Range of investments

When it comes to choosing between J.P. Morgan Self-Directed Investing and Ally Invest, investors will find that both platforms offer a comprehensive set of investment options, yet some differences might sway your decision. Both platforms provide stock trading, margin trading, mutual funds, options trading, and over-the-counter (OTC) stocks. However, J.P. Morgan Self-Directed Investing has the edge with its fractional shares trading capability, while Ally Invest does not offer this feature. Though neither platform supports futures or crypto trading, each offers traditional IRA and Roth IRA accounts, alongside advisor services. Both platforms are similarly rated, with J.P. Morgan earning 4 stars and Ally Invest slightly higher at 4.5 stars for their range of investments.

J.P. Morgan Self-Directed Investing appeals to those who value flexibility in their investment options, particularly with its fractional shares trading feature that allows for diversified portfolios with smaller amounts of money. On the other hand, Ally Invest stands out with its slightly superior rating for its range of investments and higher rank in StockBrokers.com's comparison of 14 brokers. This makes Ally Invest an attractive choice for those prioritizing variety and broader investment options without the need for fractional shares trading.

Both platforms serve as viable options for self-directed investors, offering common investment categories like mutual funds and options. However, if fractional shares are a critical feature for your investment strategy, J.P. Morgan Self-Directed Investing takes precedence. On the contrary, those leaning towards an all-encompassing range of investment options minus this feature might find Ally Invest to be the preferable option. Ultimately, your decision should weigh the small differences in offerings against your specific trading needs.

|

Feature |

J.P. Morgan Self-Directed Investing J.P. Morgan Self-Directed Investing

|

Ally Invest Ally Invest

|

|

Stock Trading

info

|

Yes

|

Yes

|

|

Account Feature - Margin Trading

info

|

Yes

info |

Yes

|

|

Fractional Shares (Stocks)

info

|

Yes

|

No

|

|

OTC Stocks

info

|

Yes

|

Yes

|

|

Mutual Funds

info

|

Yes

|

Yes

|

|

Options Trading

info

|

Yes

|

Yes

|

|

Futures Trading

info

|

No

|

No

|

|

Crypto Trading

info

|

No

|

No

|

|

Crypto Trading - Total Coins

info

|

0

|

0

|

|

Range of Investments

|

|

|

Dive deeper: Best Options Trading Platforms for 2026, Best Futures Trading Platforms for 2026

Trading platforms and tools

Ally Invest has a slight edge over J.P. Morgan Self-Directed Investing for trading platforms and tools. StockBrokers.com rates Ally at 3 stars and 10th out of 14 brokers, while J.P. Morgan earns 2.5 stars and ranks 13th. Both are web-only—no downloadable Windows or Mac platforms—and neither offers paper trading or a trading journal. If you want deeper charting and more customization, Ally is stronger; if bigger watchlists matter, J.P. Morgan gives you more fields at a glance.

Access and workflow are similar: each broker runs in a browser with no desktop app. You can’t adjust open orders directly on a chart at either firm, and neither shows historical trades on charts. Watchlists are a differentiator, though—J.P. Morgan supports up to 20 columns per list versus Ally’s 10, which can help if you track many metrics at once.

Charting favors Ally Invest for power users: it offers 120 technical indicators and 36 drawing tools, plus notes on charts, automated pattern recognition, saved multi-chart profiles, and eight fields when editing an SMA study. J.P. Morgan provides 36 indicators, 10 drawing tools, three SMA edit fields, and a helpful overlay of corporate events like earnings, splits, and dividends. Both lack custom studies, custom date ranges, and historical trade markers on charts.

|

Feature |

J.P. Morgan Self-Directed Investing J.P. Morgan Self-Directed Investing

|

Ally Invest Ally Invest

|

|

Web Trading Platform

info

|

Yes

|

Yes

|

|

Desktop Trading Platform

info

|

No

|

No

|

|

Desktop Platform (Mac)

info

|

No

|

No

|

|

Paper Trading

info

|

No

|

No

|

|

Watchlists - Total Fields

info

|

20

|

10

|

|

Charting - Indicators / Studies

info

|

36

|

120

|

|

Charting - Drawing Tools

info

|

10

|

36

|

|

Platforms & Tools

|

|

|

Dive deeper: Best Trading Platforms for 2026, Best Paper Trading Apps & Platforms for 2026

A full-featured account for investing

Get up to $1K on new brokerage account*

Beginners and education

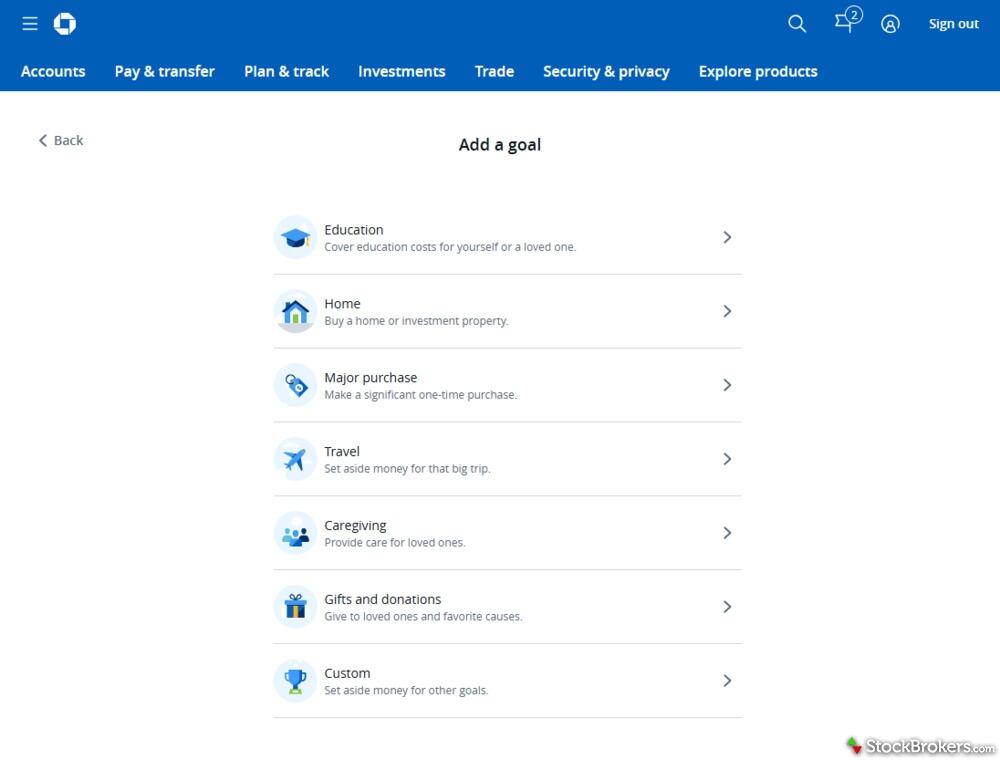

For investment beginners seeking education, both J.P. Morgan Self-Directed Investing and Ally Invest provide a comprehensive range of resources to aid your learning journey. Both platforms offer educational content on stocks, ETFs, options, mutual funds, and bonds. However, J.P. Morgan Self-Directed Investing enhances its offerings with educational videos and webinars, features that are not available with Ally Invest. Unfortunately, neither platform currently supports paper trading or offers educational quizzes, and you won't find learning progress tracking on either.

In terms of user ratings and expert rankings, J.P. Morgan Self-Directed Investing stands out slightly with a 4.5-star rating, compared to Ally Invest's 4-star rating. According to StockBrokers.com, J.P. Morgan ranks 6th out of 14 brokers for investor education, while Ally Invest is close behind in the 7th position. Whether you choose J.P. Morgan's video and webinar content or Ally's straightforward educational approach, both platforms provide valuable resources to help you begin your investing journey.

|

Feature |

J.P. Morgan Self-Directed Investing J.P. Morgan Self-Directed Investing

|

Ally Invest Ally Invest

|

|

Education (Stocks)

info

|

Yes

|

Yes

|

|

Education (ETFs)

info

|

Yes

|

Yes

|

|

Education (Options)

info

|

Yes

|

Yes

|

|

Education (Mutual Funds)

info

|

Yes

|

Yes

|

|

Education (Fixed Income)

info

|

Yes

|

Yes

|

|

Videos

info

|

Yes

|

No

|

|

Webinars

info

|

Yes

|

No

|

|

Education

|

|

|

Dive deeper: Best Stock Trading Platforms for Beginners of 2026

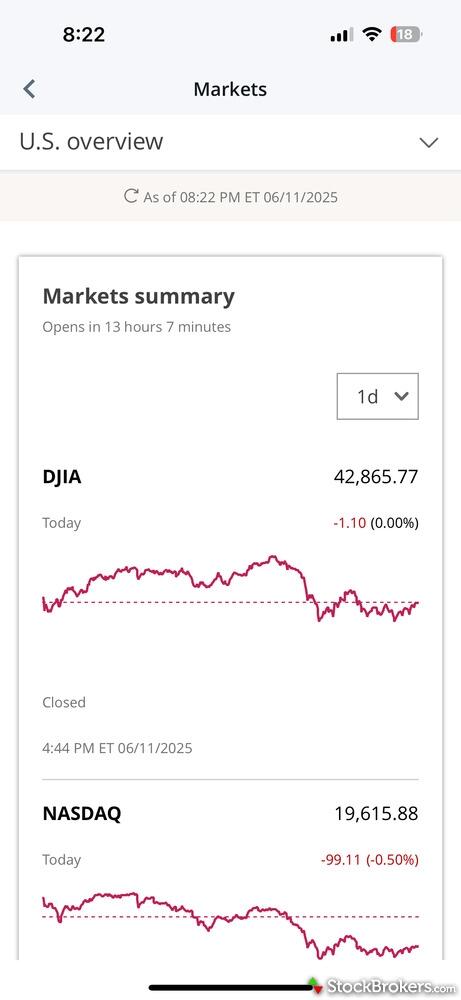

Stock trading apps

When choosing between J.P. Morgan Self-Directed Investing and Ally Invest for stock trading apps, both platforms offer distinct advantages and limitations. While both are rated four out of five stars for their stock trading apps, J.P. Morgan holds a slight edge, being ranked #12 versus Ally Invest’s #13 ranking. J.P. Morgan provides a more comprehensive charting experience with support for 36 technical studies and offers customizable watch lists and columns. In contrast, Ally Invest provides streaming quotes, a feature that J.P. Morgan does not include, which can be crucial for active traders.

Both J.P. Morgan Self-Directed Investing and Ally Invest have accessible iPhone and Android apps, but neither provides an Apple Watch app. Mobile options trading is available on both platforms, but only J.P. Morgan features custom watch list creation and column customization. This customization may benefit traders who want a more tailored view of their investments. Additionally, J.P. Morgan allows users to view charts in landscape mode, providing an enhanced experience for those who rely heavily on chart analysis.

Ally Invest stands out with its streaming quotes feature, offering real-time data that can be extremely valuable for users who need up-to-the-minute market information. However, it lacks technical studies for charting, which may limit the depth of analysis for users focusing on technical analysis. Both platforms do not offer video-on-demand or live TV streaming, showing a shared gap in multimedia features. Each broker's offerings cater to different trading styles, making it essential for users to consider which features are most aligned with their trading needs before choosing the right platform for their needs.

|

Feature |

J.P. Morgan Self-Directed Investing J.P. Morgan Self-Directed Investing

|

Ally Invest Ally Invest

|

|

iPhone App

info

|

Yes

|

Yes

|

|

Android App

info

|

Yes

|

Yes

|

|

Apple Watch App

info

|

No

|

No

|

|

Stock Alerts

info

|

Yes

|

No

|

|

Charting - After-Hours

info

|

No

|

No

|

|

Charting - Technical Studies

info

|

36

|

0

|

|

Mobile Trading Apps

|

|

|

Dive deeper: Best Stock Trading Apps for 2026

Fees

Overall, both J.P. Morgan Self-Directed Investing and Ally Invest keep core trading costs low with $0 minimum deposits and $0 stock commissions. Ally Invest is the better pick for frequent options traders and anyone likely to use margin, thanks to cheaper options contracts and slightly lower margin rates. J.P. Morgan stands out with a $0 fee for partial account transfers, but it charges more for full transfers and IRA closures. Both brokers charge $0 for options exercise and assignment.

Trade pricing: both require a $0 minimum deposit and charge $0 for regular stock trades. Options contract fees are lower at Ally Invest at $0.50 per contract versus J.P. Morgan’s $0.65. Margin interest tilts cheaper at Ally across the listed tiers: under $25,000 balances are 12% at Ally vs 12.25% at J.P. Morgan; $25,000–$49,999 are 11.75% vs 12%; and $50,000–$99,999 are 11% vs 11.5%.

Account and transfer fees: both brokers have $0 IRA annual fees. IRA closure costs are lower at Ally Invest ($25) than J.P. Morgan ($75). For ACAT transfers, J.P. Morgan charges $0 for partial and $75 for full, while Ally Invest charges $50 for both partial and full. Options exercise and assignment fees are $0 at both firms.

|

Feature |

J.P. Morgan Self-Directed Investing J.P. Morgan Self-Directed Investing

|

Ally Invest Ally Invest

|

|

Minimum Deposit

info

|

$0.00

|

$0.00

|

|

Stock Trades

info

|

$0.00

|

$0.00

|

|

Options (Per Contract)

info

|

$0.65

|

$0.50

|

|

Options Exercise Fee

info

|

$0.00

|

$0.00

|

|

Options Assignment Fee

info

|

$0.00

|

$0.00

|

|

IRA Annual Fee

info

|

$0.00

|

$0.00

|

|

IRA Closure Fee

info

|

$75.00

|

$25.00

|

Dive deeper: Best Free Trading Platforms for 2026

Day Trading

When it comes to day trading, both J.P. Morgan Self-Directed Investing and Ally Invest present similar platforms, providing essential trading services but lacking certain advanced tools. Neither broker offers streaming time and sales for stocks, which might deter those looking for real-time data and advanced trade execution features. Additionally, features like streaming live TV for market news or direct market routing for stocks are absent in both platforms. This could influence day traders who are accustomed to leveraging real-time insights and direct execution methods.

For those looking for enhanced trading functionalities such as ladder trading, trading hotkeys, or level 2 quotes, both J.P. Morgan Self-Directed Investing and Ally Invest fall short. Strategy backtesting, whether basic or advanced, is also unavailable on both platforms. Furthermore, both fail to provide a short locator tool for real-time availability of shares to short, and neither offers liquidity rebates. Day traders seeking comprehensive tools for intricate trading strategies might need to consider other options that deliver these advanced features.

|

Feature |

J.P. Morgan Self-Directed Investing J.P. Morgan Self-Directed Investing

|

Ally Invest Ally Invest

|

|

Streaming Time & Sales

info

|

No

|

No

|

|

Streaming TV

info

|

No

|

No

|

|

Direct Market Routing - Equities

info

|

No

|

No

|

|

Level 2 Quotes - Stocks

info

|

No

|

No

|

|

Trade Ideas - Backtesting

info

|

No

|

No

|

|

Trade Ideas - Backtesting Adv

info

|

No

|

No

|

|

Short Locator

info

|

No

|

No

|

Dive deeper: Best Day Trading Platforms of 2026 for Beginners and Active Traders

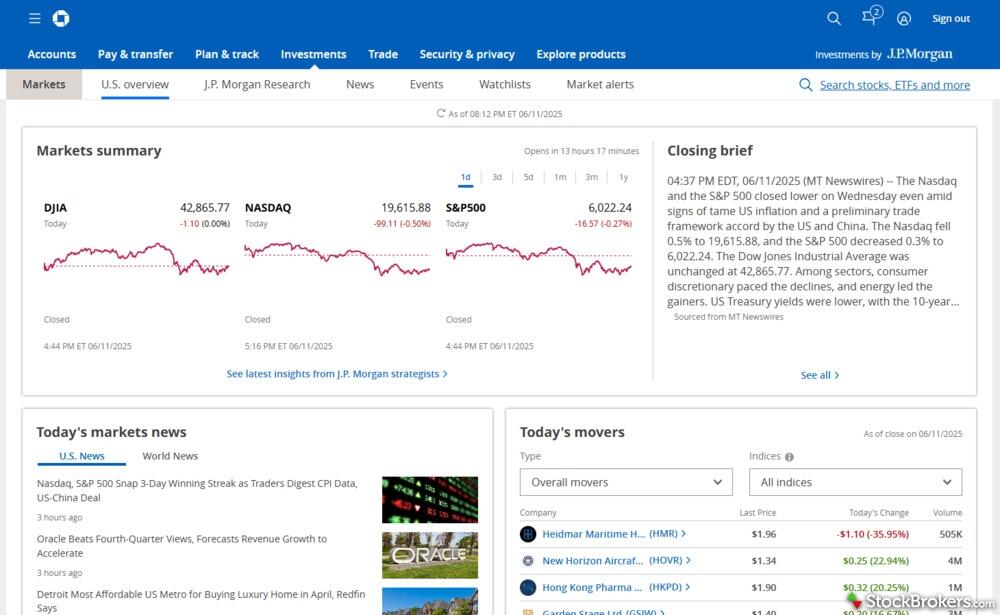

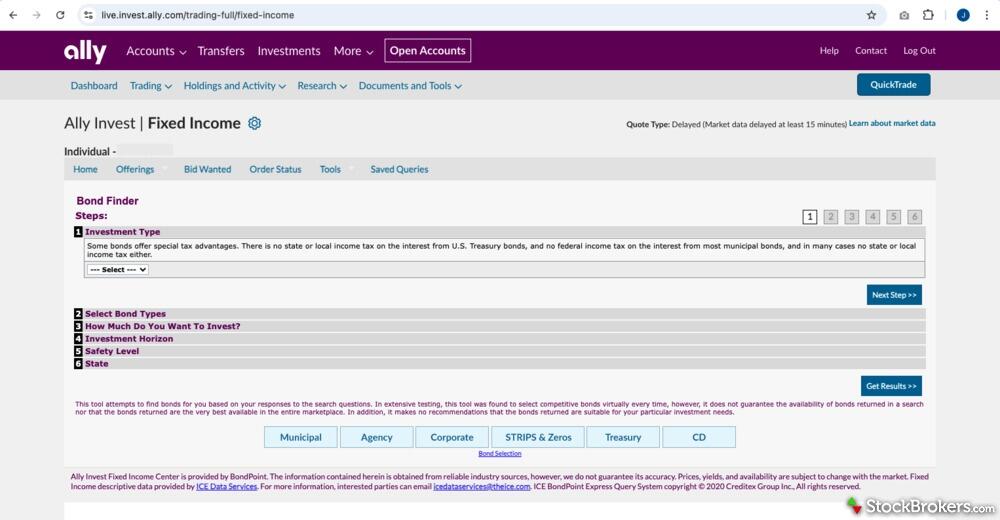

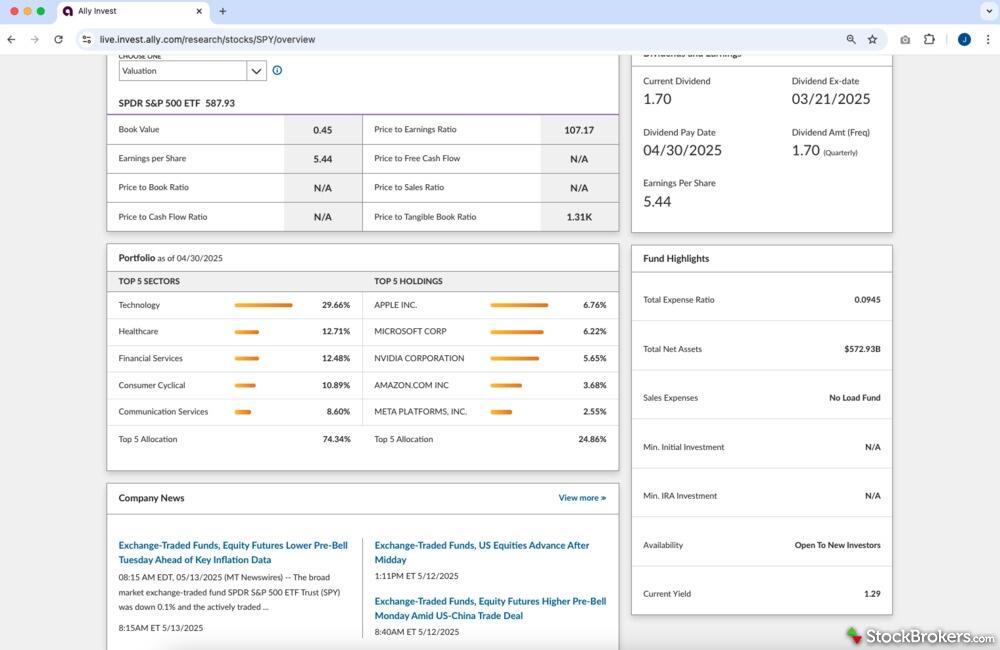

Market Research

When deciding between J.P. Morgan Self-Directed Investing and Ally Invest for market research, J.P. Morgan Self-Directed Investing holds a slight edge. With a rating of 4 out of 5 stars compared to Ally Invest's 3.5, J.P. Morgan Self-Directed is ranked 7th among 14 brokers by StockBrokers.com, just above Ally Invest at 8th. This positioning highlights its broader suite of available market research tools and resources, which may be appealing to investors seeking comprehensive data and analysis capabilities.

For market research, both J.P. Morgan Self-Directed Investing and Ally Invest offer in-depth data on stocks, ETFs, mutual funds, and bonds. They both facilitate research on Pink Sheets and OTCBB. However, J.P. Morgan stands out by providing downloadable PDF research reports for stocks — something Ally Invest does not offer. While neither platform provides downloadable reports for ETFs or mutual funds, they both offer screeners for stocks and bonds, with J.P. Morgan extending this feature to mutual funds as well. This advantage is part of the reason J.P. Morgan receives slightly higher ratings in market research capabilities.

Although both platforms cover essential areas in market research, certain unique offerings are available for distinct investor needs. For instance, J.P. Morgan provides a view of portfolio allocation by asset class, a tool that ensures greater insight into one's investment stance. In contrast, Ally Invest capitalizes on innovative approaches by providing stock research using social media sentiment data. However, both platforms currently lack the ESG research feature. Ultimately, both brokers offer solid market research options, with J.P. Morgan slightly ahead due to its broader range of services and resources in certain areas.

|

Feature |

J.P. Morgan Self-Directed Investing J.P. Morgan Self-Directed Investing

|

Ally Invest Ally Invest

|

|

Research - Stocks

info

|

Yes

|

Yes

|

|

Screener - Stocks

info

|

Yes

|

Yes

|

|

Research - ETFs

info

|

Yes

|

Yes

|

|

Screener - ETFs

info

|

Yes

|

Yes

|

|

Research - Mutual Funds

info

|

Yes

|

Yes

|

|

Screener - Mutual Funds

info

|

Yes

|

No

|

|

Research - Fixed Income

info

|

Yes

|

Yes

|

|

Screener - Fixed Income

info

|

Yes

|

Yes

|

|

Research

|

|

|

Banking

J.P. Morgan Self-Directed Investing and Ally Invest both provide a range of banking services that cater to everyday banking needs. Both platforms offer checking and savings accounts, enabling users to manage their finances with ease. Customers can also benefit from debit and credit cards offered by each, allowing easy access to their funds and convenient payment options. Further enhancing their financial offerings, both J.P. Morgan Self-Directed Investing and Ally Invest provide mortgage loans for those looking to purchase a home. Finally, if you're interested in securing savings at a fixed interest rate, both platforms offer Certificates of Deposit (CDs). This comprehensive suite of services makes either platform a compelling choice for individuals seeking a one-stop solution for their banking requirements.

Dive deeper: Best Brokerage Checking Accounts for 2026

Winner

After opening live accounts and testing 14 of the best online brokers, our research and live account testing finds that J.P. Morgan Self-Directed Investing is better than Ally Invest. J.P. Morgan Self-Directed Investing finished with an overall score of 85.4%, while Ally Invest finished with a score of 80.1%.

J.P. Morgan Self-Directed Investing makes it easy for Chase Bank customers to invest and allows access to J.P. Morgan research. On the downside, the broker features are sparse compared to industry leaders.

FAQs

Can you trade cryptocurrency with J.P. Morgan Self-Directed Investing or Ally Invest?

Does J.P. Morgan Self-Directed Investing or Ally Invest offer IRAs?

Both J.P. Morgan Self-Directed Investing and Ally Invest offer traditional and Roth IRA accounts with no annual fees. However, J.P. Morgan charges a $75 closure fee for IRA accounts, while Ally Invest's closure fee is only $25, making it a more cost-effective option for account closures.

Dive deeper: Best IRA Accounts for 2026

Popular trading guides

More trading guides

Popular broker reviews

navigate_before

navigate_next

|

Broker Screenshots

|

J.P. Morgan Self-Directed Investing |

Ally Invest |

|

|

Broker Gallery (click to expand) |

|

|

|

|

Trading Fees

|

J.P. Morgan Self-Directed Investing |

Ally Invest |

|

|

Minimum Deposit info

|

$0.00

|

$0.00

|

|

|

Stock Trades info

|

$0.00

|

$0.00

|

|

|

Penny Stock Fees (OTC) info

|

$0.00

|

$4.95

info

|

|

|

Mutual Fund Trade Fee info

|

$0

|

$0.00

|

|

|

Options (Per Contract) info

|

$0.65

|

$0.50

|

|

|

Futures (Per Contract) info

|

(Not offered)

|

(Not offered)

|

|

|

Broker Assisted Trade Fee info

|

Varies

|

$20

|

|

|

Margin Rates

|

J.P. Morgan Self-Directed Investing |

Ally Invest |

|

|

Margin Rate Under $25,000 info

|

12.25%

|

12%

|

|

|

Margin Rate $25,000 to $49,999.99 info

|

12%

|

11.75%

|

|

|

Margin Rate $50,000 to $99,999.99 info

|

11.5%

|

11%

|

|

|

Margin Rate $100,000 to $249,999.99 info

|

11.25%

|

9.75%

|

|

|

Margin Rate $250,000 to $499,999.99 info

|

11.25%

|

8.75%

|

|

|

Margin Rate $500,000 to $999,999.99 info

|

10.5%

|

8.25%

|

|

|

Margin Rate Above $1,000,000 info

|

10%

info

|

7.5%

|

|

|

Account Fees

|

J.P. Morgan Self-Directed Investing |

Ally Invest |

|

|

IRA Annual Fee info

|

$0.00

|

$0.00

|

|

|

IRA Closure Fee info

|

$75.00

|

$25.00

|

|

|

Account Transfer Out (Partial) info

|

$0.00

|

$50.00

|

|

|

Account Transfer Out (Full) info

|

$75.00

|

$50.00

|

|

|

Options Exercise Fee info

|

$0.00

|

$0.00

|

|

|

Options Assignment Fee info

|

$0.00

|

$0.00

|

|

|

Investment Options

|

J.P. Morgan Self-Directed Investing |

Ally Invest |

|

|

Stock Trading info

|

Yes

|

Yes

|

|

|

Account Feature - Margin Trading info

|

Yes

info

|

Yes

|

|

|

Fractional Shares (Stocks) info

|

Yes

|

No

|

|

|

OTC Stocks info

|

Yes

|

Yes

|

|

|

Options Trading info

|

Yes

|

Yes

|

|

|

Complex Options Max Legs info

|

1

|

4

|

|

|

Futures Trading info

|

No

|

No

|

|

|

Forex Trading info

|

No

|

No

|

|

|

Crypto Trading info

|

No

|

No

|

|

|

Crypto Trading - Total Coins info

|

0

|

0

|

|

|

Fixed Income (Treasurys) info

|

Yes

|

Yes

|

|

|

Fixed Income (Corporate Bonds) info

|

Yes

|

Yes

|

|

|

Fixed Income (Municipal Bonds) info

|

Yes

|

Yes

|

|

|

Traditional IRAs info

|

Yes

|

Yes

|

|

|

Roth IRAs info

|

Yes

|

Yes

|

|

|

Advisor Services info

|

Yes

|

Yes

|

|

|

International Countries (Stocks) info

|

0

|

0

|

|

|

Order Types

|

J.P. Morgan Self-Directed Investing |

Ally Invest |

|

|

Order Type - Market info

|

Yes

|

Yes

|

|

|

Order Type - Limit info

|

Yes

|

Yes

|

|

|

Order Type - After Hours info

|

No

|

Yes

|

|

|

Order Type - Stop info

|

Yes

|

Yes

|

|

|

Order Type - Trailing Stop info

|

No

|

No

|

|

|

Order Type - OCO info

|

No

|

No

|

|

|

Order Type - OTO info

|

No

|

No

|

|

|

Order Type - Broker Assisted info

|

Yes

|

Yes

|

|

|

Beginners

|

J.P. Morgan Self-Directed Investing |

Ally Invest |

|

|

Education (Stocks) info

|

Yes

|

Yes

|

|

|

Education (ETFs) info

|

Yes

|

Yes

|

|

|

Education (Options) info

|

Yes

|

Yes

|

|

|

Education (Mutual Funds) info

|

Yes

|

Yes

|

|

|

Education (Fixed Income) info

|

Yes

|

Yes

|

|

|

Education (Retirement) info

|

Yes

|

Yes

|

|

|

Retirement Calculator info

|

Yes

|

No

|

|

|

Investor Dictionary info

|

No

|

Yes

|

|

|

Paper Trading info

|

No

|

No

|

|

|

Videos info

|

Yes

|

No

|

|

|

Webinars info

|

Yes

|

No

|

|

|

Progress Tracking info

|

No

|

No

|

|

|

Interactive Learning - Quizzes info

|

No

|

No

|

|

|

Stock Trading Apps

|

J.P. Morgan Self-Directed Investing |

Ally Invest |

|

|

iPhone App info

|

Yes

|

Yes

|

|

|

Android App info

|

Yes

|

Yes

|

|

|

Apple Watch App info

|

No

|

No

|

|

|

Trading - Stocks info

|

Yes

|

Yes

|

|

|

Trading - After-Hours info

|

No

|

Yes

|

|

|

Trading - Simple Options info

|

Yes

|

Yes

|

|

|

Trading - Complex Options info

|

No

|

Yes

|

|

|

Order Ticket RT Quotes info

|

Yes

|

Yes

|

|

|

Order Ticket SRT Quotes info

|

No

|

No

|

|

|

Stock App Features

|

J.P. Morgan Self-Directed Investing |

Ally Invest |

|

|

Mobile Research - Market Movers info

|

Yes

|

Yes

|

|

|

Stream Live TV info

|

No

|

No

|

|

|

Videos on Demand info

|

No

|

No

|

|

|

Stock Alerts info

|

Yes

|

No

|

|

|

Option Chains Viewable info

|

Yes

|

Yes

|

|

|

Watchlist (Real-time) info

|

Yes

|

Yes

|

|

|

Watchlist (Streaming) info

|

No

|

No

|

|

|

Mobile Watchlists - Create & Manage info

|

Yes

|

Yes

|

|

|

Mobile Watchlists - Column Customization info

|

Yes

|

No

|

|

|

Stock App Charting

|

J.P. Morgan Self-Directed Investing |

Ally Invest |

|

|

Charting - After-Hours info

|

No

|

No

|

|

|

Charting - Can Turn Horizontally info

|

Yes

|

No

|

|

|

Charting - Multiple Time Frames info

|

Yes

|

Yes

|

|

|

Charting - Technical Studies info

|

36

|

0

|

|

|

Charting - Study Customizations info

|

Yes

|

No

|

|

|

Charting - Stock Comparisons info

|

No

|

No

|

|

|

Trading Platforms

|

J.P. Morgan Self-Directed Investing |

Ally Invest |

|

|

Active Trading Platform info

|

No

|

N/A

|

|

|

Desktop Trading Platform info

|

No

|

No

|

|

|

Desktop Platform (Mac) info

|

No

|

No

|

|

|

Web Trading Platform info

|

Yes

|

Yes

|

|

|

Paper Trading info

|

No

|

No

|

|

|

Trade Journal info

|

No

|

No

|

|

|

Watchlists - Total Fields info

|

20

|

10

|

|

|

Stock Chart Features

|

J.P. Morgan Self-Directed Investing |

Ally Invest |

|

|

Charting - Adjust Trades on Chart info

|

No

|

No

|

|

|

Charting - Indicators / Studies info

|

36

|

120

|

|

|

Charting - Drawing Tools info

|

10

|

36

|

|

|

Charting - Notes info

|

No

|

Yes

|

|

|

Charting - Historical Trades info

|

No

|

No

|

|

|

Charting - Corporate Events info

|

Yes

|

No

|

|

|

Charting - Custom Date Range info

|

No

|

No

|

|

|

Charting - Custom Time Bars info

|

No

|

No

|

|

|

Charting - Automated Analysis info

|

No

|

Yes

|

|

|

Charting - Save Profiles info

|

No

|

Yes

|

|

|

Trade Ideas - Technical Analysis info

|

No

|

No

|

|

|

Charting - Study Customizations info

|

3

|

8

|

|

|

Charting - Custom Studies info

|

No

|

No

|

|

|

Day Trading

|

J.P. Morgan Self-Directed Investing |

Ally Invest |

|

|

Streaming Time & Sales info

|

No

|

No

|

|

|

Streaming TV info

|

No

|

No

|

|

|

Direct Market Routing - Equities info

|

No

|

No

|

|

|

Ladder Trading info

|

No

|

No

|

|

|

Trade Hot Keys info

|

No

|

No

|

|

|

Level 2 Quotes - Stocks info

|

No

|

No

|

|

|

Trade Ideas - Backtesting info

|

No

|

No

|

|

|

Trade Ideas - Backtesting Adv info

|

No

|

No

|

|

|

Short Locator info

|

No

|

No

|

|

|

Order Liquidity Rebates info

|

No

|

No

|

|

|

Research Overview

|

J.P. Morgan Self-Directed Investing |

Ally Invest |

|

|

Research - Stocks info

|

Yes

|

Yes

|

|

|

Research - ETFs info

|

Yes

|

Yes

|

|

|

Research - Mutual Funds info

|

Yes

|

Yes

|

|

|

Research - Pink Sheets / OTCBB info

|

Yes

|

Yes

|

|

|

Research - Fixed Income info

|

Yes

|

Yes

|

|

|

Screener - Stocks info

|

Yes

|

Yes

|

|

|

Screener - ETFs info

|

Yes

|

Yes

|

|

|

Screener - Mutual Funds info

|

Yes

|

No

|

|

|

Screener - Fixed Income info

|

Yes

|

Yes

|

|

|

Portfolio Asset Allocation info

|

Yes

|

No

|

|

|

Stock Research

|

J.P. Morgan Self-Directed Investing |

Ally Invest |

|

|

Stock Research - PDF Reports info

|

2

|

0

|

|

|

Stock Research - Earnings info

|

Yes

|

No

|

|

|

Stock Research - Insiders info

|

No

|

Yes

|

|

|

Stock Research - Social info

|

No

|

Yes

|

|

|

Stock Research - News info

|

Yes

|

Yes

|

|

|

Stock Research - ESG info

|

No

|

No

|

|

|

Stock Research - SEC Filings info

|

No

|

No

|

|

|

ETF Research

|

J.P. Morgan Self-Directed Investing |

Ally Invest |

|

|

ETFs - Investment Objective info

|

Yes

|

No

|

|

|

ETF Fund Facts - Inception Date info

|

Yes

|

No

|

|

|

ETF Fund Facts - Expense Ratio info

|

Yes

|

Yes

|

|

|

ETF Fund Facts - Total Assets info

|

Yes

|

Yes

|

|

|

ETF Fund Facts - Total Holdings info

|

Yes

|

No

|

|

|

ETFs - Top 10 Holdings info

|

Yes

|

Yes

|

|

|

ETFs - Sector Exposure info

|

Yes

|

No

|

|

|

ETFs - Risk Analysis info

|

No

|

No

|

|

|

ETFs - Ratings info

|

Yes

|

Yes

|

|

|

ETFs - Morningstar StyleMap info

|

Yes

|

No

|

|

|

ETFs - PDF Reports info

|

No

|

No

|

|

|

Mutual Fund Research

|

J.P. Morgan Self-Directed Investing |

Ally Invest |

|

|

Mutual Funds - Investment Objective info

|

Yes

|

Yes

|

|

|

Mutual Funds - Performance Chart info

|

Yes

|

Yes

|

|

|

Mutual Funds - Performance Analysis info

|

Yes

|

No

|

|

|

Mutual Funds - Prospectus info

|

No

|

No

|

|

|

Mutual Funds - 3rd Party Ratings info

|

Yes

|

Yes

|

|

|

Mutual Funds - Fees Breakdown info

|

Yes

|

No

|

|

|

Mutual Funds - Top 10 Holdings info

|

Yes

|

Yes

|

|

|

Mutual Funds - Asset Allocation info

|

Yes

|

No

|

|

|

Mutual Funds - Sector Allocation info

|

Yes

|

Yes

|

|

|

Mutual Funds - Country Allocation info

|

Yes

|

No

|

|

|

Mutual Funds - StyleMap info

|

Yes

|

No

|

|

|

Options Trading

|

J.P. Morgan Self-Directed Investing |

Ally Invest |

|

|

Option Chains - Total Greeks info

|

0

|

5

|

|

|

Option Analysis - P&L Charts info

|

No

|

No

|

|

|

Banking

|

J.P. Morgan Self-Directed Investing |

Ally Invest |

|

|

Bank (Member FDIC) info

|

Yes

|

Yes

|

|

|

Checking Accounts info

|

Yes

|

Yes

|

|

|

Savings Accounts info

|

Yes

|

Yes

|

|

|

Credit Cards info

|

Yes

|

Yes

|

|

|

Debit Cards info

|

Yes

|

Yes

|

|

|

Mortgage Loans info

|

Yes

|

Yes

|

|

|

Customer Service

|

J.P. Morgan Self-Directed Investing |

Ally Invest |

|

|

Phone Support (Prospective Customers) info

|

No

|

Yes

|

|

|

Phone Support (Current Customers) info

|

Yes

|

Yes

|

|

|

Email Support info

|

Yes

|

Yes

|

|

|

Live Chat (Prospective Customers) info

|

No

|

No

|

|

|

Live Chat (Current Customers) info

|

No

|

Yes

|

|

|

24/7 Support info

|

Yes

|

Yes

|

|

arrow_upward