MKN TESTING ALL

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nam turpis ante, sollicitudin dignissim ornare eu, dictum et sem. In nec malesuada arcu, vehicula pretium metus. Praesent porta, lectus sit amet imperdiet venenatis, mi massa vehicula odio, a imperdiet sem nunc id ligula. Aenean sollicitudin lectus ante, sit amet rhoncus quam maximus non. Aenean sed scelerisque libero. Duis sit amet tempor lorem. Donec turpis justo, convallis a gravida et, interdum quis turpis. In porta mauris sed risus scelerisque elementum. Fusce lobortis facilisis neque non fringilla. Phasellus neque enim, vestibulum vel luctus sed, viverra nec eros. Morbi et congue mi, id gravida ligula. Sed vitae laoreet nisi. Nunc a varius leo.

STACKED CARD TESTING

- Minimum Deposit: $0.00

- Stock Trades: $0.00

- Options (Per Contract): $0.65

For most investors, the search for a great broker ends with Charles Schwab. Retaining the #1 Overall ranking in 2026, Schwab continues to set the industry standard. The broker uniquely balances scale with sophistication, offering both simplified mobile tools and the professional-grade thinkorswim platform. From buying a first fractional share to managing a multimillion-dollar estate, Schwab provides a platform tailored to every need, serving as the definitive operating system for modern wealth. Read full review

- thinkorswim is the industry benchmark for professional-grade trading and charting.

- Best in Class Research features actionable daily updates and deep fundamental data.

- Top-tier education with webinars, videos, and courses.

- No spot crypto trading (limited to ETFs and futures).

- "Stock Slices" (fractional shares) are limited to S&P 500 companies.

- Base margin rates are significantly higher than dedicated low-cost competitors.

- Minimum Deposit: $0.00

- Stock Trades: $0.00

- Options (Per Contract): $0.65

Fidelity is a value-driven online broker offering $0 trades, industry-leading research, excellent trading tools and an easy-to-use mobile app. Read full review

- Excellent research and mobile app

- Top-notch education

- Decades of reliable client service

- No dedicated mobile app for active trading

- Minimum Deposit: $0.00

- Stock Trades: $0.00

- Options (Per Contract): $0.65

With two distinct platforms (E*TRADE Web and Power E*TRADE) the broker effectively serves both the "set-it-and-forget-it" investor and the high-volume derivatives trader. Whether you aim to construct a long-term retirement portfolio or deploy complex options strategies, E*TRADE provides a sophisticated, dependable environment that grows with your ambition. Read full review

- High-quality experience for both passive investors and active traders.

- Access to Morgan Stanley’s deep market analysis and interactive reports.

- Excellent bond resource center and a user-friendly ladder tool.

- Base margin rates, starting at over 12%, are significantly higher than top competitors.

- You can’t buy Bitcoin or Ethereum directly; crypto exposure is limited to ETFs and futures.

- You can’t buy fractional shares of individual stocks.

- Minimum Deposit: $0.00

- Stock Trades: $0.00

- Options (Per Contract): $0.00

Webull has evolved past its origins as a low-cost disruptor, solidifying its position as a sophisticated hub for active market participants. It offers a great mobile experience and a fantastic paper trading platform that offers a perfect sandbox to test strategies without risking capital. With AI-powered summaries that slice through market noise and industry-leading paper trading tools for testing strategies, Webull presents a compelling choice for traders. Read full review

- Zero commissions for options contracts.

- Crypto trading has been reintegrated into the main app.

- Phenomenal, award-winning paper trading platform.

- Lack of account types like Inherited IRAs, Trust accounts, and custodial accounts.

- Constructing multi-leg options strategies can feel cumbersome.

- Education is often disorganized and can be confusing for beginners.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nam turpis ante, sollicitudin dignissim ornare eu, dictum et sem. In nec malesuada arcu, vehicula pretium metus. Praesent porta, lectus sit amet imperdiet venenatis, mi massa vehicula odio, a imperdiet sem nunc id ligula. Aenean sollicitudin lectus ante, sit amet rhoncus quam maximus non. Aenean sed scelerisque libero. Duis sit amet tempor lorem. Donec turpis justo, convallis a gravida et, interdum quis turpis. In porta mauris sed risus scelerisque elementum. Fusce lobortis facilisis neque non fringilla. Phasellus neque enim, vestibulum vel luctus sed, viverra nec eros. Morbi et congue mi, id gravida ligula. Sed vitae laoreet nisi. Nunc a varius leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nam turpis ante, sollicitudin dignissim ornare eu, dictum et sem. In nec malesuada arcu, vehicula pretium metus. Praesent porta, lectus sit amet imperdiet venenatis, mi massa vehicula odio, a imperdiet sem nunc id ligula. Aenean sollicitudin lectus ante, sit amet rhoncus quam maximus non. Aenean sed scelerisque libero. Duis sit amet tempor lorem. Donec turpis justo, convallis a gravida et, interdum quis turpis. In porta mauris sed risus scelerisque elementum. Fusce lobortis facilisis neque non fringilla. Phasellus neque enim, vestibulum vel luctus sed, viverra nec eros. Morbi et congue mi, id gravida ligula. Sed vitae laoreet nisi. Nunc a varius leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nam turpis ante, sollicitudin dignissim ornare eu, dictum et sem. In nec malesuada arcu, vehicula pretium metus. Praesent porta, lectus sit amet imperdiet venenatis, mi massa vehicula odio, a imperdiet sem nunc id ligula. Aenean sollicitudin lectus ante, sit amet rhoncus quam maximus non. Aenean sed scelerisque libero. Duis sit amet tempor lorem. Donec turpis justo, convallis a gravida et, interdum quis turpis. In porta mauris sed risus scelerisque elementum. Fusce lobortis facilisis neque non fringilla. Phasellus neque enim, vestibulum vel luctus sed, viverra nec eros. Morbi et congue mi, id gravida ligula. Sed vitae laoreet nisi. Nunc a varius leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nam turpis ante, sollicitudin dignissim ornare eu, dictum et sem. In nec malesuada arcu, vehicula pretium metus. Praesent porta, lectus sit amet imperdiet venenatis, mi massa vehicula odio, a imperdiet sem nunc id ligula. Aenean sollicitudin lectus ante, sit amet rhoncus quam maximus non. Aenean sed scelerisque libero. Duis sit amet tempor lorem. Donec turpis justo, convallis a gravida et, interdum quis turpis. In porta mauris sed risus scelerisque elementum. Fusce lobortis facilisis neque non fringilla. Phasellus neque enim, vestibulum vel luctus sed, viverra nec eros. Morbi et congue mi, id gravida ligula. Sed vitae laoreet nisi. Nunc a varius leo.

Charles Schwab has earned its crown as the best overall brokerage firm, scoring top marks in nearly every category we evaluate. With the acquisition and seamless integration of TD Ameritrade, Schwab has entered a new era, delivering an unbeatable combination of advanced trading platforms, robust research, and investor-focused tools.

Schwab has something for every investor, and that’s no small feat. Need in-depth research? Schwab delivers. Fixed-income tools or advanced trading platforms? Check and check. Looking for education that’s not only top-notch but actually makes sense? Done. Schwab doesn’t just keep pace with the industry — it sets the standard, blending substance and value to be the best overall brokerage firm in the industry.

-

Minimum Deposit:

$0.00 -

Stock Trades:

$0.00 -

Options (Per Contract):

$0.65

| Mobile Trading Apps | |

| Advanced Trading | |

| Research | |

| Commissions & Fees | N/A |

| Ease of Use | |

| Education |

Check out StockBrokers.com's picks for the best stock brokers in 2026.

| 2025 | #4 |

| 2024 | #2 |

| 2023 | #3 |

-

Minimum Deposit:

$0.00 -

Stock Trades:

$0.00 -

Options (Per Contract):

$0.65

| Mobile Trading Apps | |

| Advanced Trading | |

| Research | |

| Commissions & Fees | N/A |

| Ease of Use | |

| Education |

Check out StockBrokers.com's picks for the best stock brokers in 2026.

| #1 Active Trading Desktop Platform | Winner |

| 2025 | #1 |

| 2024 | #3 |

| 2023 | #5 |

-

Minimum Deposit:

$0.00 -

Stock Trades:

$0.00 -

Options (Per Contract):

$0.65

| Mobile Trading Apps | |

| Advanced Trading | |

| Research | |

| Commissions & Fees | N/A |

| Ease of Use | |

| Education |

Check out StockBrokers.com's picks for the best stock brokers in 2026.

| #1 Investor App | Winner |

| 2025 | #3 |

| 2024 | #1 |

| 2023 | #1 |

-

Minimum Deposit:

$0.00 -

Stock Trades:

$0.00 -

Options (Per Contract):

$0.00

| Mobile Trading Apps | |

| Advanced Trading | |

| Research | |

| Commissions & Fees | N/A |

| Ease of Use | |

| Education |

Check out StockBrokers.com's picks for the best stock brokers in 2026.

| 2025 | #12 |

| 2024 | #10 |

| 2023 | #10 |

-

Minimum Deposit:

$0.00 -

Stock Trades:

$0.00 -

Options (Per Contract):

$0.00

| Mobile Trading Apps | |

| Advanced Trading | |

| Research | |

| Commissions & Fees | N/A |

| Ease of Use | |

| Education |

Check out StockBrokers.com's picks for the best stock brokers in 2026.

| 2025 | #8 |

| 2024 | #9 |

| 2023 | #8 |

Table of Contents

Pros & Cons

Pros

- Schwab customers now get access to one of the most powerful trading platforms in the game: the thinkorswim suite.

- Schwab provides an extensive array of research tools, from in-depth stock analysis with analyst reports and valuation metrics to comprehensive fixed-income research supported with integrated contextual education.

- Schwab’s education center is fantastic. With live webinars, interactive courses, articles, and videos, you’ll quickly go from asking, “What’s a P/E ratio?” to confidently using it to choose stocks. Even better, Schwab integrates contextual education right into the platform.

Cons

- If crypto trading is your thing, Schwab isn’t your platform. The platform keeps the door firmly shut on direct cryptocurrency trading. No Bitcoin, Ethereum, or Dogecoin here. That said, you gain crypto exposure through ETFs at Schwab.

- Schwab’s “Stock Slices” are a great way to buy a piece of high-priced stocks, but only if they are companies in the S&P 500.

- Schwab charges $5 for trades placed through its automated phone system, a fee that feels like a penalty for those who prefer more traditional methods. It can be slightly inconvenient, especially for older or less tech-savvy clients who might rely on this option.

Range of Investments

From my point of view, Charles Schwab is the ultimate full-service brokerage firm, and that’s not a term I use lightly. When I think “full service,” I expect a wide array of investment products and account types, all of which Schwab delivers.

From an investment product perspective, you’ll find stocks (including fractional shares via “Stock Slices”), ETFs, mutual funds, options, bonds, CDs, futures, and even access to forex through thinkorswim. The only noticeable gap is cryptocurrency trading, but for most investors, Schwab’s expansive range of offerings more than compensates for it.

Interested in the forex trading?

If you intend to trade forex, check out our comprehensive Charles Schwab forex review focusing primarily on this market at our sister site, ForexBrokers.com.

When it comes to account types, Schwab has too many to list. Individual accounts, traditional and Roth IRAs, rollover IRAs, spousal and beneficiary IRAs, 529 plans, custodial accounts, small business accounts, charitable accounts — you name it, they’ve got it. For even more details on its retirement services, head on over to our in-depth review of Charles Schwab's IRA.

One of Schwab’s standout features, though not unique to them, is their commitment to personalized support. Local branches, specialized representatives for fixed income and active trading, and dedicated high-net-worth advisors ensure you’re never left figuring things out on your own. Having spent years on an active trader desk myself, I know firsthand how invaluable access to these experts can be for investors navigating the market.

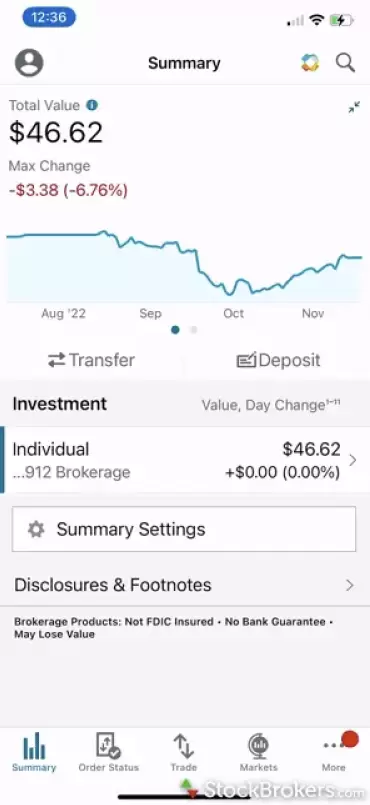

Caption sample goes right here in this box under the alt / title section. Caption sample goes right here in this box under the alt / title section.

I also found Schwab’s Investor Starter Kit intriguing. It’s Investing 101 with a clever twist. When you open and fund your account, Schwab gives you $101 to split equally across the top five stocks in the S&P 500, along with tools and education to guide your next steps. It’s a creative way to help new investors hit the ground running. Schwab also offers automated investing options and tax-efficient strategies, making it accessible to every type of investor.

| Feature |

Robinhood Robinhood

|

|---|---|

| Stock Trading | Yes |

| Account Feature - Margin Trading | Yes |

| Fractional Shares (Stocks) | Yes |

| OTC Stocks | Yes |

| Options Trading | Yes |

| Complex Options Max Legs | 4 |

| Fixed Income (Treasurys) | No |

| Futures Trading | Yes |

| Forex Trading | No |

| Crypto Trading | Yes |

| Crypto Trading - Total Coins | 22 |

| Traditional IRAs | Yes |

| Roth IRAs | Yes |

| Advisor Services | Yes |

One of the best for high net worth

We analyzed online brokers' offerings for clients with over $1 million of liquid, investable assets. See our guide to the Best Brokerage Firms for High Net Worth Individuals.

Charles Schwab fees

At Schwab, listed stock and ETF trades are $0, and options trades are priced at $0.65 per contract, standard pricing that aligns with the rest of the industry. In my opinion, zero-dollar commissions on stocks and ETFs are the baseline these days. What really sets Schwab and other brokerages apart isn’t the price point but the tools and research they offer.

Penny stocks: Schwab charges $6.95 for OTC trades. If that’s what you gravitate toward, take a look at our penny stock trading guide, because some other brokers don’t tack on a fee.

Compare Robinhood to Top Competitors

Mobile Trading Apps

At Schwab, listed stock and ETF trades are $0, and options trades are priced at $0.65 per contract, standard pricing that aligns with the rest of the industry. In my opinion, zero-dollar commissions on stocks and ETFs are the baseline these days. What really sets Schwab and other brokerages apart isn’t the price point but the tools and research they offer.

Penny stocks: Schwab charges $6.95 for OTC trades. If that’s what you gravitate toward, take a look at our penny stock trading guide, because some other brokers don’t tack on a fee.

Trading Platform

Robinhood IRA Review

Robinhood Crypto Review

Research

Education

Banking Services

Final Thoughts

| Feature |

Robinhood Robinhood

|

|---|---|

| Stock Trading | Yes |

| Account Feature - Margin Trading | Yes |

| Fractional Shares (Stocks) | Yes |

| OTC Stocks | Yes |

| Options Trading | Yes |

| Complex Options Max Legs | 4 |

| Fixed Income (Treasurys) | No |

| Futures Trading | Yes |

| Forex Trading | No |

| Crypto Trading | Yes |

| Crypto Trading - Total Coins | 22 |

| Traditional IRAs | Yes |

| Roth IRAs | Yes |

| Advisor Services | Yes |

Robinhood's 2025 Star Ratings

FAQs

Stockbrokers.com Review Methodology

Read next

- Best Brokers for Penny Stock Trading of 2026

- Best Stock Brokers for 2026

- Best Options Trading Platforms for 2026

- Best Stock Trading Platforms for Beginners of 2026

- Best Paper Trading Apps & Platforms for 2026

- Best Day Trading Platforms of 2026 for Beginners and Active Traders

- Best Futures Trading Platforms for 2026

- Best Stock Trading Apps for 2026

More Guides

Popular Stock Broker Reviews

END page here!

Trade Ideas

Trade Ideas

StockHero

StockHero

TrendSpider

TrendSpider