Interactive Brokers Review

For the serious market practitioner, Interactive Brokers (IBKR) is less of a standard brokerage and more of a direct gateway to the global financial system. It remains the gold standard for professionals, offering a breadth of assets and a depth of advanced platform tools that virtually no competitor can match.

But the story for 2026 is no longer just about raw power; it is about accessibility. With the rapid evolution of the IBKR Desktop platform, the firm is successfully wrapping its immense capabilities in a modern, intuitive interface that invites exploration rather than intimidation. Whether you are an institutional veteran managing complex derivatives or a sophisticated individual looking to trade international markets, IBKR provides an uncompromising environment designed to maximize every ounce of your trading edge.

-

Minimum Deposit:

$0.00 -

Stock Trades:

$0.00 -

Options (Per Contract):

$0.65

| Range of Investments | |

| Mobile Trading Apps | |

| Advanced Trading | |

| Research | |

| Education | |

| Ease of Use | |

| Customer Service |

Check out StockBrokers.com's picks for the best stock brokers in 2026.

| #1 Range of Investments | Winner |

| #1 Active Traders | Winner |

| #1 Futures Trading | Winner |

| #1 International Trading | Winner |

| #1 Trader App | Winner |

| #1 Client Dashboard | Winner |

| #1 New Tool | Winner |

| #1 Thematic Investing | Winner |

| #1 Professional Trading | Winner |

| #1 24-Hour Trading | Winner |

| 2026 | #3 |

| 2025 | #2 |

| 2024 | #5 |

| 2023 | #6 |

| 2022 | #5 |

| 2021 | #4 |

| 2020 | #5 |

| 2019 | #5 |

| 2018 | #5 |

| 2017 | #6 |

| 2015 | #9 |

| 2014 | #13 |

| 2013 | #10 |

| 2012 | #14 |

| 2011 | #7 |

Led by Jessica Inskip, Director of Investor Research, the StockBrokers.com research team collects thousands of data points across hundreds of variables. We evaluate features important to every kind of investor, including beginners, casual investors, passive investors, and active traders. We carefully track data on margin rates, trading costs, and fees to rate stock brokers across our proprietary testing categories.

Our researchers open personal brokerage accounts and test all available platforms on desktop, web, and mobile for each broker reviewed on StockBrokers.com. Learn more about how we test.

Table of Contents

Pros & cons

Pros

- Trade stocks, options, futures, currencies, and bonds across 170+ markets from a single, unified account.

- The evolving IBKR Desktop platform successfully bridges the gap between institutional power and intuitive usability.

- Industry-leading margin rates and competitive interest yields on idle cash maximize your bottom line.

Cons

- Despite improvements, the sheer density of features requires a significant time investment to master.

- While the educational content is CFA-accredited and rigorous, it often skips over the absolute basics for true beginners.

- Certain tools, such as the economic calendar, list thousands of events but lack the curated context needed to prioritize them effectively.

My top takeaways for Interactive Brokers in 2026:

- The industry’s cost leader: Interactive Brokers continues to set the benchmark for cost efficiency, offering margin rates and high yields on idle cash that consistently outperform the competition. For the active trader, these are not just perks — they are material contributors to the bottom line.

- A new era of usability: The narrative of "powerful but difficult" is changing. With the rapid maturation of IBKR Desktop, the firm now offers a modern, intuitive bridge to its institutional capabilities, allowing traders to access sophisticated tools like the MultiSort Screener without the intimidation factor of the legacy platform.

- True global command: IBKR remains the ultimate gateway to the wider financial world, providing seamless access to over 170 markets, 29 currencies for trading, and 23 currencies for funding. Whether you are trading Japanese equities or European bonds, the platform handles international exposure with the same fluidity as a domestic trade.

Range of investments

Interactive Brokers (IBKR) took the top spot for Range of Investments in 2026. If you can trade it, you can likely find it here. IBKR acts less like a standard brokerage and more like a global gateway, offering extensive access to stocks, options, futures, spot currencies, US spot gold, fixed income, and mutual funds. They have even integrated forecast contracts, their own proprietary structure rather than a third-party integration, allowing traders to speculate on economic and political events.

To further cement its status as a global powerhouse, Interactive Brokers offers 24-hour trading on select U.S. stocks and ETFs. This overnight capability allows traders to react instantly to market-moving news regardless of their time zone, effectively bridging the gap between the US close and global market opens. For the international investor, or simply the restless trader, this seamless access to liquidity ensures that the market truly never sleeps.

Managing such a massive portfolio requires professional-grade tools, and this is where I believe IBKR truly separates itself from the pack. I was particularly impressed by the positions page, which is far more than a simple ledger. It is a fully customizable command center with over 350 columns available to display data ranging from fundamentals and technicals to ESG scores and Greek values. You can view correlation coefficients, z-scores, and various ratios right alongside your P&L. It can be overwhelming at first, but for the sophisticated trader, this level of granularity is essential.

Interested in forex trading?

If you intend to trade forex, check out our comprehensive Interactive Brokers forex review at our sister site, ForexBrokers.com.

Beyond the assets themselves, the account structures are equally robust. While I was disappointed to see a lack of 529 accounts (though UTMA and UGMA are available), IBKR excels in supporting complex entities. They support small business corporations, partnerships, limited liability companies (LLCs), and unincorporated legal structures, alongside SEP and SIMPLE IRAs. This makes IBKR a prime destination for business owners and family offices, not just individual traders.

For those seeking a more hands-off approach, the "Interactive Advisors" program offers a compelling hybrid model. You can choose from diverse thematic portfolios, ranging from "Better Planet" to "Undervalued Companies," with fees sitting reasonably between 0.10% and 0.75% annually. Uniquely, you can convert these managed accounts back to self-directed ones, a flexibility I rarely see elsewhere. Whether you are trading multiple different cryptocurrencies or managing a corporate trust, the sheer breadth of what is possible here is unmatched.

| Feature |

Interactive Brokers Interactive Brokers

|

|---|---|

| Stock Trading | Yes |

| Account Feature - Margin Trading | Yes |

| Fractional Shares (Stocks) | Yes |

| OTC Stocks | Yes |

| Options Trading | Yes |

| Complex Options Max Legs | 6 |

| Fixed Income (Treasurys) | Yes |

| Futures Trading | Yes |

| Forex Trading | Yes |

| Crypto Trading | Yes |

| Crypto Trading - Total Coins | 11 |

| Traditional IRAs | Yes |

| Roth IRAs | Yes |

| Advisor Services | No |

One of the best for high net worth

We analyzed online brokers' offerings for clients with over $1 million of liquid, investable assets. See our guide to the Best Brokerage Firms for High Net Worth Individuals.

Interactive Brokers fees

Interactive Brokers offers a pricing structure that is as versatile as its platform, effectively splitting into two distinct plans: IBKR Lite and IBKR Pro. This dual approach allows them to serve two very different demographics: the casual investor seeking simplicity and the professional trader demanding precision.

Commissions: For the everyday investor, IBKR Lite delivers the industry standard: $0 commissions on U.S. listed stocks and ETFs. It is a straightforward, no-nonsense model that competes directly with the major retail brokerages. IBKR Pro, however, is where the firm’s institutional roots shine. While this tier charges commissions per share, it prioritizes superior order execution. For high-volume traders, the math often works out in your favor, especially when you factor in the available order liquidity rebates.

Derivatives: When we look at derivatives, the pricing remains aggressive. Options trades are charged at a standard $0.65 per contract, with no fee for exercise or assignment, which is a crucial detail for those running complex strategies. Futures traders are treated exceptionally well here, with costs coming in at just $0.85 per contract.

Margin rates: The standout feature, however, is undoubtedly the margin rates. While many competitors charge double-digit interest rates for smaller balances, Interactive Brokers remains an outlier in the best possible way, offering rates between 4.140%-6.140%. In an environment where borrowing costs can silently erode returns, this rate is a massive advantage for active traders using leverage. Coupled with $0 fees for account transfers (ACAT), IRA maintenance, or closures, Interactive Brokers proves that institutional-grade pricing is accessible to the individual investor.

| Feature |

Interactive Brokers Interactive Brokers

|

|---|---|

| Minimum Deposit | $0.00 |

| Stock Trades | $0.00 |

| Penny Stock Fees (OTC) | $0.01 |

| Options (Per Contract) | $0.65 |

| Options Exercise Fee | $0.00 |

| Options Assignment Fee | $0.00 |

| Futures (Per Contract) | $0.85 |

| Mutual Fund Trade Fee | $14.95 |

| Broker Assisted Trade Fee | Varies |

Mobile trading apps

Interactive Brokers took home the Industry Award for #1 Trader App in 2026, and after extensive testing, it is easy to see why. Rather than trying to force every type of investor into a single experience, IBKR offers a suite of tailored applications: the flagship IBKR Mobile for power users, GlobalTrader for simplified global access, the Impact app for ESG-focused investing, and the newly launched InvestMentor for education.

IBKR Mobile (Flagship): The flagship application is a powerhouse that puts institutional-grade tools in your pocket. The depth of data available on a single screen is staggering. When pulling a stock quote, I was impressed to find over 24 data points instantly available — including forward P/E ratios, which are surprisingly rare on mobile — alongside a new AI-powered news summary that digests headlines into bulleted takeaways.

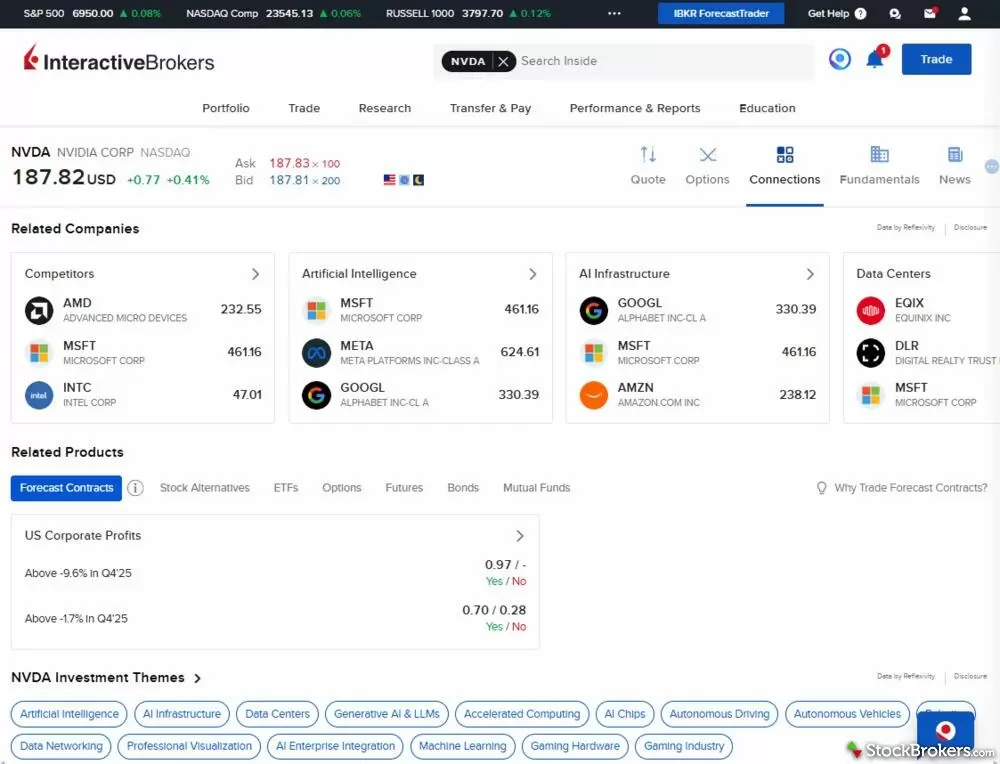

The standout feature here is the "Connections" tab, which visualizes the relationships between the stock and its competitors, suppliers, and correlated ETFs. It turns a simple quote into a web of investable ideas.

Interactive Brokers’ flagship mobile app puts professional-grade tools at your fingertips with its fully-loaded Toolbox feature. Investors can access AI-powered trade ideas, options strategies, tax optimization tools, auto-investing, crypto trading, and market scanners, all in one place. This mobile experience makes it easy to manage sophisticated strategies on the go, rivaling many desktop platforms.

Options trading: I am incredibly picky when it comes to mobile options chains, as most brokers struggle to balance density with usability. IBKR Mobile handles this masterfully. I loved that the chain displays crucial options statistics, like Implied Volatility (IV) rank and percentiles, right at the top of the screen, saving me from digging through menus. Constructing multi-leg trades is intuitive; tapping a bid or ask instantly builds the strategy, and the horizontal scroll for expiration dates makes navigating the calendar seamless. With over 20 customizable columns, including every Greek imaginable, it is a professional trader's dream.

Charting and tools: For technical analysis, the app is equally comprehensive, offering nearly 100 technical studies (97 to be exact) and fully customizable charts. Beyond analysis, the execution capabilities are unmatched. You aren't limited to simple market or limit orders; you can execute complex algorithmic orders like "Adaptive" or "Dark Ice" directly from your phone.

The ecosystem: For those who find the flagship app too dense, IBKR GlobalTrader offers a streamlined, user-friendly interface that focuses on global stock and crypto trading. IBKR Impact continues to lead the industry for values-based investing, allowing you to grade your portfolio against personal values like clean energy or fair labor. Finally, the new IBKR InvestMentor app gamifies the learning process with bite-sized lessons, rounding out an ecosystem that truly has an entry point for everyone.

| Feature |

Interactive Brokers Interactive Brokers

|

|---|---|

| iPhone App | Yes |

| Android App | Yes |

| Apple Watch App | Yes |

| Stock Alerts | Yes |

| Charting - After-Hours | Yes |

| Charting - Technical Studies | 97 |

| Charting - Study Customizations | Yes |

| Watchlist (Streaming) | Yes |

| Mobile Watchlists - Create & Manage | Yes |

| Mobile Watchlists - Column Customization | Yes |

Investing in the U.K.

Interactive Brokers also made our top picks for trading apps in the United Kingdom, along with four other strong contenders. Read more on our sister site, UK.StockBrokers.com.

Advanced trading platforms

Interactive Brokers (IBKR) has long been the pinnacle for professional trading, but its platform ecosystem is currently undergoing a significant and welcome evolution. While the flagship Trader Workstation (TWS) remains the undisputed winner for high-frequency and institutional-grade action, the newer IBKR Desktop is rapidly becoming the star of the show, bridging the gap between sophisticated power and modern usability.

IBKR Desktop

This is where I am seeing the most exciting development from IBKR. IBKR Desktop is not just a "lite" version of TWS; it is a reimagining of how traders interact with data. It retains the core power of IBKR’s execution engine but wraps it in a streamlined, visually rich interface that feels intuitive from day one.

The noteworthy feature here is the MultiSort Screener. Traditional screeners often force you to sort by a single metric, leaving you to mentally juggle competing priorities. MultiSort changes the game by allowing you to select up to 10 factors, such as P/E ratio, dividend yield, and volatility, and then blends them into a single "rank" score. I found this incredibly effective for finding needles in the haystack; instead of scrolling through raw data, I was presented with a visual map of securities that best matched my combined criteria.

Interactive Brokers’ MultiSort Screener takes stock screening to the next level by letting users assign custom weightings to each selection criteria. Beyond traditional filters like P/E ratio or dividend yield, investors can prioritize what matters most, whether it’s earnings growth, valuation, or analyst ratings. This advanced screening tool helps surface results that truly match your personal investment strategy.

Option traders will appreciate the Option Lattice, a graphical tool that visualizes a stock’s 30-day price history alongside "bubbles" representing open interest, volume, or implied volatility across different strikes. It’s a brilliant way to spot outliers and activity clusters at a glance, rather than squinting at rows of numbers in a traditional chain. When you combine this with the Strategy Builder, which allows you to construct multi-leg spreads that the system automatically recognizes, you have a platform that feels modern without sacrificing the analytical depth serious traders require.

Trader Workstation (TWS)

For the purist who demands total control, TWS is the trading platform of choice. It is an environment built for those who treat trading as a profession. The sheer depth of the charting is staggering: I counted 155 technical indicators and 85 drawing tools. I was able to draw a trendline, extend it, and then dive into the settings to adjust specific data points for pixel-perfect precision, which is a level of granularity that is rare in the retail space.

TWS also excels in customization. With 659 available data columns for watch lists, you can build a monitor that tracks virtually any metric imaginable. The algorithmic trading menu is equally vast, offering advanced order types like TWAP, VWAP, and Dark Ice for minimizing market impact.

My favorite aspect of the TWS experience, however, is the Risk Navigator. This tool allowed me to run complex "what-if" scenarios and beta-weight my entire portfolio against a benchmark, giving me a clear picture of my true exposure. While TWS has a steeper learning curve than IBKR Desktop, the payoff is a trading environment that empowers you to execute strategies that other brokers simply cannot support.

Interactive Brokers offers one of the most comprehensive watchlists in the industry, available on both its web and desktop trading platforms. This screenshot highlights the desktop experience, where investors can track real-time quotes, market data, and customizable columns across multiple asset classes.

Additional features

Tax Planner: For the tax-sensitive investor, Interactive Brokers has evolved its offering from simple optimization to holistic planning. The new Tax Planner within IBKR's PortfolioAnalyst is a standout addition for 2026, allowing you to create a personal tax profile that accounts for external income, deductions, and withholdings to estimate your year-end tax bill. This pairs perfectly with the legacy Tax Optimizer, which still provides essential on-the-fly control for toggling between lot-matching methods like FIFO or LIFO. I also appreciate the new Close Specific Lots tool, which brings precision to the trading interface by letting you select exactly which tax lots to liquidate before you place the trade. It provides a level of granular control that active traders and tax strategists will value.

Thematic Investing: The Impact Dashboard remains the gold standard for values-based investing, directly contributing to IBKR's recognition as the #1 broker for Thematic Investing. It asks you to identify what matters most, whether that is racial equality, emissions reduction, or LGBTQ+ inclusion, and grades your portfolio against those values. I found the ability to flag specific business practices to avoid, such as animal testing, particularly thoughtful. It is a tailored experience that seamlessly blends personal values with professional value investing.

AI tools: Finally, IBKR has democratized professional-grade portfolio management through PortfolioAnalyst and the new Ask IBKR AI assistant. PortfolioAnalyst now includes a comprehensive Retirement Planner that lets you model future cash flows and spending needs with advisor-level detail. Meanwhile, Ask IBKR changes how you interact with your data. Instead of digging through reports, I could simply ask, "What is my exposure to the tech sector?" or "Show me my top dividend payers," and receive an instant, data-backed answer. It saves countless hours of research and allows self-directed investors to manage their wealth with the sophistication of a dedicated financial advisor.

| Feature |

Interactive Brokers Interactive Brokers

|

|---|---|

| Active Trading Platform | IBKR Desktop and Trader Workstation (TWS) |

| Desktop Trading Platform | Yes |

| Desktop Platform (Mac) | Yes |

| Web Trading Platform | Yes |

| Paper Trading | Yes |

| Trade Journal | Yes |

| Watchlists - Total Fields | 659 |

| Charting - Indicators / Studies | 155 |

| Charting - Drawing Tools | 85 |

| Charting - Study Customizations | 6 |

| Charting - Save Profiles | Yes |

| Trade Ideas - Technical Analysis | Yes |

| Streaming Time & Sales | Yes |

| Trade Ideas - Backtesting | Yes |

Research

Interactive Brokers has long been synonymous with raw information density, providing a depth of market data that is as exhaustive as it is complex. However, the platform has made significant strides in organizing this intelligence into a cohesive narrative. While it may not hand-hold you through the basics, IBKR offers an institutional-grade library that rewards the curious investor with a depth of insight few competitors can match.

Connections: My favorite improvement in IBKR's research offering is the new Connections feature. It serves as a brilliant navigational bridge, linking the stock I was analyzing to related competitors, ETFs, and even relevant investment themes. On the detailed quote pages, I found the AI-driven news summary to be a significant time-saver; rather than parsing dozens of headlines, I got a concise bulleted list of exactly why a stock was moving. I also appreciated the intuitive search functionality within the quote window. When I searched for "payout ratio," the platform navigated me directly to the correct dividend sub-tab, saving me from hunting through menus.

Interactive Brokers’ Connections tab, shown here for NVIDIA (NVDA), gives investors a 360° contextual research view by linking the selected stock to related competitors, thematic sectors like AI infrastructure and data centers, and tradable products such as Forecast Contracts and ETFs. Connections helps traders uncover peers, trends, and broader market relationships beyond just the price quote.

Screeners: For idea generation, IBKR has leveled up significantly. I was thoroughly impressed by the MultiSort Screener. Unlike traditional screeners that force binary filters, this tool allowed me to assign weightings to different criteria, prioritizing P/E ratio over dividend yield, for example, to generate a ranked list of opportunities. This pairs perfectly with the Investment Themes tool, which rightfully helped IBKR earn the #1 spot for Thematic Investing in 2026. Whether I was looking into quantum computing or electric vehicles, I could instantly pull up an equal-weighted basket of relevant companies and analyze their performance against the theme.

Despite these advances, the sheer volume of data can still be a daunting task to sort through. I found the economic calendar to be overwhelming; while it lists hundreds of events, it lacks the contextual education and historical data (like a simple CPI history chart) that helps investors understand why an event matters. Similarly, macro-level insights felt somewhat tucked away under the "Education" tab rather than being integrated into the core research flow. That said, for the trader who knows what they are looking for, and wants access to 17 third-party research providers and real-time short-selling data, IBKR remains an unparalleled resource.

| Feature |

Interactive Brokers Interactive Brokers

|

|---|---|

| Research - Stocks | Yes |

| Stock Research - ESG | Yes |

| Stock Research - PDF Reports | 17 |

| Screener - Stocks | Yes |

| Research - ETFs | Yes |

| Screener - ETFs | Yes |

| Research - Mutual Funds | Yes |

| Screener - Mutual Funds | Yes |

| Research - Pink Sheets / OTCBB | Yes |

| Research - Fixed Income | Yes |

Education

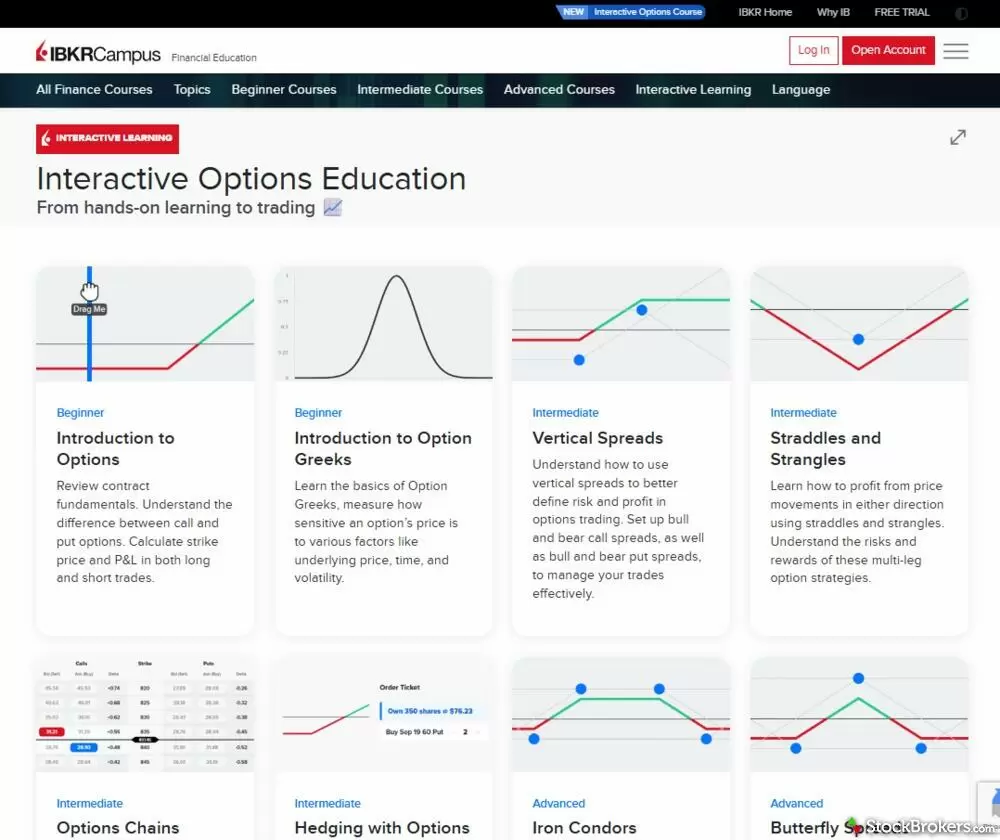

Interactive Brokers approaches education with the same intensity it brings to trading, creating an ecosystem that feels less like a corporate blog and more like a finance university. The IBKRCampus is the centerpiece of this effort, offering a depth of material so rigorous that many of the courses actually qualify for CFA Institute professional learning credits. For the serious student of the markets, this is a distinct validation of quality that sets IBKR apart from competitors who offer only surface-level tutorials.

Interactive courses: I was particularly impressed by the platform’s shift toward immersive learning with the new Options Interactive Course. Rather than reading dry text about Greeks, I was engaged in a beautifully designed environment that included a "challenge mode": a gamified approach that made testing my knowledge genuinely fun. The curriculum for Fixed Income is equally impressive; while many brokers gloss over bonds, IBKR provides a fantastic deep dive into corporate debt, covering complex topics like default risk, primary versus secondary markets, and interest rate sensitivity with a level of detail usually reserved for institutional training programs.

IBKRCampus: The educational philosophy here leans heavily on understanding the "why" behind market movements. I found the macro-focused courses, covering business cycles, sector investing, and monetary policy, to be superior to the standard "what is a ticker?" lessons found elsewhere. While this academic lens might feel slightly overwhelming for a complete novice looking for simple definitions, the integration of community features softens the curve. I loved seeing active comment sections within the courses, allowing learners to ask questions and debate concepts right alongside the material. With a schedule that boasted 15 upcoming webinars in a single month covering everything from AI investing to tax planning, IBKRCampus is a living, breathing classroom for the engaged investor.

The Interactive Brokers IBKRCampus Interactive Options Education course brings options learning to life with hands-on materials that span beginner to advanced strategies. From understanding option Greeks to mastering spreads, straddles, and iron condors, this guided curriculum helps traders build real-world skills with interactive tools designed to turn theory into confident execution.

| Feature |

Interactive Brokers Interactive Brokers

|

|---|---|

| Education (Stocks) | Yes |

| Education (ETFs) | Yes |

| Education (Options) | Yes |

| Education (Mutual Funds) | Yes |

| Education (Fixed Income) | Yes |

| Education (Retirement) | Yes |

| Videos | Yes |

| Webinars | Yes |

| Progress Tracking | Yes |

| Interactive Learning - Quizzes | Yes |

Banking services

Interactive Brokers makes it very clear: it is an investment firm, not a bank. If you are looking for a traditional checking account with bill pay and a local branch, this is not the place for you. However, for the investor who wants their liquid cash to work as hard as their equities, IBKR offers a compelling alternative to the traditional savings account.

Cash interest: The primary draw here is the yield. IBKR pays interest on idle cash balances at a rate of the benchmark minus 0.5% for Pro accounts. This is a formula that consistently places them near the top of the industry for cash returns. I appreciate the transparency of this dynamic rate; there are no teaser periods or hoops to jump through, just a competitive yield that adjusts automatically with the Federal Reserve.

Credit card: While the broker discontinued its debit card and bill pay services in 2024, they have recently filled that void with the introduction of the Karta Visa Infinite Credit Card. Launched in late 2025, this card links directly to your brokerage account, allowing you to spend against your equity without needing to sell positions. For international travelers, the lack of foreign transaction fees is a nice touch. Additionally, investors can access a wide range of CDs directly through the platform, further reinforcing the idea that while IBKR may not be a bank, it is an excellent place to park cash.

| Feature |

Interactive Brokers Interactive Brokers

|

|---|---|

| Bank (Member FDIC) | No |

| Checking Accounts | No |

| Savings Accounts | No |

| Credit Cards | Yes |

| Debit Cards | No |

| Mortgage Loans | No |

Customer service

To score Customer Service, StockBrokers.com partners with customer experience research firm Confero to conduct phone tests from locations throughout the United States. For this year's testing, 132 customer service tests were conducted over six weeks, with wait times logged for each call.

Customer service representatives were asked for assistance or details for prospective customers in several areas of broker services, including account opening, trading tools, apps, crypto offerings, active trading, and more. Here are the results for Interactive Brokers.

- Average Connection Time: 1.4 minutes

- Average Net Promoter Score: 7.0 / 10

- Average Professionalism Score: 6.7 / 10

- Overall Score: 7.35 / 10

- Ranking: 9th of 11

Interactive Brokers IRA review

Interactive Brokers is likely overkill for the passive investor looking for a simple target-date fund, but for the self-directed strategist, it offers a ceiling that few competitors can reach. Opening an IRA at IBKR effectively removes the handcuffs often placed on retirement accounts, granting you unrestricted access to international exchanges and complex asset classes. I found the ability to trade international equities, options, and currencies within a tax-advantaged account to be a significant differentiator. For those who view retirement planning as active portfolio management rather than passive accumulation, this depth is essential.

The platform supports this rigorous approach with tools like PortfolioAnalyst, which I found to be excellent for consolidating a complete financial picture. I was able to link external accounts, such as credit cards and held-away assets, into the Retirement Planner to generate a bird's eye view of my net worth rather than relying on isolated projections. While the learning curve is steeper than a standard brokerage, the efficiency of zero custody fees and the ability to buy fractional shares ensures that every dollar of your contribution is working immediately. It is a powerful vehicle, provided you have the skill to drive it.

Interactive Brokers crypto review

For the multi-asset trader, Interactive Brokers offers a cryptocurrency experience that prioritizes market structure and execution quality over gamification. While previous iterations of the platform felt like a conservative "holding pen" for Bitcoin and Ethereum, the 2025 expansion of the roster has transformed IBKR into a formidable crypto venue. By integrating with both Paxos Trust Company and Zero Hash, IBKR has successfully widened its scope to include major Layer 1s and DeFi blue chips like Solana (SOL), Cardano (ADA), Ripple (XRP), Avalanche (AVAX), Chainlink (LINK), and even Dogecoin (DOGE). It is still not the place to hunt for micro-cap tokens, but for the serious investor, the gang is all here.

Pricing: The true "alpha" of the IBKR crypto experience, however, is the pricing model. In a brokerage landscape rife with "fee-free" offers that hide exorbitant costs in the spread, Interactive Brokers remains defiantly transparent. I found the commission schedule, ranging from 0.12% to 0.18% of trade value with a $1.75 minimum, to be refreshing. Critically, there is no added spread or markup. You are trading against liquidity providers with professional execution, not getting scalped by a retail desk. For larger orders, the savings compared to spread-based brokers are mathematically undeniable.

Integration: Functionally, the integration is seamless. I appreciate that crypto balances are not siloed; they sit alongside your equities, options, and futures, allowing for a unified view of your net liquidating value. This allows for sophisticated hedging strategies that are simply impossible elsewhere. You can hold spot Bitcoin in the same sub-account where you trade CME Bitcoin futures or micro-futures, allowing you to manage basis risk or hedge exposure without ever leaving Trader Workstation. For the trader who treats crypto as an asset class rather than a casino, this is a great implementation.

Funding: In early 2026, Interactive Brokers also expanded its crypto ecosystem by enabling eligible IB LLC clients to fund brokerage accounts using stablecoin. Clients can now deposit USDC with near-instant processing and 24/7 availability, including weekends and holidays, allowing them to move capital into global markets and begin trading within minutes. For international investors accustomed to slow or expensive USD wire transfers, this improves access to IBKR’s multi-asset platform.

Final thoughts

Interactive Brokers sets an uncompromising standard for the professional trader, offering a depth of execution, data, and global access that few competitors can even approach. For the sophisticated investor, the platform does everything it needs to do. Whether you are utilizing the Risk Navigator to beta-weight a portfolio, constructing complex options spreads with the Strategy Builder, or capitalizing on rock-bottom margin rates, the power at your fingertips is undeniable.

The narrative of IBKR as "powerful but hostile" is also outdated. With the rapid evolution of IBKR Desktop and the introduction of intuitive tools like the MultiSort Screener and Connections, the firm is successfully bridging the gap between institutional capability and modern usability. While it is not the right home for a passive investor who wants a simple interface for buying mutual funds, for anyone who treats trading as a serious discipline, IBKR offers an environment where your potential is limited only by your own skill.

Interactive Brokers Star Ratings

| Feature |

Interactive Brokers Interactive Brokers

|

|---|---|

| Overall |

|

| Range of Investments |

|

| Mobile Trading Apps |

|

| Advanced Trading |

|

| Research |

|

| Customer Service |

|

| Education |

|

| Ease of Use |

|

StockBrokers.com Review Methodology

Why you should trust us

Jessica Inskip is Director of Investor Research at StockBrokers.com, bringing 15 years of experience in brokerage and trading strategy. A former FINRA-licensed rep, she held Series 7, 63, 66, and 4 licenses. Jessica focuses on investor education and brokerage industry research, appears regularly on CNBC, Bloomberg, The Schwab Network, Fox Business, and Yahoo! Finance, and hosts the Market MakeHer podcast.

Blain Reinkensmeyer, co-founder of StockBrokers.com, has been investing and trading for over 25 years. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. Today, Blain is widely respected as a leading expert on finance and investing, specifically the U.S. online brokerage industry. Blain has been quoted in The New York Times, The Wall Street Journal, Forbes, and Fast Company, among others. Blain created the original scoring rubrics for StockBrokers.com and oversees all testing and rating methodologies.

How we tested

- We used our own brokerage accounts for testing.

- We collected thousands of data points across the brokers we review.

- We tested each online broker's website, desktop platforms, and mobile app, where applicable.

- We maintained strict editorial independence; brokers cannot pay for inclusion or a higher rating.

Our research team meticulously collected data on every feature of importance to a wide range of customer profiles, including beginners, casual investors, passive investors, and active traders. We carefully track variables like margin rates, trading costs, fees, and platform features and use them to help rate brokers across a range of categories measuring ease of use, range of investments, research, education, and more.

At StockBrokers.com, our reviewers use a variety of computing devices to evaluate platforms and tools. Our reviews and data collection were conducted using the following devices: iPhone SE running iOS 17.5.1, MacBook Pro M1 with 8 GB RAM running the current MacOS, and a Dell Vostro 5402 laptop i5 with 8 GB RAM running Windows 11 Pro.

Each broker was evaluated and scored on over 200 different variables across seven key categories: Range of Investments, Platforms & Tools, Research, Mobile Trading, Education, Ease of Use, and Overall. Learn more about how we test.

Trading platforms tested in 2026

We tested 14 online trading platforms in 2026:

Read next

- Best Stock Trading Apps for 2026

- Best Brokers for Penny Stock Trading of 2026

- Best Stock Brokers for 2026

- Best Stock Trading Platforms for Beginners of 2026

- Best Futures Trading Platforms for 2026

- Best Day Trading Platforms of 2026 for Beginners and Active Traders

- Best Paper Trading Apps & Platforms for 2026

- Best Options Trading Platforms for 2026

More Guides

Popular Stock Broker Reviews

About Interactive Brokers

Headquartered in Greenwich, Connecticut, Interactive Brokers (NASDAQ: IBKR) was founded in 1978 by Thomas Peterffy, who is respected as "an early innovator in computer-assisted trading." Interactive Brokers is most widely recognized for its extensive international reach. The firm places about 3 million trades per day and services over 3.4 million client accounts with over $591 billion in customer equity.