NinjaTrader Review

NinjaTrader is an NFA-regulated futures broker and platform provider that serves as a powerful gateway to the futures market for traders of all skill levels. Now acquired by Kraken, NinjaTrader combines professional-grade software, including its famous SuperDOM for ultra-fast, one-click trading, with one of the most aggressive pricing models in the industry.

Traders can use the platform for free for advanced charting and unlimited simulated trading, or purchase a Lifetime License to unlock commissions as low as $0.09 per micro contract. With flexible intraday margins, access to affordable micro and nano futures, and a vast ecosystem of third-party add-ons, NinjaTrader offers an accessible path for beginners while retaining the depth required by professionals.

-

Minimum deposit:

$0.00 -

Commission per side (Standard):

$1.29 -

Commission per side (Micro):

$0.39

| Trading costs | |

| Range of Markets | |

| Trading Platforms | |

| Mobile Trading Apps | |

| Research | |

| Education |

Led by Jessica Inskip, Director of Investor Research, the StockBrokers.com research team collects thousands of data points across hundreds of variables. We evaluate features important to every kind of investor, including beginners, casual investors, passive investors, and active traders. We carefully track data on margin rates, trading costs, and fees to rate stock brokers across our proprietary testing categories.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on StockBrokers.com. Learn more about how we test.

Table of Contents

Pros & cons

Pros

- Industry-leading pricing: Commissions start at just $0.09 per micro contract for Lifetime License holders, or $0.39 for the free plan.

- Professional execution: The flagship SuperDOM (Depth of Market) allows for ultra-fast, one-click order entry and cancellation.

- Active community: Access daily live streams and webinars.

- Market data: Funded accounts receive free CME market data on free and paid plans, reducing upfront costs for futures traders.

Cons

- Steep learning curve: The desktop platform is highly complex and generally not ideal for beginners or casual traders.

- Limited asset class: NinjaTrader Brokerage is strictly for futures; it does not offer stocks, ETFs, or direct options trading.

My top takeaways for NinjaTrader in 2026:

- Futures‑first brokerage: NinjaTrader supports all major futures asset classes and offers standard, E-mini, micro, and even nano contracts. Micro and nano contracts are one-tenth or one-hundredth the size of standard contracts, allowing traders to size positions more precisely and manage risk with smaller exposure.

- Flexible pricing plans: Traders can opt for a free plan, a $99 monthly plan, or a $1,499 lifetime license. The free tier charges $1.29 per standard contract and $0.39 per micro, while the lifetime plan drops pricing to $0.59 per standard and $0.09 per micro. Clearing and routing fees of about $0.19–$0.25 per contract, so total trading expenses depend on both the product traded and the chosen plan.

- Powerful trading tools: The NinjaTrader 8 Desktop platform delivers professional-grade charting, advanced order-flow analytics, customizable indicators built on the C# programming language, automation tools, developer access via a REST API, and a market replay feature.

- Growing education and community: NinjaTrader streams live sessions daily, providing pre-market analysis and trade ideas. Combined with its trading simulator, which offers a free 14-day trial and unlimited paper trading for funded accounts, new traders can learn, test strategies, and practice in a risk-free environment.

- Limited research beyond futures analytics: While the charting and technical tools are strong, there is very little fundamental research or stock analysis, underscoring the platform’s clear focus on futures trading.

NinjaTrader fees

NinjaTrader’s pricing model is transparent and varies by both the plan you choose and the futures contract sizes you trade, including standard, E-mini, micro, and nano contracts. NinjaTrader utilizes a tiered pricing structure that rewards commitment. You can trade on the Free Plan with slightly higher commissions, or purchase a license (Monthly or Lifetime) to drastically reduce your costs. During my testing, I found the Lifetime License offers the best value for high-volume traders, though the break-even point depends on your asset class. To cover the $1,499 cost, a trader would need to execute roughly 1,070 round turns of standard contracts, or about 5,000 micro contracts.

Commissions: Commissions per side start at $1.29 for standard and E-mini contracts and $0.39 for micro contracts on the free plan. Rates drop to $0.99 and $0.29 on the monthly plan, and as low as $0.59 and $0.09 on the lifetime plan, which requires a one-time $1,499 payment to lock in pricing indefinitely. For traders spending a few hundred dollars or more per month, the lifetime plan makes sense if futures trading is a long-term commitment.

Nano crypto futures, available through Coinbase Derivatives, are priced even lower at roughly $0.20 per side on the free plan.

Fees: Exchange fees and NFA clearing costs add about $0.19 per contract and are standard regardless of the broker. Order routing through CQG or Rithmic adds another $0.25 per contract. There is no minimum deposit requirement, and ACH deposits and withdrawals are free.

Margin rates: Margin requirements at NinjaTrader vary by product and differ between overnight initial margin and reduced intraday day-trading margin. Intraday requirements can be as low as $25 for nano contracts and as high as $20,000 for certain crypto indices. It’s also important to note that 15 minutes before major economic news releases, NinjaTrader often increases intraday margin requirements by as much as four times, and they may remain elevated for five minutes or longer after volatility subsides.

| Feature |

NinjaTrader NinjaTrader

|

|---|---|

| Minimum deposit | $0.00 |

| Commission per side (Standard) | $1.29 |

| Commission per side (Mini) | $1.29 |

| Commission per side (Micro) | $0.39 |

| Commission per side (Nano) | $0.20 |

| Market data fees | No |

| Active trader/VIP discount | No |

Range of markets

NinjaTrader provides access to more than 100 futures contracts spanning equity indexes, currencies, interest rates, metals, energy, and agricultural markets. Micro contracts are available for many of the most popular products, including the S&P 500, Nasdaq 100, Dow 30, Russell 2000, gold, silver, crude oil, and major forex pairs, each sized at one-tenth of the standard or E-mini contract.

NinjaTrader also supports crypto futures, including micro Bitcoin and micro Ethereum contracts from CME, along with nano Bitcoin and nano Ethereum via Coinbase Derivatives. Exchange access, however, is limited to CME Group markets (CME, CBOT, NYMEX, COMEX, and MGE), ICE US, and Eurex, with no connectivity to CBOE futures or to Asian exchanges such as HKEX, DCE, or ZCE.

NinjaTrader Prop: NinjaTrader provides its trading platform to more than a dozen third-party proprietary trading firms through what it labels the NinjaTrader Prop program. These offerings are paid demo-account evaluations run entirely by the prop firms, not NinjaTrader, and are governed by strict trading rules and profit targets. Paying an evaluation fee does not guarantee a payout, funded status, or continued access. If you meet the performance criteria, you may earn a cash payout; if not, you forfeit the evaluation fee. While these challenges may be designed to help experienced traders refine and test their skills, they are not a substitute for live trading and are generally unsuitable for beginners, who are better served by starting with a free demo account.

| Feature |

NinjaTrader NinjaTrader

|

|---|---|

| Forex futures | Yes |

| Equity futures | Yes |

| Interest rate futures | Yes |

| Metal futures | Yes |

| Agricultural futures | Yes |

| Energy futures | Yes |

| CME Group | Yes |

| ICE | Yes |

| Eurex | Yes |

| Cboe | No |

| HKEX | No |

| Exchange-traded futures | Yes |

| Off-exchange futures (CFDs/derivatives) | No |

| Forward futures | No |

| Options futures | Yes |

Trading platforms

NinjaTrader centers its offering around its flagship platform, available on web, desktop, and mobile, while also supporting third-party platforms such as CQG and TradingView. The web version of NinjaTrader is the most accessible and the one I’d recommend to most users, whereas the desktop platform requires more setup and is better suited to experienced futures traders.

NinjaTrader Web: When logging into the web platform, the initial layout feels clean and uncluttered. While it appears simple on the surface, there’s depth beneath it, with modular components you can drag and drop to add features such as news, sentiment tools, and the ability to modify orders directly on the chart by dragging along the price axis.

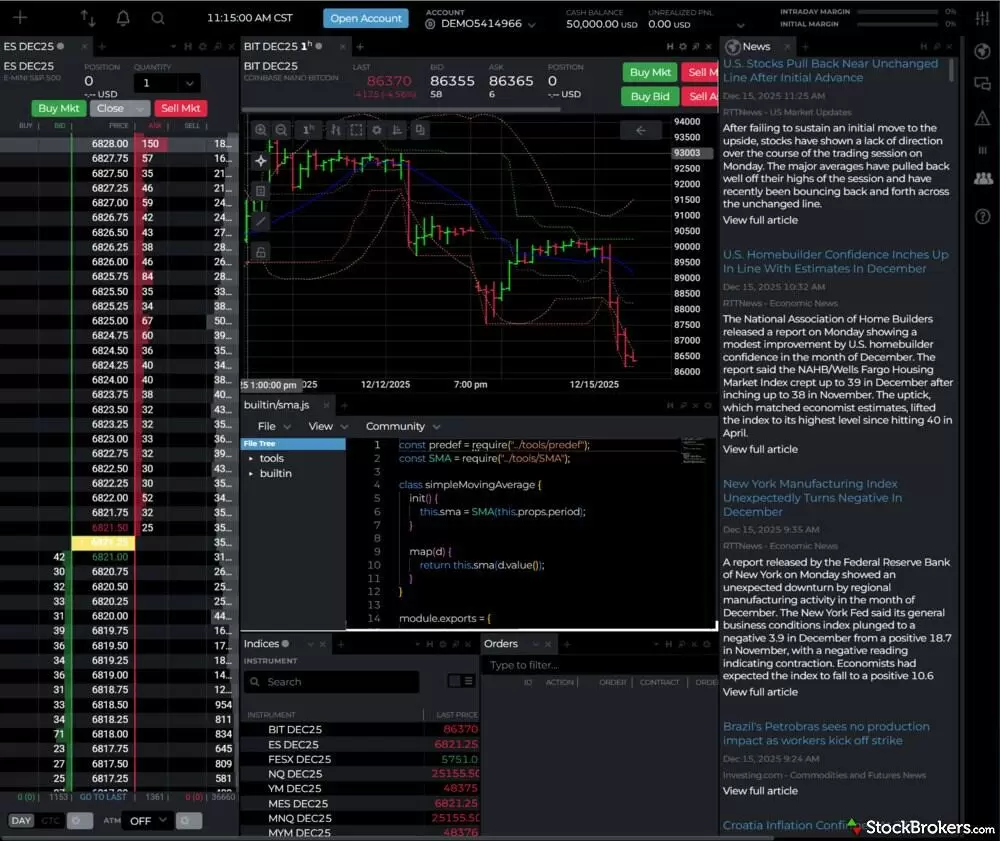

The NinjaTrader Web platform offers a clean, modular interface that runs natively in modern browsers. This workspace layout showcases the SuperDOM (left) for fast order execution on E-mini S&P 500 futures, positioned alongside a chart tracking Nano Bitcoin (BIT). A key feature for technical traders is the Script Editor (center-bottom), which allows users to view and modify the code for indicators. On the far right, the integrated News panel streams real-time headlines from sources like RTTNews and Investing.com.

NinjaTrader Desktop: The NinjaTrader 8 desktop platform is one of the most powerful tools available for futures trading. It offers multi-time-frame charting, hundreds of technical indicators, customizable hotkeys, and advanced order types. News headlines stream from RTT News and Investing.com, just as they do on the web platform. One drawback I noticed is that opening news articles displays them in an iframe from the original source, often cluttered with banner ads, which makes reading the articles less seamless.

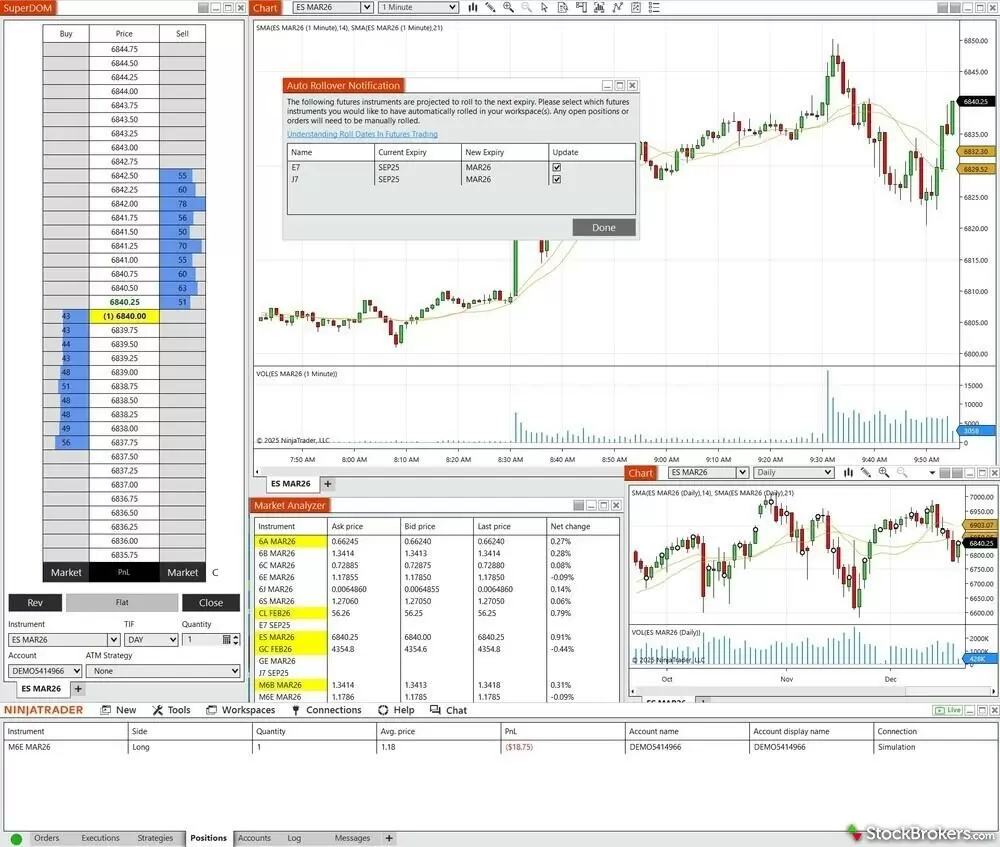

The desktop version of NinjaTrader isn’t ideal for beginners or traders who prefer a streamlined interface, since it requires lengthy setup to arrange floating windows after logging in. By contrast, the web platform keeps everything neatly organized in one browser tab. For experienced traders and technical analysis enthusiasts, however, the desktop platform delivers all the advanced charting and tools NinjaTrader is known for:

- NinjaScript: Using NinjaScript, traders can manage workspaces, run market replay simulations, and develop strategies through the built-in NinjaScript Editor and Strategy Builder, complete with five example strategies. I found the editor particularly powerful, offering access to hundreds of files and 114 native indicators that can be edited directly at the source-code level.

- Strategy Builder: The Strategy Builder is designed to simplify the process compared to coding a bot directly in C#, but it still involves nuance, with dozens of input parameters and settings to configure during the wizard. I wouldn’t consider it beginner-friendly unless you’re willing to experiment or test it in a demo environment.

- Strategy Analyzer: The Strategy Analyzer module includes powerful backtesting tools, ranging from multi-objective and forward-walk optimizations to an experimental AI Generate feature, which is highly CPU intensive and can take hours or even days to complete.

The NinjaTrader 8 desktop platform features a modular, fully customizable workspace. This layout highlights the flagship SuperDOM (left) for one-click order entry, running alongside advanced charting for the E-mini S&P 500. A critical feature for futures maintenance is the Auto Rollover Notification (center popup), which alerts traders when it is time to switch open positions to the next contract expiry date. The Market Analyzer window (bottom) allows for real-time tracking of quotes and net changes across multiple instrument lists.

Important note for Mac users:

NinjaTrader 8 (the advanced desktop software) does not run natively on macOS. To use the full desktop platform, you must use Windows virtualization software like Parallels. If you do not want to use Parallels, your only option is the NinjaTrader Web platform (or Tradovate), which runs in your browser but lacks the advanced custom indicators and Strategy Analyzer found in the desktop version.

Charts: Charting includes more than 30 drawing tools, one of which I found particularly useful: the Risk-Reward tool. It lets you visualize a trade by plotting stop-loss and take-profit levels as red and green horizontal lines, based on a predefined ratio. For example, 1.5:1 would mean 1.5 units of profit for every unit of risk. Order management is also straightforward, with a convenient Flatten Everything button that acts as a Close All command and even provides audio cues to confirm that orders have been filled.

SuperDOM: The integrated SuperDOM and Order Flow+ suite allow traders to visualize market depth and volume profiles, and they stand out immediately upon logging in. Algorithmic traders can automate strategies using NinjaScript or access developer tools via the REST API, with the option to publish apps to the NinjaTrader Ecosystem for community use. For TradingView users, a $9.99 per month add-on enables direct order routing from TradingView charts to a NinjaTrader brokerage account, with Level I CME data included. CQG Desktop is also supported for professional-grade order routing at $0.25 per contract.

NinjaTrader Ecosystem: I was impressed by the sheer number of community-built add-ons available in the NinjaTrader Ecosystem, where users share custom indicators, scripts, and automated strategies, either for free or via paid subscriptions. It reminded me of the MQL5 Marketplace for MetaTrader, though the layout and design are quite different. Navigation was intuitive, making it easy to browse and sort through trading tools and indicators.

Tradovate brand: NinjaTrader users can also access the Tradovate platform using the same login credentials, eliminating the need for a separate account. Because Tradovate is powered by the same engine, it offers nearly identical features, along with matching commissions and margin requirements. Tradovate is part of the NinjaTrader Group.

| Feature |

NinjaTrader NinjaTrader

|

|---|---|

| Proprietary trading platform | Yes |

| Mobile Trading | Yes |

| Demo accounts | Yes |

| API access | Yes |

| TradingView | Yes |

| CQG | Yes |

| MetaTrader 5 | No |

Mobile trading apps

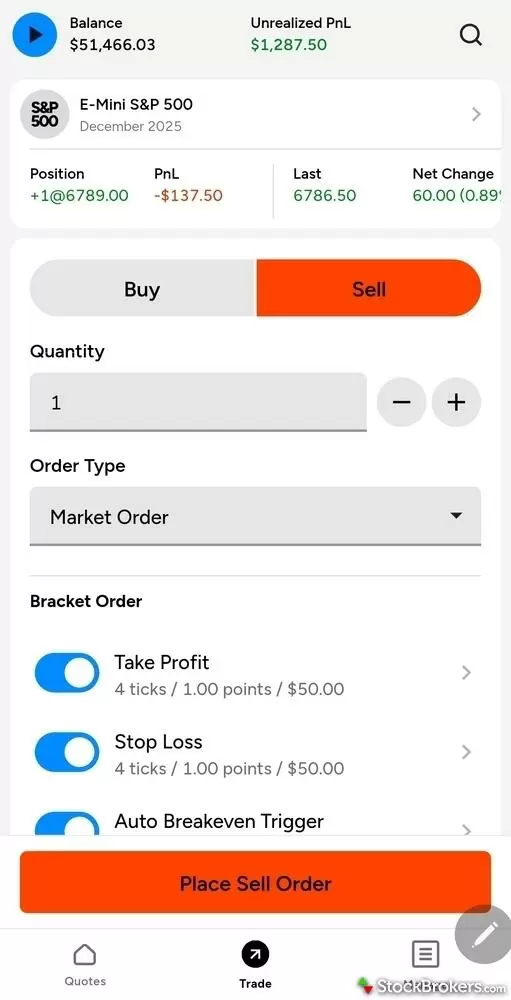

NinjaTrader’s iOS and Android apps offer a clean, minimalist interface with real-time quotes, charting, and order entry. While research and news are notably absent, there’s still plenty to like for futures trading on the go. Having reviewed nearly 100 brokerage mobile apps in the global industry over the past decade, I was impressed by how much functionality NinjaTrader packs into such a simple layout. With only three main navigation tabs, the app still provides detailed access to watchlists, charts, and SuperDOM functionality.

Mobile charts: Selecting a contract from your watchlist or a predefined list opens a chart for that instrument. The charts are flexible, offering multiple chart types, granular timeframes, access to more than 100 indicators, and buy and sell buttons. While open trades are visible on the chart, I found drag-to-modify order adjustments somewhat awkward. A small arrow appears, requiring you to tap and step the order up or down rather than freely drag it. By comparison, order modification is much smoother in the SuperDOM, where dragging works as expected, though the same arrow appears if you tap instead. Overall, the mobile charting experience is more than capable for most traders and technical enthusiasts, and it met my expectations.

The NinjaTrader Mobile app (shown here on Android) provides a clean, responsive interface for managing active futures trades on the go. This E-Mini S&P 500 chart demonstrates the platform's visual trading capabilities, displaying working Buy (green) and Sell (red) limit orders directly on the price screen. Traders can quickly switch between views using the top navigation tabs while utilizing standard technical tools like the Simple Moving Average (SMA) and volume histogram.

Predefined lists: The app includes nearly a dozen predefined lists organized by asset class, covering futures contracts across indexes, micros, crypto, financials, currencies, energies, metals, grains, meats, and soft commodities. You can also see open positions directly within your watchlists, clearly indicating whether you’re long or short a given contract.

Trade ticket: The trade ticket offers solid versatility, supporting multiple order types, including bracket orders and trailing stop-losses. I also found it easy to access from nearly any screen via the small arrow icon next to the favorites heart.

The NinjaTrader Mobile trade ticket delivers robust risk management tools directly from the order entry screen. This layout displays a Market Sell order for the E-Mini S&P 500, where the trader has activated a Bracket Order strategy. Critical for active risk control, the Take Profit and Stop Loss toggles are enabled and pre-calculated at 4 ticks ($50.00) per side. Additionally, the Auto Breakeven Trigger (bottom) allows for automated trade management, ensuring stops move to breakeven once a specific profit target is hit.

Risk Manager: The integrated Risk Manager lets you set predefined rules such as daily and weekly profit and loss limits, with the option to lock trading once those thresholds are reached. I found these controls helpful for encouraging discipline and reflective of the better aspects of prop trading technology, which aims to improve a trader’s chances of passing evaluations. That said, it’s important to understand that losses are still possible, even with these safeguards enabled. These tools are only one part of a broader risk framework, and choosing the right values depends on your risk tolerance and trading goals. Overall, I was glad to see this feature included and believe the Risk Manager can be effective when used as part of a well-defined trading strategy.

Research

NinjaTrader delivers research through in-platform news headlines, supplemented by market analysis from its in-house team and content partners. This material is also featured in livestreamed events that are syndicated on the company’s YouTube channel.

Order Flow+: The NinjaTrader platform excels in technical analysis, with sophisticated charting and market depth features such as the Order Flow+ suite, a $59 monthly add-on. By applying volume delta to candle charts, Order Flow+ helps traders spot changes in sentiment. These same tools are used by NinjaTrader analysts in their live video sessions, where technical setups are discussed in the context of upcoming and recent economic events.

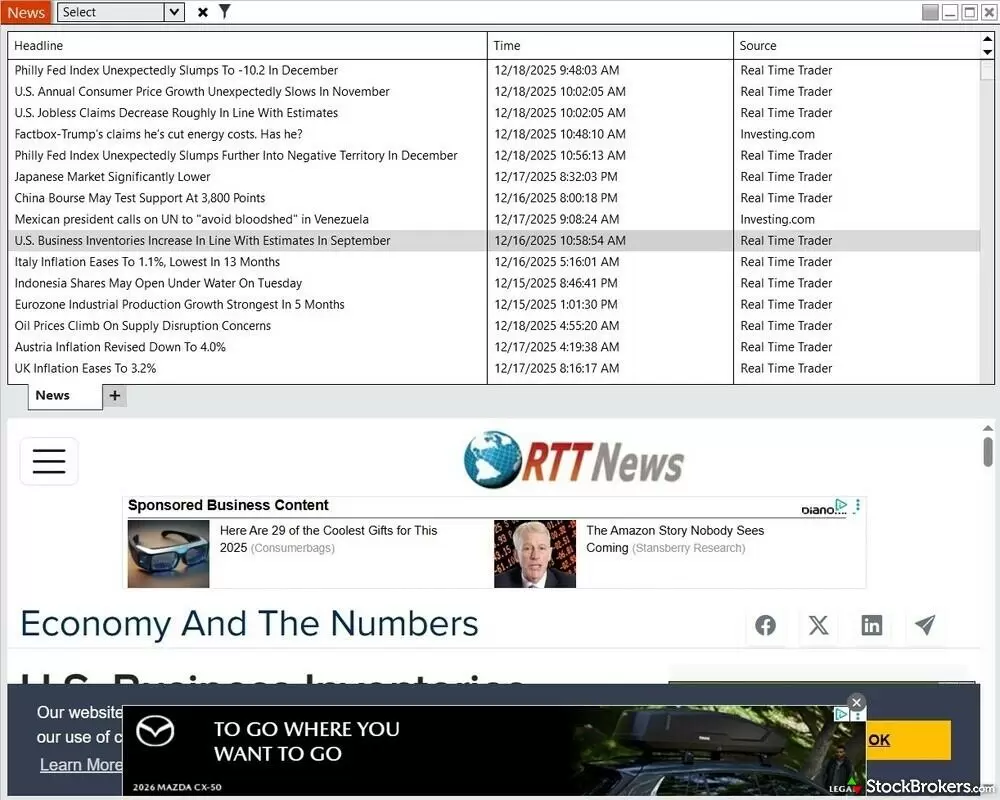

News headlines: Alongside daily live streams and a library of video tutorials focused on technical indicators and trading strategies, NinjaTrader also integrates news headlines from RTT News and Investing.com directly into the platform. I also appreciated the inclusion of client sentiment data through the Pulse tool, which nicely complements the broader research offering.

The NinjaTrader 8 desktop platform integrates fundamental research via its dedicated News window. This interface aggregates real-time headlines from sources like RTTNews and Investing.com, allowing traders to track key economic indicators such as inflation data and jobless claims. As shown in the bottom pane, selecting a headline loads the full article within an embedded browser; however, because it renders the original source page, the reading experience is often cluttered with third-party banner ads.

While NinjaTrader provides timely headlines, it lacks the depth of fundamental and macroeconomic research typically found at full-service brokers. Its focus remains on self-directed futures traders rather than research-driven investors. Overall, the research offering has a strong foundation, with clear opportunities to grow through additional fundamental analysis and more diverse written content.

Education

NinjaTrader provides a well-rounded set of educational resources for futures traders, including video content, blog articles, a support knowledge base, and a community-driven Discord server. For beginners, there are multiple getting-started guides, such as its “Introduction to Futures Trading,” alongside more than 400 other archived articles on NinjaTrader’s blog.

Educational resources: NinjaTrader publishes several daily or weekly live video series, including The Sunday Open, Trade the Open, and Trade the Close which blend research and educational themes in an engaging, high-quality format. It also provides recorded introductory tutorials for beginners, such as Develop the Trader in You. Other practical resources, such as futures contract rollover dates, link directly to related information on the CME website.

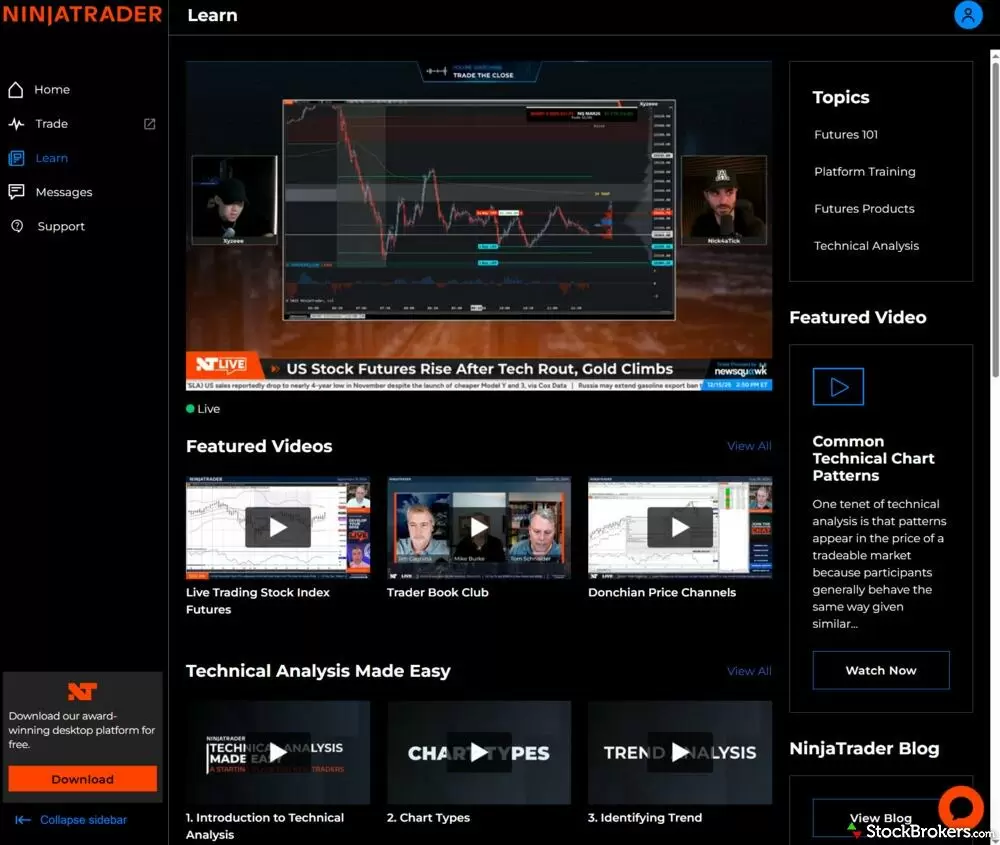

The NinjaTrader Web education portal anchors its offering with daily live streams, providing real-time market analysis and trade ideas directly within the platform. In this view, a live broadcast covers US Stock Futures and Gold, featuring chart analysis from industry experts. The organized dashboard also provides on-demand access to curated video libraries, ranging from Futures 101 and Platform Training to advanced Technical Analysis series and the "Trader Book Club."

AI Tools: NinjaTrader’s AI-powered chatbot, through a partnership with Ada, leverages generative AI and, in my experience, delivered thoughtful answers across a broad range of questions. Rather than relying on generic responses, it handled technical and educational queries with useful depth.

Arena: NinjaTrader also operates the “Arena,” where traders can compete in risk-free simulated trading contests that promote learning and community engagement. Depending on the event, participants may earn real cash prizes or account credits. Unlike prop trading evaluations, there are no entry fees to participate.

Overall, NinjaTrader offers a strong educational support system with plenty of high-quality content. A logical next step would be the introduction of dedicated courses with quizzes and progress tracking, which could help elevate the offering to a more university-grade learning experience.

Final thoughts

NinjaTrader stands out as a top-tier platform for active futures traders who prioritize powerful tools, flexible pricing, and granular contract sizing. Its appeal is strengthened by a growing, community-driven ecosystem, thousands of third-party add-ons, and a consistent stream of in-house research and educational video content.

With a powerful desktop platform, complemented by browser-based and mobile apps, plus integration with TradingView and CQG, traders have multiple ways to access the futures markets to suit different styles and workflows. While a limited range of supported futures exchanges are important considerations, NinjaTrader delivers excellent value and cutting-edge technology for those focused primarily on U.S. futures markets.

| Feature |

NinjaTrader NinjaTrader

|

|---|---|

| Overall |

|

| Trading costs |

|

| Range of Markets |

|

| Mobile Trading Apps |

|

| Research |

|

| Education |

|

Read next

Popular stock broker reviews

About NinjaTrader

NinjaTrader was founded in 2003 and began as a trading technology developer before expanding into a fully regulated futures brokerage under the NinjaTrader Group. The platform has earned a strong reputation over the years and is trusted by more than 800,000 traders and investors. In 2025, NinjaTrader became part of Kraken, a leading global cryptocurrency exchange. NinjaTrader and its affiliated brands, including Tradovate and Kraken, operate as a registered Futures Commission Merchant (FCM) with the Commodity Futures Trading Commission (CFTC) and are overseen by the National Futures Association (NFA).