Top picks for options trading apps

Best options trading app - tastytrade

| Company |

Overall |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

tastytrade tastytrade

|

|

$0.00 |

$0.00 |

$0.50 info |

Even though this is a mobile app guide, tastytrade earns the top spot because it’s not just good for options trading, it’s built for it. No other platform is as deeply committed to serving options traders, from strategy construction to execution to education. Options are at the heart of tastytrade’s platform, and that focus carries over beautifully to the mobile app.

Platform and tools: I’ll be honest, I’ve always been hesitant to trade complex strategies on a mobile app, but tastytrade changed that. The well-designed trade ticket makes it easy to toggle between option chains, adjust strikes and expirations, and visualize trades on a probability curve.

With customizable option chains, intuitive multi-leg strategy builders, and integrated metrics like probability of profit (POP) and net Greeks, tastytrade supports everyone from beginners to advanced traders.

Mobile app: The app’s interface is fast, responsive, and packed with trader-focused features. You can monitor earnings, scan movers and dividends, view market performance, and sync watchlists across devices. Real-time quotes come loaded with insights like IV rank and SPY correlation, customizable by symbol.

Where tastytrade really sets itself apart is education: through tastylive, you get access to livestreamed market commentary, actionable trade ideas, and strategy breakdowns that are actually entertaining. Whether you're placing a basic put or building a broken wing butterfly, tastytrade’s mobile app delivers a seamless, pro-level trading experience. It’s the closest thing to carrying a full trading deck in your pocket.

Best for data-driven options traders - Interactive Brokers (IBKR)

| Company |

Overall |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

Interactive Brokers Interactive Brokers

|

|

$0.00 |

$0.00 |

$0.65 info |

IBKR Mobile is one of the most comprehensive trading apps I’ve ever tested. Almost everything from the desktop experience is here — detailed quotes, synced watchlists, advanced trade tickets, and even recurring investments can be set up directly in the app.

Platform and tools: Now, more importantly, options. I rarely trade options on mobile because it’s usually clunky, slow, and stripped of the tools I need. But with IBKR Mobile, I might actually change my stance. The options chain is clean and easy to navigate, making it easy to trade directly from the chain. Plus, the Options Wizard and Analyzer are fully integrated, giving me all the metrics I look for, including the Greeks, probability models, and even volatility data, all in one mobile experience.

Mobile app: The app is built for serious traders who want depth and control without sacrificing mobility. While the interface isn’t as beginner-friendly as tastytrade or Firstrade, if you’re a data-driven options trader who knows what you need and where to find it, IBKR gives you the full toolkit in the palm of your hand.

Best for single-leg options trading - Firstrade

| Company |

Overall |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

Firstrade Firstrade

|

|

$0.00 |

$0.00 |

$0.00 |

Options traders, take note: Firstrade’s mobile app delivers an experience that rivals platforms built specifically for options trading. Packing advanced tools into a clean, mobile-first interface without sacrificing usability isn’t easy, but Firstrade pulls it off beautifully.

Platform and tools: Firstrade offers a suprisingly robust trading platform that caters to both casual investors and active traders. Its web platform, Firstrade Navigator, provides customizable dashboards where you can monitor watchlists, view real-time market data, and access advanced charting tools.

Although Firstrade doesn’t yet support advanced features like options leg pairing for position management, it does offer commission-free trading for stocks, ETFs, and options with no per-contract fees.

Mobile app: While testing the app, I was genuinely impressed by how intuitive the options trade ticket is. Major Greeks, delta, gamma, theta, vega, are clearly listed, and the trade visually builds as I added legs. The stock price stayed pinned to the top as I structured my position, a small but crucial detail many apps overlook. It’s clear Firstrade’s app was designed with real options traders in mind.

Order entry is smooth and efficient, especially for single-leg trades. Managing existing positions is a bit more challenging since the app doesn’t support pairing options legs, which would make managing spreads or multi-leg positions much easier. If and when that’s added, Firstrade could climb even higher on this list.

For now, if you're trading single-legged calls and puts, Firstrade offers one of the cleanest, most functional mobile experiences out there, which is an impressive feat for a platform that isn’t exclusively options-focused.

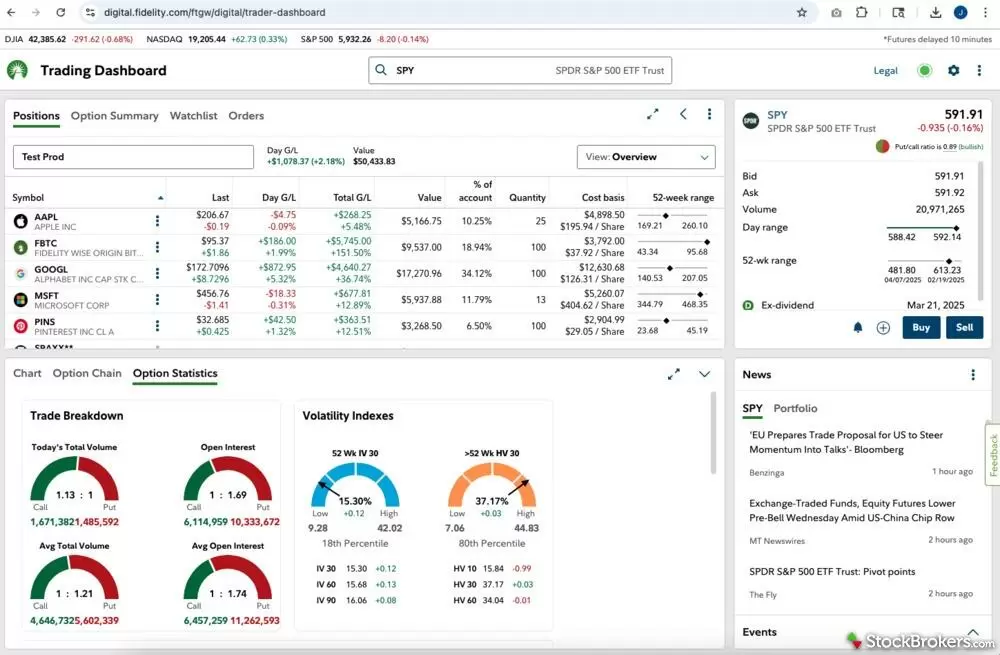

Best overall for options trading - Fidelity

| Company |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

Fidelity Fidelity

|

$0.00 |

$0.00 |

$0.65 |

Fidelity stands out as a top-tier platform for both beginners and experienced traders who focus on income strategies like covered calls, cash-secured puts, and spreads. It’s one of the most powerful and well-rounded platforms for managing options trading, especially if you care about precision and control.

Platform and tools: Managing open options positions is incredibly easy with the Options Summary View, which displays position pairings, margin requirements, and cost basis at a glance. You can even roll all or part of a position or close part of it entirely from this view.

Fidelity also integrates OptionsPlay, a powerful tool that surfaces trading ideas, flags risks like upcoming earnings or potential assignment, and suggests exit or roll strategies. While OptionsPlay does require a subscription, it’s seamlessly tied into your portfolio and watchlists, making idea generation both actionable and easy to follow.

Add in Fidelity’s Trading Strategy Desk, staffed with licensed professionals offering personalized support and live events, and you’ve got one of the most comprehensive options platforms for income-focused investors.

Mobile app: Fidelity’s mobile app delivers a clean and efficient experience, though it’s not quite as specialized as something like tastytrade for advanced options trades. That said, you can still trade single-leg and basic multi-leg strategies with ease, monitor your open positions, and track key market data. The app syncs with your desktop watchlists and integrates educational content, market news, and alerts to help you stay informed on the go.

Where it really shines is in position management and portfolio integration, making it ideal for income traders who want control and transparency. While the app doesn’t go overboard with visual tools or probability models, it does provide the core tools you need, especially when paired with the depth of the web platform.

Best app for basic options trading - WeBull

| Company |

Minimum Deposit |

Stock Trades |

Options (Per Contract) |

Webull Webull

|

$0.00 |

$0.00 |

$0.00 |

Webull is a solid choice for beginners looking to get hands-on with options trading, especially if you’re the type who learns by doing. The platform offers commission-free options trading, real-time data, and a clean, intuitive options chain that’s easy to navigate whether you’re on mobile or desktop.

Platform and tools: One feature I really appreciate is Webull’s paper trading mode. It lets you test strategies without risking real money, which makes it a great place to practice and build confidence. The platform also supports multi-leg trades and offers a clean, highly visual options chain. Implied volatility (IV) is displayed on a number line, and key stats, including the Greeks, are easily accessible without overwhelming the screen.

In my experience, this layout helps traders make quick, informed decisions without digging through clutter. While Webull doesn’t offer deep educational resources, it makes up for it with tech-forward tools, responsive design, and a user experience that’s genuinely built for the active, curious beginner.

Mobile app: Webull’s mobile app is impressively fluid and thoughtfully designed. It mirrors much of the desktop experience, offering real-time quotes, customizable watchlists, and full access to the options chain with multi-leg trading support. Navigation is intuitive, making it easy to go from exploring a trade idea to executing it all from your phone. The app also features community-driven insights through Webull’s social investing tools, where users can share strategies, ideas, and opinions in real time.

While Webull isn’t the most robust platform for advanced traders or in-depth education, it’s one of the best mobile experiences out there for newer options traders who want to learn by doing and grow their skills over time.

FAQs

What option trading apps offer paper trading?

Webull is a great choice if you're looking for an options trading app with paper trading capabilities. It offers a full paper trading mode so you can practice without risking any money, which is a huge plus for beginners and experienced traders testing new strategies.

I also love the way Webull displays its options chain: the layout is clean, and implied volatility (IV) is shown on a number line, making it easy to visualize at a glance. You also get full access to options statistics, which many mobile apps either hide or oversimplify. On top of that, Webull’s social investing features create a unique community vibe you won’t find on most other trading apps, perfect for traders who like learning, sharing, and staying connected with others.

What app has the best user interface for trading options?

tastytrade easily takes the top spot here. Across both mobile and desktop, it’s hands down the best options trading platform when it comes to user experience. The mobile app is fast, intuitive, and built specifically around how options traders think. From constructing multi-leg trades to visualizing probability curves and monitoring key metrics like POP and IV rank, tastytrade’s platform suite is designed to make options trading seamless without sacrificing depth.

What app provides the best tools for advanced option strategies?

If you’re building advanced trades like iron condors, broken wing butterflies, or calendar spreads, tastytrade is the clear winner. It’s designed specifically for options traders, with tools like probability curves, customizable multi-leg builders, and easy visualization of complex positions.

Interactive Brokers (IBKR) comes in a close second, offering a more data-heavy approach with the Options Wizard and Analyzer fully integrated into the mobile app. If you know exactly what you’re looking for and want access to every detail, both apps deliver, but tastytrade makes the process feel smoother and more intuitive.

What should I look for in an options trading app?

Options trading apps need to do more than just show quotes, they have to condense complex data into a format that’s easy to navigate on a small screen. Look for apps that offer customizable options chains, net Greeks, multi-leg trade builders, and real-time data.

Bonus points if the app syncs with desktop, provides educational content, or lets you trade directly from the positions page. And if you’re trading multi-leg strategies, make sure the brokerage displays paired options on your positions page.

What is the easiest app to trade options on?

From a usability standpoint, Firstrade offers one of the most straightforward mobile experiences for trading basic options. It’s clean, intuitive, and makes placing single-leg trades feel effortless. If you’re new to options and want a smooth entry point, Firstrade is a strong pick.

Are there any options apps with education built in?

Yes, and this is where tastytrade stands out. With tastylive built directly into the app, you get live shows, tutorials, and actionable trade ideas designed specifically for options traders. While many platforms offer blog posts or static content, tastytrade delivers real-time education right to your screen.

Our testing

Why you should trust us

Jessica Inskip is Director of Investor Research at StockBrokers.com, bringing 15 years of experience in brokerage and trading strategy. A former FINRA-licensed rep, she held Series 7, 63, 66, and 4 licenses. Jessica focuses on investor education and brokerage industry research, appears regularly on CNBC, Bloomberg, The Schwab Network, Fox Business, and Yahoo! Finance, and hosts the Market MakeHer podcast.

Blain Reinkensmeyer, co-founder of StockBrokers.com, has been investing and trading for over 25 years. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. Today, Blain is widely respected as a leading expert on finance and investing, specifically the U.S. online brokerage industry. Blain has been quoted in The New York Times, The Wall Street Journal, Forbes, and Fast Company, among others. Blain created the original scoring rubrics for StockBrokers.com and oversees all testing and rating methodologies.

How we tested

- We used our own brokerage accounts for testing.

- We collected thousands of data points across the brokers we review.

- We tested each online broker's website, desktop platforms, and mobile app, where applicable.

- We maintained strict editorial independence; brokers cannot pay for inclusion or a higher rating.

Our research team meticulously collected data on every feature of importance to a wide range of customer profiles, including beginners, casual investors, passive investors, and active traders. We carefully track variables like margin rates, trading costs, fees, and platform features and use them to help rate brokers across a range of categories measuring ease of use, range of investments, research, education, and more.

At StockBrokers.com, our reviewers use a variety of computing devices to evaluate platforms and tools. Our reviews and data collection were conducted using the following devices: iPhone SE running iOS 17.5.1, MacBook Pro M1 with 8 GB RAM running the current MacOS, and a Dell Vostro 5402 laptop i5 with 8 GB RAM running Windows 11 Pro.

Each broker was evaluated and scored on over 200 different variables across seven key categories: Range of Investments, Platforms & Tools, Research, Mobile Trading, Education, Ease of Use, and Overall. Learn more about how we test.

Trading platforms tested

We tested 14 online trading platforms for this guide: