversees all testing and rating methodologies.

How we tested

- We used our own brokerage accounts for testing.

- We collected thousands of data points across the brokers we review.

- We tested each online broker's website, desktop platforms, and mobile app, where applicable.

- We maintained strict editorial independence; brokers cannot pay for inclusion or a higher rating.

Our research team meticulously collected data on every feature of importance to a wide range of customer profiles, including beginners, casual investors, passive investors, and active traders. We carefully track variables like margin rates, trading costs, fees, and platform features and use them to help rate brokers across a range of categories measuring ease of use, range of investments, research, education, and more.

At StockBrokers.com, our reviewers use a variety of computing devices to evaluate platforms and tools. Our reviews and data collection were conducted using the following devices: iPhone SE running iOS 17.5.1, MacBook Pro M1 with 8 GB RAM running the current MacOS, and a Dell Vostro 5402 laptop i5 with 8 GB RAM running Windows 11 Pro.

Each broker was evaluated and scored on over 200 different variables across seven key categories: Range of Investments, Platforms & Tools, Research, Mobile Trading, Education, Ease of Use, and Overall. Learn more about how we test.

Trading platforms tested in 2026

We tested 14 online trading platforms in 2026:

Read next

- Best Stock Trading Platforms for Beginners of 2026

- Best Options Trading Platforms for 2026

- Best Paper Trading Apps & Platforms for 2026

- Best Futures Trading Platforms for 2026

- Best Brokers for Penny Stock Trading of 2026

- Best Stock Brokers for 2026

- Best Day Trading Platforms of 2026 for Beginners and Active Traders

- Best Stock Trading Apps for 2026

More Guides

Popular Stock Broker Reviews

About J.P. Morgan Self-Directed Investing

J.P. Morgan Chase & Co., headquartered in New York City, is the parent company of the Chase Bank and J.P. Morgan brands, which merged in 2000. The firm's origins date back to 1799, and it has evolved through the consolidation of approximately 1,200 predecessor institutions. As of September 30, 2024, J.P. Morgan's Asset & Wealth Management division reported assets under management (AUM) of $3.9 trillion, reflecting a 23% increase from the previous year. Today, J.P. Morgan Chase stands as the largest bank in the United States, managing a vast array of financial services for a diverse clientele.

Compare J.P. Morgan Self-Directed Investing

See how J.P. Morgan Self-Directed Investing stacks up against other brokers.

Show all